Oilfield Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Oilfield Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

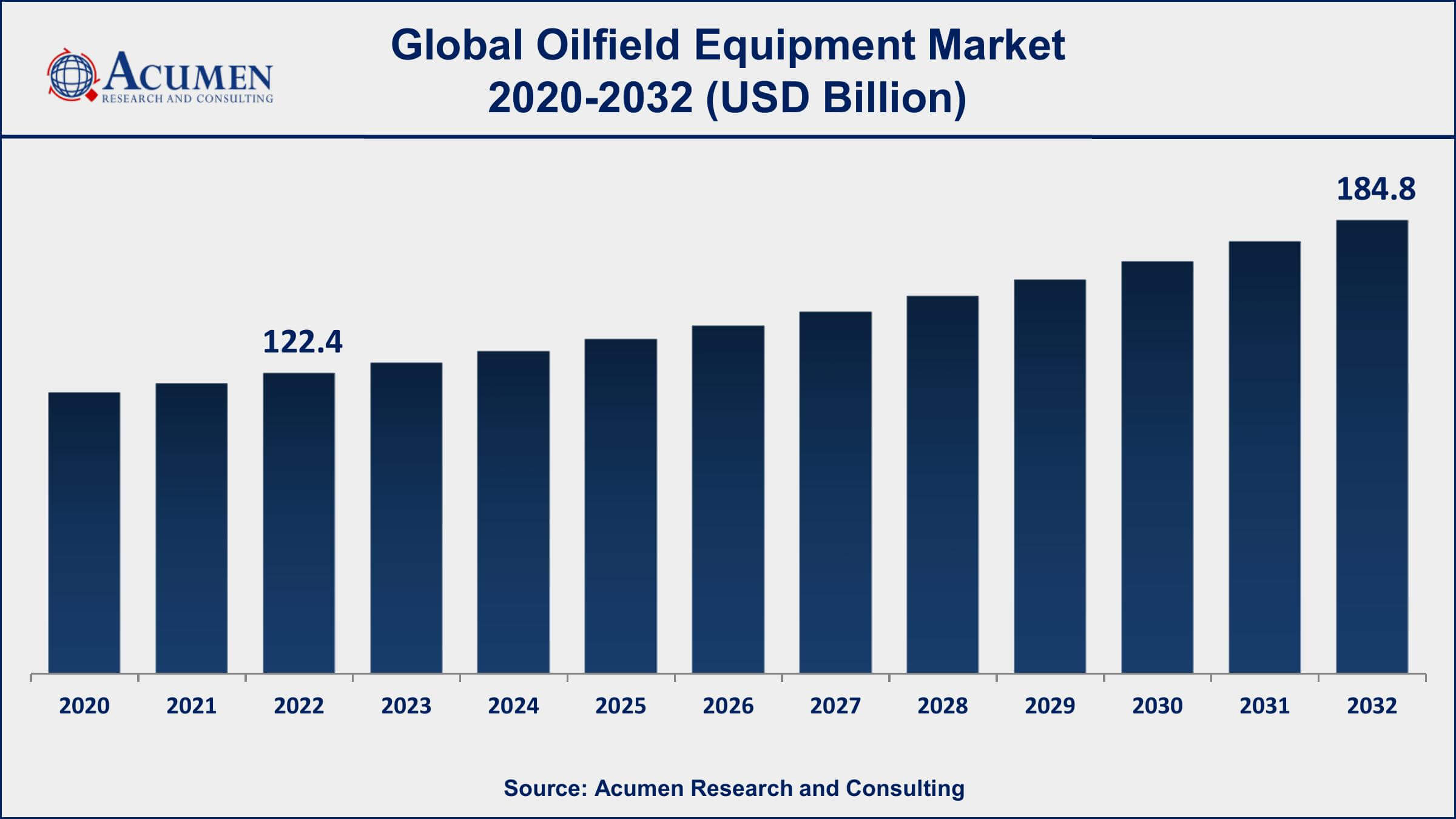

The Global Oilfield Equipment Market Size accounted for USD 122.4 Billion in 2022 and is projected to achieve a market size of USD 184.8 Billion by 2032 growing at a CAGR of 3.8% from 2023 to 2032.

