Nuclear Medicine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Nuclear Medicine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

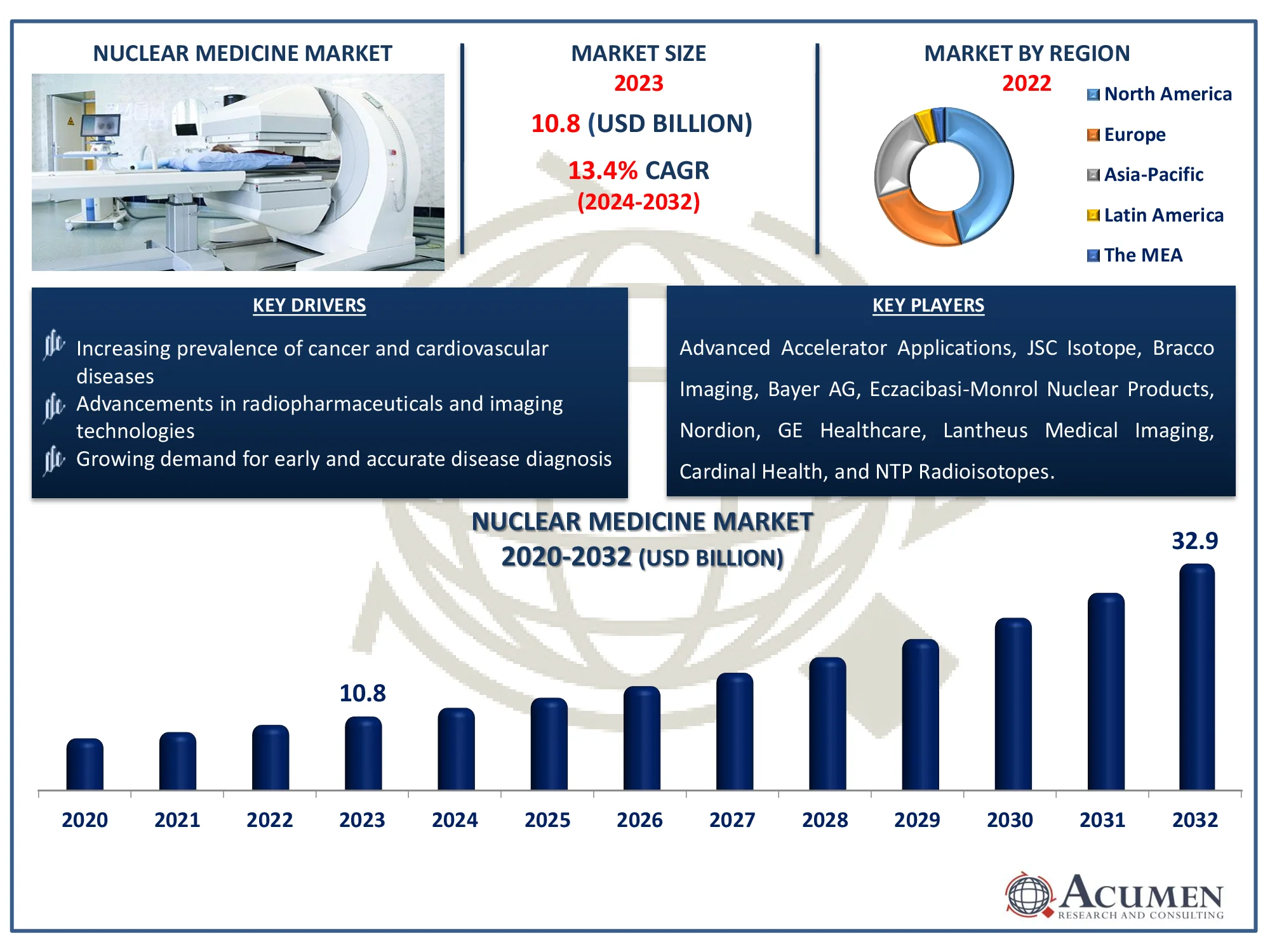

The Global Nuclear Medicine Market Size accounted for USD 10.8 Billion in 2023 and is estimated to achieve a market size of USD 32.9 Billion by 2032 growing at a CAGR of 13.4% from 2024 to 2032.

