Multirotor Drones Market | Acumen Research and Consulting

Multirotor Drones Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

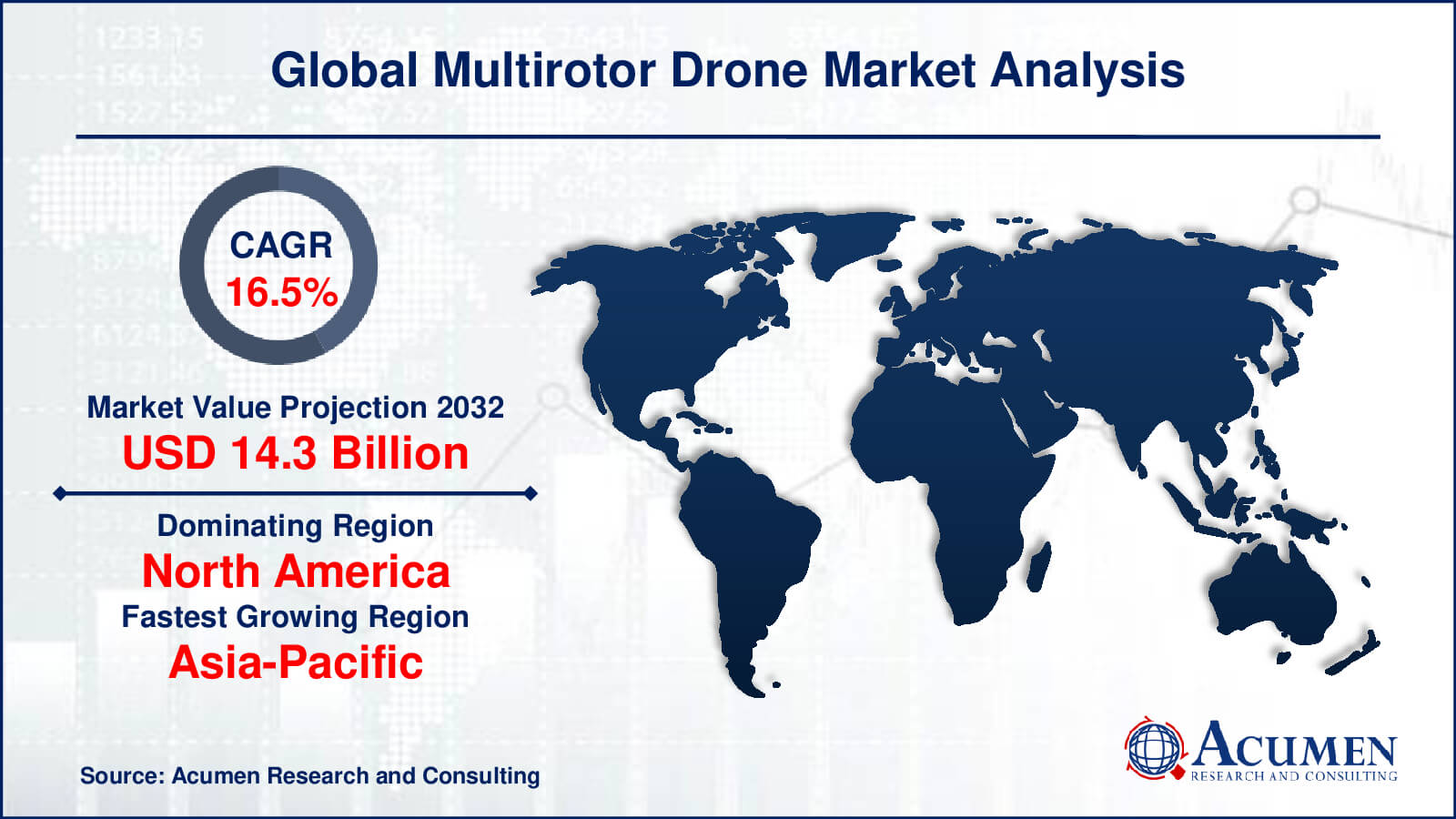

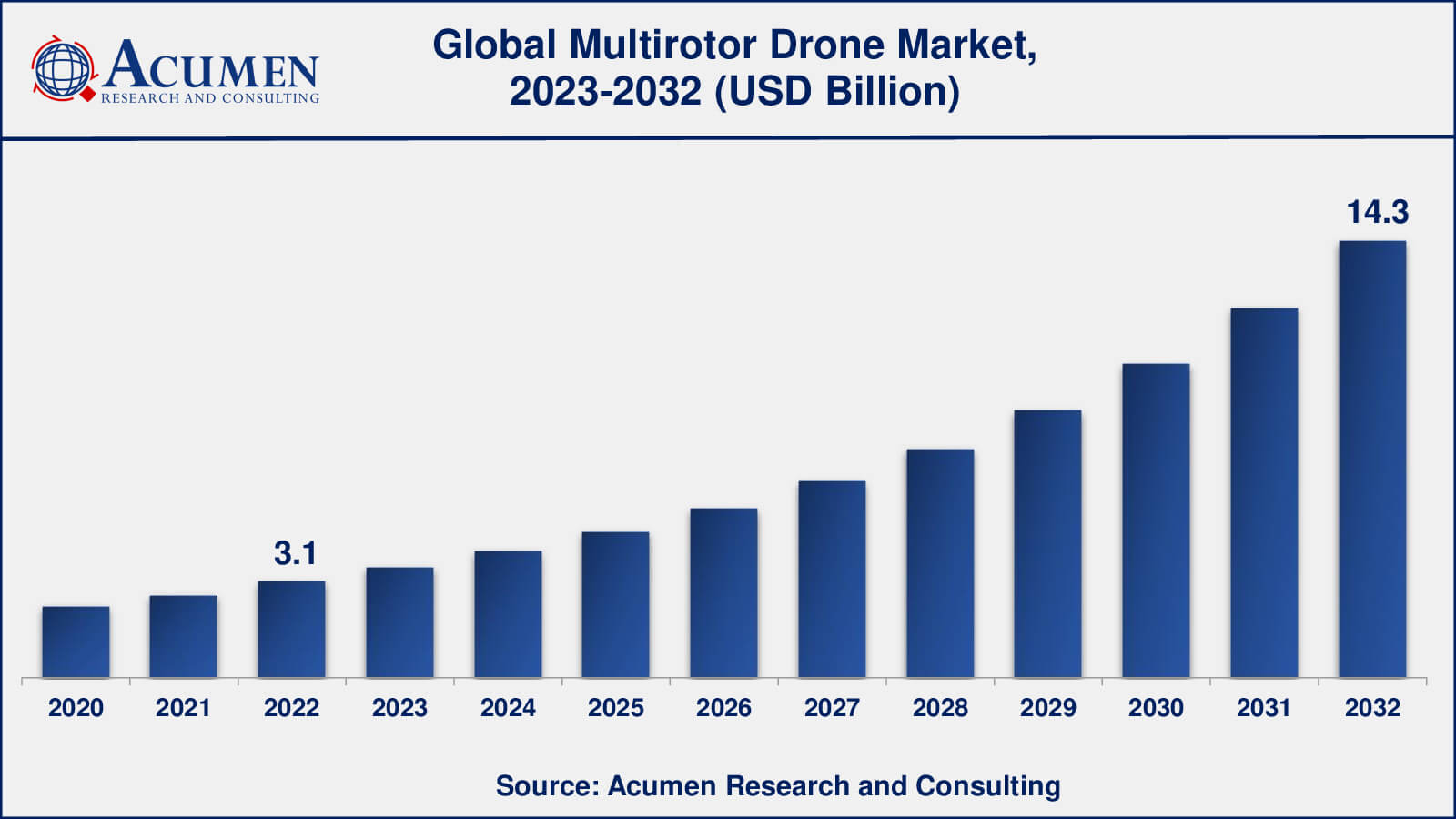

The Global Multirotor Drones Market Size accounted for USD 3.1 Billion in 2022 and is estimated to achieve a market size of USD 14.3 Billion by 2032 growing at a CAGR of 16.5% from 2023 to 2032.

Multirotor Drones Market Highlights

- Global multirotor drones market revenue is poised to garner USD 14.3 billion by 2032 with a CAGR of 16.5% from 2023 to 2032

- North America multirotor drones market value occupied around USD 1.3billion in 2022

- Asia-Pacific multirotor drones market growth will record a CAGR of more than 17% from 2023 to 2032