Oilfield Equipment Market Report Key Highlights

- Global oilfield equipment market revenue is expected to increase by USD 184.8 Billion by 2032, with a 3.8% CAGR from 2023 to 2032

- North America region led with more than 37% of oilfield equipment market share in 2022

- In 2019, the US produced approximately 2 million barrels of oil per day from offshore drilling, accounting for about 16% of total US oil production.

- The oil and gas industry is expected to invest approximately $1.9 trillion in exploration and production between 2021 and 2025

- The oil and gas industry accounts for approximately 70% of the world's primary energy consumption.

- The offshore drilling segment is expected to grow at the highest CAGR of 5.6% during the forecast period

- Increasing demand for high-quality, long-lasting, and sustainable infrastructure, drives the oilfield equipment market size

Oilfield equipment refers to the machines and tools that are used to extract oil and gas from beneath the earth's surface. This equipment is utilized in the drilling, exploration, production, and transportation of oil and gas. Oilfield equipment is essential for the oil and gas industry, and its market growth has been significant in recent years due to the rising demand for energy.

The global oilfield equipment market is projected to grow at a compound annual growth rate (CAGR) of 3.8% from 2023 to 2032. The growth of the market is attributed to the increase in oil and gas exploration activities, especially in developing countries. The rising demand for crude oil and natural gas, coupled with the growing demand for energy, is driving the growth of the market. Moreover, the advancement of technology and the introduction of new drilling techniques are also contributing to the oilfield equipment market growth.

Global Oilfield Equipment Market Trends

Market Drivers

- Increasing demand for oil and gas

- Development of new oil and gas fields

- Growing demand for energy from emerging economies

- Advancements in drilling technology and equipment

- Increased offshore exploration and production activities

- Government initiatives to boost oil and gas production

Market Restraints

- Volatility in oil and gas prices

- Environmental concerns and regulations

- High cost of oilfield equipment and operations

Market Opportunities

- Increasing focus on offshore exploration and production

- Advancements in automation and digital technologies

- Growing demand for equipment rental services

Oilfield Equipment Market Report Coverage

| Market | Oilfield Equipment Market |

| Oilfield Equipment Market Size 2022 | USD 122.4 Billion |

| Oilfield Equipment Market Forecast 2032 | USD 184.8 Billion |

| Oilfield Equipment Market CAGR During 2023 - 2032 | 3.8% |

| Oilfield Equipment Market Analysis Period | 2020 - 2032 |

| Oilfield Equipment Market Base Year | 2022 |

| Oilfield Equipment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ABB, Delta Corporation, Baker Hughes, Integrated Equipment, EthosEnergy Group Limited, MSP/Drilex, Inc., Jereh Oilfield Equipment, Uztel S.A, Sunnda Corporation, and Weir Group. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

An increase in crude-yielding activities around the globe owing to the increasing demand for crude oil is anticipated to be the key reason behind the growth of the oilfield equipment market value in the coming years. Oilfield equipment is the instruments used by oilfield operators to extract gas and oil from reservoirs. Oil equipment can be either taken on rent or bought by oil operators. Most of the time these oil operators rent the equipment as it reduces capital expenditure.

The industrialization has led to the budding demand for the development of high-performance, reliable, and efficient oilfield tools for improving yielding results. Thus, several industry players are anticipated to strategize heavy capitalization into R&D not only for the development of better equipment in order to improvise the productivity and recovery of crude operations but also to ensure the safety and security of workers while functioning this equipment. Capitalization and investment by market participants are expected to boost the growth of the oilfield equipment market in the coming years. Moreover, the industry shift inclined towards the development of unconventional energy sources to fulfill the demand is also predicted to notably contribute to market growth in the future.

