Neurodiagnostics Market | Acumen Research and Consulting

Neurodiagnostics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

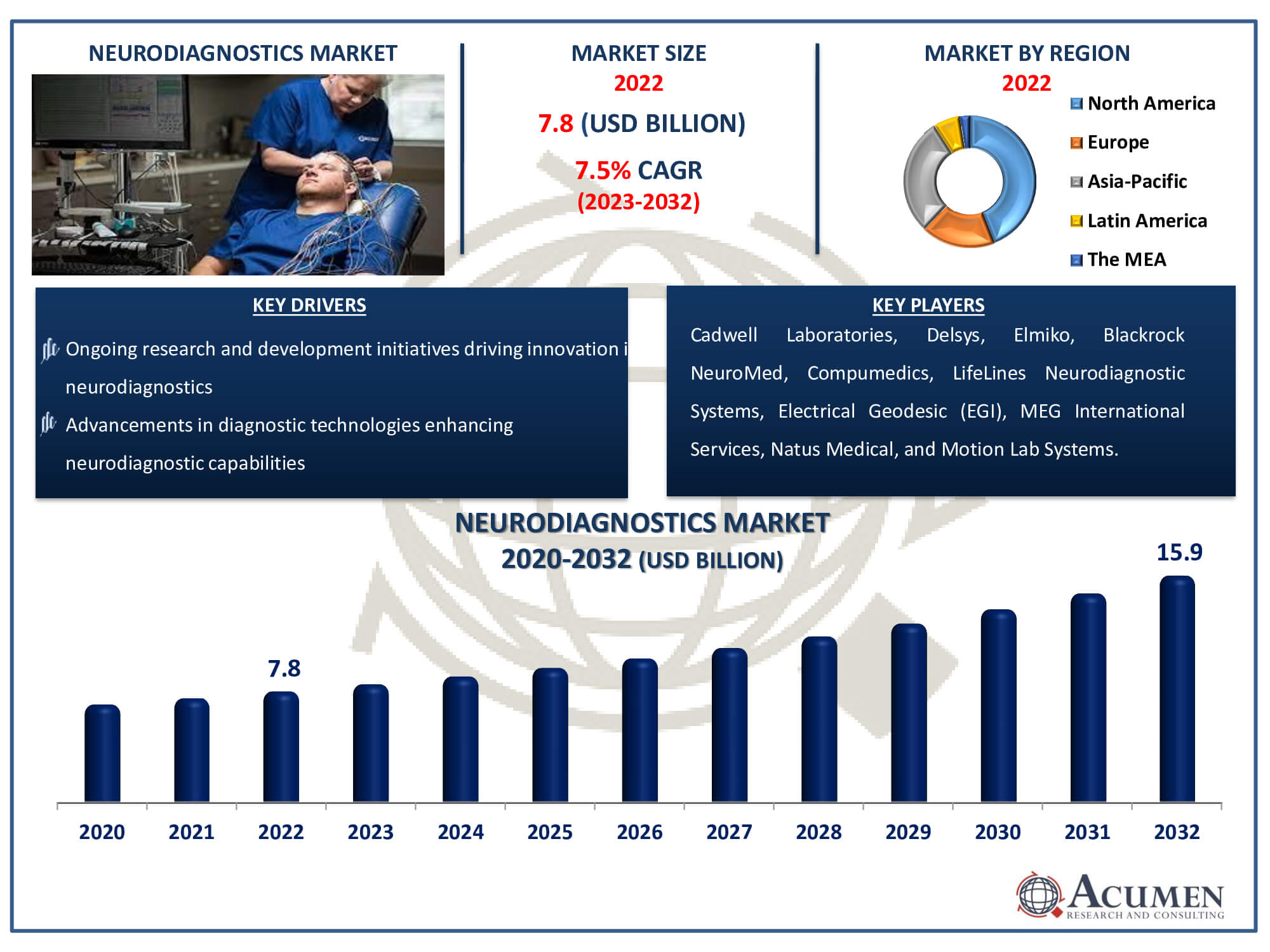

The Neurodiagnostics Market Size accounted for USD 7.8 Billion in 2022 and is estimated to achieve a market size of USD 15.9 Billion by 2032 growing at a CAGR of 7.5% from 2023 to 2032.

