Microbiome Skincare Products Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Microbiome Skincare Products Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

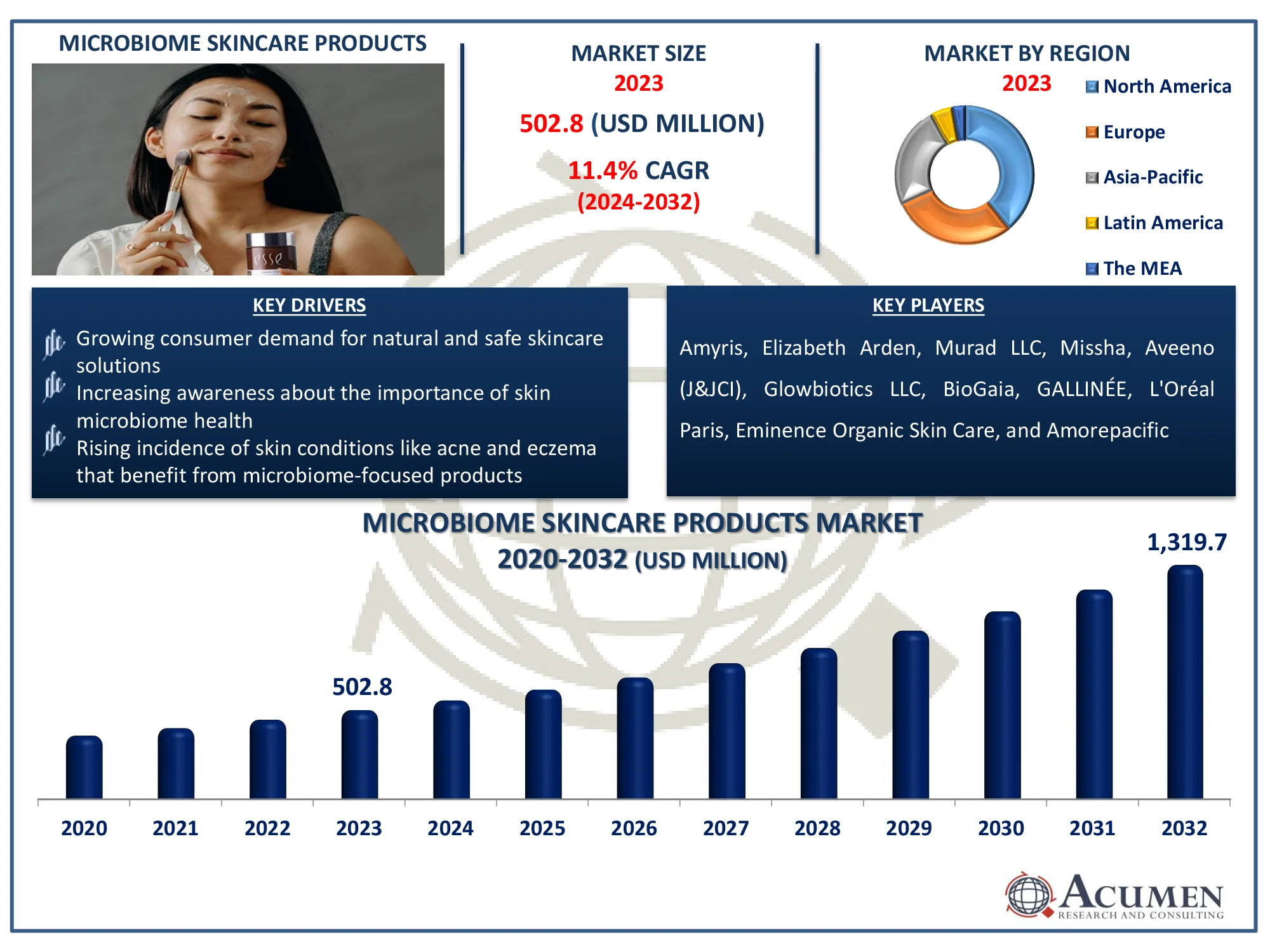

The Global Microbiome Skincare Products Market Size accounted for USD 502.8 Million in 2023 and is estimated to achieve a market size of USD 1,319.7 Million by 2032 growing at a CAGR of 11.4% from 2024 to 2032

Microbiome Skincare Products Market Highlights

- The global microbiome skincare products market is projected to reach USD 1,319.7 million by 2032, growing at a CAGR of 11.4% from 2024 to 2032

- According to WHO statistics, around 1.8 billion people experience skin conditions at any given time

- In 2023, the North American microbiome skincare products market was valued at approximately USD 197 million

- The Asia-Pacific microbiome skincare products market is expected to grow at a CAGR exceeding 12.8% from 2024 to 2032

- Creams accounted for 36% of the microbiome skincare products market share in 2023

- The hypermarket/supermarket distribution channel held 42% of the face care segment's market share in 2023

- Advances in biotechnology driving innovation in probiotics, prebiotics, and postbiotics for skincare is the microbiome skincare products market trend that fuels the industry demand

Microbiome skincare solutions are designed to promote and balance the skin's natural microbiome, which includes beneficial bacteria, fungus, and other microorganisms that reside on the skin. These products include substances including prebiotics, probiotics, and postbiotics, which nourish and protect the skin's microbial community.

