Molding and Occlusion Balloon Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

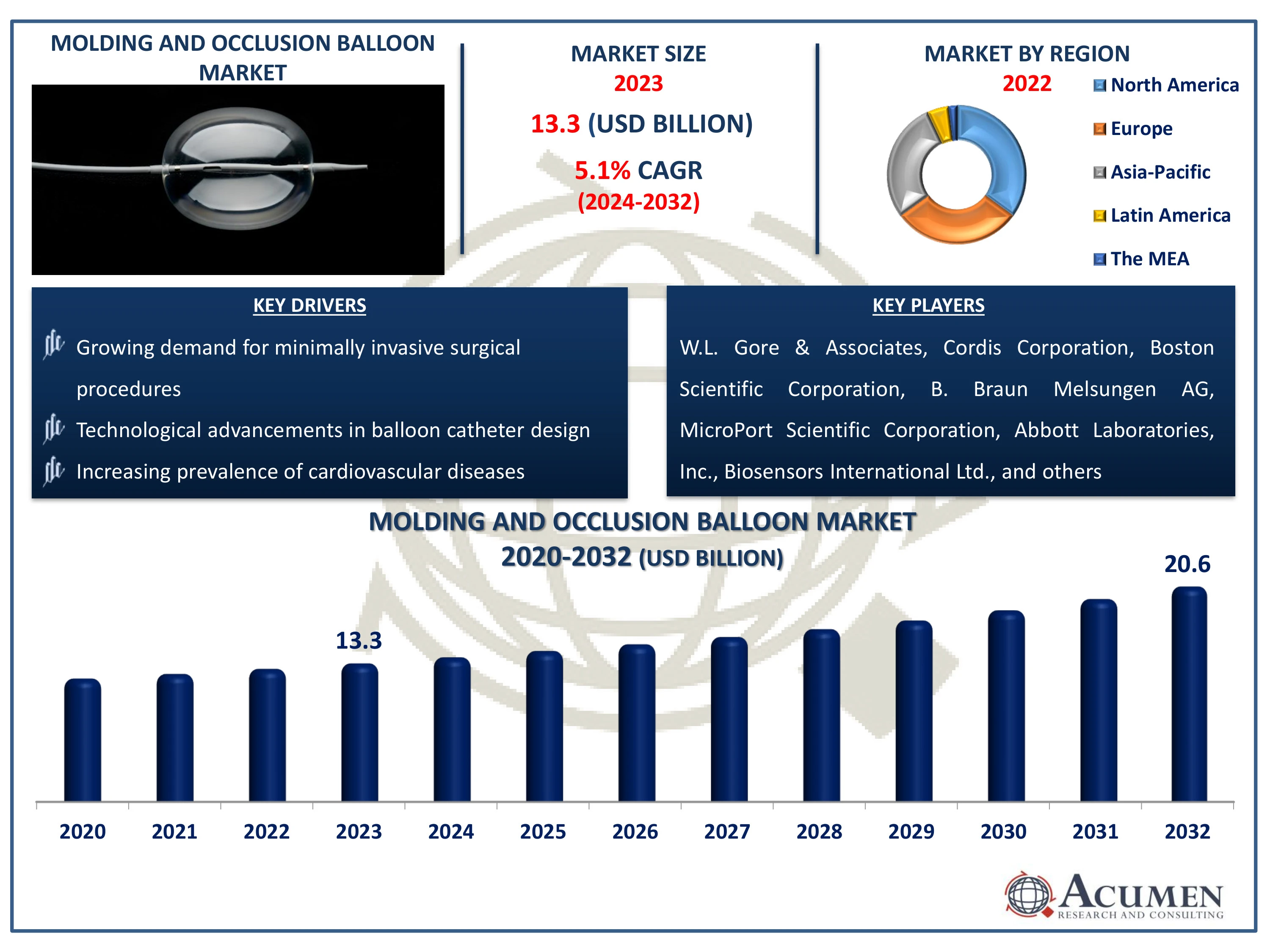

The Global Molding and Occlusion Balloon Market Size accounted for USD 13.3 Billion in 2023 and is estimated to achieve a market size of USD 20.6 Billion by 2032 growing at a CAGR of 5.1% from 2024 to 2032.

