Methazolamide Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Methazolamide Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

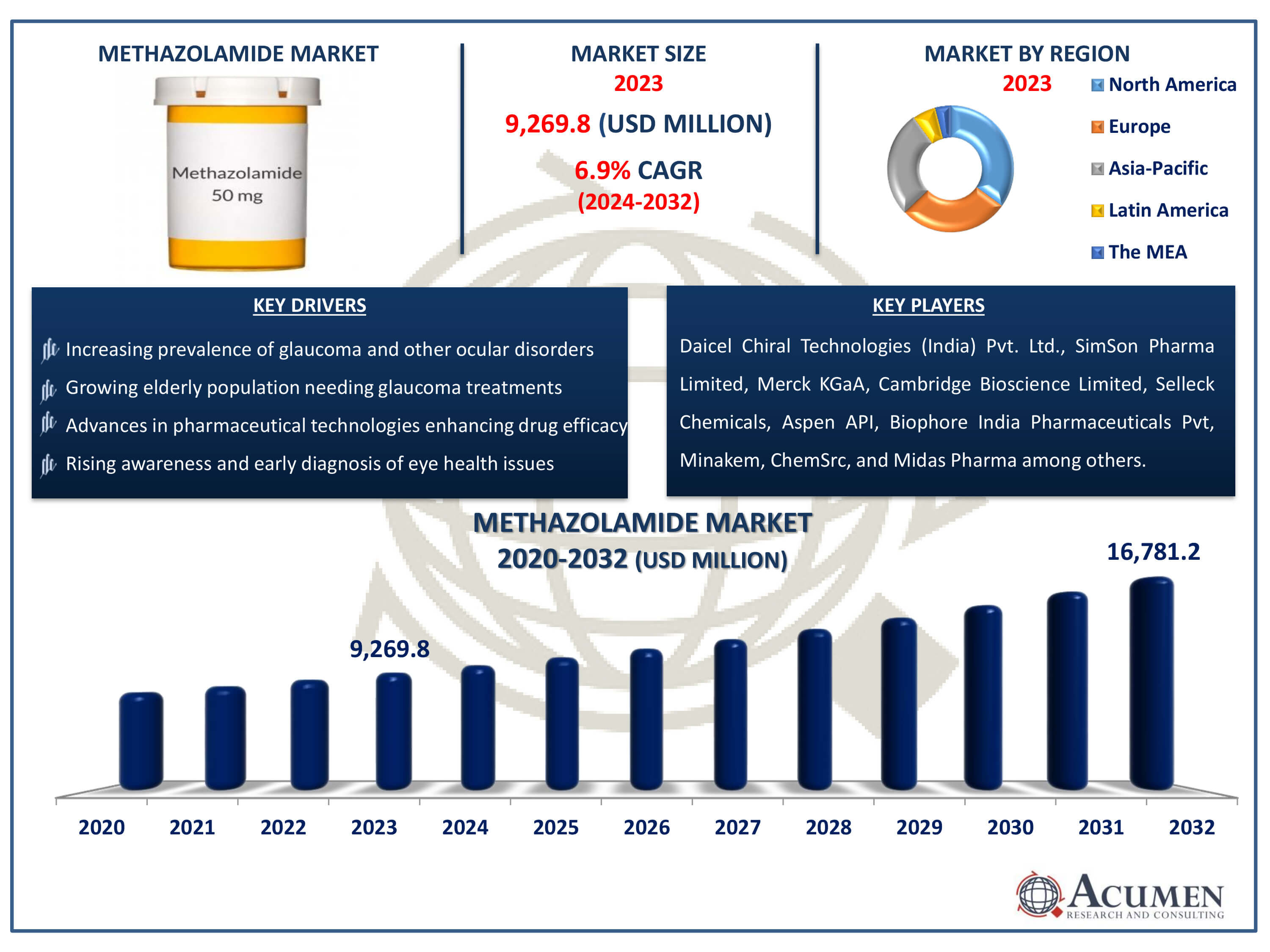

The Methazolamide Market Size accounted for USD 9,269.8 Million in 2023 and is estimated to achieve a market size of USD 16,781.2 Million by 2032 growing at a CAGR of 6.9% from 2024 to 2032.