Nuclear Medicine Market Highlights

- The global nuclear medicine market is anticipated to reach USD 32.9 billion by 2032, growing at a CAGR of 13.4% from 2024 to 2032

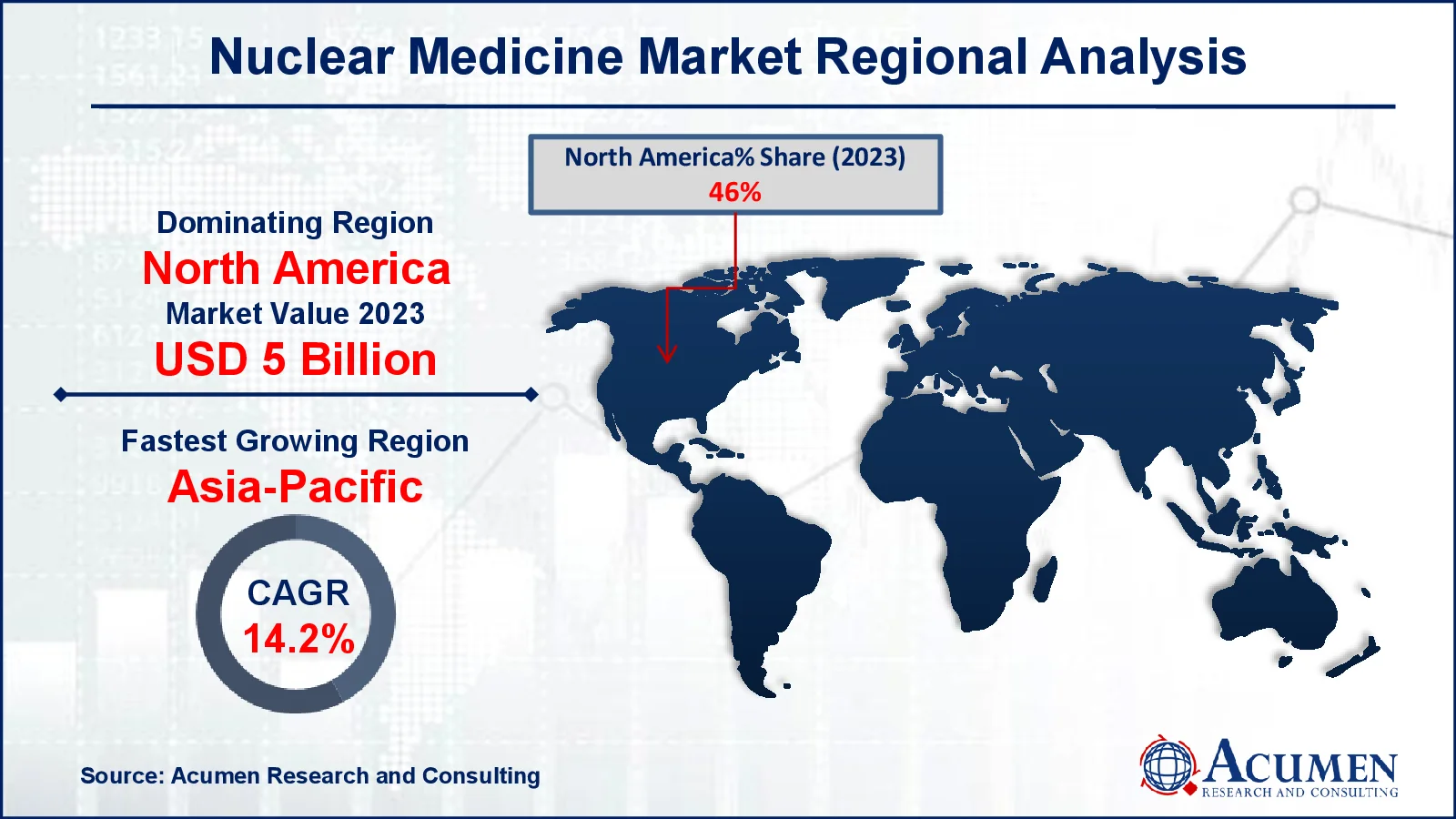

- In 2023, the North American nuclear medicine market was valued over USD 5 billion

- The Asia-Pacific region is projected to experience a CAGR of over 14.2% from 2024 to 2032

- Diagnostic products represented 78% of the market share in 2023

- The cardiology application sub-segment accounted for 23% of the market share in 2023

- The hospitals end-user sub-segment captured 55% of the market share in 2023

- Increasing adoption of hybrid imaging technologies, such as PET-CT and SPECT-CT, for enhanced diagnostic accuracy is the nuclear medicine market trend that fuels the industry demand

Nuclear medicine is a medical specialty that uses radioactive compounds, sometimes known as radiopharmaceuticals, to diagnose and treat various disorders. In diagnostic applications, radioactive tracers are introduced into the body and their emissions are captured by imaging devices such as PET (Positron Emission Tomography) and SPECT (Single Photon Emission Computed Tomography) to visualize organ function and detect abnormalities such as cancer, heart disease, and neurological disorders. Nuclear medicine treats specific tissues, such as thyroid diseases and certain types of cancer, by destroying dangerous cells. This approach enables precise, non-invasive diagnosis and successful treatment with few adverse effects. It is also employed in bone scans and renal function tests, which broadens its application in patient care.

