Nitrocellulose Market | Acumen Research and Consulting

Nitrocellulose Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format : ![]()

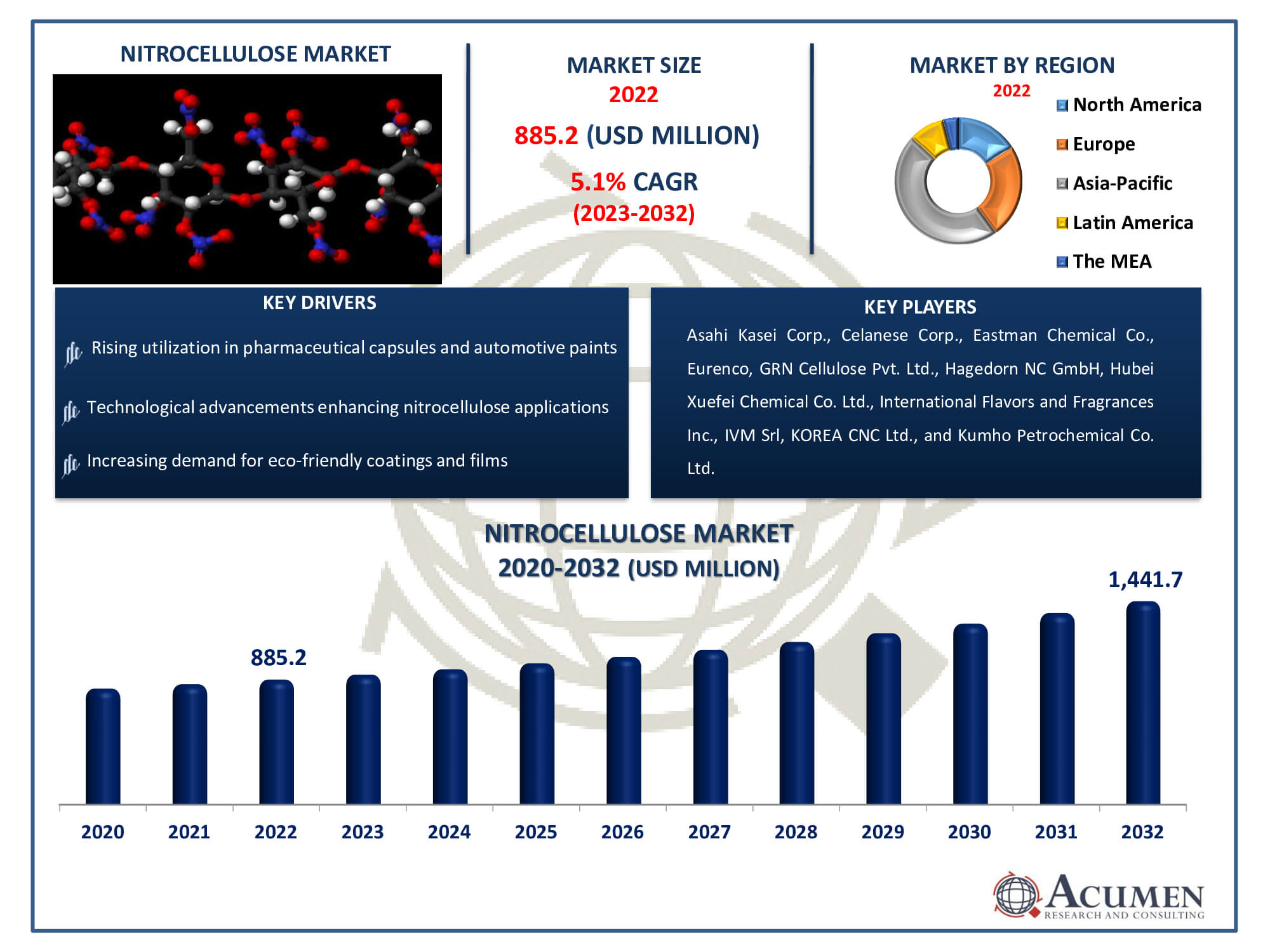

The Nitrocellulose Market Size accounted for USD 885.2 Million in 2022 and is estimated to achieve a market size of USD 1,441.7 Million by 2032 growing at a CAGR of 5.1% from 2023 to 2032.

