Micro Inverter Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Micro Inverter Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

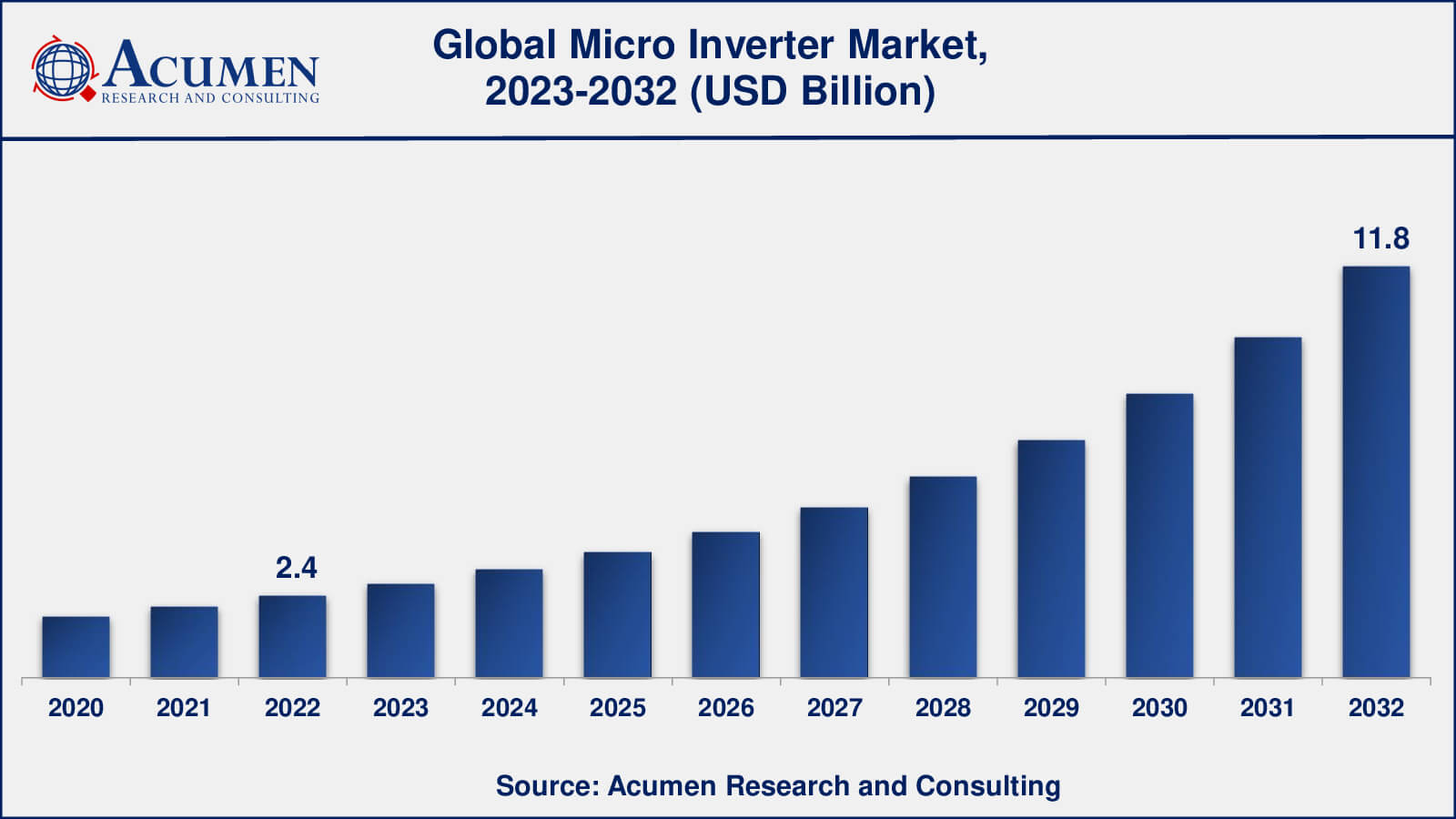

The global Micro Inverter Market size was valued at USD 2.4 Billion in 2022 and is projected to attain USD 11.8 Billion by 2032 mounting at a CAGR of 17.8% from 2023 to 2032.

