Multi-Factor Authentication Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Multi-Factor Authentication Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

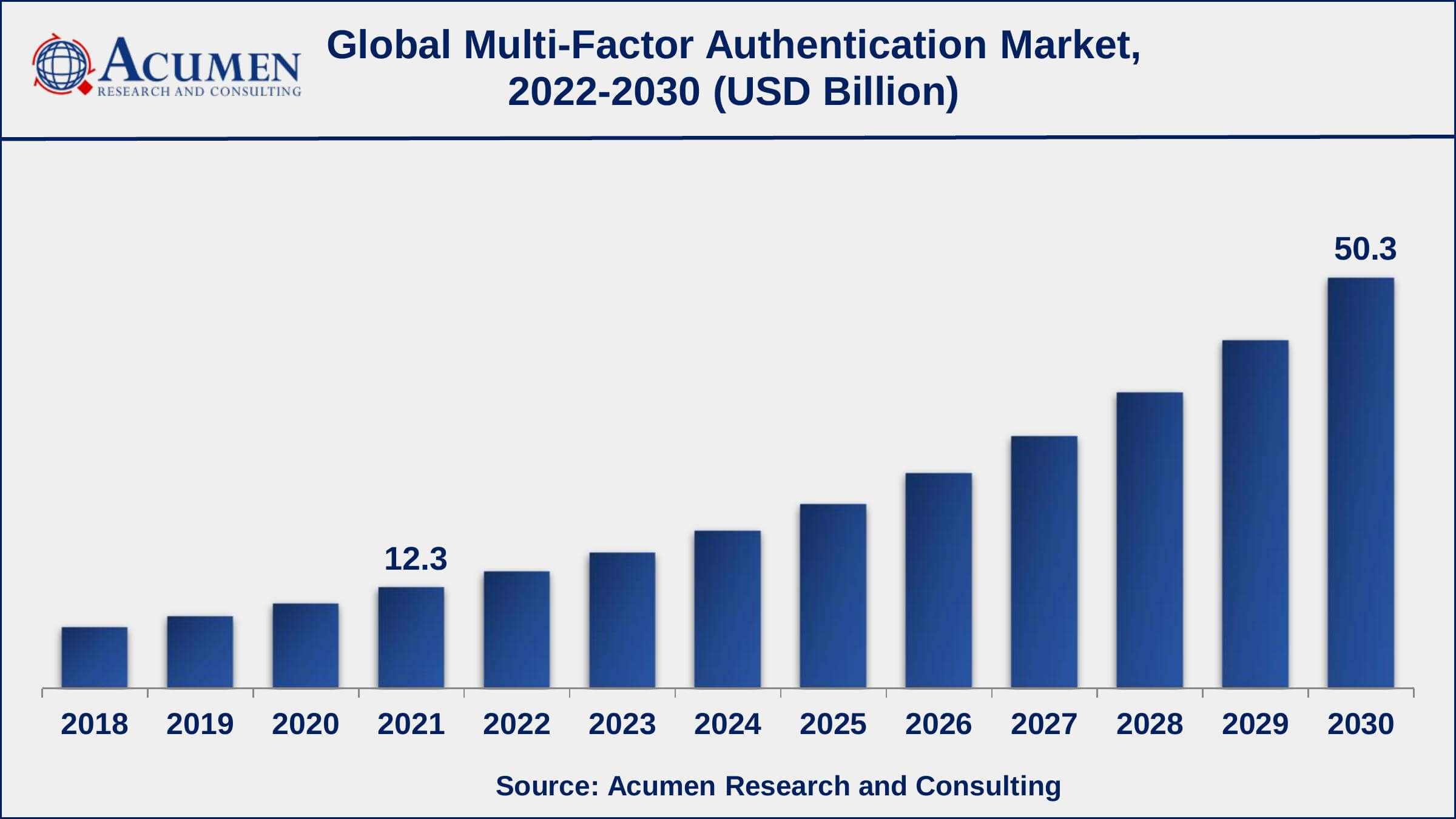

The Global Multi-Factor Authentication Market Size accounted for USD 12.3 Billion in 2021 and is projected to occupy a market size of USD 50.3 Billion by 2030 growing at a CAGR of 17.1% from 2022 to 2030.

