Microsilica Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Microsilica Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

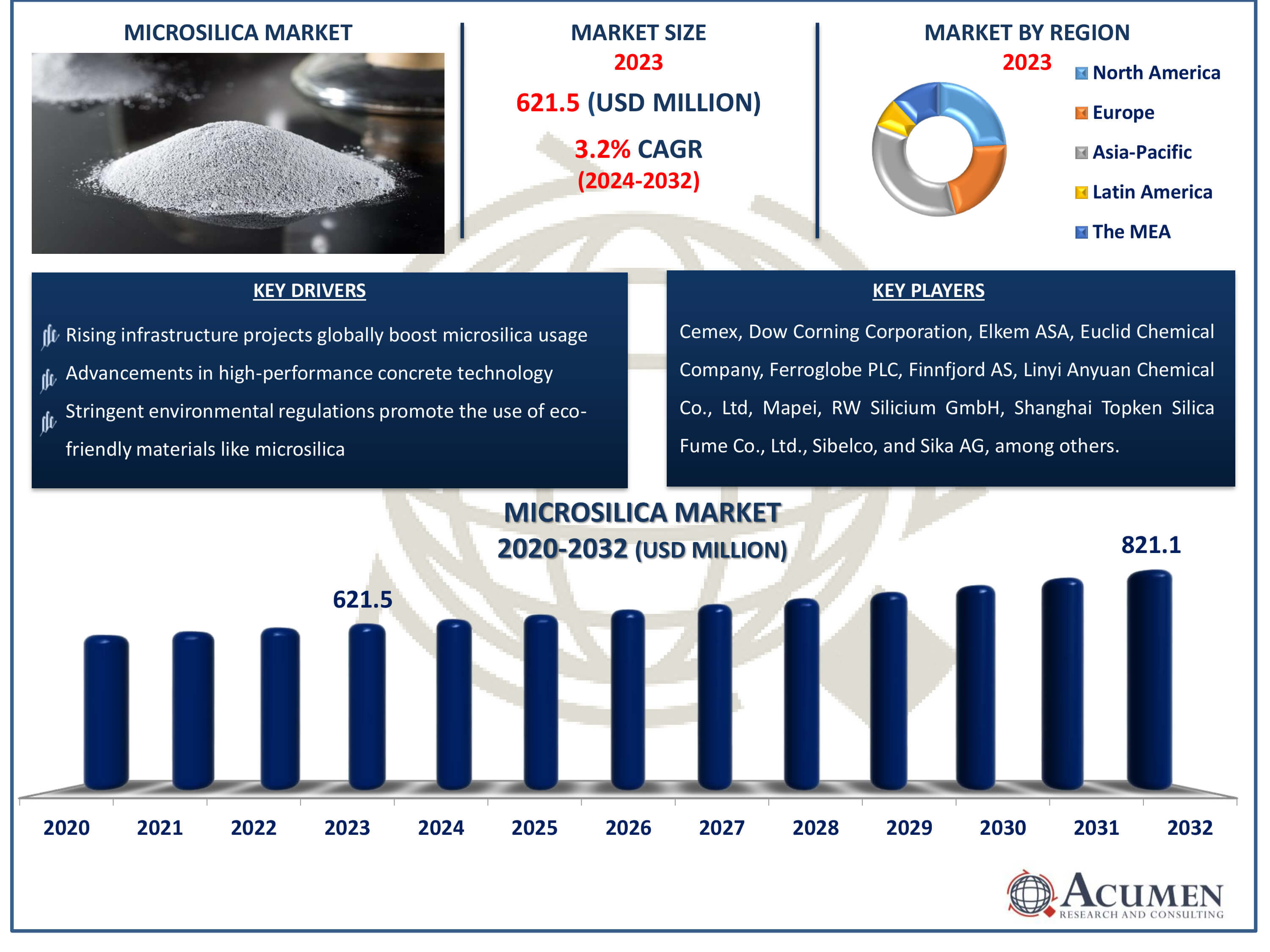

The Microsilica Market Size accounted for USD 621.5 Million in 2023 and is estimated to achieve a market size of USD 821.1 Million by 2032 growing at a CAGR of 3.2% from 2024 to 2032.

Microsilica Market Highlights

- The global microsilica market revenue is projected to reach USD 821.1 million by 2032, growing at a CAGR of 3.2% from 2024 to 2032.