However, ongoing geopolitical issues coupled with a lack of skilled workers can be a few of the factors restraining the market growth. Also, a shift in focus towards the encouragement of green energy sources can adversely impact the activities of extracting energy sources, which in turn can pull back the market growth, globally. Nonetheless, trending utilization of cutting techniques, such as ER and IOR are expected to generate healthy opportunities for the oilfield equipment market in coming years.

Oilfield Equipment Market Segmentation

The global oilfield equipment market segmentation is based on type, application, and geography.

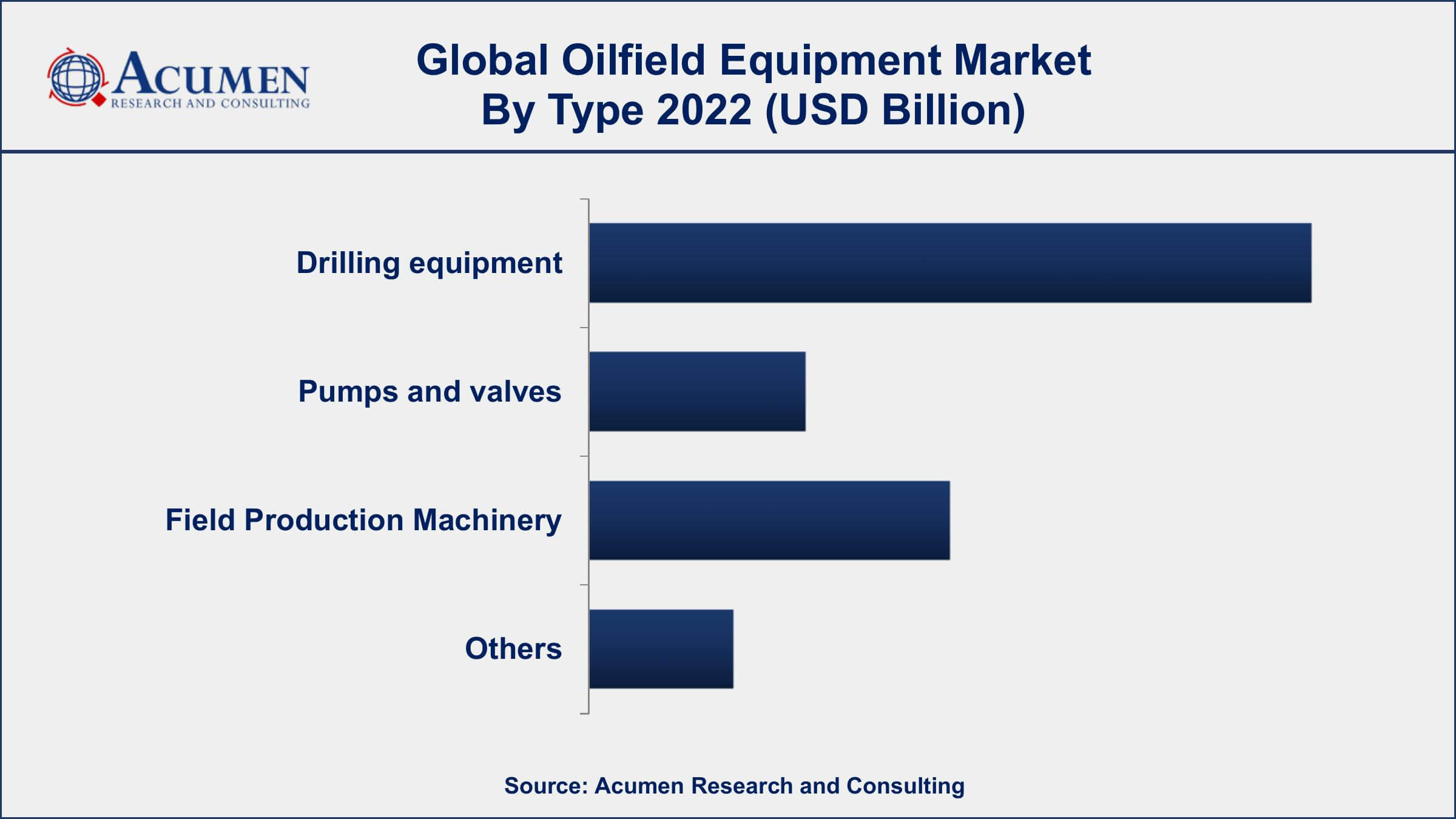

Oilfield Equipment Market By Type

- Drilling equipment

- Pumps and valves

- Field Production Machinery

- Others

According to an oilfield equipment industry analysis, the drilling equipment segment is one of the major segments of the market. It includes various types of drilling rigs, such as land rigs, offshore rigs, and mobile rigs, as well as drill bits, mud pumps, and other equipment used in drilling operations. The demand for drilling equipment is directly linked to the exploration and production activities in the oil and gas industry. The global drilling equipment market is expected to witness significant growth over the next few years due to the increasing demand for oil and gas, particularly from emerging economies. Advancements in drilling technology, such as horizontal drilling and hydraulic fracturing, have enabled the extraction of oil and gas from unconventional sources, which has further driven the demand for drilling equipment.

