Military Simulation And Virtual Training Market | Acumen Research and Consulting

Military Simulation and Virtual Training Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

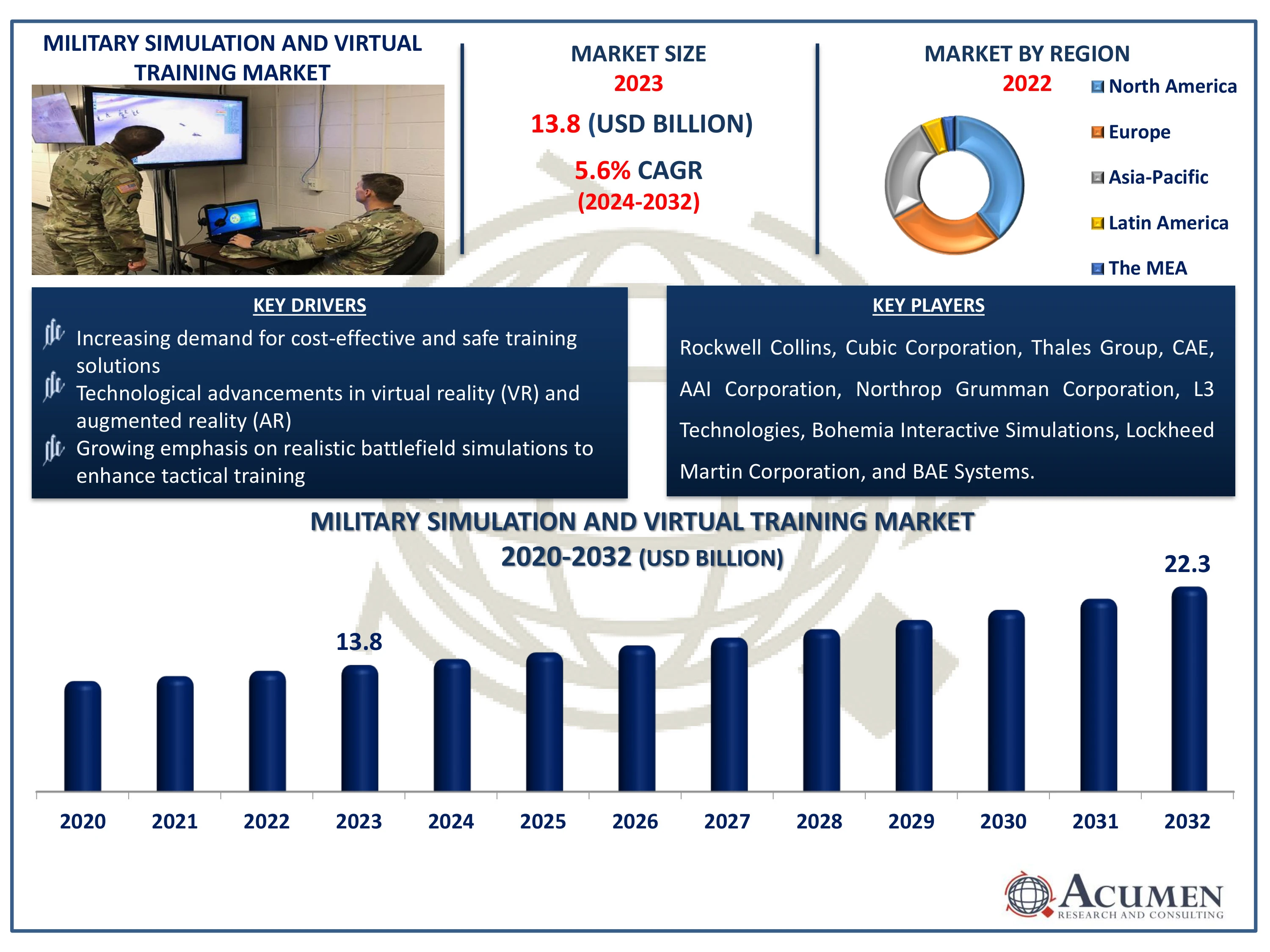

The Global Military Simulation and Virtual Training Market Size accounted for USD 13.8 Billion in 2023 and is estimated to achieve a market size of USD 22.3 Billion by 2032 growing at a CAGR of 5.6% from 2024 to 2032.

