Methyl Acetate Market | Acumen Research and Consulting

Methyl Acetate Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

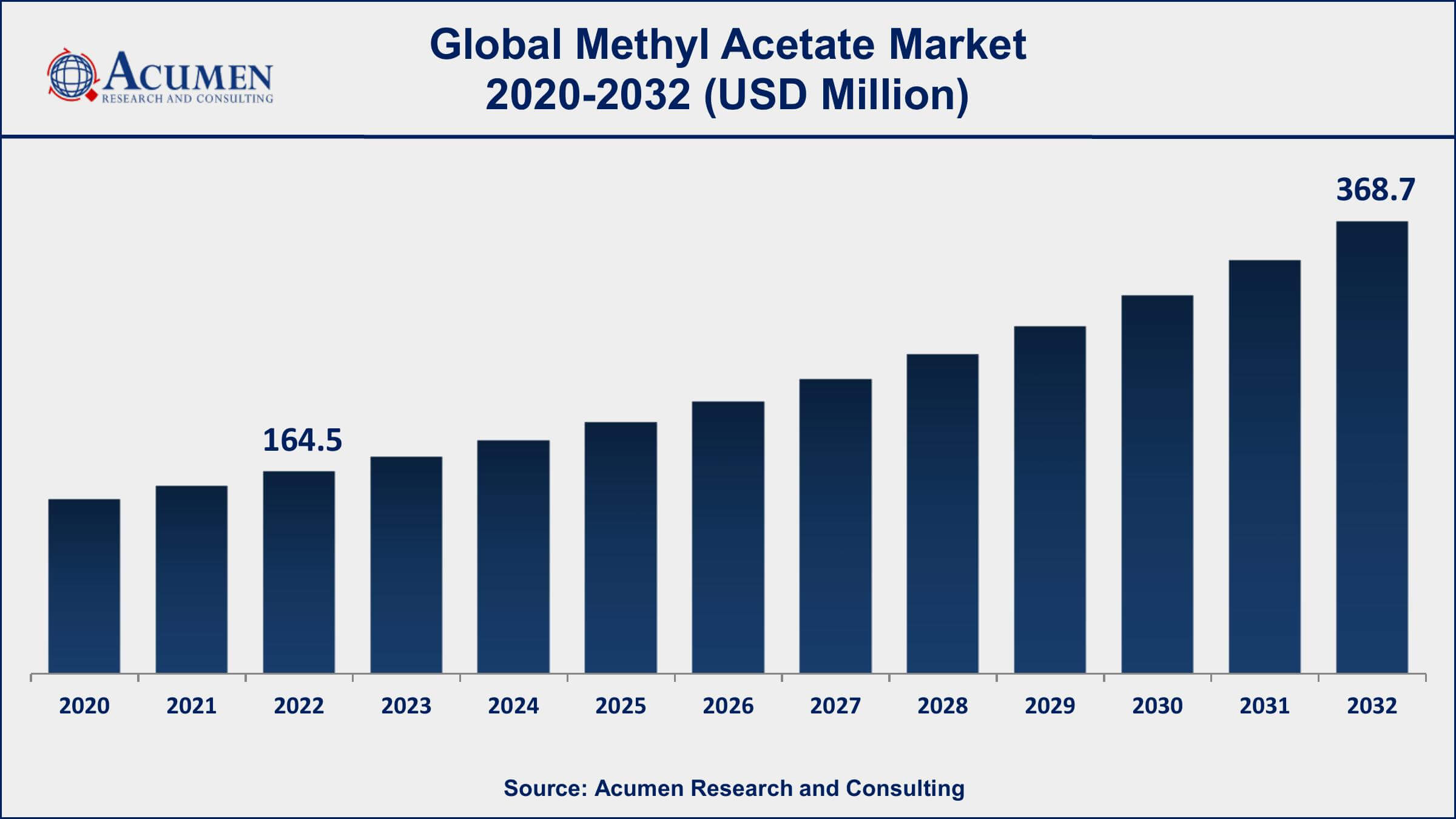

The Global Methyl Acetate Market Size accounted for USD 164.5 Million in 2022 and is projected to achieve a market size of USD 368.7 Million by 2032 growing at a CAGR of 8.5% from 2023 to 2032.