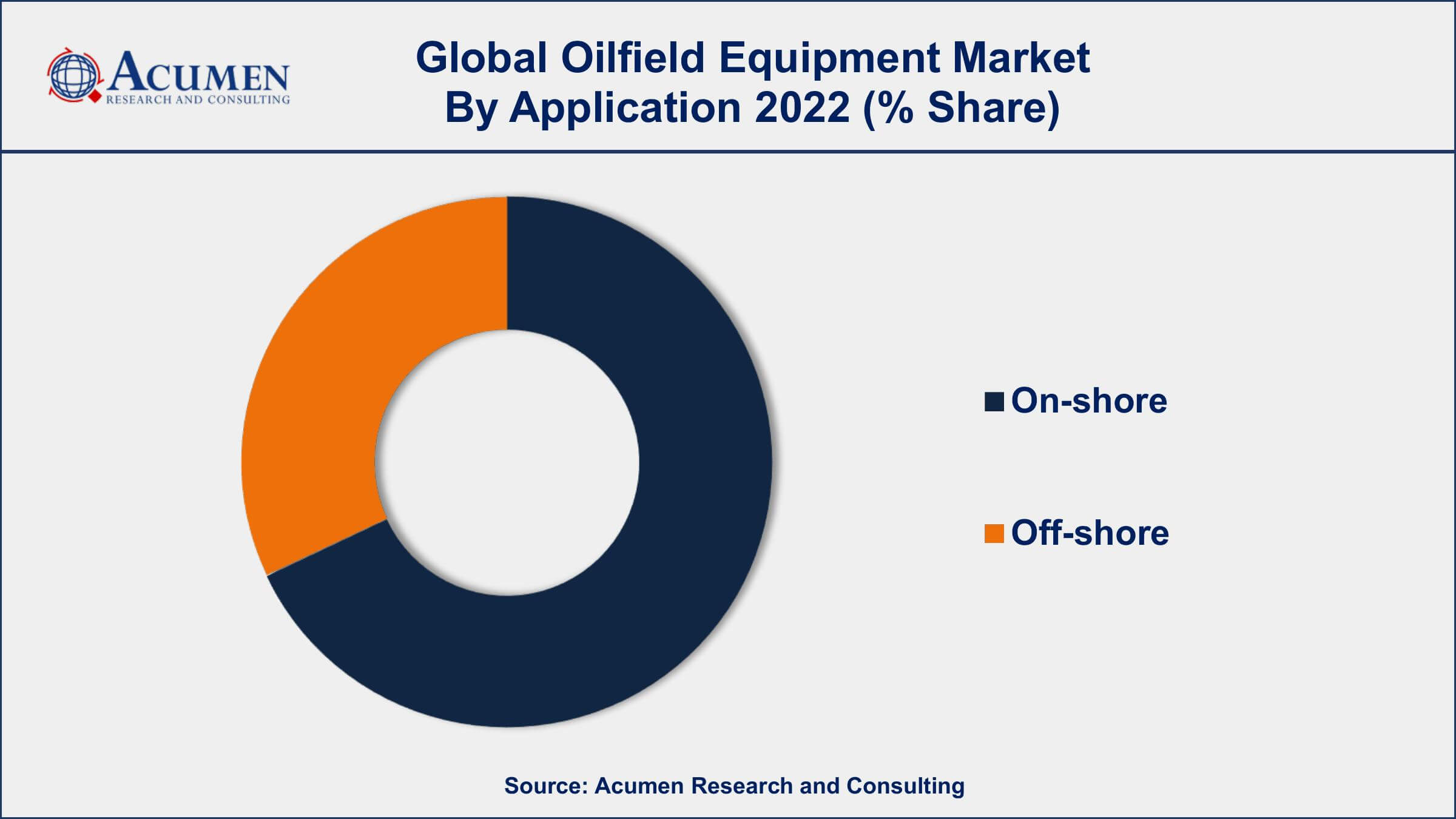

Oilfield Equipment Market By Application

- On-shore

- Off-shore

According to the oilfield equipment market forecast, the onshore segment is expected to witness significant growth over the next few years. This growth is driven by increasing demand for oil and gas, particularly from emerging economies, and the development of new oil and gas fields. The onshore segment includes various types of drilling rigs, such as vertical and horizontal drilling rigs, as well as equipment used in drilling operations, such as drilling bits, mud pumps, and drill pipes. The completion equipment used in onshore operations includes wellheads, casing, and tubing, while the production equipment includes pumps, compressors, and separators. Additionally, the increasing demand for automation and digital technologies in onshore operations has created new opportunities for market players. The use of data analytics, artificial intelligence, and robotics in onshore operations has improved efficiency and reduced costs.

Oilfield Equipment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Oilfield Equipment Market Regional Analysis

North America is dominating the oilfield equipment market due to the significant growth of shale oil and gas production in the region. The development of advanced hydraulic fracturing and horizontal drilling technologies has enabled the extraction of oil and gas from unconventional sources, particularly in the United States. This has driven the demand for oilfield equipment, such as drilling rigs, pumps, and completion equipment. The United States is one of the largest producers of oil and gas in the world, and this has contributed to the dominance of North America in the oilfield equipment market.

