Microencapsulation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Microencapsulation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

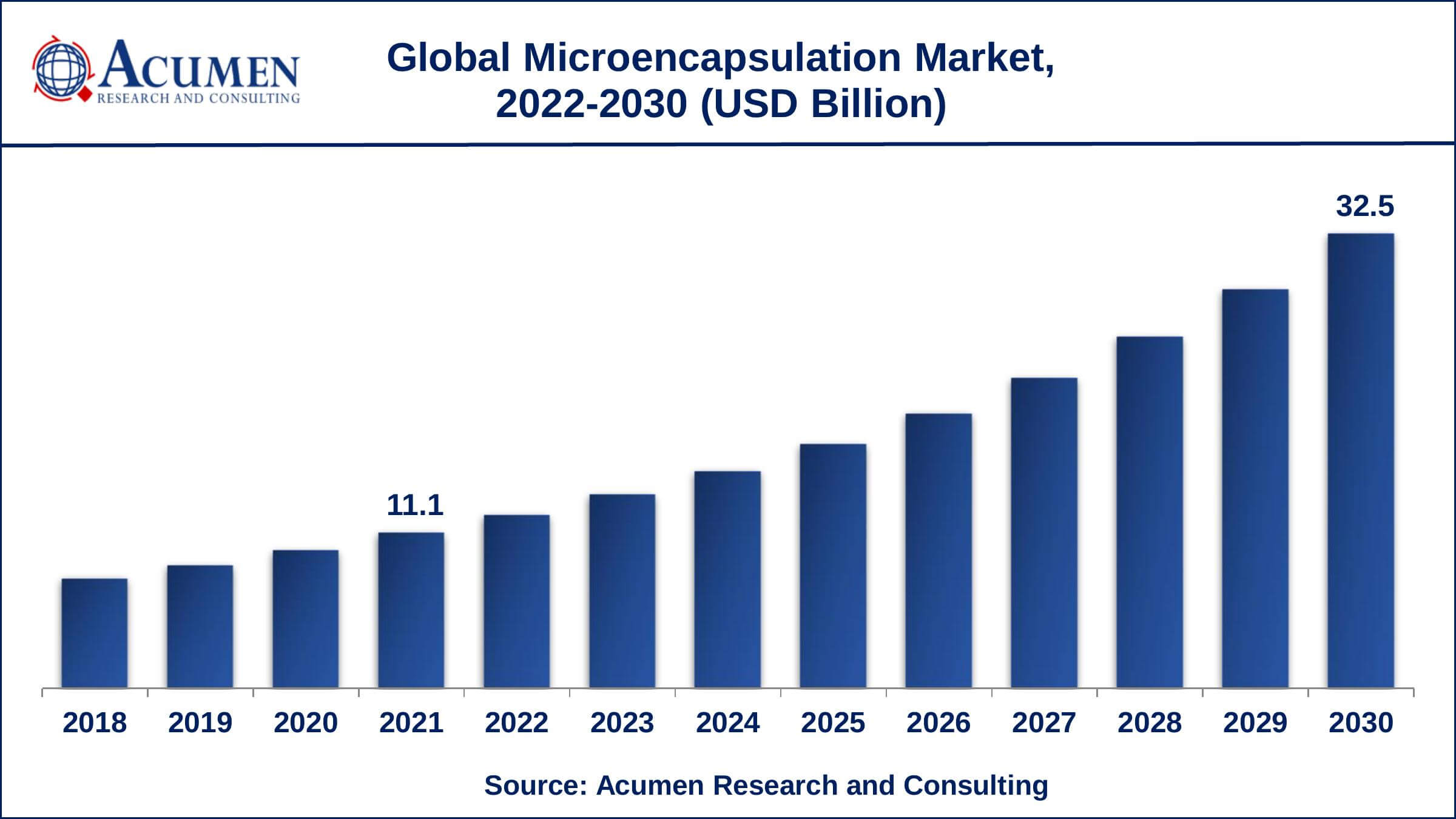

The Global Microencapsulation Market Size accounted for USD 11.1 Billion in 2021 and is projected to occupy a market size of USD 32.5 Billion by 2030 growing at a CAGR of 12.8% from 2022 to 2030.