Nitrocellulose Market Highlights

- Global nitrocellulose market revenue is poised to garner USD 1,441.7 million by 2032 with a CAGR of 5.1% from 2023 to 2032

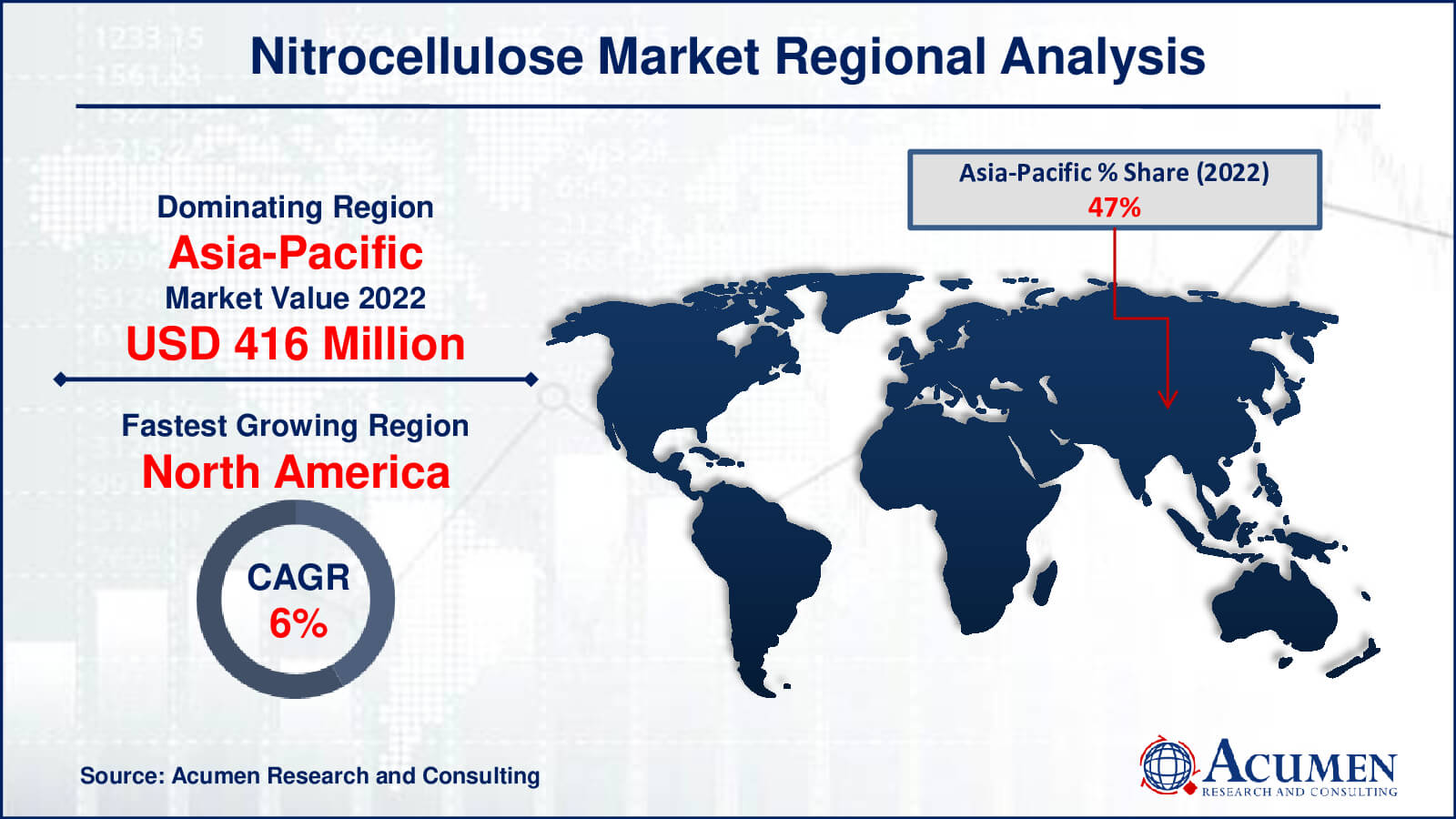

- Asia-Pacific nitrocellulose market value occupied around USD 416 million in 2022

- North America nitrocellulose market growth will record a CAGR of more than 6% from 2023 to 2032

- Among product, the M grade cellulose sub-segment generated over US$ 424.9 million revenue in 2022

- Based on application, the printing inks sub-segment generated around 28% share in 2022

- Collaborations for novel applications in electronics and healthcare sectors is a popular nitrocellulose market trend that fuels the industry demand

Nitrocellulose is a highly combustible chemical with a wide range of applications that is derived from cellulose, nitric acid, or strong nitrate agents. Beyond its use in controlled explosions, guncotton is a substance that is highly versatile and useful in a variety of industries. Its uses include the formation of plastic film, the improvement of wood coatings, and the facilitation of ink printing, especially in cases when the cellulose isn't completely nitrated. Over the next six years, forecasts indicate a notable growth in the global market for nitrocellulose. Its vital function in various industries, particularly in explosive goods, printing materials, and coatings for wood and plastic films globally, is driving this rise.

