Molded Plastics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Molded Plastics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Molded Plastics Market Size accounted for USD 518.2 Billion in 2023 and is estimated to achieve a market size of USD 876.2 Billion by 2032 growing at a CAGR of 6.1% from 2024 to 2032.

Molded Plastics Market Highlights

- Global molded plastics market revenue is poised to garner USD 876.2 billion by 2032 with a CAGR of 6.1% from 2024 to 2032

- Asia-Pacific molded plastics market value occupied around USD 202.1 billion in 2023

- Europe molded plastics market growth will record a CAGR of more than 7% from 2024 to 2032

- Among product, the polypropylene (PP) sub-segment expected to generated 22% of the market share in 2023

- Based on application , the packaging segment generated 53% market share in 2023

- Increasing demand for sustainable and biodegradable molded plastics alternatives is molded plastics market trend that fuels the industry demand

Molded plastics are synthetic materials shaped into desired forms through various molding processes such as injection molding, blow molding, and extrusion. These versatile materials offer properties like durability, flexibility, lightweight, and resistance to corrosion and chemicals, making them suitable for a wide range of applications. In the automotive industry, molded plastics are used for manufacturing components such as dashboards, bumpers, and fuel tanks, contributing to vehicle weight reduction and fuel efficiency. In the packaging sector, they provide solutions for bottles, containers, and packaging films, enhancing product protection and shelf life. The electronics industry benefits from molded plastics in the production of housings, connectors, and insulators due to their excellent electrical insulating properties.

Additionally, the medical field employs molded plastics for creating medical devices, surgical instruments, and disposable syringes, ensuring sterility and safety. For instance, in November 2021, Dutch mold maker IGS GeboJagema, based in Eindhoven, established a U.S. subsidiary located in Washington D.C. The new entity aims to initially serve its current customer network across North America. IGS GeboJagema specializes in designing, manufacturing, and validating high-precision injection molds used in medical and healthcare sectors. Their products include molds for contact lenses, asthma inhalers, insulin pens, and blood diagnostic devices. Molded plastics are also prominent in consumer goods, construction materials, and industrial equipment, demonstrating their indispensable role across various sectors.

Global Molded Plastics Market Dynamics

Market Drivers

- Increasing demand for lightweight and durable materials in the automotive and aerospace industries

- Rising consumer electronics production and consumption

- Growing use of molded plastics in the medical device industry

Market Restraints

- Environmental concerns and regulations regarding plastic waste and recyclability

- Volatility in raw material prices affecting production costs

- Competition from alternative materials such as bioplastics and metals

Market Opportunities

- Advancements in recycling technologies enhancing sustainability

- Expansion of the 3D printing market utilizing molded plastics

- Increasing adoption of bioplastics and biodegradable plastics in various industries

Molded Plastics Market Report Coverage

| Market | Molded Plastics Market |

| Molded Plastics Market Size 2022 | USD 518.2 Billion |

| Molded Plastics Market Forecast 2032 | USD 876.2 Billion |

| Molded Plastics Market CAGR During 2023 - 2032 | 6.1% |

| Molded Plastics Market Analysis Period | 2020 - 2032 |

| Molded Plastics Market Base Year |

2022 |

| Molded Plastics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product , By Technology, By End Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Mitsubishi Chemical Corporation, Huntsman Corporation, Atlantis Plastics, Inc., Petro Packaging Company, Inc, GSH Industries, Pexco LLC, Mitsui Chemicals Inc, Reliance Industries Limited, Chevron Philips Chemical Company, INEOS Group AG, DuPont Company, LyondellBasell Industries N.V., PSI Molded Plastics, BASF SE, SABIC, and EASTMAN CHEMICAL COMPANY. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Molded Plastics Market Insights

The increasing demand for lightweight and durable materials in the automotive and aerospace industries is significantly driving the growth of the molded plastics market. For instance, according to Department of Energy, by integrating lightweight components and employing high-efficiency engines made possible by advanced materials, a transformation of one quarter of the U.S. fleet could result in savings of over 5 billion gallons of fuel each year by 2030. These industries require materials that enhance fuel efficiency and reduce emissions, qualities that molded plastics inherently possess due to their light weight and high strength. Additionally, the versatility of molded plastics allows for intricate designs and complex shapes, meeting the specific needs of automotive and aerospace applications. Innovations in polymer technology further boost the performance and sustainability of these materials, making them an attractive choice. As a result, the molded plastics market is experiencing robust expansion, driven by these industrial demands.

