Methylene Diphenyl Diisocayanate Market | Acumen Research and Consulting

Methylene Diphenyl Diisocyanate Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

The Global Methylene Diphenyl Diisocyanate Market Size accounted for USD 28.4 Billion in 2023 and is estimated to achieve a market size of USD 45.4 Billion by 2032 growing at a CAGR of 5.4% from 2024 to 2032.

Methylene Diphenyl Diisocyanate Market Highlights

- Global methylene diphenyl diisocyanate market revenue is poised to garner USD 45.4 billion by 2032 with a CAGR of 5.4% from 2024 to 2032

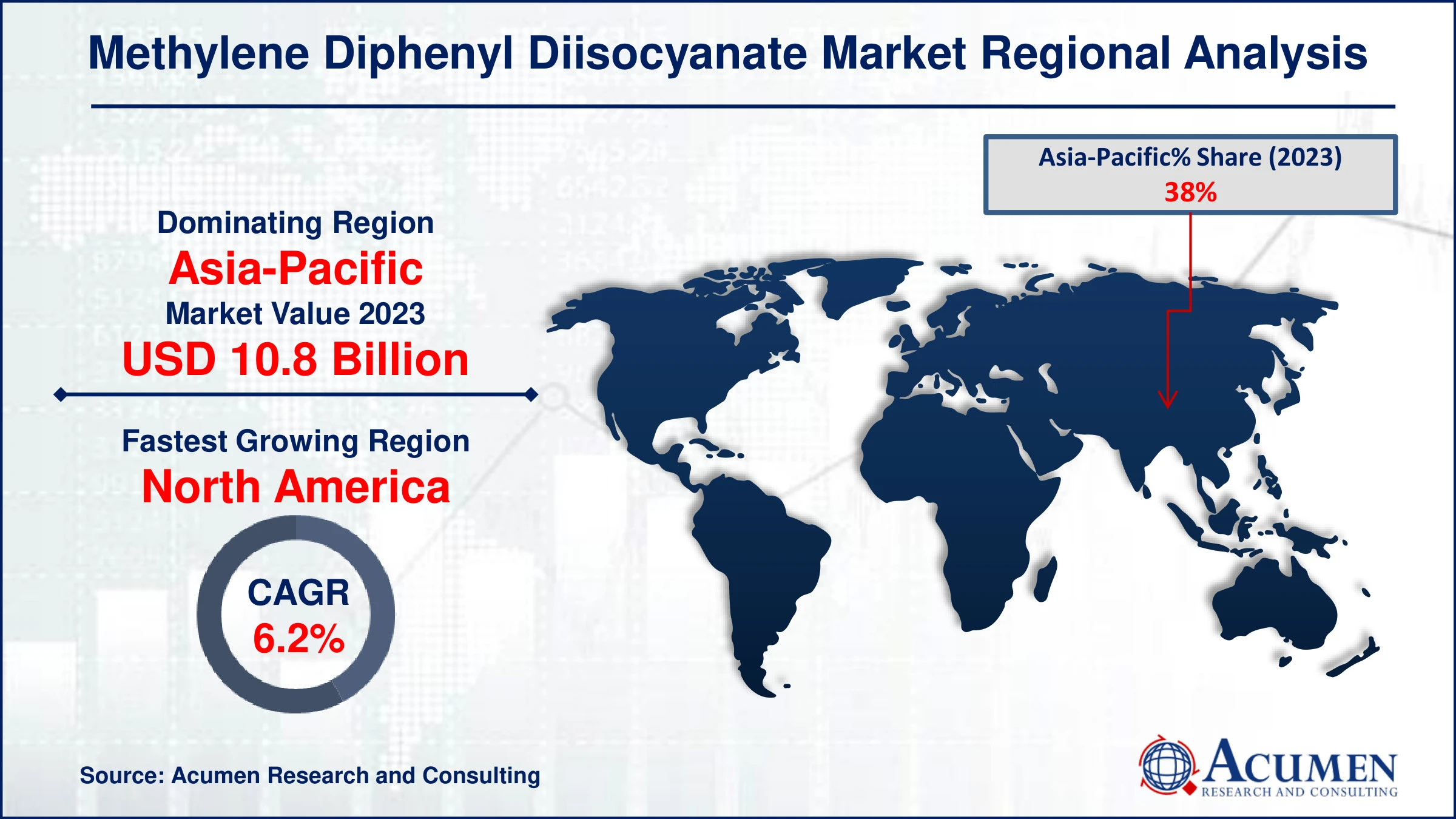

- Asia-Pacific methylene diphenyl diisocyanate market value occupied around USD 10.8 billion in 2023

- North America methylene diphenyl diisocyanate market growth will record a CAGR of more than 6.2% from 2024 to 2032

- Based on application, the rigid foam sub-segment generated 19% of market share in 2023

- Based on end-user, the construction sub-segment accomplished 27% of share in 2023

Increasing demand for low free MDI formulations in polyurethane applications due to regulatory pressures and health concerns is the methylene diphenyl diisocyanate market trend that fuels the industry demand

Methylene diphenyl diisocyanate (MDI) is a chemical compound primarily used in the production of polyurethane foams. These foams are versatile materials employed extensively in construction for insulation, in refrigeration for thermal insulation, and in the furniture industry for cushioning and padding. MDI is also a crucial component in the manufacture of elastomers, adhesives, sealants, and coatings, contributing to their durability and flexibility. Additionally, MDI is used in the automotive industry to produce lightweight parts that enhance fuel efficiency. Its applications extend to binders for wood products, such as particleboard and oriented strand board (OSB), ensuring structural integrity. Due to its diverse utility, MDI plays a significant role in various industrial and commercial sectors.

Global Methylene Diphenyl Diisocyanate Market Dynamics

Market Drivers

- Growing demand for polyurethane foams in construction and automotive industries

- Increasing urbanization and infrastructure development activities