Methyl Acetate Market Key Highlights

- Global methyl acetate market revenue is expected to increase by USD 368.7 Million by 2032, with a 8.5% CAGR from 2023 to 2032

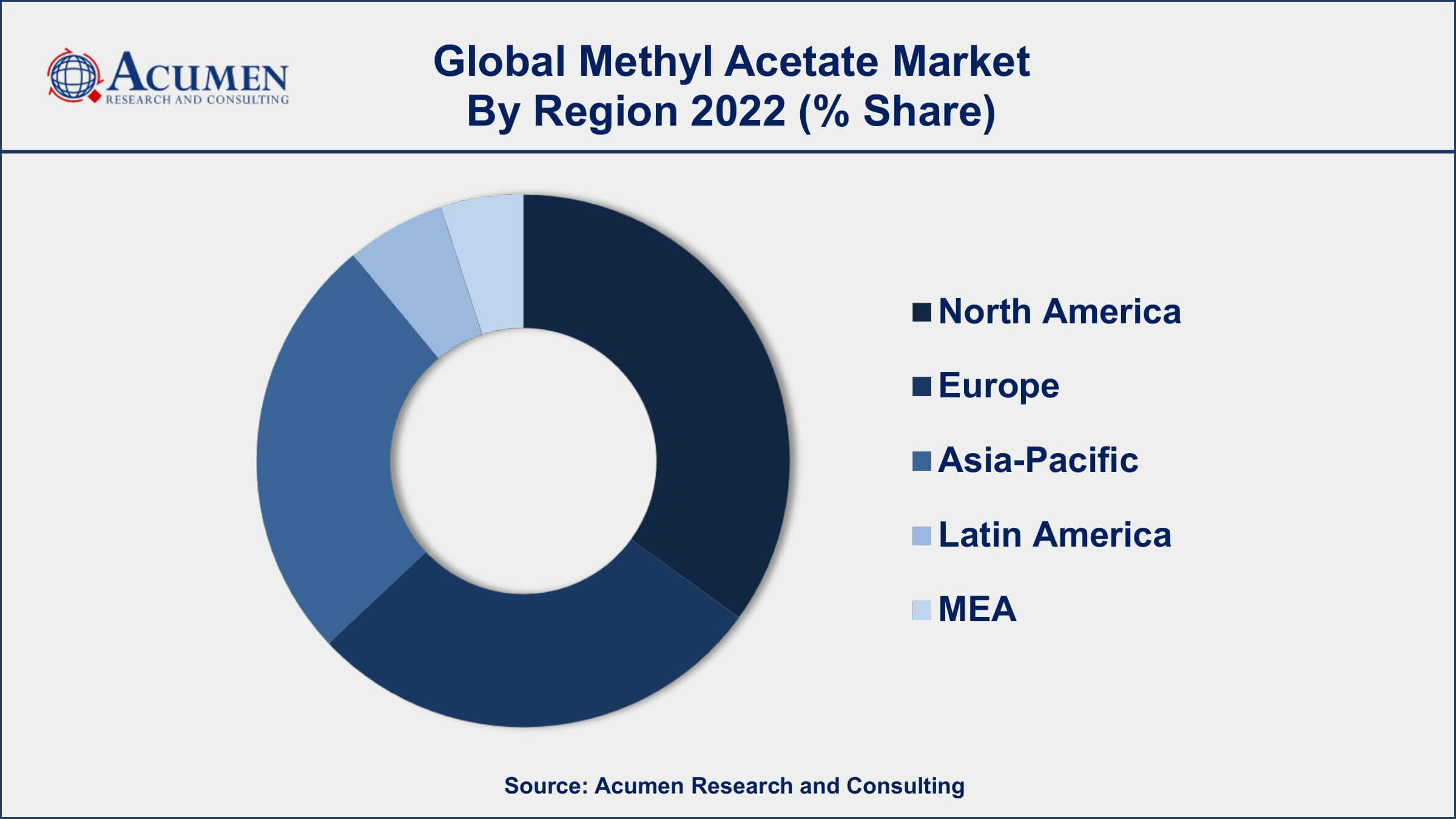

- North America region led with more than 34% of methyl acetate market share in 2022

