Mining Automation Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Mining Automation Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

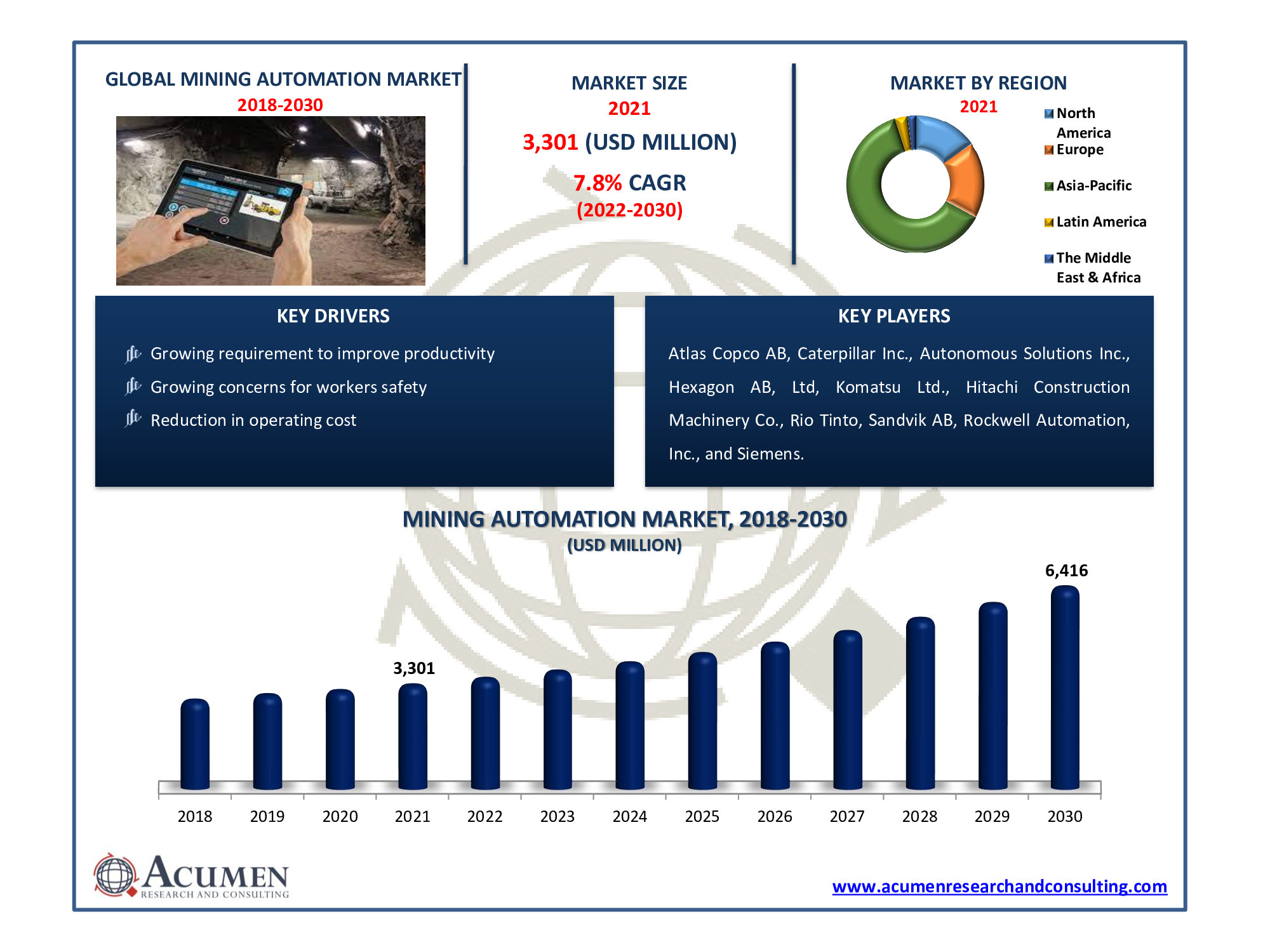

The Global Mining Automation Market size accounted for USD 3,301 Mn in 2021 and is estimated to reach USD 6,416 by 2030, with a significant CAGR of 7.8% from 2022 to 2030.