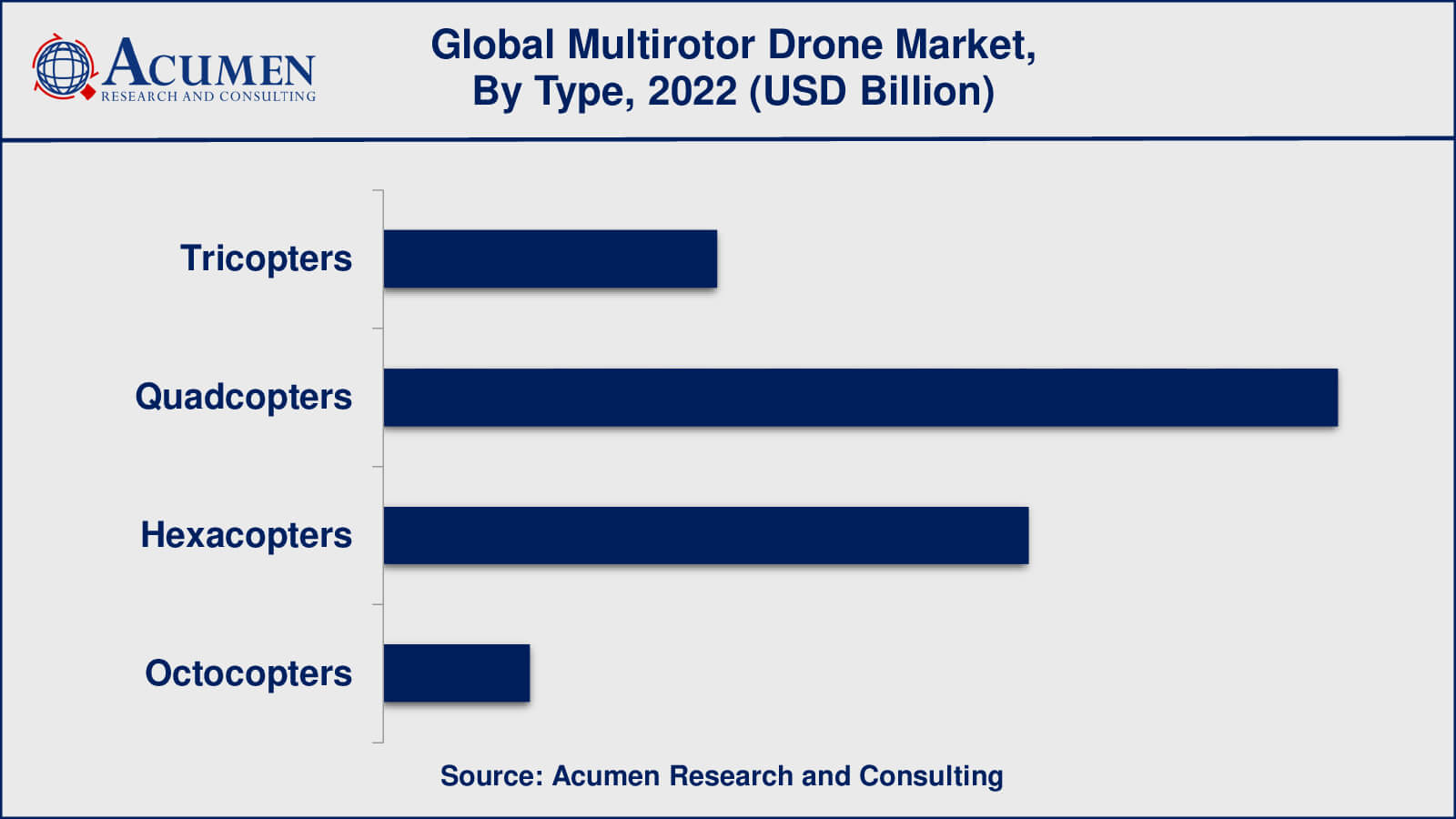

- Among type, the tricopters sub-segment generated over US$ 1.4 billion revenue in 2022

