Motion Preservation Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Motion Preservation Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

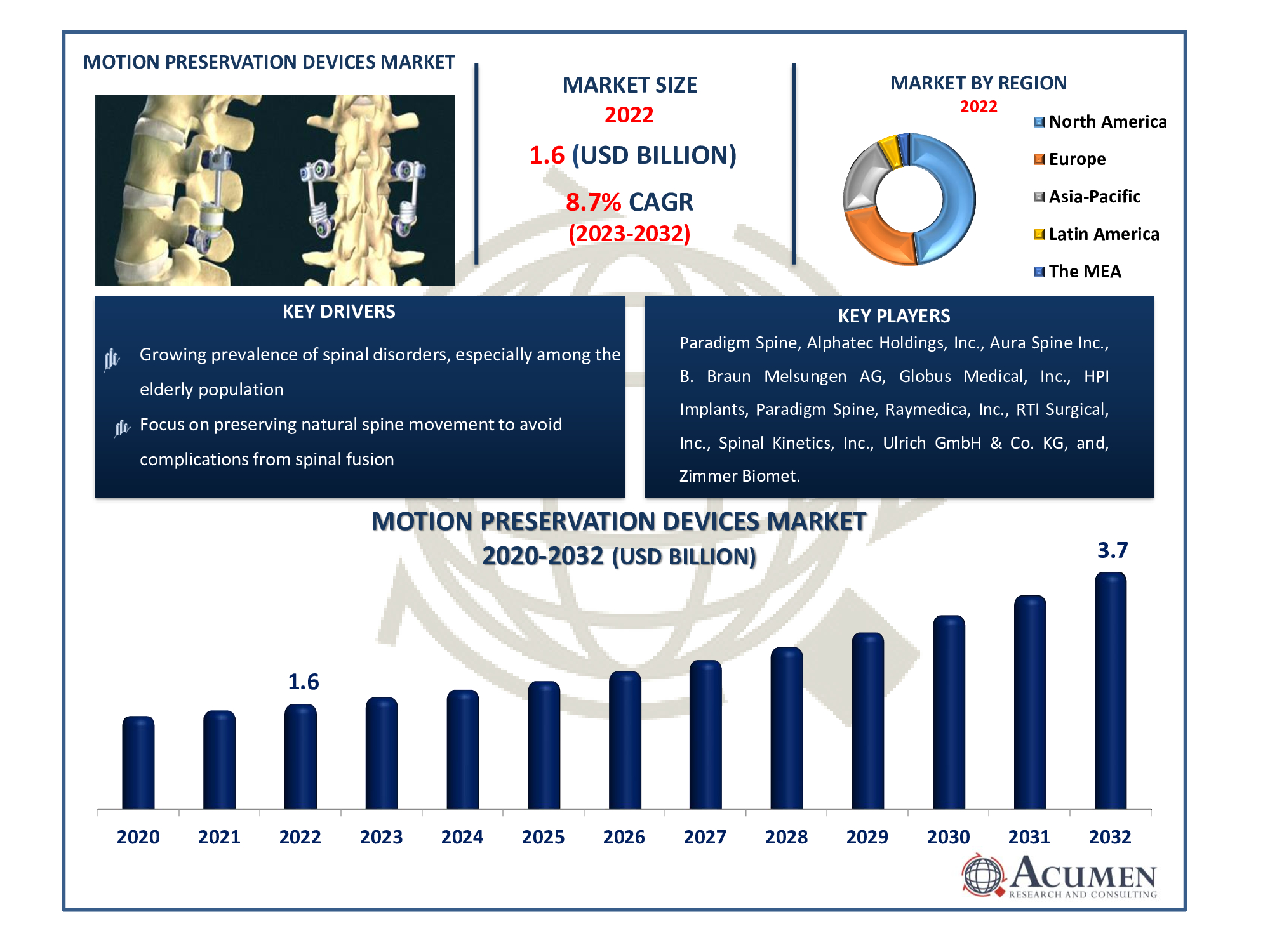

The Motion Preservation Devices Market Size accounted for USD 1.6 Billion in 2022 and is estimated to achieve a market size of USD 3.7 Billion by 2032 growing at a CAGR of 8.7% from 2023 to 2032.

