Narcotics Scanner Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Narcotics Scanner Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

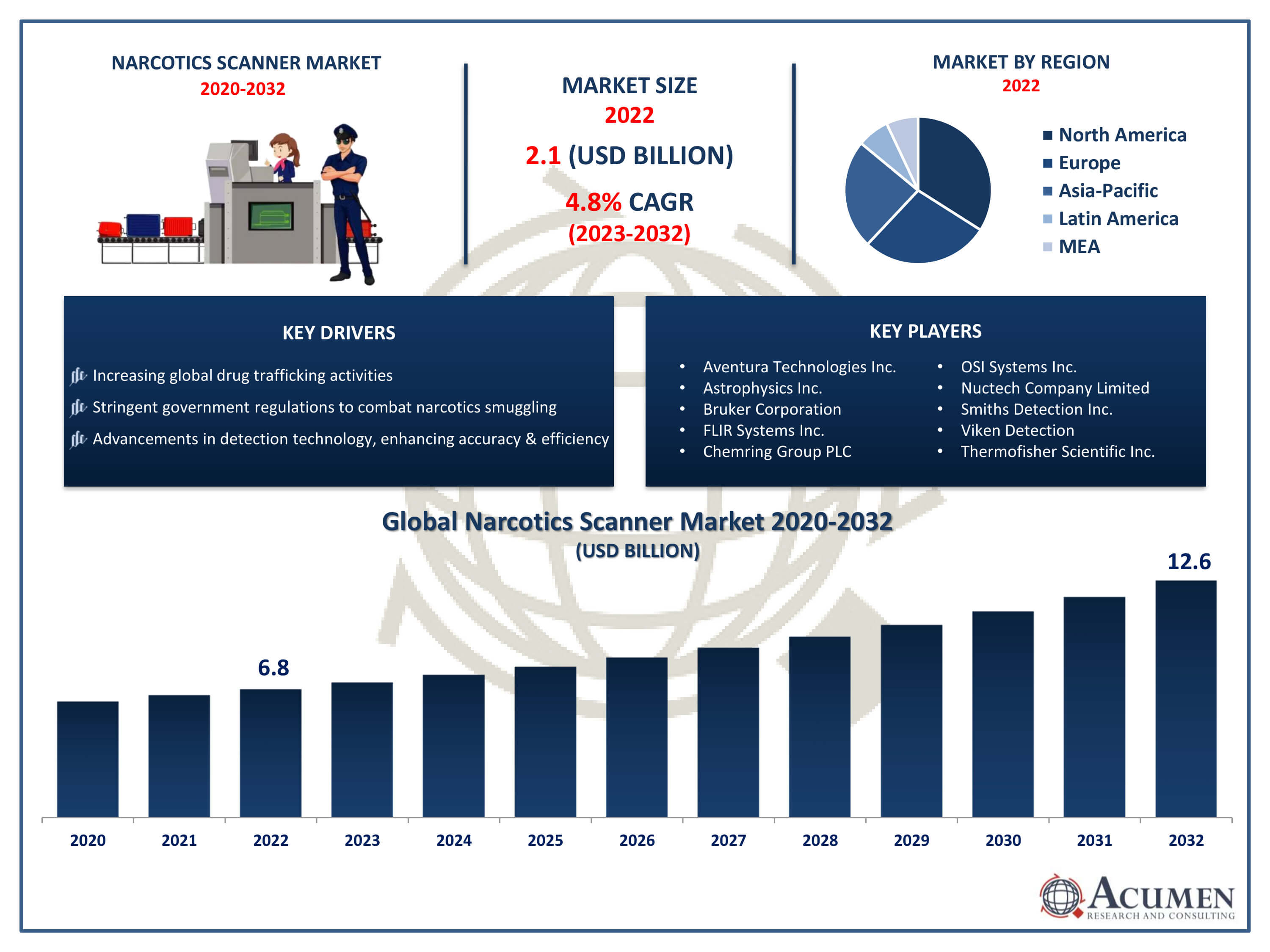

The Narcotics Scanner Market Size accounted for USD 6.8 Billion in 2022 and is projected to achieve a market size of USD 12.6 Billion by 2032 growing at a CAGR of 6.4% from 2023 to 2032.

