Microfluidics Market | Acumen Research and Consulting

Microfluidics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

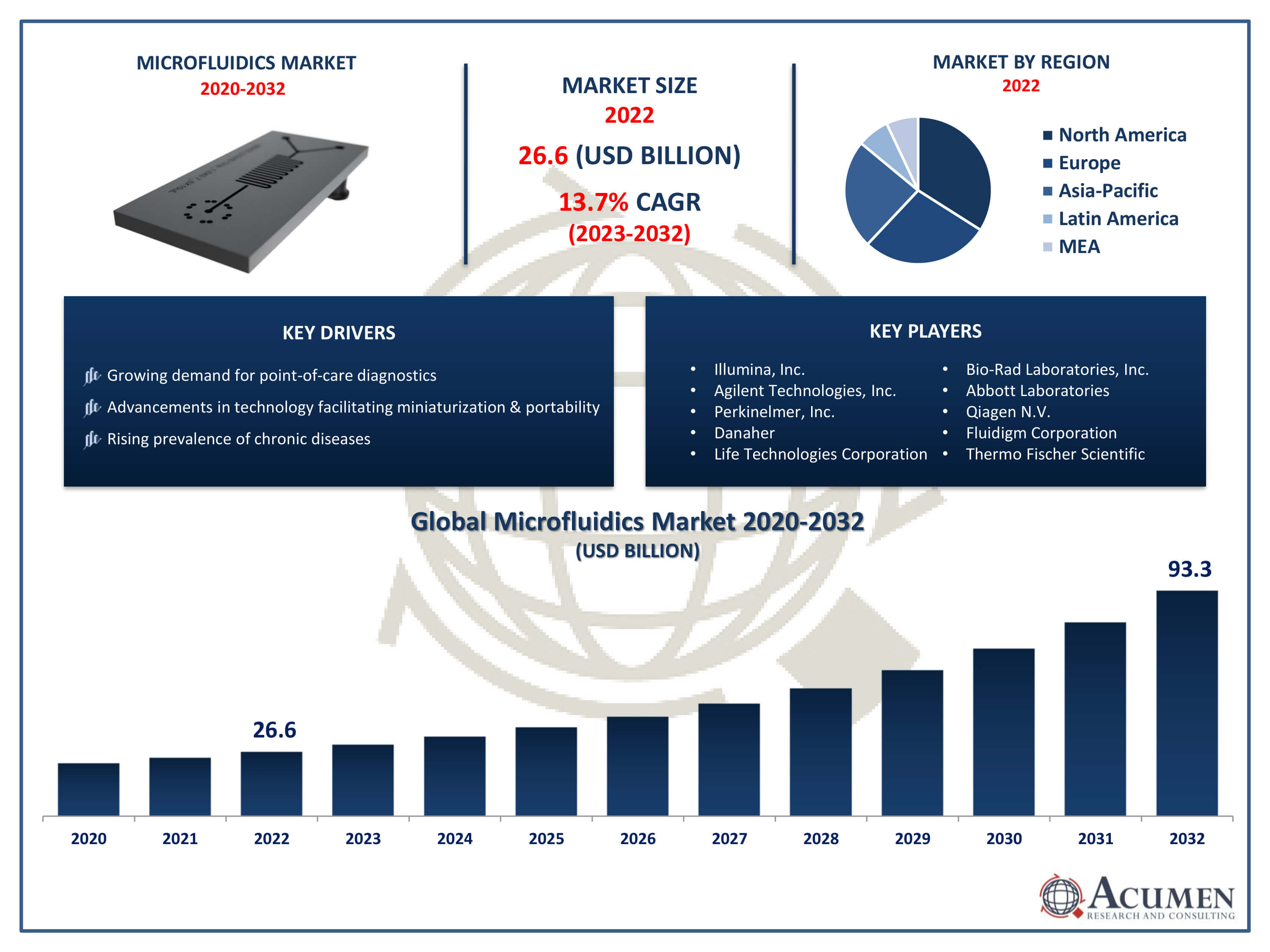

The Microfluidics Market Size accounted for USD 26.6 Billion in 2022 and is projected to achieve a market size of USD 93.3 Billion by 2032 growing at a CAGR of 13.7% from 2023 to 2032.

