Needle Free Injection Systems Market | Acumen Research and Consulting

Needle Free Injection Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

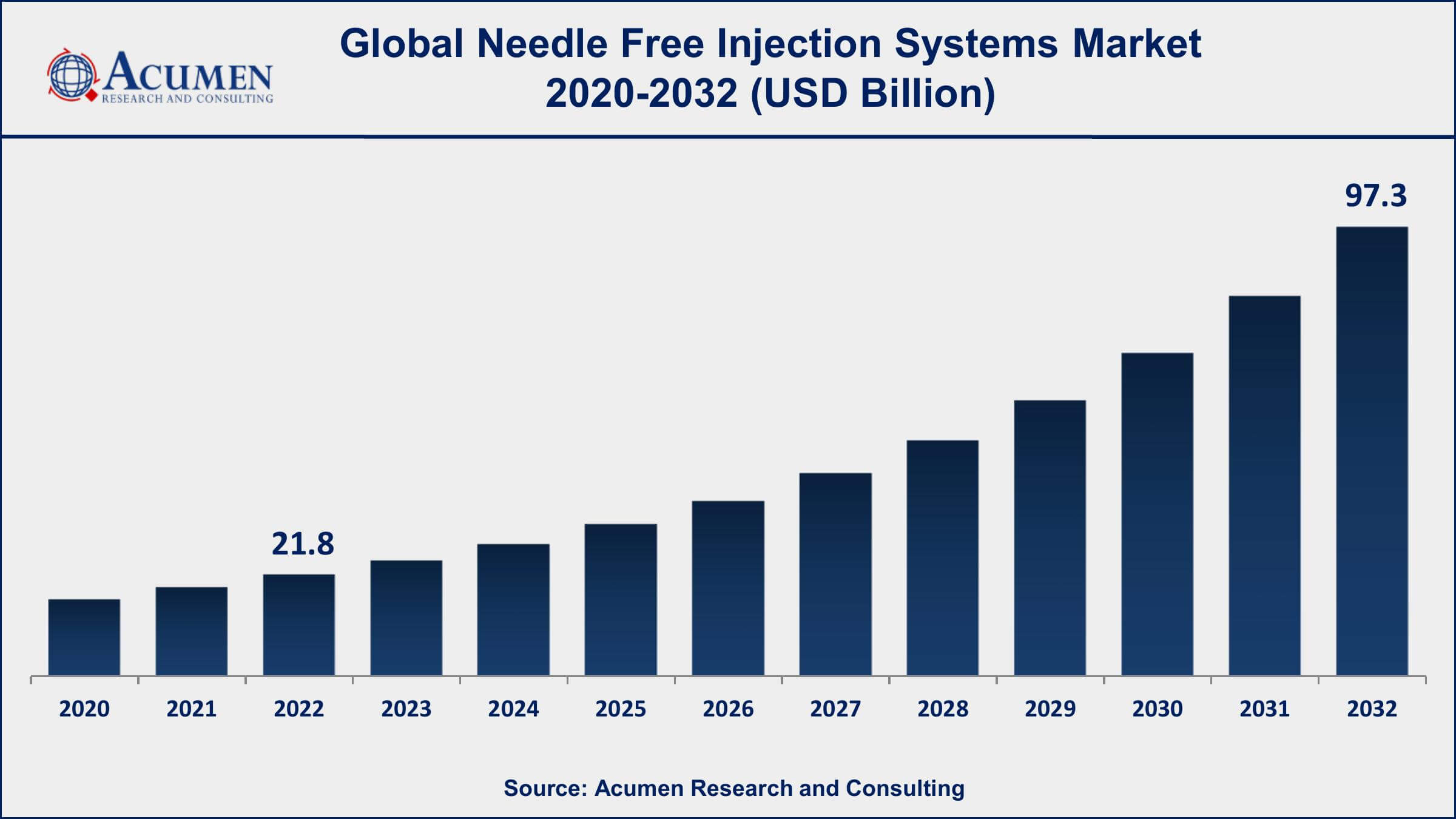

The Global Needle Free Injection Systems Market Size accounted for USD 21.8 Billion in 2022 and is projected to achieve a market size of USD 97.3 Billion by 2032 growing at a CAGR of 16.3% from 2023 to 2032.

