Modular Construction Market Size - Global Industry Analysis, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Modular Construction Market Size - Global Industry Analysis, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Modular Construction Market Size accounted for USD 102.8 Billion in 2023 and is estimated to achieve a market size of USD 196.8 Billion by 2032 growing at a CAGR of 7.6% from 2024 to 2032.

Modular Construction Market Highlights

- Global modular construction market revenue is poised to garner USD 196.8 billion by 2032 at a CAGR of 7.6% from 2024 to 2032

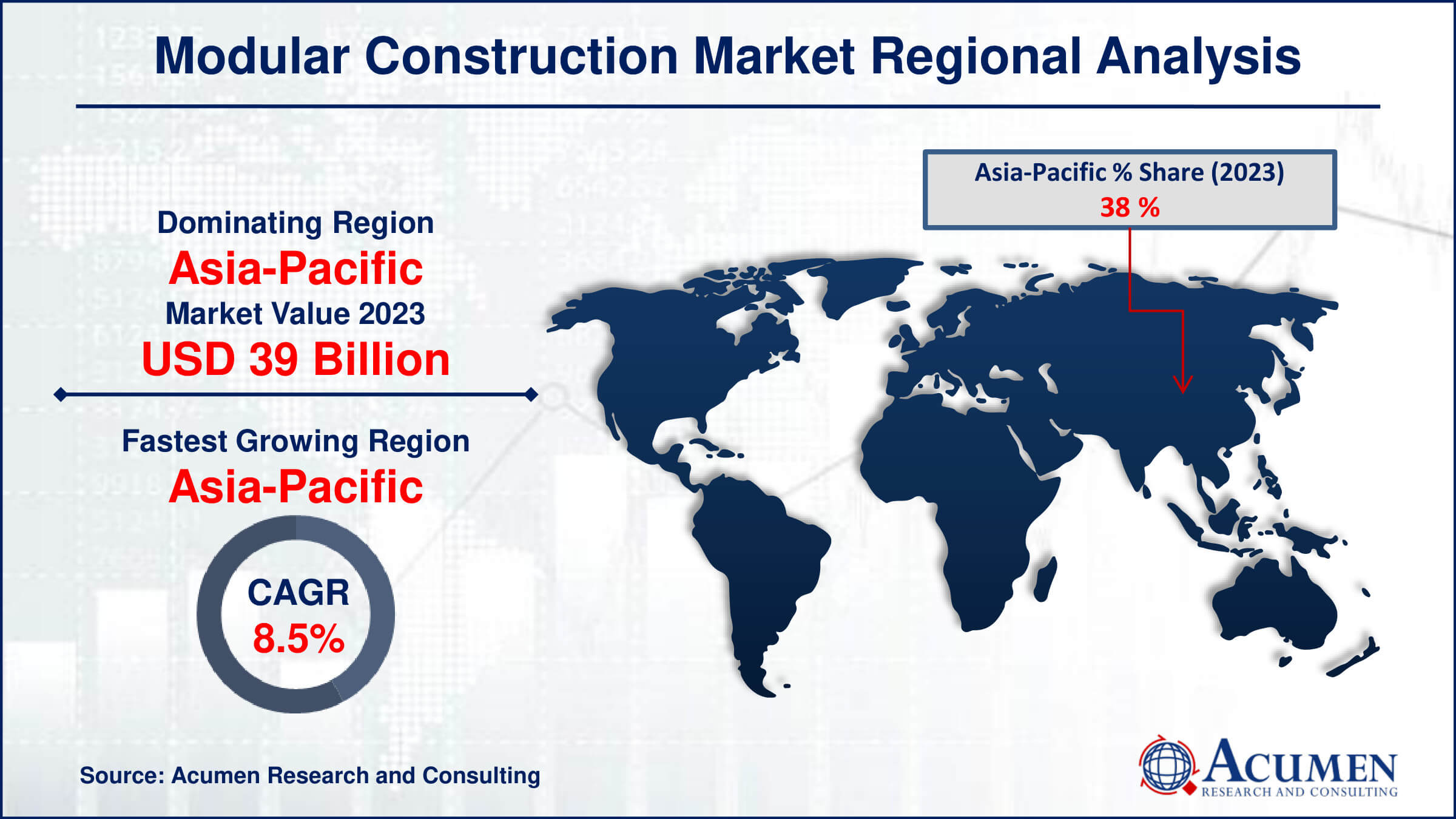

- Asia-Pacific modular construction market value occupied around USD 39 billion in 2023