Narcotics Scanner Market Highlights

- Global narcotics scanner market revenue is expected to increase by USD 12.6 Billion by 2032, with a 6.4% CAGR from 2023 to 2032

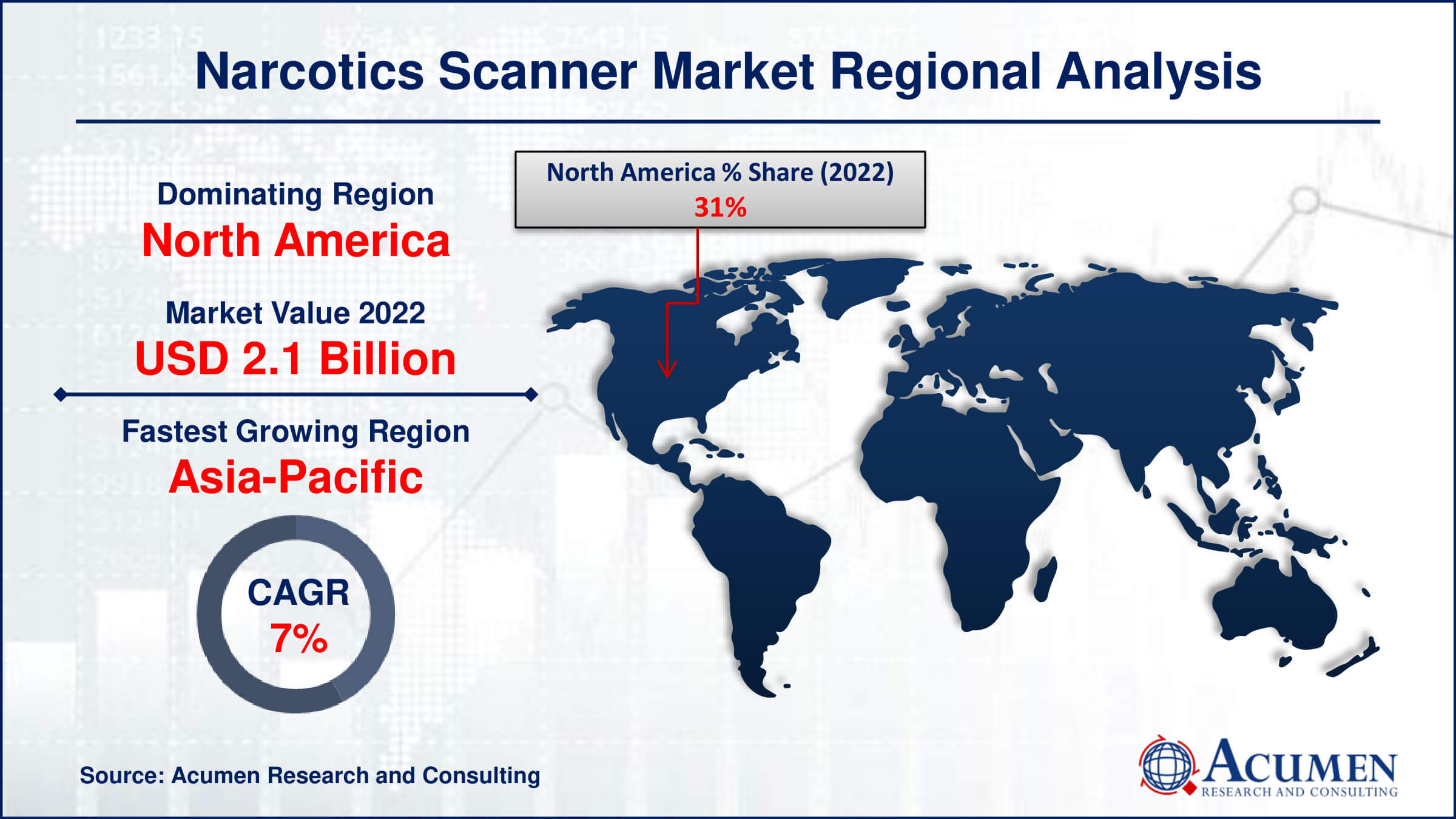

- North America region led with more than 31% of narcotics scanner market share in 2022

- Asia-Pacific narcotics scanner market growth will record a CAGR of more than 7.1% from 2023 to 2032

- By product type, the walkthrough scanner segment captured more than 46% of revenue share in 2022.

- By end user, the airport segment is projected to expand at the fastest CAGR over the projected period

- Increasing global drug trafficking activities, drives the narcotics scanner market value

A narcotics scanner, also known as a drug detector or drug scanner, is a device designed to identify and detect the presence of illegal drugs or narcotics. These scanners employ various technologies such as ion mobility spectrometry, mass spectrometry, infrared spectroscopy, and others to detect even trace amounts of narcotics in different environments, including airports, border checkpoints, prisons, and public venues. They are crucial tools in the fight against drug trafficking and substance abuse, helping law enforcement agencies and security personnel to intercept illegal drugs and prevent their circulation.