Micro Inverter Market Highlights

- Global micro inverter market revenue is poised to garner USD 11.8 billion by 2032 with a CAGR of 17.8% from 2023 to 2032

- Asia-Pacific micro inverter market value occupied around USD 820 million in 2022

- Asia-Pacific micro inverter market growth will record a CAGR of more than 20% from 2023 to 2032

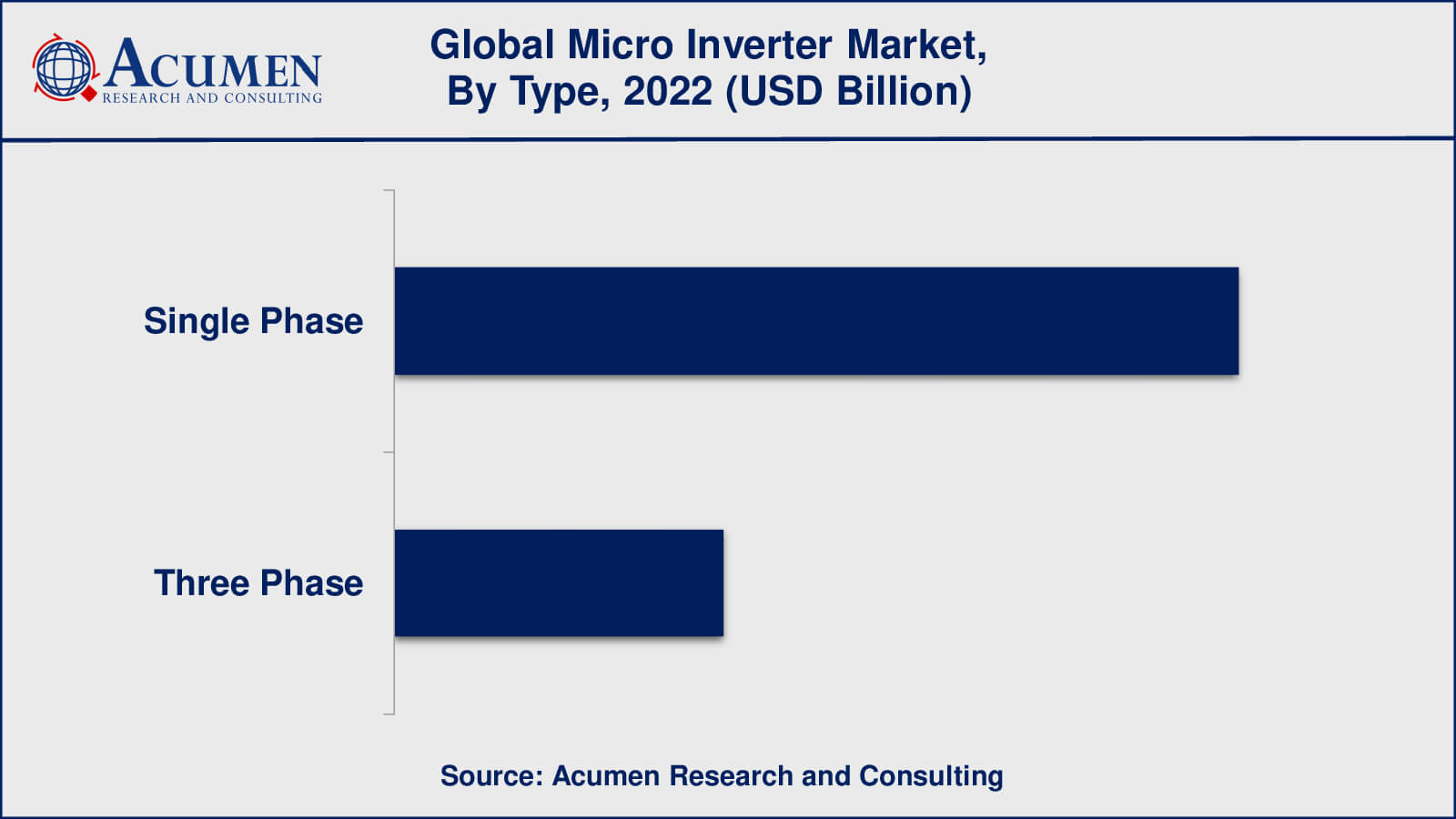

- Among type, the single phase sub-segment occupied over US$ 1.7 billion revenue in 2022