Neurodiagnostics Market Highlights

- Global neurodiagnostics market revenue is poised to garner USD 15.9 billion by 2032 with a CAGR of 7.5% from 2023 to 2032

- North America neurodiagnostics market value occupied around USD 3.4 billion in 2022

- Asia-Pacific neurodiagnostics market growth will record a CAGR of more than 8.4% from 2023 to 2032

- Among product, the diagnostic & imaging systems sub-segment generated more than USD 5 billion in 2022

- Based on end-use, the diagnostic laboratories & imaging centers degenerative diseases sub-segment generated around 42% share in 2022

- Collaborations and partnerships for research and development is a popular neurodiagnostics market trend that fuels the industry demand

When a patient is suspected of having disorders affecting the central nervous system, such as the brain or spinal cord, neurodiagnostic testing is carried out. These tests can be divided into two groups: electrical pulse sensing (which includes EEG and EMG) and imaging tests or scans (which include X-ray, CT, MRI, and PET scans). In each instance, research is done. Tracking, observing, and assessing nervous system performance is made possible by neurodiagnostics, which is essential for providing efficient illness care. The market for neurodiagnostics is expanding significantly thanks to developments in diagnostic technology. Growing knowledge and comprehension of neurological illnesses, along with rising healthcare costs, support the market's growth. Furthermore, continuing neurodiagnostics research and development projects stimulate market innovation and present viable options for better patient care.

Global Neurodiagnostics Market Dynamics

Market Drivers

- Advancements in diagnostic technologies enhancing neurodiagnostic capabilities

- Increasing prevalence and awareness of neurological disorders

- Growing healthcare expenditure and infrastructure development

- Ongoing research and development initiatives driving innovation in neurodiagnostics

Market Restraints

- High initial costs associated with advanced neurodiagnostic equipment

- Limited accessibility to neurodiagnostic services in certain regions

- Regulatory complexities impacting market entry

Market Opportunities

- Rising demand for personalized and precision medicine in neurology

- Integration of artificial intelligence in neurodiagnostics for enhanced analysis

- Expansion in emerging markets with unmet neurodiagnostic needs

Neurodiagnostics Market Report Coverage

| Market | Neurodiagnostics Market |

| Neurodiagnostics Market Size 2022 | USD 7.8 Billion |

| Neurodiagnostics Market Forecast 2032 | USD 15.9 Billion |

| Neurodiagnostics Market CAGR During 2023 - 2032 | 7.5% |

| Neurodiagnostics Market Analysis Period | 2020 - 2032 |

| Neurodiagnostics Market Base Year |

2022 |

| Neurodiagnostics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Condition, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Cadwell Laboratories, Blackrock NeuroMed, Compumedics, Delsys, Elmiko, LifeLines Neurodiagnostic Systems, Electrical Geodesic (EGI), MEG International Services, Natus Medical, and Motion Lab Systems. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Neurodiagnostics Market Insights

The development of the neurodiagnostic market has gradually occurred, primarily due to the increasing occurrence of neurological disorders in the modern age. The introduction of new technology to enhance testing performance, thereby promoting the diagnostic process, has also elevated the demand. Policy programs addressing neurological disorders and increasing public awareness have turned the sector into a fertile ground for investment. Key players are investing in various industrial approaches, including the competitive landscape, and market growth is expected to accelerate with merger and acquisition strategies. However, competition has somewhat diminished with regulatory bodies like the FDA and high procedural costs.

The high cost of sophisticated diagnostic techniques and equipment is a major barrier to the neurodiagnostics market. Adopting state-of-the-art technologies, such as molecular diagnostics and advanced imaging methods, frequently comes with high costs. This expense aspect may prevent certain people from accessing neurodiagnostic services, hindering market expansion. To overcome this barrier, efforts should focus on making these technologies more affordable and accessible.

The neurodiagnostics industry presents significant opportunities due to ongoing technical improvements. Advances in data analytics, biomarker identification, and imaging modalities improve diagnosis accuracy, contributing to better patient care.

Opportunities for market expansion arise from the growing awareness of neurological illnesses and the importance of early diagnosis. Education campaigns can enhance awareness, prompt diagnosis, and treatment of neurological diseases among the general public and healthcare professionals, leading to increased demand for neurodiagnostic services and products.

Neurodiagnostics Market Segmentation

The worldwide market for neurodiagnostics is split based on product, condition, end-use, and geography.