Methazolamide Market Highlights

- The global methazolamide market revenue is projected to reach USD 16,781.2 million by 2032, growing at a CAGR of 6.9% from 2024 to 2032.

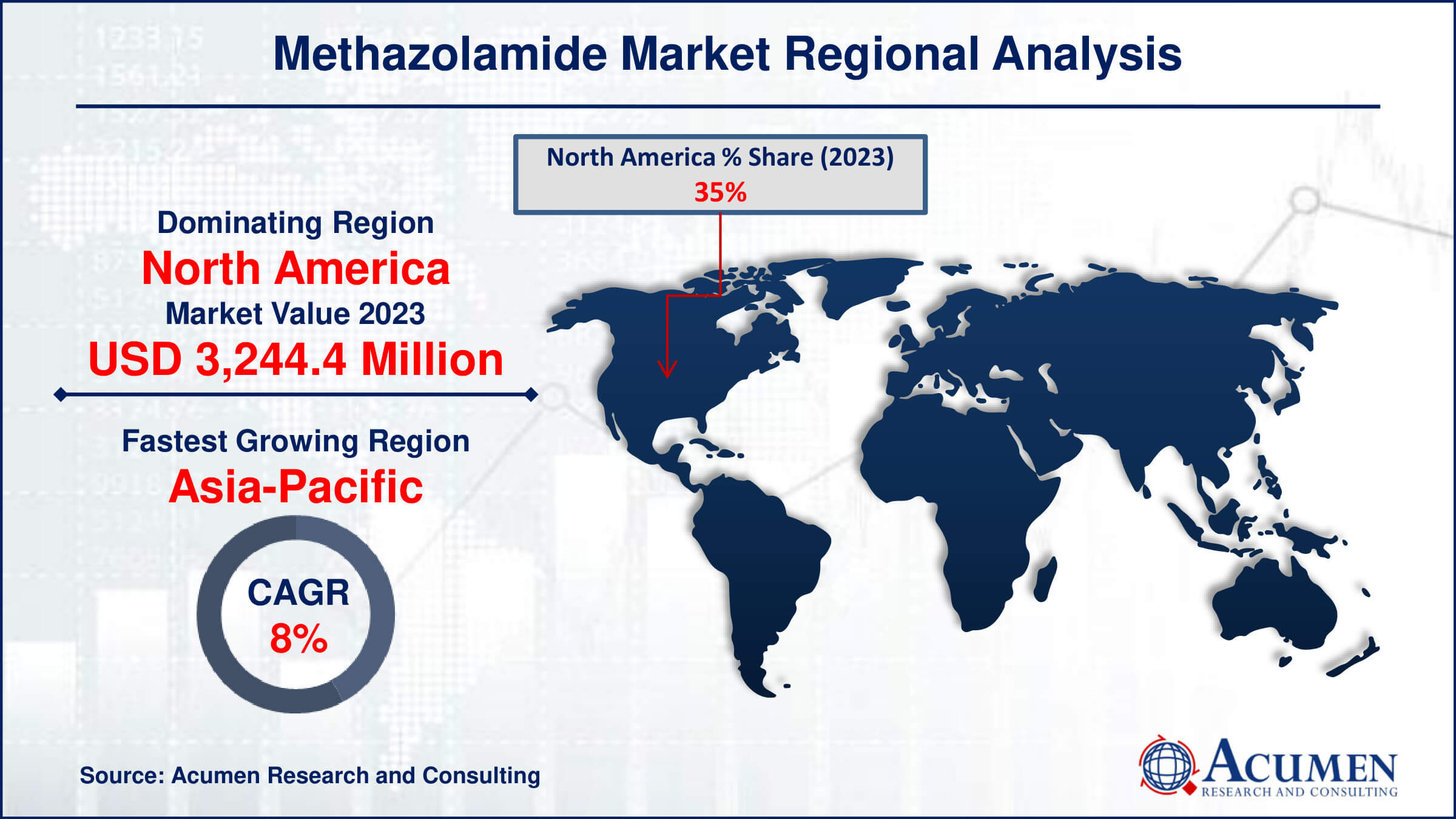

- In 2023, the North America methazolamide market was valued at approximately USD 3,244.4 million

