Offshore Oil & Gas Paints & Coatings Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Offshore Oil & Gas Paints & Coatings Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

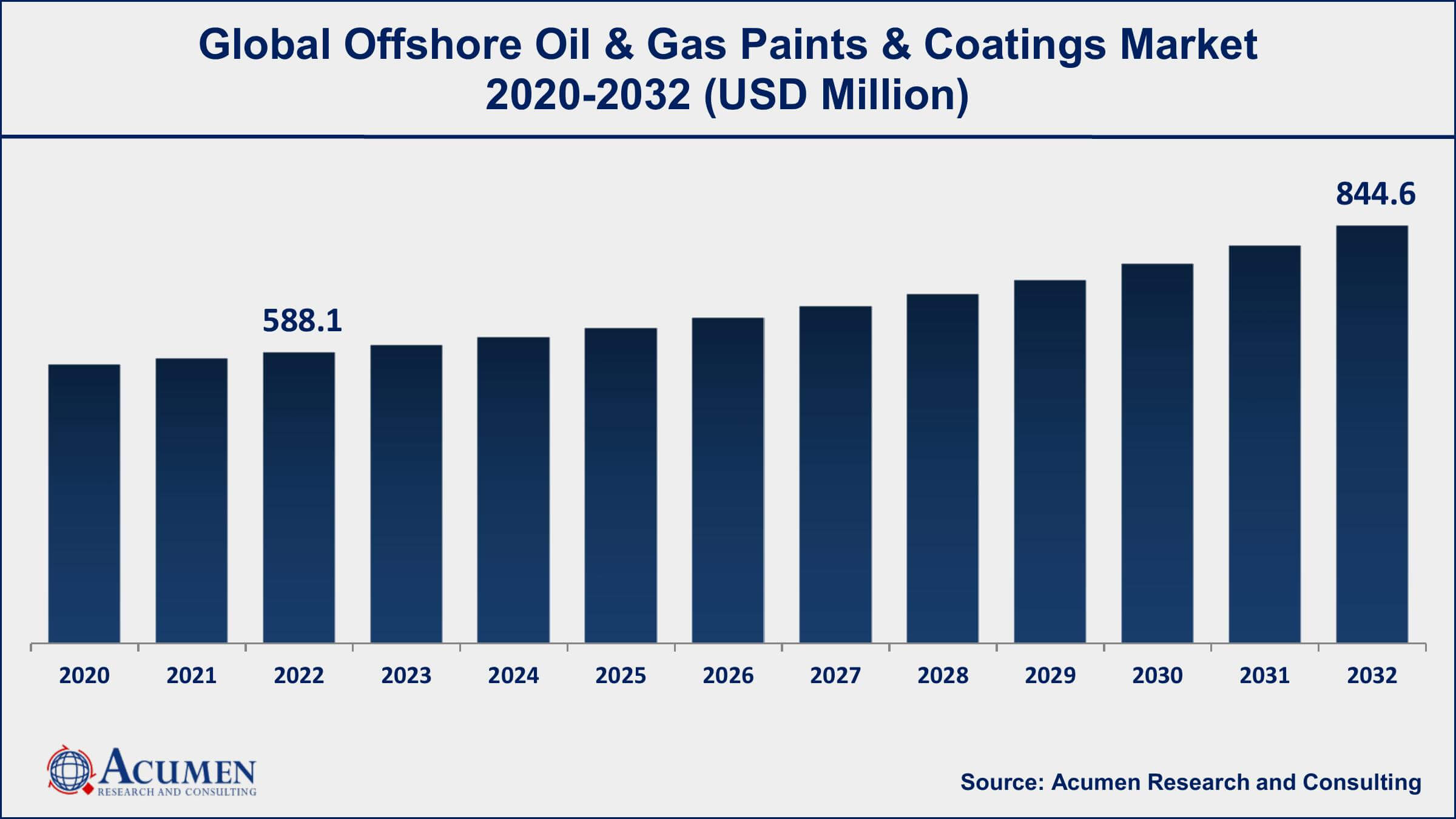

The Global Offshore Oil & Gas Paints & Coatings Market Size accounted for USD 588.1 Million in 2022 and is projected to achieve a market size of USD 844.6 Million by 2032 growing at a CAGR of 3.8% from 2023 to 2032.

