Mobile Pumps Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Mobile Pumps Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

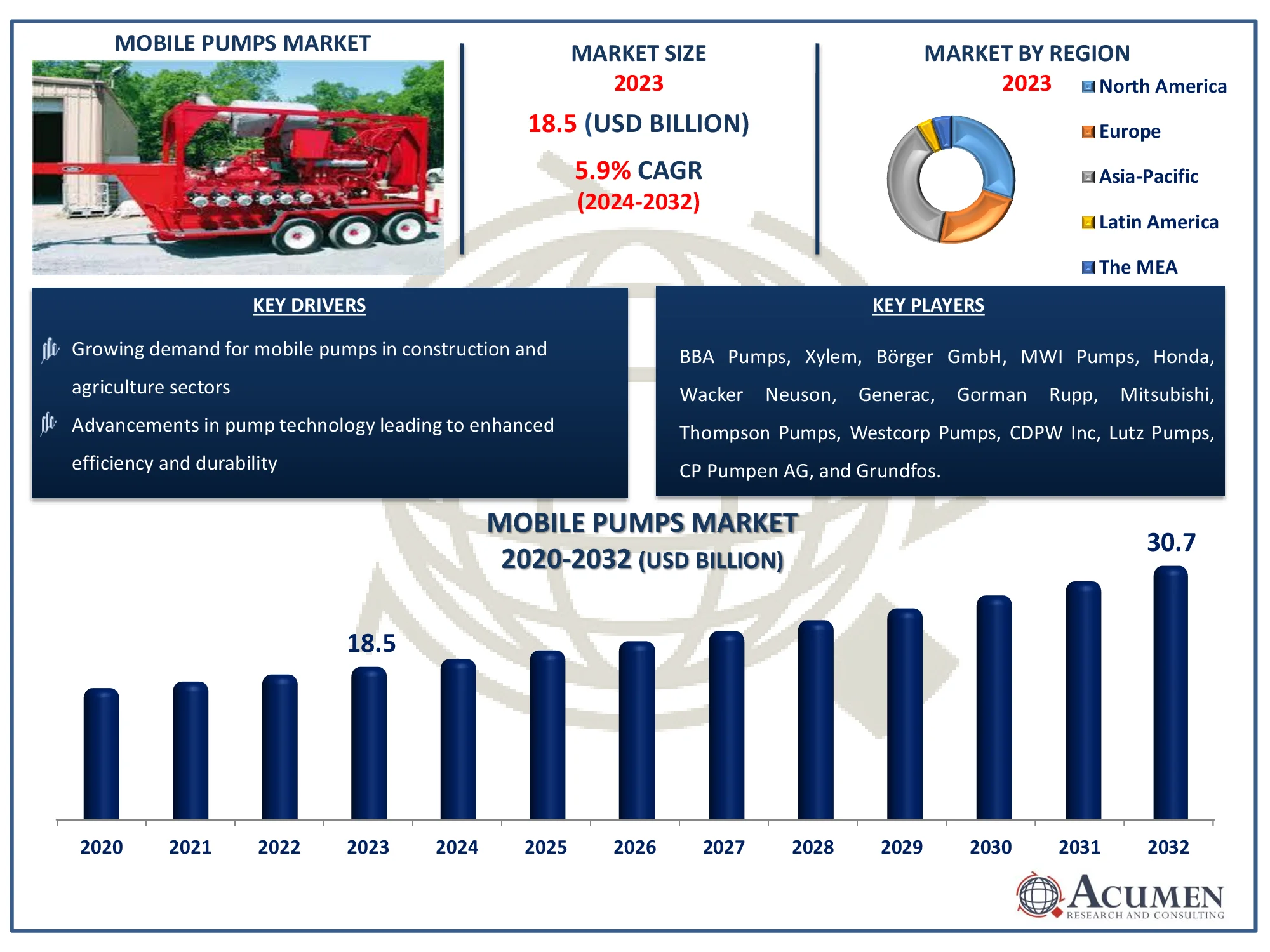

The Global Mobile Pumps Market Size accounted for USD 18.5 Billion in 2023 and is estimated to achieve a market size of USD 30.7 Billion by 2032 growing at a CAGR of 5.9% from 2024 to 2032.