The market for narcotics scanners has been witnessing steady growth due to several factors. The increasing incidence of drug trafficking and the proliferation of illicit drug use globally have propelled the demand for advanced detection technologies. Moreover, stringent regulations and policies by governments to combat drug smuggling and abuse have further stimulated the adoption of narcotics scanners. Additionally, advancements in technology have led to the development of more efficient and compact scanners, enhancing their usability and effectiveness. The market is also influenced by factors such as the rise in international trade and travel, which necessitates stringent security measures at ports, airports, and border crossings, thereby boosting the demand for narcotics detection equipment.

Global Narcotics Scanner Market Trends

Market Drivers

- Increasing global drug trafficking activities

- Stringent government regulations to combat narcotics smuggling

- Advancements in detection technology, enhancing accuracy and efficiency

- Growing international trade and travel, necessitating heightened security measures

- Integration of artificial intelligence and machine learning for enhanced detection capabilities

Market Restraints

- High initial investment and maintenance costs

- Concerns regarding privacy invasion and civil liberties

Market Opportunities

- Rising demand for portable and handheld narcotics scanners

- Integration of narcotics detection systems with other security solutions

Narcotics Scanner Market Report Coverage

| Market | Narcotics Scanner Market |

| Narcotics Scanner Market Size 2022 | USD 6.8 Billion |

| Narcotics Scanner Market Forecast 2032 |

USD 12.6 Billion |

| Narcotics Scanner Market CAGR During 2023 - 2032 | 6.4% |

| Narcotics Scanner Market Analysis Period | 2020 - 2032 |

| Narcotics Scanner Market Base Year |

2022 |

| Narcotics Scanner Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Technology, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Aventura Technologies Inc., Astrophysics Inc., Bruker Corporation, FLIR Systems Inc., Chemring Group PLC, L-3 Security And Detection Systems Inc., OSI Systems Inc., Nuctech Company Limited, Smiths Detection Inc., Viken Detection, and Thermofisher Scientific Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

A narcotics scanner is a device utilized to detect and identify the presence of illegal drugs or narcotics in various settings. These scanners employ advanced technologies such as ion mobility spectrometry, mass spectrometry, and infrared spectroscopy to analyze samples and detect even trace amounts of narcotics. Typically used by law enforcement agencies, security personnel, and customs officials, narcotics scanners play a crucial role in combating drug trafficking and substance abuse by intercepting illicit drugs before they can enter circulation. The applications of narcotics scanners span across a wide range of environments and industries. One primary application is in border security and customs checkpoints, where scanners are deployed to inspect cargo, luggage, and vehicles for hidden narcotics. Additionally, narcotics scanners are extensively used in airports and transportation hubs to screen passengers and their belongings for illicit substances. They are also employed in prisons and correctional facilities to prevent the smuggling of drugs into these institutions.

The narcotics scanner market has been experiencing notable growth driven by a combination of factors. With the persistent global challenge of drug trafficking and the continuous evolution of smuggling tactics, governments and law enforcement agencies are increasingly investing in advanced detection technologies. This has created a significant demand for narcotics scanners across various sectors including transportation, border control, law enforcement, and security. The market growth is further fueled by stringent regulatory frameworks aimed at combating drug trafficking and substance abuse, prompting organizations to prioritize the deployment of effective narcotics detection systems. Moreover, technological advancements play a pivotal role in driving market growth. Manufacturers are continually innovating to develop more sophisticated and efficient narcotics scanners capable of detecting even trace amounts of illicit substances. Integration of artificial intelligence and machine learning algorithms has enhanced the accuracy and speed of detection, making these scanners indispensable tools in the fight against drug trafficking.

Narcotics Scanner Market Segmentation

The global narcotics scanner market segmentation is based on product type, technology, end user, and geography.

Narcotics Scanner Market By Product Type

- Handheld Scanner

- Walkthrough Scanner

- Tabletop Scanner

According to the narcotics scanner industry analysis, the walkthrough scanner segment accounted for the largest market share in 2022. This growth is owing to its effectiveness in detecting hidden narcotics in individuals passing through checkpoints. These scanners are commonly deployed in airports, prisons, and high-security facilities where screening large volumes of people is essential. The growth of this segment is propelled by several factors, including the rising concern over drug smuggling and terrorism, prompting stringent security measures. Additionally, technological advancements have led to the development of walkthrough scanners with enhanced sensitivity and speed, improving their ability to detect concealed narcotics accurately. Moreover, the increasing adoption of walkthrough scanners is attributed to the growing awareness among governments and security agencies about the importance of preventive measures against drug trafficking and substance abuse. The ease of operation and non-intrusive nature of walkthrough scanners make them a preferred choice for high-traffic areas, contributing to their market growth.

