Oil Pipeline Infrastructure Market | Acumen Research and Consulting

Oil Pipeline Infrastructure Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

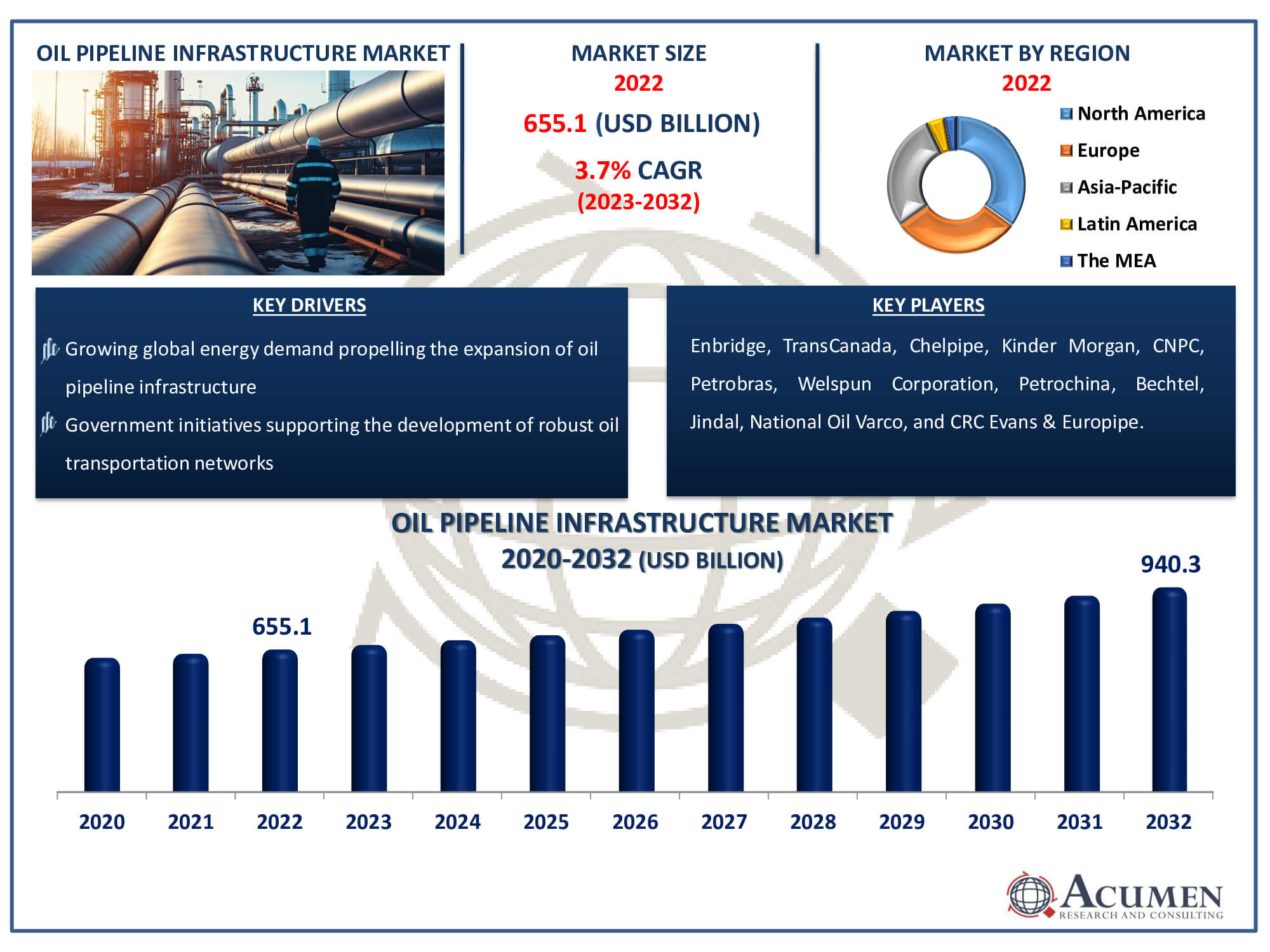

The Oil Pipeline Infrastructure Market Size accounted for USD 655.1 Billion in 2022 and is estimated to achieve a market size of USD 940.3 Billion by 2032 growing at a CAGR of 3.7% from 2023 to 2032.

