Naloxone Market | Acumen Research and Consulting

Naloxone Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

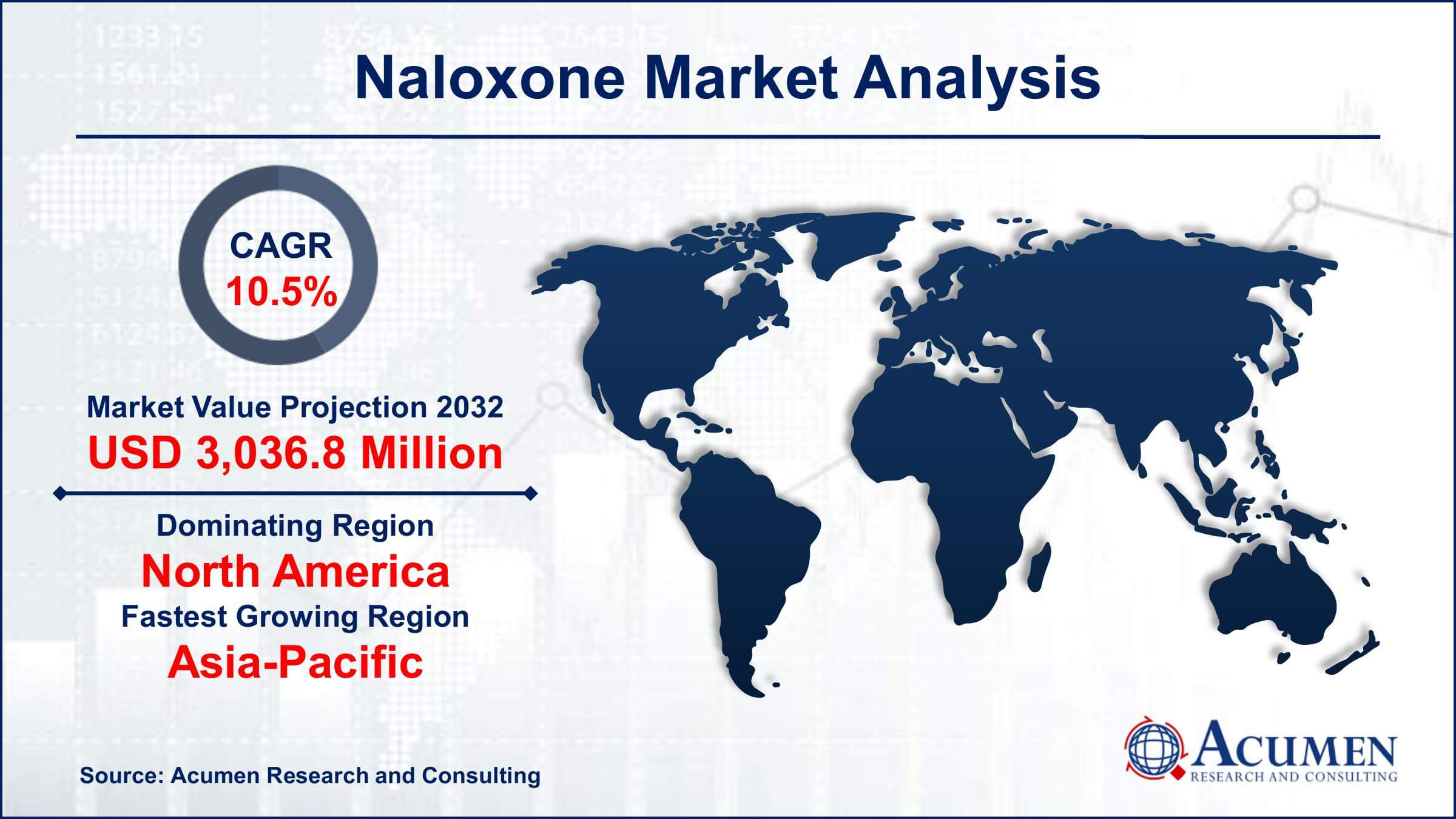

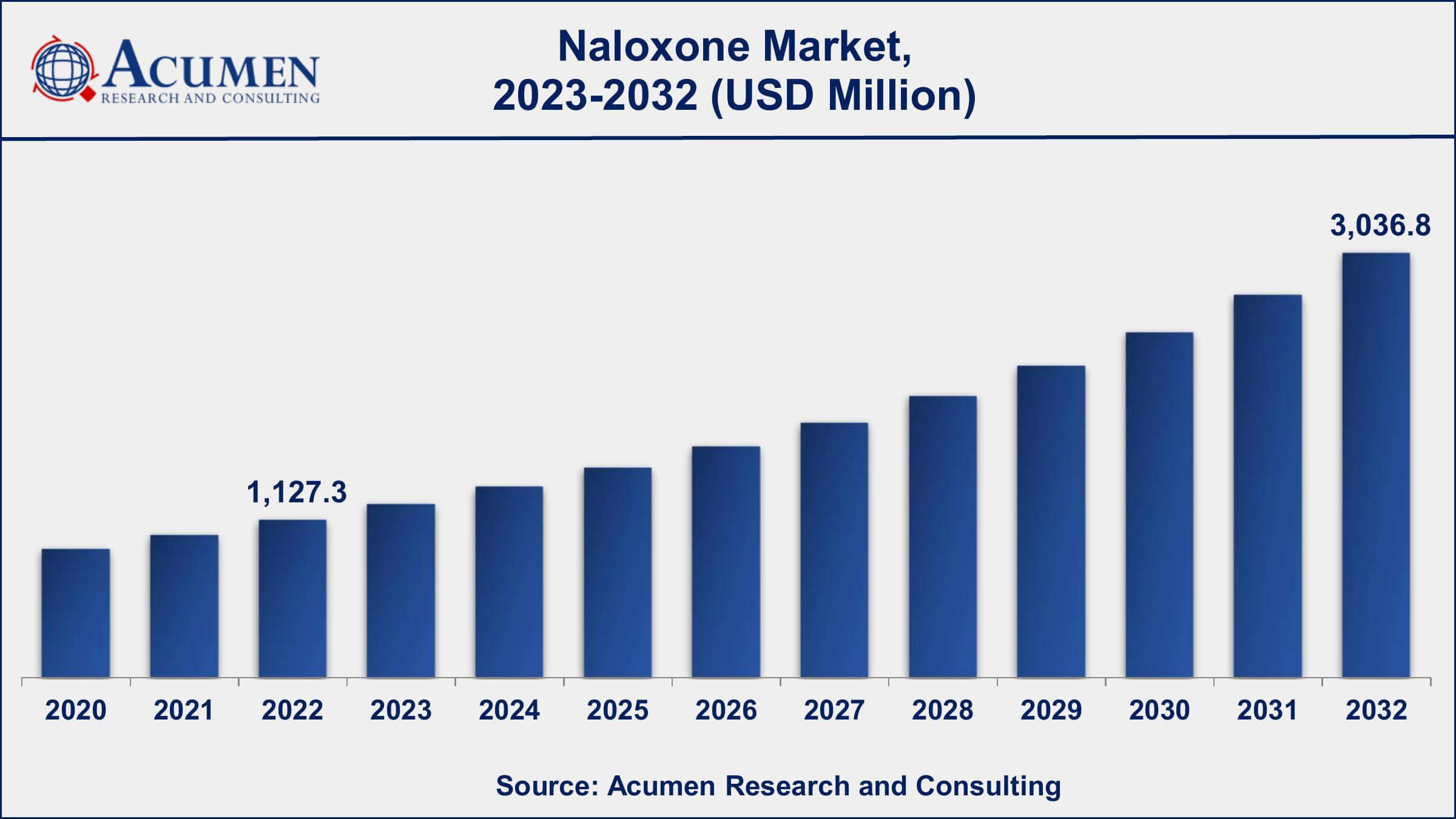

The global Naloxone Market gathered USD 1,127.3 Million in 2022 and is expected to reach USD 3,036.8 Million by 2032, growing at a CAGR of 10.5% from 2023 to 2032.

Naloxone Market Highlights

- The global naloxone market is poised to achieve a revenue of USD 3,036.8 million by 2032, experiencing a CAGR of 10.5% from 2023 to 2032

- In 2022, the North America naloxone market held a value of approximately USD 665.1 million

- The Asia-Pacific naloxone market is expected to witness substantial growth, with a projected CAGR of over 11% from 2023 to 2032

- Among strengths, the 2.0 mg/0.1 ml and 4.0 mg/ml sub-segment accounted for revenue exceeding USD 574 million in 2022

- In terms of distribution channel, the hospital pharmacies sub-segment claimed a significant share, surpassing 40% in 2022

- Increasing government initiatives for naloxone distribution is one of the notable naloxone market trends

Naloxone (also known as Narcan or Naxolene) is a medication used to rapidly reverse opioid overdose. Opioids include prescription painkillers like oxycodone and hydrocodone, as well as illegal drugs like heroin and fentanyl. Naloxone works by binding to the same receptors in the brain that opioids bind to, blocking their effects and reversing the slowed breathing and other life-threatening symptoms of overdose. Naloxone is available as an injection or nasal spray and can be administered by anyone with basic training, including family members, healthcare providers, and first responders.