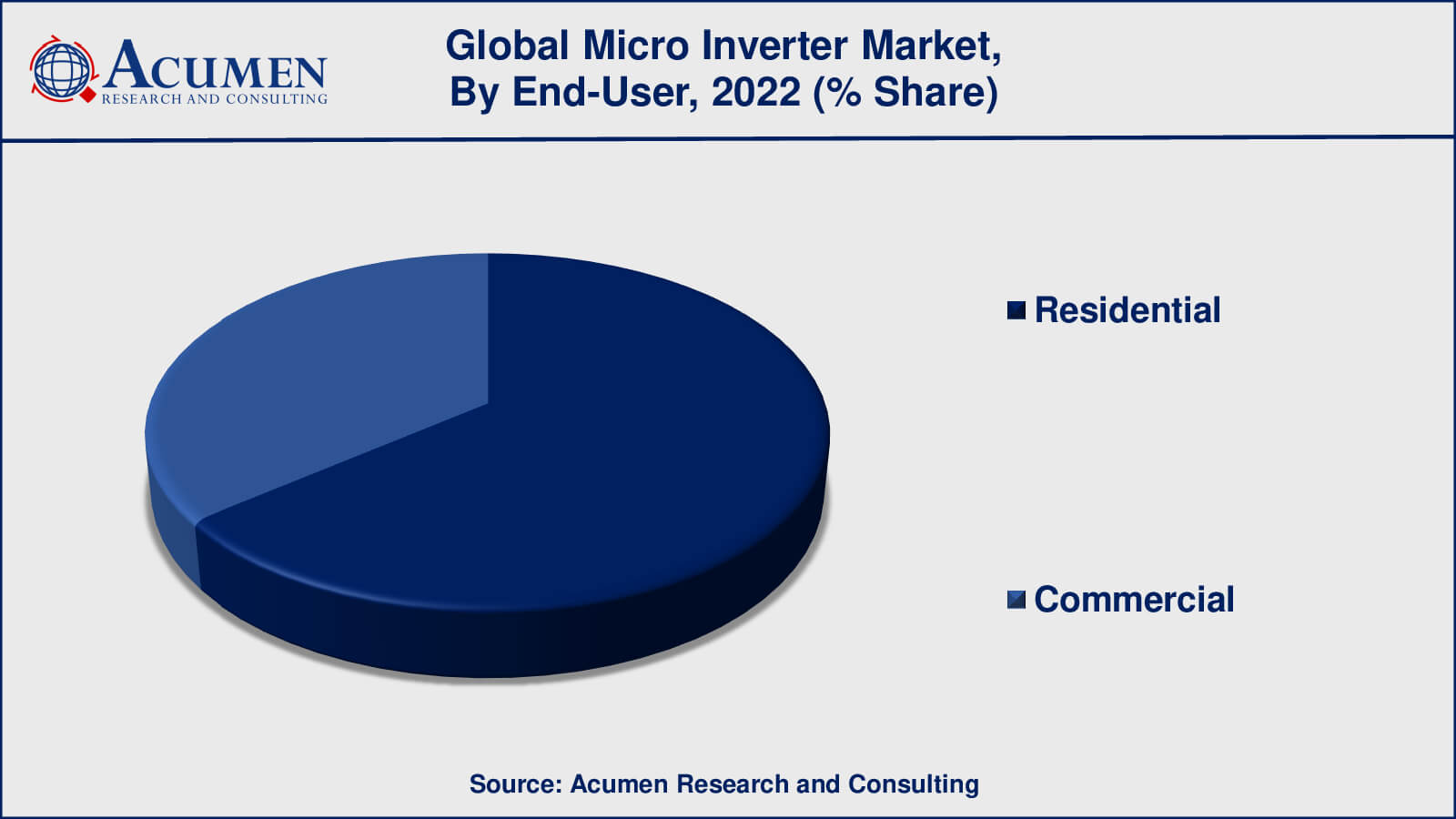

- Based on end-user, the residential sub-segment gathered around 67% share in 2022

- Increased integration with smart grid technologies is a popular micro inverter market trend that drives the industry demand

A micro inverter is a type of power conversion equipment found in solar energy systems. Micro inverters, as opposed to typical string inverters that are widely used in solar installations, are designed to function on a per-panel basis. Each individual solar panel in a solar panel array has its own micro inverter, which converts the direct current (DC) power produced by the solar panel into alternating current (AC) electricity appropriate for use in homes and businesses.