A procedure known as microencapsulation allows for the storage of individual active agent particles in a shell, encirclement, or coating of continuous polymeric material to create particles in the micrometre to millimetre range, for protection and/or later release. One of the most promising techniques for controlled drug delivery is microencapsulation. As drug delivery systems, micro particles have several advantages, including effective protection of the encapsulated agent against degradation, ease of administration, and so on. Microencapsulation innovation epitomizes dynamic fixing with a covering material and is classified into the covering, emulsion, splash, and trickling systems. The shape and size of the dynamic fixings, substance properties, porousness, degradability, and biocompatibility of the covering materials are the key variables considered while choosing fitting microencapsulation systems.

Microencapsulation Market Report Statistics

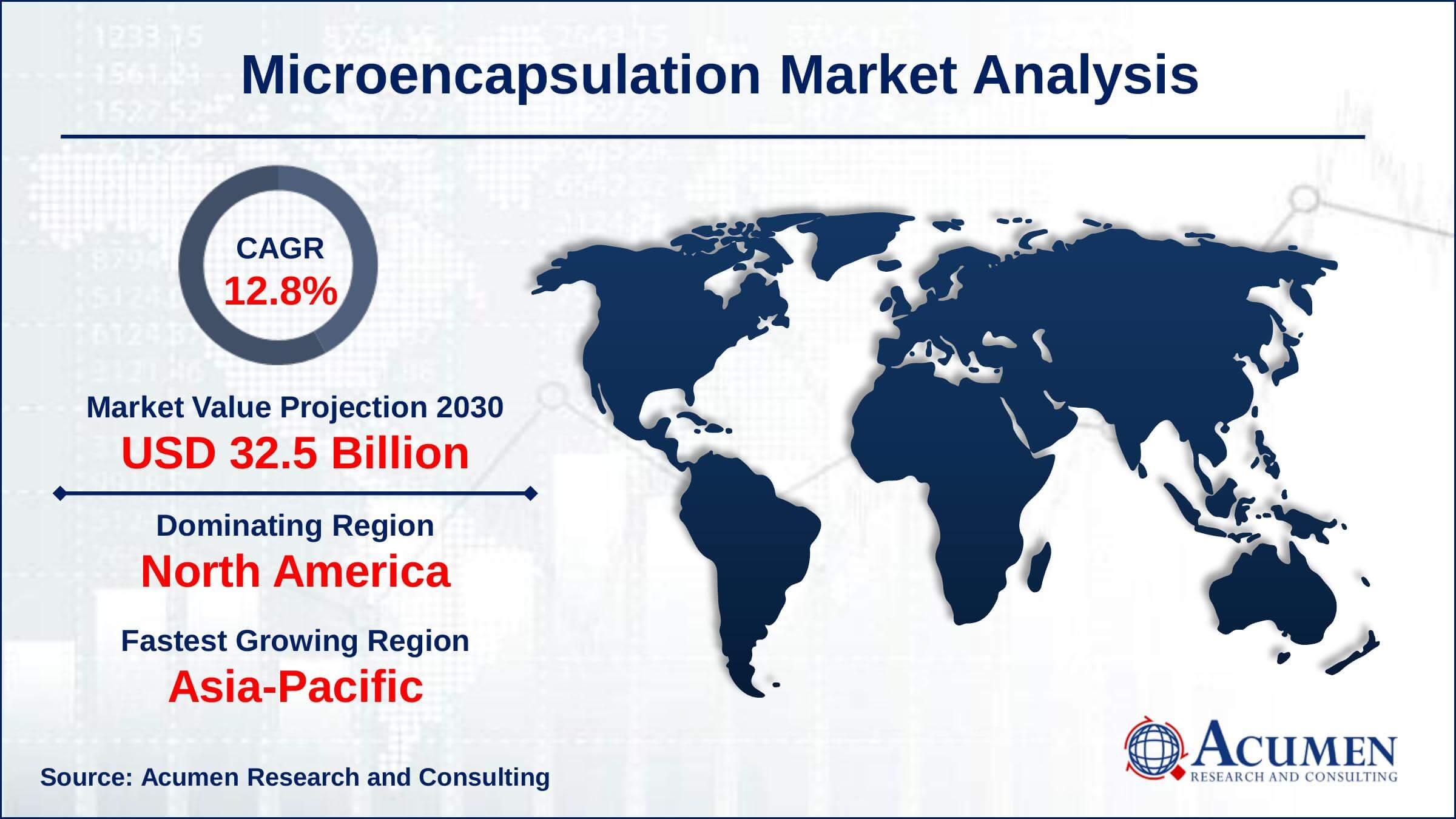

- Global microencapsulation market revenue is estimated to reach USD 32.5 Billion by 2030 with a CAGR of 12.8% from 2022 to 2030

- North America microencapsulation market share generated over 38% shares in 2021

- Asia-Pacific microencapsulation market growth will record substantial CAGR of over 13% from 2022 to 2030

- Based on materials, carbohydrates captured around 20% of the overall market share in 2021

