Micro LED Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Micro LED Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

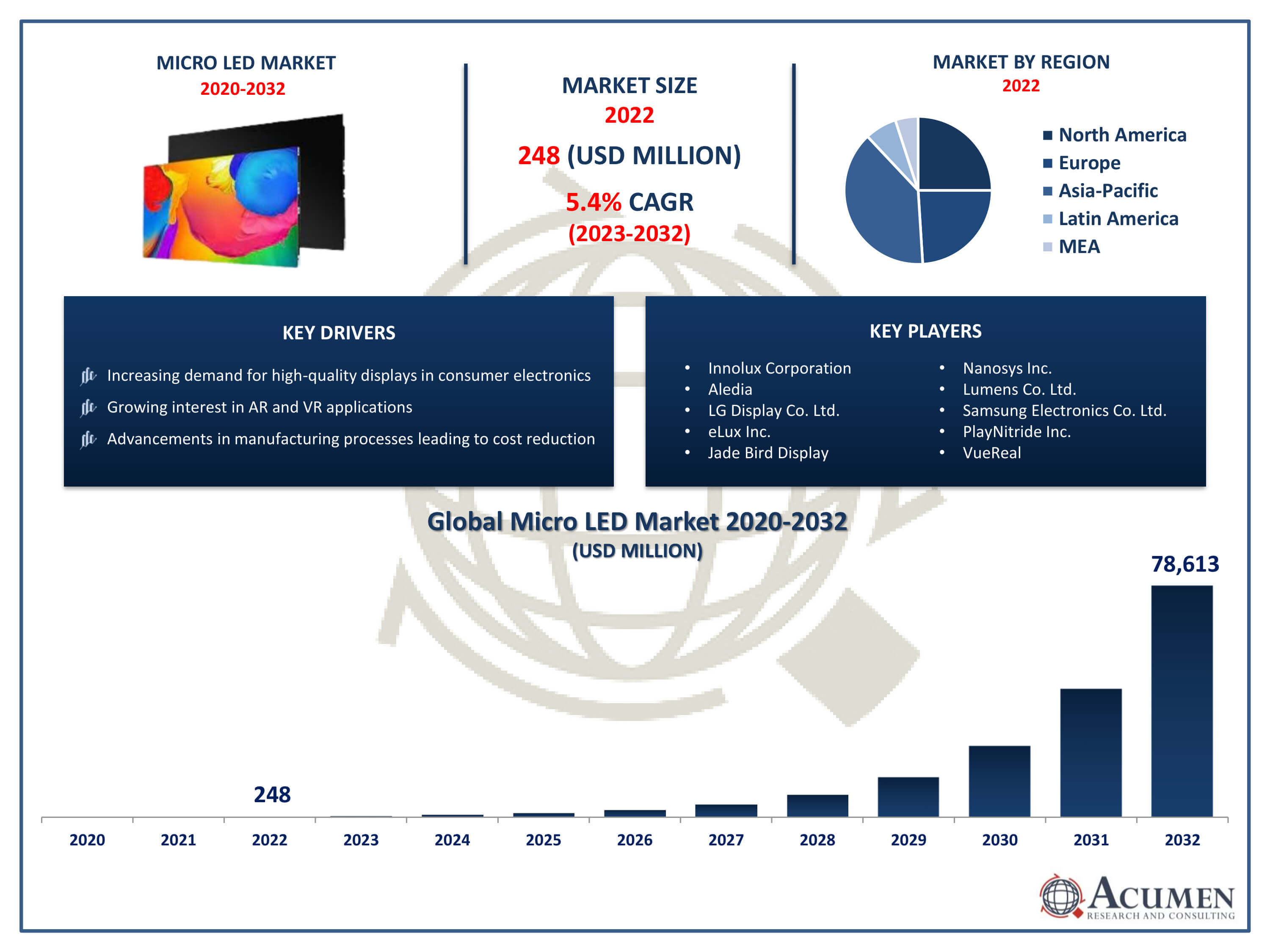

The Micro LED Market Size accounted for USD 248 Million in 2022 and is projected to achieve a market size of USD 78,613 Million by 2032 growing at a CAGR of 78.1%from 2023 to 2032.

