Neurovascular Embolectomy Device Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Neurovascular Embolectomy Device Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

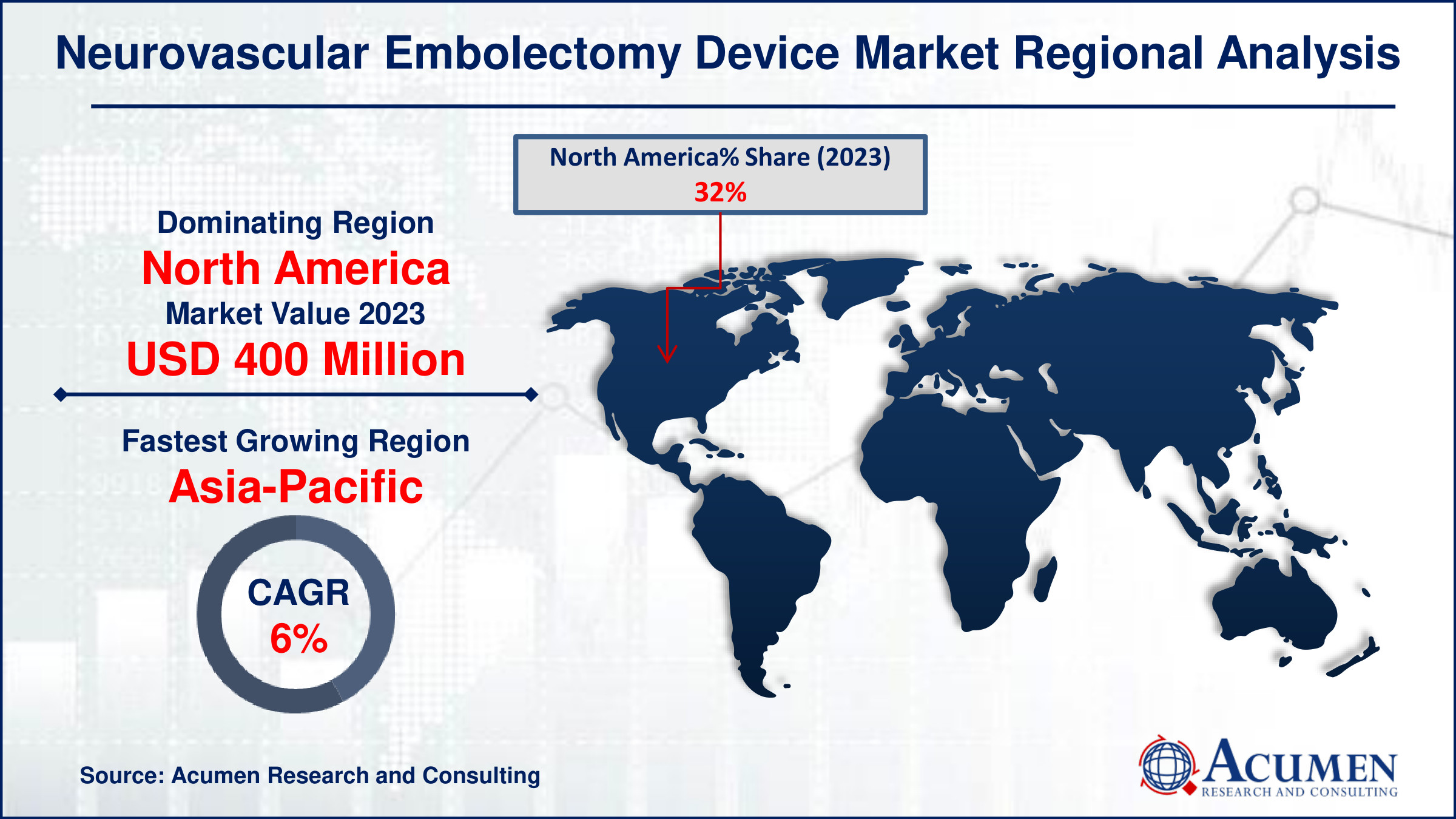

The Neurovascular Embolectomy Device Market Size accounted for USD 1.25 Billion in 2023 and is estimated to achieve a market size of USD 1.95 Billion by 2032 growing at a CAGR of 5.3% from 2024 to 2032.