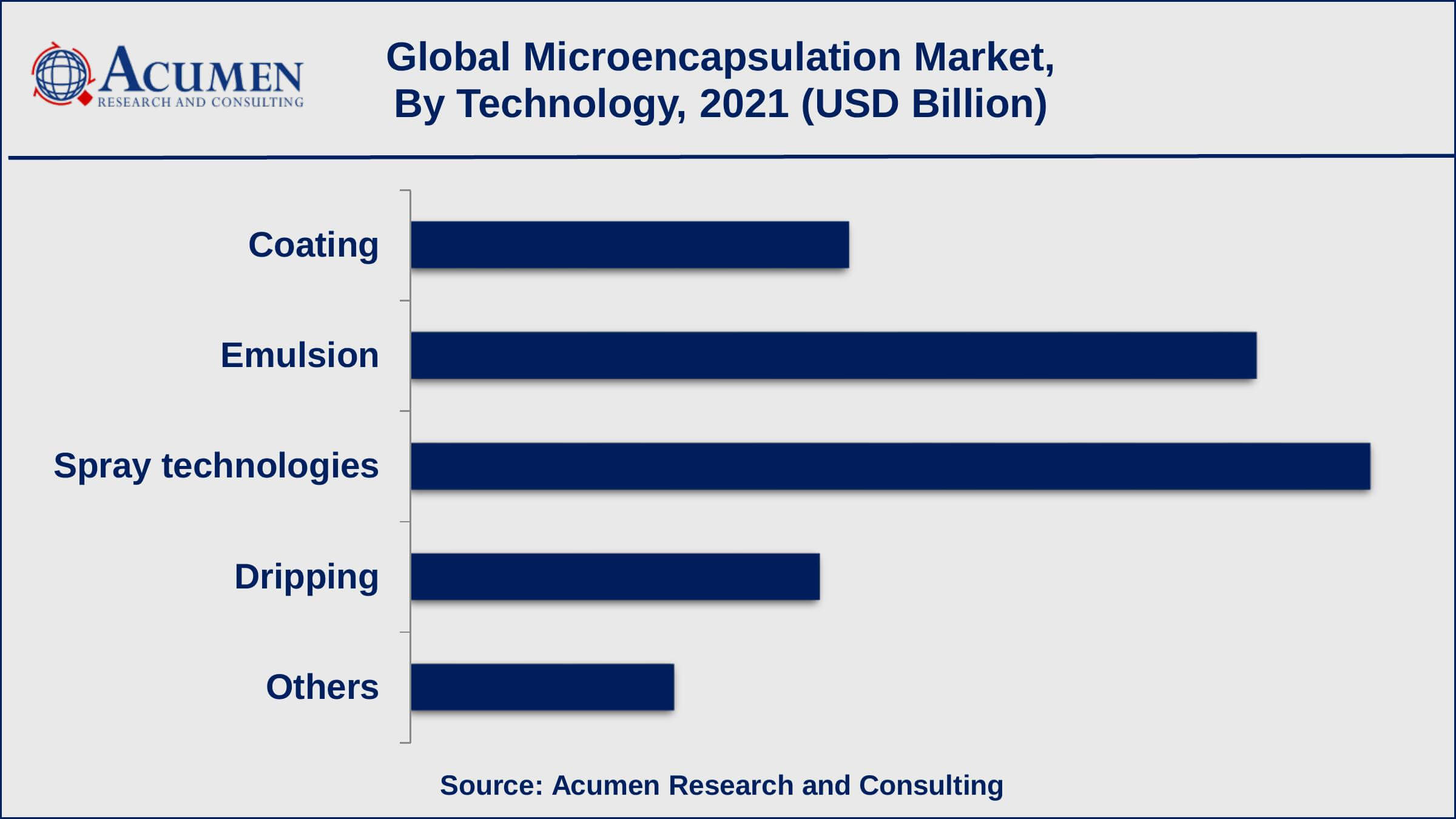

- Among technologies, spray technology generated shares of over 34% in 2021

- Increase in bioavailability and reduction in capsule size is a popular microencapsulation market trend that is fueling the industry demand

Global Microencapsulation Market Dynamics

Market Drivers

- Growing demand for fortified products

- Surging application in the pharmaceutical industry

- Increasing acceptance for cleaning agents and specialty detergents

- Rising consumer demand for functional products

Market Restraints

- High cost associated with microencapsulated process

- Requirement of extensive research

Market Opportunities

- Introduction of new technologies in microencapsulation

- Growing adoption in the food & beverage industry

Microencapsulation Market Report Coverage

| Market | Microencapsulation Market |

| Microencapsulation Market Size 2021 | USD 11.1 Billion |

| Microencapsulation Market Forecast 2030 | USD 32.5 Billion |

| Microencapsulation Market CAGR During 2022 - 2030 | 12.8% |

| Microencapsulation Market Analysis Period | 2018 - 2030 |

| Microencapsulation Market Base Year | 2021 |

| Microencapsulation Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Materials, By Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Qatar Fertilizer Company (S.A.Q.) / QAFCO, Yara International ASA, Koch Industries, Inc., SABIC, OCI NV, CF Industries, Nutrien Ltd., EuroChem Agro GmbH, Hubei Yihua Chemical Industry, Sinopec Hubei Chemical Fertilizer Company, and CNPC. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Microencapsulation Market Growth Factors

Rising acknowledgment of microencapsulated materials in the food and beverage, pharmaceutical, and agrochemical industries is expected to positively affect the market growth. The business players are frequently occupied with vital associations with innovation clients from end-client enterprises. High interest in R&D to improve innovation effectiveness is required to be a key factor for the market extension. Rising appropriation of the innovation by little and medium scale end clients is relied upon to drive the market.

Microencapsulation procedure is significantly utilized for covering taste, smell, and action of the typified structures, which go about as practical elements for application ventures, for example, pharmaceutical and social insurance. Splash innovation is relied upon to observe critical development in the U.S. by virtue of the nearness of countless ventures.

Microencapsulation Market Segmentation

The global microencapsulation market is segmented based on materials, technology, application, and geography.

Microencapsulation Market By Materials

- Carbohydrates

- Gums & Resins

- Lipids

- Polymers

- Proteins

Carbohydrates including chitosan, starch, maltodextrin, cyclodextrin, and corn syrup are the key covering materials. According to the data centre liquid cooling industry analysis, the fragment represented 20% offer of the general income in 2021. Prevalent dissolvability offered by these items, combined with their capacity to support in an unpredictable domain, is required to positively affect the growth.