Mining automation is referred to as the reduction of human labor from the mining process. The mining industry is in the process of becoming more automated. It can nevertheless necessitate a significant quantity of human capital, especially in underdeveloped countries where labor prices are cheap and there is no incentive to improve efficiency. According to estimates, today's mining activities are 28% less efficient than a decade earlier. Declining ore grades, rising costs, a scarcity of skilled personnel, market volatility, and demanding regulatory compliance have prompted the mining industry to seek measures to enhance productivity and efficiency. Business processes in the mining sector cover a wide range of rule-based and knowledge-based repetitive tasks that provide no value to the overall business or the end-users who perform them. Automation is a method for using software robots to automate monotonous and non-value-added labor. Increasing profitability in the mining business necessitates a continuous focus on efficiency, transportation, and metal extraction to maximize ore flow. However, incremental advancements are experiencing diminishing marginal returns, and the business is gradually shifting its focus to automation as the next source of opportunity.

Global Mining Automation Market Dynamics

Market Growth Drivers:

- Growing requirement to improve productivity

- Growing concerns for workers safety

- Reduction in operating cost

Market Restraints:

- Lack of high-skilled and qualified labor

- Depletion of natural resources

Market Opportunities:

- Availability of technologically advanced equipment

- Rising digitization leading to smart mines

Report Coverage

| Market | Mining Automation Market |

| Market Size 2021 | US$ 3,301 Mn |

| Market Forecast 2030 | US$ 6,416 Mn |

| CAGR | 7.8% During 2022 - 2030 |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Technique, By Type, By workflow, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Atlas Copco AB, Caterpillar Inc., Autonomous Solutions Inc., Hexagon AB, Ltd, Komatsu Ltd., Hitachi Construction Machinery Co., Rio Tinto, Sandvik AB, Rockwell Automation, Inc., and Siemens. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Increasing productivity in the mining process through automation is the leading factor driving the growth of the global mining automation market. The mining industry is currently facing a unique set of difficulties, including increasing output and lowering costs while maintaining workers' health and safety, safeguarding fixed assets, and conserving the environment. With the goal of increasing productivity and addressing the mining industry's issues, automation and digitalization are widely regarded as the most influential trends in the mining automation market worldwide.

The increasing number of mining accidents has long been a source of concern for mining management and the government. Miners frequently endanger their lives by traveling deep underground in dangerous conditions in order to bring lucrative commodities to the surface. By automating underground chores and deploying robots or other advanced technology that can function efficiently without being inhibited by any kind of cause, workers and their managers will undoubtedly benefit. This element will contribute considerably to a greater mining automation market share in the next years.

The use of sophisticated mining equipment in mining activities is expected to save time and money, which is boosting market demand. This is hastening the mining industry's move to automation. However, operating complex mining equipment requires highly competent and qualified professionals, which they lack. Furthermore, natural resource depletion will eventually reduce mining activity, perhaps resulting in a major revenue decline. These factors have been limiting the mining automation market's revenue for several years. Furthermore, rising digitization in the automation process is anticipated to create numerous growth opportunities in the market throughout the forecast timeframe. By automating machinery operation, advances in artificial intelligence (AI), machine learning, and the industrial internet of things (IoT) have the potential to save the sector billions of dollars and hundreds of lives in the coming few years.

Global Mining Automation Market Segmentation

The global mining automation market is segmented based on technique, type, workflow, and geography.

