Offshore Drilling Fluids Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Offshore Drilling Fluids Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

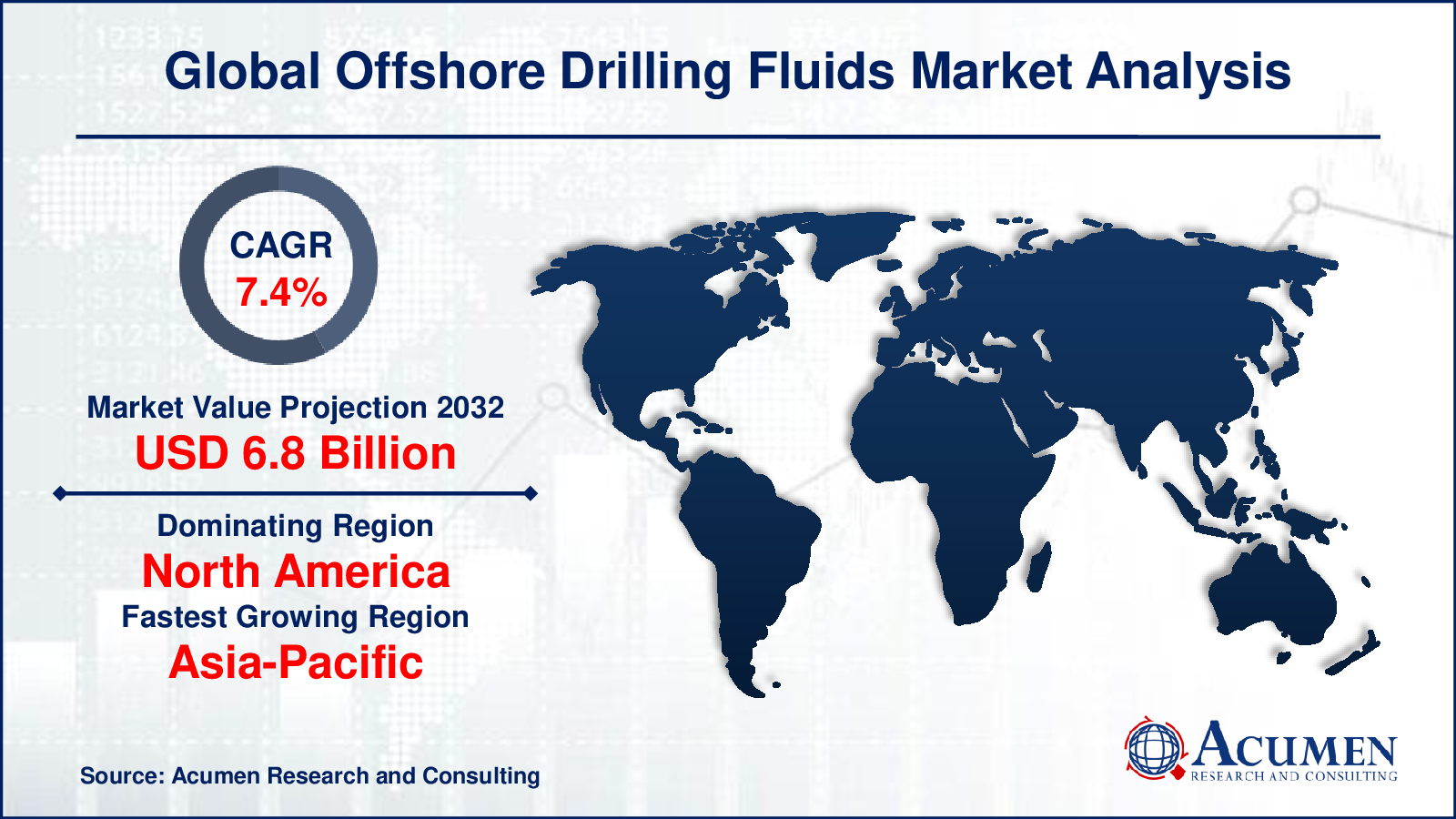

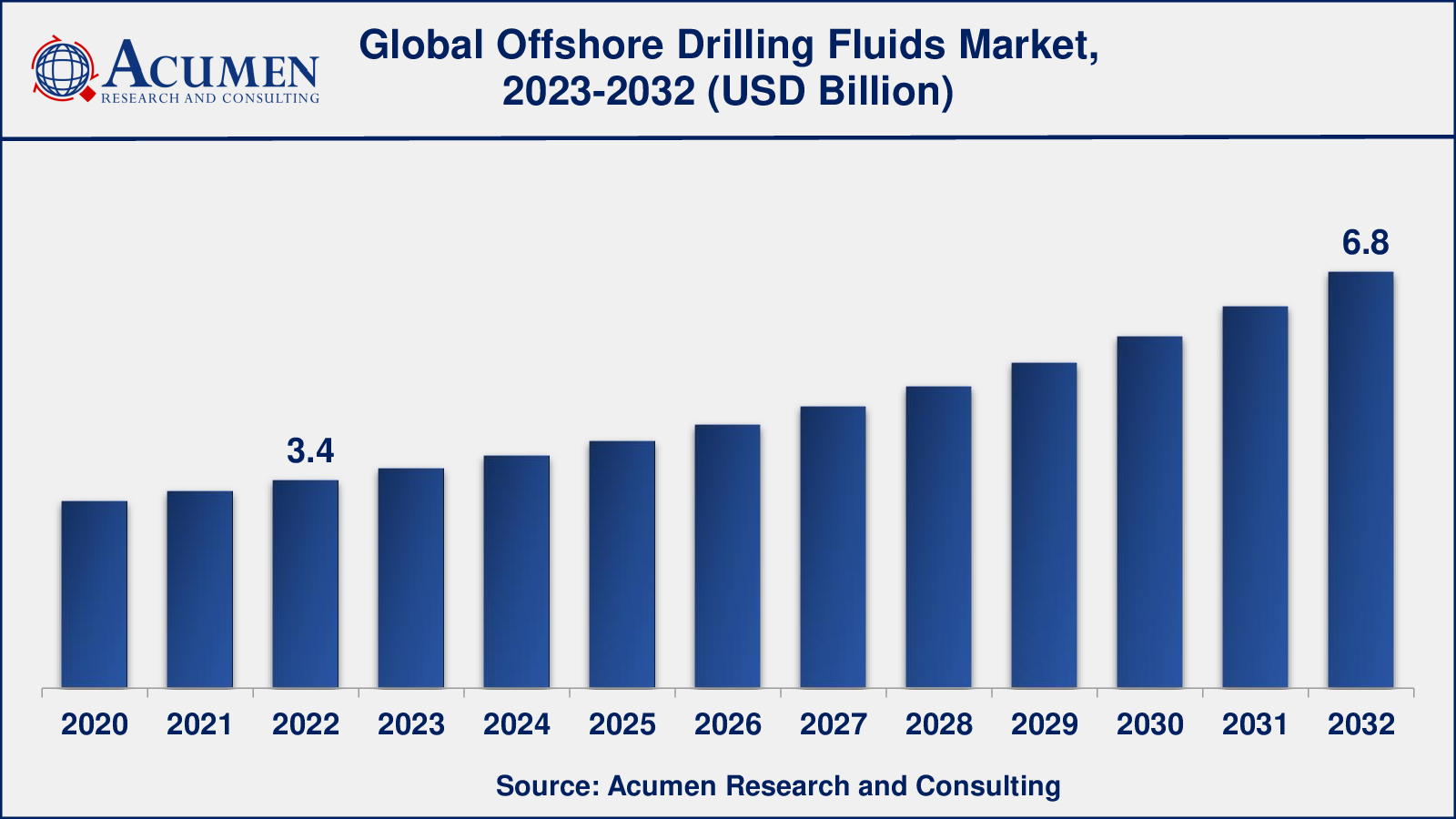

The Global Offshore Drilling Fluids Market Size accounted for USD 3.4 Billion in 2022 and is estimated to achieve a market size of USD 6.8 Billion by 2032 growing at a CAGR of 7.4% from 2023 to 2032.

