Metal Forming Fluids Market | Acumen Research and Consulting

Metal Forming Fluids Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

The Metal Forming Fluids Market Size accounted for USD 10.2 Billion in 2023 and is estimated to achieve a market size of USD 14.3 Billion by 2032 growing at a CAGR of 3.9% from 2024 to 2032.

Metal Forming Fluids Market Highlights

- Global metal forming fluids market revenue is poised to garner USD 14.3 billion by 2032 with a CAGR of 3.9% from 2024 to 2032

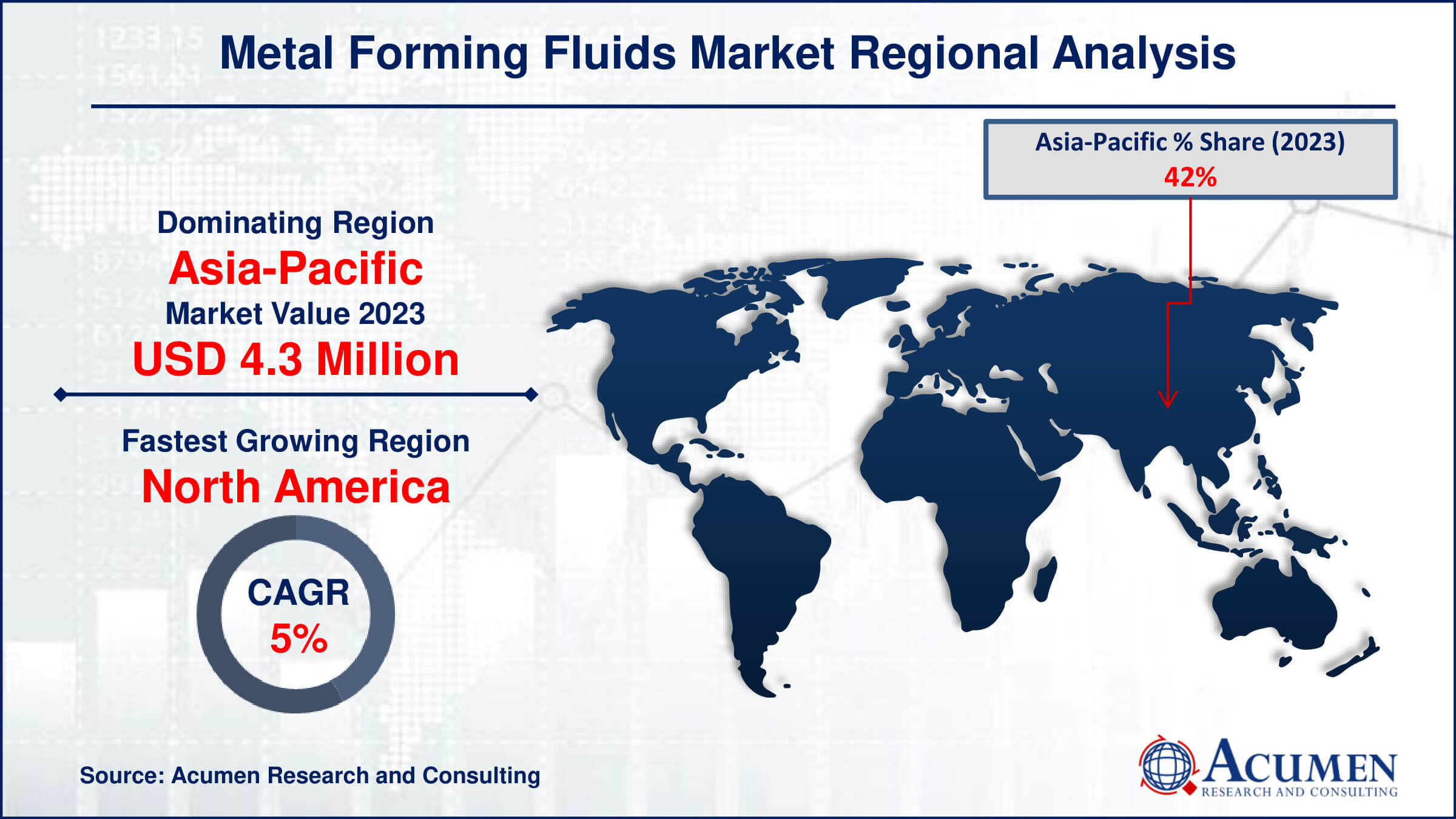

- Asia-Pacific metal forming fluids market value occupied around USD 4.3 billion in 2023

- North America metal forming fluids market growth will record a CAGR of more than 5% from 2024 to 2032

- Among process types, the drawing fluids sub-segment expected to generate significant share in 2023

- Based on end-user industry, the automotive sub-segment expected to generate notable market share in 2023

- Increasing demand for bio-based metal forming fluids due to environmental regulations and sustainability initiatives is the metal forming fluids market trend that fuels the industry demand

Metal forming fluids, also known as metalworking fluids (MWFs), are specialized lubricants used in various metal forming processes such as stamping, drawing, and forging. These fluids serve multiple purposes, including cooling, lubricating, and protecting metal surfaces and tools during forming operations. They help reduce friction and wear, improve surface finish, and extend the lifespan of both the tools and the metal parts being processed. Additionally, metal forming fluids play a crucial role in dissipating heat generated during these processes, thereby preventing thermal deformation and ensuring dimensional accuracy. Common types include water-soluble oils, synthetic fluids, and semi-synthetic fluids, each tailored for specific applications and metal types. They are essential in industries such as automotive, aerospace, and manufacturing, where precision and efficiency are paramount. Proper selection and management of these fluids are vital for optimizing production processes and maintaining high-quality standards in metal forming operations.

Global Metal Forming Fluids Market Dynamics

Market Drivers

- Increasing demand from the automotive industry for lightweight and high-strength metal components