Military Simulation and Virtual Training Market Highlights

- Global military simulation and virtual training market revenue is poised to garner USD 22.3 billion by 2032 with a CAGR of 5.6% from 2024 to 2032

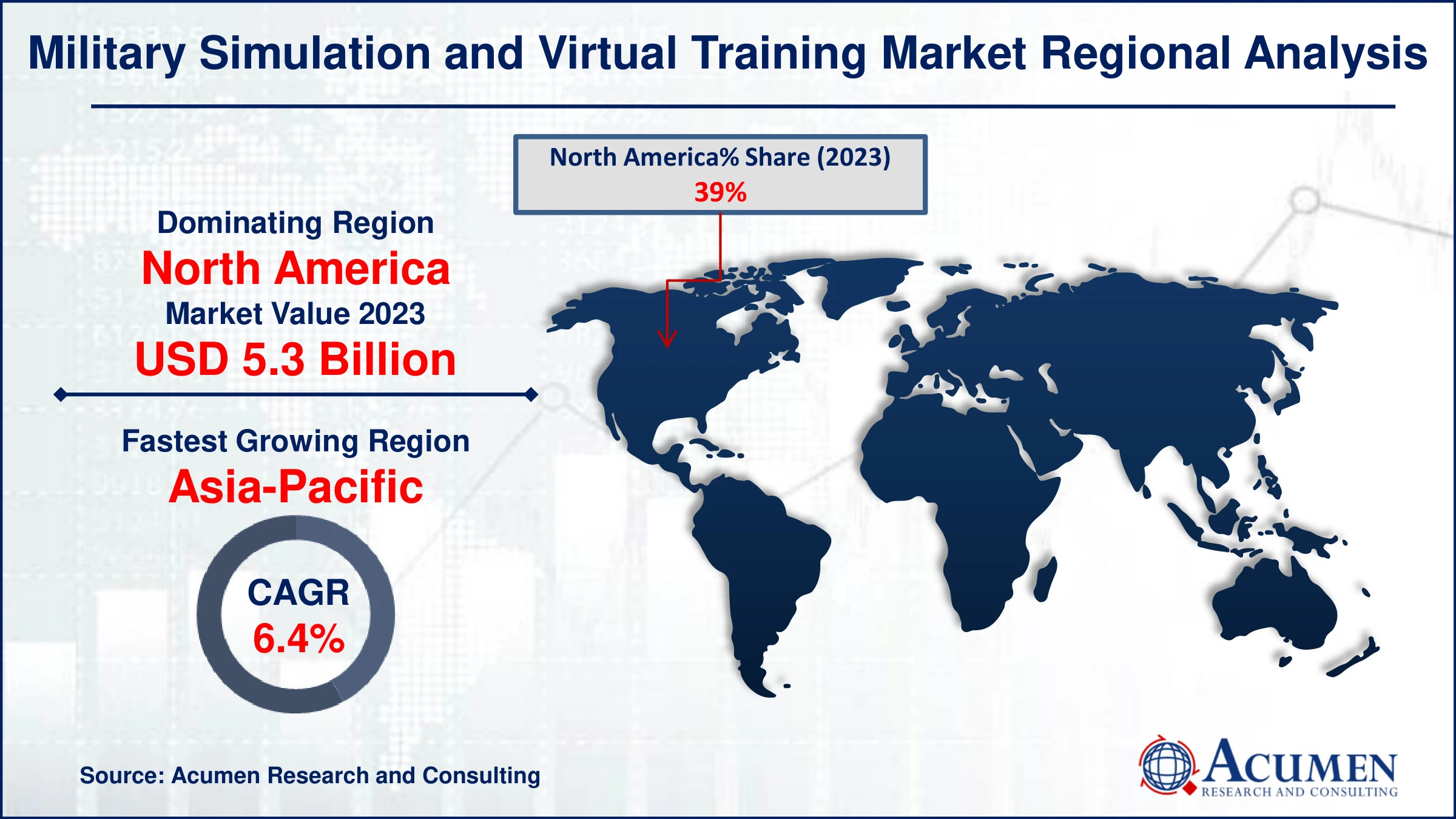

- North America military simulation and virtual training market value occupied around USD 5.3 billion in 2023