Naloxone has been shown to be highly effective in reversing opioid overdose, with studies finding that it can save many lives when administered promptly. However, it is important to note that naloxone does not cure addiction or solve the underlying causes of drug use. It is merely a tool to help prevent overdose fatalities and buy time for individuals struggling with addiction to seek treatment and support.

Some potential side effects of naloxone include rapid heartbeat, high blood pressure, nausea, vomiting, dizziness, and headache. However, these side effects are usually mild and short-lived, and the benefits of naloxone far outweigh the risks. Naloxone is not a controlled substance and does not have the potential for abuse or addiction. Overall, naloxone is an important tool in the fight against opioid addiction and overdose, and its availability and accessibility can help save many lives.

Global Naloxone Market Dynamics

Market Drivers

- Growing opioid overdose rates

- Rising government initiatives and funding for naloxone distribution programs

- Increased public awareness of opioid addiction and overdose prevention

Market Restraints

- Limited availability and distribution in some regions

- High cost of naloxone products

- Lack of awareness among healthcare providers about prescribing naloxone

Market Opportunities

- Technological advancements in naloxone delivery systems

- Increasing demand for community-based naloxone training and distribution programs

- Development of new and more effective naloxone formulations such as nasal sprays and auto-injectors

Naloxone Market Report Coverage

| Market | Naloxone Market |

| Naloxone Market Size 2022 | USD 1,127.3 Million |

| Naloxone Market Forecast 2032 | USD 3,036.8 Million |

| Naloxone Market CAGR During 2023 - 2032 | 10.5% |

| Naloxone Market Analysis Period | 2020 - 2032 |

| Naloxone Market Base Year |

2022 |

| Naloxone Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Strength, By Route of Administration, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Akorn Operating Company LLC, Amphastar Pharmaceuticals, Inc., Emergent BioSolutions Inc., Hikma Pharmaceuticals PLC, Indivior Plc., Kaleo, Inc., Kern Pharma, S.L., Mundipharma International Limited, Novartis AG, Opiant Pharmaceuticals, Pfizer, Inc., and Viatris Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Naloxone Market Insights

Several main variables have had a significant impact on the market dynamics for naloxone, a drug used to treat opioid overdoses. For starters, the opioid crisis has been a major driver of the naloxone business. Over the last several decades, there has been a significant increase in opioid-related overdoses, which has been fueled by the abuse of prescription opioids, heroin, and synthetic opioids such as fentanyl. This public health problem has raised demand for naloxone as a life-saving intervention during opioid crises. As a result of the necessity of treating this pandemic, the naloxone market has grown dramatically.

Second, government actions and public health campaigns have had a significant impact on the naloxone industry. Many governments and healthcare organizations throughout the world have recognized the necessity of increasing the availability of naloxone. They have put in place programs to provide naloxone to first responders, healthcare practitioners, and even the general population, especially in areas worst impacted by the opioid crisis. These campaigns have not only boosted the availability of Naloxone but also raised awareness about its potential for saving lives.

Changes in legislation and regulations have also played a role in propelling the naloxone industry. Many countries have revised the rules and regulations governing the distribution and accessibility of Naloxone. These developments have frequently reduced barriers to acquiring Naloxone, making it available in certain circumstances without a prescription. This legal change has made Naloxone more widely available, which has contributed to its market expansion.

Pharmaceutical businesses that produce naloxone have also had a significant impact on market dynamics. To make naloxone administration easier and more effective, they have sought to enhance formulations, boost production capacity, and investigate novel delivery techniques such as auto-injectors and nasal sprays. These efforts not only improved the product but also increased market competitiveness.

Finally, the opioid epidemic, government initiatives, regulatory reforms, and pharmaceutical developments have all had a significant impact on the Naloxone market dynamics. The need to manage opioid overdoses has fueled both demand and innovation in the Naloxone industry, making it an essential component of public health efforts to battle the opioid crisis.

Naloxone Market Segmentation

The worldwide market for naloxone is split based on strength, route of administration, distribution channel, and geography.

Naloxone Strengths

- 2.0 mg/0.1 ml and 4.0 mg/ml

- 1 mg/ml

- 0.4 mg/ml

- Others

According to a naloxone industry analysis, the 2.0 milligrams per 0.1 milliliter of solution accounted for significant market share in 2022. It is present in naloxone formulations designed for intramuscular or intravenous administration at a reasonably high concentration. In emergency cases, such high dosages are often employed by healthcare experts to swiftly reverse the effects of opioids and save lives. In severe overdose scenarios, the 2.0 mg/0.1 ml concentration provides for a prompt and efficient reaction.