Microfluidics Market Highlights

- Global Microfluidics Market revenue is expected to increase by USD 93.3 Billion by 2032, with a 13.7% CAGR from 2023 to 2032

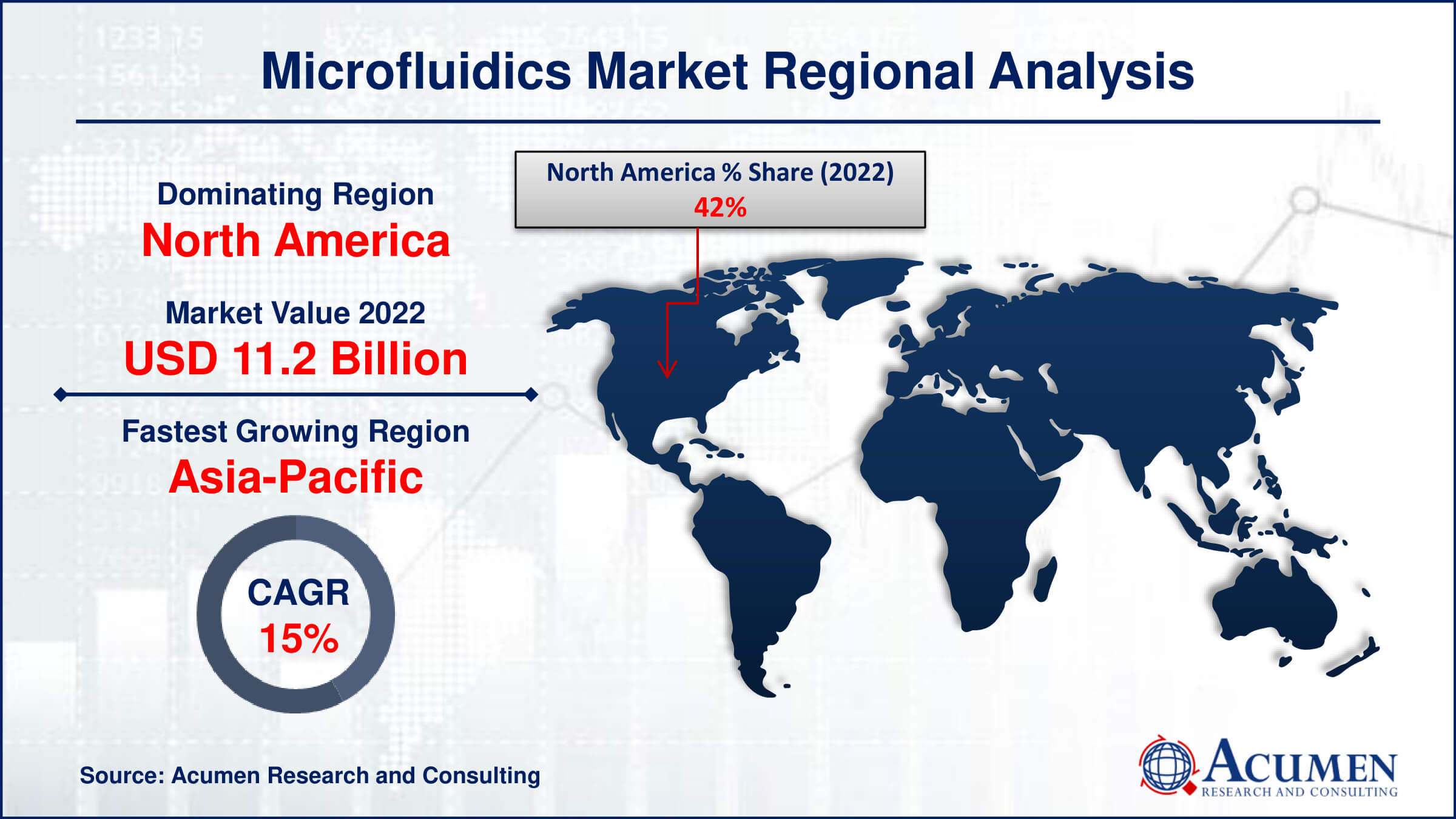

- North America region led with more than 42% of Microfluidics Market share in 2022

- Asia-Pacific Microfluidics Market growth will record a CAGR of more than 15.1% from 2023 to 2032

- By material, the Polydimethylsiloxane (PDMS) segment captured more than 34% of revenue share in 2022.

- By technology, the medical segment has held the largest market share of 82% in 2023

- Growing demand for point-of-care diagnostics, drives the Microfluidics Market value

Microfluidics is an interdisciplinary field of study that focuses on the manipulation and control of extremely tiny fluid amounts, often expressed in microliters or less. It entails the careful manipulation of fluids in microchannels or microstructures to carry out a range of tasks, including sample analysis, mixing, separating, and reacting. Microfluidic devices have applications in a variety of disciplines, including biology, chemistry, medicine, and materials science. They are frequently made utilising methods from microfabrication, such as photolithography and soft lithography.

Microfluidics is an interdisciplinary field of study that focuses on the manipulation and control of extremely tiny fluid amounts, often expressed in microliters or less. It entails the careful manipulation of fluids in microchannels or microstructures to carry out a range of tasks, including sample analysis, mixing, separating, and reacting. Microfluidic devices have applications in a variety of disciplines, including biology, chemistry, medicine, and materials science. They are frequently made utilising methods from microfabrication, such as photolithography and soft lithography.