- Rising adoption of energy-efficient insulation materials

Market Restraints

- Stringent environmental regulations on isocyanates

- Volatility in raw material prices

- Health hazards associated with MDI exposure

Market Opportunities

- Expansion of applications in emerging markets

- Technological advancements in production processes

- Development of bio-based and eco-friendly MDI alternatives

Methylene Diphenyl Diisocyanate Market Report Coverage

|

Market |

Methylene Diphenyl Diisocyanate Market |

|

Methylene Diphenyl Diisocyanate Market Size 2023 |

USD 28.4 Billion |

|

Methylene Diphenyl Diisocyanate Market Forecast 2032 |

USD 45.4 Billion |

|

Methylene Diphenyl Diisocyanate Market CAGR During 2024 - 2032 |

5.4% |

|

Methylene Diphenyl Diisocyanate Market Analysis Period |

2020 - 2032 |

|

Methylene Diphenyl Diisocyanate Market Base Year |

2023 |

|

Methylene Diphenyl Diisocyanate Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Application, By End-User, And By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Shandong Dongda Inov Polyurethane Co., Wanhua Chemical Co. Ltd., BASF SE, Huntsman Corporation, The Dow Chemical Company, Covestro, DHALOP Chemicals, Hindustan Organic Chemicals Limited, Bayer, Ningbo Best Polyurethane Co., Sumitomo Chemical Company Limited., TCI Chemicals Pvt. Ltd., Kumho Mitsui Chemicals Corporation, Gujarat Narmada Valley Fertilizers Limited, and Merck KGaA. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Methylene Diphenyl Diisocyanate Market Insights

The rising demand for polyurethane foams in the construction and automotive sectors significantly propels the growth of the methylene diphenyl diisocyanate market. In construction, polyurethane foams are prized for their superior insulation properties, contributing to energy efficiency in buildings. The automotive industry utilizes these foams for their lightweight, durable, and energy-absorbing characteristics, enhancing vehicle performance and safety. This increasing utilization underscores the essential role of MDI as a key raw material in foam production. Consequently, the expanding applications in these industries are driving a robust demand for MDI, fostering market growth.