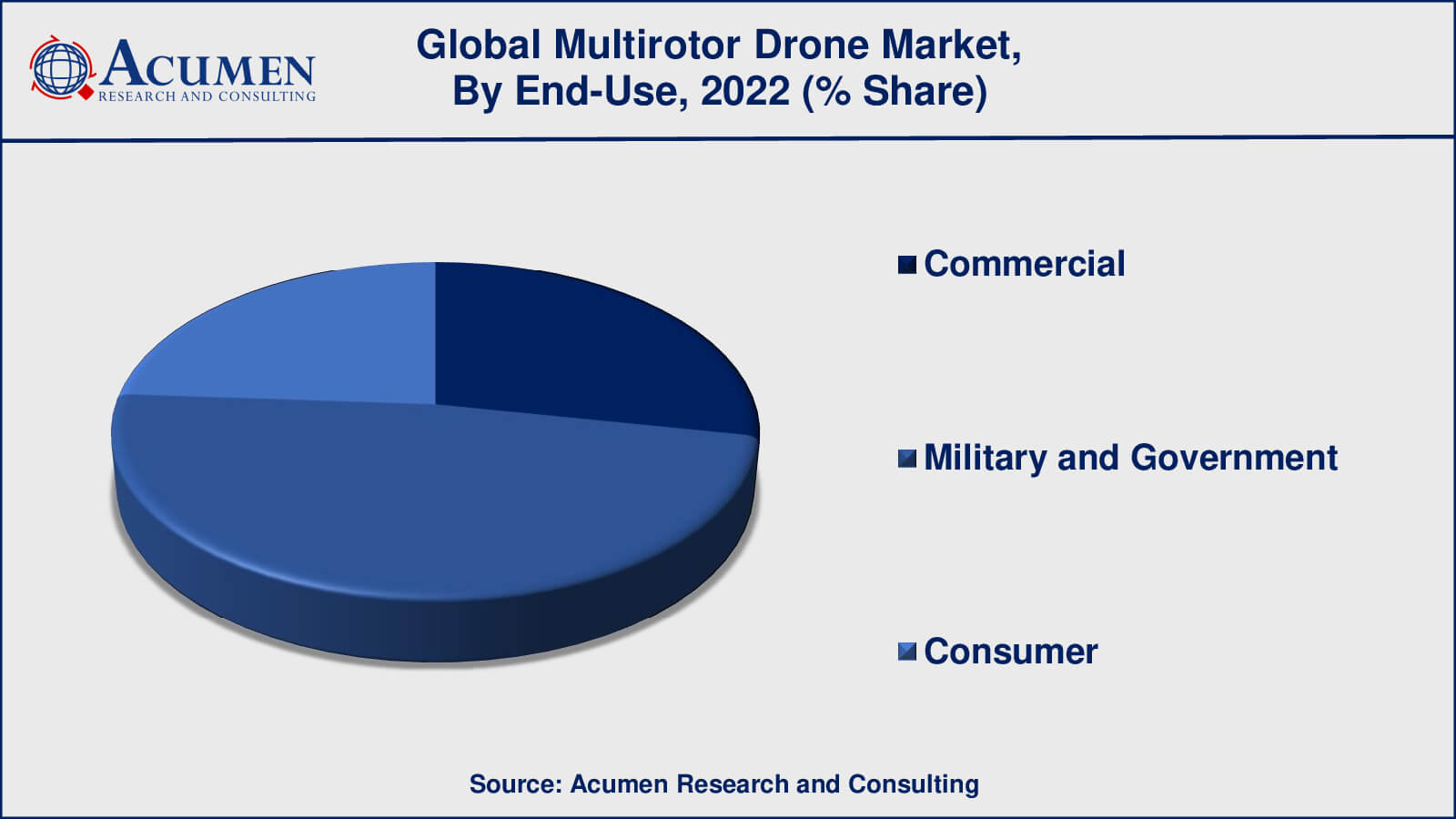

- Based on end-use, the military and government sub-segment generated around 48% share in 2022

- Development of new drone technologies for urban air mobility is a popular multirotor drones market trend that fuels the industry demand

A multirotor drone is an unmanned aerial vehicle (UAV) with many rotors, often four or more, arranged in a symmetrical configuration. An onboard flight controller controls the rotors, which provide lift and allow the drone to take off and maneuver in the air. Multi-rotor drones are in high demand due to their adaptability and ability to execute a wide range of jobs in a variety of industries. Aerial photography and videography, surveying and mapping, examination of infrastructure and structures, search and rescue operations, and delivery of products and supplies are all popular uses. In agriculture, multirotor drones are rapidly being utilized for crop monitoring, yield optimization, and pesticide application.

Several variables influence the market for multirotor drones. First, technological improvements have made drones more accessible and economical, allowing more businesses to adopt and benefit from their use. Second, the rising popularity of drones for a variety of purposes, along with increased regulatory backing, has resulted in an increase in the number of commercial drone operators. Third, the pandemic of COVID-19 has hastened the use of drones for contactless delivery, inspection, and monitoring.