Global Nitrocellulose Market Dynamics

Market Drivers

- Increasing demand for eco-friendly coatings and films

- Growth in the printing industry spurring nitrocellulose demand

- Rising utilization in pharmaceutical capsules and automotive paints

- Technological advancements enhancing nitrocellulose applications

Market Restraints

- Stringent regulations regarding flammability and safety concerns

- Volatility in raw material prices impacting production costs

- Competition from alternative materials affecting market share

Market Opportunities

- Expansion in emerging markets fostering market growth

- Innovations in nitrocellulose-based products and applications

- Rising focus on sustainable and biodegradable materials

Nitrocellulose Market Report Coverage

| Market | Nitrocellulose Market |

| Nitrocellulose Market Size 2022 | USD 885.2 Million |

| Nitrocellulose Market Forecast 2032 | USD 1,441.7 Million |

| Nitrocellulose Market CAGR During 2023 - 2032 | 5.1% |

| Nitrocellulose Market Analysis Period | 2020 - 2032 |

| Nitrocellulose Market Base Year |

2022 |

| Nitrocellulose Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Asahi Kasei Corp., Celanese Corp., Eastman Chemical Co., Eurenco, GRN Cellulose Pvt. Ltd., Hagedorn NC GmbH, Hubei Xuefei Chemical Co. Ltd., International Flavors and Fragrances Inc., IVM Srl, KOREA CNC Ltd., Kumho Petrochemical Co. Ltd., MAXAMCORP HOLDING SL, Merck KGaA, and AGROFERT AS. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Nitrocellulose Market Insights

The increasing utilization of nitrocellulose-based inks is anticipated to positively impact the economic growth in the coating and paint industries, particularly in emerging economies such as China, Vietnam, and Colombia. Guncotton, a highly flammable compound, is subject to stringent regulations governing its use and storage due to its involvement as a propellant or low-order explosive in cellulose reactions. The expansion of nitric acid and sulfuric acid usage is expected, primarily in fertilizer production. The production of cellulose nitrate involves various costs, encompassing raw materials, equipment, utilities, maintenance, labor, land leasing, transportation, and associated expenses like depreciation and financing. Notably, a significant portion of the production cost comprises raw materials.

Additional costs encompass pre-operational expenditures and operational capital, distinct from the fixed investment or capital outlay. This includes expenses related to installation, setup, capitalized interest, engineering, management, and commissioning. The ink sector experiences momentum driven by technological advancements and a surge in eco-friendly ink consumption. Printing and flexographic product utilization deliver high-quality, durable outcomes. Flexographic imprints find applications across various materials like plastics, metallic films, paper, and other substrates. Cylindrical base engraving is a prevalent method used in rotary presses for image printing.

Due to their superior properties such as fast drying, good adhesion, and easy application, these tints are preferred over other products. The substance finds utility in both military and civil applications, containing approximately 12.6 percent nitrogen. However, stringent regulations governing hazardous substance disposal, driven by adverse health effects and high inflammability, pose potential hindrances to market growth. Several governments have imposed strict regulations to prevent misuse and safeguard public interest. For instance, Brazil has prohibited imports of this product into the country to prevent potential misuse.

Nitrocellulose Market Segmentation

The worldwide market for nitrocellulose is split based on product, application, and geography.

Nitrocellulose Products

- M Grade Cellulose

- E Grade Cellulose

- Others

The remarkable quality and wide range of uses of M grade cellulose make it stand out as the largest segment in the nitrocellulose market. M grade cellulose is a key component used in the synthesis of nitrocellulose and is renowned for its uniformity and purity. It is highly sought-after in a variety of industries because to its outstanding qualities, which include a high cellulose content and exact manufacturing requirements. M grade cellulose is subjected to strict quality control procedures, guaranteeing ideal nitration throughout the production process, which has a direct impact on the calibre and functionality of the resulting nitrocellulose. Its application is found in many different industries, including explosives, inks, coatings, and pharmaceuticals. This is because it can give finished products desired properties including adherence, durability, and quick drying. As a major force behind the nitrocellulose business, M grade cellulose's dependability and effectiveness have contributed to its domination over other product categories.