Needle Free Injection Systems Market Key Highlights

- Global needle free injection systems market revenue is expected to increase by USD 97.3 Billion by 2032, with a 16.3% CAGR from 2023 to 2032

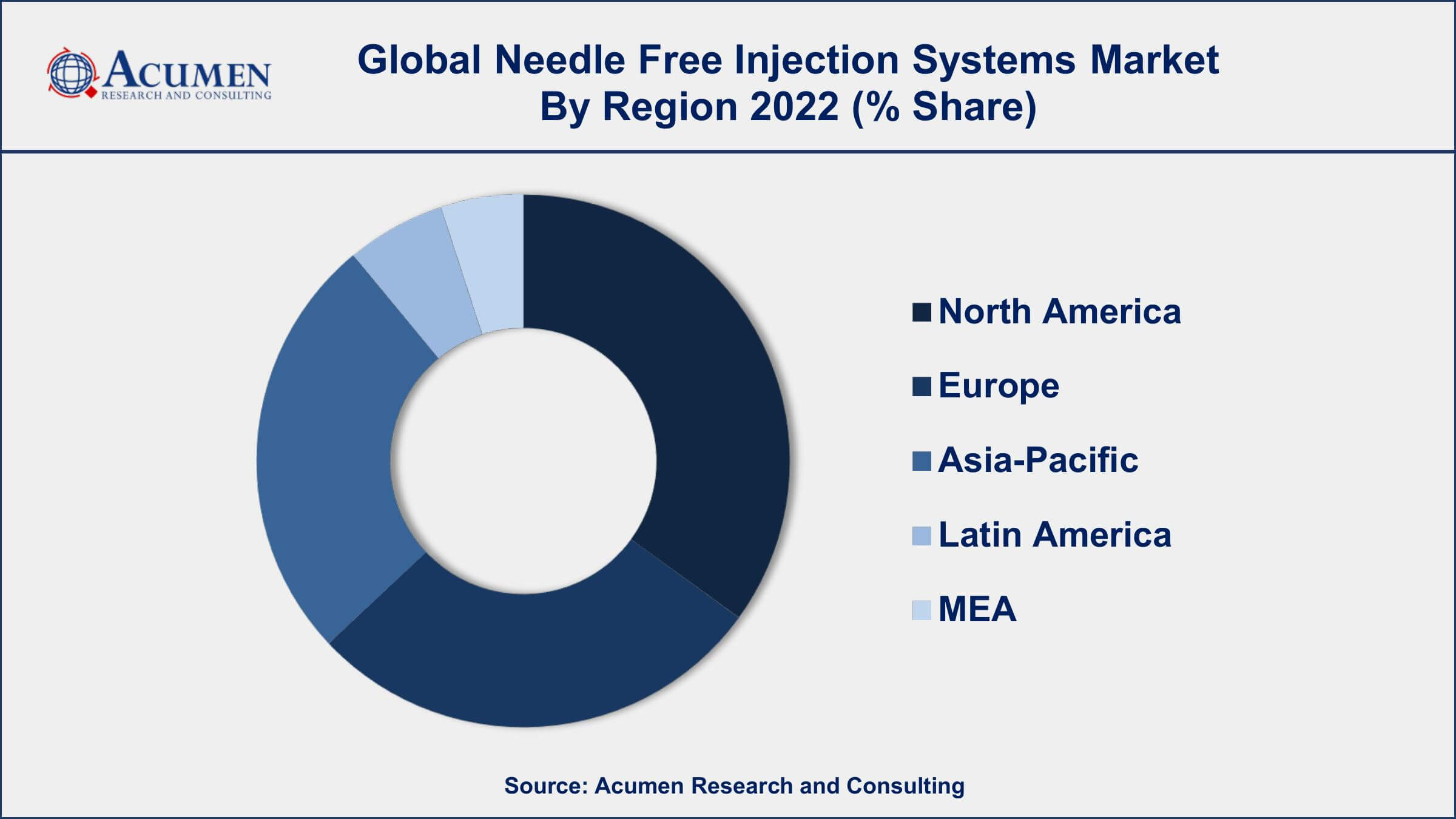

- North America region led with more than 42% of needle free injection systems market share in 2022

- Asia-Pacific needle-free injection systems market growth will record a CAGR of around 17% from 2023 to 2032

- The fillable needle-free injection systems are the most widely used type of needle-free injection systems, accounting for over 62% of the market share in 2022

- The vaccine delivery segment in the needle-free injection systems market is expected to grow at a CAGR of 16.8% from 2023 to 2032

- Rising awareness about the benefits of needle-free injection systems, drives the needle free injection systems market value

Needle-free injection systems, also known as jet injectors, are medical devices that use high pressure to deliver medication through the skin without the use of a needle. These devices work by creating a high-velocity jet of fluid that penetrates the skin and delivers the medication directly into the underlying tissue. Needle-free injection systems are commonly used for vaccines, insulin, and other medications that require frequent injections.