Neurovascular Embolectomy Device Market Highlights

- The global neurovascular embolectomy device market is expected to reach USD 1.95 billion by 2032, with a CAGR of 5.3% from 2024 to 2032

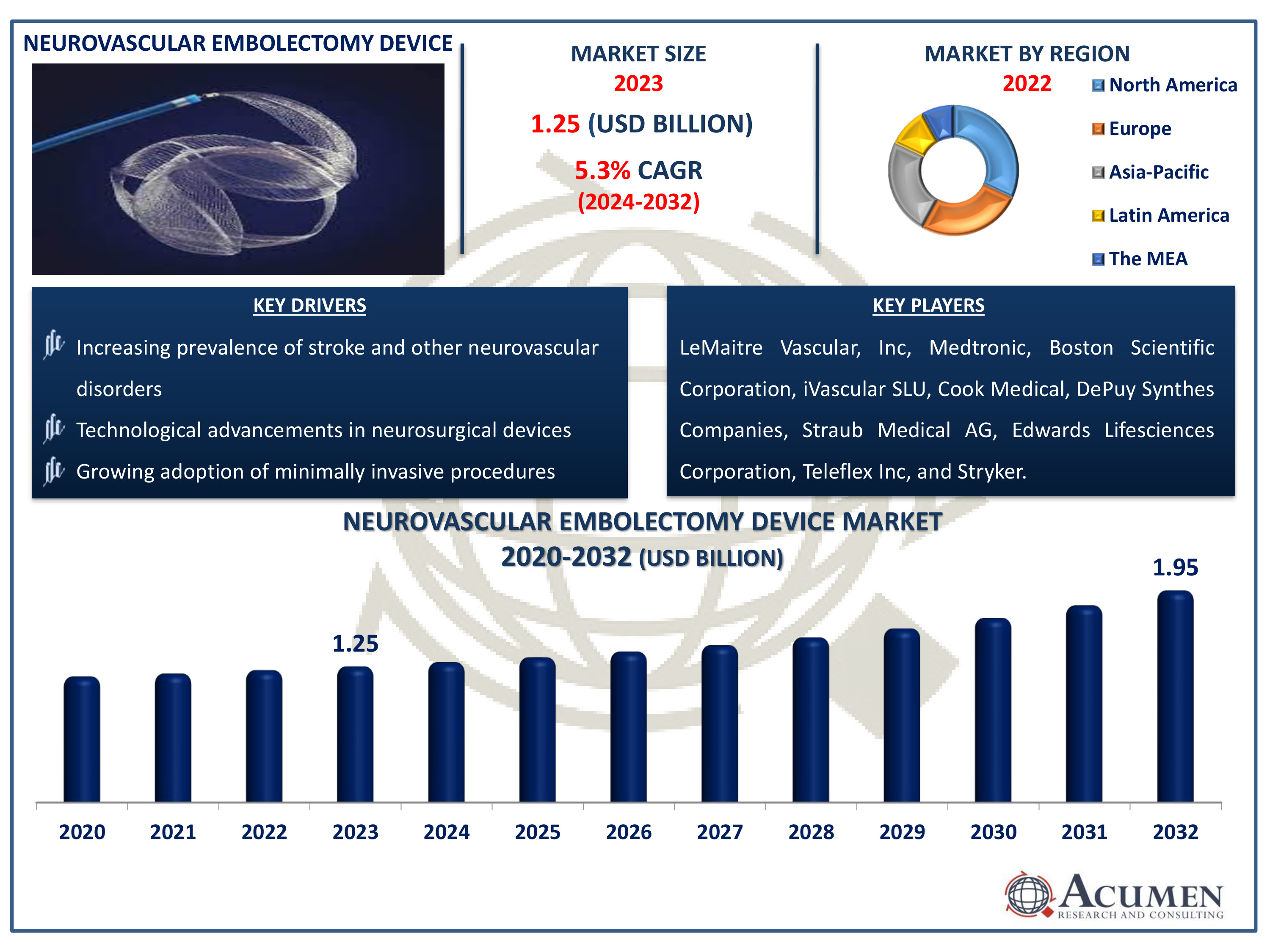

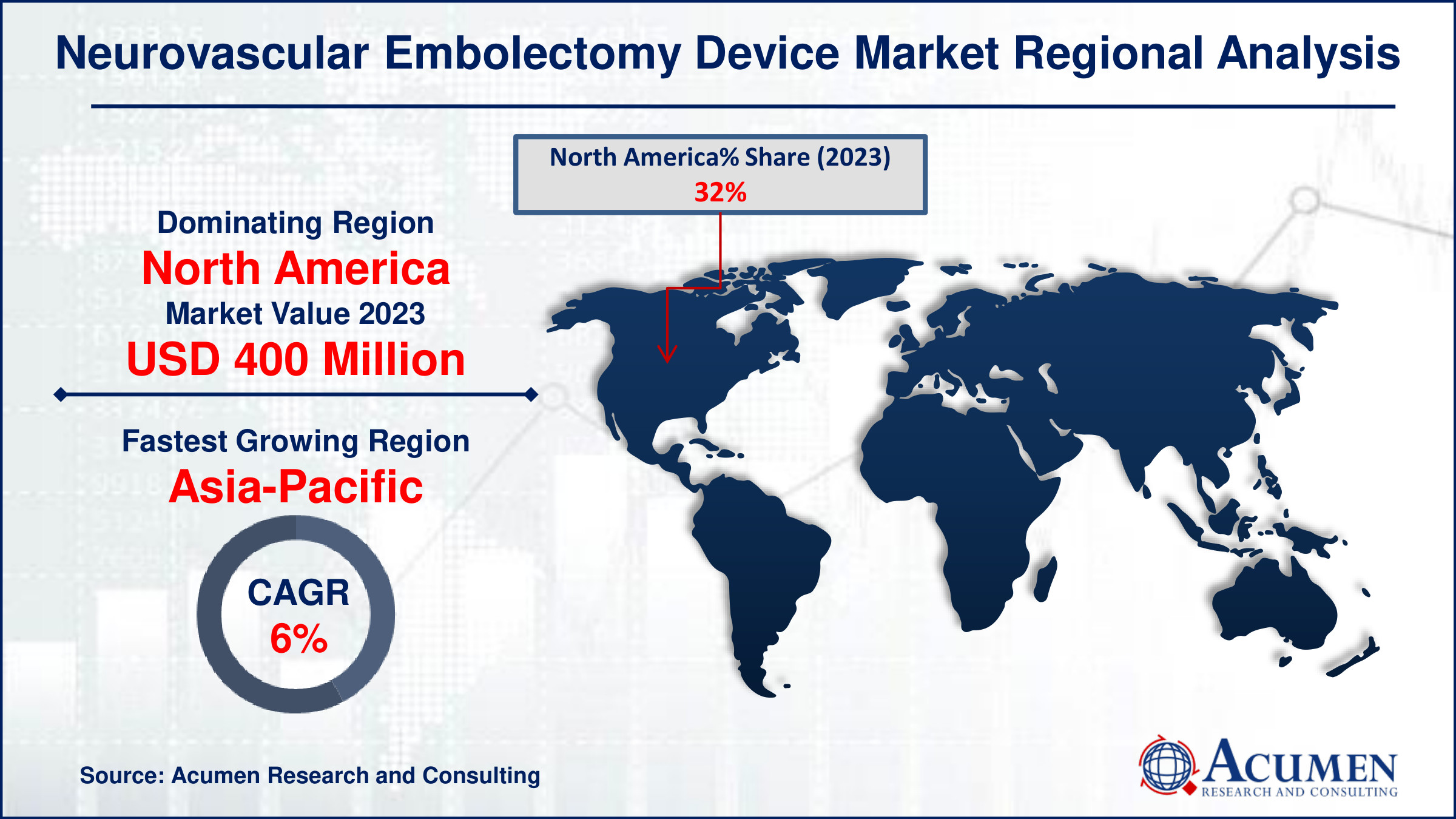

- In 2023, the North American neurovascular embolectomy device market was valued at approximately USD 400 million

- The Asia-Pacific region's neurovascular embolectomy device market is projected to grow at a CAGR of over 6% from 2024 to 2032

- The embolic coils sub-segment accounted for 76% of the market share in 2023

- The hospitals sub-segment held a 71% market share in 2023 based on end-users

- Integration of robotics and AI in neurovascular embolectomy devices for more precise and minimally invasive procedures is the neurovascular embolectomy device market trend that fuels the industry demand

A neurovascular embolectomy device is a specialized medical tool designed to remove blood clots (emboli) from blood vessels in the brain, specifically within the neurovascular system. This device is crucial in treating conditions such as ischemic stroke, where prompt removal of clots can restore blood flow and minimize brain damage. It typically consists of a catheter with a retrievable basket or stent-like mechanism that can capture and extract the clot without causing significant trauma to surrounding tissues. The device is guided through the blood vessels using advanced imaging techniques such as fluoroscopy or angiography, ensuring precise placement and effective clot retrieval. Neurovascular embolectomy devices have revolutionized stroke care by offering a minimally invasive alternative to traditional surgical methods, thereby reducing recovery times and improving patient outcomes. Ongoing advancements in device technology continue to enhance their effectiveness, making them an essential tool in the arsenal against ischemic stroke and other neurovascular emergencies.