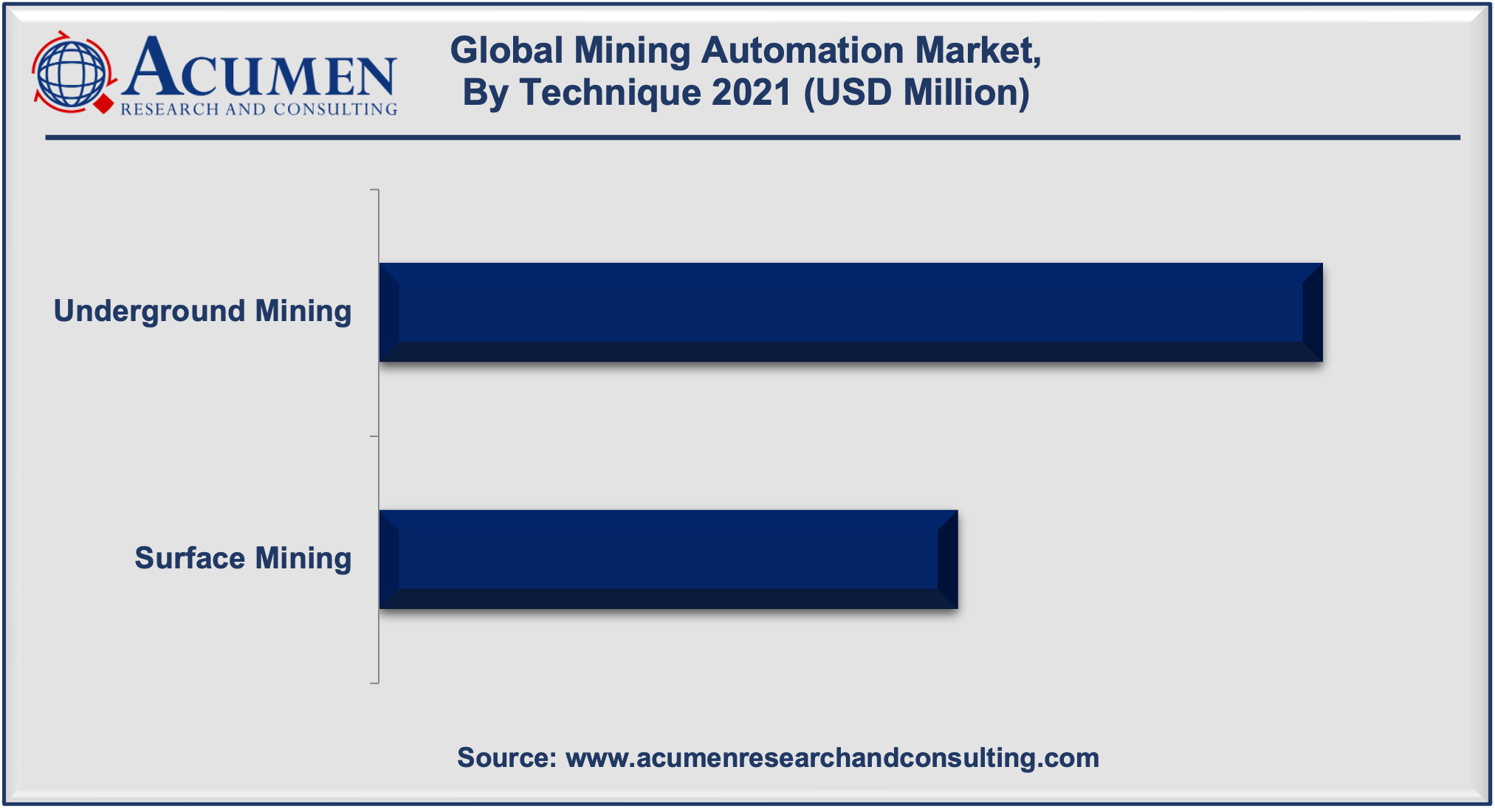

Global Mining Automation Market by Technique

- Surface Mining

- Underground Mining

Based on technique, the underground mining segment achieved maximum mining automation market share in 2021 as mining is carried out more underground as compared to the surface. Working in underground mining is tough due to potential hazards such as inadequate ventilation, exposure to hazardous gases, and negative health effects. Because underground mining is considered exceedingly dangerous, the demand for modern automated mining equipment is greater for underground mining techniques. Meanwhile, by applying automated mining, all significant threats can be avoided, contributing to the mining automation market's growth.