Mobile Pumps Market Highlights

- Global mobile pumps market revenue is poised to garner USD 30.7 billion by 2032 with a CAGR of 5.9% from 2024 to 2032

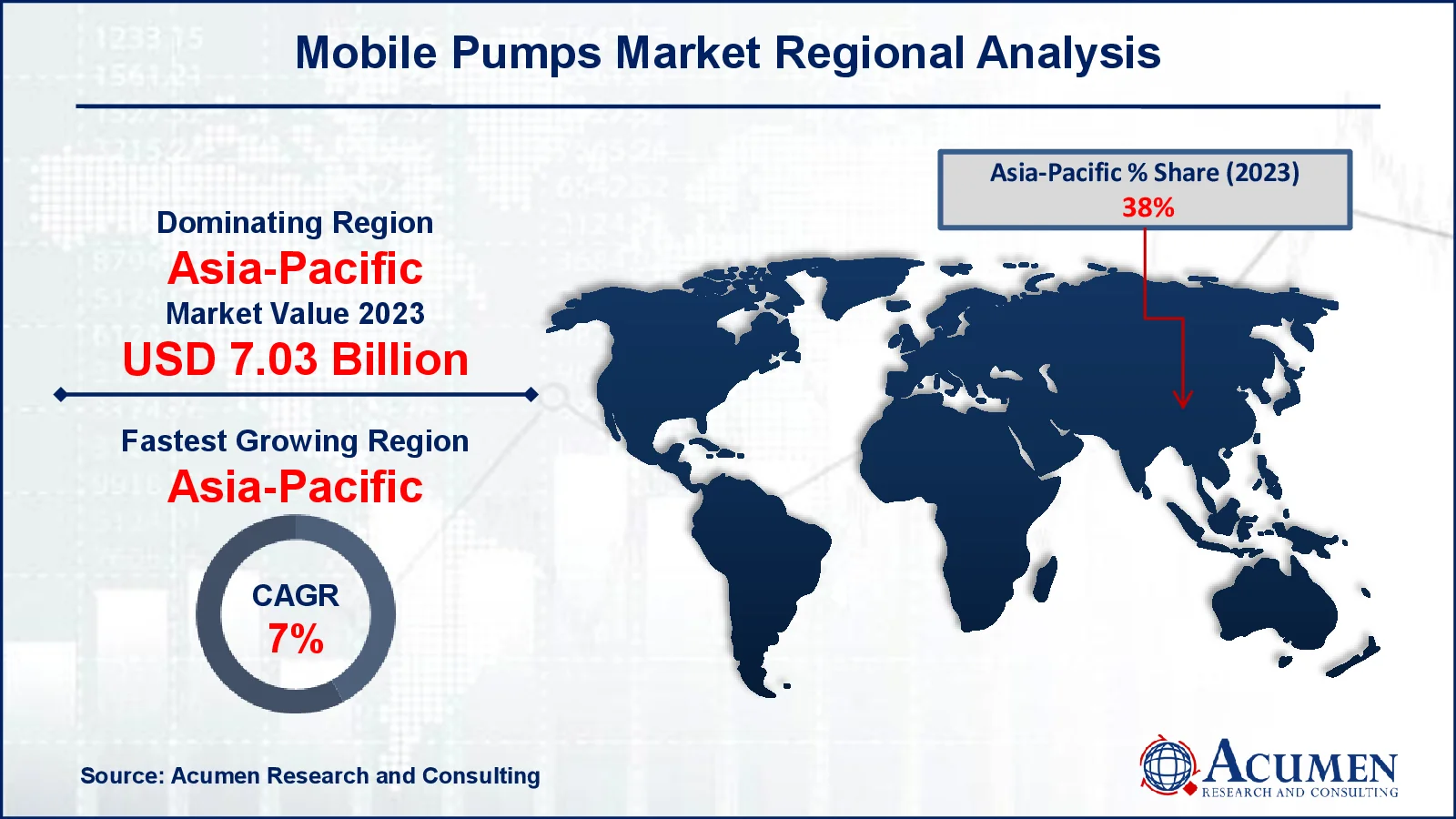

- Asia-Pacific mobile pumps market value occupied around USD 7 billion in 2023

- Asia-Pacific mobile pumps market growth will record a CAGR of more than 7% from 2024 to 2032

- Among type, the diesel-powered mobile pumps sub-segment generated around USD 7.4 billion revenue in 2023

- Based on application, the construction and mining sub-segment generated notable mobile pumps market share in 2023

- Growing demand for mobile pumps in disaster relief and emergency situations is a popular mobile pumps market trend that fuels the industry demand

A pump refers to the device which uses pressure or suction to raise or move compress gases, liquids, or force air through mechanical action. The mobile pumps are those which can be moved from one place to another for accomplishing the same task. The operation of the pumps is carried out through the engine has driven or electrical driven forces, where engine-driven pumps require petrol or diesel for the operation and electrical driven utilize electric power for the operation.

