Oleochemicals Market

Published :

Report ID:

Pages :

Format :

Oleochemicals Market

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

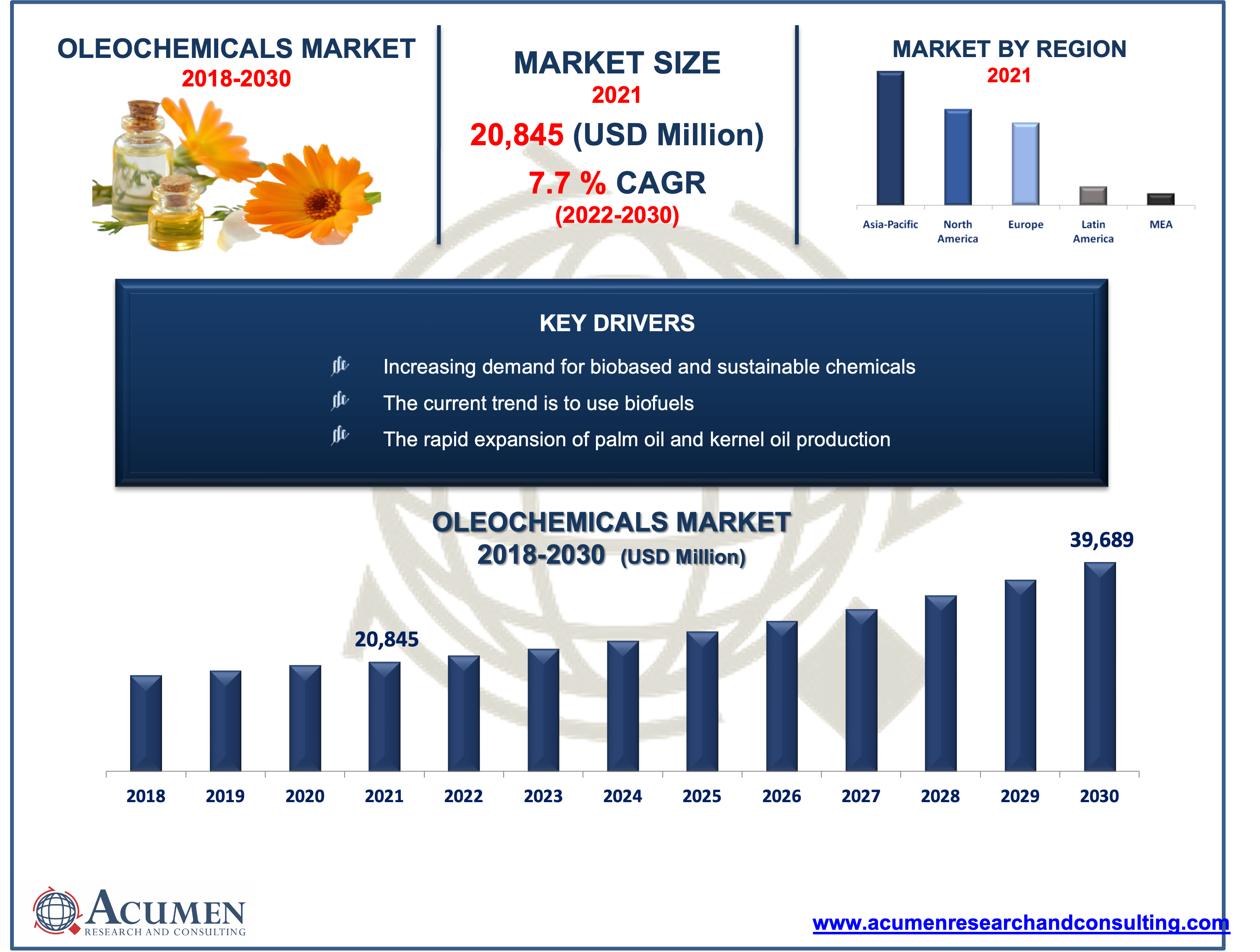

Request Sample Report

The Global Oleochemicals Market accounted for US$ 20,845 Mn in 2021 and is expected to reach US$ 39,689 Mn by 2030 with a considerable CAGR of 7.7% during the forecast timeframe of 2022 to 2030.