Multi-factor authentication (MFA) simply means that users must use more than one authentication factor to access a device or account. Multi factor authentication improves security because unauthorized users are unlikely to meet the second authentication needs if one credential is compromised. In this way, a cybercriminal will be unable to access the aimed physical space, device, network, or database. Google admitted in 2017 that hackers steal nearly 250,000 web logins per week. This figure could be even higher now. And each incident has the potential to be extremely dangerous.

Multi-Factor Authentication Market Report Statistics

- Global multi-factor authentication market revenue is projected to reach USD 50.3 Billion by 2030 with a CAGR of 17.1% from 2022 to 2030

- According to a recent study, cybercriminals have stolen more than 15 million credentials from people worldwide

- As per our analysis, more than 55% global enterprises uses multi-factor authentication to protect their data

- North America multi factor authentication market share gathered more than 36% in 2021

- Asia-Pacific multi-factor authentication market growth will record a CAGR of around 19% from 2022 to 2030

- Based on model type, the two-factor authentication sub-segment achieved approx 45% shares in 2021

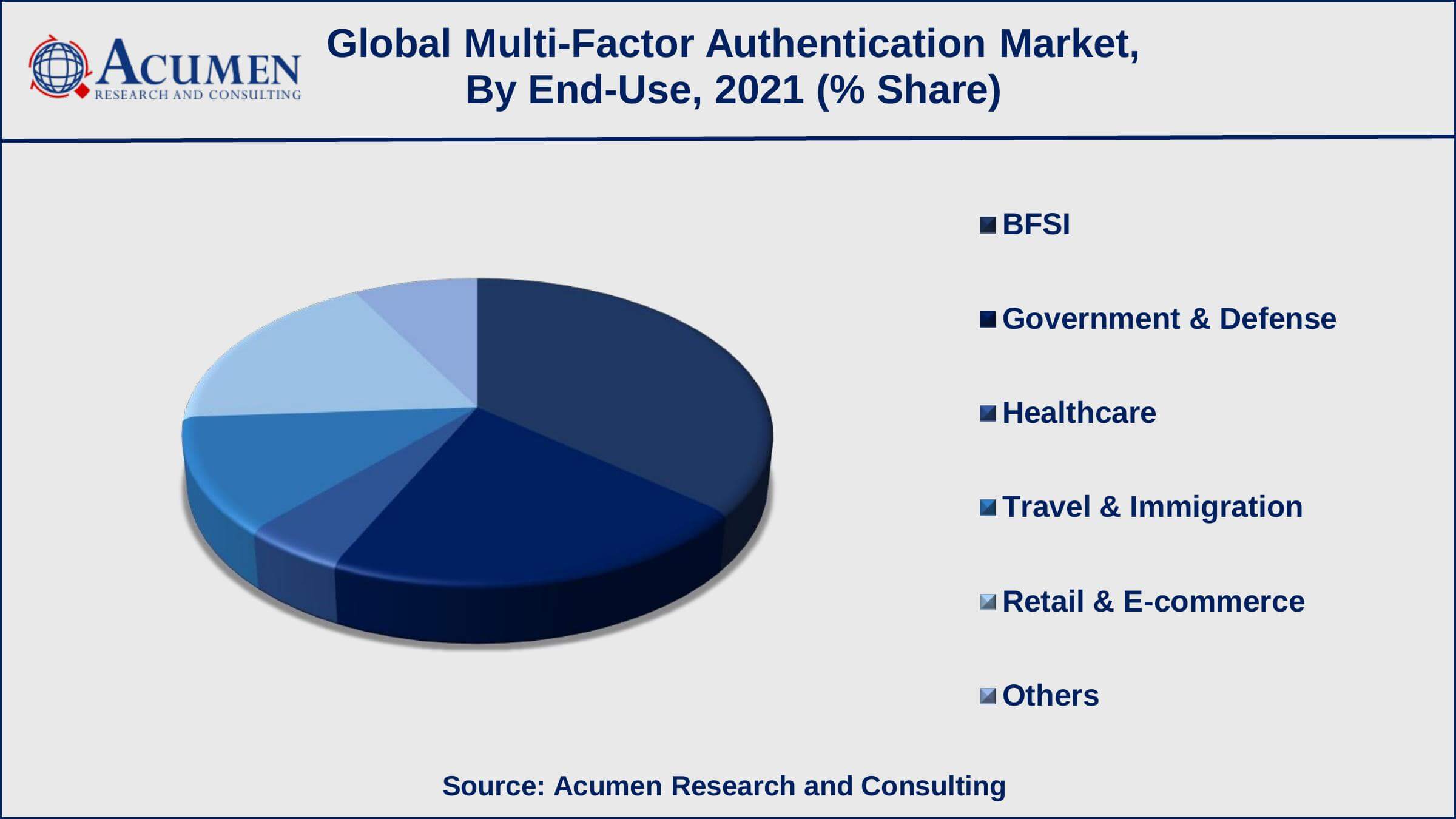

- Among end-use, the BFSI sub-segment occupied around 36% of shares in 2021

- The increasing advancements for recognition platform is a prominent multi-factor authentication market trend that drives the industry demand

Global Multi-Factor Authentication Market Dynamics

Market Drivers

- Increasing occurrence of cyberattacks and security breaches

- Growing stringent regulatory guidelines for the adoption of MFA

- Rising incidences of identity theft and fraud

- Surging trend of developing more tailored user experiences

Market Restraints

- Growth in data safety and security concerns

- Shortage of cybersecurity professionals

Market Opportunities

- Increasing scope for internet platform

- Surging adoption of interconnected devices

Multi-Factor Authentication Market Report Coverage

| Market | Multi-Factor Authentication Market |

| Multi-Factor Authentication Market Size 2021 | USD 12.3 Billion |

| Multi-Factor Authentication Market Forecast 2030 | USD 50.3 Billion |

| Multi-Factor Authentication Market CAGR During 2022 - 2030 | 17.1% |