Oil Pipeline Infrastructure Market Highlights

- Global oil pipeline infrastructure market revenue is poised to garner USD 940.3 billion by 2032 with a CAGR of 3.7% from 2023 to 2032

- North America oil pipeline infrastructure market value occupied around USD 229.3 billion in 2022

- Asia-Pacific oil pipeline infrastructure market growth will record a CAGR of more than 4% from 2023 to 2032

- Among operation, the transmission sub-segment generated over US$ 438.9 billion revenue in 2022

- Based on application, the onshore sub-segment generated around 60% share in 2022

- Collaboration with governments for sustainable and eco-friendly pipeline projects is a popular oil pipeline infrastructure market trend that fuels the industry demand

In order to efficiently transport crude oil from extraction sites to refineries and end customers, the oil pipeline infrastructure market is essential to the global energy environment. This vital infrastructure is made up of a vast network of storage facilities, pumping stations, and pipelines that are intended to maintain a safe and dependable supply chain. The necessity for economical and ecologically friendly ways to transport oil is driving the market for oil pipeline infrastructure as the world's energy consumption keeps growing. To fulfill the expanding demand for energy while maintaining the sustainability and dependability of oil transportation networks, governments, industry participants, and investors all contribute to the development and upkeep of this infrastructure. They place a strong emphasis on technological improvements and safety measures.

Global Oil Pipeline Infrastructure Market Dynamics

Market Drivers

- Growing global energy demand propelling the expansion of oil pipeline infrastructure

- Advancements in pipeline technology enhancing efficiency and safety

- Increasing exploration and production activities in oil-rich regions

- Government initiatives supporting the development of robust oil transportation networks

Market Restraints

- Environmental concerns and opposition, leading to regulatory hurdles

- Volatility in oil prices impacting investment and project feasibility

- Land acquisition challenges and community resistance to pipeline projects

Market Opportunities

- Expansion opportunities in emerging markets with rising energy consumption

- Adoption of digital technologies for pipeline monitoring and maintenance

- Integration of renewable energy sources into existing pipeline infrastructure

Oil Pipeline Infrastructure Market Report Coverage

| Market | Oil Pipeline Infrastructure Market |

| Oil Pipeline Infrastructure Market Size 2022 | USD 655.1 Billion |

| Oil Pipeline Infrastructure Market Forecast 2032 | USD 940.3 Billion |

| Oil Pipeline Infrastructure Market CAGR During 2023 - 2032 | 3.7% |

| Oil Pipeline Infrastructure Market Analysis Period | 2020 - 2032 |

| Oil Pipeline Infrastructure Market Base Year |

2022 |

| Oil Pipeline Infrastructure Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By Operation, By Diameter, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Enbridge, TransCanada, Chelpipe, Kinder Morgan, CNPC, Petrobras, Welspun Corporation, Petrochina, Bechtel, Jindal, National Oil Varco, CRC Evans, and Europipe |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Oil Pipeline Infrastructure Market Insights

The global market size is driven by flourishing energy demand in rapidly growing economies. Globalization has accelerated international trade, increasing the demand for reliable infrastructure. Major oil-rich economies, including Saudi Arabia, Iran, and Iraq, are heavily investing in infrastructural expansion to support exports and provide reliable flows to centers of demand. The further development of a dedicated pipeline system will be encouraged to facilitate the transport of crude oil and refined products under long-term supply contracts. The continued replacement of aging infrastructure for oil and gas will drive the global market for streamlined and economic transport. However, strict regulatory policies, coupled with rising environmental safety concerns, may affect industry growth. According to a Greenpeace report, Energy Transfer Partners spilled more than 3.6 million gallons of crude oil from 2002 to 2017.

Due to global discoveries and the development of pipeline infrastructure, the oil pipeline industry has grown enormously in the past decade. The number of installation projects has increased to meet this surge in demand, with almost 3,802 km of pipelines under construction worldwide and planned in 2017. Currently, oil is the primary energy source in most countries globally. However, the global shift to renewable energy sources poses a significant threat to the demand for oil and gas, presenting a major challenge to the growth of pipelines and gas plants in the oil pipeline infrastructure industry forecast period.

Oil Pipeline Infrastructure Market Segmentation

The worldwide market for oil pipeline infrastructure is split based on product, application, operation, diameter, and geography.

Oil Pipeline Infrastructure Product

- Petroleum Product

- Crude Oil

According to oil pipeline infrastructure industry analysis, in response to the growing demand for dedicated networks providing points of contact and access to resources, the market is poised for expansion. The development of new pipeline projects will commence, fueled by increased investments in Exploration and Production (E&P) activities coupled with booming production from shale plays. Key advantages, including low operating costs and safe and efficient transport, will further incentivize the use of pipelines over other means of transportation.

The pipeline infrastructure market will be bolstered by upcoming refineries across Asia and the modernization of existing units in Europe and North America. Refined pipelines will deliver crude oil condensates from refineries to various companies and consumers relying on feedstock for their operations. Increasing demand from industries and various business facilities will enhance the industry outlook. Notably, most airports across North America depend on the direct supply of jet fuel from pipelines with dedicated networks.

Oil Pipeline Infrastructure Application

- Offshore

- Onshore

The largest and most often used use of oil pipeline infrastructure is the onshore sector, which is crucial to the global energy landscape. In order to connect production locations, refineries, and distribution centres, onshore pipelines are essential for the overland transportation of crude oil and refined products. The importance of onshore pipelines can be attributed to their effectiveness, affordability, and dependability in satisfying the increasing worldwide need for energy.