Environmental concerns and stringent regulations regarding plastic waste and recyclability pose significant challenges to the growth of the molded plastics market. Governments and environmental agencies worldwide are increasingly implementing policies aimed at reducing plastic pollution, such as bans on single-use plastics and mandates for higher recycling rates. For instance, the government has made changes to the Plastic Waste Management Rules in 2021. By 2022, certain single-use plastic items will be banned. Additionally, the thickness of plastic carry bags has been increased from 50 to 75 microns starting September 30, 2021, and will further increase to 120 microns by December 31, 2022. These changes are aimed at reducing plastic waste and improving environmental sustainability. These measures increase compliance costs for manufacturers and necessitate investments in sustainable materials and technologies. Additionally, growing consumer awareness and preference for eco-friendly products drive demand away from traditional molded plastics. Consequently, the industry faces pressures to innovate and adapt, potentially slowing its expansion.

The rising adoption of bioplastics and biodegradable plastics across diverse industries is significantly driving growth in the molded plastics market. For instance, The European Commission is exploring strategies to address issues associated with plastic, such as pollution during production, inadequate disposal, and insufficient recycling. One potential solution under consideration involves promoting bioplastics-materials that either degrade naturally or are derived from plants. This approach aims to lessen dependence on fossil fuels and mitigate environmental impacts linked to plastic waste. The proposed plan includes supporting the bio-based industry and developing standards for the use of bioplastics. As these eco-friendly materials become more popular due to their reduced environmental impact, manufacturers are increasingly investing in advanced molding technologies to produce a variety of sustainable plastic products. This shift not only caters to the growing consumer demand for green alternatives but also spurs innovation in molding techniques, enhancing the quality and functionality of molded plastics.

Molded Plastics Market Segmentation

The worldwide market for molded plastics is split based on product, technology, end use industry, and geography.

Molded Plastic Market By Products

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

- Others

According to the molded plastics industry analysis, polyethylene (PE) dominates the market due to its versatility, affordability, and wide range of applications. As a thermoplastic polymer, PE is valued for its durability, chemical resistance, and ease of processing, making it ideal for packaging, consumer goods, and industrial products. Its availability in various densities, such as low-density (LDPE) and high-density (HDPE), allows for tailored properties to meet specific needs. Additionally, PE's recyclability and lightweight nature contribute to its sustainability and cost-effectiveness, further solidifying its market dominance.

Molded Plastic Market By Technologyies

- Injection Molding

- Blow Molding

- Thermoforming

- Extrusion Molding

- Rotational Molding

- Others

The injection molding is expected to dominate the molded plastics market due to its efficiency in mass production, enabling high-volume output with minimal material waste. This process offers superior precision, allowing for the creation of complex and intricate designs that meet stringent quality standards. Additionally, the versatility of injection molding supports a wide range of materials and applications, catering to diverse industries such as automotive, healthcare, and consumer goods. For instance, in October 2022, Evco Plastics announced plans to invest $11 million in expanding production capacity in Wisconsin, USA. Currently, the company operates 183 injection molding machines. As a result, its cost-effectiveness and adaptability drive its prominence in the molded plastics sector.

Molded Plastic Market By End-Use Industries

- Automotive

- Building and Construction

- Electronics

- Packaging

- Pharmaceuticals

- Agriculture

- Others

According to the molded plastics market forecast, packaging industry is expected to dominate the industry due to its extensive use in creating containers, bottles, and other packaging materials. Molded plastics offer versatility, allowing for intricate designs and customization to meet diverse packaging needs. Their lightweight nature contributes to cost-effectiveness in transportation and storage, while also providing durability and resistance to external elements. These qualities make molded plastics particularly suitable for food and beverage packaging, pharmaceuticals, cosmetics, and household products, where safety, hygiene, and shelf appeal are crucial factors.

