Neoprene Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Neoprene Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

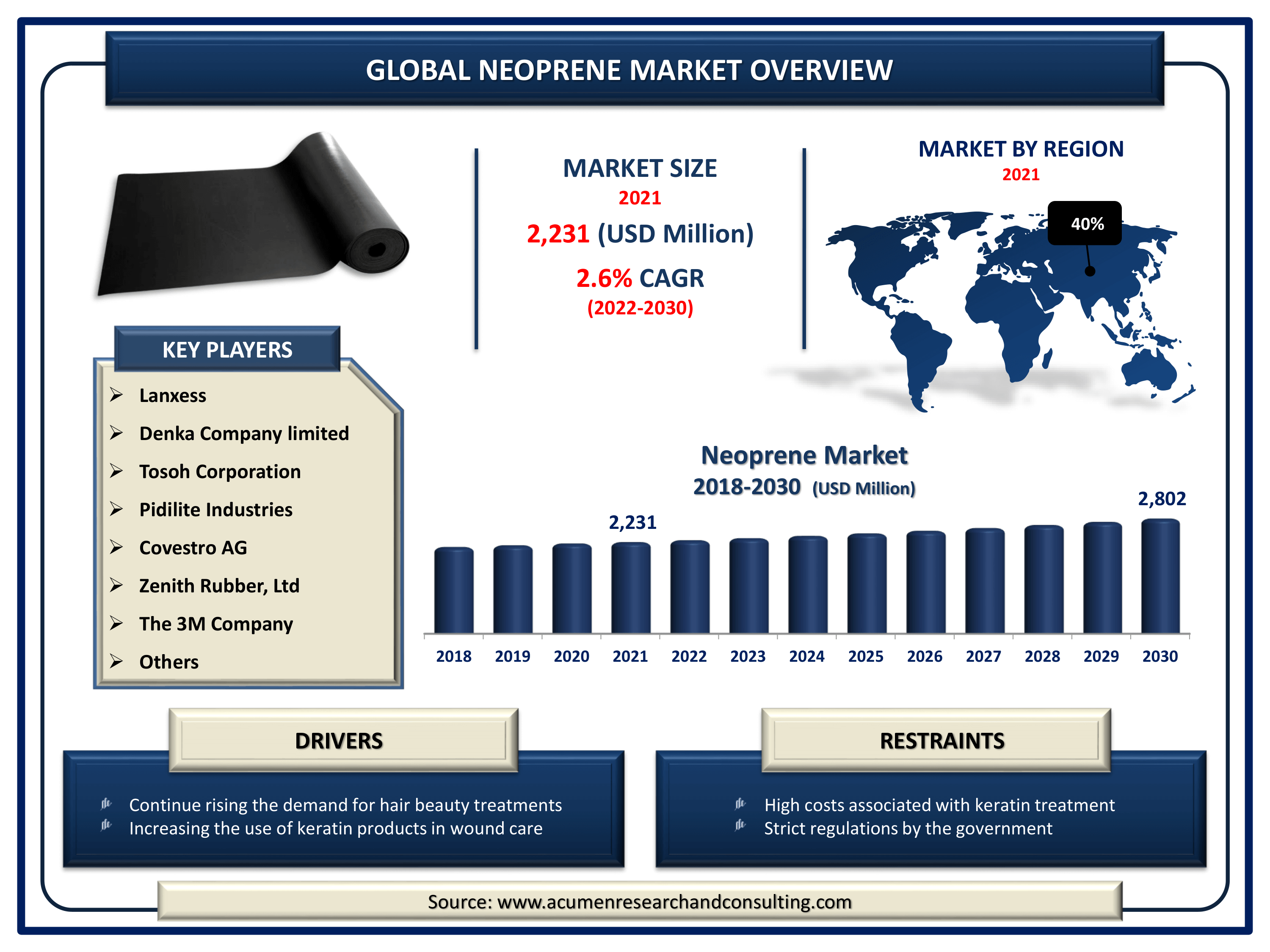

Request Sample Report

The Global Neoprene Market Size accounted for USD 2,231 Million in 2021 and is estimated to achieve a market size of USD 2,802 Million by 2030 growing at a CAGR of 2.6% from 2022 to 2030. One of the primary factors driving market expansion is the rising demand for neoprene across various industrial verticals like automotive, construction, electrical, and others. Furthermore, neoprene's distinguishing qualities, including ozone & weather resistances, as well as better tensile strength, have become significant factors driving the worldwide neoprene market expansion.

Neoprene Market Report Key Highlights

- Global neoprene market value is estimated to expand by USD 2,802 million by 2030, with a 2.6% CAGR from 2022 to 2030.

- Asia-Pacific neoprene market accounting for nearly 40% of the total market share in 2021

- Among end-user, automotive segment grew at the fastest pace of nearly 2.8% during the projection period

- According to the OICA, automobile manufacturing in India would reach 4,399,112 units in 2021

- Based on product, neoprene rubber sheet segment will account for more than 50% of overall market share in 2021

- Denka is a prominent player in this sector, with an estimated market share of more than 23%

Neoprene is a artificial polymer that is synthesized artificially using free radical crystallization of chloroprene. It was invented in the 1930s as an oil-resistant alternative to natural rubber latex, and DuPont was the first company to market it in 1931. Neoprene has several benefits over latex from natural rubber and other synthetic materials. Neoprene has excellent resistance to oxidizing agents including oils, alcohols, and acids, as well as to any acetonic solvents. It also has strong resilience to physical breakdowns such as cuts and is resistant to flexing, abrasion, and twisting damage. It also does not disintegrate the exposure to sunlight, ozone, and weather, and it adheres well to fabrics or metals. Furthermore, Neoprene has exceptional physical and chemical properties as well as sustains elasticity over a diverse range of temperatures.

