Next-Generation Solar Cell Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Next-Generation Solar Cell Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Next-Generation Solar Cell Market Size accounted for USD 2.6 Billion in 2022 and is estimated to achieve a market size of USD 21.4 Billion by 2032 growing at a CAGR of 21.4% from 2024 to 2032.

Next-Generation Solar Cell Market Highlights

- Global next-generation solar cell market revenue is poised to garner USD 21.4 billion by 2032 with a CAGR of 21.4% from 2024 to 2032

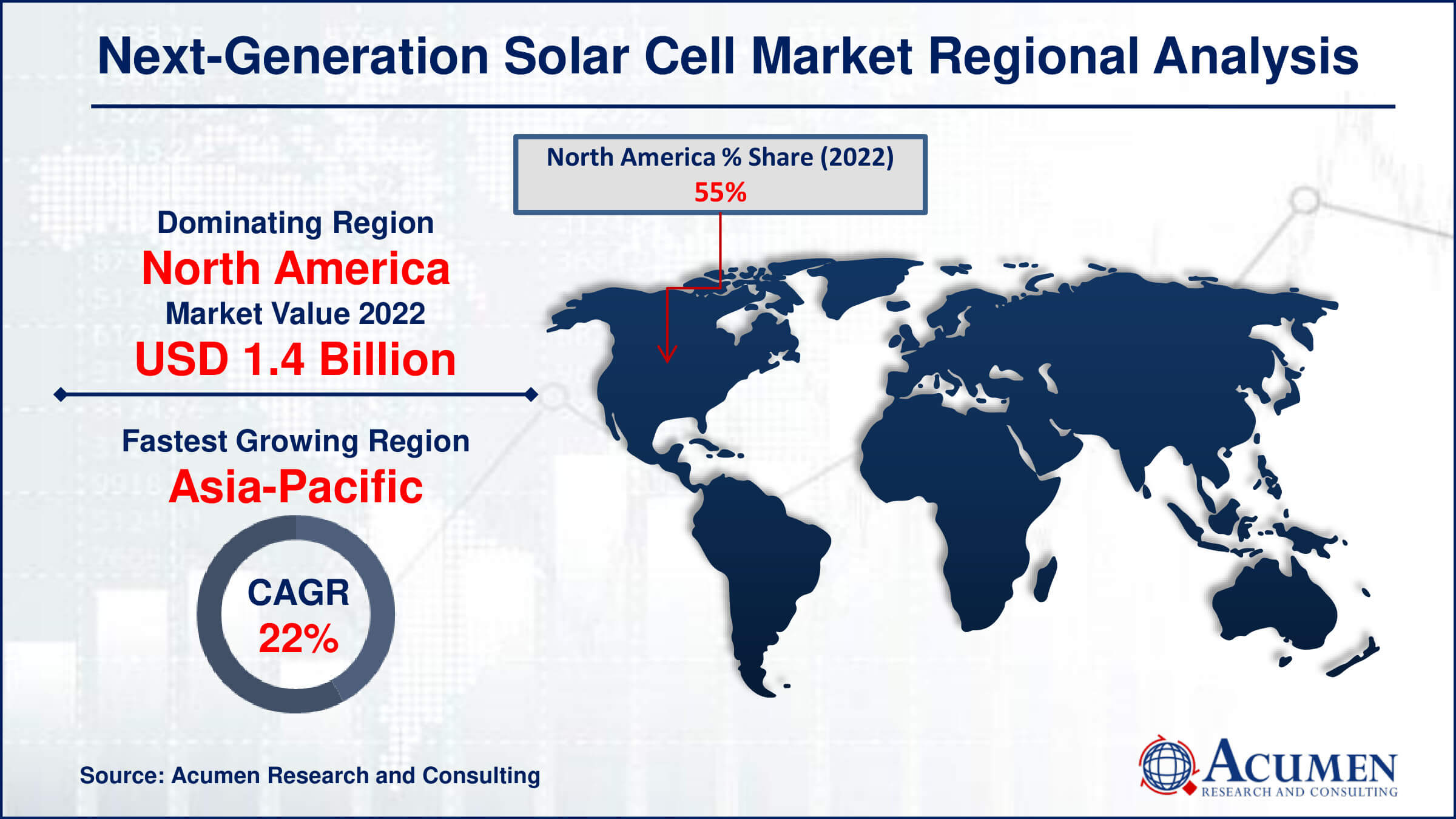

- North America next-generation solar cell market value occupied around USD 1.4 billion in 2022