Micro LED Market Highlights

- Global Micro LED Market revenue is expected to increase by USD 78,613 Million by 2032, with a 78.1% CAGR from 2023 to 2032

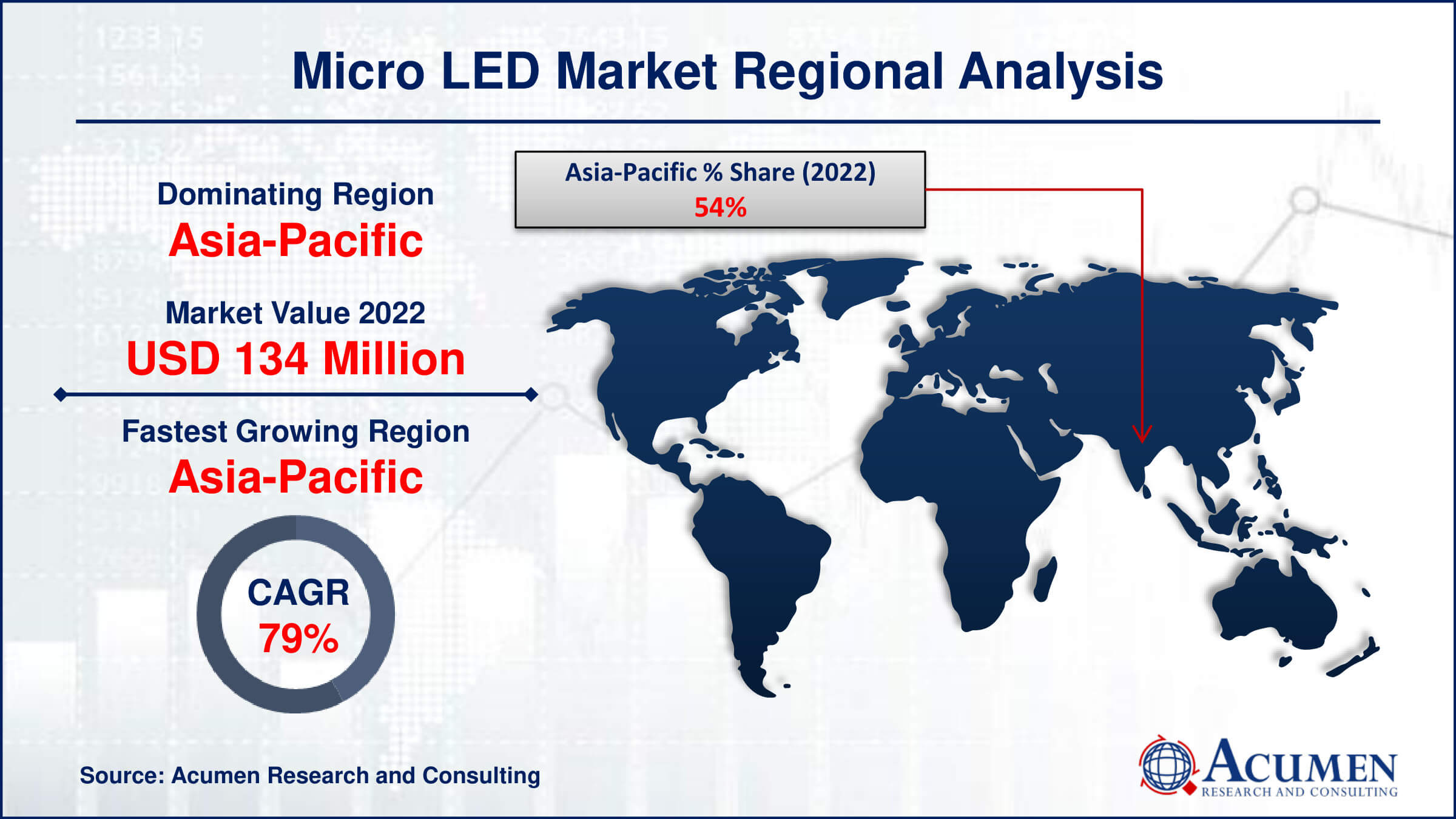

- Asia-Pacific region led with more than 54% of Micro LED Market share in 2022

- North America Micro LED Market growth will record a CAGR of more than 78.6% from 2023 to 2032

- By product, the large-scale display segment captured more than 61% of revenue share in 2022.