Molded Plastics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

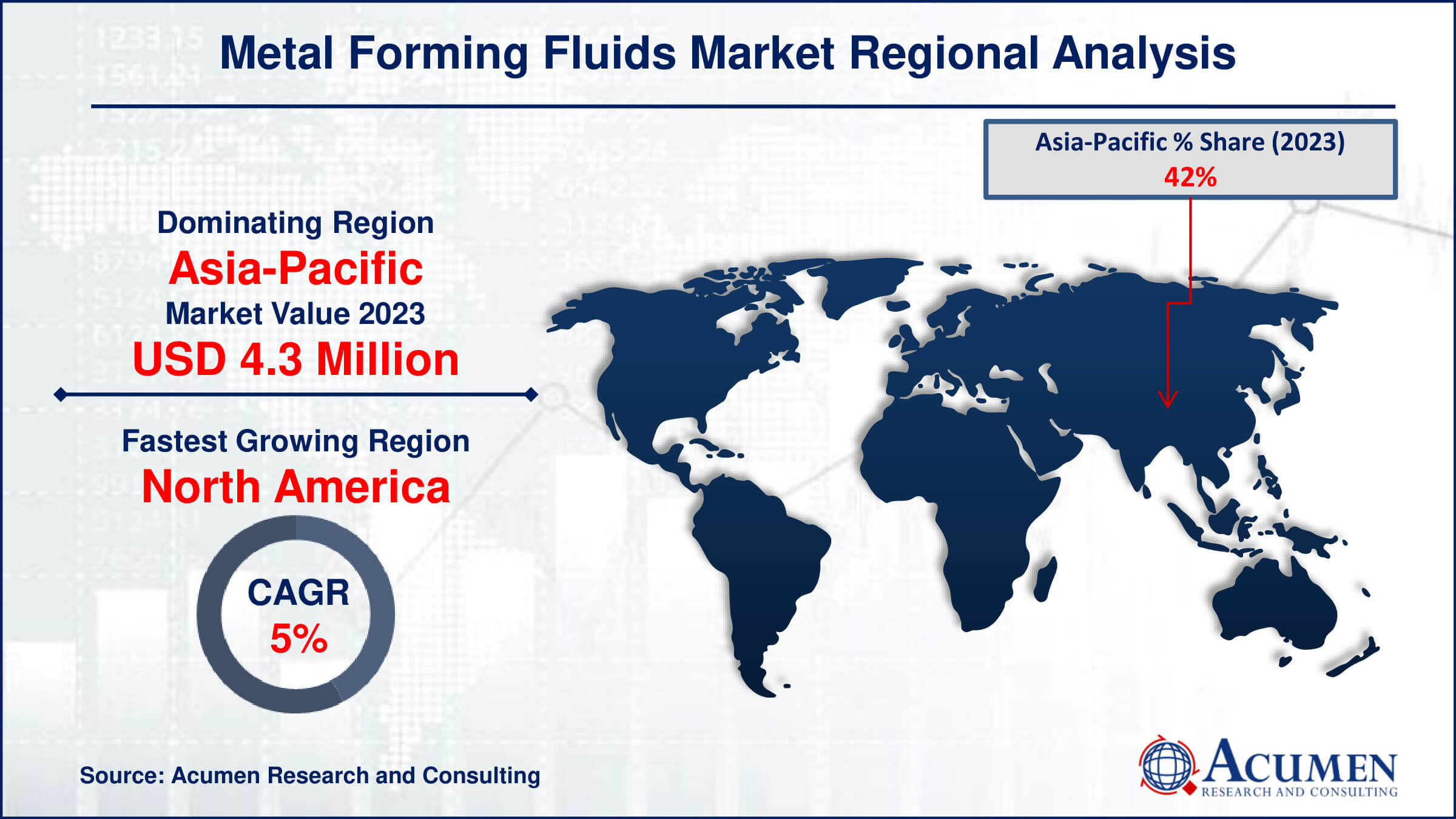

Molded Plastics Market Regional Analysis

For several reasons, the Asia-Pacific region has emerged as a dominant force in the global molded plastics market, owing to several key factors. First, the region benefits from robust manufacturing capabilities and a skilled labor force, which support the production of high-quality molded plastic products. Second, the presence of numerous industries such as automotive, electronics, and consumer goods fosters substantial demand for molded plastics. Third, favorable government policies and investments in infrastructure further bolster the market growth. For instance, ALPLA planned to establish its third plant, following Austria and Germany, in India with a state-of-the-art mold shop anticipated in July 2022. This facility aimed to leverage advanced technology to deliver tailored solutions for the region. The investment would potentially increase ALPLA's total commitment in Pashamylaram, India, to USD 61 million. Lastly, rapid industrialization and urbanization in countries like China, India, and Japan drive the increased consumption of molded plastics across various applications, ensuring that Asia-Pacific remains a pivotal player in shaping the future of the molded plastics industry globally.

Europe is the fastest-growing region in the molded plastics market, driven by increasing demand in automotive, packaging, and construction sectors. Advanced manufacturing technologies and sustainability initiatives are propelling growth. The region's emphasis on innovative plastic solutions aligns with stringent environmental regulations. This dynamic market expansion is supported by significant investments and strategic partnerships within the industry.

North America's molded plastics market is witnessing notable growth due to increased demand across various industries such as automotive, packaging, and electronics. This expansion is driven by advancements in manufacturing technologies, rising consumer preference for lightweight and durable materials, and collaborations by key players. For instance, in September 2023, Danimer Scientific revealed an expanded collaboration with Chevron Phillips Chemical to employ Rinnovo polymers. These polymers are manufactured using a loop slurry reactor process and will be utilized in the production of biodegradable films and molded components. The region's robust infrastructure and strong emphasis on sustainability practices also contribute to this upward trend in the molded plastics sector.

