Microcatheters Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Microcatheters Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

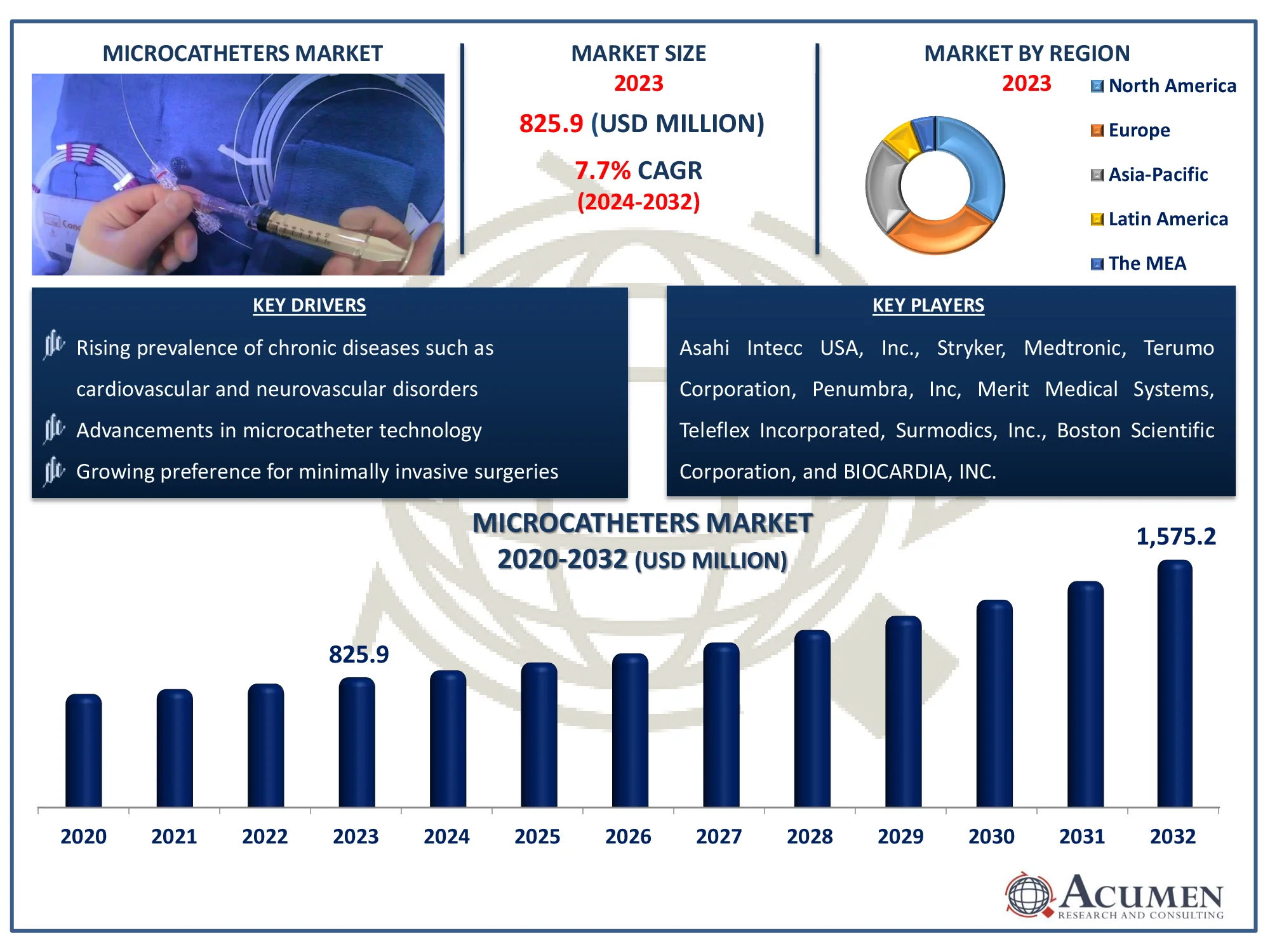

The Global Microcatheters Market Size accounted for USD 825.9 Million in 2023 and is estimated to achieve a market size of USD 1,575.2 Million by 2032 growing at a CAGR of 7.7% from 2024 to 2032.