Motion Preservation Devices Market Highlights

- Global motion preservation devices market revenue is poised to garner USD 3.7 billion by 2032 with a CAGR of 8.7% from 2023 to 2032

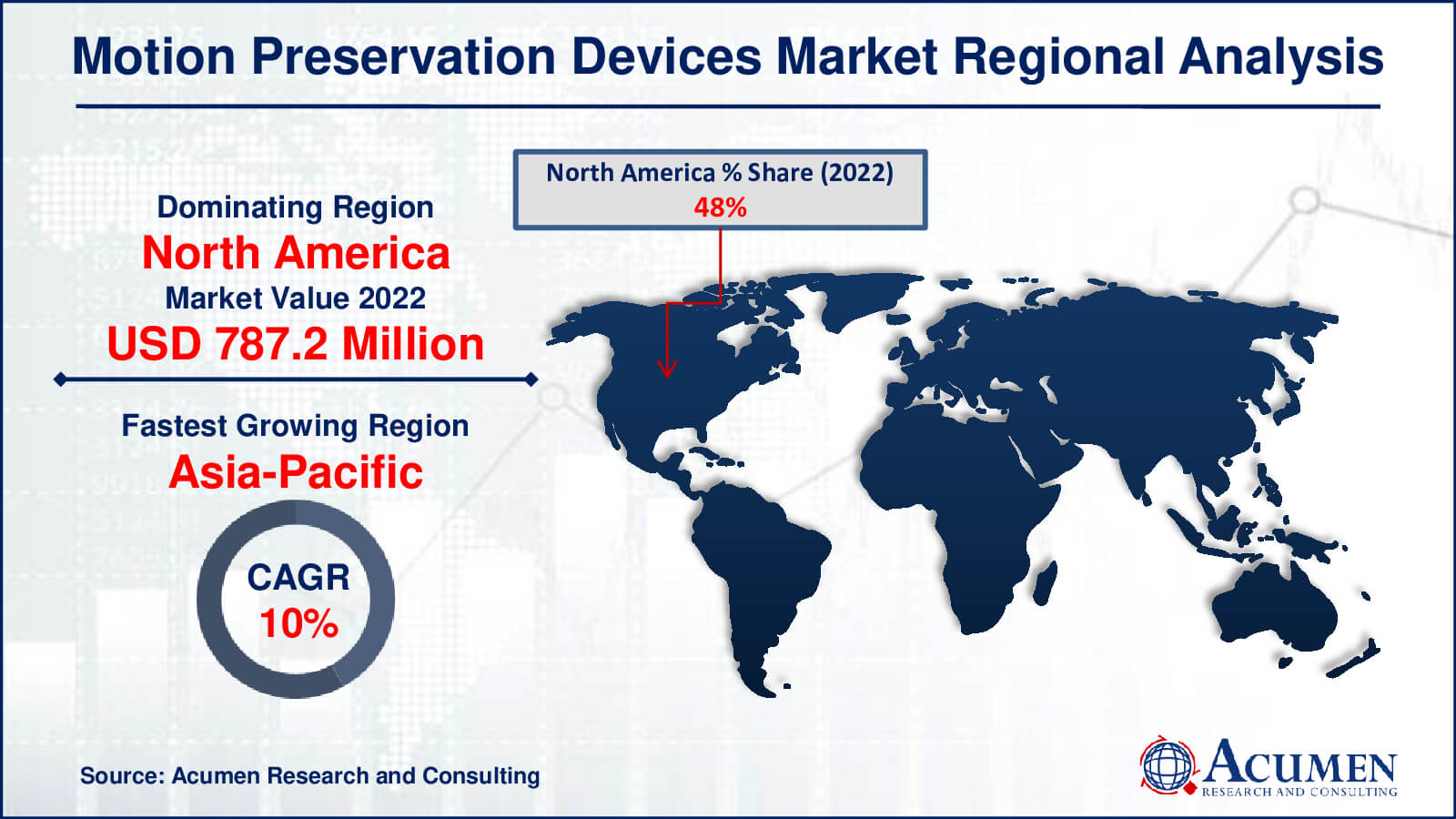

- North America motion preservation devices market value occupied around USD 787.2 million in 2022

- Asia-Pacific motion preservation devices market growth will record a CAGR of more than 10% from 2023 to 2032

- Among product type, the artificial discs sub-segment generated over US$ 656 million revenue in 2022

- Based on surgery, the open spine surgery sub-segment generated around 73% share in 2022

- Increasing awareness and education about the benefits of motion preservation over fusion surgeries is a popular motion preservation devices market trend that fuels the industry demand

Movement preservation devices are utilized in treating spinal disorders to maintain alignment and restore backbone movement. The goal is to sustain normal or near-normal movement to avoid the adverse effects associated with spinal fusion. Ideally, minimally invasive procedures serve as motion preservation devices, retaining or restoring the spine's natural motion. Among the geriatric population, spinal disorders are highly prevalent. Aging leads to structural changes in the spinal column, including bone and joint extension, and thickening of supporting tissues. A wide array of post-movement preservation devices is in various stages of development.