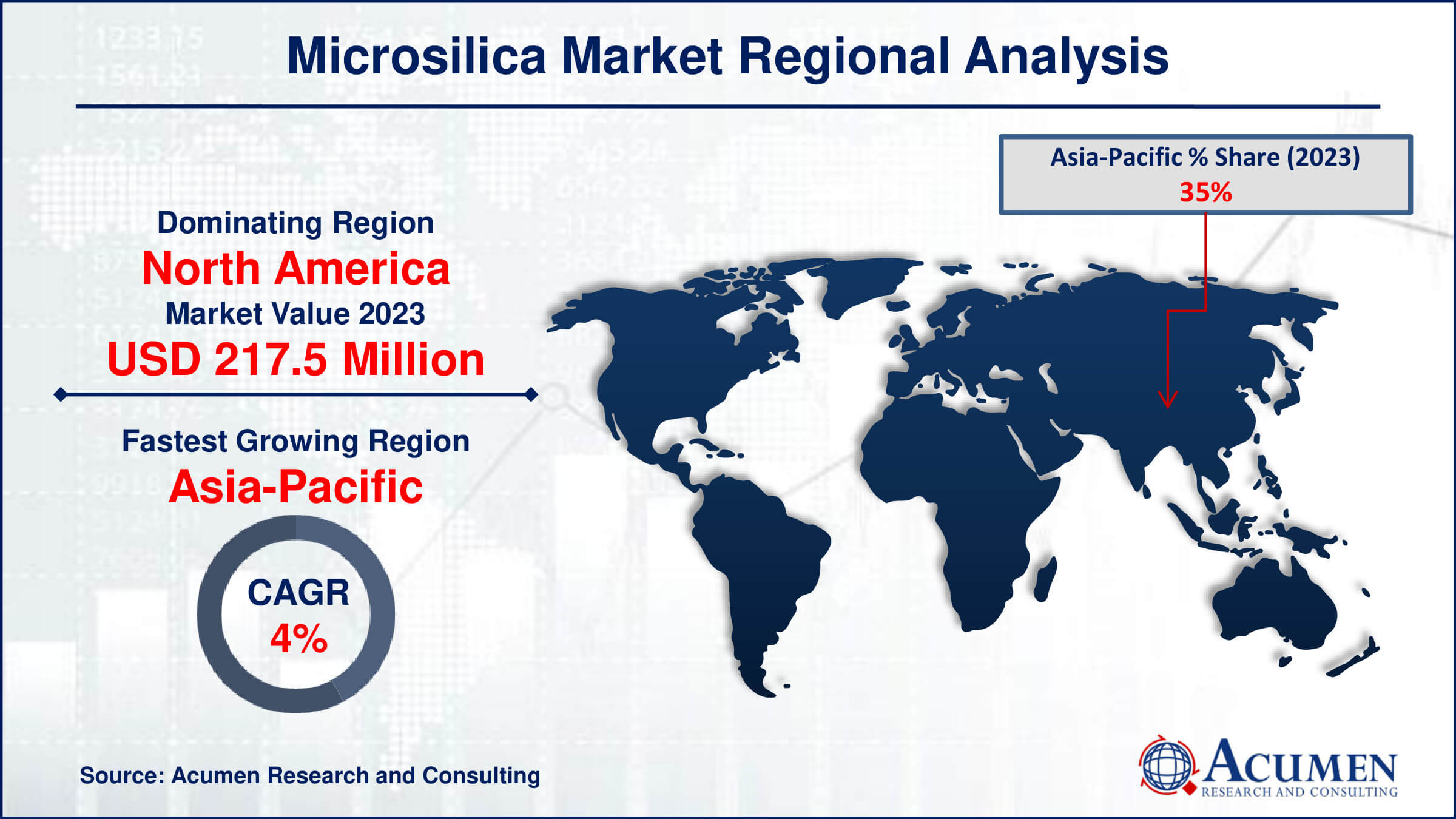

- In 2023, the Asia-Pacific microsilica market was valued at approximately USD 223.7 million

- From 2024 to 2032, the Asia-Pacific microsilica market is expected to achieve a CAGR of 4%

- Based on source of metal, the silicon metal sub-segment dominated in terms of revenue in 2023

- Among silica content, silicon dioxide (90-95%) sub-segment held the largest market share in 2023

- Increasing demand for high-performance construction materials and advancements in sustainable building practices is a popular microsilica market trend that creates demand across the world

Microsilica, or silica fume, is a byproduct of the manufacture of silicon and ferrosilicon alloys. It is an ultrafine powder made up of spherical particles with an average diameter of less than a micrometer. Microsilica is mostly composed of amorphous silicon dioxide (SiO2), accounting for 85-95% of its total composition. This substance is derived from flue gases produced during the smelting process in electric arc furnaces. Microsilica is known for its pozzolanic capabilities, which means that it may react with calcium hydroxide to produce cementitious compounds, making it extremely valuable in the building sector.

Microsilica is commonly used as an addition in concrete and refractory material. It increases the strength and durability of concrete by filling the crevices between cement particles, limiting the concrete's permeability. This results in greater resistance to water penetration, chemical attack, and abrasion. In refractory applications, microsilica is utilized to create dense and strong materials that can endure high temperatures and severe conditions. Microsilica is also utilized in the production of sophisticated ceramics and in applications that need high-performance concrete, such as bridge decks, parking buildings, and marine environments, due to its large surface area and strong reactivity.