Molded Plastics Market Players

Some of the top molded plastics companies offered in our report includes Mitsubishi Chemical Corporation, Huntsman Corporation, Atlantis Plastics, Inc., Petro Packaging Company, Inc, GSH Industries, Pexco LLC, Mitsui Chemicals Inc, Reliance Industries Limited, Chevron Philips Chemical Company, INEOS Group AG, DuPont Company, LyondellBasell Industries N.V., PSI Molded Plastics, BASF SE, SABIC, and EASTMAN CHEMICAL COMPANY.

Frequently Asked Questions

How big is the molded plastics market?

The molded plastics market size was valued at USD 518.2 billion in 2023.

What is the CAGR of the global molded plastics market from 2024 to 2032?

The CAGR of molded plastics is 6.1% during the analysis period of 2024 to 2032.

Which are the key players in the molded plastics market?

The key players operating in the global market are including Mitsubishi Chemical Corporation, Huntsman Corporation, Atlantis Plastics, Inc., Petro Packaging Company, Inc, GSH Industries, Pexco LLC, Mitsui Chemicals Inc, Reliance Industries Limited, Chevron Philips Chemical Company, INEOS Group AG, DuPont Company, LyondellBasell Industries N.V., PSI Molded Plastics, BASF SE, SABIC, and EASTMAN CHEMICAL COMPANY.

Which region dominated the global molded plastics market share?

Asia-Pacific held the dominating position in molded plastics industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of molded plastics during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global molded plastics industry?

The current trends and dynamics in the molded plastics industry include increasing demand for lightweight and durable materials in the automotive and aerospace industries, rising consumer electronics production and consumption, and growing use of molded plastics in the medical device industry.

Which Technology held the maximum share in 2023?

The injection molding technology expected to held the maximum share of the molded plastics industry.