In addition, various types of mobile pumps are available in the market which includes concrete pumps, vacuum pumps and hydraulic pumps among others. Mobile concrete pumps are used to transfer liquid concrete during high volumes during construction. Mobile vacuum pumps remove gas molecules from a sealed volume to leave behind a partial vacuum, for instance, vacuum pump removes water from one area to another. Hydraulic pumps convert mechanical power into hydraulic energy and generate flow with enough power to overcome pressure induced by the load.

Global Mobile Pumps Market Dynamics

Market Drivers

- Growing demand for mobile pumps in construction and agriculture sectors

- Advancements in pump technology leading to enhanced efficiency and durability

- Increasing urbanization and industrial activities requiring robust fluid management

- Rising need for portable and energy-efficient pumping solutions in remote areas

Market Restraints

- High initial cost and maintenance requirements of mobile pumps

- Limited availability of skilled operators to manage advanced pumping systems

- Regulatory challenges related to emissions and energy consumption

Market Opportunities

- Expansion in emerging markets with infrastructure development projects

- Innovation in battery-powered and solar-powered mobile pumps

- Adoption of IoT-enabled mobile pumps for enhanced monitoring and control

Mobile Pumps Market Report Coverage

|

Market |

Mobile Pumps Market |

|

Mobile Pumps Market Size 2023 |

USD 18.5 Billion |

|

Mobile Pumps Market Forecast 2032 |

USD 30.7 Billion |

|

Mobile Pumps Market CAGR During 2024 - 2032 |

5.9% |

|

Mobile Pumps Market Analysis Period |

2020 - 2032 |

|

Mobile Pumps Market Base Year |

2023 |

|

Mobile Pumps Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Mobility Mechanism, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

BBA Pumps, Xylem, Börger GmbH, MWI Pumps, Honda, Wacker Neuson, Generac, Gorman Rupp, Mitsubishi, Thompson Pumps, Westcorp Pumps, CDPW Inc, Lutz Pumps, CP Pumpen AG, and Grundfos. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Mobile Pumps Market Insights

The rapidly growing construction industry across the globe is primarily driving the market growth. The rapid urbanization is stimulating the demand for mobile pumps because these are easy to use and quicker in delivery, which makes them a preferred choice for large scale projects for timely execution. The recent introduction of the green buildings concept across the globe is pushing the manufacturers to develop or transform the production strategies of the pumps. Sequentially, the key players are investing in research and development activities for producing highly energy-efficient and smart pumps. These are the factors boosting the market growth.

However, the fluctuating price of raw materials and the high cost associated with the energy-efficient system pumps are likely to hamper the market growth. Whereas, the increasing adoption of internet of things (IoT) and embedded technology in the market are anticipated to create potential opportunity during the forecast period.

Mobile concrete pumps are anticipated to experience the highest growth over the forecast period owing to the rapidly growing construction sector across the globe. The mobile pumps have transformed the development of high rise and large buildings by decreasing execution time, energy and labor cost of the overall project is a factor fuelling the market growth. The increasing use of mobile pumps in larger construction projects like building, tunnels, and bridges to discharge concrete quickly and more efficiently even with high volumes is also an important factor accelerating market growth. The advantages associated with the mobile pumps like quicker setup time and provide constant flow with low labor cost is further accelerating the segment growth.

Mobile Pumps Market Segmentation

Mobile Pumps Market Segmentation

The worldwide market for mobile pumps is split based on type, mobility mechanism, application, and geography.

Mobile Pump Market By Type

- Electric-Powered Mobile Pumps

- Diesel-Powered Mobile Pumps

- Hydraulic Mobile Pumps

According to mobile pumps industry analysis, the market for diesel-powered mobile pumps is predicted to increase significantly due to their better efficiency, adaptability, and ability to handle high-pressure applications. These pumps are commonly employed in industries such as construction, mining, and oil and gas, where high performance and dependability are required. Furthermore, the rising demand for mobile and efficient pumping solutions in infrastructure construction projects has hastened their adoption. The incorporation of energy-saving features and improvements to reduce maintenance costs is boosting the global market for diesel-powered mobile pumps.