- By application, the smartphone and tablets segment is projected to expand at the fastest CAGR over the projected period

- Increasing demand for high-quality displays in consumer electronics, drives the Micro LED Market value

Micro LED (Light Emitting Diode) is an emerging display technology that utilizes microscopic LED chips to create individual pixels. Unlike traditional LED displays, micro LED displays do not require a backlight, as each pixel emits its own light. This allows for superior contrast ratios, higher brightness levels, and improved energy efficiency. Micro LED displays also offer the advantages of wide color gamuts, fast response times, and the ability to achieve high resolutions.

In recent years, the market for micro LED technology has been experiencing significant growth. The demand for high-quality displays in applications such as consumer electronics, automotive displays, large-format displays, and augmented reality (AR) devices has been a key driver. As the technology matures and manufacturing processes become more streamlined, the cost of production is expected to decrease, making micro LED displays more accessible for a broader range of applications. The market is also driven by the increasing interest in next-generation display technologies that offer improved visual experiences, and micro LED is positioned to play a pivotal role in shaping the future of displays across various industries.

Global Micro LED Market Trends

Market Drivers

- Increasing demand for high-quality displays in consumer electronics

- Growing interest in augmented reality and virtual reality applications

- Advancements in manufacturing processes leading to cost reduction

- Wide color gamuts, high resolutions, and energy efficiency advantages

- Expanding applications in automotive displays and large-format screens

Market Restraints

- High initial manufacturing costs and complexity

- Technical challenges in mass production and integration

Market Opportunities

- Penetration into emerging markets like smart wearables and IoT devices

- Continuous innovation in display technologies for niche applications

Micro LED Market Report Coverage

| Market | Micro LED Market |

| Micro LED Market Size 2022 | USD 248 Million |

| Micro LED Market Forecast 2032 | USD 78,613 Million |

| Micro LED Market CAGR During 2023 - 2032 | 78.1% |

| Micro LED Market Analysis Period | 2020 - 2032 |

| Micro LED Market Base Year |

2022 |

| Micro LED Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By Industry Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Innolux Corporation, Aledia, LG Display Co. Ltd., eLux Inc., Jade Bird Display, Nanosys Inc., Lumens Co. Ltd., Samsung Electronics Co. Ltd., PlayNitride Inc., VueReal, Plessey Semiconductors Ltd., and Sony Group Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Micro LED, short for Micro Light Emitting Diode, is a cutting-edge display technology characterized by tiny individual LED chips that serve as pixels. Each pixel emits its own light, eliminating the need for a separate backlight found in traditional LED lightingdisplays. This technology offers several advantages, including higher brightness levels, improved contrast ratios, faster response times, and enhanced energy efficiency. Micro LED displays also boast wide color gamuts and the capability to achieve high resolutions, making them ideal for applications where superior image quality and performance are crucial. The applications of micro LED extend across various industries. In consumer electronics, micro LED is utilized in high-end TVs, smartphones, and smartwatches, delivering vibrant colors and sharp visuals. The automotive industry employs micro LED for advanced in-car displays, heads-up displays (HUDs), and digital dashboards, enhancing the driving experience.

The micro LED market has been experiencing robust growth driven by a confluence of factors that are reshaping the display technology landscape. As of the latest available data, the market has been witnessing a compound annual growth rate (CAGR) in the double digits. The demand for micro LED displays has been fueled by their superior performance characteristics, including high brightness, contrast ratios, and energy efficiency. Applications in consumer electronics, such as smartphones, TVs, and smartwatches, have been a major growth driver, as consumers increasingly seek cutting-edge displays with enhanced visual experiences. Furthermore, advancements in manufacturing processes have contributed to the reduction in production costs, making micro LED displays more commercially viable. The technology has found applications in various industries, including automotive displays, digital signage, and AR/VR devices.

Micro LED Market Segmentation

The global Micro LED Market segmentation is based on product, application, industry vertical, and geography.

Micro LED Market By Product

- Micro Display

- Small and Medium-sized Display

- Large Scale Display

According to the micro LED industry analysis, the large scale display segment accounted for the largest market share in 2022. Large-scale micro LED displays are being increasingly adopted in applications such as commercial displays, digital signage, and immersive entertainment experiences. The ability of micro LED technology to offer seamless, bezel-free displays with exceptional brightness and color reproduction makes it particularly attractive for these large-scale applications, where visual impact and clarity are paramount. In addition to traditional applications, large-scale micro LED displays are finding new opportunities in sectors like command and control centers, sports arenas, and virtual production stages. The technology's capability to create massive, high-resolution screens without compromising image quality has spurred its adoption in these fields.