Global Multirotor Drones Market Dynamics

Market Drivers

- Increasing demand for unmanned aerial vehicles (UAVs) in various industries

- Advancements in drone technology, including improved battery life and enhanced payloads

- Growing popularity of aerial photography and videography for commercial and personal use

- Rise in the use of drones for surveillance and security purposes

- Government initiatives and investments in the development of drone technology for various applications

Market Restraints

- Stringent regulations and policies regarding the operation of drones, particularly in urban areas

- High initial costs associated with the purchase and maintenance of drones

- Limited battery life and range of drones, limiting their usefulness for certain applications

- Security concerns related to the potential misuse of drones

Market Opportunities

- Increasing use of drones in the delivery and transportation industry, particularly for last-mile delivery

- Expansion of drone applications in the healthcare industry for emergency medical supply delivery and patient transportation

- Growing demand for drones in the entertainment and media industries for filming and broadcasting live events

- Development of autonomous drone technology, enabling drones to perform tasks without human intervention

Multirotor Drones Market Report Coverage

| Market | Multirotor Drones Market |

| Multirotor Drones Market Size 2022 | USD 3.1 Billion |

| Multirotor Drones Market Forecast 2032 | USD 14.3 Billion |

| Multirotor Drones Market CAGR During 2023 - 2032 | 16.5% |

| Multirotor Drones Market Analysis Period | 2020 - 2032 |

| Multirotor Drones Market Base Year | 2022 |

| Multirotor Drones Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By Payload, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Biogénesis Bagó, Boehringer Ingelheim International GmbH, Elanco, Heska Corporation, HESTER BIOSCIENCES LIMITED, Idexx Commercial, Indian Immunologicals Ltd., Kareo, Inc., Merck & Co., Inc., NXGN Management, LLC, Virbac, and Zoetis. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Multirotor Drones Market Insights

A variety of dynamic variables are shaping the multi-rotor drone market, fueling growth and innovation in the industry. The growing demand for drones in various applications such as aerial photography and videography, surveying and mapping, inspection of infrastructure and structures, and delivery of products and supplies is one of the primary drivers driving the market. Drones are perfect for a wide range of jobs due to their adaptability and flexibility, and their ability to operate in difficult-to-reach regions or dangerous settings is increasing demand in industries such as construction, energy, and agriculture.

Another element propelling the market is the drone industry's rapid technological innovation. Drone hardware advancements, such as battery technology and sensor capabilities, as well as software advancements, such as flight planning and control algorithms, enable drones to execute increasingly complicated and sophisticated jobs. Drones are becoming more affordable and accessible as a result of these improvements, allowing businesses of all sizes to reap the benefits.

The multirotor drone market is also influenced by regulatory factors. Governments throughout the world have adopted laws to ensure safety and security as drone technology has evolved and the number of drones in operation has increased. These regulations have an impact on the development and adoption of drone technology since makers and operators must adhere to regulations governing drone design, operation, and safety. While laws might create entry hurdles, they can also produce a more stable and mature market environment, which can support the industry's long-term growth and innovation.

Multirotor Drones Market Segmentation

The worldwide market for multirotor drones is split based on type, application, payload, end-use, and geography.

Multirotor Drones Types

- Hexacopters

- Tricopters

- Quadcopters

- Octocopters

According to the multi-rotor industry analysis, quadcopters are the most popular and generally available type of multirotor drone, and their appeal stems from its relatively simple design, ease of usage, and low cost. Quadcopters feature four rotors and can carry payloads of varied sizes and weights, making them appropriate for a wide range of applications in diverse sectors.

In the multirotor drone market, hexacopters and octocopters are extremely popular, particularly in the professional and industrial sectors. Hexacopters have six rotors, which give more stability and lifting power than quadcopters, making them ideal for aerial photography and surveying. Octocopters have eight rotors, which provide them even more stability and lifting capacity than hexacopters, making them ideal for high payload applications like industrial inspections and delivery.

Multirotor Drones Applications

- Mapping and Surveying

- Surveillance, Inspection, and Monitoring

- Aerial Photography

- Others

In terms of application, mapping and surveying dominate the multirotor drone market. In the mapping and surveying industries, multirotor drones are widely employed to collect high-resolution imagery and data for mapping, topography, and 3D modelling. Drones can swiftly and efficiently cover enormous regions, delivering precise and up-to-date information for urban planning, infrastructure building, and environmental monitoring.

Multirotor drones can also be used for surveillance, inspection, and monitoring. Drones outfitted with cameras and other sensors can perform a variety of surveillance and inspection jobs, such as monitoring infrastructure and buildings, inspecting electricity lines and pipelines, and undertaking search and rescue operations.

Another prominent application for multirotor drones is aerial photography, notably in the film and entertainment industries. Drones with high-quality cameras and gimbals may capture breathtaking aerial video for films, TV shows and advertising, giving us a unique perspective on our surroundings.