Mobile Pump Market By Mobility Mechanism

- Truck-Mounted Mobile Pumps

- Trailer-Mounted Mobile Pumps

- Skid-Mounted Mobile Pumps

Trailer-mounted mobile pump segment is predicted to account for a notable portion of the mobile pumps market due to its adaptability across industries. These pumps are incredibly portable and simple to set up, making them suitable for usage in construction, emergency response, and agriculture. Their design allows for fast attachment to vehicles, providing efficient movement to various locations without requiring extensive modifications. Furthermore, trailer-mounted systems are preferred because they can manage a wide range of pumping capacities, making them adaptable to a variety of operational requirements. The rising emphasis on cost-effective and adaptable pumping solutions, together with their compatibility with a variety of terrains, solidifies their position as a top choice for both urban and distant projects.

Mobile Pump Market By Application

- Construction and Mining

- Municipal and Water Management

- Oil and Gas

- Agriculture and Irrigation

- Disaster Management (Flood Control and Emergency Dewatering)

- Industrial Processes

The construction and mining sectors are likely to lead the mobile pumps market due to its widespread use in heavy-duty operations that require effective fluid transfer and dewatering solutions. Infrastructure development and rising mineral demand are boosting the requirement for dependable pumping systems in excavation, site preparation, and material handling. Mobile pumps are critical for managing water accumulation and slurry conveyance while maintaining project operations. The business also benefits from ongoing global expenditures in large-scale construction projects, especially in emerging regions. The ability of mobile pumps to work successfully in challenging settings places this category as a key driver of market growth.

Mobile Pumps Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Mobile Pumps Market Regional Analysis

North America leads the mobile pumps market, owing to robust infrastructural development, widespread adoption of modern industrial technologies, and the presence of important market competitors. The region's construction, mining, and oil and gas industries rely largely on mobile pumps for effective fluid handling, especially in remote or difficult environments. Government spending on infrastructure repair projects, such as transportation networks and water management systems, has boosted demand. Furthermore, the region's stringent environmental rules encourage the use of innovative and efficient pumping techniques, which ensures long-term industry dominance.

Asia-Pacific has emerged as the fastest growing area in the mobile pumps market, due to increased industrialization, urbanization, and infrastructure developments in China, India, and Southeast Asian countries. As a result of increased population and urban migration, the region's construction and mining industries are expanding at an unprecedented rate, increasing demand for portable and high-performance pumping equipment. Furthermore, government initiatives like India's Smart Cities Mission and China's Belt and Road Initiative promote large-scale infrastructure investment. Rising knowledge of good water management and the need of flood control systems, particularly in disaster-prone areas, helps to drive the market forward. This rapid growth is being driven by growing foreign direct investment and the development of local industrial facilities to fulfill rising demand.

Mobile Pumps Market Players

Some of the top mobile pumps companies offered in our report include BBA Pumps, Xylem, Börger GmbH, MWI Pumps, Honda, Wacker Neuson, Generac, Gorman Rupp, Mitsubishi, Thompson Pumps, Westcorp Pumps, CDPW Inc, Lutz Pumps, CP Pumpen AG, and Grundfos.

Frequently Asked Questions

How big is the mobile pumps market?

The mobile pumps market size was valued at USD 18.5 billion in 2023.

What is the CAGR of the global mobile pumps market from 2024 to 2032?

The CAGR of mobile pumps is 5.9% during the analysis period of 2024 to 2032.

Which are the key players in the mobile pumps market?

The key players operating in the global market are including BBA Pumps, Xylem, B�rger GmbH, MWI Pumps, Honda, Wacker Neuson, Generac, Gorman Rupp, Mitsubishi, Thompson Pumps, Westcorp Pumps, CDPW Inc, Lutz Pumps, CP Pumpen AG, and Grundfos.

Which region dominated the global mobile pumps market share?

Asia-Pacific held the dominating position in mobile pumps industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of mobile pumps during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global mobile pumps industry?

The current trends and dynamics in the mobile pumps industry include growing demand for mobile pumps in construction and agriculture sectors, and advancements in pump technology leading to enhanced efficiency and durability.

Which application held the maximum share in 2023?

The sewage treatment application held the maximum share of the mobile pumps industry.