Neurodiagnostics Products

- Diagnostic & Imaging Systems

- Electroencephalogram (EEG) Systems

- Magnetic Resonance Imaging (MRI) Systems

- Ultrasound Imaging Systems

- Computed Tomography (CT) Scanner

- Others

- In-vitro diagnostics (IVD)

- Molecular Diagnostics

- Other IVDs

According to the neurodiagnostics industry analysis, the diagnostic & imaging systems segment is a market leader because of its critical role in offering sophisticated diagnostic capabilities for neurological illnesses. In order to visualise and analyse the structure and function of the brain and nervous system, this sector covers a variety of state-of-the-art technologies and imaging modalities. Advanced diagnostic and imaging systems comprise advanced instruments including electroencephalography (EEG), computed tomography (CT), positron emission tomography (PET), and magnetic resonance imaging (MRI). By providing comprehensive insights into patients' neurological states, these devices help medical professionals make accurate diagnosis and arrange treatments. This area is a cornerstone for comprehensive neurodiagnostic solutions due to its ongoing developments in imaging technologies, which improve precision, efficiency, and diagnostic efficacy. The dominance of the diagnostic & imaging systems segment can be attributed to its vital role in improving patient outcomes by improving knowledge and management of neurological illnesses.

Neurodiagnostics Conditions

- Neuro Degenerative Diseases

- Epilepsy

- Stroke

- Headache Disorders

- Sleep Disorders

- Other Diseases

The neuro degenerative diseases category leads the market and its expected to grow over the neurodiagnostics industry forecast period due to the rising prevalence of diseases like Parkinson's, Alzheimer's, and other neurodegenerative disorders, as well as their significant impact on world health. The need for neurodiagnostic instruments and services has been driven by the ageing population as well as the increased awareness and early diagnosis of these diseases. For neurodegenerative disease management and intervention to be successful, early and accurate diagnosis is essential. The neuro degenerative diseases section is leading the way in utilising neurodiagnostic technologies to tackle the intricate problems linked to these incapacitating illnesses.

Neurodiagnostics End-Uses

- Hospitals and Surgery Centers

- Neurology Centers

- Ambulatory Care Centers

- Diagnostic Laboratories & Imaging Centers

- Research Laboratories & Academic Institutes

Diagnostic laboratories & imaging centers segment is the largest in the market. After that the hospitals and surgery centres is the second largest segment, which is essential to the identification, treatment, and control of neurological illnesses. Hospitals are the main hubs for primary healthcare, providing full range of neurological treatments, including sophisticated imaging and diagnostic procedures. The requirement for specialised care and the rising incidence of neurological diseases have made hospitals and surgery centres essential to neurodiagnostic practices. This market is dominated by a concentration of highly qualified medical professionals, who have access to state-of-the-art technologies and are capable of handling complex cases. As a result, this market is crucial for offering effective neurodiagnostic solutions to a wide range of patient populations.