Molding and Occlusion Balloon Market Highlights

- Global molding and occlusion balloon market revenue is poised to garner USD 20.6 billion by 2032 with a CAGR of 5.1% from 2024 to 2032

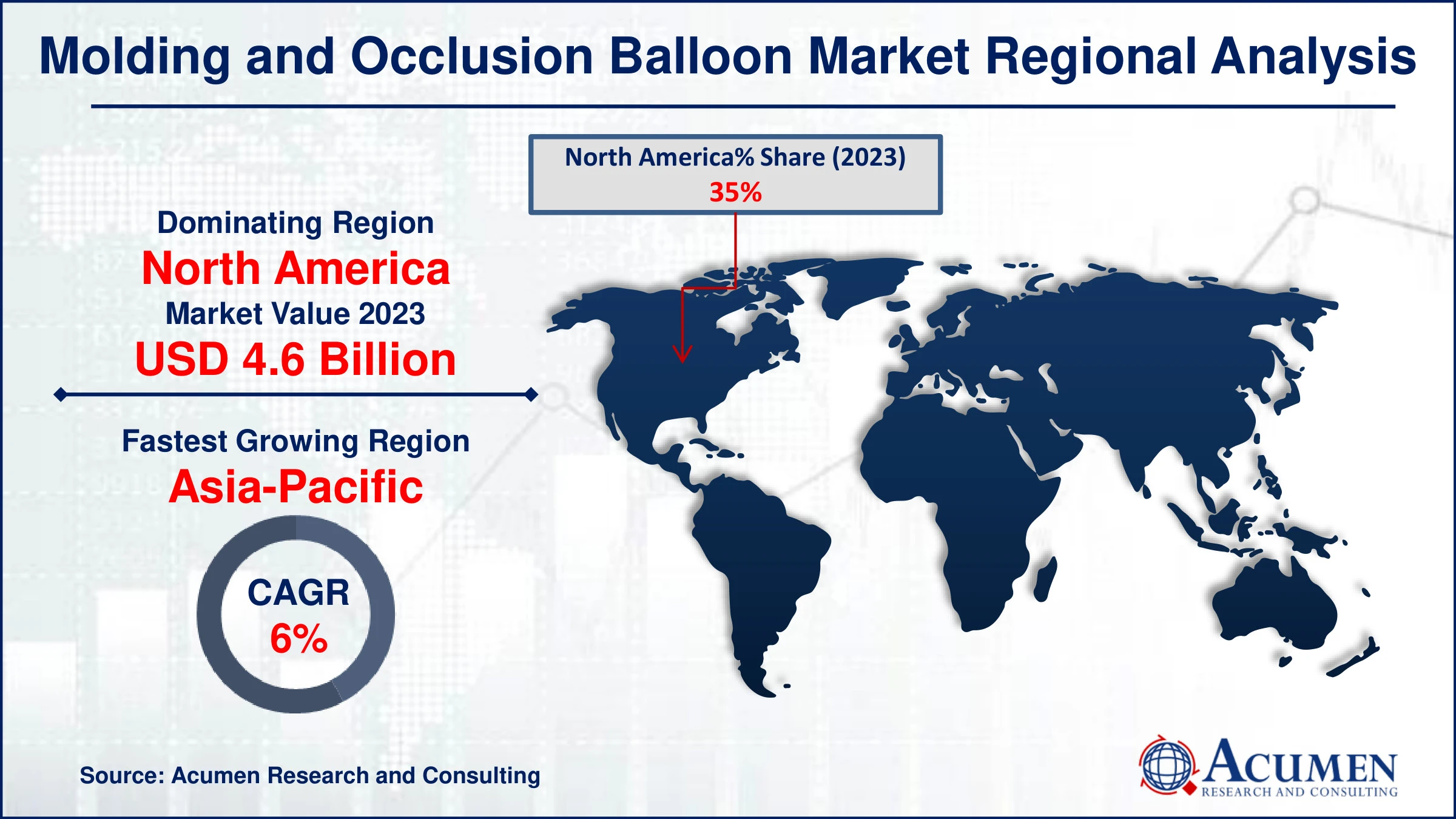

- North America molding and occlusion balloon market value occupied around USD 4.6 billion in 2023

- Asia-Pacific molding and occlusion balloon market growth will record a CAGR of more than 6% from 2024 to 2032

- Among product, the drug-eluting balloon catheters sub-segment generated significant market share in 2023

- Based on application, the cardiology sub-segment generated notable market share in 2023

Growing prevalence of cardiology disease is the molding and occlusion balloon market trend that fuels the industry demand

Molding and occlusion balloons are medical devices used primarily in interventional cardiology and radiology. These balloons are designed to inflate within blood vessels or ducts, aiding in the dilation of narrowed passages or sealing off vessels temporarily during procedures. In cardiology, molding balloons are crucial for angioplasty, where they help expand narrowed coronary arteries, improving blood flow. Occlusion balloons, on the other hand, are used to block blood flow temporarily in specific vessels, facilitating controlled treatment or embolization procedures in radiology. These devices play a vital role in minimally invasive procedures, enabling precise and effective treatment of cardiovascular and other vascular conditions.