Global Neurovascular Embolectomy Device Market Dynamics

Market Drivers

- Increasing prevalence of stroke and other neurovascular disorders

- Technological advancements in neurosurgical devices

- Growing adoption of minimally invasive procedures

Market Restraints

- High cost associated with neurovascular embolectomy devices

- Stringent regulatory approvals for new devices

- Limited accessibility to advanced healthcare facilities in developing regions

Market Opportunities

- Rising healthcare expenditure in emerging economies

- Development of innovative clot retrieval techniques

- Expansion of neurovascular interventions in outpatient settings

Neurovascular Embolectomy Device Market Report Coverage

| Market | Neurovascular Embolectomy Device Market |

| Neurovascular Embolectomy Device Market Size 2022 | USD 1.25 Billion |

| Neurovascular Embolectomy Device Market Forecast 2032 | USD 1.95 Billion |

| Neurovascular Embolectomy Device Market CAGR During 2023 - 2032 | 5.3% |

| Neurovascular Embolectomy Device Market Analysis Period | 2020 - 2032 |

| Neurovascular Embolectomy Device Market Base Year |

2022 |

| Neurovascular Embolectomy Device Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | LeMaitre Vascular, Inc, Medtronic, Boston Scientific Corporation, iVascular SLU, Cook Medical, DePuy Synthes Companies, Straub Medical AG, Edwards Lifesciences Corporation, Teleflex Inc, and Stryker. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Neurovascular Embolectomy Device Market Insights

The neurovascular embolectomy device market is experiencing growth driven by the increasing prevalence of stroke and other neurovascular disorders. For instance, according to Centers of Disease Control and Prevention, in the United States, stroke ranked as the fifth leading cause of death in 2021. From 2011–2013 to 2020–2022, there was a 7.8% increase in stroke prevalence nationwide. This rise was observed across adults aged 18–64 years, both females and males. Moreover, these devices play a crucial role in the treatment of conditions such as ischemic stroke by removing blood clots from affected blood vessels. Advancements in technology, such as the development of minimally invasive procedures, have expanded the market by improving patient outcomes and reducing recovery times. Additionally, rising awareness about the importance of early intervention in stroke cases has further propelled market demand. As healthcare systems worldwide prioritize neurovascular care, the market for embolectomy devices is expected to continue its upward trajectory.

Stringent regulatory approvals pose a significant challenge to the neurovascular embolectomy device market, creating barriers for new devices to enter the market swiftly. These regulations, often designed to ensure patient safety and device efficacy, require extensive clinical trials and data submission, prolonging the time and cost involved in bringing new products to market. Manufacturers must navigate complex approval processes, including rigorous testing and documentation, which can delay product launches and limit innovation. Consequently, these regulatory hurdles can stifle market growth and innovation in neurovascular embolectomy devices, impacting both manufacturers and healthcare providers seeking advanced treatment options for patients.

Rising healthcare expenditure in emerging economies has fueled increased demand for advanced medical technologies, including neurovascular embolectomy devices. For instance, according to Invest India, the hospital industry in India, constituting 80% of the healthcare market, is experiencing significant investor interest from global and domestic stakeholders due to expanding coverage, services, and expenditure. Neurovascular embolectomy devices play a crucial role in treating conditions like strokes by removing blood clots from arteries. As healthcare infrastructure improves and awareness grows, more patients are seeking timely interventions, driving market expansion. Manufacturers are innovating to enhance device efficacy and safety, catering to the specific needs of diverse patient populations. This growth presents significant opportunities for market players to expand their presence and address unmet medical needs in neurovascular care across emerging economies.

Neurovascular Embolectomy Device Market Segmentation

The worldwide market for neurovascular embolectomy device is split based on product, end-user, and geography.

Neurovascular Embolectomy Device Products

- Embolic Coils

- Flow Diversion Devices

- Liquid Embolic Agents

- Aneurysm Clips

- Others

As per the neurovascular embolectomy device market forecast, the embolic coils segment is expected to dominate over the industry throguhout 2024 to 2032. Embolic coils are a crucial component in neurovascular embolectomy, designed to treat intracranial aneurysms and vessel malformations. For instance, in January 2023, Fluidx Medical Technology, Inc. disclosed successful in-vivo studies utilizing the IMPASS embolic coil device for embolizing the middle meningeal artery (MMA) to treat chronic subdural hematomas (CSDH) located on the brain's outer layer. These devices work by being deployed into the affected blood vessel, where they induce clot formation and occlusion, preventing further risk of rupture or hemorrhage. Their dominance in the market stems from their efficacy in minimally invasive procedures, reducing recovery times and complications compared to traditional surgical methods. Continuous innovation has led to the development of detachable coils, enhancing precision and patient outcomes. As the demand for minimally invasive treatments grows, embolic coils are expected to maintain their prominent role in neurovascular interventions.