- Asia-Pacific military simulation and virtual training market growth will record a CAGR of more than 6.4% from 2024 to 2032

- Based on types, the flight simulation sub-segment generated 39% market share in 2023

- Based on application, the air sub-segment shows a 44% share in 2023

- Growing adoption of VR and AR technologies in military training to simulate realistic battlefield environments and enhance training effectiveness is the military simulation and virtual training market trend that fuels the industry demand

Military simulation and virtual training (MSVT) involves the use of advanced technologies like virtual reality (VR), augmented reality (AR), and computer simulations to replicate real-world military scenarios for training purposes. These simulations provide a safe and cost-effective environment for soldiers to practice combat techniques, strategic planning, and decision-making skills without the risks associated with live training exercises. Applications of MSVT include mission rehearsals, equipment training, and crisis response simulations, enhancing readiness and operational effectiveness. Additionally, MSVT is used for joint force training, enabling coordination and collaboration between different branches of the military. By immersing trainees in realistic, interactive scenarios, MSVT helps improve proficiency, adaptability, and performance in actual combat situations.

Global Military Simulation and Virtual Training Market Dynamics

Market Drivers

- Increasing demand for cost-effective and safe training solutions

- Technological advancements in virtual reality (VR) and augmented reality (AR)

- Growing emphasis on realistic battlefield simulations to enhance tactical training

Market Restraints

- High initial setup costs and ongoing maintenance expenses

- Concerns regarding data security and cyber threats

- Regulatory challenges and compliance issues in different regions

Market Opportunities

- Integration of artificial intelligence (AI) for enhanced scenario customization

- Expansion of military budgets in emerging economies

- Adoption of cloud-based solutions for scalability and accessibility

Military Simulation and Virtual Training Market Report Coverage

| Market | Military Simulation and Virtual Training Market |

| Military Simulation and Virtual Training Market Size 2022 | USD 13.8 Billion |

| Military Simulation and Virtual Training Market Forecast 2032 | USD 22.3 Billion |

| Military Simulation and Virtual Training Market CAGR During 2023 - 2032 | 5.6% |

| Military Simulation and Virtual Training Market Analysis Period | 2020 - 2032 |

| Military Simulation and Virtual Training Market Base Year |

2022 |

| Military Simulation and Virtual Training Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Rockwell Collins Inc., Cubic Corporation, Thales Group, CAE Inc., AAI Corporation, Northrop Grumman Corporation, L3 Technologies, Bohemia Interactive Simulations, Lockheed Martin Corporation, BAE Systems, and others. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Military Simulation and Virtual Training Market Insights

The military simulation and virtual training market is experiencing growth driven by increasing demand for cost-effective and safe training solutions. These technologies provide realistic environments for training without the logistical challenges and risks associated with live exercises. Governments and defense organizations worldwide are investing in these solutions, and manufacturers are collaborating to enhance the readiness and effectiveness of their armed forces. For instance, in July 2022, PLEXSYS, Thales, and Hadean joined forces to provide advanced operational training solutions to the UK Ministry of Defence (MoD). This collaboration seeks to leverage PLEXSYS's expertise in simulation and training, Thales's proficiency in defense systems, and Hadean's capabilities in synthetic environments and digital twins. Advancements in simulation technologies, including virtual reality (VR) and augmented reality (AR), are further propelling market expansion by offering immersive and adaptable training scenarios.

The high initial setup costs and ongoing maintenance expenses pose significant restraints for the military simulation and virtual training market. These simulations require sophisticated hardware and software systems capable of accurately replicating combat scenarios, which can be costly to procure and install. Furthermore, maintaining these systems involves regular updates, security protocols, and technical support, all of which add to the overall expense. For military organizations already managing tight budgets, these financial commitments can limit the scale and frequency of simulation training exercises, potentially impacting readiness and operational awareness. Balancing the need for realistic training with the financial constraints remains a critical challenge for the industry.

The integration of artificial intelligence (AI) in military simulation and virtual training markets offers significant opportunities for enhanced scenario customization. For instance, in October 2022, Red Hat and Lockheed Martin partnered to integrate advanced AI technologies into Lockheed Martin's military platforms. This collaboration involves the use of Red Hat Device Edge to enhance U.S. security missions by standardizing and implementing AI solutions in geographically challenging environments. AI can dynamically adjust scenarios based on real-time data inputs, improving realism and adaptability. This capability allows for more realistic training environments that can simulate a wide range of scenarios, from battlefield conditions to complex logistical challenges. By leveraging AI, military personnel can undergo more effective and personalized training experiences, preparing them better for diverse operational situations and increasing overall readiness.