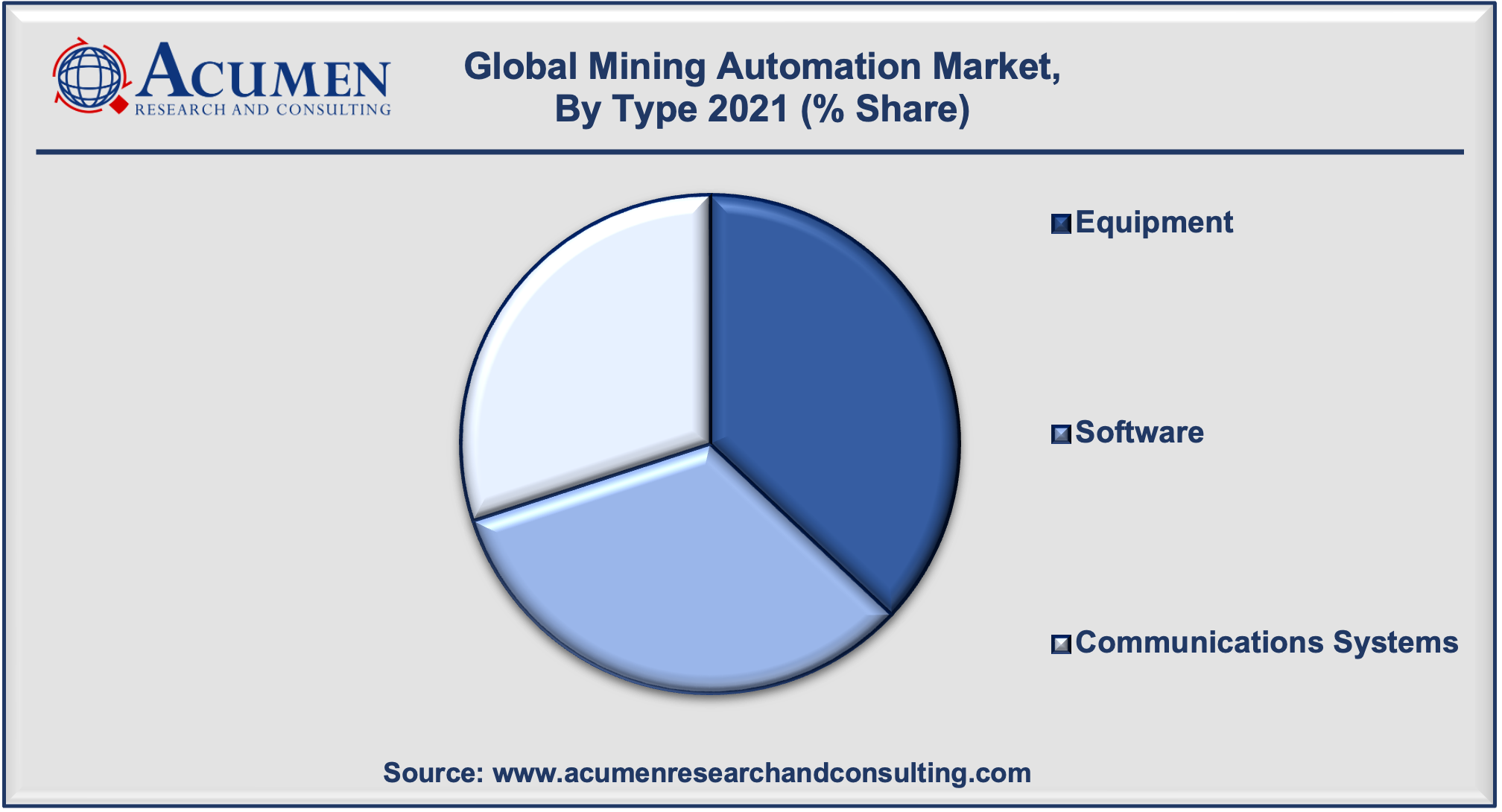

Global Mining Automation Market by Type

- Communications Systems

- Software

- Equipment

The mining equipment segment is expected to generate significant mining automation market revenue in 2021. Automated mining equipment is recognized to reduce the use of human labor in mining techniques. Furthermore, mining businesses around the world are quickly embracing technology advancements to better utilize their equipment and human resources in order to increase safety. For example, Bis, a logistics firm, and Israel Aerospace Industries (IAI) announced a collaboration in September 2020 for 'Auto-mate,' a new joint venture to deliver autonomous technologies for mining operations.

Global Mining Automation Market by Workflow

Mining Process

- Autonomous Haulage

- Automated Drilling

Mine Maintenance

- HVAC

- Mine Dewatering

Mine Development

- Tunnel Boring

- Construction of Access Roads

- Site Preparation and Clearing

The mining process segment is anticipated to lead the market during the forecasted years. The mining process is sub-segmented into autonomous haulage and autonomous drilling. The autonomous haulage segment obtained a significant market share among them, as carrying ore from the mining pit to the dumping site is among the most critical and capital-intensive tasks in mining operations. The increasing use of digitized and integrated technology such as GPS, wireless connections, complex software, and electronic controls has resulted in extremely competent autonomous hauling.

Global Mining Automation Market Regional Overview

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Mexico

· Brazil

· Rest of Latin America

Asia-Pacific

· India

· Japan

· China

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa

Presence of Immense Natural Reserves in Asia-Pacific Boosts the Regional Market Growth

