Military Laser Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Military Laser Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

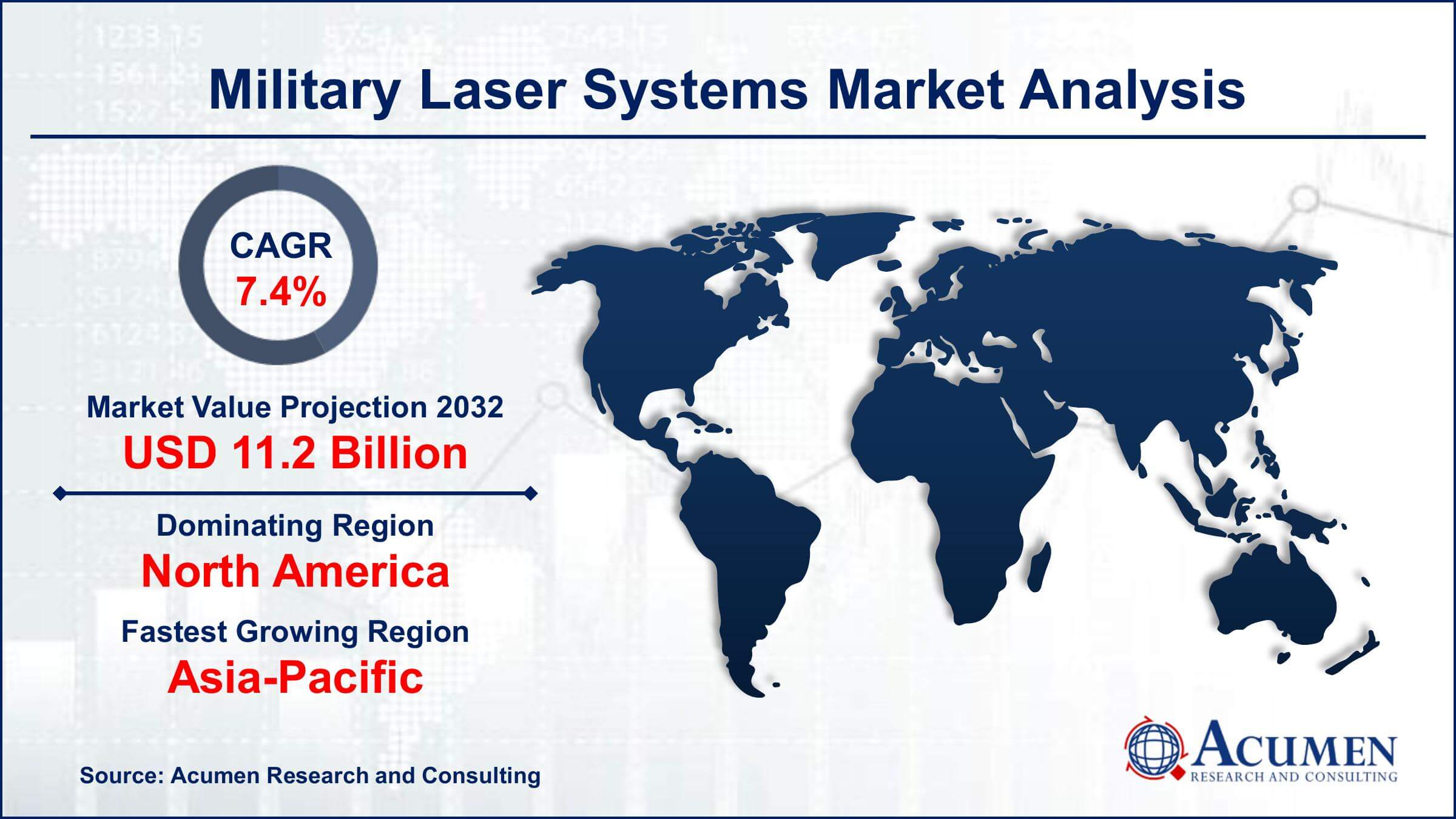

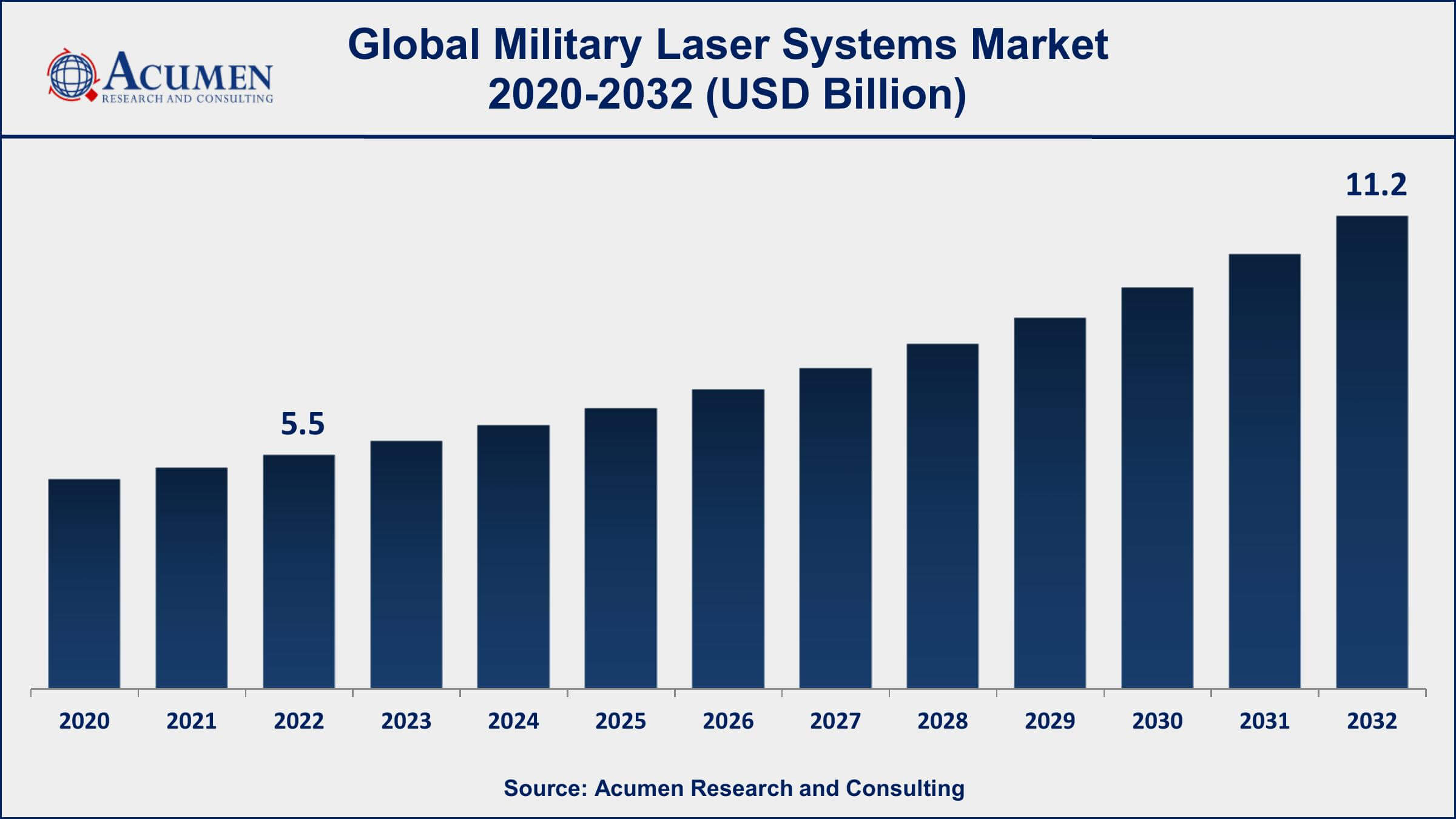

The Global Military Laser Systems Market Size accounted for USD 5.5 Billion in 2022 and is projected to achieve a market size of USD 11.2 Billion by 2032 growing at a CAGR of 7.4% from 2023 to 2032.

Military Laser Systems Market Highlights

- Global Military Laser Systems Market revenue is expected to increase by USD 11.2 Billion by 2032, with a 7.4% CAGR from 2023 to 2032

- North America region led with more than 37% of Military Laser Systems Market share in 2022

- The United States leads the way with USD 877 billion in military spending in 2022, accounting for 40% of total global military spending

- Asia-Pacific Military Laser Systems Market growth will record a CAGR of around 8.6% from 2023 to 2032

- By application, the target designation and ranging segment is expected to expand at the biggest CAGR of 8% from 2023 to 2033

- Growing demand for precision strike capabilities with laser-guided munitions, drives the Military Laser Systems Market Value

Military laser systems refer to advanced technologies that utilize lasers for various defense and security applications. These systems harness the power of focused light to deliver precise and lethal effects on enemy targets. They have diverse applications, including laser-guided munitions, target designation, countermeasure systems, range finding, and even high-energy laser weapons capable of shooting down missiles or unmanned aerial vehicles (UAVs).