Oleochemicals are chemical compounds that are naturally extracted from plant and animal oils and can be used as feedstock or additives in a variety of industries. Oleochemicals are used as an alternative to petrochemicals, which are petroleum-based products. Oleochemicals are used in a variety of industries, including personal care, cosmetics, pharmaceuticals and nutraceuticals, coatings, adhesives, food, elastomers and sealants, and household and industrial cleaning. Oilseed production is expected to increase as demand for oleochemicals rises. Manufacturers switched from petrochemical to oleochemical products as crude oil prices raised in the late 1970s because plant-based saturated fatty oils derived from palm oil are much less expensive. And since, palm oil has majorly been used in the manufacture of laundry detergent and hygiene products such as toothpaste, shower cream, soap bars, and shampoo.

Drivers

· Increasing demand for biobased and sustainable chemicals

· The current trend is to use biofuels

· The rapid expansion of palm oil and kernel oil production

Restraints

· Production of volatile organic compounds during glycerin pretreatment

· Price fluctuations in raw materials

Opportunity

· Increased use of bio-based lubricants to replace synthetic and traditional lubricants

· Recent advances in these chemicals have resulted in new applications in polymers and bio-surfactants

Report Coverage

| Market | Oleochemicals Market |

| Market Size 2021 | US$ 20,845 Mn |

| Market Forecast 2030 | US$ 39,689 Mn |

| CAGR | 7.7 % During 2022 - 2030 |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2021 - 2028 |

| Segments Covered | By Product , By Application And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Cargill, Inc., Twin Rivers, SABIC, Croda Industrial Chemicals, Kuala Lumpur Kepong Berhad, Evonik Industries, BASF SE, Emery Olechemicals, Oleon N.V., IOI Group Berhad, Wilmar International, and Kao Corp. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Oleochemicals Market Dynamics

The primary factors driving the market growth are rising biodiesel demand and the rapid development of the fast-moving consumer goods (FMCG) industry. The global oleochemicals market is being influenced by the growing global demand for biodegradable and sustainable solutions. Furthermore, the growing use of oleochemicals by major manufacturers to produce bio-lubricants, bio-surfactants, and biopolymers as green alternatives to petrochemicals is a major growth driver. Furthermore, organic ingredients are gaining popularity in baby care products, soaps, cosmetics, and food ingredients, which are driving the market. Other factors, such as increased research and development into metabolic engineering strategies for producing oleochemicals from sustainable and renewable feedstocks, are expected to drive the market even further.

Government rules and regulations are increasing the demand for biodiesel, which will drive up biofuel prices. This factor may limit the growth of the oleochemicals market. The technological development required for industrial oleochemical production appears to be a barrier to the growth of the global oleochemical market.