The market for needle-free injection systems has been growing steadily over the past few years, driven by several factors such as the increasing prevalence of chronic diseases, rising demand for self-injection devices, and growing awareness about the benefits of needle-free injection systems over traditional needle-based injections. The needle-free injection systems market is also expected to be driven by technological advancements such as the development of more efficient and accurate devices, as well as the growing adoption of these systems in the healthcare industry. Furthermore, the COVID-19 pandemic has also played a significant role in driving market growth, as the demand for vaccines has surged globally, leading to a significant increase in the demand for needle-free injection systems.

Global Needle Free Injection Systems Market Trends

Market Drivers

- Increasing prevalence of chronic diseases

- Growing demand for self-injection devices

- Rising awareness about the benefits of needle-free injection systems

- Technological advancements in the development of more efficient and accurate devices

- Growing adoption of needle-free injection systems in the healthcare industry

Market Restraints

- High cost of needle-free injection systems

- Lack of awareness and availability in developing countries

Market Opportunities

- Growing demand for point-of-care diagnostics and treatment

- Increasing investment in research and development of novel needle-free injection systems

Needle Free Injection Systems Market Report Coverage

| Market | Needle Free Injection Systems Market |

| Needle Free Injection Systems Market Size 2022 | USD 21.8 Billion |

| Needle Free Injection Systems Market Forecast 2032 | USD 97.3 Billion |

| Needle Free Injection Systems Market CAGR During 2023 - 2032 | 16.3% |

| Needle Free Injection Systems Market Analysis Period | 2020 - 2032 |

| Needle Free Injection Systems Market Base Year | 2022 |

| Needle Free Injection Systems Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Usability, By Technology, By Type of Medication, By Site of Delivery, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Antares Pharma Inc., Zogenix Inc., PharmaJet Inc., Valeritas Inc., Inovio Pharmaceuticals Inc., 3M Company, PenJet Corporation, Crossject SA, Injex Pharma AG, and Consort Medical plc (Bespak). |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Needle-free injection systems, also known as jet injectors, are medical devices that use high pressure to deliver medication through the skin without the use of a needle. These devices work by creating a high-velocity jet of fluid that penetrates the skin and delivers the medication directly into the underlying tissue. Needle-free injection systems are commonly used for vaccines, insulin, and other medications that require frequent injections.

One of the key applications of needle-free injection systems is in the administration of vaccines. Vaccines are essential for preventing the spread of infectious diseases, and needle-free injection systems offer several advantages over traditional needle-based injections, including reduced pain and anxiety, improved safety, and easier administration. Needle-free injection systems are also commonly used for the delivery of insulin in diabetic patients, as well as for the administration of other injectable drugs such as epinephrine, growth hormones, and fertility drugs.

The needle-free injection systems market has been experiencing significant growth over the past few years and is expected to continue to grow in the coming years. The market growth is primarily driven by factors such as the increasing prevalence of chronic diseases, rising demand for self-injection devices, and growing awareness about the benefits of needle-free injection systems over traditional needle-based injections. Furthermore, technological advancements in the development of more efficient and accurate devices, as well as the growing adoption of these systems in the healthcare industry, are expected to fuel market growth.

Needle Free Injection Systems Market Segmentation

The global needle free injection systems market segmentation is based on product, usability, technology, type of medication, site of delivery, application, end-use, and geography.

Needle Free Injection Systems Market By Product

- Fillable

- Prefilled

According to needle-free injection systems industry analysis, the fillable segment held the largest market share in 2022. This growth is driven by factors such as the increasing demand for customized dosages, targeted drug delivery, and the growing adoption of self-administration devices. Fillable needle-free injection systems allow for the delivery of drugs in precise dosages, which is particularly important in the treatment of chronic diseases such as diabetes, where precise insulin dosages are critical.

Needle Free Injection Systems Market By Usability

- Reusable

- Disposable

In terms of usability, the reusable segment is dominating the market in 2022. This growth is driven by factors such as the cost-effectiveness and eco-friendliness of these devices, as well as the growing demand for self-administration devices. Reusable needle-free injection systems can be used multiple times, making them more cost-effective and environmentally sustainable than single-use devices. They also offer greater flexibility, allowing patients to use the same device for multiple medications and dosages.

Needle Free Injection Systems Market By Technology

- Jet-Based

- Spring-Based

- Laser-Powered

- Vibration Based

According to the needle free injection systems market forecast, the jet-based segment is expected to witness significant growth in the coming years. This growth is driven by factors such as the ability to deliver medications at high speeds and achieve deeper penetration into tissues, making them ideal for the treatment of chronic conditions such as diabetes, arthritis, and osteoporosis. Jet-based needle-free injection systems use high-pressure jets of medication to penetrate the skin and deliver drugs directly into the bloodstream, muscles, or subcutaneous tissue.