Global Neoprene Market Dynamics

Market Drivers

- Increasing adoption of neoprene rubber in the Automotive Sector

- Continually growing construction and electronic industries in emerging economies

- The increase in chloroprene production capacity expansion

- rapid advancements in polymer and increased application

Market Restraints

- Crude oil price volatility

- The presence of effective alternatives

Market Opportunities

- The increase in technical advancements

- Modernization of manufacturing procedures

Neoprene Market Report Coverage

| Market | Neoprene Market |

| Neoprene Market Size 2021 | USD 2,231 Million |

| Neoprene Market Forecast 2030 | USD 2,802 Million |

| Neoprene Market CAGR During 2022 - 2030 | 2.6% |

| Neoprene Market Analysis Period | 2018 - 2030 |

| Neoprene Market Base Year | 2021 |

| Neoprene Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By End-user, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Lanxess, The 3M Company, Tosoh Corporation, Covestro AG, Zenith Rubber, Ltd, TuHuang Chemical Co., Pidilite Industries, Denka Company limited, BGK GmbH Endlosband, and Shanxi Synthetic Rubber Group Co Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

The growing usage of neoprene in the architecture and building sectors due to its high tensile toughness, in the semiconductor industry for wire jackets, and in the garment and footwear industries is likely to fuel market revenue growth during the forecast period. Furthermore, rapid advances in polymer research, the use of neoprene in application fields such as corrosion-resistant coating materials and landfill linings, and the increasing use of neoprene for a protective coating for personal computers are some variables expected to drive market growth for neoprene and contribute significantly to market revenue growth in the future. Neoprene seems to be a solvent-resistant elastomeric that is being used to manufacture many automotive raw materials such as tires, hoses, as well as belts, and this is another reason that is projected to fuel market revenue growth in the future.

