Metallocene Lldpe Market | Acumen Research and Consulting

Metallocene LLDPE Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

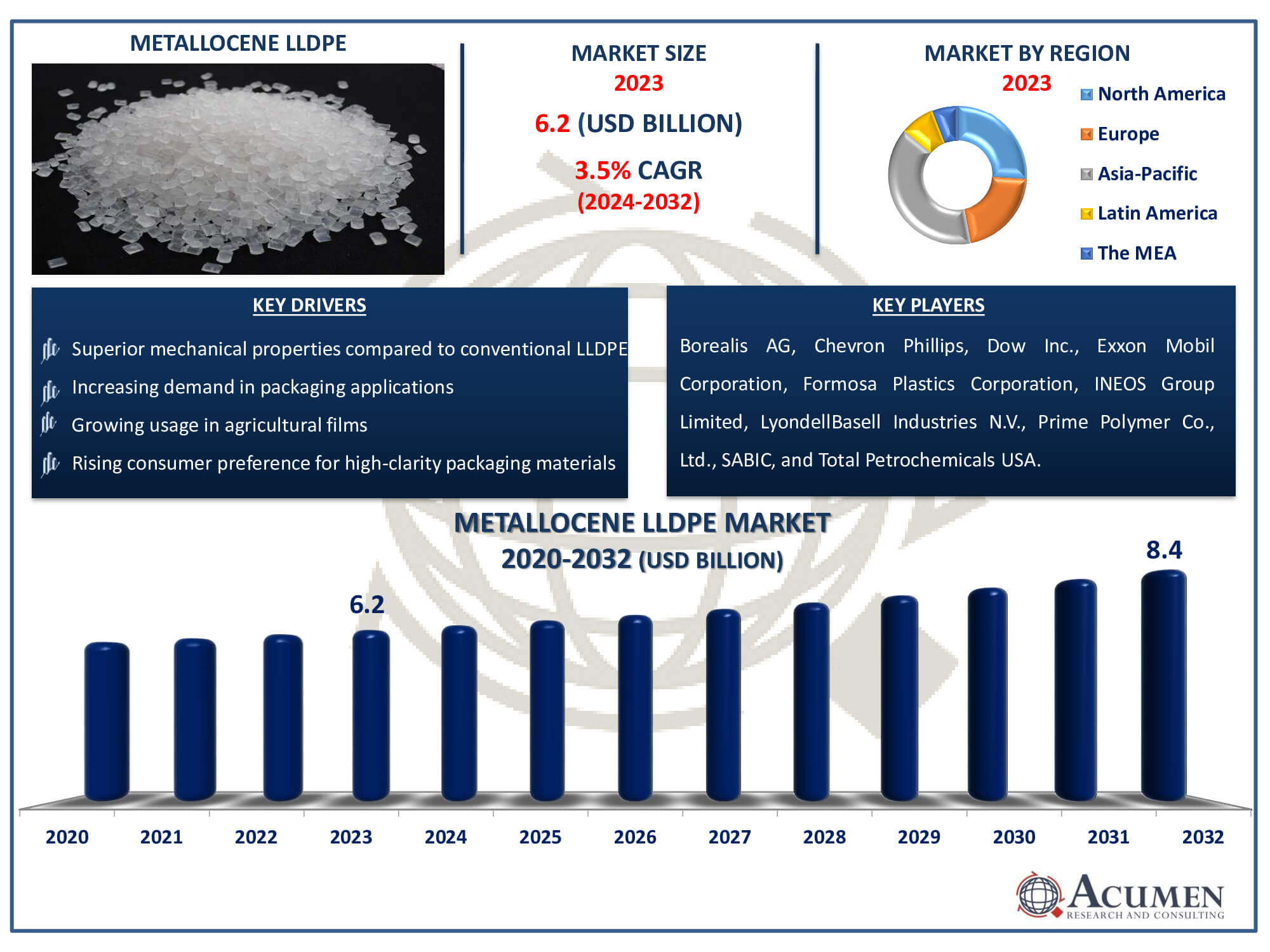

The Metallocene LLDPE Market Size accounted for USD 6.2 Billion in 2023 and is estimated to achieve a market size of USD 8.4 Billion by 2032 growing at a CAGR of 3.5% from 2024 to 2032.