The primary objective of motion preservation devices is to offer superior treatments compared to spinal fusion for pain and functional loss resulting from spinal cord stenosis, degenerative disc disease, and facet pain. Multiple motion preservation techniques, such as cervical replacement with artificial discs, aim to decompress the spine and nerve roots while maintaining natural neck movement, typically recommended for stenosis and disc herniation patients. Similarly, artificial lumbar disc replacement facilitates decompression of nerve roots and the spinal canal while preserving natural back movement.

Global Motion Preservation Devices Market Dynamics

Market Drivers

- Increasing demand for minimally invasive procedures

- Growing prevalence of spinal disorders, especially among the elderly population

- Advancements in technology leading to more effective motion preservation devices

- Focus on preserving natural spine movement to avoid complications from spinal fusion

Market Restraints

- High cost associated with motion preservation devices

- Limited insurance coverage for certain advanced devices

- Regulatory challenges and approval processes for new devices

Market Opportunities

- Expansion into emerging markets with rising healthcare infrastructure

- Development of innovative materials and designs for better device efficacy

- Collaborations and partnerships for research and development

Motion Preservation Devices Market Report Coverage

| Market | Motion Preservation Devices Market |

| Motion Preservation Devices Market Size 2022 | USD 1.6 Billion |

| Motion Preservation Devices Market Forecast 2032 | USD 3.7 Billion |

| Motion Preservation Devices Market CAGR During 2023 - 2032 | 8.7% |

| Motion Preservation Devices Market Analysis Period | 2020 - 2032 |

| Motion Preservation Devices Market Base Year |

2022 |

| Motion Preservation Devices Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Surgery, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Paradigm Spine, Alphatec Holdings, Inc., Aura Spine Inc., B. Braun Melsungen AG, Globus Medical, Inc., HPI Implants, Paradigm Spine, Raymedica, Inc., RTI Surgical, Inc., Spinal Kinetics, Inc., Ulrich GmbH & Co. KG, and, Zimmer Biomet. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Motion Preservation Devices Market Insights

The growth of the motion preservation devices market is driven by the rising incidence of spinal disorders coupled with an increase in the geriatric population and technological advancements in motion conservation devices. The increasing popularity of minimally invasive spine procedures, alongside heightened patient awareness about advanced spine operations, will further bolster the overall development of the motion preservation devices market. Motion preservation procedures aid in restoring movement, leading to increased acceptance of these operations. However, the growth of the motion preservation devices market could be constrained by expensive implants and the high cost of procedures. Stringent regulatory approvals and unfavorable reimbursement scenarios also hinder the growth of the motion preservation device market.

The global market for motion preservation products is projected to witness a boost during the motion preservation devices industry forecast period, driven by emerging technologies aimed at preserving movement. The demand for motion preservation products is also increasing due to the integration of digital monitoring and display, further enhancing the market. Additionally, innovations in remote-controlled mechanisms are propelling the market forward.

Motion preservation devices, such as artificial disc substitutions, dominate the market due to the rising adoption of these substitutes. The increased incidence of spinal disorders among the geriatric population has led to the adoption of minimally invasive techniques, consequently expanding the market for motion protection devices. Furthermore, advancements in bone graft technology will significantly boost the overall market for movement preservation devices. With increasing popularity, a significant segment of the motion conservation equipment market will also include various other motion preservation products.

Motion Preservation Devices Market Segmentation

The worldwide market for motion preservation devices is split based on product type, surgery, end use, and geography.