This amounts to 4.0 milligrammes of Naloxone per millilitre of fluid. This concentration is often used in the formulation of Naloxone nasal sprays. Nasal sprays are intended for use by laypeople, such as bystanders and family members, who may need to deliver Naloxone to someone experiencing an opioid overdose. When applied as a nasal spray, the 4.0 mg/ml concentration delivers an effective dosage, allowing for a non-invasive and potentially life-saving intervention.

Naloxone Route of Administrations

- Intranasal

- Intramuscular/Subcutaneous

- Intravenous

According to the naxolene market analysis, intranasal route of administration generated significant revenue in 2022. Intranasal spray versions of naloxone are available. This method is intended for simple and non-invasive delivery to patients who have overdosed on opioids by laypeople such as bystanders and family members. The medicine is absorbed through the nasal mucosa after being sprayed into one nostril. Naloxone can be injected into the muscle (IM) or just beneath the skin (SC). This approach is frequently employed by skilled workers in healthcare settings. It enables for quick drug absorption and is especially effective in severe overdose scenarios.

Naloxone may be delivered intravenously, straight into a vein, in some clinical settings. IV injection provides the fastest onset of effect and is appropriate for urgent overdose scenarios. It is usually done by healthcare practitioners.

Naloxone Distribution Channels

- Hospitals Pharmacies

- Clinics Pharmacies

- Retail Pharmacies

- Others

As per the naxolene market forecast, hospital pharmacies play a significant role in the distribution of Naloxone, a life-saving medication used to reverse opioid overdoses. Their prominence in this regard can be attributed to several key factors. Firstly, hospital pharmacies are strategically located within healthcare facilities, ensuring immediate access to Naloxone during emergencies. This proximity is vital for addressing overdose cases within the hospital environment promptly.

Secondly, hospitals deal with patients who are at a heightened risk of opioid overdose. These may include individuals receiving opioid pain management, undergoing surgical procedures, or suffering from substance use disorders. Hospital pharmacies are well-equipped to manage this elevated risk and can readily provide Naloxone when required.

Naloxone Market Regional Segmentation

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Naloxone Market Regional Analysis

The opioid crisis has had a huge impact on North America, notably the United States and Canada. As a result, the Naloxone market in these nations has grown significantly. To address opioid overdoses, many actions have been adopted, including laws allowing for the public distribution of Naloxone. Naloxone access programs have been widely implemented, allowing medicine to be obtained not just in clinical settings but also in community pharmacies, harm reduction programs, and schools.

Overdose rates and Naloxone availability might differ between European nations. Some areas have more opioid-related problems than others. Efforts have been undertaken in nations such as the United Kingdom to increase Naloxone access, including the distribution of Naloxone kits to those at risk of overdose and their relatives. The European Naloxone market is impacted by different healthcare systems and regulatory approaches to opioid overdose prevention.

Overdose rates for opioids vary dramatically among Asia-Pacific regions. Some countries have seen an increase in opioid abuse. Naloxone availability and delivery techniques may differ greatly amongst nations in this area. Healthcare infrastructure and government regulations may have an impact on Naloxone awareness and access.

Naloxone Market Players

Some of the top naloxone companies offered in our report includes Akorn Operating Company LLC, Amphastar Pharmaceuticals, Inc., Emergent BioSolutions Inc., Hikma Pharmaceuticals PLC, Indivior Plc., Kaleo, Inc., Kern Pharma, S.L., Mundipharma International Limited, Novartis AG, Opiant Pharmaceuticals, Pfizer, Inc., and Viatris Inc.

Frequently Asked Questions

What was the size of the global naloxone market in 2022?

The size of naloxone market was USD 1,127.3 million in 2022.

What is the naloxone market CAGR from 2023 to 2032?

The naloxone market CAGR during the analysis period of 2023 to 2032 is 10.5%.

Which are the key players in the naloxone market?

The key players operating in the global naloxone market are Akorn Operating Company LLC, Amphastar Pharmaceuticals, Inc., Emergent BioSolutions Inc., Hikma Pharmaceuticals PLC, Indivior Plc., Kaleo, Inc., Kern Pharma, S.L., Mundipharma International Limited, Novartis AG, Opiant Pharmaceuticals, Pfizer, Inc., and Viatris Inc.

Which region dominated the global naloxone market share?

North America region held the dominating position in naloxone industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of naloxone during the analysis period of 2023 to 2032.

What are the current trends in the global naloxone industry?

The current trends and dynamics in the naloxone industry include growing opioid overdose rates, rising government initiatives and funding for naloxone distribution programs, and increased public awareness of opioid addiction and overdose prevention.

Which Strength held the maximum share in 2022?

The 2.0 mg/0.1 ml and 4.0 mg/ml held the maximum share of the naloxone industry.