Global Molding and Occlusion Balloon Market Dynamics

Market Drivers

- Growing demand for minimally invasive surgical procedures

- Technological advancements in balloon catheter design

- Increasing prevalence of cardiovascular diseases

Market Restraints

- Stringent regulatory requirements for product approval

- High cost associated with balloon catheter procedures

- Limited reimbursement policies for balloon catheter treatments

Market Opportunities

- Rising adoption of balloon catheters in emerging markets

- Development of specialized balloon catheters for specific medical conditions

- Expansion of applications beyond cardiovascular diseases, such as gastrointestinal and neurological disorders

Molding and Occlusion Balloon Market Report Coverage

|

Market |

Molding and Occlusion Balloon Market |

|

Molding and Occlusion Balloon Market Size 2023 |

USD 13.3 Billion |

|

Molding and Occlusion Balloon Market Forecast 2032 |

USD 20.6 Billion |

|

Molding and Occlusion Balloon Market CAGR During 2024 - 2032 |

5.1% |

|

Molding and Occlusion Balloon Market Analysis Period |

2020 - 2032 |

|

Molding and Occlusion Balloon Market Base Year |

2023 |

|

Molding and Occlusion Balloon Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Application, By End Users, and By Geography |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

W.L. Gore & Associates, Cordis Corporation, Boston Scientific Corporation, B. Braun Melsungen AG, MicroPort Scientific Corporation, Abbott Laboratories, Inc., Biosensors International Ltd., Cardionovum GmbH, Terumo Corporation, Cook Medical Inc., Artivion (JOTEC GmbH), Medtronic Plc, and Biotronik, Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Molding and Occlusion Balloon Market Insights

The increasing prevalence of cardiovascular diseases globally has spurred demand for advanced medical technologies like molding and occlusion balloons. For instance, according to American Journal of Preventive Medicine, the national age-adjusted mortality rate for cardiovascular disease (CVD) rose by 9.3% from 2019 to 2022, reaching 454.5 per 100,000, a rate similar to that of 2010 (456.7 per 100,000). These devices are crucial in minimally invasive procedures such as angioplasty and embolization, where they help reshape vessels and block abnormal blood flow paths. As healthcare systems focus more on reducing surgical invasiveness and improving patient outcomes, the market for these balloons is expanding rapidly. Technological advancements, such as the development of biocompatible materials and improved design for better efficacy, further drive market growth.

Stringent regulatory requirements pose a significant challenge for the molding and occlusion balloon Market, impacting product approval timelines and costs. These requirements often necessitate extensive clinical trials and documentation, which can delay market entry and increase development expenses. Moreover, varying regulatory standards across different regions necessitate compliance with multiple sets of guidelines, further complicating the process. Companies in this market must allocate substantial resources to ensure compliance, potentially limiting innovation and market competitiveness. Navigating these regulatory hurdles effectively is crucial for success in the molding and occlusion balloon market.

The molding and occlusion balloon market, traditionally focused on cardiovascular applications, is poised for expansion into gastrointestinal and neurological disorders. Gastrointestinal applications could leverage occlusion balloons for non-surgical treatments like controlling bleeding or sealing perforations. In neurological disorders, these balloons may find use in minimally invasive procedures such as controlling hemorrhages or delivering localized therapies. This diversification not only broadens the market's scope but also presents opportunities for innovation in balloon technology tailored to these specific medical needs, driving growth and adoption in new therapeutic areas beyond cardiovascular disease.

Molding and Occlusion Balloon Market Segmentation

The worldwide market for molding and occlusion balloon is split based on product, application, end use, and geography.

Molding and Occlusion Balloon Products

- Normal Balloon Catheters

- Cutting Balloon Catheters

- Scoring Balloon Catheters

- Drug Eluting Balloon Catheters

- Stent Graft Balloon Catheters

According to the molding and occlusion balloon industry analysis, drug-eluting balloon catheter holds notable growth in 2023, due to their ability to deliver medication directly to the site of treatment, reducing restenosis rates compared to traditional balloons. These catheters combine the mechanical benefits of balloon angioplasty with the therapeutic effects of drug delivery, making them highly effective in treating complex lesions and preventing recurrence. Their widespread adoption is driven by clinical evidence supporting improved patient outcomes and reduced need for additional interventions, positioning them as a preferred choice for interventional cardiologists and vascular surgeons globally.