Micro LED Market By Application

- Smartphone and Tablets

- Smartwatch

- TV

- PC and Laptop

- Others

In terms of applications, the smartphone and tablets segment is expected to witness significant growth in the coming years. Micro LED technology offers a range of advantages that are particularly appealing for smartphones and tablets, including enhanced brightness, energy efficiency, and the ability to produce vibrant colors. The absence of a backlight and the capability of micro LEDs to emit their own light enable manufacturers to create thinner and more power-efficient devices, addressing key considerations in the design of modern smartphones and tablets. As the technology continues to mature, manufacturing processes become more refined, and production costs decrease, micro LED displays are becoming more accessible for mass production in smartphones and tablets. Consumers are increasingly valuing superior display quality, and micro LED's potential to deliver sharper images, improved contrast ratios, and better color accuracy positions it as a transformative technology in the mobile device industry.

Micro LED Market By Industry Vertical

- Consumer Electronics

- Automotive

- Entertainment and Sports

- Government and Defense

- Retail

- Others

According to the micro LED market forecast, the consumer electronics segment is expected to witness significant growth in the coming years. Micro LED technology has gained significant traction in consumer electronics, including televisions, smartwatches, and laptops. The appeal lies in its ability to provide superior visual experiences, offering features such as high resolution, vibrant colors, and energy efficiency. As consumers seek cutting-edge technology and improved display performance, manufacturers are incorporating micro LED displays to meet these expectations and stay competitive in the market. One of the key factors contributing to the growth of micro LED in consumer electronics is its potential to enable flexible and foldable displays. This innovation allows for new form factors in devices like smartphones and wearables, enhancing user experiences and expanding the possibilities of device design. With ongoing advancements in manufacturing processes and increasing economies of scale, the cost barriers associated with micro LED production are gradually diminishing, making it more accessible for integration into a broader range of consumer electronics.

Micro LED Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Micro LED Market Regional Analysis

The Asia-Pacific region has emerged as the dominating force in the micro-LED market, driven by a combination of technological innovation, robust manufacturing capabilities, and a burgeoning demand for high-quality displays. Several key players in the micro LED industry, including major manufacturers and technology innovators, are based in countries such as China, South Korea, and Japan. These nations have established themselves as leaders in the development and production of micro LED displays, contributing significantly to the region's dominance. The Asia-Pacific region benefits from a strong ecosystem that encompasses research and development, manufacturing infrastructure, and a growing consumer electronics market. Government initiatives, strategic investments, and collaborations between industry stakeholders further fuel the region's leadership in micro LED technology. Additionally, the presence of major consumer electronics manufacturers in the region has facilitated the rapid adoption of micro-LED displays in products like smartphones, televisions, and wearable devices. As the demand for high-performance displays continues to rise globally, the Asia-Pacific region is expected to maintain its dominance in the micro-LED market, shaping the trajectory of the industry in the coming years.

Micro LED Market Player

Some of the top Micro LED Market companies offered in the professional report include Innolux Corporation, Aledia, LG Display Co. Ltd., eLux Inc., Jade Bird Display, Nanosys Inc., Lumens Co. Ltd., Samsung Electronics Co. Ltd., PlayNitride Inc., VueReal, Plessey Semiconductors Ltd., and Sony Group Corporation.

Frequently Asked Questions

How big is the micro LED market?

The micro LED market size was USD 248 Million in 2022.

What is the CAGR of the global Micro LED Market from 2023 to 2032?

The CAGR of micro LED is 78.1% during the analysis period of 2023 to 2032.

Which are the key players in the Micro LED Market?

The key players operating in the global market are including Innolux Corporation, Aledia, LG Display Co. Ltd., eLux Inc., Jade Bird Display, Nanosys Inc., Lumens Co. Ltd., Samsung Electronics Co. Ltd., PlayNitride Inc., VueReal, Plessey Semiconductors Ltd., and Sony Group Corporation.

Which region dominated the global Micro LED Market share?

Asia-Pacific held the dominating position in micro LED industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of micro LED during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global micro LED industry?

The current trends and dynamics in the micro LED industry include increasing demand for high-quality displays in consumer electronics, growing interest in augmented reality and virtual reality applications, and advancements in manufacturing processes leading to cost reduction.

Which application held the maximum share in 2022?

The smartphone and tablets application held the maximum share of the micro LED industry.