The MDI market faces significant restraints due to the health hazards associated with MDI exposure. Prolonged or high-level exposure to MDI can lead to respiratory issues, skin irritation, and sensitization, posing serious occupational health risks. For instance, according to Office of Environmental Health Hazard Assessment, exposure to MDI through inhalation typically causes irritation in the lungs and upper respiratory tract, leading to symptoms such as headaches, a sore throat, coughing, and a sensation of tightness in the chest. Regulatory bodies have imposed stringent guidelines and safety measures to mitigate these health risks, increasing compliance costs for manufacturers. Additionally, growing awareness and advocacy for safer alternatives are steering industries away from MDI-based products. Consequently, these health-related concerns are limiting the market growth and adoption of MDI across various sectors.

The development of bio-based and eco-friendly alternatives to MDI presents a significant opportunity for the methylene diphenyl diisocyanate (MDI) Market by addressing growing environmental concerns and regulatory pressures. For instance, in February 2022, BSAF diversified its MDI portfolio by introducing Lupranat ZERO, an aromatic isocyanate that is greenhouse gas-neutral, marking a substantial move towards a sustainable polyurethane value chain. TÜV Nord, a German technical inspection association, has verified the carbon footprint calculation for this product, which finds application in the construction sector for manufacturing MDI polyisocyanurate panels and rigid polyurethane foam. BASF's product lineup also features other MDI-based variants made from renewable raw materials. These sustainable alternatives offer reduced carbon footprints and lower toxicity, aligning with the increasing consumer demand for greener products. As industries such as construction, automotive, and furniture manufacturing seek to enhance their sustainability profiles, the adoption of bio-based MDI alternatives can drive market growth.

Methylene Diphenyl Diisocyanate Market Segmentation

The worldwide market for methylene diphenyl diisocyanate is split based on application, end-user, and geography.

Methylene Diphenyl Diisocyanate (MDI) Market By Application

- Rigid Foam

- Flexible Foam

- Coatings

- Elastomers

- Adhesives & Sealants

- Others

The rigid foam segment is the largest application category in the methylene diphenyl diisocyanate (MDI) market and it is expected to increase over the industry. This is primarily due to its extensive use in the construction industry for insulation purposes, driven by the growing demand for energy-efficient buildings. Rigid foam's superior thermal insulation properties, structural strength, and low cost make it the preferred choice in both residential and commercial construction. For instance, in March 2022, Evonik, a German specialty chemicals company, unveiled plans to establish a state-of-the-art production facility for its advanced rigid polymethacrylimide foam in Darmstadt, Germany. Additionally, the increasing focus on sustainability and reducing energy consumption further boosts the demand for MDI in rigid foam applications.

Methylene Diphenyl Diisocyanate (MDI) Market By End-User

- Construction

- Furniture & Interiors

- Electronics & Appliances

- Automotive

- Footwear

- Others

According to the methylene diphenyl diisocyanate (MDI) industry analysis, the construction sector is the predominant end-use due to MDI's critical role in producing rigid polyurethane foams. These foams are essential for insulation materials, offering superior thermal performance and energy efficiency in buildings. The demand is further driven by stringent energy-saving regulations and the growing emphasis on green building practices. For instance, the International Trade Administration projects that global investment in new infrastructure from 2021 to 2025 is expected to reach approximately USD 4.2 trillion. China's 14th 5-Year Plan highlights initiatives aimed at enhancing energy efficiency and promoting green building development, including plans to construct more than 50 Million square meters of zero-energy consumption buildings. Additionally, MDI-based products are favored for their durability, versatility, and ability to improve structural integrity. As a result, the construction industry significantly propels the MDI market forward.