A polymer as a covering material is relied upon to enlist a CAGR of 14% over the anticipated period because of their excellent characteristics. Polylactic corrosive (PLA) and polylactic-co-glycolic corrosive (PLGA) have been the most favored polymers attributable to their broad use in items, for example, careful sutures and warehouse definitions, endorsed by the U.S. Nourishment and Drug Administration (FDA).

Microencapsulation Market By Technology

- Coating

- Emulsion

- Spray Technologies

- Dripping

- Others

Coating technologies innovations including container covering, fluidized bed covering, and air suspension covering are relied upon to enlist a CAGR of 13% from 2022 to 2030. The container covering process can epitomize generally substantial particles, which are relied upon to impel their interest in pharmaceutical application over the anticipated period.

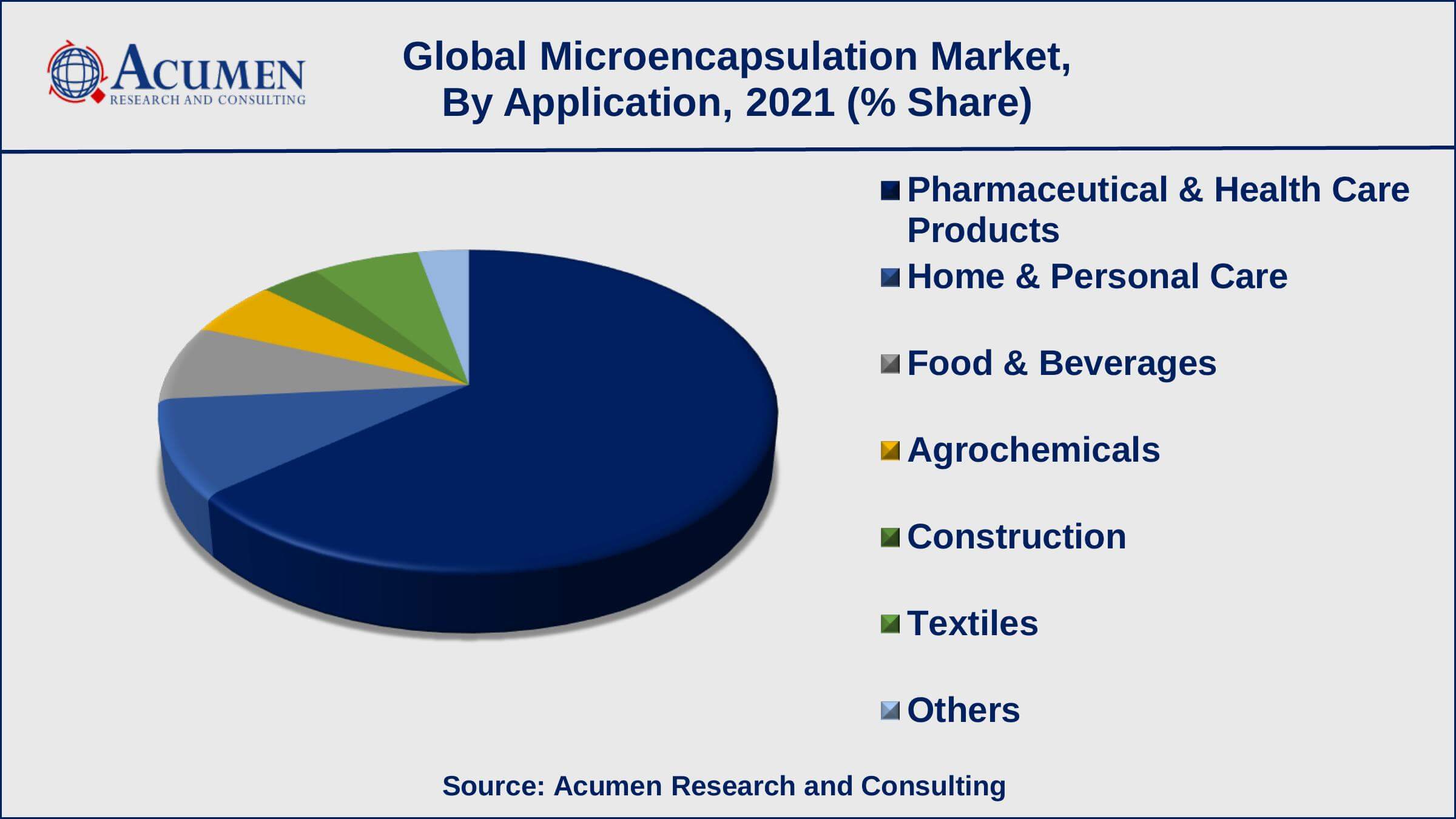

Microencapsulation Market By Application

- Pharmaceutical & Health Care Products

- Home & Personal Care

- Food & Beverages

- Agrochemicals

- Construction

- Textiles

- Others

The pharmaceutical and healthcare products application fragment represented the most elevated market share in 2018. The innovation is utilized to veil the severe taste of the medications and lessen the gastric and other G.I. track aggravations brought about by medications. It is likewise used to decrease the hygroscopic properties, smell, and instability of center materials.

The home and personal care industry use the innovation to exemplify hues, scents, and fundamental oils (EOs) in corrective items. Expanding interest for basic oils in the aroma business is required to drive innovation request over the anticipated period.

Raw material accessibility is likewise expected to remain a key worry for the market players. Producers are required to build up key organizations with the purchasers crosswise over application fragments so as to tap the customer base, in this manner expanding the focused competition over the business members.

Microencapsulation Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Microencapsulation Market Regional Analysis

North America market represented 38% offer of the general income in 2021 by virtue of high item interest for pharmaceutical and nourishment and refreshment applications. Advancements in the material business to fuse the innovation for development in items' quality and quality is required to supplement the growth over the anticipated period.