Offshore Oil & Gas Paints & Coatings Market Highlights

- Global offshore oil & gas paints & coatings market revenue is expected to increase by USD 844.6 Million by 2032, with a 3.8% CAGR from 2023 to 2032

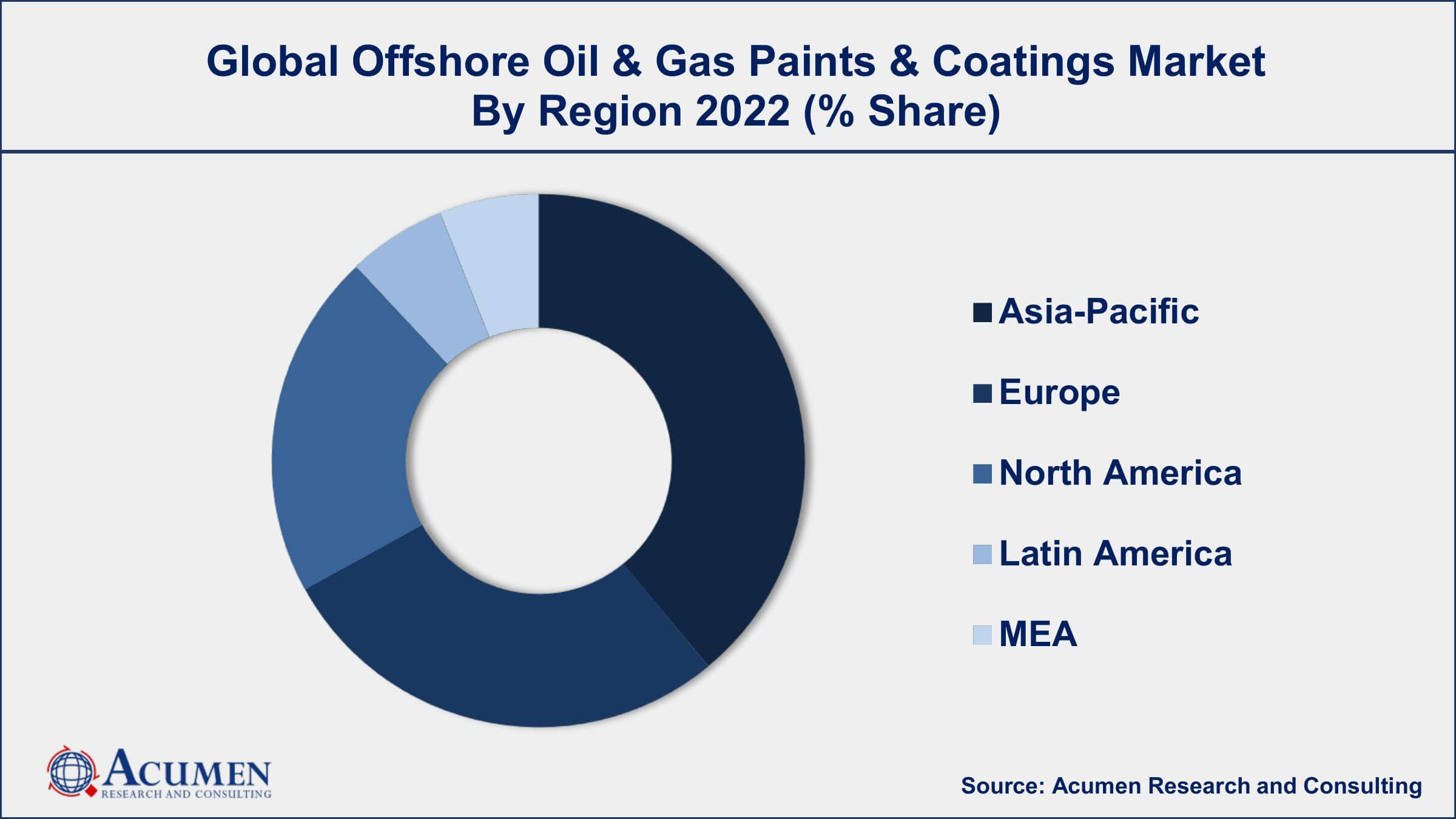

- Asia-Pacific region led with more than 37% of offshore oil & gas paints & coatings market share in 2022

- According to a study, offshore oil and gas production accounts for more than 30% of the world's total oil production

- By resin type, epoxy is the largest segment of the market, accounting for over 32% of the global market share

- By installation type, drillship is one of the largest and fastest-growing segments of the offshore oil & gas paints & coatings industry

- Increasing offshore oil and gas exploration and production activities, drives the offshore oil & gas paints & coatings market value

Offshore oil and gas paints and coatings are specially formulated coatings used for protecting offshore oil and gas structures and equipment from corrosion, weathering, and other environmental factors. These structures and equipment include pipelines, platforms, drilling rigs, subsea equipment, and storage tanks. Offshore oil and gas paints and coatings also help to improve the longevity and performance of the equipment, thereby reducing maintenance costs and improving operational efficiency.