Metallocene LLDPE Market Highlights

- The global metallocene LLDPE market is projected to reach USD 8.4 billion by 2032, growing at a CAGR of 3.5% from 2024 to 2032

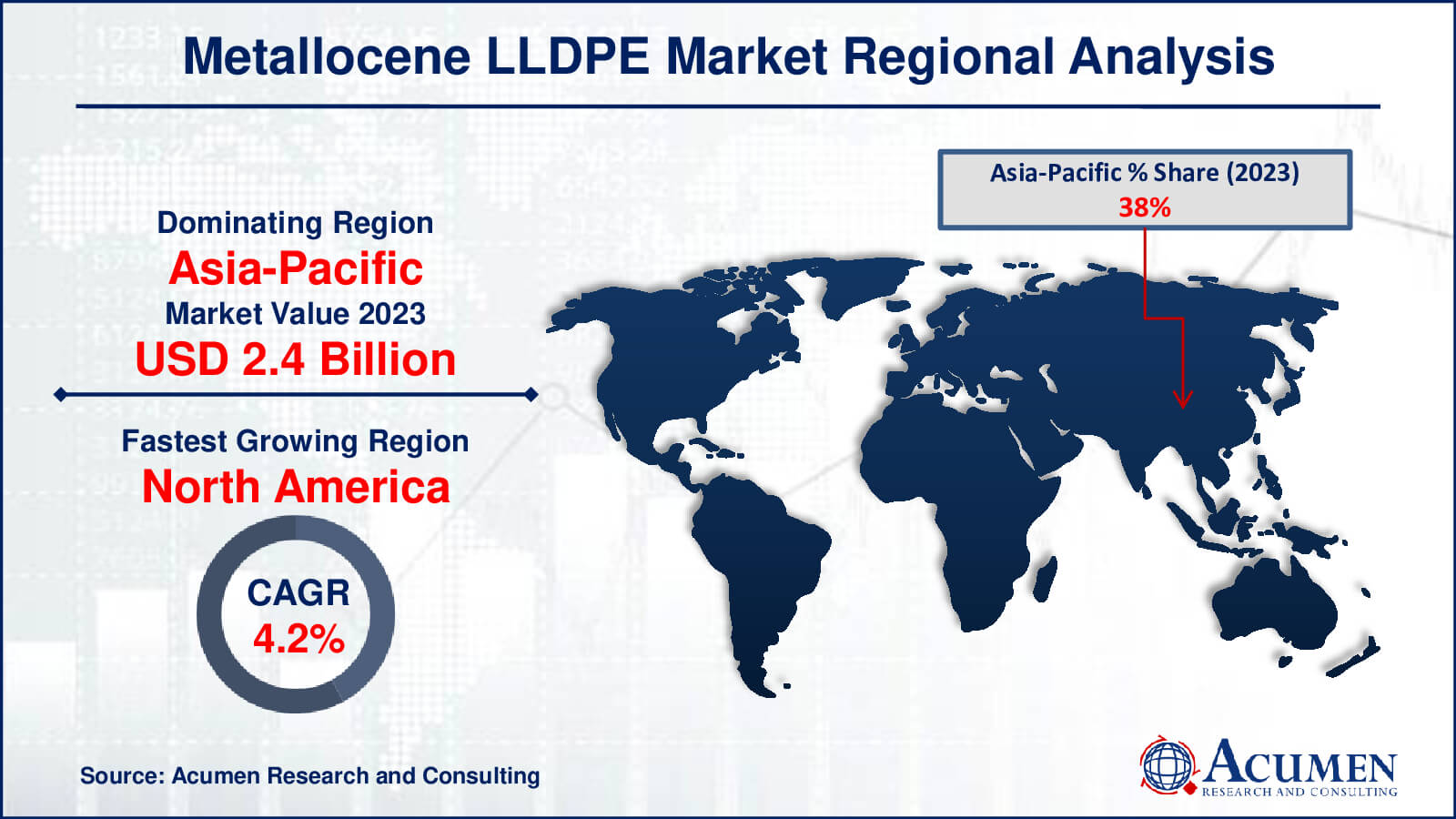

- The Asia-Pacific metallocene LLDPE market was valued at USD 2.4 billion in 2023

- North America metallocene LLDPE market is expected to grow at a CAGR of 4.2% from 2024 to 2032

- Based on type, the C8 mLLDPE (octene-based metallocene LLDPE) occupied significant revenue in 2023

- The film application held around 55% share in the metallocene LLDPE market in 2023

- Increasing adoption of sustainable and recyclable packaging solutions is a key trend in the metallocene LLDPE market, boosting industry growth

Metallocene linear low-density polyethylene (mLLDPE) is a kind of polyethylene made with metallocene catalysts. These catalysts are more exact than typical catalysts, giving you greater control over the polymer's molecular structure. As a result, mLLDPE offers superior qualities than traditional LLDPE, such as increased toughness, clarity, and tensile strength. The metallocene technique produces polymers with uniform molecular weight distribution and precise comonomer insertion, resulting in a higher performance material that is especially valuable in applications requiring exceptional mechanical qualities and optical clarity.

mLLDPE is frequently utilized in the packaging industry due to its superior sealing qualities, puncture resistance, and flexibility. It is widely used in the manufacture of films for food packaging, stretch wrap, and heavy-duty sacks. Furthermore, its improved mechanical qualities make it appropriate for use in industrial packaging, agricultural films, and consumer products. Manufacturers benefit from the material's better processability and uniformity because it enables more efficient production processes and reduces material waste. Overall, mLLDPE's unique qualities and numerous applications make it a popular choice in industries that require high-performance polyethylene.