Needle Free Injection Systems Market By Type of Medication

- Liquid Based

- Projectile/Depot Based

- Powder Based

Based on the type of medication, the liquid based segment is expected to witness significant growth in the coming years. This growth is driven by factors such as the ability to deliver a wide range of medications in liquid form, the growing demand for self-administration devices, and the increasing prevalence of chronic diseases. Liquid-based needle-free injection systems use a small needle or nozzle to create a fine stream of liquid medication, which is delivered into the skin or subcutaneous tissue.

Needle Free Injection Systems Market By Site of Delivery

- Intradermal Injectors

- Subcutaneous Injectors

- Intramuscular Injectors

In terms of site of delivery, the subcutaneous injectors segment has been experiencing significant growth in recent years. This growth is driven by factors such as the growing prevalence of chronic diseases, the increasing demand for targeted drug delivery, and the need for more patient-friendly injection devices. Subcutaneous injectors use high-pressure streams of medication to deliver drugs directly into the subcutaneous tissue, providing fast and effective drug delivery with reduced pain and discomfort.

Needle Free Injection Systems Market By Application

- Vaccine Delivery

- Insulin Delivery

- Pain Management

- Others

In terms of application, the vaccine delivery segment accounted for the largest revenue share over the forecast period. This growth is driven by factors such as the increasing demand for vaccines, the need for more efficient and effective vaccine delivery methods, and the growing focus on immunization programs worldwide. Needle-free injection systems offer a promising alternative to traditional needle-based injections for the delivery of vaccines, providing a safe and effective way to deliver vaccines without the pain and discomfort associated with traditional injections.

Needle Free Injection Systems Market By End-Use

- Hospitals & Clinics

- Home Care Settings

- Research Laboratories

- Others

In terms of end-user, the home care settings segment gained momentous growth in 2022. This growth is driven by factors such as the increasing demand for self-administration devices, the growing prevalence of chronic diseases, and the need for more patient-friendly injection devices. Needle-free injection systems offer a promising alternative to traditional needle-based injections for use in home care settings, providing a safe and effective way to deliver medications without the need for a healthcare professional.

Needle Free Injection Systems Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Needle Free Injection Systems Market Regional Analysis

North America dominates the needle-free injection systems market due to several factors such as the high prevalence of chronic diseases, the strong presence of key market players, and the high adoption rate of advanced medical technologies. The region is home to some of the world's largest pharmaceutical companies, which have been investing heavily in the development of needle-free injection systems to meet the growing demand for more patient-friendly drug delivery methods. Furthermore, the increasing awareness about the benefits of needle-free injection systems, such as reduced pain and discomfort, improved patient compliance, and greater accuracy and consistency of dosing, has also contributed to the growth of the market in North America. The region also has a well-established healthcare infrastructure and regulatory environment, which has encouraged the adoption of advanced medical technologies, including needle-free injection systems.

Needle Free Injection Systems Market Player

Some of the top needle-free injection systems market companies offered in the professional report include Antares Pharma Inc., Zogenix Inc., PharmaJet Inc., Valeritas Inc., Inovio Pharmaceuticals Inc., 3M Company, PenJet Corporation, Crossject SA, Injex Pharma AG, and Consort Medical plc (Bespak).

Frequently Asked Questions

What was the market size of the global needle free injection systems in 2022?

The market size of needle free injection systems was USD 21.8 Billion in 2022.

What is the CAGR of the global needle free injection systems market from 2023 to 2032?

The CAGR of needle free injection systems is 16.3% during the analysis period of 2023 to 2032.

Which are the key players in the needle free injection systems market?

The key players operating in the global market are including Antares Pharma Inc., Zogenix Inc., PharmaJet Inc., Valeritas Inc., Inovio Pharmaceuticals Inc., 3M Company, PenJet Corporation, Crossject SA, Injex Pharma AG, and Consort Medical plc (Bespak).

Which region dominated the global needle free injection systems market share?

North America held the dominating position in needle free injection systems industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of needle free injection systems during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global needle free injection systems industry?

The current trends and dynamics in the needle free injection systems industry include increasing prevalence of chronic diseases, growing demand for self-injection devices, and rising awareness about the benefits of needle-free injection systems.

Which product held the maximum share in 2022?

The fillable product held the maximum share of the needle free injection systems industry.