Due to rapid industrialization, the uses of Neoprene have increased dramatically in recent years, as the qualities of Neoprene are predicted to hold a unique position in industrial sector applications. Neoprene is a rubberized material with several applications, including fire-proof insulation, electrical wings, and civil engineering. Furthermore, the surge in urbanization is fueling an increase in urban infrastructure development such as smart urban. Rising demand for neoprene across various end-user sectors is expected to generate incremental income throughout the opportunity evaluation period. On the other hand, volatility in crude oil and petroleum derivative prices are projected to be important factors impeding the growth of the worldwide neoprene market in the coming years.

Neoprene Market Segmentation

The worldwide neoprene market segmentation is based on the product, end-user, and geography.

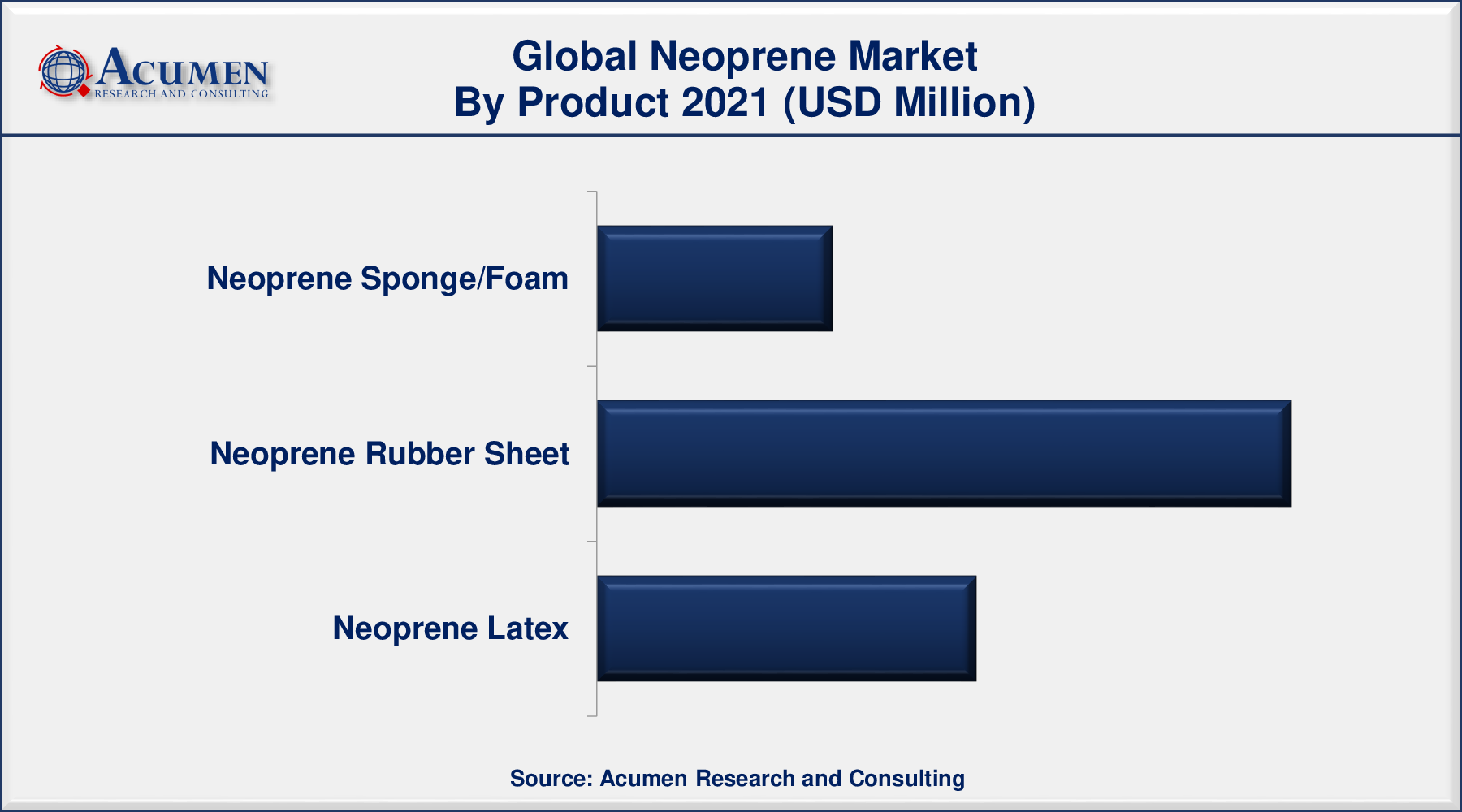

Neoprene Market By Product

- Neoprene Sponge/Foam

- Neoprene Rubber Sheet

- Neoprene Latex

According to the neoprene industry analysis, the neoprene sheet segment is predicted to account for a significant revenue share of the worldwide market over the forecast period. Neoprene rubber sheets are incredibly adaptable and resistant to petroleum, lubricants, and variations in weather conditions. Due to their stability and resistance to the harmful effects of UV radiation and ozone, neoprene sheets are favored over cheap rubber sheets. In the automotive sector, neoprene sheets are commonly utilized for under-the-hood as well as underbody parts purposes.