Global Microsilica Market Dynamics

Microsilica (Silica Fume) Market Drivers

- Increased demand in construction as microsilica enhances the strength and durability of concrete

- Rising infrastructure projects globally boost microsilica usage

- Advancements in high-performance concrete technology drive microsilica demand

- Stringent environmental regulations promote the use of eco-friendly materials like microsilica

Microsilica (Silica Fume) Market Restraints

- High production costs make producing microsilica prohibitive

- Availability of substitutes like fly ash and slag reduces microsilica's market share

- Supply chain disruptions due to fluctuations in raw materials impact market stability

Microsilica (Silica Fume) Market Opportunities

- Rapid urbanization in emerging economies creates new market opportunities

- Technological advancements in microsilica production methods can lower costs and improve quality

- Increasing focus on sustainability in construction drives demand for microsilica

Microsilica Market Report Coverage

| Market | Microsilica Market |

| Microsilica Market Size 2022 | USD 621.5 Million |

| Microsilica Market Forecast 2032 | USD 821.1 Million |

| Microsilica Market CAGR During 2023 - 2032 | 3.2% |

| Microsilica Market Analysis Period | 2020 - 2032 |

| Microsilica Market Base Year |

2022 |

| Microsilica Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Source of Metal, By Silicon Content, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Cemex, Dow Corning Corporation, Elkem ASA, Euclid Chemical Company, Ferroglobe PLC, Finnfjord AS, Linyi Anyuan Chemical Co., Ltd, Mapei, RW Silicium GmbH, Shanghai Topken Silica Fume Co., Ltd., Sibelco, Sika AG, Simcoa Operations Pty Ltd, Wacker Chemie AG, and Wuhan Newreach Materials Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Microsilica Market Insights

Several critical variables drive the global microsilica (silica fume) market dynamics, including demand, production restrictions, and developing opportunities. For starters, microsilica's potential to improve the strength and durability of concrete is a crucial factor. As urbanization accelerates globally, particularly in emerging economies, there is an increasing demand for long-lasting infrastructure. Microsilica's capacity to improve the mechanical qualities of concrete, such as compressive strength and resistance to chemical attack and abrasion, makes it an essential component in construction projects ranging from buildings to transportation infrastructure.

Second, the market is benefiting from increased investments in global infrastructure projects. Governments and corporate sectors are investing extensively in infrastructure development, increasing demand for high-performance construction materials such as microsilica. Furthermore, advances in concrete technology are driving market expansion. Innovations in mixing procedures and integration methods are improving the dispersion and effectiveness of microsilica, boosting its use in a variety of applications.

However, the microsilica (silica fume) market confronts obstacles like as high manufacturing costs and the availability of substitutes such as fly ash and slag, which may limit its widespread adoption. Supply chain disruptions, caused by volatility in raw material supply and transit constraints, potentially threaten market stability. Nonetheless, prospects exist, especially with current technological developments in microsilica production processes. These developments aim to lower production costs, improve product quality, and broaden its application reach, creating new opportunities for growth in sustainable construction practices and other niche industries that require high-performance materials.

Microsilica Market Segmentation

The worldwide market for microsilica is split based on source of metal, silica content, application, end-user, and geography.

Microsilica (Silica Fume) Market By Source of Metal

- Silicon Metal

- Ferrosilicon

- Others

According to the microsilica industry analysis, silicon metal is the most important source of metal in the manufacturing of silica fume. During the smelting process for silicon metal, silica fume is produced in large amounts. This source has a major market share since silicon metal is produced on a big scale over the world, particularly in China, the United States, and Europe. Because of its high purity and consistency, silica fume generated from silicon metal is chosen in applications that need precise chemical composition and outstanding performance qualities in concrete and refractory materials. As the silica fume market grows due to infrastructure development and developments in building technologies, silicon metal remains critical in satisfying the global need for high-quality microsilica.

Microsilica (Silica Fume) Market By Silica Content

- Silicon Dioxide (80-90%)

- Silicon Dioxide (90-95%)

- Silicon Dioxide (95% and above)

In the silica fume market, silica content ranging from 90-95% dominates due to its optimal balance of purity and performance characteristics. This type of silica fume has improved pozzolanic qualities, making it extremely efficient in boosting the strength, durability, and chemical resistance of concrete and refractory materials. As infrastructure projects develop globally and demand for high-performance construction materials rises, silica fume containing 90-95% silicon dioxide is preferred for its ability to dramatically improve the mechanical and chemical properties of concrete. This content range ensures that silica fume satisfies high industry standards and provides cost-effective solutions for sustainable building practices and sophisticated construction applications.