| Multi-Factor Authentication Market Analysis Period | 2018 - 2030 |

| Multi-Factor Authentication Market Base Year | 2021 |

| Multi-Factor Authentication Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Authentication Type, By Model Type, By Component, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Broadcom, Cisco, CyberArk, ESET, ForgeRock, HID Global, Microsoft, Micro Focus, OneSpan, Okta, Oracle, Ping Identity, RSA Security, Salesforce, Thales, and Yubico. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Multi Factor Authentication Market Growth Factors

The rising occurrence of data and identity theft is driving the global multi factor authentication market. While usernames and passwords are vulnerable to attacks nowadays, requiring the use of an MFA factor such as a thumbprint or physical hardware key will increase confidence that an organization will be safe from cybercriminals. The upsurge in cyberattacks during the COVID-19 pandemic has created a buzz for multi-factor authentication solutions from a single-user to a multinational business. The F5 Labs survey showed that there was a 220% growth in the number of phishing attacks in the first phase of the lockdown. In 2021, there were 396,012 complaints about fraudulent Government & Defense documents or benefits. According to the FTC, credit card fraud, the most popular form of identity theft from 2017 to 2019, was the second most frequent form of identity fraud in 2021, with 389,845 reported incidents.

Government & Defense documents or monetary fraud was the most common types of identity theft in 2021, as it had been in 2020. This followed FTC consumer warnings and enforcement actions aimed at criminal exploitation of the COVID-19 pandemic's confusion and anxiety.

Frauds are also witnessed to be increased on account of the growing adoption of online systems, smartphones, and mobile platform. A lack of aware users across the world is susceptible to online fraud and tends to lose hundreds of dollars at a time. In addition, the growing BFSI, healthcare, retail & ecommerce, and other industries are increasing the demand for authentication solutions to protect businesses and customers. However, the high cost of technical difficulties in incorporating MFA solutions will stifle market growth. Furthermore, a lack of cybersecurity professionals in emerging markets is expected to be a key impediment to the growth of the MFA market.