The global offshore oil and gas paints and coatings market has been growing steadily in recent years, driven by the increasing demand for oil and gas around the world. The market is also benefiting from the development of new oil and gas fields in offshore locations, as well as the need for maintenance and repair of existing infrastructure. Furthermore, the development of new technologies and materials is also contributing to the growth of the market, as companies are looking for more effective and durable coatings that can withstand harsh offshore environments. Furthermore, the development of new and innovative coatings that offer improved durability, corrosion resistance, and reduced maintenance costs is also expected to drive the growth of the market in the coming years.

Global Offshore Oil & Gas Paints & Coatings Market Trends

Market Drivers

- Increasing investments in offshore oil and gas exploration and production activities

- Growing demand for high-performance coatings that can withstand harsh offshore environments

- Development of new oil and gas fields in offshore locations

- Need for maintenance and repair of existing offshore infrastructure

- Growing awareness about the benefits of using protective coatings in offshore applications

Market Restraints

- Volatility in crude oil prices

- Stringent environmental regulations

Market Opportunities

- Increasing adoption of eco-friendly coatings

- Growing focus on asset management and lifecycle costing in the oil and gas industry

Offshore Oil & Gas Paints & Coatings Market Report Coverage

| Market | Offshore Oil & Gas Paints & Coatings Market |

| Offshore Oil & Gas Paints & Coatings Market Size 2022 | USD 588.1 Million |

| Offshore Oil & Gas Paints & Coatings Market Forecast 2032 | USD 844.6 Million |

| Offshore Oil & Gas Paints & Coatings Market CAGR During 2023 - 2032 | 3.8% |

| Offshore Oil & Gas Paints & Coatings Market Analysis Period | 2020 - 2032 |

| Offshore Oil & Gas Paints & Coatings Market Base Year | 2022 |

| Offshore Oil & Gas Paints & Coatings Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Resin Type, By Installation Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AkzoNobel, PPG Industries, Hempel, Jotun, Sherwin-Williams, BASF, RPM International, KCC Corporation, Carboline, Chugoku Marine Paints, Nippon Paint Marine, and Wacker Chemie AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The offshore oil and gas industry is a key market for paints and coatings. Paints and coatings are used in a variety of applications, such as protecting offshore structures from corrosion and providing visual safety markings on platforms and pipelines. Over the years, the offshore oil and gas paints and coatings market has evolved significantly in response to changing industry needs and regulations. One of the biggest drivers of change in the offshore oil and gas paints and coatings market has been the need to reduce environmental impact. As the industry faces increasing scrutiny over its environmental footprint, there is a growing demand for coatings that are more eco-friendly. This has led to the development of new coatings that are free from harmful chemicals, have a lower carbon footprint, and are more durable in harsh offshore environments.

The offshore oil and gas paints and coatings market refers to the use of specialized coatings and paints in offshore oil and gas facilities and structures such as pipelines, rigs, and platforms. The coatings and paints used in these applications are designed to protect the structures from corrosion, abrasion, and other types of damage that can occur in harsh marine environments. The growth is further propelled by the need for long-term protection against corrosion, as well as the need for increased safety in offshore oil and gas facilities. The use of specialized coatings and paints also helps to extend the lifespan of offshore oil and gas facilities and structures, reducing maintenance costs and downtime.

Offshore Oil & Gas Paints & Coatings Market Segmentation

The global offshore oil & gas paints & coatings market segmentation is based on resin type, installation type, and geography.