Offshore Drilling Fluids Market Highlights

- Global offshore drilling fluids market revenue is poised to garner USD 6.8 billion by 2032 with a CAGR of 7.4% from 2023 to 2032

- North America offshore drilling fluids market value occupied almost USD 1.2 billion in 2022

- Asia-Pacific offshore drilling fluids market growth will record a CAGR of over 8% from 2023 to 2032

- Among type, the water-based fluids (WBF) sub-segment generated over US$ 1.7 billion revenue in 2022

- Based on end-use, the deepwater drilling sub-segment generated around 41% share in 2022

- Growing focus on environmentally sustainable drilling practices is a popular offshore drilling fluids market trend that fuels the industry demand

Drilling fluids, also known as drilling mud, assume a significant part in drilling activities in mineral extraction, oil, and gas extraction, and bore wells. These drilling fluids are utilized to evacuate cuttings, grease up and cool the drilling bits, control the formation pressure, and keep up the stability of the well. In addition to this, offshore drilling fluids are used as shale inhibitors, corrosion inhibitors, defoamers, emulsifiers, filtration reducers, breakers, biocides, and weighting operators, with particular additives. The drilling fluids are basically of four types viz, water-based, oil-based, synthetic, and pneumatic fluids.

Global Offshore Drilling Fluids Market Dynamics

Market Drivers

- Increasing demand for oil and gas from emerging economies

- Rising investments in offshore oil and gas exploration and production

- Advancements in drilling technology and equipment

- Increase in deepwater and ultra-deepwater drilling projects

Market Restraints

- Volatility in crude oil prices

- Stringent government regulations regarding offshore drilling practices

- Fluctuations in demand for drilling fluids due to changes in drilling activity

Market Opportunities

- Growing demand for specialized drilling fluids for unconventional oil and gas resources

- Increasing demand for drilling fluids in offshore wind turbine installations and tidal energy projects

- Increasing adoption of environmentally friendly drilling fluids

- Development of customized and high-performance drilling fluid formulations

Offshore Drilling Fluids Market Report Coverage

| Market | Offshore Drilling Fluids Market |

| Offshore Drilling Fluids Market Size 2022 | USD 3.4 Billion |

| Offshore Drilling Fluids Market Forecast 2032 | USD 6.8 Billion |

| Offshore Drilling Fluids Market CAGR During 2023 - 2032 | 7.4% |

| Offshore Drilling Fluids Market Analysis Period | 2020 - 2032 |

| Offshore Drilling Fluids Market Base Year | 2022 |

| Offshore Drilling Fluids Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Application, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Anchor Drilling Fluids USA, Inc., Baker Hughes, Calumet Specialty Products Partners, L.P., CES Energy Solutions Corp., Clariant AG, General Electric, Halliburton, National Oilwell Varco, Newpark Resources, Solvay S.A., Schlumberger, TETRA Technologies, and Weatherford International. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Offshore Drilling Fluids Market Insights

Expanding support to manage the energy demand predominantly from North America and Europe combined with a developing number of profound water discoveries in the Persian Gulf and Pacific areas is anticipated to drive the demand for offshore drilling fluids market over the forecast period. Manufacturing companies are moving their emphasis on growing new solutions in light of nanotechnology to beat mechanical and natural challenges.

Expanded maintenance costs and environmental dangers related to offshore areas have urged companies to deploy mud for cost-effective E&P exercises. Developing interest in expanding the production rates, and productivity and mitigating gas-related capital expenditures are required to drive the market for offshore drilling fluids in the near future. The increasing number of progressing ventures in the Middle East and Africa including, Maydan Mahzam and Bul Hanine fields are anticipated to drive the demand throughout the forecast period.

Offshore Drilling Fluids Market, By Segmentation

The worldwide market for offshore drilling fluids is split based on product type, application, end-use industry, and geography.