- From 2024 to 2032, the Asia-Pacific methazolamide market is expected to achieve a CAGR of 8%

- Based on product type, oral tablets sub-segment dominated in terms of revenue in 2023

- Among applications, glaucoma treatment sub-segment held the largest market share in 2023

- Research focus on combination therapies to enhance treatment efficacy is a popular methazolamide market trend that creates demand across the world

Methazolamide is a carbonic anhydrase inhibitor that is often used to treat glaucoma, which is characterized by elevated intraocular pressure. Methazolamide lowers intraocular pressure by blocking the enzyme carbonic anhydrase, which causes the eye to produce less aqueous fluid. This action helps to avoid optic nerve damage and visual loss in glaucoma sufferers. Unlike several other glaucoma drugs, methazolamide is given orally, making it a systemic therapy option.

Methazolamide is used to treat metabolic and respiratory problems, in addition to glaucoma. It can help to rectify metabolic alkalosis and has been used to treat altitude sickness by reducing symptoms like headache, nausea, and dizziness. The medication accomplishes this by causing a moderate acidosis, which can counteract the alkalosis that frequently occurs in high-altitude situations. However, like with any medication, methazolamide can cause adverse effects such as weariness, taste changes, and more serious reactions such as electrolyte imbalance and blood problems, demanding close medical supervision while in use.

Global Methazolamide Market Dynamics

Market Drivers

- Increasing prevalence of glaucoma and other ocular disorders globally

- Growing elderly population needing glaucoma treatments

- Advances in pharmaceutical technologies enhancing drug efficacy

- Rising awareness and early diagnosis of eye health issues

Market Restraints

- Potential side effects limiting widespread usage

- Availability and preference for alternative glaucoma treatments

- High treatment costs impacting patient accessibility

Market Opportunities

- Expansion into untapped emerging markets

- Development of innovative combination therapies

- Research into new therapeutic applications for methazolamide

Methazolamide Market Report Coverage

| Market | Methazolamide Market |

| Methazolamide Market Size 2022 | USD 9,269.8 Million |

| Methazolamide Market Forecast 2032 | USD 16,781.2 Million |

| Methazolamide Market CAGR During 2023 - 2032 | 6.9% |

| Methazolamide Market Analysis Period | 2020 - 2032 |

| Methazolamide Market Base Year |

2022 |

| Methazolamide Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Daicel Chiral Technologies (India) Pvt. Ltd., SimSon Pharma Limited, Merck KGaA, Cambridge Bioscience Limited, Selleck Chemicals, Aspen API, Biophore India Pharmaceuticals Pvt, Minakem, ChemSrc, Midas Pharma GmbH, Novartis AG, and Teva Pharmaceutical Industries Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Methazolamide Market Insights

The methazolamide market is driven by the growing prevalence of glaucoma and other ocular disorders worldwide. As a primary treatment for glaucoma, methazolamide effectively reduces intraocular pressure, thereby preventing optic nerve damage and vision loss. The increasing geriatric population, which is more susceptible to glaucoma, further fuels demand for the medication. Advances in pharmaceutical technology have also enhanced methazolamide's efficacy and safety profile, making it a preferred choice among healthcare professionals.

Despite its benefits, the market faces challenges. Methazolamide's potential side effects, including electrolyte imbalances and blood disorders, limit its widespread adoption. Alternative treatments, such as other medications and surgical options, also pose stiff competition. Additionally, high treatment costs can hinder patient accessibility in developing regions. However, methazolamide remains a crucial component of glaucoma management for patients who do not respond to other treatments.

Emerging markets present opportunities for growth, as healthcare infrastructure improves and ocular health awareness increases. Expanding into these markets could significantly boost sales and market penetration. Innovative combination therapies that include methazolamide could enhance treatment efficacy and patient compliance. Research into new therapeutic applications beyond glaucoma also presents growth potential.