Moreover, the presence of major oilfield equipment manufacturers in North America has contributed to the growth of the market. Companies such as Schlumberger, Halliburton, and Baker Hughes have their headquarters in the United States, and they have significant operations in Canada as well. These companies are investing heavily in research and development to develop advanced equipment that can improve efficiency and reduce costs in oil and gas production activities.

Oilfield Equipment Market Player

Some of the top oilfield equipment market companies offered in the professional report includes ABB, Delta Corporation, Baker Hughes, Integrated Equipment, EthosEnergy Group Limited, MSP/Drilex, Inc., Jereh Oilfield Equipment, Uztel S.A, Sunnda Corporation, and Weir Group.

Frequently Asked Questions

What was the market size of the global oilfield equipment in 2022?

The market size of oilfield equipment was USD 122.4 Billion in 2022.

What is the CAGR of the global oilfield equipment market during forecast period of 2023 to 2032?

The CAGR of oilfield equipment market is 3.8% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global oilfield equipment market are ABB, Delta Corporation, Baker Hughes, Integrated Equipment, EthosEnergy Group Limited, MSP/Drilex, Inc., Jereh Oilfield Equipment, Uztel S.A, Sunnda Corporation, and Weir Group.

Which region held the dominating position in the global oilfield equipment market?

North America held the dominating position in oilfield equipment market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for oilfield equipment market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global oilfield equipment market?

The current trends and dynamics in the oilfield equipment industry include the increased offshore exploration and production activities and government initiatives to boost oil and gas production.

Which type held the maximum share in 2022?

The drilling equipment type held the maximum share of the oilfield equipment market.