Offshore Drilling Fluid Product Types

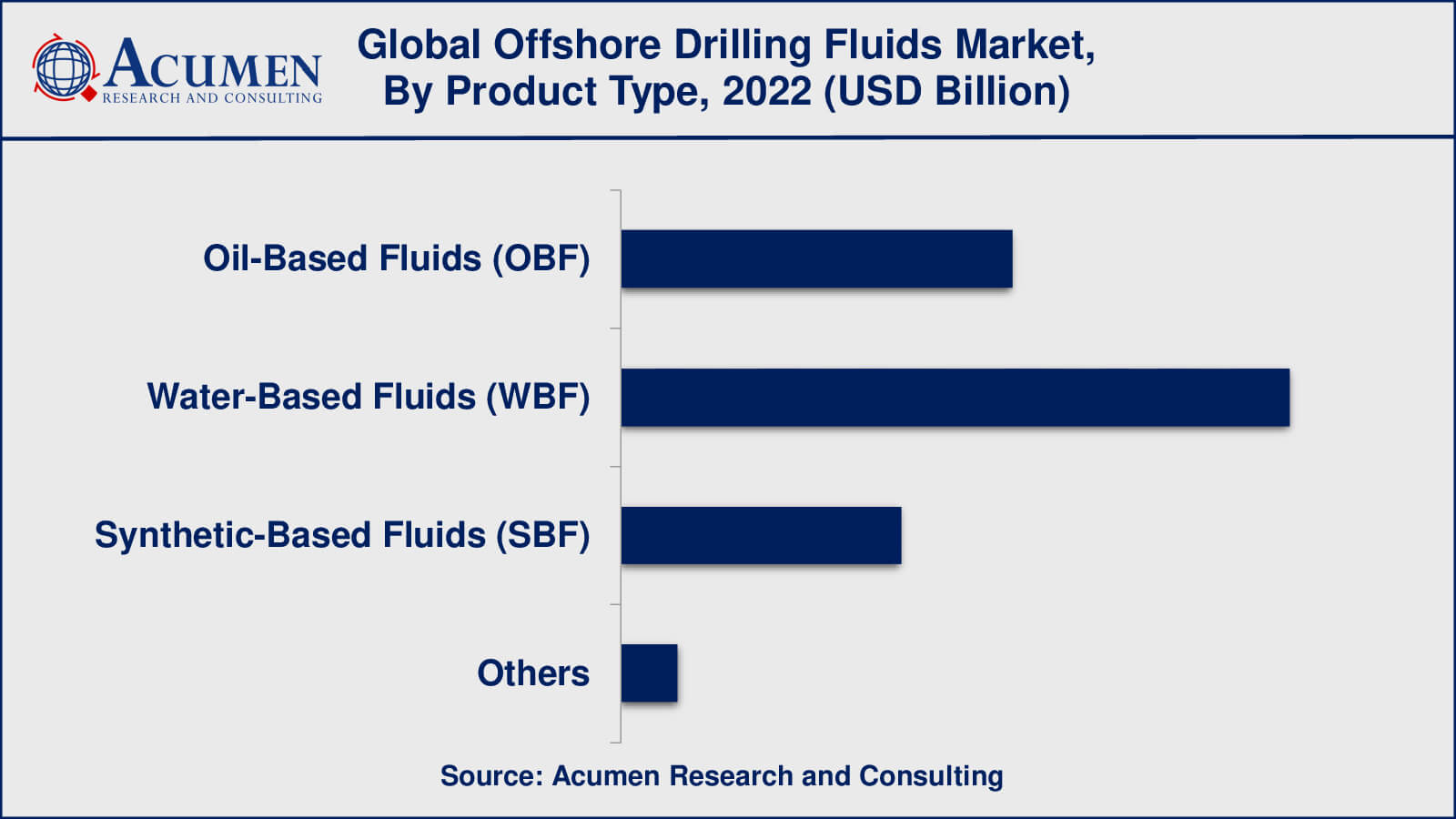

- Oil-Based Fluids (OBF)

- Water-Based Fluids (WBF)

- Synthetic-Based Fluids (SBF)

- Others

According to our offshore drilling fluids industry analysis, water-based fluids (WBF) have controlled the offshore drilling fluids market due to their environmentally friendly nature and cost-effectiveness when compared to oil-based fluids (OBF). Synthetic-based fluids (SBF) have gained popularity in some regions, such as the North Sea, due to their superior performance in high-temperature, high-pressure drilling conditions. However, depending on the specific needs of each drilling project, all types of offshore drilling fluids, including OBF and SBF, are still extensively used in the industry.