Global Metallocene LLDPE Market Dynamics

Market Drivers

- Superior mechanical properties compared to conventional LLDPE

- Increasing demand in packaging applications for enhanced durability

- Growing usage in agricultural films due to its superior performance

- Rising consumer preference for high-clarity packaging materials

Market Restraints

- Higher production costs compared to traditional LLDPE

- Limited availability of metallocene catalysts

- Fluctuations in raw material prices affecting production costs

Market Opportunities

- Expansion into emerging markets with rising packaging demands

- Technological advancements in catalyst development for cost reduction

- Increasing use in medical and pharmaceutical packaging applications

Metallocene LLDPE Market Report Coverage

| Market | Metallocene Linear Low-Density Polyethylene Market |

| Metallocene Linear Low-Density Polyethylene Market Size 2022 | USD 6.2 Billion |

| Metallocene Linear Low-Density Polyethylene Market Forecast 2032 | USD 8.4 Billion |

| Metallocene Linear Low-Density Polyethylene Market CAGR During 2023 - 2032 | 3.5% |

| Metallocene Linear Low-Density Polyethylene Market Analysis Period | 2020 - 2032 |

| Metallocene Linear Low-Density Polyethylene Market Base Year |

2022 |

| Metallocene Linear Low-Density Polyethylene Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Borealis AG, Chevron Phillips Chemical Company, Dow Inc., Exxon Mobil Corporation, Formosa Plastics Corporation, INEOS Group Limited, LyondellBasell Industries N.V., Prime Polymer Co., Ltd., SABIC, and Total Petrochemicals USA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Metallocene LLDPE Market Insights

The metallocene linear low-density polyethylene (mLLDPE) market is influenced by a number of main factors. One of the key motivations is mLLDPE's higher performance characteristics when compared to standard LLDPE. Metallocene catalysts provide greater control over the polymer structure, resulting in improved mechanical qualities such as increased tensile strength, impact resistance, and clarity. These characteristics make mLLDPE particularly appealing for use in high-quality packaging films, agricultural films, and industrial films where performance and durability are essential. The increased demand for high-performance packaging materials from the food and beverage, healthcare, and consumer goods industries is driving market expansion.

Despite its benefits, the mLLDPE market has various constraints that may limit its growth. Metallocene catalysts have greater production costs than typical catalysts, which presents a considerable hurdle. This pricing gap may hinder the adoption of mLLDPE, especially among small and medium-sized businesses that are vulnerable to price swings. Furthermore, the scarcity of metallocene catalysts might cause supply chain disruptions, compromising the regular manufacture of mLLDPE. Fluctuations in raw material costs, notably ethylene, add to market instability, affecting the total cost structure and profitability of mLLDPE makers.

Technological developments and new applications have created numerous opportunities in the mLLDPE market. The development of new and more efficient metallocene catalysts has the potential to significantly lower manufacturing costs and improve the characteristics of mLLDPE, making it more competitive with regular LLDPE. The increased emphasis on sustainability and environmental responsibility creates new opportunities for mLLDPE, since its superior mechanical qualities enable the manufacturing of thinner, stronger films, decreasing material usage and waste. Furthermore, expanding into new areas, where industrialization and urbanization are quickly increasing, offers tremendous growth opportunities. These regions are experiencing an increase in demand for high-quality packaging and construction materials, creating an atmosphere conducive to the use of mLLDPE.