Nitrocellulose Applications

- Printing inks

- Leather finishes

- Nail Varnishes

- Automotive paints

- Wood coatings

- Others

According to nitrocellulose industry analysis, wood coatings have emerged as the second-largest application segment, attributed to increased residential construction activities. Cellulose wood coatings, derived from nitrates, offer diverse applications such as sap stains, fillers, overall stains, and toners, used in sliding doors, windows, furniture coverings, and more. The furniture sector's rapid development and high demand are poised to further drive growth in this segment.

Elevated living standards have heightened the demand for furniture, notably leveraging growth. Nitrocellulose-based lacquered wood coatings are prevalent as finishing agents for musical instruments like guitars, mandolins, and banjos with steel strings. Automotive paints, featuring multi-layered coatings, enhance aesthetics and shield against scratches, UV rays, corrosion, oxidation, and acid rains, leveraging thinners, pigments, and binders with high solid content and low VOC compounds.

Cellulose nitrate's application in this segment is propelled by these factors. Guncotton finds usage in nail varnishes due to safety concerns under regulatory pressure, also in transportation and packaging adhering to United Nations (UN) standards. Despite a slowdown in cellulose nitrate industries due to emerging substitutes, the expanding cosmetics industry is expected to boost nail lacquer demand in the nitrocellulose market forecast period.

High-performance cotton finds utility in disposable medical equipment, mining, and artificial jewelry due to its exceptional features. Other applications include pharmaceuticals, sealants, and adhesive production, where cellulose nitrate-produced adhesives offer prolonged shelf life and weather resistance.

Nitrocellulose Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Nitrocellulose Market Regional Analysis

According to the nitrocellulose industry analysis, in 2022, Asia-Pacific stood out as the world's leading consumer, accounting for over 45% of the global consumption. Emerging economies like India, Thailand, and China served as major producers and importers of cellulose materials in this region. Cellulose nitrate witnessed high trade and usage in these countries due to escalating demands from various end-use industries such as printing inks, automotive paints, wood coatings, and leather tanning and finishing.

To trim production costs, many producers relocated their bases to this region, benefiting from both cheaper labor and low-cost commodities. China particularly emerged as the primary user of nitrocellulose raw materials, with the rapid expansion of the printing ink industry driving product demand.

Europe followed Asia Pacific, representing 20.21% of global volumes in 2018, emerging as the second-largest regional market. Despite this, growth markets in Asia-Pacific and Latin America are expected to see a reduction in their share. Brazil and Mexico, due to increasing demand for coating applications, are significant revenue generators in Latin America. Additionally, the Automotive Lacquered and Wood Coatings industries in North America are anticipated to experience growth during nitrocellulose industry forecast period.

Nitrocellulose Market Players

Some of the top nitrocellulose companies offered in our report includes Asahi Kasei Corp., Celanese Corp., Eastman Chemical Co., Eurenco, GRN Cellulose Pvt. Ltd., Hagedorn NC GmbH, Hubei Xuefei Chemical Co. Ltd., International Flavors and Fragrances Inc., IVM Srl, KOREA CNC Ltd., Kumho Petrochemical Co. Ltd., MAXAMCORP HOLDING SL, Merck KGaA, and AGROFERT AS.

Frequently Asked Questions

How big is the nitrocellulose market?

The nitrocellulose market size was USD 885.2 million in 2022.

What is the CAGR of the global nitrocellulose market from 2023 to 2032?

The CAGR of nitrocellulose is 5.1% during the analysis period of 2023 to 2032.

Which are the key players in the nitrocellulose market?

The key players operating in the global market are including Asahi Kasei Corp., Celanese Corp., Eastman Chemical Co., Eurenco, GRN Cellulose Pvt. Ltd., Hagedorn NC GmbH, Hubei Xuefei Chemical Co. Ltd., International Flavors and Fragrances Inc., IVM Srl, KOREA CNC Ltd., Kumho Petrochemical Co. Ltd., MAXAMCORP HOLDING SL, Merck KGaA, and AGROFERT AS.

Which region dominated the global nitrocellulose market share?

Asia-Pacific held the dominating position in nitrocellulose industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of nitrocellulose during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global nitrocellulose industry?

The current trends and dynamics in the nitrocellulose industry include increasing demand for eco-friendly coatings and films, growth in the printing industry spurring nitrocellulose demand, rising utilization in pharmaceutical capsules and automotive paints, and technological advancements enhancing nitrocellulose applications.

Which product held the maximum share in 2022?

The m grade cellulose product held the maximum share of the nitrocellulose industry.