Methazolamide Market Segmentation

The worldwide market for methazolamide is split based on type, application, and geography.

Methazolamides Market By Product Type

- Oral Tablets

- Injectable

According to the methazolamide industry analysis, oral tablets outperform injectables due to their ease, more patient compliance, and cost-effectiveness. Oral tablets are favored for chronic illnesses such as glaucoma because they can be self-administered at home, reducing the need for frequent physician appointments. Furthermore, oral formulations are more widely available in pharmacies and online, making them more convenient for patients. These reasons contribute to oral tablets having a larger market share in the methazolamide industry than injectable versions.

Methazolamides Market By Application

- Glaucoma Treatment

- Altitude Sickness

- Metabolic Disorders

- Others

According to our methazolamide market analysis, glaucoma treatment dominates over other applications. Glaucoma is a common chronic eye disorder that requires ongoing treatment to lower intraocular pressure and prevent vision loss. According to the World Health Organization (WHO), there were more than 60 million suspected cases of glaucoma worldwide in 2023. Methazolamide is extensively given as an oral drug due to its efficacy in decreasing intraocular pressure, making it an essential treatment for glaucoma sufferers. While methazolamide is also used to treat altitude sickness and metabolic disorders, it is most commonly used to treat glaucoma due to its high demand and prevalence worldwide. As a result, glaucoma therapy greatly outperforms other uses in boosting the methazolamide industry.

Methazolamide Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Methazolamide Market Regional Analysis

The methazolamide market exhibits varying dynamics across different regions globally. North America and Europe are prominent regions, driven by advanced healthcare infrastructure, high prevalence of glaucoma, and robust pharmaceutical industries. These regions benefit from extensive research and development activities, which contribute to the introduction of innovative therapies and formulations. Moreover, the presence of key pharmaceutical companies and well-established distribution networks further strengthens market growth in these areas. The regions' strong economies and high disposable incomes also enable patients to access premium treatments.

Asia-Pacific is emerging as a significant market for methazolamide, fueled by increasing healthcare expenditure, improving access to healthcare services, and rising awareness about ocular health. The region's large population base, coupled with the aging population and changing lifestyles, contributes to the expanding market opportunities. Latin America and the Middle East & Africa regions are also experiencing gradual growth in the methazolamide market, supported by improving healthcare infrastructure and increasing initiatives to combat eye diseases.

Methazolamide Market Players

Some of the top methazolamide companies offered in our report include Daicel Chiral Technologies (India) Pvt. Ltd., SimSon Pharma Limited, Merck KGaA, Cambridge Bioscience Limited, Selleck Chemicals, Biophore India Pharmaceuticals Pvt, Minakem, ChemSrc, Midas Pharma GmbH, Novartis AG, and Teva Pharmaceutical Industries Ltd.

Frequently Asked Questions

How big is the methazolamide market?

The methazolamide market size was valued at USD 9,269.8 million in 2023.

What is the CAGR of the global methazolamide market from 2024 to 2032?

The CAGR of methazolamide industry is 6.9% during the analysis period of 2024 to 2032.

Which are the key players in the methazolamide market?

The key players operating in the global market are including Daicel Chiral Technologies (India) Pvt. Ltd., SimSon Pharma Limited, Merck KGaA, Cambridge Bioscience Limited, Selleck Chemicals, Aspen API, Biophore India Pharmaceuticals Pvt, Minakem, ChemSrc, Midas Pharma GmbH, Novartis AG, and Teva Pharmaceutical Industries Ltd.

Which region dominated the global methazolamide market share?

North America held the dominating position in methazolamide industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of methazolamide during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global methazolamide industry?

The current trends and dynamics in the methazolamide industries include increasing prevalence of glaucoma and other ocular disorders globally, growing elderly population needing glaucoma treatments, and advances in pharmaceutical technologies enhancing drug efficacy.

Which product type held the maximum share in 2023?

The oral tablets held the maximum share of the methazolamide industry.