Offshore Drilling Fluid Applications

- Deepwater Drilling

- Shallow Water Drilling

- Ultra-Deepwater Drilling

The market for offshore drilling fluids has been dominated by deepwater drilling because of the rising demand for oil and gas from deepwater reserves. Oil and gas companies are exploring deeper waters to access new reserves due to advancements in drilling technology and equipment, resulting in an increase in deepwater drilling projects. Furthermore, due to advancements in drilling technology and the discovery of new oil and gas reserves in ultra-deep waters, ultra-deepwater drilling has seen significant growth in recent years. Shallow water drilling, on the other hand, remains a significant part of the offshore drilling fluids market, particularly in regions with abundant shallow water reserves, such as the Gulf of Mexico and the North Sea.

Offshore Drilling Fluid End-Use Industries

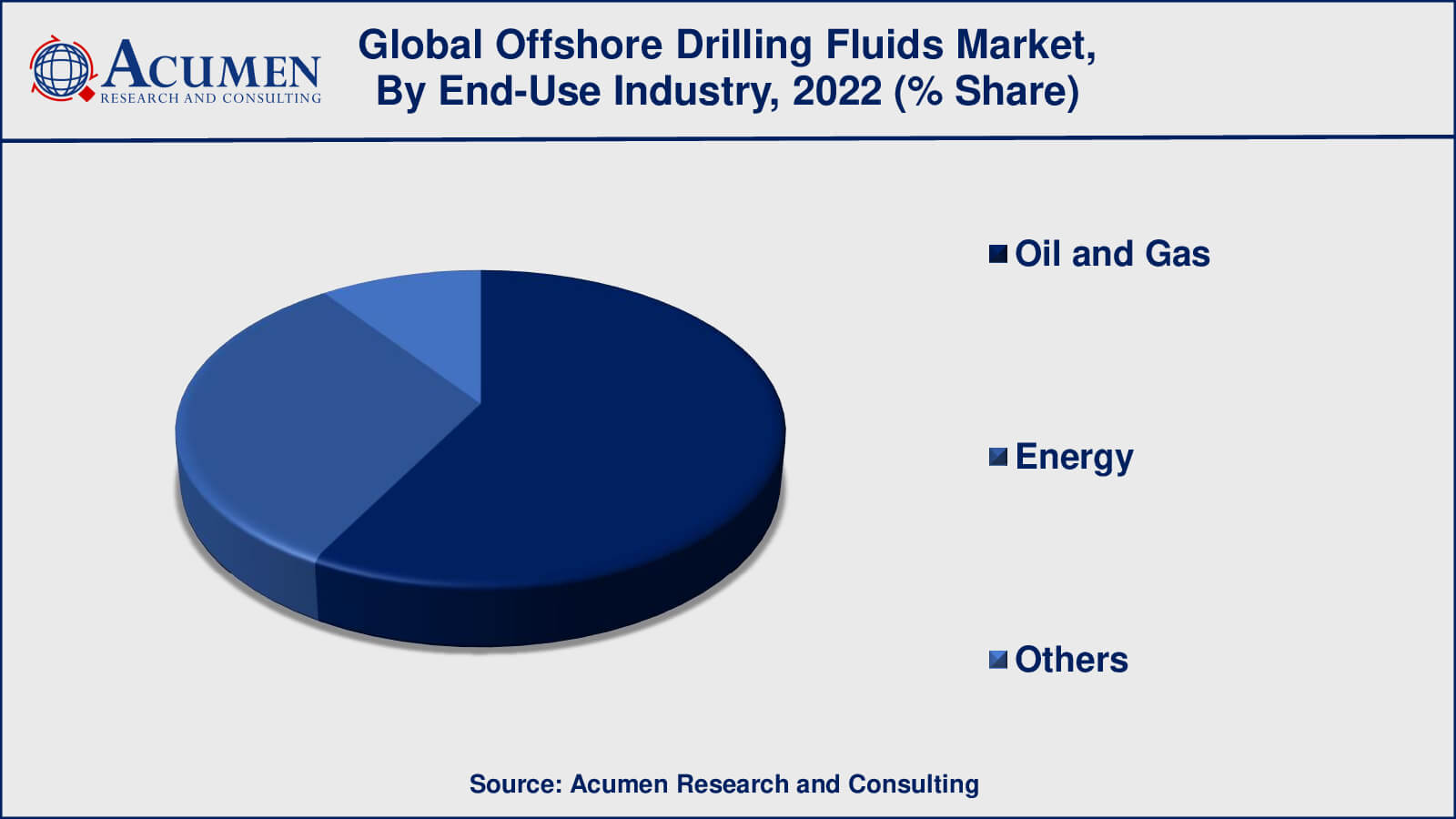

- Oil and Gas

- Energy

- Others

As per our offshore drilling fluids market forecast, the oil and gas industry is expected to lead the industry as offshore drilling is a vital part of oil and gas exploration and production. Offshore drilling fluids are used in the oil and gas industry to lubricate drill bits, maintain wellbore stability, and control formation pressure during drilling operations. Furthermore, rising demand for oil and gas from emerging economies has resulted in an increase in offshore drilling projects, fueling the growth of the offshore drilling fluids market.

Aside from the oil and gas industry, another significant end-use industry for offshore drilling fluids is the energy industry. Offshore drilling fluids are used in a variety of energy-related projects, including the installation of offshore wind turbines and tidal energy projects. These projects necessitate the use of specialised drilling fluids in order to maintain wellbore stability and prevent equipment damage.

Offshore Drilling Fluids Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Offshore Drilling Fluids Market Regional Analysis

The United States and Canada, which are major oil and gas producing countries, drive the North American offshore drilling fluids market. With a large number of deepwater and ultra-deepwater drilling projects, the Gulf of Mexico off the coast of the United States is a significant region for offshore drilling fluids.