Microcatheters Market Highlights

- The global microcatheters market is projected to reach USD 1,575.2 million by 2032, growing at a CAGR of 7.7% from 2024 to 2032

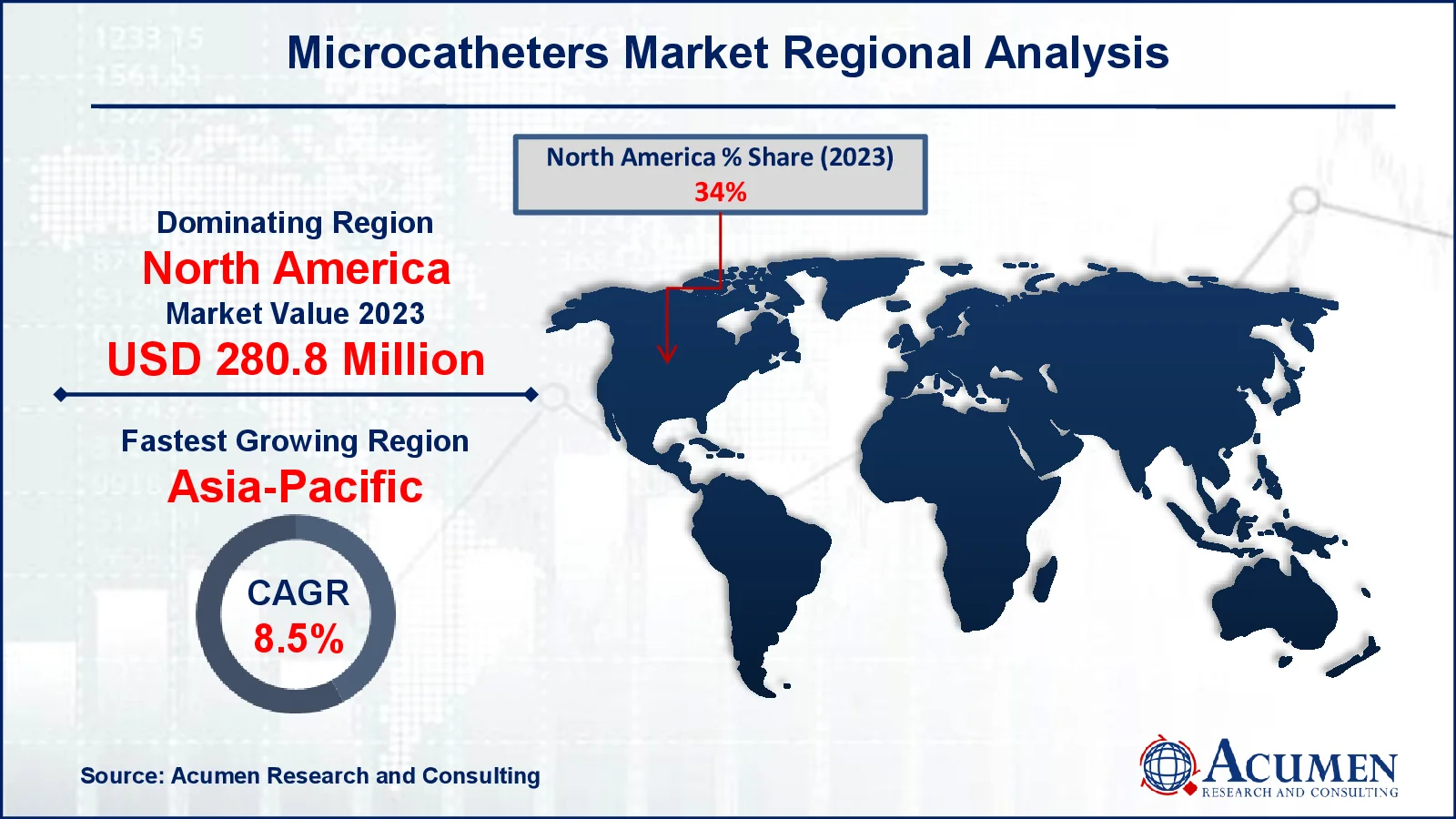

- In 2023, North America's microcatheters market was valued at approximately USD 280.8 million

- According to the Centers for Disease Control and Prevention, six in ten Americans have at least one chronic disease, while four in ten have two or more chronic diseases

- The Asia-Pacific microcatheters market is expected to grow at a CAGR of over 8.5% from 2024 to 2032

- India ranks third, behind China and the US. Global Cancer Observatory anticipated that cancer cases in India would climb to 2.08 million, accounting for a rise of 57.5 percent in 2040 over 2020

- By type, the thrombectomy catheters sub-segment accounted USD 421.2 million in revenue in 2023

- Based on indication, the coronary sub-segment held 47% of the market share in 2023

- The hemorrhagic stroke application segment covered revenue of USD 462.5 million in 2023

- Among end users, hospitals led the microcatheters market, holding 56% of the market share

- Surge precision diagnostics for chronic diseases is the microcatheters market trend that fuels the industry demand

Microcatheters are thin, flexible tubes used in minimally invasive medical treatments to navigate the body's intricate circulatory system. They often have a diameter of less than one millimeter, allowing for precise access to tight and complicated blood arteries. Microcatheters are mostly employed in neurovascular and cardiovascular treatments to deliver diagnostic agents, therapeutic medications, or medical equipment to the target site. Their flexibility and agility enable healthcare providers to access difficult anatomical regions while reducing patient trauma and recovery time.

According to the National Institute of Health (NIH), with the growth of neurointerventional theory, techniques, and materials, microcatheter shape, as an important aspect of neurointerventional procedures, has advanced in recent years. Shaping methods have progressed from traditional hand shaping to composite bending, 3D model help, and now computer