Molding and Occlusion Balloon Application

- Cardiology

- Neurology

- Peripheral Vascular

The cardiology segment is the largest application category in the molding and occlusion balloon market and it is expected to increase over the industry, due to the high prevalence of cardiovascular diseases requiring procedures like angioplasty and stent placement. Cardiologists frequently use molding balloons to shape stents and manage vessel occlusions effectively. Neurology applications follow, often involving balloon angioplasty in cerebral arteries for conditions such as aneurysms. Peripheral vascular applications, while significant, tend to be less dominant due to lower procedural volumes compared to cardiac and neurovascular interventions. Overall, the dominance of cardiology in this market is driven by the absolute volume of cardiovascular procedures globally.

Molding and Occlusion Balloon End-Users

- Ambulatory Surgical Centers

- Hospitals

- Cardiac Catherization Laboratories

- Others

According to the molding and occlusion balloon market forecast, hospitals are the expected to dominant end users. This is primarily because hospitals handle a wide range of medical procedures requiring balloon catheters, including angioplasty and other cardiovascular interventions. Hospitals have the infrastructure and expertise to perform complex procedures, making them the primary users of molding and occlusion balloons. Additionally, hospitals often have higher patient volumes, necessitating a consistent demand for these specialized medical devices. This trend is further reinforced by the need for advanced medical care and procedural capabilities, which hospitals are well-equipped to provide compared to ambulatory surgical centers or cardiac catheterization laboratories.

Molding and Occlusion Balloon Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Molding and Occlusion Balloon Market Regional Analysis

For several reasons, North America dominates molding and occlusion balloon market. First, the region benefits from advanced healthcare infrastructure and high levels of healthcare expenditure, fostering widespread adoption of medical technologies like molding and occlusion balloons. Second, a robust regulatory environment ensures product quality and safety, boosting consumer confidence and market growth. Third, a strong presence of leading medical device manufacturers and research institutions supports innovation and technological advancements in the field. For instance, in February 2022, Vena Medical's Vena balloon distal access catheter became the first medical device of its kind to receive a Health Canada license. This device integrates features from both balloon guide catheters and distal access catheters used in thrombectomy procedures to remove clots from stroke patients' brains. Lastly, strategic collaborations between healthcare providers and industry players further enhance market expansion and product accessibility across the continent.

Asia-Pacific is fastest-growing region in molding and occlusion balloon market, driven by increasing healthcare expenditure and advancements in medical technologies. For instance, in August 2022, Otsuka Pharmaceutical Factory Inc. introduced a new intermittent urological catheter named the OT-Balloon Catheter. Furthermore, this industry’s growth is supported by rising awareness about minimally invasive procedures and the expanding geriatric population, driving demand for such medical devices. Key economies like China, India, and Japan are pivotal in driving this market expansion across the region.

Molding and Occlusion Balloon Market Players

Some of the top molding and occlusion balloon companies offered in our report include W.L. Gore & Associates, Cordis Corporation, Boston Scientific Corporation, B. Braun Melsungen AG, MicroPort Scientific Corporation, Abbott Laboratories, Inc., Biosensors International Ltd., Cardionovum GmbH, Terumo Corporation, Cook Medical Inc., Artivion (JOTEC GmbH), Medtronic Plc, and Biotronik, Inc.

Frequently Asked Questions

How big is the molding and occlusion balloon market?

The molding and occlusion balloon market size was valued at USD 13.3 billion in 2023.

What is the CAGR of the global molding and occlusion balloon market from 2024 to 2032?

The CAGR of molding and occlusion balloon is 5.1% during the analysis period of 2024 to 2032.

Which are the key players in the molding and occlusion balloon market?

The key players operating in the global market are including W.L. Gore & Associates, Cordis Corporation, Boston Scientific Corporation, B. Braun Melsungen AG, MicroPort Scientific Corporation, Abbott Laboratories, Inc., Biosensors International Ltd., Cardionovum GmbH, Terumo Corporation, Cook Medical Inc., Artivion (JOTEC GmbH), Medtronic Plc, and Biotronik, Inc.

Which region dominated the global molding and occlusion balloon market share?

North America held the dominating position in molding and occlusion balloon industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of molding and occlusion balloon during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global molding and occlusion balloon industry?

The current trends and dynamics in the molding and occlusion balloon industry include growing demand for minimally invasive surgical procedures, technological advancements in balloon catheter design, and increasing prevalence of cardiovascular diseases.

Which product held the maximum share in 2023?

The drug eluting balloon catheters product held the maximum share of the molding and occlusion balloon industry.