One of the key benefits of micro inverters is their capacity to individually optimize the performance of each solar panel. In a classic string inverter configuration, if one panel in the array faces shade, dirt, or any other condition that affects its output, the performance of the entire string might suffer. However, because each panel has its own inverter, the impact of shading or panel-level faults is restricted to that individual panel with micro inverters. As a result, overall system efficiency and energy production improve.

Global Micro-Inverter Market Dynamics

Market Drivers

- Enhanced panel performance through optimization

- Increased system reliability due to panel-level operation

- Improved energy production in varying sunlight conditions

Market Restraints

- Higher costs compared to traditional string inverters

- More labor-intensive installation process

- Initial investment challenges, especially in less mature markets

Market Opportunities

- Growing demand for solar energy systems

- Competition driving innovation and cost-efficiency

- Potential for reduced costs through technological advancements and economies of scale

Micro Inverter Market Report Coverage

| Market | Micro Inverter Market |

| Micro Inverter Market Size 2022 | USD 2.4 Billion |

| Micro Inverter Market Forecast 2032 | USD 11.8 Billion |

| Micro Inverter Market CAGR During 2023 - 2032 | 17.8% |

| Micro Inverter Market Analysis Period | 2020 - 2032 |

| Micro Inverter Market Base Year | 2022 |

| Micro Inverter Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Connection Type, By Power Rating, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ABB Group, Delta Energy Systems GmbH, Enphase Energy, Inc., Involar, P and P Energy Technology Co Limited, ReneSola, Siemens AG, SMA Solar Technology AG, SolarEdge Technologies Inc., and SunPower Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Micro Inverter Market Insights

The micro-inverter market is defined by the dynamic interaction of numerous elements that drive its growth and evolution. The persistent search of improved solar panel performance is a major driving force. Because of its capacity to optimize individual panel output, mitigate shading effects, and increase overall system efficiency, micro inverters have gained popularity. This basic benefit has piqued the interest of both residential and commercial solar systems looking to maximize their energy production capacity.

Another motivator is a greater emphasis on system dependability. Micro inverters function on a per-panel basis, reducing the chance of system-wide failures. Because detecting and treating difficulties at the panel level is easier than diagnosing problems in centralized string inverter systems, this modular architecture streamline maintenance and troubleshooting operations. As a result, as consumers prioritise systems that deliver continuous and stable energy generation, the need for micro inverters has increased.

In addition, the micro inverter industry is inextricably linked to wider trends in renewable energy consumption and technical innovation. The rising global need for sustainable energy solutions has fueled the growth of solar installations, creating an advantageous climate for micro inverter makers to increase their market reach. The competitive landscape is encouraging innovation and cost-efficiency, prompting manufacturers to improve the capabilities of their products while aiming to cut prices, making micro inverters more accessible to a broader spectrum of consumers.

However, there are several issues to consider. Some potential consumers may be put off by the higher costs of micro inverters compared to typical string inverters, particularly in areas with lower solar adoption rates. The installation method also necessitates extra labor because each panel must be outfitted with its own micro inverter. Furthermore, the initial investment necessary for a micro inverter system may deter potential consumers, particularly in areas where solar energy adoption is still in its early stages.

Finally, the micro-inverter market is influenced by a complex set of variables that determine its growth and trajectory. Adoption is being driven by the quest of enhanced panel performance, system dependability, and alignment with wider renewable energy trends. Higher prices and installation complexity are offset by increased demand for renewable energy solutions and a competitive push for innovation. The micro inverter industry is positioned to adapt and develop as the renewable energy environment evolves, contributing to the continuous transition to sustainable energy sources.

Micro Inverter Market Segmentation

The worldwide market for micro inverter is split based on type, connection type, power rating, end-user, and geography.

Micro Inverter Types

- Single Phase

- Three Phase

According to a micro inverter industry analysis, single phase has always been more dominant and widely used in the market. In domestic solar systems, single-phase micro inverters are often employed. They are well-suited for smaller systems and residential roofs with reduced energy demands. Due to its compatibility with single-phase home electrical networks, residential solar installations have been a primary driver for single-phase micro inverters.

In bigger commercial and industrial solar projects, three-phase micro inverters are frequently used. These systems often demand more power and are connected to three-phase power networks. Three-phase micro inverters are excellent for commercial buildings, industries, and other large-scale applications because they are intended to withstand higher energy demands associated with bigger installations.