Offshore Oil & Gas Paints & Coatings Market By Resin Type

- Epoxy

- Inorganic Zinc

- Polyurethane

- Acrylic

- Alkyd

- Others

In terms of resin types, the epoxy segment has seen significant growth in recent years. Epoxy coatings offer excellent corrosion resistance, adhesion, and durability, making them ideal for use in harsh offshore environments. Epoxy coatings are also used for a wide range of offshore applications, including pipelines, subsea equipment, and offshore platforms. One of the key factors driving the growth of the epoxy segment is the increasing demand for high-performance coatings that can withstand harsh offshore environments. Epoxy coatings are known for their excellent resistance to water, chemicals, and abrasion, which makes them ideal for offshore applications. Furthermore, the development of new and innovative epoxy coatings is also expected to drive the growth of the segment. Companies are investing in research and development to develop new coatings that offer improved durability, corrosion resistance, and reduced maintenance costs. For example, some companies are developing epoxy coatings with special additives that can enhance the performance of the coating in offshore environments.

Offshore Oil & Gas Paints & Coatings Market By Installation Type

- Jackups

- Drillships

- Floaters

- Semisubmersibles

- Others

According to the offshore oil & gas paints & coatings market forecast, the drillships segment is expected to witness significant growth in the coming years. Drillships are one of the major types of offshore oil and gas structures that require protective coatings. These structures are equipped with drilling rigs and are used for exploratory drilling and production of oil and gas in offshore locations. Drillships are exposed to harsh environmental conditions, such as saltwater, UV radiation, and extreme temperatures, which can cause corrosion and damage to the equipment. Therefore, the use of high-performance paints and coatings is essential to protect the drillships and ensure their long-term performance. One of the key drivers of the growth of this segment is the increasing investments in offshore oil and gas exploration and production activities. As the demand for oil and gas continues to grow, companies are expanding their exploration and production activities in offshore locations, which is driving the demand for protective coatings for drillships. Furthermore, the development of new and innovative coatings is also expected to drive the growth of the drillships segment.

Offshore Oil & Gas Paints & Coatings Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Offshore Oil & Gas Paints & Coatings Market Regional Analysis

Asia-Pacific is the dominant region in the offshore oil and gas paints and coatings market. One of the key reasons for this dominance is the significant investments in offshore oil and gas exploration and production activities in the region. Countries such as China, India, and Indonesia have been investing heavily in offshore oil and gas exploration, which is driving the demand for protective coatings for offshore structures such as drilling rigs, pipelines, and offshore platforms. Furthermore, the presence of a large number of offshore oil and gas companies in the region is also driving the growth of the market. Many multinational companies, as well as local players, are operating in the offshore oil and gas industry in Asia-Pacific. These companies require high-quality and durable coatings to protect their offshore assets from the harsh environmental conditions in the region, which is driving the demand for protective coatings. In addition, the development of new and innovative coatings in the region is also contributing to the growth of the market.

Offshore Oil & Gas Paints & Coatings Market Player

Some of the top offshore oil & gas paints & coatings market companies offered in the professional report include AkzoNobel, PPG Industries, Hempel, Jotun, Sherwin-Williams, BASF, RPM International, KCC Corporation, Carboline, Chugoku Marine Paints, Nippon Paint Marine, and Wacker Chemie AG.

Frequently Asked Questions

What was the market size of the global offshore oil & gas paints & coatings in 2022?

The market size of offshore oil & gas paints & coatings was USD 588.1 Million in 2022.

What is the CAGR of the global offshore oil & gas paints & coatings market from 2023 to 2032?

The CAGR of offshore oil & gas paints & coatings is 3.8% during the analysis period of 2023 to 2032.

Which are the key players in the offshore oil & gas paints & coatings market?

The key players operating in the global market are including AkzoNobel, PPG Industries, Hempel, Jotun, Sherwin-Williams, BASF, RPM International, KCC Corporation, Carboline, Chugoku Marine Paints, Nippon Paint Marine, and Wacker Chemie AG.

Which region dominated the global offshore oil & gas paints & coatings market share?

Asia-Pacific held the dominating position in offshore oil & gas paints & coatings industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of offshore oil & gas paints & coatings during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global offshore oil & gas paints & coatings industry?

The current trends and dynamics in the offshore oil & gas paints & coatings market growth include increasing investments in offshore oil and gas exploration and production activities, growing demand for high-performance coatings that can withstand harsh offshore environments, and development of new oil and gas fields in offshore locations.

Which resin type held the maximum share in 2022?

The epoxy resin type held the maximum share of the offshore oil & gas paints & coatings industry.