Over the past several years, the market for microfluidics has grown significantly due to the growing need for portable and miniaturized devices in a variety of sectors. Microfluidic technologies are transforming diagnostics in the healthcare industry, making it possible to screen for illnesses including cancer, infectious diseases, and genetic abnormalities more quickly and accurately. Furthermore, research workflows have been expedited by the use of microfluidic devices in drug development and discovery procedures, which has reduced costs and increased efficiency. Furthermore, as the healthcare sector continues to place a premium on accessibility and accuracy in medical interventions, the growing application of microfluidics in point-of-care testing and personalized medicine is anticipated to drive market expansion in the years to come.

Global Microfluidics Market Dynamics

Market Drivers

- Growing demand for point-of-care diagnostics

- Advancements in technology facilitating miniaturization and portability

- Rising prevalence of chronic diseases

- Increasing investment in research and development

- Integration with other technologies like nanotechnology and artificial intelligence

Market Restraints

- Challenges in scaling up production for commercial applications

- High initial costs associated with development and implementation

Market Opportunities

- Expansion into emerging economies with increasing healthcare expenditures

- Customization and personalization of healthcare solutions

Microfluidics Market Report Coverage

| Market | Microfluidics Market |

| Microfluidics Market Size 2022 | USD 26.6 Billion |

| Microfluidics Market Forecast 2032 | USD 93.3 Billion |

| Microfluidics Market CAGR During 2023 - 2032 | 13.7% |

| Microfluidics Market Analysis Period | 2020 - 2032 |

| Microfluidics Market Base Year |

2022 |

| Microfluidics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Material, By Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Illumina, Inc., Agilent Technologies, Inc., Perkinelmer, Inc., Danaher, Life Technologies Corporation, Bio-Rad Laboratories, Inc., Abbott Laboratories, Qiagen N.V., Fluidigm Corporation, Thermo Fischer Scientific, Hoffmann-La Roche Ltd, and Cellix Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The manipulation and control of small fluid volumes, often at the nanoliter or microliter range, is the focus of the multidisciplinary field of microfluidics. With this technique, fluids are handled precisely inside microchannels, which are frequently created on microscale electronics or devices. Microfluidic systems provide a broad range of applications by using concepts from engineering, chemistry, biology, and physics. Compared to conventional macro-scale techniques, the miniaturisation of fluidic systems enables improved control, smaller sample quantities, quicker reaction times, and cheaper costs. Microfluidics finds use in a wide range of sectors, such as pharmaceuticals, biotechnology, healthcare, chemistry, and environmental monitoring. Microfluidic devices are used in healthcare for point-of-care diagnostics, where they allow for the sensitive and quick identification of illnesses such genetic disorders, infectious infections, and cancer biomarkers.

Recent years have seen the microfluidics business develop rapidly, fueled numbers of important factors. Technological developments have made it possible to create ever-more complex microfluidic systems, which provide increased accuracy, effectiveness, and adaptability for a range of uses. Chemical analysis, biotechnology, pharmaceuticals, and healthcare are just a few of the industries that make substantial use of these systems. The need for point-of-care diagnostics and personalized medication has increased, especially in the healthcare industry, which has accelerated the deployment of microfluidic devices for quick and precise testing. For example, BeforCure, an Elvesys spin-off, created a very quick PCR-on-chip method to identify the virus. This device uses the benefits of microfluidics to produce test results in less than 30 minutes, based on Fastgen technology. Furthermore, the increasing global incidence of chronic illnesses is driving the market's expansion and creating a demand for novel medication delivery and diagnostic technologies. Microfluidics has become a viable approach to these problems due to its capacity to process tiny sample volumes quickly and carry out intricate investigations.

Microfluidics Market Segmentation

The global Microfluidics Market segmentation is based on material, technology, application, and geography.

Microfluidics Market By Material

- Glass

- Polymers

- Silicon

- PDMS

- Others

According to the microfluidics industry analysis, in 2022, the polydimethylsiloxane (PDMS) category held the most market share. Because of its exceptional biocompatibility, transparency, flexibility, and simplicity of production, PDMS is a material that is frequently utilized in microfluidics. Because of these qualities, PDMS is a great option for a wide range of applications. In biological and biomedical research, for example, compatibility with cells and biological samples is essential. The extensive use of PDMS in the creation of lab-on-a-chip devices for analytical chemistry, medication administration, and point-of-care diagnostics is a key reason propelling the segment's expansion. Researchers and medical professionals may conduct intricate experiments and assays in a smaller scale with PDMS-based microfluidic devices, which allows for quicker analysis, less sample volume, and less expenses.