The market for military laser systems has been experiencing significant growth in recent years. Advancements in laser technology, coupled with increasing defense budgets in several countries, have driven the development and deployment of these systems. The demand for more accurate and efficient weapons has led to the adoption of laser-guided munitions in precision strike missions. Additionally, the need for reliable and cost-effective solutions for defense against UAVs and other aerial threats has also boosted the market for directed energy weapons (DEWs) based on lasers. Furthermore, military forces are exploring the potential of lasers for non-lethal applications such as disabling enemy sensors or optics.

Global Military Laser Systems Market Trends

Market Drivers

- Increasing defense budgets in various countries

- Advancements in laser technology, making military lasers more powerful and efficient

- Growing demand for precision strike capabilities with laser-guided munitions

- Need for reliable and cost-effective solutions for defense against aerial threats, such as UAVs and missiles

- Potential to enhance situational awareness and target identification through laser target designation systems

Market Restraints

- High development and procurement costs associated with advanced laser systems

- Technical challenges, such as beam control, power efficiency, and atmospheric interference

Market Opportunities

- Potential use of military lasers in civilian applications, like remote sensing and infrastructure protection

- Adoption of additive manufacturing (3D printing) for producing complex laser components at lower costs

Military Laser Systems Market Report Coverage

| Market | Military Laser Systems Market |

| Military Laser Systems Market Size 2022 | USD 5.5 Billion |

| Military Laser Systems Market Forecast 2032 | USD 11.2 Billion |

| Military Laser Systems Market CAGR During 2023 - 2032 | 7.4% |

| Military Laser Systems Market Analysis Period | 2020 - 2032 |

| Military Laser Systems Market Base Year | 2022 |

| Military Laser Systems Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Product Type, By Application, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Thales Group, BAE Systems plc, Rheinmetall AG, L3Harris Technologies, Inc., Saab AB, Hanwha Corporation, Leonardo S.p.A., Elbit Systems Ltd., and Boeing Defense, Space & Security |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Military laser systems are advanced technologies that utilize lasers for various defense and security applications. These systems harness the power of highly focused light to deliver precise and lethal effects on enemy targets. Military lasers can be broadly categorized into two types: laser-guided systems and high-energy laser weapons.

Laser-guided systems are primarily used for precision strike missions. They employ lasers to guide munitions, such as bombs or missiles, to their intended targets with incredible accuracy. Laser designators, mounted on ground or aerial platforms, illuminate the target with a laser beam, and laser-seeking sensors on the munitions detect and home in on the reflected laser light, guiding the weapon to its destination. This capability significantly reduces collateral damage and enhances the effectiveness of military operations.

High-energy laser weapons, on the other hand, are designed to engage and neutralize threats directly using focused laser beams. These directed energy weapons have the potential to shoot down enemy missiles, drones, or other airborne threats. The laser's speed and precision offer advantages over traditional kinetic weapons, providing a rapid response to fast-moving targets.

The military laser systems market has been experiencing robust growth in recent years and is expected to continue expanding in the coming years. Advancements in laser technology, coupled with increasing defense budgets in various countries, have been significant drivers of this growth. The demand for precise and efficient weapons with reduced collateral damage has led to the adoption of laser-guided munitions and target designation systems, which have become essential components of modern warfare. Moreover, the rise of asymmetric warfare and the need to counter small-scale threats and swarm attacks have further fueled the demand for military laser systems. The market growth is also driven by the growing need for reliable and cost-effective solutions for defense against aerial threats, such as UAVs and missiles. High-energy laser weapons, capable of shooting down these threats, have shown promising results in testing and are being actively developed and deployed.

Military Laser Systems Market Segmentation

The global Military Laser Systems Market segmentation is based on technology, product type, application, end use, and geography.

Military Laser Systems Market By Technology

- Fiber Laser

- Chemical Laser

- Solid- State Laser

- Semiconductor Laser

- CO2 Laser

- Others

According to the military laser systems industry analysis, the fiber laser segment accounted for the largest market share in 2022. Fiber lasers have emerged as a prominent technology due to their numerous advantages over other types of lasers. These advantages include high efficiency, compact size, robustness, and excellent beam quality, making them ideal for various military applications. As defense forces seek more advanced and versatile laser systems, fiber lasers have gained traction in precision strike missions, target designation, and countermeasure systems. In precision strike missions, fiber lasers play a crucial role in providing accurate and lethal effects on enemy targets. The precise beam control and high power output of fiber lasers enable them to guide munitions with precision, minimizing collateral damage and increasing mission success rates.