- Asia-Pacific modular construction market growth will record a CAGR of more than 8.5% from 2024 to 2032

- Among material, the steel sub-segment generated more than USD 43.2 billion revenue in 2023

- Based on end use, the residential sub-segment generated around 52% market share in 2023

- Vertical expansion in urban areas is a popular modular construction market trend that fuels the industry demand

The notion of modular construction is the use of standardized designs, patterns, and materials to create structures off-site. The structures are then transported and assembled on-site. When compared to traditional building procedures, this strategy reduces both site noise and pollution. Furthermore, modular architecture has the benefit of being easily disassembled, allowing for quick relocation or repurposing of existing structures. For example, mobile houses may be swiftly disassembled and transported, reducing the need for raw materials and resources generally necessary for new building projects. As a result, modular building offers a sustainable and eco-friendly way to address housing demands while reducing environmental impact and increasing resource efficiency.

Global Modular Construction Market Dynamics

Market Drivers

- Increasing urbanization drives demand for rapid builds, benefiting modular construction

- Streamlined processes in modular construction reduce expenses, attracting more projects

- Growing sustainability awareness favors modular construction for its eco-friendly attributes

- Technological advancements in automation and materials enhance speed and quality in modular construction

Market Restraints

- Design limitations in modular construction may not meet every architectural need

- Transportation challenges arise when moving large modules to remote sites

- Resistance to change from tradition-bound stakeholders slows the adoption of modular construction

Market Opportunities

- Increasing demand for affordable housing drives the need for quick, cheap, and scalable modular solutions

- Rising need for disaster relief calls for fast deployment of modular structures to aid displaced populations

- Growing demand for healthcare facilities creates opportunities for tailored, speedy modular construction to meet urgent medical needs

Modular Construction Market Report Coverage

| Market | Modular Construction Market |

| Modular Construction Market Size 2022 | USD 102.8 Billion |

| Modular Construction Market Forecast 2032 |

USD 196.8 Billion |

| Modular Construction Market CAGR During 2024 - 2032 | 7.6% |

| Modular Construction Market Analysis Period | 2020 - 2032 |

| Modular Construction Market Base Year |

2022 |

| Modular Construction Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Type, By Material, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Balfour Beatty PLC, ACS Actividades de Construcción y Servicios S.A., Red Sea Housing Services, Laing O’rourke, Atco, Bouygues Construction, Vinci, Fluor Corporation, Algeco Scotsman, Kleusberg GmbH & Co. Kg, Kef Katerra, and Lendlease Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Modular Construction Market Insights

Several main factors are driving the modular building market forward. To begin, rising industrialization and urbanization are driving an increase in global demand for complicated infrastructure projects. As urban populations grow, there is a pressing demand for inexpensive and ecological housing alternatives, which modular building technologies are ideally adapted to meeting. The capacity to swiftly assemble modular structures enables efficient construction in highly populated metropolitan areas, fulfilling the need for housing and infrastructure at reasonable prices. Additionally, there is a growing need for new building approaches, with modular construction emerging as a realistic option. This tendency is especially visible in underdeveloped nations, where traditional construction methods may be wasteful or impracticable. The modular model is appealing to developers and governments looking to accelerate infrastructure construction since it is fast, cost-effective, and flexible.

The modular building business is also growing thanks to government backing in the form of legislation and programmes. Many governments see the benefits of modular building, such as its ability to alleviate housing shortages, decrease construction waste, and lower carbon emissions. As a result, rules and incentives are being developed to promote the use of modular building systems. However, despite these positive drivers, there are several difficulties that may impede the modular construction market's growth. Affordability remains a crucial challenge, since modular building may have greater upfront expenses than traditional techniques. Furthermore, visibility and marketing in the supply chain are critical aspects that might influence industry growth. To overcome scepticism and opposition, modular construction businesses must effectively explain the benefits of their goods and services to potential consumers and stakeholders.

Modular Construction Market Segmentation

The worldwide market for modular construction is split based on type, material, end use, and geography.

Modular Construction Types

- Re-locatable

- Permanent

According to modular construction industry analysis, the permanent subsegment is the largest and most important type. This sector includes buildings that are built to last and provide high-quality solutions for a variety of industries and applications. Permanent modular building has various advantages over traditional approaches, including lower costs, shorter construction timetables, and increased sustainability. These buildings are constructed off-site in controlled manufacturing conditions, allowing for accurate fabrication and quality control. Once constructed, modules are delivered to the site for assembly, reducing on-site disturbances and environmental effect. Permanent modular construction is versatile enough to be used in a variety of industries, including residential, commercial, healthcare, and education. With rising demand for efficient and ecological building solutions, the permanent segment of the modular construction industry is positioned for further expansion and innovation.