Microsilica (Silica Fume) Market By Application

- Cement and Concrete

- Refractory

- Ceramics

- Steel

- Others

Cement and concrete dominate the microsilica market, as they do in the silica fume market. This industry has a considerable share because silica fume can improve the strength, durability, and performance of concrete. Silica fume improves the mechanical qualities of concrete, such as compressive strength and abrasion resistance, making it an essential component in high-performance concrete applications. This comprises infrastructure projects such as bridges, highways, and buildings, which require high resilience and endurance.

While cement and concrete dominate silica fume applications, other industries also contribute to the silica fume market. Silica fume is used in refractory applications to improve the thermal and mechanical properties of refractory materials, especially in industries that require high temperature resistance, such as steel making and petrochemical processing. Ceramics benefit from silica fume's ability to improve the density and mechanical strength of ceramic products, whereas the steel sector uses it as a deoxidizer and to improve the quality of steel production. These numerous applications illustrate silica fume's versatility and importance in a wide range of industrial areas other than cement and concrete.

Microsilica (Silica Fume) Market By Application

- Residential Construction

- Commercial Buildings

- Industrial Buildings

- Infrastructure

- Manufacturing

- Others

The microsilica market is driven by its widespread use in the infrastructure sector, particularly in construction projects such as bridges, highways, dams, and tunnels. The demand for microsilica is high due to its ability to improve concrete performance by enhancing compressive strength, durability, and resistance to chemical attacks. This makes it essential for infrastructure construction, ensuring long-term durability and reducing maintenance costs.

While infrastructure projects dominate the silica fume market, other sectors also contribute significantly. Residential and commercial construction utilize silica fume to enhance the quality and durability of concrete in buildings and residential complexes. Industrial buildings benefit from its ability to withstand harsh conditions and chemical exposure, ensuring structural integrity. Manufacturing industries also use silica fume in specialized applications requiring high-performance concrete, ceramics, and refractories. The diverse range of end-user applications highlights the broad utility of silica fume across various sectors, driving its importance in advancing construction technologies and meeting stringent performance requirements.

Microsilica Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Microsilica Market Regional Analysis

Asia-Pacific stands out as a significant revenue generating region in the microsilica market. Countries like China, India, and Southeast Asian nations are witnessing robust urbanization and industrialization, fueling substantial investments in infrastructure projects. The burgeoning construction sector in these economies drives significant demand for silica fume, particularly in high-rise buildings, transportation infrastructure, and industrial facilities. Moreover, increasing initiatives towards sustainable construction practices and infrastructure development projects underpin the growth prospects for microsilica in the Asia-Pacific region. This regional diversity highlights varying market dynamics shaped by economic growth, infrastructure investments, and regulatory frameworks influencing the adoption of microsilica across different continents.

North America and Europe are witnessing notable silica fume market share, characterized by stringent environmental regulations driving the adoption of eco-friendly construction materials like silica fume. These regions also benefit from extensive infrastructure networks and high standards in construction practices, boosting the demand for high-performance concrete and refractory materials where microsilica plays a crucial role.

Microsilica Market Players

Some of the top microsilica companies offered in our report include Cemex, Dow Corning Corporation, Elkem ASA, Euclid Chemical Company, Ferroglobe PLC, Finnfjord AS, Linyi Anyuan Chemical Co., Ltd, Mapei, RW Silicium GmbH, Shanghai Topken Silica Fume Co., Ltd., Sibelco, Sika AG, Simcoa Operations Pty Ltd, Wacker Chemie AG, and Wuhan Newreach Materials Co., Ltd.

Frequently Asked Questions

How big is the microsilica market?

The microsilica market size was valued at USD 621.5 million in 2023.

What is the CAGR of the global microsilica market from 2024 to 2032?

The CAGR of microsilica industry is 3.2% during the analysis period of 2024 to 2032.

Which are the key players in the microsilica market?

The key players operating in the global market are including Cemex, Dow Corning Corporation, Elkem ASA, Euclid Chemical Company, Ferroglobe PLC, Finnfjord AS, Linyi Anyuan Chemical Co., Ltd, Mapei, RW Silicium GmbH, Shanghai Topken Silica Fume Co., Ltd., Sibelco, Sika AG, Simcoa Operations Pty Ltd, Wacker Chemie AG, and Wuhan Newreach Materials Co., Ltd.

Which region dominated the global microsilica market share?

Asia-Pacific held the dominating position in microsilica industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of microsilica during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global microsilica industry?

The current trends and dynamics in the microsilica industries include rising infrastructure projects globally boost microsilica usage, advancements in high-performance concrete technology drive microsilica demand, and stringent environmental regulations promote the use of eco-friendly materials like microsilica

Which source of metal held the maximum share in 2023?

The silicon metal held the maximum share of the microsilica industry.