Methylene Diphenyl Diisocyanate Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Methylene Diphenyl Diisocyanate Market Regional Analysis

For several reasons, the Asia-Pacific region leads the methylene diphenyl diisocyanate (MDI) industry, driven by rapid industrialization and urbanization, particularly in China and India. For instance, Minister of Industry and Information Technology Jin Zhuanglong emphasized China's commitment to advancing its modernization through robust promotion of new industrialization, he highlighted that China's manufacturing sector has maintained global leadership for 14 consecutive years and is now positioned at an advantageous starting point for further growth. The demand for MDI, essential for producing polyurethane foams used in construction, automotive, and furniture industries, is soaring due to the region's booming infrastructure projects and manufacturing activities. Additionally, the growth of the automotive sector and increased production of consumer electronics contribute significantly to this dominance. For instance, according to International Trade Administration, China remains the global leader in vehicle market size, leading in both annual sales and manufacturing output, with projections indicating domestic production could reach 35 Million vehicles by 2025. Favorable government policies and investments in expanding production capacities further bolster the market. Consequently, Asia-Pacific's strategic initiatives and robust economic growth underpin its leadership in the global MDI market.

North America is fastest-growing region in methylene diphenyl diisocyanate (MDI) market due to expanding applications in construction, automotive, and electronics sectors. For instance, in January 2023, BASF commenced the construction of the third and final phase of its methylene diphenyl diisocyanate (MDI) expansion project at its integrated facility in Geismar, LA. This initiative, announced in July 2022, aims to meet the rising demand from North American MDI customers by boosting annual production capacity to around 600,000 tonnes by the middle of the decade. Increasing demand for energy-efficient insulation materials and stringent environmental regulations are driving this growth. Moreover, technological advancements and investments in infrastructure further bolster the region's MDI industry expansion.

Methylene Diphenyl Diisocyanate Market Players

Some of the top methylene diphenyl diisocyanate companies offered in our report include Shandong Dongda Inov Polyurethane Co., Wanhua Chemical Co. Ltd., BASF SE, Huntsman Corporation, The Dow Chemical Company, Covestro, DHALOP Chemicals, Hindustan Organic Chemicals Limited, Bayer, Ningbo Best Polyurethane Co., Sumitomo Chemical Company Limited., TCI Chemicals Pvt. Ltd., Kumho Mitsui Chemicals Corporation, Gujarat Narmada Valley Fertilizers Limited, and Merck KGaA.

Frequently Asked Questions

How big is the methylene diphenyl diisocyanate market?

The methylene diphenyl diisocyanate market size was valued at USD 28.4 billion in 2023.

What is the CAGR of the global methylene diphenyl diisocyanate market from 2024 to 2032?

The CAGR of methylene diphenyl diisocyanate is 5.4% during the analysis period of 2024 to 2032.

Which are the key players in the methylene diphenyl diisocyanate market?

The key players operating in the global market are including Shandong Dongda Inov Polyurethane Co., Wanhua Chemical Co. Ltd., BASF SE, Huntsman Corporation, The Dow Chemical Company, Covestro, DHALOP Chemicals, Hindustan Organic Chemicals Limited, Bayer, Ningbo Best Polyurethane Co., Sumitomo Chemical Company Limited., TCI Chemicals Pvt. Ltd., Kumho Mitsui Chemicals Corporation, Gujarat Narmada Valley Fertilizers Limited, and Merck KGaA.

Which region dominated the global methylene diphenyl diisocyanate market share?

Asia Pacific held the dominating position in methylene diphenyl diisocyanate industry during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global methylene diphenyl diisocyanate industry?

The current trends and dynamics in the methylene diphenyl diisocyanate industry include growing demand for polyurethane foams in construction and automotive industries, increasing urbanization and infrastructure development activities, and rising adoption of energy-efficient insulation materials.

Which application held the maximum share in 2023?

The rigid foam held the maximum share of the MDI industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date