- Asia-Pacific next-generation solar cell market growth will record a CAGR of more than 22% from 2024 to 2032

- Among installation, the on grid sub-segment generated 55% share in 2022 due to low temperature coefficient

- Based on end use industry, the utilities sub-segment generated around 60% market share in 2022 due to growing focus on sustainable energy solutions

- Development of perovskites solar cells due to high efficiency and low maintenance cost is a popular next-generation solar cell market trend that fuels the industry demand

Next-generation solar cells refer to advanced photovoltaic technologies designed to enhance the efficiency, durability, and versatility of solar energy conversion. These innovative cells include materials, such as perovskites, quantum dots, or organic polymers, along with cutting-edge fabrication techniques to improve performance and reduce costs. They revolutionize solar energy utilization by offering higher conversion efficiencies, even under low-light conditions. Next-generation solar cells aim to address the limitations of traditional silicon-based solar cells, making solar energy more accessible and sustainable for a wide range of applications, including residential, commercial, and industrial sectors, as well as portable electronics and wearable devices.

Global Next-Generation Solar Cell Market Dynamics

Market Drivers

- Advancements in technology in next-generation solar cell

- Increasing adoption of photovoltaic cells

- Growing approval of smart grid integration and energy storage solution

Market Restraints

- High cost restraint

- Concerns related to toxicity

- Supply chain disruptions

Market Opportunities

- Growing concerns associated with environment and sustainability

- Rising demand of energy

Next-Generation Solar Cell Market Report Coverage

| Market | Next-Generation Solar Cell Market |

| Next-Generation Solar Cell Market Size 2022 | USD 2.6 Billion |

| Next-Generation Solar Cell Market Forecast 2032 |

USD 17.5 Billion |

| Next-Generation Solar Cell Market CAGR During 2024 - 2032 | 21.4% |

| Next-Generation Solar Cell Market Analysis Period | 2020 - 2032 |

| Next-Generation Solar Cell Market Base Year |

2022 |

| Next-Generation Solar Cell Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Material Type, By Installation, By End Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Toshiba, ARMOR Group, Sumitomo Chemical, AGC, Advent Technologies Inc, Heliatek, Sunew, Mitsubishi Chemical, Henkel, and Belectric. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Next-Generation Solar Cell Market Insights

The advancements in technology in next-generation solar cells are becoming a driver for the next-generation solar cell market in the coming years. For instance, a research project initiated by Aarhus University in January 2020 aimed to develop small-scale organic PV technology. This method could potentially be employed to fabricate neural-stimulating scaffolds using light within the human body. Innovations in manufacturing techniques, like roll-to-roll processing and 3D printing, are reforming production and scalability. These advancements are not only enhancing the performance of solar cells but also expanding their applications, from rooftop installations to integrated photovoltaics in buildings and vehicles. As these technologies continue to grow, they are expected to drive significant growth in the next-generation solar cell market.

However, high cost constraints impede the growth of the next-generation solar cell market. Advancements in technology, the operating costs associated with research, development, and manufacturing hinder widespread adoption. This financial barrier limits accessibility and affordability for consumers and businesses, slowing down the transition to more efficient and sustainable energy solutions. These cost challenges, though, through innovation and efficiency improvements, may hinder the growth of the next-generation solar cell market.

Growing concerns associated with the environment and sustainability create an opportunity for the next-generation solar cell market. With a global trend towards renewable energy sources, innovative technologies in solar cells are gaining traction. These advancements promise enhanced efficiency, affordability, and scalability, making solar power a viable alternative to traditional energy sources. From perovskite to organic photovoltaics, these emerging solar technologies revolutionize energy production, driving the transition towards a cleaner and more sustainable future. As governments and industries prioritize environmental responsibility, the next-generation solar cell market is expected to grow significantly in the forecasted years.

Next-Generation Solar Cell Market Segmentation

The worldwide market for next-generation solar cell is split based on material type, installation, end-use industry, and geography.