algorithm-assisted procedures. As a result, every interventionalist is constantly striving for improved precision in microcatheter shape. The advancement in microcatheter shaping techniques, contributes to the increased precision and efficiency of neurointerventional procedures, thereby driving the growth of the microcatheters market.

Global Microcatheters Market Dynamics

Market Drivers

- Rising prevalence of chronic diseases such as cardiovascular and neurovascular disorders increases demand for microcatheters

- Advancements in microcatheter technology enhance precision and safety in complex medical procedures

- Growing preference for minimally invasive surgeries boosts adoption of microcatheters

Market Restraints

- High costs associated with microcatheter procedures limit accessibility in low-income regions

- Stringent regulatory requirements pose challenges for market entry and product approvals

- Lack of skilled professionals trained in microcatheter techniques hampers widespread adoption

Market Opportunities

- Expansion into emerging markets with increasing healthcare investments presents growth potential

- Development of innovative microcatheter designs tailored for specific medical applications can meet evolving clinical needs

- Collaborations between manufacturers and research institutions can accelerate technological advancements and market penetration

Microcatheters Market Report Coverage

|

Market |

Microcatheters Market |

|

Microcatheters Market Size 2023 |

USD 825.9 Million |

|

Microcatheters Market Forecast 2032 |

USD 1,575.2 Million |

|

Microcatheters Market CAGR During 2024 - 2032 |

7.7% |

|

Microcatheters Market Analysis Period |

2020 - 2032 |

|

Microcatheters Market Base Year |

2023 |

|

Microcatheters Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Indication, By Application, By End-User, And By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Asahi Intecc USA, Inc., Stryker, Medtronic, Terumo Corporation, Penumbra, Inc, Merit Medical Systems, Teleflex Incorporated, Surmodics, Inc., Boston Scientific Corporation, and BIOCARDIA, INC. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Microcatheters Market Insights