Military Laser Systems Market By Product Type

- Laser Designator

- 3D Scanning

- LIDAR

- Laser Range Finder

- Laser Weapon

- Laser Altimeter

- Ring Laser Gyro

- Others

In terms of product types, the 3D scanning segment is expected to witness significant growth in the coming years. 3D scanning technology, which uses lasers to capture and create detailed three-dimensional models of objects and environments, offers significant advantages for military applications. One of the primary uses of 3D scanning in the military is for reconnaissance and situational awareness. Unmanned aerial vehicles (UAVs) equipped with 3D scanning sensors can quickly and accurately map enemy territories, providing valuable intelligence to military forces. Moreover, 3D scanning plays a crucial role in reverse engineering and maintenance of military equipment. By scanning and creating precise 3D models of damaged or outdated components, defense forces can expedite the process of manufacturing spare parts or upgrading existing systems. This capability is particularly valuable in remote or challenging operational environments where traditional supply chains may be limited or disrupted.

Military Laser Systems Market By Application

- Target Designation and Ranging

- Defensive Countermeasures

- Directed Energy Weapon

- Guiding Munitions

- Others

According to the military laser systems market forecast, the target designation and ranging segment is expected to witness significant growth in the coming years. Target designation involves the use of lasers to precisely identify and mark enemy targets for guided munitions or other attack systems. Laser target designation systems provide crucial real-time intelligence to guide munitions with high accuracy, reducing the risk of collateral damage and increasing mission success rates. These systems play a vital role in modern warfare, where precision strikes on specific targets are essential to minimize civilian casualties and infrastructure damage. Moreover, laser rangefinders are an integral part of military operations, providing accurate distance measurements to enemy targets or objects of interest. Rangefinders based on laser technology offer several advantages, including fast response times, long-range capabilities, and accuracy in various operational environments.

Military Laser Systems Market By End Use

- Defense

- Homeland Security

Based on the end use, the defense segment is expected to continue its growth trajectory in the coming years. As defense forces around the world face evolving threats and challenges, there is a growing emphasis on advanced and effective defense technologies. Military lasers offer a range of capabilities that make them valuable assets for defense applications. High-energy laser weapons, in particular, have shown great promise in countering aerial threats such as drones, missiles, and rockets. These directed energy weapons can rapidly engage and disable incoming threats with precision and speed, providing a proactive defense against potential attacks. Additionally, defense forces are investing in laser-based countermeasure systems to protect against hostile actions.

Military Laser Systems Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Military Laser Systems Market Regional Analysis

Geographically, North America is dominating the military laser systems market for several key reasons. First and foremost, North America is home to some of the world's largest and most technologically advanced defense industries. The region boasts a robust defense research and development ecosystem, with significant investments in cutting-edge technologies, including military lasers. This has allowed North American defense companies to stay at the forefront of innovation, developing and producing state-of-the-art laser systems that cater to the evolving needs of defense forces worldwide. Furthermore, the United States, in particular, has a substantial defense budget, making it one of the largest spenders on military technology globally. The strong financial backing allows for extensive research, testing, and procurement of military laser systems. The U.S. Department of Defense, along with various defense contractors and research institutions, plays a pivotal role in driving the development and adoption of military lasers in the region.

Military Laser Systems Market Player

Some of the top military laser systems market companies offered in the professional report include Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Thales Group, BAE Systems plc, Rheinmetall AG, L3Harris Technologies, Inc., Saab AB, Hanwha Corporation, Leonardo S.p.A., Elbit Systems Ltd., and Boeing Defense, Space & Security.

Frequently Asked Questions

What was the market size of the global military laser systems in 2022?

The market size of military laser systems was USD 5.5 Billion in 2022.

What is the CAGR of the global military laser systems market from 2023 to 2032?

The CAGR of military laser systems is 7.4% during the analysis period of 2023 to 2032.

Which are the key players in the military laser systems market?

The key players operating in the global market are including Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Thales Group, BAE Systems plc, Rheinmetall AG, L3Harris Technologies, Inc., Saab AB, Hanwha Corporation, Leonardo S.p.A., Elbit Systems Ltd., and Boeing Defense, Space & Security.

Which region dominated the global military laser systems market share?

North America held the dominating position in military laser systems industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of military laser systems during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global military laser systems industry?

The current trends and dynamics in the military laser systems industry include increasing defense budgets in various countries, advancements in laser technology, making military lasers more powerful and efficient, and growing demand for precision strike capabilities with laser-guided munitions.

Which end use held the maximum share in 2022?

The defense end use held the maximum share of the military laser systems industry.