Based on the regional segmentation, the Asia-Pacific region accounted for the maximum share in 2021. The leading share of North America is attributed to the significant economic development in China and India. In addition, the need for high productivity and efficiency in mines is leading to more adoption. In addition, the government and private enterprises are investing significant funds in improving mining activities, paving the road for Asia-Pacific mining automation to progress. Europe is the next most important main player, with the biggest market share. Exploration activity in this region is always increasing. It is resulting in the widespread use of automation devices.

Mining Automation Market Players

Some of the top vendors offered in the professional report include Atlas Copco AB, Caterpillar Inc., Autonomous Solutions Inc., Hexagon AB, Ltd, Komatsu Ltd., Hitachi Construction Machinery Co., Rio Tinto, Sandvik AB, Rockwell Automation, Inc., and Siemens.

Frequently Asked Questions

How big was the global mining automation market in 2021?

The estimated value of global mining automation market in 2021 was accounted to be USD 3,301 Mn.

What will be the projected CAGR for global mining automation market during forecast period of 2022 to 2030?

The projected CAGR of mining automation market during the analysis period of 2022 to 2030 is 7.8%.

Which are the prominent competitors operating in the market?

The prominent players of the global mining automation market involve Atlas Copco AB, Caterpillar Inc., Autonomous Solutions Inc., Hexagon AB, Ltd, Komatsu Ltd., Hitachi Construction Machinery Co., Rio Tinto, Sandvik AB, Rockwell Automation, Inc., and Siemens.

Which region held the dominating position in the global mining automation market?

Asia-Pacific held the dominating share for mining automation during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

The Middle East & Africa region exhibited fastest growing CAGR for mining automation during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global mining automation market?

Growing requirement to improve productivity, growing concerns for workers safety, and reduction in operating cost drives the growth of global Mining Automation market.

By segment technique, which sub-segment held the maximum share?

Based on technique, underground mining segment held the maximum share for Mining Automation market in 2021.