Nutraceutical Product Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Nutraceutical Product Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global Nutraceutical Product Market Size accounted for USD 335.5 Billion in 2022 and is projected to achieve a market size of USD 673.9 Billion by 2032 growing at a CAGR of 7.3% from 2023 to 2032.

Nutraceutical Product Market Key Highlights

- Global nutraceutical product market revenue is expected to increase by USD 673.9 Billion by 2032, with a 7.3% CAGR from 2023 to 2032

- North America region led with more than 37% of nutraceutical product market share in 2022

- Asia-Pacific is expected to be the fastest-growing region for nutraceuticals, with a CAGR of 9% from 2022 to 2032

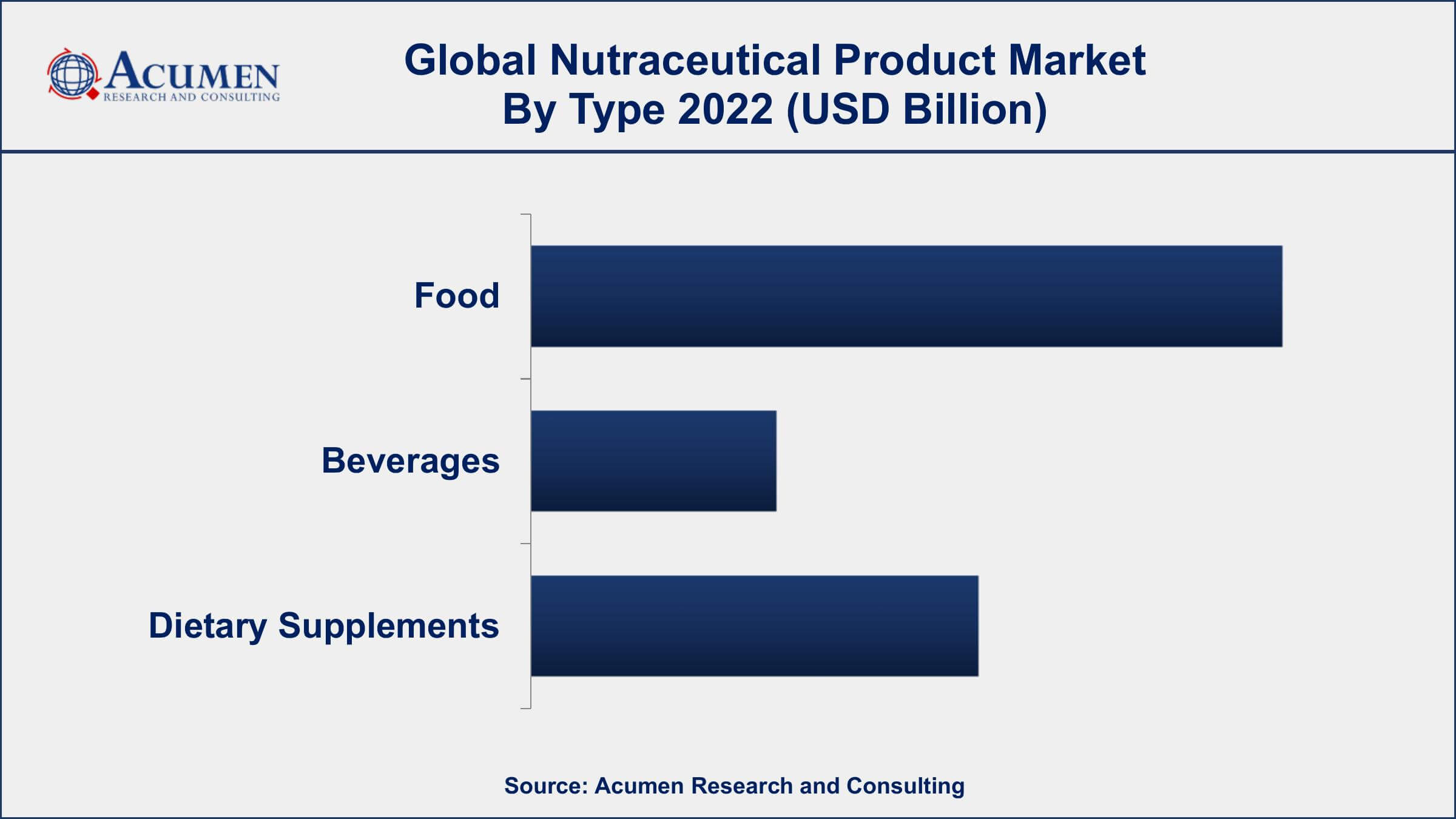

- By type, food segment accounted for the largest revenue share of over 52% in 2022

- The top nutraceutical ingredients in terms of market share include vitamins, minerals, and herbals/botanicals

- Increasing demand for functional food and dietary supplements, drives the nutraceutical product market size

Nutraceutical products are food or dietary supplements that contain bioactive compounds with potential health benefits beyond their nutritional value. They are derived from natural sources such as plants, animals, or microorganisms and are used to enhance overall health and prevent or treat various diseases. Nutraceutical products are available in various forms such as capsules, tablets, powders, liquids, and gummies.