Next-Generation Solar Cell Material Types

- Transceivers

- Cadmium Telluride (CdTe)

- Copper Indium Gallium Selenide(CIGS)

- Amorphous Silicon (a-Si)

- Gallium-Arsenide (GaAs)

- Others

- Organic Solar Cell

- Dye Solar Cell

- Perovskite Solar Cell

According to the next-generation solar cell industry forecast, cadmium telluride (CdTe) is expected to rise in the forecast year. Cadmium telluride (CdTe) includes large-scale solar power plants designed to feed electricity into the grid. Cadmium telluride (CdTe) is frequently used in the utility-scale solar industry. The cost-effectiveness and high efficiency factors of cadmium telluride (CdTe) make it the preferred choice for the next-generation solar cell market in the coming years. Additionally, the 'others' segment is anticipated to rise in the next-generation solar cell market. Organic solar cells are rapidly being used in small electronic devices such as wearable technology, smartphones, and tablets.

Next-Generation Solar Cell Installations

- On Grid

- Off Grid

The on-grid segment is the largest category in the next-generation solar cell market and is expected to increase over the industry's forecast period. For instance, for the installation of on-grid systems, Navitas Solar launched Next-generation N-type TOPcon modules at The Smarter E-India in February 2024. These modules offer a low temperature coefficient, remarkable energy yield, and improved overall efficiency.

Next-Generation Solar Cell End User Industries

- Residential

- Commercial & Industrial

- Utilities

- Others

The utilities end-user industry maintains the highest proportion in the next-generation solar cell industry. With a growing global focus on sustainable energy solutions, utilities are increasingly turning to advanced solar cell. This trend underscores the pivotal role utilities play in driving the adoption and integration of next-generation solar cells into energy systems. As the demand for clean energy continues to escalate, the utilities sector stands poised to spearhead the widespread implementation of these innovative solar technologies.

Next-Generation Solar Cell Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Next-Generation Solar Cell Market Regional Analysis

North America is the largest region in the next-generation solar cell market for several reasons. Fueled by technological innovation and robust investment, the region's solar industry has witnessed exponential growth. For example, in April 2022, First Solar declared that its ethically manufactured photovoltaic (PV) solar module technology would supply 17% of Nevada Gold Mines' (NGM) yearly energy requirements, making it the principal supplier to the world's largest gold-producing complex. Advancements in materials science, such as perovskite and organic photovoltaics, have bolstered the efficiency and versatility of solar cells, driving adoption across various applications. Additionally, supportive government policies have further propelled the market forward, encouraging research and development. With a growing focus on sustainability and renewable energy, North America continues to lead the next-generation solar cell market.

Asia-Pacific is the fastest-growing region in the market. Advancements in technology in next-generation solar cells and increasing adoption of photovoltaic cells fuel the demand for this market in countries like China, India, Japan, and South Korea. Rising approval of smart grid integration and energy storage solutions further maintains Asia-Pacific’s position in the market. Furthermore, key players focus on innovations and developing new technologies to increase demand for the next-generation solar cell market. For instance, to position itself as a full-service supplier of clean energy solutions for residential and commercial end-users, Hanwha Q CELLS acquired 66% of LYNQTECH GmbH in July 2022.

Next-Generation Solar Cell Market Players

Some of the top next-generation solar cell companies offered in our report includes Toshiba, ARMOR Group, Sumitomo Chemical, AGC, Advent Technologies Inc, Heliatek, Sunew, Mitsubishi Chemical, Henkel, and Belectric.

Frequently Asked Questions

How big is the next-generation solar cell market?

The next-generation solar cell market size was valued at USD 2.6 billion in 2022.

What is the CAGR of the global next-generation solar cell market from 2024 to 2032?

The CAGR of next-generation solar cell is 21.4% during the analysis period of 2024 to 2032.

Which are the key players in the next-generation solar cell market?

The key players operating in the global market are including Toshiba, ARMOR Group, Sumitomo Chemical, AGC, Advent Technologies Inc, Heliatek, Sunew, Mitsubishi Chemical, Henkel, and Belectric.

Which region dominated the global next-generation solar cell market share?

North America held the dominating position in next-generation solar cell industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of next-generation solar cell during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global next-generation solar cell industry?

The current trends and dynamics in the next-generation solar cell industry include advancements in technology in next-generation solar cell, increasing adoption of photovoltaic cells, and growing approval of smart grid integration and energy storage solution

Which installation held the maximum share in 2022?

The on grid held the maximum share of the next-generation solar cell industry.