Multirotor Drones Payloads

- Camera and Imaging Systems

- Control Systems

- Tracking Systems

- Others

According to the multirotor drones market forecast, camera and imaging systems account for the highest market share in the multirotor drone payload sub-segment. Aerial photography and videography are popular uses for multirotor drones, which necessitate high-quality cameras and image systems. Drones with cameras and gimbals can take high-resolution photographs and video from unusual angles and viewpoints, making them perfect for film and entertainment, advertising, and real estate.

Furthermore, control systems are a critical payload for multirotor drones, especially in the industrial and commercial sectors. Flight controllers and navigation systems enable drones to fly safely and effectively even in difficult conditions or in the presence of impediments. Furthermore, tracking systems, such as GPS and other positioning technologies, are also frequently utilised as payloads for multirotor drones. Drones with tracking systems can navigate and hold their position reliably, making them ideal for surveying and mapping.

Multirotor Drones End-Uses

- Commercial

- Military and Government

- Consumer

The commercial end-use category accounted for the majority of the multirotor drone market. Mapping and surveying, aerial photography and videography, inspection and monitoring, and agriculture are some of the commercial applications for multirotor drones. Drone commercial use has risen quickly in recent years, driven by technological developments and an increasing demand for efficient and cost-effective solutions across a wide range of businesses.

The military and government end-use market, notably in the defence and security industries, is also substantial. Multirotor drones are used for a variety of purposes, including reconnaissance, surveillance, and target acquisition, and are a significant tool for military and government agencies. Although the consumer end-use category is the smallest of the three, it remains a considerable market for multirotor drones. Consumer drones are readily accessible and utilised for a variety of recreational and hobbyist purposes, such as aerial photography, racing, and drone sports.

Multirotor Drones Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Multirotor Drones Market Regional Analysis

North America is the largest market for multirotor drones, with the United States driving market growth. The growing use of drones in business applications such as mapping and surveying, inspection and monitoring, and aerial photography is driving the North American industry. Drones are also employed for surveillance, reconnaissance, and border control in the military and government sectors in the region.

Europe is another important market for multirotor drones, owing to the growing use of drones in a variety of industries such as construction, agriculture, and media and entertainment. In addition, the region is home to a number of prominent drone manufacturers and suppliers, which contributes to market growth.

The Asia-Pacific area is predicted to grow fast in the next years, owing to the rising use of drones in a variety of industries including as agriculture, mining, and oil & gas. China is a big contributor to regional market growth, as the country is home to a huge number of drone manufacturers and suppliers.

Multirotor Drones Market Players

Some of the top multirotor drones companies offered in our report include 3D Robotics, AeroVironment, Autel Robotics, DJI, Ehang, Parrot, PrecisionHawk, senseFly, Skydio, Yuneec International, Airware, CybAero, Intel Corporation, Lockheed Martin Corporation, and Northrop Grumman Corporation.

In 2020, Doosan Mobility Innovation, a South Korean drone manufacturer, has announced a new relationship with 3D Robotics. The integration of 3D Robotics' Site Scan drone software platform with Doosan's DS30 drone is part of the agreement.

In 2019, Yuneec International has introduced the Typhoon H3, a drone with a 20-megapixel camera and six rotors for improved stability. The drone also comes with a new remote control with a 7-inch screen for real-time video transmission.

Frequently Asked Questions

What was the market size of the global multirotor drones in 2022?

The market size of multirotor drones was USD 3.1 billion in 2022.

What is the CAGR of the global multirotor drones market from 2023 to 2032?

The CAGR of multirotor drones is 16.5% during the analysis period of 2023 to 2032.

Which are the key players in the multirotor drones market?

The key players operating in the global market are including 3D Robotics, AeroVironment, Autel Robotics, DJI, Ehang, Parrot, PrecisionHawk, senseFly, Skydio, Yuneec International, Airware, CybAero, Intel Corporation, Lockheed Martin Corporation, and Northrop Grumman Corporation.

Which region dominated the global multirotor drones market share?

North America held the dominating position in multirotor drones industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of multirotor drones during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global multirotor drones industry?

The current trends and dynamics in the multirotor drones industry include increasing demand for unmanned aerial vehicles (UAVs) in various industries, advancements in drone technology, including improved battery life and enhanced payloads, and growing popularity of aerial photography and videography for commercial and personal use.

Which type held the maximum share in 2022?

The quadcopters type held the maximum share of the multirotor drones industry.