The nutraceutical product market has seen significant growth in recent years. This growth can be attributed to several factors, including an increasing focus on preventive healthcare, growing consumer awareness about the health benefits of natural products, and rising demand for functional foods and dietary supplements. The market is expected to be driven by the increasing demand for functional foods and dietary supplements, as well as the growing interest in personalized nutrition and the use of nutraceuticals in the treatment of chronic diseases. Some of the key factors driving the growth of the nutraceutical market include rising healthcare costs, increasing awareness of the health benefits of nutraceuticals, and a growing trend towards healthy eating and lifestyle choices.

Global Nutraceutical Product Market Trends

Market Drivers

- Increasing demand for functional food and dietary supplements

- Rising prevalence of chronic diseases

- Growing health consciousness among consumers

- Favorable government regulations promoting the use of nutraceuticals

Market Restraints

- Lack of standardization and regulations in the industry

- High costs associated with research and development of nutraceutical products

Market Opportunities

- Growing demand for organic and plant-based nutraceutical products

- Increasing focus on personalized nutrition and customization of nutraceutical products

Nutraceutical Product Market Report Coverage

| Market | Nutraceutical Product Market |

| Nutraceutical Product Market Size 2022 | USD 335.5 Billion |

| Nutraceutical Product Market Forecast 2032 | USD 673.9 Billion |

| Nutraceutical Product Market CAGR During 2023 - 2032 | 7.3% |

| Nutraceutical Product Market Analysis Period | 2020 - 2032 |

| Nutraceutical Product Market Base Year | 2022 |

| Nutraceutical Product Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Distribution Channel, By Source, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Amway Corporation, Herbalife Nutrition Ltd., Nestle S.A., GNC Holdings Inc., General Nutrition Centers Inc., Archer Daniels Midland Company, Pfizer Inc., GlaxoSmithKline Plc, Bayer AG, Nature's Bounty Co., Nutraceutical International Corporation, and The Himalaya Drug Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Nutraceutical products are functional food and dietary supplements that not only assist in treating or preventing diseases but also provide medicinal benefits. Nutraceutical products are said to reduce the risk of cardiac ailment and cancer, improve cognitive health, and digestive health and may also prevent or treat chronic diseases such as high cholesterol, hypertension, obesity, diabetes, insomnia, osteoporosis, arthritis, eye-related diseases, and menopausal symptoms. The word ‘Nutraceutical’ is derived from the combination of two words including nutrition and pharmaceutical; however, these are not regulated or tested to the extent of pharmaceutical drugs. In addition, nutraceuticals are also called medical foods, designer foods, phytochemicals, functional foods, and nutritional supplements. Some of the nutraceutical products include probiotics-fortified food, ionized salt, omega fatty acid fortified food, fruit & vegetable juices and drinks, iodized salt, dairy drinks, noncarbonated drinks, proteins & peptides, vitamins & minerals, herbals, and personal care among others. Apart from these, major players are emphasizing the use of organic and non-GMO ingredients during the production of nutraceutical products.

The increasing demand for nutraceutical ingredients in the cosmeceutical and dietary supplements industry is primarily driving market growth. The increasing aging population and their focus on preventive healthcare solutions are also increasing the demand for the same. The growing number of partnerships between key players that result in co-branding and co-marketing between ingredient manufacturers and suppliers of finished products is favoring the market growth.

However, higher cost associated with fortified food products because of healthier naturally sourced ingredients is hindering the market growth. In addition, the high cost of R&D activities and the long lab-to-market pipeline is expected to limit the market growth to an extent over the forecast period. Technological innovations in nutraceutical product manufacturing are expected to create further opportunities in the market.

Nutraceutical Product Market Segmentation

The global nutraceutical product market segmentation is based on type, distribution channel, source, and geography.