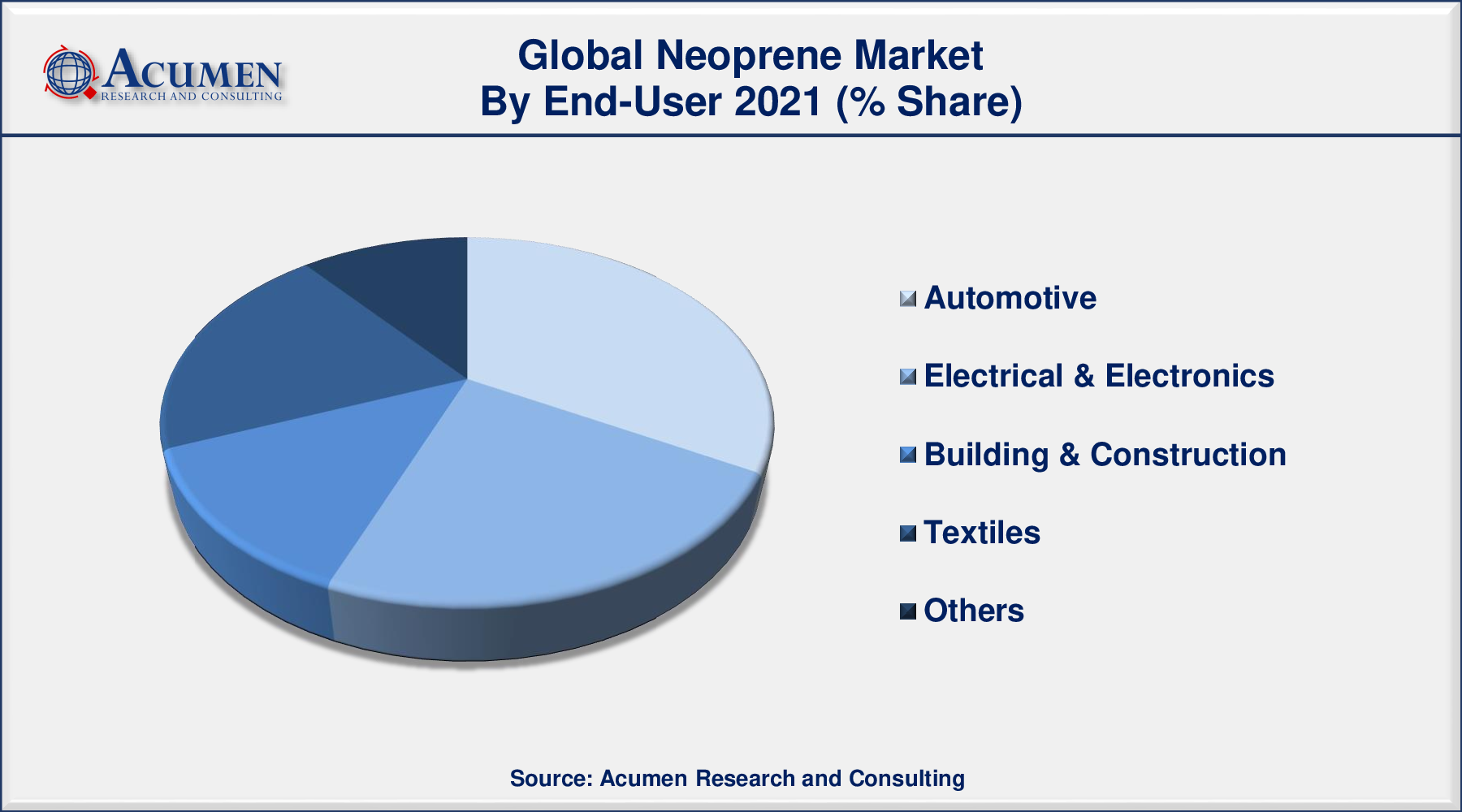

Neoprene Market By End-user

- Automotive

- Electrical & Electronics

- Building & Construction

- Textiles

- Others

According to the neoprene market forecast, the automotive segment would experience a considerable revenue increase during the projected timeframe. This is owing to the increased use of neoprene rubber in the manufacture of auto parts and components due to its properties such as great durability against abrasion, physical damage, grease, and weather changes. Neoprene rubber is frequently utilized in automobile components such as hose covers, fan belts, steering system components, as well as shock absorber gaskets, among others. Car seat covers are also made from neoprene textiles. Neoprene cloth interiors offer outstanding protection against filth, scratches, or moisture, and their water resistance makes them an excellent choice as a covering to safeguard original automotive parts from spills and other contaminants.

Neoprene Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Asia-Pacific Region Is Expected To Dominate The Market

Due to the high concentration of neoprene end-users in the Asia-Pacific region, the region is currently holding a significant market share in the worldwide Neoprene industry. The dense presence of industries such as automobile and engineering in Asia-Pacific growing countries such as China, India, the Philippines, Malaysia, and Indonesia is likely to grow at a high rate throughout the forecast period. The government agencies of advanced economies are growingly making investments in infrastructure and rapid industrialization, which is eventually increasing demand for components used, and neoprene is one of these materials, so the neoprene market in emerging economies is predicted to expand at a significant rate throughout the forecast period.