Neurovascular Embolectomy Device End-Users

- Hospitals

- Specialty Clinics

- Others

According to the neurovascular embolectomy device industry analysis, hospital segment holds a dominant position due to several key factors. Hospitals are the primary centers where acute stroke and other neurovascular conditions are treated, making them the largest users of these specialized devices. For instance, in May 2023, researchers achieved a significant milestone in medical history by successfully conducting in-utero surgery at a hospital to treat a severe vascular malformation called vein of Galen malformation in a fetus. This groundbreaking procedure aimed to cure a potentially fatal developmental condition before birth and was reviewed in the Stroke journal, the primary publication of the American Stroke Association, a branch of the American Heart Association. Moreover, the critical nature of neurovascular procedures necessitates reliable and high-quality devices, which hospitals prioritize in their procurement strategies, further solidifying their dominance in this market segment.

Neurovascular Embolectomy Device Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Neurovascular Embolectomy Device Market Regional Analysis

For several reasons, in North America, the neurovascular embolectomy device market holds a dominant position driven by advanced healthcare infrastructure and high adoption rates of innovative medical technologies. The region benefits from extensive research and development activities, leading to a robust pipeline of neurovascular devices. Additionally, favorable reimbursement policies and a strong presence of key market players contribute significantly to market growth. For instance, In July 2023, MicroVention, Inc., published 5-year monitoring data for their intrasaccular device, the WEB, and introduced two new sizes (SL 7x2 and SL 6x2) for aneurysm embolization technology. These updates enhance its suitability for a wider range of aneurysm types and sizes, making it more appealing to healthcare providers and patients interested in neurovascular embolization. Continuous advancements in minimally invasive procedures and increasing awareness among healthcare professionals further bolster the market expansion in North America. Overall, the region's leadership in this sector underscores its pivotal role in shaping global neurovascular healthcare advancements.

The Asia-Pacific region is experiencing rapid growth in the neurovascular embolectomy device market, driven by increasing incidences of stroke and vascular diseases. Advances in healthcare infrastructure and rising awareness among patients are further fueling this growth. Key factors include technological advancements in medical devices and improving access to healthcare services across emerging economies. For instance, in December 2022, Stryker opened a new research and development center in India with the primary aim of accelerating the development of advanced neurovascular devices for treating strokes. This inauguration bolstered Stryker's R&D capabilities, provided access to a skilled workforce, expanded its global presence, and offered valuable insights into the local market. This region's dynamic expansion underscores its pivotal role in shaping the global neurovascular healthcare landscape.

Neurovascular Embolectomy Device Market Players

Some of the top neurovascular embolectomy device companies offered in our report include LeMaitre Vascular, Inc, Medtronic, Boston Scientific Corporation, iVascular SLU, Cook Medical, DePuy Synthes Companies, Straub Medical AG, Edwards Lifesciences Corporation, Teleflex Inc, and Stryker.

Frequently Asked Questions

How big is the neurovascular embolectomy device market?

The neurovascular embolectomy device market size was valued at USD 1.25 billion in 2023.

What is the CAGR of the global neurovascular embolectomy device market from 2024 to 2032?

The CAGR of neurovascular embolectomy device is 5.3% during the analysis period of 2024 to 2032.

Which are the key players in the neurovascular embolectomy device market?

The key players operating in the global market are including LeMaitre Vascular, Inc, Medtronic, Boston Scientific Corporation, iVascular SLU, Cook Medical, DePuy Synthes Companies, Straub Medical AG, Edwards Lifesciences Corporation, Teleflex Inc and Stryker

Which region dominated the global neurovascular embolectomy device market share?

North America held the dominating position in neurovascular embolectomy device industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of neurovascular embolectomy device during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global neurovascular embolectomy device industry?

The current trends and dynamics in the neurovascular embolectomy device industry include increasing prevalence of stroke and other neurovascular disorders, technological advancements in neurosurgical devices, and growing adoption of minimally invasive procedures

Which product held the maximum share in 2023?

The embolic coils expected to hold the maximum share of the neurovascular embolectomy device industry.