Multi-Factor Authentication Market Segmentation

The global multi-factor authentication market is segmented based on authentication type, model type, component, end-use, and geography.

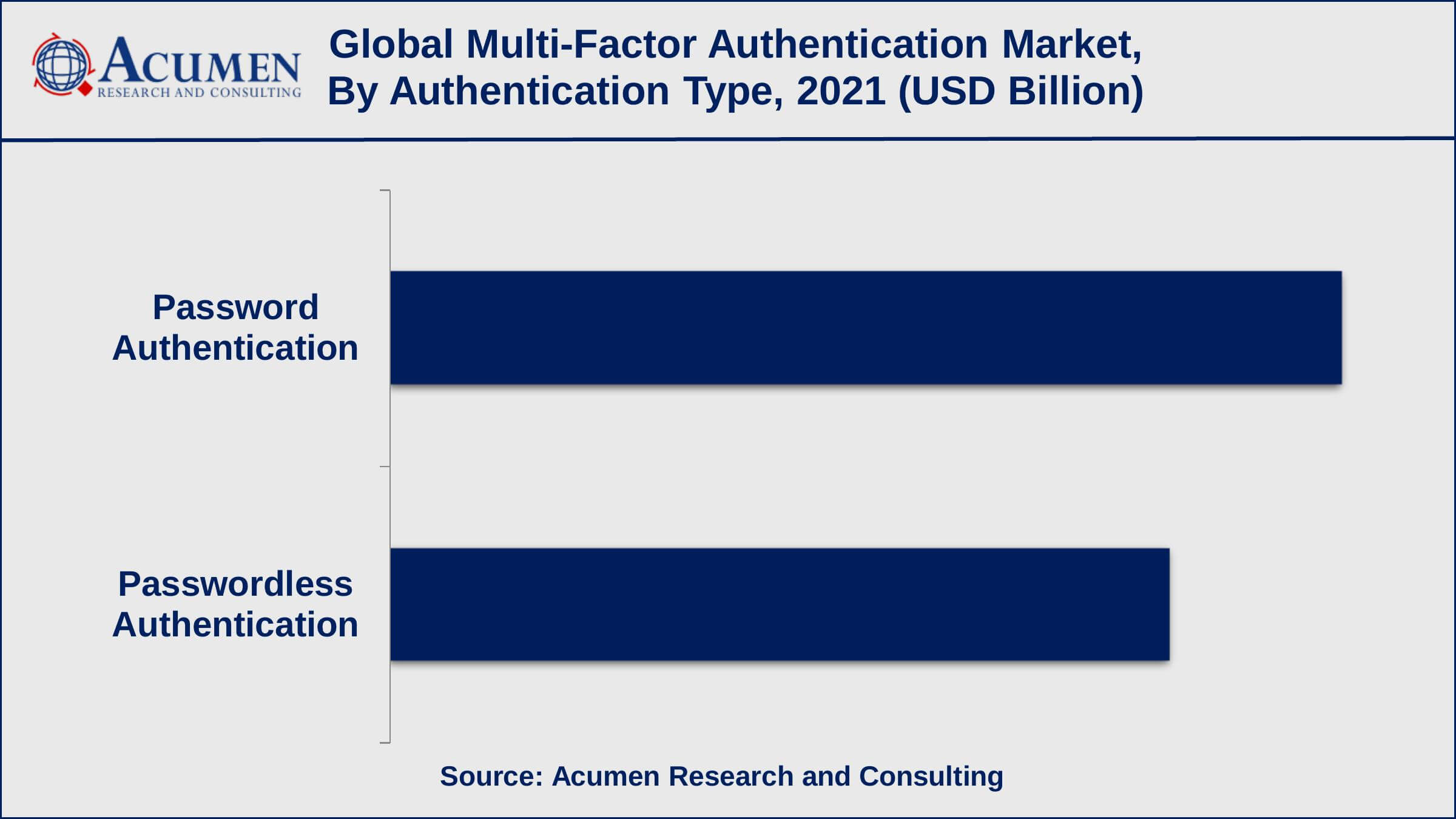

Multi-Factor Authentication Market By Authentication Type

- Password Authentication

- Passwordless Authentication

The authentication type sub-segment is divided into two parts: password authentication and passwordless authentication. The password authentication type generated the most market revenue in 2021. MFA, like passwordless authentication, can use biometric or possessive factors; although, MFA still uses usernames and passwords. However, the trend of password authentication will diminish in the coming years, while the demand for passwordless authentication will increase.