Narcotics Scanner Market By Technology

- Ion Mobility Spectrum Technology

- Videoscope Inspection System

- Contraband Detection Equipment

- Infrared Spectroscopy

In terms of technology, the ion mobility spectrometry (IMS) technology segment is expected to witness significant growth in the coming years. IMS-based narcotics scanners are widely utilized in various security applications, including border control checkpoints, customs facilities, and law enforcement agencies. The growth of this segment is propelled by the increasing sophistication of drug smuggling tactics, necessitating advanced detection technologies to intercept illegal substances effectively. IMS scanners excel in detecting a wide range of narcotics, including synthetic drugs, explosives, and chemical agents, making them indispensable tools in the fight against illicit activities. Furthermore, the adoption of IMS technology is driven by its ability to provide real-time results, enabling quick decision-making by security personnel. As drug trafficking continues to pose a significant threat to national security and public safety, governments and security agencies are investing heavily in IMS-based narcotics scanners to bolster their detection capabilities.

Narcotics Scanner Market By End User

- Airport

- Law Enforcement

- Defense and Military

- Public Transportation

- Others

According to the narcotics scanner market forecast, the airport segment is expected to witness significant growth in the coming years. Airports serve as crucial transit points for drug smuggling, prompting authorities to implement stringent measures to detect and intercept illicit substances. As a result, there has been a growing demand for advanced narcotics detection technologies at airports worldwide. This has led to the widespread adoption of narcotics scanners equipped with various detection technologies such as X-ray, ion mobility spectrometry (IMS), and millimeter-wave imaging. Moreover, the continuous expansion of global air travel and the proliferation of international trade have further fueled the growth of narcotics scanner deployment in airports. With millions of passengers and tons of cargo passing through airports daily, ensuring effective narcotics detection is paramount to safeguarding national security and public safety. Additionally, regulatory initiatives mandating enhanced security measures at airports have propelled investments in advanced scanning technologies, driving market growth.

Narcotics Scanner Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Narcotics Scanner Market Regional Analysis

North America dominates the narcotics scanner market for several reasons, primarily driven by stringent regulatory frameworks, technological advancements, and substantial investments in security infrastructure. The region faces significant challenges related to drug trafficking due to its extensive borders and ports of entry, prompting governments to prioritize the deployment of advanced narcotics detection systems. Additionally, the United States, in particular, has been at the forefront of implementing robust security measures at airports, seaports, and land border crossings, contributing to the high demand for narcotics scanners. Moreover, North America boasts a robust ecosystem of technology developers and manufacturers specializing in security solutions, including narcotics detection systems. The region benefits from a strong research and development infrastructure, fostering innovation and the continuous improvement of detection technologies. Furthermore, the presence of key market players and government agencies collaborating on security initiatives enhances the accessibility and adoption of advanced narcotics scanners in North America. As a result, the region remains at the forefront of the global narcotics scanner market, with sustained investments in security measures and technological advancements reinforcing its dominant position.

Narcotics Scanner Market Player

Some of the top narcotics scanner market companies offered in the professional report include Aventura Technologies Inc., Astrophysics Inc., Bruker Corporation, FLIR Systems Inc., Chemring Group PLC, L-3 Security And Detection Systems Inc., OSI Systems Inc., Nuctech Company Limited, Smiths Detection Inc., Viken Detection, and Thermofisher Scientific Inc.

Frequently Asked Questions

How big is the narcotics scanner market?

The narcotics scanner market size was USD 6.8 Billion in 2022.

What is the CAGR of the global narcotics scanner market from 2023 to 2032?

The CAGR of narcotics scanner is 6.4% during the analysis period of 2023 to 2032.

Which are the key players in the narcotics scanner market?

The key players operating in the global market are including Aventura Technologies Inc., Astrophysics Inc., Bruker Corporation, FLIR Systems Inc., Chemring Group PLC, L-3 Security And Detection Systems Inc., OSI Systems Inc., Nuctech Company Limited, Smiths Detection Inc., Viken Detection, and Thermofisher Scientific Inc.

Which region dominated the global narcotics scanner market share?

North America held the dominating position in narcotics scanner industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of narcotics scanner during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global narcotics scanner industry?

The current trends and dynamics in the narcotics scanner industry include increasing global drug trafficking activities, stringent government regulations to combat narcotics smuggling, and advancements in detection technology, enhancing accuracy and efficiency.

Which technology held the maximum share in 2022?

The ion mobility spectrum technology held the maximum share of the narcotics scanner industry.