The transportation of hydrocarbons from extraction stations, which are frequently situated in remote areas, to major consumption centres and distribution hubs is made easier by the large network of onshore pipelines. This infrastructure makes oil delivery safer and more environmentally friendly by reducing the need for other, less effective modes of transportation like trucks or trains.

Onshore pipelines also help local industries, create jobs, and facilitate the growth of oil-rich areas, all of which are factors in economic development. Onshore pipeline projects' scalability makes it possible to accommodate rising production capacity and adjust to the changing needs of the oil and gas sector. Furthermore, compared to offshore projects, onshore pipelines are subject to less complicated regulatory processes, which speeds up their construction.

Oil Pipeline Infrastructure Operation

- Gathering

- Transmission

Within the oil pipeline infrastructure market, the transmission segment is the largest. By moving crude oil and processed products over great distances from producing areas to refining facilities and ultimate users, it plays a crucial part in the energy supply chain. The need for dependable and effective long-distance transportation has led to significant expenditures in transmission pipelines. The importance of this segment is derived from its capacity to enable the smooth transportation of oil over large networks, hence augmenting the general dependability and availability of energy resources.

Oil Pipeline Infrastructure Diameters

- > 24 Inch

- ≤ 8 Inch

- >8-24 Inch

The demand for oil pipeline infrastructure ranging from more than 8 to 24 inches has been fueled by rapid progress in Exploration and Production (E&P) technology, along with the integration of digital software and equipment. Governments allocate funds for upgrading and expanding the existing network, utilizing these pipelines as trunk lines for long-distance transmission.

With the increasing installation of greenfield transmission pipelines, those exceeding 24 inches are expected to gain momentum. The industry will be further enhanced by ongoing discoveries and increased production from existing oil fields. Moreover, large-diameter pipes are installed across offshore installations and major pipeline projects.

Oil Pipeline Infrastructure Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Oil Pipeline Infrastructure Market Regional Analysis

According to the most recent data available, the North American region is the greatest market for oil pipeline infrastructure because of its huge and well-established network that serves the significant oil output in both the United States and Canada. The large sums of money invested in pipeline projects, especially to speed up the transfer of crude oil from large shale fields, highlight the region's dominance. North America's leading position in the worldwide oil pipeline infrastructure market is mostly due to the region's use of pipelines for the transportation of gas and oil.

On the other hand, the oil pipeline infrastructure market with the quickest rate of growth is the Asia-Pacific area. Rapid industrialization and economic expansion in nations like China and India have increased energy consumption, necessitating the development of effective and dependable methods of moving oil. To keep up with the growing demand for energy resources, governments in the Asia-Pacific area are making large investments in modernising and expanding their oil pipeline infrastructure. The region's continued exploration and production efforts further add to the growing need for pipeline networks.

In addition, the Asia-Pacific area gains from the formation of strategic alliances and joint ventures, such the one between Exxon Mobil and Repsol in the Caribbean Sea, which aims to investigate underwater production. The region's quick expansion in this market is partly attributed to these collaborations, which promote technological breakthroughs and improve the overall capacity and efficiency of oil pipeline infrastructure. Overall, the global market for oil pipeline infrastructure is expanding at the highest rate in Asia-Pacific due to the region's dynamic economic environment, notwithstanding North America's existing dominance.

Oil Pipeline Infrastructure Market Players

Some of the top oil pipeline infrastructure companies offered in our report Enbridge, TransCanada, Chelpipe, Kinder Morgan, CNPC, Petrobras, Welspun Corporation, Petrochina, Bechtel, Jindal, National Oil Varco, CRC Evans, and Europipe.

Frequently Asked Questions

How big is the oil pipeline infrastructure market?

The market size of oil pipeline infrastructure was USD 655.1 billion in 2022.

What is the CAGR of the global oil pipeline infrastructure market from 2023 to 2032?

The CAGR of oil pipeline infrastructure is 3.7% during the analysis period of 2023 to 2032.

Which are the key players in the oil pipeline infrastructure market?

The key players operating in the global market are including Enbridge, TransCanada, Chelpipe, Kinder Morgan, CNPC, Petrobras, Welspun Corporation, Petrochina, Bechtel, Jindal, National Oil Varco, CRC Evans, and Europipe.

Which region dominated the global oil pipeline infrastructure market share?

North America held the dominating position in oil pipeline infrastructure industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of oil pipeline infrastructure during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global oil pipeline infrastructure industry?

The current trends and dynamics in the oil pipeline infrastructure industry include rising air travel demand and increasing passenger numbers, growing disposable incomes, fostering demand for premium in-flight catering, advancements in technology, including efficient Application ordering systems, and robust marketing strategies by major brands enhancing in-flight dining experiences

Which operation held the maximum share in 2022?

The transmission operation held the maximum share of the oil pipeline infrastructure industry.