Neoprene Market Players

Some of the top neoprene market companies offered in the professional report include Lanxess, The 3M Company, Tosoh Corporation, Covestro AG, Zenith Rubber, Ltd, TuHuang Chemical Co., Pidilite Industries, Denka Company limited, BGK GmbH Endlosband, and Shanxi Synthetic Rubber Group Co Ltd.

Frequently Asked Questions

What is the size of global neoprene market in 2021?

The estimated value of global neoprene market in 2021 was accounted to be USD 2,231 Million.

What is the CAGR of global neoprene market during forecast period of 2022 to 2030?

The projected CAGR neoprene market during the analysis period of 2022 to 2030 is 2.6%.

Which are the key players operating in the market?

The prominent players of the global neoprene market are Lanxess, Denka Company limited, Tosoh Corporation, Pidilite Industries, Covestro AG, Zenith Rubber, Ltd, BGK GmbH Endlosband, TuHuang Chemical Co., The 3M Company, and Shanxi Synthetic Rubber Group Co Ltd.

Which region held the dominating position in the global neoprene market?

Which region held the dominating position in the global neoprene market?

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for neoprene during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global Neoprene market?

Increasing adoption of neoprene rubber in the automotive Sector, as well as expanding construction and electronic industries in emerging economies, drives the growth of global neoprene market.

By product segment, which sub-segment held the maximum share?

Based on product, neoprene rubber sheet segment is expected to hold the maximum share neoprene market.