Micro Inverter Connection Types

- Stand Alone

- Grid Connected

Grid-connected micro-inverters have been more prevalent in the micro-inverter market. This is due to the fact that grid-connected solar systems are the most popular and commonly used kind of solar installation. Grid-connected micro inverters allow solar energy to be sent back into the electrical grid, allowing users to earn credits or compensation for excess energy produced, a concept known as net metering. This configuration is very common in residential and commercial applications where customers want to balance their power use and even earn money from excess energy output.

Off-grid micro inverters, also known as stand-alone micro inverters, are utilised when the solar energy system is not linked to the main electrical grid. These systems are often found in distant areas or when a dependable grid connection is not accessible. Off-grid cottages, distant research sites, and other isolated places where solar energy is the major source of electricity employ stand-alone micro inverters.

Micro Inverter Power Rating

- Below 250 W

- Between 250 W and 500 W

- Above 500 W

Micro inverters have traditionally been connected with solar panels that produce less than 250 W or between 250 W and 500 W. Micro inverters are frequently utilised in residential and small business setups where individual solar panels have power outputs that fall within these ranges. These power ratings are appropriate for rooftop installations and smaller solar energy systems found on residences, small businesses, and other comparable locations.

Micro inverters with power ratings more than 500 W may be connected with bigger commercial and industrial systems that use high-wattage solar panels. It is crucial to note, however, that solar panel technology has advanced significantly, and panel wattages have increased over time. This might lead to shifts in the micro inverter industry.

Micro Inverter End-Users

- Residential

- Commercial

As per our micro inverter market forecast, residential installations are likely to dominate the market from 2023 to 2032. Micro inverters are ideal for residential rooftops because they enable individual panel optimisation, which is critical for overcoming shading challenges that are prevalent in residential situations. Micro inverters are tempting to homeowners who want to maximise energy production from limited roof space because of their capacity to obtain the maximum energy output from each panel.

Commercial installations, which include companies, schools, hospitals, and other non-residential enterprises, account for a sizable percentage of the micro-inverter market. Larger solar arrays in these environments frequently need careful attention to shading and system optimisation, making micro inverters an appealing solution.

Micro Inverter Market Regional Segmentation

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Micro Inverter Market Regional Analysis

The North American micro inverter industry has been robust due to widespread solar adoption, notably in the United States and Canada. Government incentives, net metering rules, and a growing awareness of the benefits of renewable energy have fueled demand for micro inverters in both the residential and commercial sectors.

Europe is another important market for micro inverters, with Germany, the Netherlands, and the United Kingdom leading the way. Renewable energy objectives, feed-in tariffs, and progressive solar laws have all aided in the uptake of micro inverters, particularly in residential installations.

The Asia-Pacific area, which includes China, Japan, and Australia, has showed significant economic potential. Rapid urbanization, rising power consumption, and a desire for more environmentally friendly energy sources have all bolstered the micro inverter industry. Japan's home solar sector, in particular, has embraced micro inverters to alleviate shading issues in highly populated regions.

Micro Inverter Market Players

Some of the top micro inverter companies offered in our report include ABB Group, Delta Energy Systems GmbH, Enphase Energy, Inc., Involar, P and P Energy Technology Co Limited, ReneSola, Siemens AG, SMA Solar Technology AG, SolarEdge Technologies Inc., and SunPower Corporation.

Frequently Asked Questions

What was the size of the global micro inverter market in 2022?

The size of micro inverter market was USD 2.4 billion in 2022.

What is the micro inverter market CAGR from 2023 to 2032?

The micro inverter market CAGR during the analysis period of 2023 to 2032 is 17.8%.

Which are the key players in the micro inverter market?

The key players operating in the global micro inverter market are including ABB Group, Delta Energy Systems GmbH, Enphase Energy, Inc., Involar, P and P Energy Technology Co Limited, ReneSola, Siemens AG, SMA Solar Technology AG, SolarEdge Technologies Inc., and SunPower Corporation.

Which region dominated the global micro inverter market share?

Asia-Pacific region held the dominating position in micro inverter industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of micro inverter during the analysis period of 2023 to 2032.

What are the current trends in the global micro inverter industry?

The current trends and dynamics in the micro inverter industry include enhanced panel performance through optimization, increased system reliability due to panel-level operation, and improved energy production in varying sunlight conditions.

Which connection type held the maximum share in 2022?

The single phase connection type held the maximum share of the micro inverter industry.