The U.S. ruled the market in North America with an offer of over 80% in 2021 attributable to the high infiltration of the procedure in the pharmaceuticals and human services businesses. Nearness of significant pharmaceutical organizations including Merck and Co, Johnson and Johnson, Pfizer, Bristol-Myers Squibb Company and Eli Lilly and Company in the nation is required to push growth.

Microencapsulation Market Players

Major companies contributing the global microencapsulation market are Qatar Fertilizer Company (S.A.Q.) / QAFCO, Yara International ASA, Koch Industries, Inc., SABIC, OCI NV, CF Industries, Nutrien Ltd., EuroChem Agro GmbH, Hubei Yihua Chemical Industry, Sinopec Hubei Chemical Fertilizer Company, and CNPC.

Frequently Asked Questions

What is the size of global microencapsulation market in 2021?

The market size of microencapsulation market in 2021 was accounted to be USD 11.1 Billion.

What is the CAGR of global microencapsulation market during forecast period of 2022 to 2030?

The projected CAGR of microencapsulation market during the analysis period of 2022 to 2030 is 12.8%.

Which are the key players operating in the market?

The prominent players of the global microencapsulation payments transaction market include Qatar Fertilizer Company (S.A.Q.) / QAFCO, Yara International ASA, Koch Industries, Inc., SABIC, OCI NV, CF Industries, Nutrien Ltd., EuroChem Agro GmbH, Hubei Yihua Chemical Industry, Sinopec Hubei Chemical Fertilizer Company, and CNPC.

Which region held the dominating position in the global microencapsulation market?

North America held the dominating microencapsulation during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for microencapsulation during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global microencapsulation market?

Growing demand for fortified products, surging application in the pharmaceutical industry, increasing acceptance for cleaning agents and specialty detergents, and rising consumer demand for functional products drives the growth of global microencapsulation market.

Which materials held the maximum share in 2021?

Based on materials, carbohydrates segment is expected to hold the maximum share microencapsulation market.?