- Asia-Pacific methyl acetate market growth will record a CAGR of more than 9% from 2023 to 2032

- The paints and coatings segment is the largest application segment for methyl acetate, accounting for over 50% of the global demand.

- By end-use industry, the automotive segment captured the majority of the market

- Growing demand from the pharmaceutical and food industries, drives the methyl acetate market value

Methyl acetate is a clear, colorless, and highly volatile liquid that is commonly used as a solvent in various industrial applications. It is a naturally occurring ester that is produced by the reaction of methanol and acetic acid. Methyl acetate has a pleasant fruity odor and is biodegradable, which makes it an environmentally friendly alternative to many other solvents. It is used in the production of coatings, adhesives, and inks, as well as in the pharmaceutical, food, and personal care industries.

The market growth for methyl acetate has experienced significant growth in recent years, driven by increasing demand from various end-use industries. The growing use of methyl acetate as a solvent in the paints and coatings industry is a key factor driving the market growth. The automotive industry is also a major consumer of methyl acetate, which is used as a solvent for coatings and adhesives. In addition, the rising demand for eco-friendly and sustainable solvents are expected to further boost the market growth.

Global Methyl Acetate Market Trends

Market Drivers

- Growing demand from the paints and coatings industry

- Increasing use as a solvent in various industrial applications

- Rising demand for eco-friendly and sustainable solvents

- Growing demand from the pharmaceutical and food industries

- Advancements in production technologies and processes

Market Restraints

- Volatility in raw material prices

- Stringent government regulations on the use of solvents

Market Opportunities

- Increasing focus on research and development activities to enhance product properties and applications

- Introduction of bio-based methyl acetate for sustainable applications

Methyl Acetate Market Report Coverage

| Market | Methyl Acetate Market |

| Methyl Acetate Market Size 2022 | USD 164.5 Million |

| Methyl Acetate Market Forecast 2032 | USD 368.7 Million |

| Methyl Acetate Market CAGR During 2023 - 2032 | 8.5% |

| Methyl Acetate Market Analysis Period | 2020 - 2032 |

| Methyl Acetate Market Base Year | 2022 |

| Methyl Acetate Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Application, By End-use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Eastman Chemical Company, Celanese Corporation, Wacker Chemie AG, BASF SE, Dow Chemical Company, INEOS AG, Solventis Ltd., Jiangsu Sopo (Group) Co. Ltd., Anhui Wanwei Group Co. Ltd., Chang Chun Group, Nippon Paint Holdings Co. Ltd., and LyondellBasell Industries Holdings B.V. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Methyl Acetate Market Dynamics

Methyl acetate is an acidic corrosive methyl ester or methyl ethanoate with the formula CH3COOCH3. Methyl acetate is often utilized as a solvent being pitifully polar and lipophilic. Methyl acetate is naturally found in apples and is a flavor enhancer. Methyl acetate derivation seems to be an ester incorporated from methanol and acidic corrosive in nearness to solid acids (say sulfuric corrosive) in an esterification response.

Growing applications of methyl acetate as a solvent in paints coupled with its deployment in nail polish removers and glues for various extractions and chemical reactions is poised to surge the market growth in coming years. Methyl acetate with a solubility of 25% is a non-polar and too weakly polar such as a hydrophilic aprotic solvent. In the presence of various strong aqueous acids or bases, methyl acetate loses its stability. The rapid technological advancements in the chemical industry have further led to this product majorly in developed regions such as North America which has further contributed to market growth.

Methyl Acetate Market Segmentation

The global methyl acetate market segmentation is based on application, end-use industry, and geography.