Countries with extensive offshore oil and gas reserves in the North Sea, such as Norway and the United Kingdom, drive the European offshore drilling fluids market. In recent years, there has been a growing emphasis in Europe on sustainable and environmentally friendly drilling practices, which has led to an increase in the popularity of water-based and synthetic-based drilling fluids.

The Asia-Pacific offshore drilling fluids market is mainly influenced by countries with significant offshore oil and gas reserves, such as China, Indonesia, and Australia. The rising demand for energy from the region's emerging economies is propelling the offshore drilling fluids market forward.

Offshore Drilling Fluids Market Players

Some of the top offshore drilling fluids companies offered in the professional report include Anchor Drilling Fluids USA, Inc., Baker Hughes, Calumet Specialty Products Partners, L.P., CES Energy Solutions Corp., Clariant AG, General Electric, Halliburton, National Oilwell Varco, Newpark Resources, Solvay S.A., Schlumberger, TETRA Technologies, and Weatherford International.

Frequently Asked Questions

What was the market size of the global offshore drilling fluids in 2022?

The market size of offshore drilling fluids was USD 3.4 billion in 2022.

What is the CAGR of the global offshore drilling fluids market from 2023 to 2032?

The CAGR of offshore drilling fluids is 7.4% during the analysis period of 2023 to 2032.

Which are the key players in the offshore drilling fluids market?

The key players operating in the global offshore drilling fluids market are includes Anchor Drilling Fluids USA, Inc., Baker Hughes, Calumet Specialty Products Partners, L.P., CES Energy Solutions Corp., Clariant AG, General Electric, Halliburton, National Oilwell Varco, Newpark Resources, Solvay S.A., Schlumberger, TETRA Technologies, and Weatherford International.

Which region dominated the global offshore drilling fluids market share?

North America held the dominating position in offshore drilling fluids industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of offshore drilling fluids during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global offshore drilling fluids industry?

The current trends and dynamics in the offshore drilling fluids industry include increasing demand for oil and gas from emerging economies, rising investments in offshore oil and gas exploration and production, and advancements in drilling technology and equipment.

Which product type held the maximum share in 2022?

The oil-based fluids (OBF) product type held the maximum share of the offshore drilling fluids industry.