Multi-Factor Authentication Market By Model Type

- Two Factor Authentication

- Three Factor Authentication

- Four Factor Authentication

- Five Factor Authentication

Based on multi-factor authentication industry analysis, the two factor authentication model type will command a sizable market share in 2021. Currently, two factor authentication is popular in the banking, retail and ecommerce, healthcare, and insurance industries. This is due to the simple and quick transaction, as well as the reduced password reset and authentication time. Furthermore, from 2022 to 2030, three factor authentication held the second largest market share.

Multi-Factor Authentication Market By Component

- Solutions

- Hardware

- Services

Hardware is the leading component segment in 2021 and will maintain this position in the coming years. However, solution segment will gain significant impetus in the coming years. Because multi-factor authentication relies heavily on online solutions, this category generates significant revenue. CISCO Duo Security, Idaptive MFA, OKTA Adaptive Multi-Factor Authentication, OneLogin, OneSpan, and RSA SecureID Access are some of the popular MFA solutions provided by key players.

Multi-Factor Authentication Market By End-Use

- BFSI

- Government & Defense

- Healthcare

- Retail & Ecommerce

- Media & Entertainment

- Others

According to our multi-factor authentication market forecast, the BFSI industry will hold a significant market share between 2022 and 2030. The BFSI industry will hold a significant market share between 2022 and 2030, according to our multi-factor authentication market forecast. MFA is a critical tool for the BFSI sector because it protects online transactions from cyberattacks and can save hundreds and thousands of dollars. Furthermore, the sector has seen the highest adoption of MFA solutions, which facilitate businesses to secure transactions while reducing financial fraud and data loss. The healthcare sector, on the other hand, experienced significant growth from 2022 to 2030.

Multi-Factor Authentication Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Multi-Factor Authentication Market Regional Analysis

According to the multi-factor authentication regional analysis, the largest market share is held by North America. The growing need to prevent cyberattacks, commercial espionage, frauds, and theft, as well as providing data security and privacy and preventing sensitive information leaks for business development are the key factors that will drive the North American multi-factor authentication market. Asia Pacific, on the other hand, is expected to gain an impressive growth rate from 2022 to 2030. The region's growth can be attributed to rising spending on connected devices, rapid spending in different cloud and IoT technologies, and a surge in need for digital services.

Multi-Factor Authentication Market Players

Some of the leading multi-factor authentication companies include Broadcom, Cisco, CyberArk, ESET, ForgeRock, HID Global, Microsoft, Micro Focus, OneSpan, Okta, Oracle, Ping Identity, RSA Security, Salesforce, Thales, and Yubico.

Frequently Asked Questions

What is the size of global multi-factor authentication market in 2021?

The market size of multi-factor authentication market in 2021 was accounted to be USD 12.3 Billion.

What is the CAGR of global multi-factor authentication market during forecast period of 2022 to 2030?

The projected CAGR of multi-factor authentication market during the analysis period of 2022 to 2030 is 17.1%.

Which are the key players operating in the market?

The prominent players of the global multi-factor authentication market include Broadcom, Cisco, CyberArk, ESET, ForgeRock, HID Global, Microsoft, Micro Focus, OneSpan, Okta, Oracle, Ping Identity, RSA Security, Salesforce, Thales, and Yubico.

Which region held the dominating position in the global multi-factor authentication market?

North America held the dominating multi-factor authentication during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for multi-factor authentication during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global multi-factor authentication market?

Increasing occurrence of cyberattacks and security breaches, growing stringent regulatory guidelines for the adoption of MFA, and rising incidences of identity theft and fraud drives the growth of global multi-factor authentication market.

Which component held the maximum share in 2021?

Based on component, solutions segment is expected to hold the maximum share of the multi-factor authentication market.