Methyl Acetate Market By Application

- Adhesives and Sealants

- Intermediates

- Paints and Coatings

- Process Solvent

- Pigments

- Others

In terms of applications, the adhesives and sealants segment has seen significant growth in the methyl acetate market in recent years. Methyl acetate is widely used as a solvent in the production of adhesives and sealants. It provides good solubility for a range of polymers and resins used in adhesive and sealant formulations. The growth of the adhesives and sealants segment is driven by the increasing demand for these products from various end-use industries such as automotive, construction, packaging, and textiles. The growing demand for lightweight and fuel-efficient vehicles is expected to further increase the use of adhesives and sealants in the automotive industry, which in turn will drive the demand for methyl acetate. Moreover, the growing construction industry in emerging economies such as China and India is expected to boost the demand for adhesives and sealants, thereby driving the segment growth.

Methyl Acetate Market By End-use Industry

- Paints & Coatings

- Automotive

- Pharmaceutical

- Packaging

- Others

According to the methyl acetate market forecast, the automotive segment is expected to witness significant growth in the coming years. Methyl acetate is widely used in the automotive industry as a solvent for coatings and adhesives. The growth of the automotive segment is driven by the increasing demand for lightweight and fuel-efficient vehicles, which require the use of high-performance coatings and adhesives. Methyl acetate-based coatings are used in various automotive applications, such as exterior and interior parts, and provide excellent adhesion, gloss, and durability. In addition, methyl acetate is used as a solvent for automotive refinish coatings, which are used for repairing and repainting damaged vehicles. The growing demand for automotive refinish coatings, especially in emerging economies, is expected to drive the automotive segment growth.

Methyl Acetate Market Regional Outlook

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Methyl Acetate Market Regional Analysis

North America is one of the largest markets for methyl acetate globally, with the United States being the major contributor to the region's dominance. The growth of the North America can be attributed to several factors, including the presence of a well-established manufacturing base, increasing demand from various end-use industries, and favorable government regulations. The United States has a well-established manufacturing sector, which drives the demand for methyl acetate as a solvent for various industrial applications, including coatings, adhesives, and inks. The country also has a large automotive industry, which is a major consumer of methyl acetate-based coatings and adhesives. In addition, the increasing demand for eco-friendly and sustainable solvents in the country is expected to further boost the regional market growth.

Methyl Acetate Market Player

Some of the top methyl acetate market companies offered in the professional report include Eastman Chemical Company, Celanese Corporation, Wacker Chemie AG, BASF SE, Dow Chemical Company, INEOS AG, Solventis Ltd., Jiangsu Sopo (Group) Co. Ltd., Anhui Wanwei Group Co. Ltd., Chang Chun Group, Nippon Paint Holdings Co. Ltd., and LyondellBasell Industries Holdings B.V.

Frequently Asked Questions

What was the market size of the global methyl acetate in 2022?

The market size of methyl acetate was USD 164.5 Million in 2022.

What is the CAGR of the global methyl acetate market from 2023 to 2032?

The CAGR of methyl acetate is 8.5% during the analysis period of 2023 to 2032.

Which are the key players in the methyl acetate market?

The key players operating in the global market are including Eastman Chemical Company, Celanese Corporation, Wacker Chemie AG, BASF SE, Dow Chemical Company, INEOS AG, Solventis Ltd., Jiangsu Sopo (Group) Co. Ltd., Anhui Wanwei Group Co. Ltd., Chang Chun Group, Nippon Paint Holdings Co. Ltd., and LyondellBasell Industries Holdings B.V.

Which region dominated the global methyl acetate market share?

North America held the dominating position in methyl acetate industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of methyl acetate during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global methyl acetate industry?

The current trends and dynamics in the methyl acetate industry include growing demand from the paints and coatings industry, and increasing use as a solvent in various industrial applications.

Which application held the maximum share in 2022?

The adhesives and sealants application held the maximum share of the methyl acetate industry.