Market Segmentation

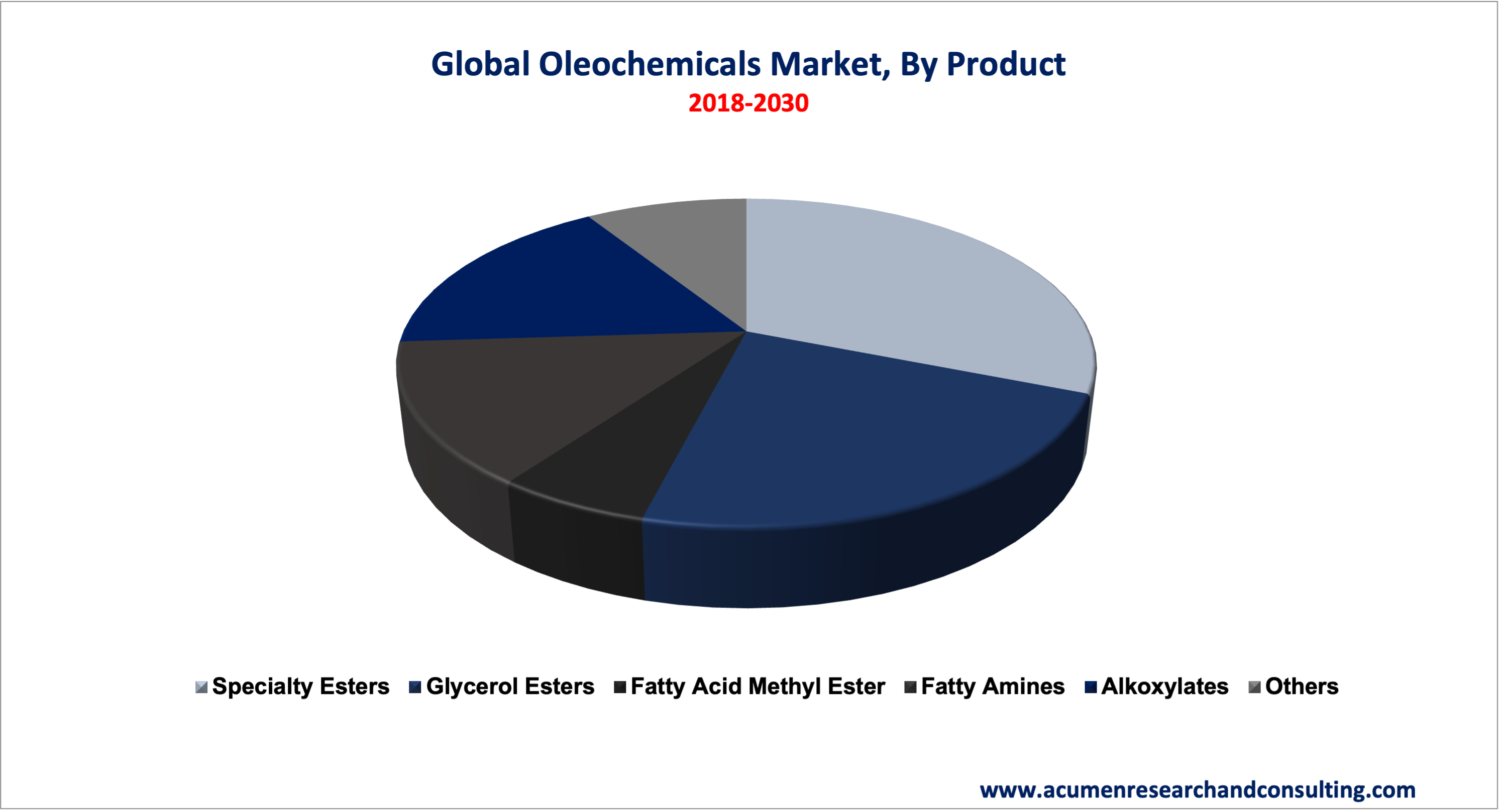

Market by Product

· Specialty Esters

· Glycerol Esters

· Fatty Amines

· Fatty Acid Methyl Ester

· Alkoxylates

· Others

In terms of product, specialty esters held the largest market share in 2021. Specialty esters are chemical compounds formed by replacing a hydroxyl group in organic or inorganic acids with an alkyl group. They are used in a variety of products, such as paints, fragrances, and varnishes, as well as lubricants. The emergence of bio-based esters, the dramatic growth of the automobile and construction sectors, and the increasing use of specialty esters in the formulation of solvents, lubricants, surfactants, personal care products, and flavoring agents, and so on are some of the major factors driving the segment. Esters contribute to flavor enhancement and are becoming a popular emulsification remedy in the foodservice industry.