Motion Preservation Device Product Types

- Dynamic Stabilization Devices

- Artificial Discs

- Annulus Repair Devices

- Nuclear Disc Prostheses Device

Artificial discs are the industry leader in motion preservation devices because of their vital role in restoring spinal motion and mitigating the issues related to traditional spinal fusion. With their similar flexibility and mobility to that of genuine spinal discs, these inventive devices present a strong substitute. Patients who want to resume an active lifestyle after surgery are drawn to them because of their ability to treat degenerative disc disorders and preserve spinal function. As the field of spinal interventions continues to develop, artificial discs are becoming more and more well-known due to their improved durability and capacity to lessen surrounding segment degeneration. This has cemented their place as the treatment of choice.

Motion Preservation Device Surgeries

- Open Spine Surgery

- Minimally Invasive Spine Surgery

According to motion preservation devices industry analysis, the market is dominated by open spine surgery due to its long history and versatility in treating various spinal ailments. This conventional method gives surgeons direct access to the spine, giving them a thorough view and tactile input while doing operations. Even with improvements in minimally invasive procedures, open surgery remains the gold standard for complicated spinal diseases because it allows for large interventions and precise adjustments. Its established history, familiarity with surgeons, and capacity to treat a variety of spinal problems all play a part in its sustained dominance, particularly when major reconstruction is required or when less invasive methods may not be sufficient to provide the best results.

Motion Preservation Device End-Uses

- Hospitals

- Ambulatory Surgical Centers

- Orthopedic Centers and Clinics

Hospitals are the biggest market segment for motion preservation devices because of their extensive infrastructure and capacity to meet a wide range of medical requirements. Hospitals treat a variety of spinal problems and provide a range of motion preservation operations thanks to their specialised departments, state-of-the-art surgical facilities, and multidisciplinary approach. Their ability to do intricate surgeries, such as those involving prolonged recuperation, places them in a leading position for spinal interventions. While orthopaedic clinics and ambulatory surgery centres are important players in the motion preservation devices market, hospitals take the lead because of their capacity to handle complex cases, deliver specialized care, and provide a full range of services.

Motion Preservation Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Motion Preservation Devices Market Regional Analysis

In terms of motion preservation devices market analysis, due to the existence of important industry players and high rates of technological adoption, North America accounted for a sizeable portion of the worldwide market in 2022. Due mainly to the rising incidence of spinal injuries, the market in the area was expected to expand. The growing elderly population in the United States and the growing costs of diabetes, spinal injuries, and cardiovascular disorders were also anticipated to propel the market.

In terms of growth rates, the motion preservation devices market is fastest expanding in the Asia-Pacific area. The ageing population, the growing healthcare infrastructure, and the increased prevalence of spinal illnesses are the main drivers of this expansion. Further contributing to the market's explosive growth in this area are rising healthcare expenditures and rising public knowledge of cutting-edge treatment choices.

Motion Preservation Devices Market Players

Some of the top motion preservation devices companies offered in our report includes Paradigm Spine, Alphatec Holdings, Inc., Aura Spine Inc., B. Braun Melsungen AG, Globus Medical, Inc., HPI Implants, Paradigm Spine, Raymedica, Inc., RTI Surgical, Inc., Spinal Kinetics, Inc., Ulrich GmbH & Co. KG, and, Zimmer Biomet.

Frequently Asked Questions

How big is the motion preservation devices market?

The motion preservation devices market size was USD 1.6 billion in 2022.

What is the CAGR of the global motion preservation devices market from 2023 to 2032?

The CAGR of motion preservation devices is 8.7% during the analysis period of 2023 to 2032.

Which are the key players in the motion preservation devices market?

The key players operating in the global market are including Paradigm Spine, Alphatec Holdings, Inc., Aura Spine Inc., B. Braun Melsungen AG, Globus Medical, Inc., HPI Implants, Paradigm Spine, Raymedica, Inc., RTI Surgical, Inc., Spinal Kinetics, Inc., Ulrich GmbH & Co. KG, and, Zimmer Biomet.

Which region dominated the global motion preservation devices market share?

North America held the dominating position in motion preservation devices industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of motion preservation devices during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global motion preservation devices industry?

The current trends and dynamics in the motion preservation devices industry include increasing demand for minimally invasive procedures, growing prevalence of spinal disorders, especially among the elderly population, advancements in technology leading to more effective motion preservation devices, and focus on preserving natural spine movement to avoid complications from spinal fusion.

Which product type held the maximum share in 2022?

The artificial discs product type held the maximum share of the motion preservation devices industry.?