The rising prevalence of chronic diseases, particularly cardiovascular and neurovascular disorders has resulted in a greater demand for microcatheters. According to the World Health Organization, neurological diseases impact more than one-third of the world's population and are the major cause of illness and disability. Furthermore, the Centers for Disease Control and Prevention (CDC) reports that heart disease is the leading cause of mortality in the United States for men, women, and people of all races and ethnicities. Every 33 seconds, one person dies from cardiovascular disease. In 2022, 702,880 individuals died of heart disease. That is the equivalent of one out of every five deaths. As the world population ages and lifestyle-related health conditions become more prevalent, there is an increasing demand for less invasive remedies such as microcatheters.

Technological advances in microcatheter design, such as increased flexibility, greater navigation, and higher safety features, are propelling micro catheter market expansion. For example, on February 29, 2024, Embolx received FDA approval for its Soldier High Flow Microcatheter, which features breakthrough ultra-thin wall technology for greater precision in vascular treatments. These developments provide more precision and control during difficult medical operations, which improves patient outcomes. Continuous R&D investments are driving the development of next-generation microcatheters that meet the changing needs of healthcare professionals.

The high expense of microcatheter operations, including equipment and related healthcare services, is a barrier to wider adoption. This is especially hard in low-income areas with inadequate healthcare funding. As a result, cost limits reduce accessibility and decrease the microcatheter market’s growth potential.

Healthcare investments, infrastructure improvements, and increased knowledge of innovative medical treatments are all taking place in emerging economies. According to Health Affairs, health-care spending in the United States hit $4.9 trillion and climbed by 7.5 percent in 2023, up from 4.6% in 2022. Additionally, according to PRSIndia, the Ministry of Health and Family Welfare has been granted Rs 89,155 crore for 2023-24. This is a 13% increase over the revised forecast for 2022-23. The Department of Health Research has been granted Rs 2,980 crores. This opens up huge growth opportunities for micro catheter market to extend their presence and contribute to the industry's expansion in the projection year.

Microcatheters Market Segmentation

Microcatheters Market Segmentation

The worldwide market for microcatheters is split based on type, indication, application, end-user, and geography.

Microcatheter Market By Type

- Balloon Catheters

- Thrombectomy Catheters

- Others

According to the microcatheters industry analysis, thrombectomy catheters are widely used in minimally invasive procedures to remove blood clots, particularly in stroke and cardiovascular therapy. Their effectiveness in restoring blood flow rapidly and safely has resulted in significant demand from healthcare providers. Advances in technology, such as increased flexibility and precision, have improved their usage and results. With the increasing prevalence of cardiovascular illnesses and strokes worldwide, demand for thrombectomy catheters is likely to rise further, cementing their dominant position in the microcatheters market.

Microcatheter Market By Indication

- Neurovascular

- Coronary

- General Peripheral Vascular

According to the microcatheters industry analysis, coronary indications will take the lead in 2023, owing to the rising frequency of cardiovascular disorders such as coronary artery disease and heart attack. According to the World Health Organization, India accounts for one-fifth of all deaths (diabetes, chronic respiratory ailments, and so on), particularly among young people. The results of the Global Burden of Disease study show that India has an age-standardized CVD death rate of 272 per 100,000 people, which is significantly higher than the global average of 235. Microcatheters are vital for sophisticated cardiac treatments like angioplasty and stent implantation, which need precision and maneuverability. As cardiovascular disease remains a significant cause of death worldwide, the demand for coronary-specific microcatheters remains strong, ensuring their dominance in the market.