Metallocene LLDPE Market Segmentation

The worldwide market for metallocene LLDPE is split based on type, application, end-use industry, and geography.

mLLDPE Market By Type

- C4 mLLDPE (Butene-based Metallocene LLDPE)

- C6 mLLDPE (Hexene-based Metallocene LLDPE)

- C8 mLLDPE (Octene-based Metallocene LLDPE)

According to the metallocene LLDPE industry report, C8 mLLDPE (octene-based metallocene LLDPE) has dominated the market due to superior qualities over other varieties. C8 mLLDPE has improved toughness, puncture resistance, and clarity, making it perfect for high-performance applications such premium packaging films and industrial films. Its ability to make stronger and thinner films without sacrificing strength or durability has made it the top choice for producers looking for high-quality, efficient materials. C8 mLLDPE has been widely used due to its adaptability and high mechanical properties, making it the dominant type in the metallocene LLDPE market.

mLLDPE Market By Application

- Film

- Packaging Films

- Agricultural Films

- Industrial Films

- Stretch and Shrink Films

- Rotational Molding

- Injection Molding

- Pipe

- Others (Extrusion Coating, Wire and Cable Insulation, and Compounding and Blending)

As per the metallocene LLDPE market forecast, film applications, namely packaging films, would dominate due to its widespread use in food packaging, consumer goods, and industrial applications. This dominance stems from mLLDPE's outstanding qualities, which include excellent strength, puncture resistance, and clarity, making it perfect for flexible packaging applications. Agricultural films also serve an important role, benefiting from mLLDPE's durability and barrier characteristics. While other applications such as rotational molding, injection molding, and pipe coatings contribute to the market, film applications stand out due to their widespread use across several industries, creating significant demand and market share in the mLLDPE segment.

mLLDPE Market By End-Use Industry

- Food and Beverage

- Healthcare

- Agriculture

- Consumer Goods

- Industrial

- Construction

- Others

The food and beverage sectors, holds a substantial share of the mLLDPE (metallocene linear low-density polyethylene) market. The exceptional qualities of mLLDPE, such as high strength, flexibility, and barrier performance, are ideal for the severe needs of food packaging and preservation. The consumer products industry also plays an important role, since it uses mLLDPE in a variety of packaging applications due to its exceptional clarity and impact resistance. While other industries, such as healthcare, agricultural, and industrial applications, benefit from the adaptability and durability of mLLDPE, the packaging industry remains the major user, creating significant demand and market growth for mLLDPE globally.

Metallocene LLDPE Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Metallocene LLDPE Market Regional Analysis

The regional study of the metallocene LLDPE (mLLDPE) market reveals various demand patterns in key worldwide areas. North America and Europe are major markets, driven by tight packaging requirements and a significant emphasis on environmentally friendly packaging solutions. These regions value mLLDPE for its better performance in food packaging and consumer goods, indicating strong growth in these industries. Rapid industrialization and urbanization in Asia-Pacific are driving increasing demand for mLLDPE in the packaging, construction, and automotive industries, which is backed by rising consumer markets and infrastructure development. The region also benefits from increased agricultural activity, which raises demand for mLLDPE in agricultural films and other uses.

Latin America, the Middle East, and Africa are seeing an increase in mLLDPE use as industrial sectors and infrastructural projects expand. These regions use mLLDPE for packaging, building, and industrial uses, which are aided by economic expansion and increased urbanization. Overall, while mature markets in North America and Europe lead in terms of technological advancements and stringent regulatory environments that encourage mLLDPE adoption, Asia-Pacific and emerging regions provide significant growth opportunities due to their expanding economies and changing industrial landscapes.

Metallocene LLDPE Market Players

Some of the top metallocene LLDPE companies offered in our report includes Borealis AG, Chevron Phillips Chemical Company, Dow Inc., Exxon Mobil Corporation, Formosa Plastics Corporation, INEOS Group Limited, LyondellBasell Industries N.V., Prime Polymer Co., Ltd., SABIC, and Total Petrochemicals USA.

Frequently Asked Questions

How big is the metallocene LLDPE market?

The metallocene LLDPE market size was valued at USD 6.2 billion in 2023.

What is the CAGR of the global metallocene LLDPE market from 2024 to 2032?

The CAGR of metallocene LLDPE industry is 3.5% during the analysis period of 2024 to 2032.

Which are the key players in the metallocene LLDPE market?

The key players operating in the global market are including Borealis AG, Chevron Phillips Chemical Company, Dow Inc., Exxon Mobil Corporation, Formosa Plastics Corporation, INEOS Group Limited, LyondellBasell Industries N.V., Prime Polymer Co., Ltd., SABIC, and Total Petrochemicals USA.

Which region dominated the global metallocene LLDPE market share?

Asia-Pacific held the dominating position in metallocene LLDPE industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of metallocene LLDPE during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global metallocene LLDPE industry?

The current trends and dynamics in the metallocene LLDPE market include superior mechanical properties compared to conventional LLDPE, increasing demand in packaging applications for enhanced durability, and growing usage in agricultural films due to its superior performance.

Which type held the maximum share in 2023?

The C8 mLLDPE (octene-based metallocene LLDPE) held the maximum share of the metallocene LLDPE industry.