Neurodiagnostics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

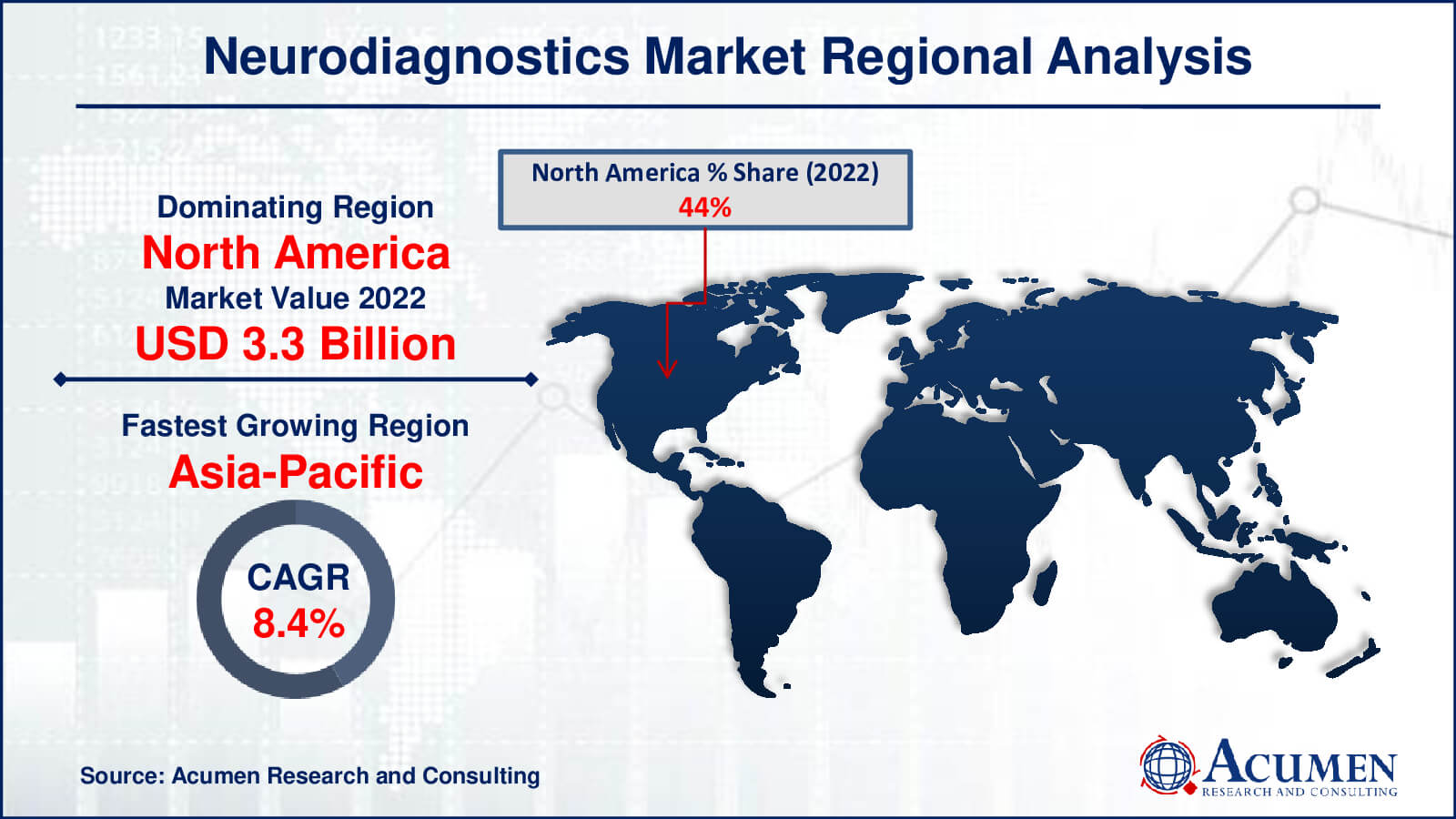

Neurodiagnostics Market Regional Analysis

North America commands a major market share in the global neurodiagnostics market, driven by the increasing demand for high-end neurodiagnostic systems and a rising prevalence of neurological disorders. For instance, in 2012, the Alzheimer's Association estimated approximately 5.1 Billion individuals in the USA suffering from Alzheimer's, with projections exceeding 16 Billion by 2020. The growing prevalence of neurological disorders, coupled with the presence of key players, solidifies the region's position in neurodiagnosis. Europe holds the second-largest share, attributed to the aging population and the increasing incidence of neurological disorders like stroke and Parkinson's disease. The Asia-Pacific region is expected to play a significant role in expanding the market, driven by a rising target audience and robust growth. Direct marketing campaigns and the introduction of new products, such as Hitachi's ECHELON Smart MRI device, contribute to market expansion. Limited access to treatment facilities and technological advancements may constrain growth, resulting in the lowest expansion rates.

Neurodiagnostics Market Players

Some of the top neurodiagnostics companies offered in our report includes Cadwell Laboratories, Blackrock NeuroMed, Compumedics, Delsys, Elmiko, LifeLines Neurodiagnostic Systems, Electrical Geodesic (EGI), MEG International Services, Natus Medical, and Motion Lab Systems.

Frequently Asked Questions

How big is the neurodiagnostics market?

The neurodiagnostics market size was valued at USD 7.8 billion in 2022.

What is the CAGR of the global neurodiagnostics market from 2023 to 2032?

The CAGR of neurodiagnostics is 7.5% during the analysis period of 2023 to 2032.

Which are the key players in the neurodiagnostics market?

The key players operating in the global market are including Cadwell Laboratories, Blackrock NeuroMed, Compumedics, Delsys, Elmiko, LifeLines Neurodiagnostic Systems, Electrical Geodesic (EGI), MEG International Services, Natus Medical, and Motion Lab Systems.

Which region dominated the global neurodiagnostics market share?

North America held the dominating position in neurodiagnostics industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of neurodiagnostics during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global neurodiagnostics industry?

The current trends and dynamics in the neurodiagnostics industry include advancements in diagnostic technologies enhancing neurodiagnostic capabilities, increasing prevalence and awareness of neurological disorders, growing healthcare expenditure and infrastructure development, and ongoing research and development initiatives driving innovation in neurodiagnostics.

Which end-use held the maximum share in 2022?

The diagnostic laboratories & imaging centers end-use held the maximum share of the neurodiagnostics industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date