Microcatheter Market By Application

- Hemorrhagic Stroke

- Ischemic Stroke

According to the microcatheters industry analysis, biggest share of hemorrhagic stroke applications is attributable to the increased demand for minimally invasive procedures to treat brain bleeds and aneurysms. Microcatheters are critical for delivering coils and embolic agents with pinpoint accuracy, lowering the risk of problems during neurovascular treatments. Their flexibility and tiny diameter enable neurosurgeons to successfully navigate complicated cerebral veins. With the rising prevalence of hemorrhagic strokes and developments in neurointerventional procedures, the need for microcatheters in this application grows, reinforcing their market leadership.

Microcatheter Market By End-User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

According to the microcatheters market forecast, hospitals are the primary end consumers due to their large volume of sophisticated surgical operations, such as cardiovascular and neurovascular therapies. They have excellent medical infrastructure and trained specialists, making them ideal for minimally invasive procedures. Furthermore, growing healthcare spending and patient desire for hospital-based therapies contribute to their market dominance.

Microcatheters Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Microcatheters Market Regional Analysis

Microcatheters Market Regional Analysis

For several reasons, North America dominates the microcatheter market. The presence of important industry players, as well as ongoing R&D activities, help to improve its micro catheter market position. For example, Merit Medical Systems, Inc. announced in March 2023 that its SwiftNINJA Steerable Microcatheter line would be expanded. The redesigned line now includes additional sizes, such as a low-profile 2.4F distal diameter variant in 125-cm length and new longer 150-cm alternatives. Furthermore, the rising prevalence of cardiovascular and neurovascular illnesses in the region drives up demand for microcatheters in sophisticated medical operations. According to the National Cancer Institute's Burden of Cancer in the United States, an estimated 2,001,140 new cancer cases will be identified in 2024, with 611,720 individuals dying from the disease.

The Asia-Pacific microcatheter market is rising rapidly, owing to increased healthcare investments and medical tourism. For example, PlacidWay, a global medical health destination marketplace, established a relationship with Thailand's Vega Stem Cell Clinic in November 2023. This collaboration sought to promote health tourism and transform the landscape of regenerative medicine in the Asia-Pacific area. Rising knowledge of minimally invasive procedures, along with an aging population, is driving up demand. According to the Asian Development Bank, by 2050, one-fourth of the population in Asia and the Pacific would be over 60. Between 2010 and 2050, the region's older population (those over the age of 60) will treble, reaching about 1.3 billion.

Microcatheters Market Players

Some of the top microcatheters companies offered in our report include Asahi Intecc USA, Inc., Stryker, Medtronic, Terumo Corporation, Penumbra, Inc, Merit Medical Systems, Teleflex Incorporated, Surmodics, Inc., Boston Scientific Corporation, and BIOCARDIA, INC.

Frequently Asked Questions

How big is the microcatheters market?

The microcatheters market size was valued at USD 825.9 million in 2023.

What is the CAGR of the global microcatheters market from 2024 to 2032?

The CAGR of microcatheters is 7.7% during the analysis period of 2024 to 2032.

Which are the key players in the microcatheters market?

The key players operating in the global market are including Asahi Intecc USA, Inc., Stryker, Medtronic, Terumo Corporation, Penumbra, Inc, Merit Medical Systems, Teleflex Incorporated, Surmodics, Inc., Boston Scientific Corporation, and BIOCARDIA, INC.

Which region dominated the global microcatheters market share?

North America held the dominating position in microcatheters industry during the analysis period of 2024 to 2032.

Which region registered fastest growing CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of microcatheters during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global microcatheters industry?

The current trends and dynamics in the microcatheters industry include rising prevalence of chronic diseases such as cardiovascular and neurovascular disorders increases demand for microcatheters, advancements in microcatheter technology enhance precision and safety in complex medical procedures, and growing preference for minimally invasive surgeries boosts adoption of microcatheters.

Which type held the maximum share in 2023?

The thrombectomy catheters type held the maximum share of the microcatheters industry.