Modular Construction Materials

- Wood

- Concrete

- Steel

- Others

Several significant elements contribute to the steel segment's dominance in the modular building industry. Steel has an excellent strength-to-weight ratio, making it a suitable material for modular construction, where lightweight yet strong components are required for ease of transportation and installation. Furthermore, steel modules are durable, resilient, and resistant to diverse environmental variables, assuring lifetime and structural integrity. Steel's adaptability allows for a wide range of architectural styles and customisation choices, which fit the specific needs of various projects and sectors. Moreover, steel's recyclability and sustainability appeal to ecologically aware clientele, helping to drive the increased usage of modular building technologies. With its outstanding qualities and diverse uses in residential, commercial, industrial, and institutional sectors, steel continues to fuel modular building industry development and innovation.

Modular Construction End-Uses

- Commercial

- Residential

- Industrial

- Education

- Healthcare

The residential segment emerges as the largest sector and it is expected to grow throughout the in the modular construction market forecast period due to its adaptability, efficiency, and increased desire for low-cost housing options. Modular building has major advantages over traditional techniques for residential projects, such as shorter construction timelines, lower labor costs, and improved quality control. These qualities appeal to developers and homeowners looking for quick completion times and cost-effective building options. Furthermore, modular construction's capacity to accept many architectural styles and floor layouts meets a wide range of housing demands, from single-family houses to multi-unit buildings. With rising urbanization and population growth driving the demand for efficient housing solutions, the residential segment of the modular construction industry is positioned for long-term development and expansion, revolutionizing how communities are developed and revitalized.

Modular Construction Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Modular Construction Market Regional Analysis

Based on the modular construction market analysis, in 2023, Asia Pacific held a significant market share, driven by factors such as accelerated industrialization, an increase in urban populations, and improved expenditure efficiency. China, within the Asia Pacific region, emerged as one of the leading markets. The Chinese government introduced various supportive measures, including reducing the proportion of down payments for second-house loans and exempting sales tax on ordinary homes. Additionally, the growing need for environmentally friendly and sustainable construction, along with policy funding, further fuels competition in the region's modular building industry.

Following Asia-Pacific, North America is expected to claim the largest share. Development in this region is influenced by factors such as increased investment in renewable energy for commercial properties and rising market demand for green buildings. Europe also represents a significant area for the modular building industry, expected to expand considerably due to various factors, including heightened environmental concerns, infrastructure developments, and growing interest in cost efficiency and building energy conservation.

Modular Construction Market Players

Some of the top modular construction companies offered in our report includes Balfour Beatty PLC, ACS Actividades de Construcción y Servicios S.A., Red Sea Housing Services, Laing O’rourke, Atco, Bouygues Construction, Vinci, Fluor Corporation, Algeco Scotsman, Kleusberg GmbH & Co. Kg, Kef Katerra, and Lendlease Corporation.

Frequently Asked Questions

How big is the modular construction market?

The modular construction market size was valued at USD 102.8 billion in 2023.

What is the CAGR of the global modular construction market from 2024 to 2032?

The CAGR of modular construction is 7.6% during the analysis period of 2024 to 2032.

Which are the key players in the modular construction market?

The key players operating in the global market are including Balfour Beatty PLC, ACS Actividades de Construcci�n y Servicios S.A., Red Sea Housing Services, Laing O�rourke, Atco, Bouygues Construction, Vinci, Fluor Corporation, Algeco Scotsman, Kleusberg GmbH & Co. Kg, Kef Katerra, and Lendlease Corporation.

Which region dominated the global modular construction market share?

Asia-Pacific held the dominating position in modular construction industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032

Asia-Pacific region exhibited fastest growing CAGR for market of modular construction during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global modular construction industry?

The current trends and dynamics in the modular construction industry include increasing urbanization drives demand for rapid builds, benefiting modular construction, streamlined processes in modular construction reduce expenses, attracting more projects, growing sustainability awareness favors modular construction for its eco-friendly attributes, and technological advancements in automation and materials enhance speed and quality in modular construction.

Which material held the maximum share in 2023?

The steel material held the maximum share of the modular construction industry.