Military Simulation and Virtual Training Market Segmentation

The worldwide market for military simulation and virtual training is split based on types, application, and geography.

Military Simulation and Virtual Training Types

- Flight Simulation

- Vehicle Simulation

- Battlefield Simulation

- Virtual Boot Camp

According to the military simulation and virtual training industry analysis, flight simulation dominates in the market due to its crucial role in training pilots and crew members across various military branches. These simulations provide highly realistic environments that mimic actual flight conditions, enhancing pilot skills and operational readiness without the costs and risks associated with real flights. Advanced technologies simulate diverse scenarios, from combat situations to emergency procedures, ensuring comprehensive training. This versatility and effectiveness make flight simulation a cornerstone of modern military training programs worldwide.

Military Simulation and Virtual Training Applications

- Ground

- Air

- Naval

According to the military simulation and virtual training industry analysis, the air application segment dominates market due to its critical role in training pilots and aircrew. This segment includes simulators for various aircraft, from fighter jets to transport planes, offering realistic environments for training military exercises, navigation, and emergency procedures. With advancements in technology, these simulators provide high-fidelity experiences that enhance readiness and operational effectiveness without the costs and risks associated with real-flight training. This dominance underscores the importance of air-based simulations in maintaining combat readiness and operational efficiency across military forces globally.

Military Simulation and Virtual Training Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Military Simulation and Virtual Training Market Regional Analysis

For several reasons, North America holds a prominent position in the military simulation and virtual training (MSVT) market, due to its substantial defense spending, technological innovation, and advanced infrastructure. The region benefits from a strong presence of key market players, robust research and development activities, and extensive government support for defense modernization programs. For instance, in February 2023, CAE, a well-known Canadian simulation technology company, announced its acquisition of SimCentric. This acquisition bolstered CAE's portfolio of aerospace training simulation products. This leadership is further bolstered by a strategic focus on enhancing military readiness through realistic and immersive training solutions, driving continuous growth and evolution within the sector.

The Asia-Pacific region has emerged as the fastest-growing market for military simulation and virtual training (MSVT) market due to increasing defense budgets, modernization efforts. For instance, in 2024, the budget was declared to be 1.67 trillion yuan (US$231 billion), marking a 7.2% increase from the previous year. Governments across the region are investing significantly in advanced simulation technologies to enhance military readiness and operational effectiveness. This growth is driven by a rising demand for realistic training environments that simulate complex combat scenarios and improve soldier preparedness.

Military Simulation and Virtual Training Market Players

Some of the top military simulation and virtual training companies offered in our report include Rockwell Collins Inc., Cubic Corporation, Thales Group, CAE Inc., AAI Corporation, Northrop Grumman Corporation, L3 Technologies, Bohemia Interactive Simulations, Lockheed Martin Corporation, BAE Systems, and others.

Frequently Asked Questions

How big is the military simulation and virtual training market?

The military simulation and virtual training market size was valued at USD 13.8 billion in 2023.

What is the CAGR of the global military simulation and virtual training market from 2024 to 2032?

The CAGR of military simulation and virtual training is 5.6% during the analysis period of 2024 to 2032.

Which are the key players in the military simulation and virtual training market?

The key players operating in the global market are including Rockwell Collins Inc., Cubic Corporation, Thales Group, CAE Inc., AAI Corporation, Northrop Grumman Corporation, L3 Technologies, Bohemia Interactive Simulations, Lockheed Martin Corporation, BAE Systems, and others.

Which region dominated the global military simulation and virtual training market share?

North America held the dominating position in military simulation and virtual training industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of military simulation and virtual training during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global military simulation and virtual training industry?

The current trends and dynamics in the military simulation and virtual training industry include increasing demand for cost-effective and safe training solutions, technological advancements in virtual reality (VR) and augmented reality (AR), and growing emphasis on realistic battlefield simulations to enhance tactical training.

Which type held the maximum share in 2023?

The flight simulation type holds the maximum share of the military simulation and virtual training industry.