Nutraceutical Product Market By Type

- Food

- Snacks

- Confectionery products

- Bakery products

- Dairy products

- Infant products

- Beverages

- Health drinks

- Energy drinks

- Juices

- Dietary Supplements

- Tablets

- Liquid

- Powder

- Others

According to the nutraceutical product industry analysis, the food segment accounted for the largest market share in 2022. This growth can be attributed to increasing consumer demand for functional foods that provide health benefits beyond basic nutrition. Functional foods are fortified with bioactive compounds, such as vitamins, minerals, and antioxidants, that have potential health benefits. The market for functional foods is driven by several factors, including an increasing focus on preventive healthcare, growing consumer awareness about the health benefits of natural products, and rising demand for convenient and healthy food options. Additionally, technological advancements in food processing and formulation have made it possible to incorporate bioactive compounds into a wide range of food products without affecting their taste or texture.

Nutraceutical Product Market By Distribution Channel

- Conventional stores

- Grocery stores

- Mass merchandisers

- Warehouse clubs

- Online retailers

- Specialty stores

- Bakery stores

- Confectionery stores

- Gourmet stores

- Health centers

- Cosmetics stores

In terms of distribution channels, the conventional stores segment of the nutraceutical product market is expected to experience steady growth in the coming years. Conventional stores, such as supermarkets, hypermarkets, and health food stores, remain a popular distribution channel for nutraceutical products due to their wide reach and convenience for consumers. These stores offer a one-stop shopping experience for consumers looking to purchase a variety of nutraceutical products, and also provide opportunities for in-store marketing and promotion.

Nutraceutical Product Market By Source

- Probiotics

- Proteins & amino acids

- Phytochemicals & plant extracts

- Fibers & Specialty carbohydrates

- Omega-3 fatty acids

- Vitamins

- Carotenoids

- Minerals

- Others

According to the nutraceutical product market forecast, the probiotics segment is expected to witness significant growth in the coming years. Probiotics are live microorganisms that provide health benefits when consumed in adequate amounts. They are commonly found in fermented foods such as yogurt, kefir, and sauerkraut, but can also be consumed as dietary supplements. The market for probiotics is driven by several factors, including an increasing awareness of the health benefits of probiotics, growing demand for functional foods and dietary supplements, and rising prevalence of digestive disorders. Probiotics are known to support digestive health by restoring the balance of gut microbiota, and may also have potential benefits for immune function and mental health.

Nutraceutical Product Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Nutraceutical Product Market Regional Analysis

North America is currently dominating the nutraceutical product market, with the United States being the largest market for nutraceutical products globally. There are several factors contributing to this dominance, including a growing demand for natural and functional food products, a strong focus on preventive healthcare, and favorable government regulations promoting the use of nutraceuticals. In the United States, the aging population has been a major driver of the nutraceutical product market value. Additionally, the United States has a large and sophisticated healthcare system, which has helped to drive the development and adoption of nutraceutical products.

Furthermore, the regulatory environment in North America is generally favorable towards nutraceuticals. The U.S. Food and Drug Administration (FDA) has established regulations that allow the use of certain health claims on food and dietary supplement labels, providing greater clarity for consumers and promoting the use of nutraceutical products. The Canadian government has also implemented regulations to promote the use of natural health products, which has helped to drive the growth of the nutraceutical market in Canada.

Nutraceutical Product Market Player

Some of the top nutraceutical product market companies offered in the professional report include Amway Corporation, Herbalife Nutrition Ltd., Nestle S.A., GNC Holdings Inc., General Nutrition Centers Inc., Archer Daniels Midland Company, Pfizer Inc., GlaxoSmithKline Plc, Bayer AG, Nature's Bounty Co., Nutraceutical International Corporation, and The Himalaya Drug Company.

Frequently Asked Questions

What was the market size of the global nutraceutical product in 2022?

The market size of nutraceutical product was USD 335.5 Billion in 2022.

What is the CAGR of the global nutraceutical product market from 2023 to 2032?

The CAGR of nutraceutical product is 7.3% during the analysis period of 2023 to 2032.

Which are the key players in the nutraceutical product market?

The key players operating in the global market are including Amway Corporation, Herbalife Nutrition Ltd., Nestle S.A., GNC Holdings Inc., General Nutrition Centers Inc., Archer Daniels Midland Company, Pfizer Inc., GlaxoSmithKline Plc, Bayer AG, Nature's Bounty Co., Nutraceutical International Corporation, and The Himalaya Drug Company.

Which region dominated the global nutraceutical product market share?

North America held the dominating position in nutraceutical product industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of nutraceutical product during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global nutraceutical product industry?

The current trends and dynamics in the nutraceutical product industry include increasing demand for functional food and dietary supplements, and rising prevalence of chronic diseases.

Which type held the maximum share in 2022?

The food type held the maximum share of the nutraceutical product industry.