The primary purpose is to maintain a healthy skin barrier, reduce irritation, and boost immunological function. For instance, Down To Earth Organization states that microbiome-based skincare has distinct advantages for both consumers and the beauty industry. The International Organization for Standardization (ISO) emphasizes the importance of product safety, requiring producers to take steps to prevent the introduction of hazardous microbes during production, packaging, or from raw materials.

Global Microbiome Skincare Products Market Dynamics

Market Drivers

- Growing consumer demand for natural and safe skincare solutions

- Increasing awareness about the importance of skin microbiome health

- Rising incidence of skin conditions like acne and eczema that benefit from microbiome-focused products

Market Restraints

- High production costs for microbiome-based skincare formulations

- Limited consumer awareness and understanding of microbiome science

- Regulatory challenges in developing standardized microbiome skincare products

Market Opportunities

- Expansion of microbiome skincare lines targeting sensitive skin and specific skin conditions

- Innovations in probiotics and prebiotics for enhanced skin health

- Increasing use of e-commerce and direct-to-consumer sales for microbiome skincare products

Microbiome Skincare Products Market Report Coverage

|

Market |

Microbiome Skincare Products Market |

|

Microbiome Skincare Products Market Size 2023 |

USD 502.8 Million |

|

Microbiome Skincare Products Market Forecast 2032 |

USD 1,319.7 Million |

|

Microbiome Skincare Products Market CAGR During 2024 - 2032 |

11.4% |

|

Microbiome Skincare Products Market Analysis Period |

2020 - 2032 |

|

Microbiome Skincare Products Market Base Year |

2023 |

|

Microbiome Skincare Products Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Application, By Distribution Channel, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Amyris, Elizabeth Arden, Murad LLC, Missha, BioGaia, Aveeno (J&JCI), Glowbiotics LLC, GALLINÉE, L'Oréal Paris, Eminence Organic Skin Care, and Amorepacific. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Microbiome Skincare Products Market Insights

The growing consumer preference for natural and safe skincare solutions is driving the market for microbiome skincare products, which focus on preserving the skin's natural balance without using harsh ingredients. CAS Organization states that the expanding market for natural ingredients, which is expected to grow from USD 642 million in 2022 to USD 1,095 million by 2030, demonstrates the cosmetics industry's trend toward sustainability. This trend shows a substantial shift in consumer behavior, with more than 40% of buyers preferring natural ingredients in their beauty and personal care products. Consumers are increasingly looking for formulations that are mild, effective, and promote general skin health, making microbiome-based products particularly appealing.

The increased frequency of skin disorders like acne and eczema is driving up demand for microbiome-focused skincare products that aim to restore skin balance and improve overall health. National Institute of Health states that the link between the gut and skin microbiomes is important in dermatological diseases such as acne, psoriasis, rosacea, and atopic dermatitis, as abnormalities in these microbiomes can exacerbate them. Microbiome-targeted treatments, such as probiotics and other microbiome-based therapies, are rapidly being developed to restore balance and enhance skin health. Acne has been connected to the gut-brain-skin axis, which regulates inflammation and immunological response. As a result, microbiome-focused therapies that target both skin and gut microorganisms are emerging as effective acne treatments, driving up demand for them.

Limited consumer knowledge and comprehension of microbiome science hinder the expansion of the microbiome skincare products industry, since many people are ignorant of the advantages and science underlying these products. However, innovations in probiotics and prebiotics have considerably enhanced the microbiome skincare products industry. For instance, as per National Institutes of Health (NIH), both probiotics and resident bacteria can create antimicrobial peptides that boost cutaneous immune responses and eradicate infections. Prebiotics can be used in cosmetic formulations to directly affect the skin microbiota, increasing the activity and proliferation of beneficial 'normal' skin bacteria. These substances promote good skin microorganisms, improve skin barrier function, and address a variety of skin issues, resulting in increased consumer interest and market growth.

Microbiome Skincare Products Market Segmentation

The worldwide market for microbiome skincare products is split based on product, application, distribution channel, end-user, and geography.