Additionally, according to European Association of Nuclear Medicine, Nuclear Medicine plays an important role in biomedical research by aiding the rapid development of novel medications, particularly in early-phase clinical trials.

Global Nuclear Medicine Market Dynamics

Market Drivers

- Increasing prevalence of cancer and cardiovascular diseases

- Advancements in radiopharmaceuticals and imaging technologies

- Growing demand for early and accurate disease diagnosis

Market Restraints

- High cost of equipment and radiopharmaceuticals

- Short half-life of isotopes leading to logistical challenges

- Regulatory complexities and stringent safety guidelines

Market Opportunities

- Expanding applications of nuclear medicine in neurology and oncology

- Rising adoption of hybrid imaging systems (PET-CT, SPECT-CT)

- Growing investment in developing novel radiopharmaceuticals and isotopes

Nuclear Medicine Market Report Coverage

| Market | Nuclear Medicine Market |

| Nuclear Medicine Market Size 2022 |

USD 10.8 Billion |

| Nuclear Medicine Market Forecast 2032 | USD 32.9 Billion |

| Nuclear Medicine Market CAGR During 2023 - 2032 | 13.4% |

| Nuclear Medicine Market Analysis Period | 2020 - 2032 |

| Nuclear Medicine Market Base Year |

2022 |

| Nuclear Medicine Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Advanced Accelerator Applications, JSC Isotope, Bracco Imaging, Bayer AG, Eczacibasi-Monrol Nuclear Products, Nordion, GE Healthcare, Lantheus Medical Imaging, Cardinal Health, and NTP Radioisotopes. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Nuclear Medicine Market Insights

The rapid increase in the number of patients suffering from chronic cancer, the manufacturer's approach to developing patient-specific treatments, and the significant investment by leading players in R&D activities are all projected to fuel the expansion of the worldwide nuclear medicine market. For instance, according to National Cancer Institute, in 2024, a projected 2,001,140 new instances of cancer will be identified in the United States, with 611,720 deaths from the disease.

Increased government spending on healthcare infrastructure development and the formation of new institutions is predicted to boost the target market's growth. For instance, in 2024-25, the Department of Health Research received Rs 3,002 crore, or 4% of the Ministry of Health's total budget. This is a 4% increase above what was spent in 2023-24. Over the last decade, from 2013-14 to 2022-23, the Department's budget increased by an average of 12% annually.

Additionally, increased merger and acquisition activity by prominent companies is likely to boost the nuclear medicine market growth. For instance, Bristol Myers Squibb announced in December 2023 that it will purchase RayzeBio for USD 4.1 billion. RayzeBio is now undertaking clinical trials for two potential cancer medicines based on actinium-255. Point, a RayzeBio-affiliated business, is also conducting phase 3 trials for two lutetium-177 treatments. This acquisition represents Bristol-Myers Squibb's strategic decision to broaden its portfolio.

Factors such as the government's demanding product licensing process and the limited shelf life of drugs are projected to impede the growth of the global nuclear medicine market. Furthermore, the high cost of R&D activities is projected to limit the target market's growth. However, increased investment by key players in product development and the use of radiopharmaceuticals in neurological applications are projected to open up new potential for participants in the nuclear medicine market throughout the forecast period. For instance, in September 2021, GE Healthcare announced the debut of a unique scanner with a new automated workflow feature that provides an excellent view of cardiac anatomy and pathology to assist clinicians in determining the best treatment for a patient. Furthermore, strategic alliances between regional and multinational companies, as well as the establishment of nuclear facilities by significant industry players, are likely to boost revenue growth in the target market. For example, Northern Thailand, Penang Adventist Hospital (PAH) announced the opening of a private nuclear medicine center in March 2022. This introduction is expected to have a favorable impact in the Asian market.

Nuclear Medicine Market Segmentation

The worldwide market for nuclear medicine is split based on product type, application, end-use, and geography.

Nuclear Medicine Market By Product Type

- Diagnostic Products

- SPECT

- TC-99m

- TL-201

- GA-67

- I-123

- Other SPECT products

- PET

- F-18

- SR-82/RB-82

- Other PET products

- SPECT

- Therapeutic Products

- Alpha Emitters

- RA-223

- Other alpha emitters

- Beta Emitters

- I-131

- Y-90

- SM-153

- Re-186

- Lu-117

- Other beta emitters

- Alpha Emitters

- Brachytherapy

- Cesium-131

- Iodine-125

- Palladium-103

- Iridium-192

- Other brachytherapy products

According to the nuclear medicine industry analysis, diagnostic products dominate industry because they are widely used for early and accurate illness identification. PET and SPECT scans use radiopharmaceuticals to visualize organ activity and identify illnesses such as cancer, heart disease, and neurological disorders. The rising prevalence of these disorders, combined with advances in imaging technology, has increased the demand for diagnostic nuclear medicine. Diagnostic items have emerged as a prominent market category, exceeding therapeutic uses.