Microfluidics Market By Technology

- Medical

- Gel Electrophoresis

- ELISA

- PCR & RT-PCR

- Microarrays

- Others

- Non-Medical

The medical technology is predicted to increase significantly throughout the microfluidics market forecast period. Numerous uses for microfluidics technology exist in the medical domain, such as lab-on-a-chip devices, medication delivery systems, point-of-care diagnostics, and personalised medicine. Critical issues in healthcare are addressed by these applications, including the requirement for precise medication delivery, quick and accurate diagnosis, and tailored treatment plans. The ageing of the population and the increasing incidence of chronic diseases throughout the world are two major factors propelling the expansion of the medical technology industry. Through compact diagnostic platforms that can quickly analyse tiny samples of blood, urine, or other body fluids, microfluidic devices offer early illness diagnosis, monitoring, and management. Also, the combination of microfluidics with other technologies, such artificial intelligence, sensors, and imaging methods, improves the functionality of medical equipment and makes healthcare treatments more precise and effective.

Microfluidics Market By Application

- Organs-on-chips

- Continuous Flow Microfluidics

- Lab-on-a-chip

- Acoustofluidics and Microfluidics

- Electrophoresis and Microfluidics

- Optofluidics and Microfluidics

According to the microfluidics industry forecast period, it is anticipated that the lab-on-a-chip market would expand significantly in the upcoming years. Lab-on-a-chip technologies allow complicated experimental procedures to be parallelized, automated, and miniaturised by combining many laboratory tasks onto a single chip-scale platform. With their many benefits over conventional laboratory methods such as smaller sample quantities, quicker turnaround times, and cheaper expenses these instruments are very appealing for use in drug discovery, research, and diagnostics. An important factor propelling the labonchip market's expansion is the growing need for personalised medicine and point-of-care diagnostics. At the patient's bedside or in remote locations, lab-on-a-chip devices provide the quick and portable analysis of biological samples, enabling early illness identification, monitoring, and therapy optimization.

Microfluidics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Microfluidics Market Regional Analysis

Numerous reasons have contributed to North America's rise and significance in the microfluidics industry, making it the dominant region in this market. A significant contributing aspect is the region's profusion of well-known companies and top research centers with an emphasis on microfluidics technology. Innovative companies in North America are always creating state-of-the-art microfluidic devices and solutions for a wide range of applications, such as analytical chemistry, biotechnology, healthcare, and pharmaceuticals. Furthermore, the area gains from significant investments in R&D, with government grants, commercial financing, and scholarly partnerships propel developments in microfluidics technology. Scientists, engineers, and medical professionals make up the highly trained workforce in North America, where they are actively pushing the frontiers of microfluidics innovation. This network of knowledge and assets creates a favorable atmosphere for the development and monetization of microfluidic goods and services, hence reinforcing North America's leadership position in the industry. As to the September 2021 statistics updates provided by Pharmaceutical Research and Manufacturers of America, member businesses of PhRMA have allocated almost USD 1.1 trillion towards the pursuit of novel medicines and cures, with USD 102.3 billion being invested in this regard in 2021 alone.

Microfluidics Market Player

Some of the top microfluidics market companies offered in the professional report include Illumina, Inc., Agilent Technologies, Inc., Perkinelmer, Inc., Danaher, Life Technologies Corporation, Bio-Rad Laboratories, Inc., Abbott Laboratories, Qiagen N.V., Fluidigm Corporation, Thermo Fischer Scientific, Hoffmann-La Roche Ltd, and Cellix Ltd.

Frequently Asked Questions

How big is the microfluidics market?

The microfluidics market size was USD 26.6 Billion in 2022.

What is the CAGR of the global Microfluidics Market from 2023 to 2032?

The CAGR of microfluidics is 13.7% during the analysis period of 2023 to 2032.

Which are the key players in the Microfluidics Market?

The key players operating in the global market are including Illumina, Inc., Agilent Technologies, Inc., Perkinelmer, Inc., Danaher, Life Technologies Corporation, Bio-Rad Laboratories, Inc., Abbott Laboratories, Qiagen N.V., Fluidigm Corporation, Thermo Fischer Scientific, Hoffmann-La Roche Ltd, and Cellix Ltd.

Which region dominated the global Microfluidics Market share?

North America held the dominating position in microfluidics industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of microfluidics during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global microfluidics industry?

The current trends and dynamics in the microfluidics industry include growing demand for point-of-care diagnostics, advancements in technology facilitating miniaturization and portability, and rising prevalence of chronic diseases.

Which technology held the maximum share in 2022?

The medical technology held the maximum share of the microfluidics industry.