Microbiome Skincare Products

- Serums

- Cleansers

- Creams

- Toners

- Face Masks

- Moisturizers

- Others

According to the microbiome skincare products industry analysis, creams are likely to dominate industry due to their versatility and efficacy in hydrating and nurturing the skin's natural microbiota. As customers want for products that provide hydration while preserving skin balance, creams are an excellent delivery vehicle for probiotics, prebiotics, and other beneficial components. Their ability to treat a wide range of skin issues, from dryness to irritation, makes them extremely popular.

Microbiome Skincare Products Application

- Face Care

- Body Care

- Anti-Aging

- Acne Treatment

- Sensitive Skin Care

According to the microbiome skincare products industry analysis, face care shows significant growth because to consumers' strong desire to maintain a healthy and balanced complexion, making it the primary area of concern for the majority of skincare users. The face is the most exposed region of the body, thus there is a higher demand for products that promote microbiome health and address common skin disorders such as acne and aging.

Other areas, such as body care, anti-aging, and acne treatment, are expanding as customers seek holistic treatments for skin health. Sensitive skin care is gaining popularity as people become more aware of the benefits of gentle, microbiome-friendly solutions for illnesses like eczema and rosacea.

Microbiome Skincare Products Distribution Channel

- Hypermarket/Supermarket

- Pharmacy & Drug Stores

- E-commerce

- Others

According to the microbiome skincare products market forecast, hypermarkets and supermarkets dominate market because they provide easy, one-stop shopping experiences for consumers, allowing them to access a diverse choice of items. These retail channels offer high foot traffic and excellent product exposure, which helps to raise customer awareness and stimulate spontaneous purchases of microbiome skincare products. Furthermore, hypermarkets and supermarkets frequently provide competitive prices and promotions, making microbiome skincare products more accessible to a wider audience.

Microbiome Skincare Products End-User

- Men’s Skincare

- Women’s Skincare

- Unisex

According to the microbiome skincare products market forecast, the women's skincare sector typically dominates industry due to the strong demand for new and natural treatments that promote healthy, balanced skin. Women are more inclined to invest in specific skincare regimens, especially those that address issues such as acne, aging, and sensitivity. For instance, according to the American Academy of Dermatology, acne in adults is on the rise, affecting up to 15% of women, while rosacea, a skin condition commonly linked to menopause, also primarily impacts women. These increasing skin concerns among women contribute to a higher demand for skincare products, surpassing the demand from men.

Microbiome Skincare Products Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Microbiome Skincare Products Market Regional Analysis

North America dominates the microbiome skincare products market due to high consumer awareness, advanced skincare technology, and a strong demand for natural and science-backed skincare solutions. Additionally, the growing prevalence of skin conditions like acne and eczema has fueled the adoption of microbiome-based skincare in the U.S. and Canada. For instance, as per American Academy of Dermatology Association, acne is the most common skin problem in the United States, affecting up to 50 million Americans each year. The region has a well-established skincare industry, with major brands leading innovation in microbiome-focused products.

Asia-Pacific is growing rapidly in the microbiome skincare products market, driven by rising skincare awareness in countries like China, Japan, and South Korea. As per Invest India, Skin care, hair care, and bath and shower products have the biggest market share in the India beauty and personal care industry (about 62% in 2023). Consumers in the region are becoming more conscious of the benefits of microbiome-friendly products, leading to a surge in demand. The region also has a strong tradition of skincare and beauty products, which is increasingly incorporating microbiome science.

Microbiome Skincare Products Market Players

Some of the top microbiome skincare products companies offered in our report include Amyris, Elizabeth Arden, Murad LLC, Missha, BioGaia, Aveeno (J&JCI), Glowbiotics LLC, GALLINÉE, L'Oréal Paris, Eminence Organic Skin Care, and Amorepacific

Frequently Asked Questions

How big is the Microbiome Skincare Products market?

The microbiome skincare products market size was valued at USD 502.8 Million in 2023.

What is the CAGR of the global Microbiome Skincare Products market from 2024 to 2032?

The CAGR of microbiome skincare products is 11.4% during the analysis period of 2024 to 2032.

Which are the key players in the Microbiome Skincare Products market?

The key players operating in the global market are including Amyris, Elizabeth Arden, Murad LLC, Missha, BioGaia, Aveeno (J&JCI), Glowbiotics LLC, GALLIN�E, L'Or�al Paris, Eminence Organic Skin Care, and Amorepacific.

Which region dominated the global Microbiome Skincare Products market share?

North America held the dominating position in microbiome skincare products industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of microbiome skincare products during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Microbiome Skincare Products industry?

The current trends and dynamics in the microbiome skincare products industry include growing consumer demand for natural and safe skincare solutions, increasing awareness about the importance of skin microbiome health, and rising incidence of skin conditions like acne and eczema that benefit from microbiome-focused products.

Which product held the maximum share in 2023?

The creams held the maximum share of the microbiome skincare products industry.