Nuclear Medicine Market By Application

- Cardiology

- Neurology

- Oncology

- Thyroid

- Lymphoma

- Bone Metastasis

- Endocrine Tumor

- Others

The cardiology dominates the nuclear medicine industry, owing to the increased demand for accurate diagnosis and care of cardiovascular illnesses. According to World Health Organization, cardiovascular disease (CVD) is the leading cause of mortality worldwide, killing an estimated 17.9 million people each year. Nuclear imaging techniques, such as myocardial perfusion imaging and stress testing, provide crucial information about heart function and blood flow, assisting in the diagnosis of disorders such as coronary artery disease. With the rising prevalence of heart-related illnesses and an aging population, the dependence on nuclear medicine for cardiac examinations is growing. This tendency establishes cardiology as a dominating part of the nuclear medicine market.

Nuclear Medicine Market By End-Use

- Hospitals

- Diagnostic Centers

- Others

According to the nuclear medicine market forecast, hospitals are the most important end customers in market because they provide complete diagnostic and treatment services. They use modern nuclear imaging techniques and radiopharmaceuticals to treat a variety of medical diseases, mostly in oncology and cardiology. Integrating nuclear medicine into hospital settings improves patient management and treatment outcomes. As healthcare systems adopt new technology and protocols, the need for nuclear medicine services in hospitals grows, supporting their position as market leaders.

Nuclear Medicine Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Nuclear Medicine Market Regional Analysis

For several reasons, because of the large number of cancer patients in North America, the market for nuclear medicine is likely to account for a significant portion of global revenue. Increasing medication R&D efforts, the existence of a large number of players operating in the country, and the development of innovative solutions are all likely to boost the nuclear medicine market. Furthermore, leading players' increased merger and acquisition operations to expand their client base and product offerings are projected to have an impact on the regional market's growth. For instance, Lantheus Holdings, Inc. (Lantheus) recently strengthened its position in the United States nuclear medicine market by entering into strategic agreements with Perspective Therapeutics, Inc. The agreements involve exclusive licensing for Perspective's Pb212-VMT-⍺-NET, an advanced therapy for neuroendocrine tumors, and co-development opportunities for early-stage prostate cancer treatments. Lantheus made a hefty financial contribution of USD 28 million. Lantheus also intends to acquire up to 19.9% of Perspective's common stock, investing roughly $33 million, pending a qualifying third-party financing deal. In a reciprocal move, Perspective intends to purchase Lantheus' radiopharmaceutical manufacturing facility in Somerset, New Jersey, so strengthening its competitive position.

The Asia-Pacific market is predicted to expand quicker in the nuclear medicine industry due to significant healthcare advancements in countries such as India and Australia. Furthermore, increased government investment on the medical sector is projected to promote target market expansion in the region. For instance, according to India Brand Equity Foundation, the Indian healthcare sector is seeing unprecedented expansion, with private equity and venture capital investments exceeding $1 billion in the first five months of 2024, representing a 220% rise over the previous year. Overall, key players' attention on tracking the unexplored market in developing countries is anticipated to grow in forecast year.

Nuclear Medicine Market Players

Some of the top nuclear medicine companies offered in our report include Advanced Accelerator Applications, JSC Isotope, Bracco Imaging, Bayer AG, Eczacibasi-Monrol Nuclear Products, Nordion, GE Healthcare, Lantheus Medical Imaging, Cardinal Health, and NTP Radioisotopes.

Frequently Asked Questions

How big is the nuclear medicine market?

The nuclear medicine market size was valued at USD 10.8 billion in 2023.

What is the CAGR of the global nuclear medicine market from 2024 to 2032?

The CAGR of nuclear medicine is 13.4% during the analysis period of 2024 to 2032.

Which are the key players in the nuclear medicine market?

The key players operating in the global market are including Advanced Accelerator Applications, JSC Isotope, Bracco Imaging, Bayer AG, Eczacibasi-Monrol Nuclear Products, Nordion, GE Healthcare, Lantheus Medical Imaging, Cardinal Health, and NTP Radioisotopes.

Which region dominated the global nuclear medicine market share?

North America held the dominating position in nuclear medicine industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of nuclear medicine during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global nuclear medicine industry?

The current trends and dynamics in the nuclear medicine industry include increasing prevalence of cancer and cardiovascular diseases, advancements in radiopharmaceuticals and imaging technologies, and growing demand for early and accurate disease diagnosis.

Which product type held the maximum share in 2023?

The diagnostic product type held the maximum share of the nuclear medicine industry.