Furthermore, the fatty acid methyl ester segment is expected to grow significantly in the coming years as a result of stringent environmental regulations and rising demand for biodiesel. Furthermore, its properties such as good lubricity, excellent solubility in organic solvents, and high boiling points are increasing its demand in a wide range of end-use industries including lubricants and metalworking fluids solvents, detergents & surfactants, fuels, and coating & food.

Market by Application

· Personal Care & Cosmetics

· Food & Beverages

· Consumer Goods

· Paints & Inks

· Textiles

· Industrial

· Polymer & Plastic Additives

· Healthcare & Pharmaceuticals

· Others

Based on the application, the personal care & cosmetic segment is expected to hold a significant market share in 2021. Oleochemicals are found in personal care products such as haircare and skincare essentials. They've increased in popularity because they're typically free of carcinogens and allergens. Glycerine, also known as glycerol, is a moisturizing substance derived from vegetable oils and fats. Natural cosmetics are not only healthier for the consumer, but they also perform better.

Furthermore, Oleochemicals are also used to make FDA-approved food packaging and food sanitizers. Oleochemicals are found in a wide range of foods and beverages, most prominently as emulsifiers in cake, bread, and confectionery. It is also used in the production of personalized oils and margarine. Another important use of oleochemicals is in the production of nutrient-rich materials that are widely used as ingredients in packaged food products.

Oleochemicals Market Regional Overview

North America

· U.S.

· Canada

Europe

· U.K.

· France

· Germany

· Spain

· Rest of Europe

Latin America

· Mexico

· Brazil

· Rest of Latin America

Asia-Pacific

· India

· China

· Japan

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· South Africa

· GCC

· Rest of Middle East & Africa

Asia-Pacific accounted for the largest market share in 2021, owing to rising awareness of sustainable green plastics in a wide range of industries, which has led to the rising production of raw materials such as fatty acids and other bio-based polymeric materials. Additionally, this growth could be attributed to the region's key manufacturers working together, as well as the growing use of organic products in the production of Oleochemicals. Developing countries such as China and India are the region's largest consumers of oleochemicals. Furthermore, the market will drive in the region due to the region's consumers' high demand for biodegradable products and easy access to raw materials. Furthermore, Indonesia and Malaysia are the world's largest producers of oleo chemical-based products. Asia-Pacific is not only the largest consumer of oleochemicals but also the largest producer, accounting for more than half of global production.

Competitive Landscape

Some of the prominent players in global oleochemicals market are Cargill, Inc., Twin Rivers, SABIC, Croda Industrial Chemicals, Kuala Lumpur Kepong Berhad, Evonik Industries, BASF SE, Emery Olechemicals, Oleon N.V., IOI Group Berhad, Wilmar International, and Kao Corp.

Frequently Asked Questions

How much was the estimated value of the global oleochemicals market in 2021?

The estimated value of global oleochemicals market in 2021 was accounted to be US$20,845 Mn.

What will be the projected CAGR for global oleochemicals market during forecast period of 2022 to 2030?

The projected CAGR of oleochemicals during the analysis period of 2022 to 2030 is 7.7%.

Which are the prominent competitors operating in the market?

The prominent players of the global oleochemicals market involve Cargill, Inc., Twin Rivers, SABIC, Croda Industrial Chemicals, Kuala Lumpur Kepong Berhad, Evonik Industries, BASF SE, Emery Olechemicals, Oleon N.V., IOI Group Berhad, Wilmar International, and Kao Corp.

Which region held the dominating position in the global oleochemicals market?

Asia-Pacific held the dominating share for oleochemicals during the analysis period of 2022 to 2030

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for oleochemicals during the analysis period of 2022 to 2030

What are the current trends and dynamics in the global oleochemicals market?

Increasing demand for bio based and sustainable chemicals, and rapid expansion of palm oil and kernel oil production, are the prominent factors that fuel the growth of global oleochemicals market

By segment product, which sub-segment held the maximum share?

Based on product, specialty esters segment held the maximum share for oleochemicals market in 2021