- Growing industrialization and manufacturing activities in emerging economies

- Advancements in metalworking technologies requiring high-performance metal forming fluids

Market Restraints

- Environmental regulations and disposal challenges related to metal forming fluids

- Volatility in raw material prices affecting production costs

- Health concerns and occupational hazards associated with prolonged exposure to certain chemicals in metal forming fluids

Market Opportunities

- Development of eco-friendly and biodegradable metal forming fluids

- Expansion of end-use industries like aerospace and defense requiring specialized metal forming solutions

- Technological innovations in formulation and application techniques to enhance efficiency and performance

Metal Forming Fluids Market Report Coverage

| Market | Metal Forming Fluids Market |

| Metal Forming Fluids Market Size 2022 | USD 10.2 Billion |

| Metal Forming Fluids Market Forecast 2032 | USD 14.3 Billion |

| Metal Forming Fluids Market CAGR During 2023 - 2032 | 3.9% |

| Metal Forming Fluids Market Analysis Period | 2020 - 2032 |

| Metal Forming Fluids Market Base Year |

2022 |

| Metal Forming Fluids Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Process Type, By Application, By End-User Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Houghton, Quaker, BP, Fuchs SE, ExxonMobil, Metalworking Lubricants, Chevron, Henkel, Milacron, Chemtool, Yushiro, Master Chemical, Blaser, and Doware. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Metal Forming Fluids Market Insights

The metal forming fluids market is experiencing significant growth due to the rising demand from the automotive industry for lightweight and high-strength metal components. For instance, according to National Library of Medicine, Light weighting is emerging as a major trend, impacting various industrial sectors including all forms of transportation, civil infrastructure, manufacturing, and clean energy technologies. As automakers strive to improve fuel efficiency and vehicle performance, there is an increased need for advanced materials that can withstand high stress while reducing overall weight. Metal forming fluids play a crucial role in the manufacturing processes of these components, providing necessary lubrication and cooling to ensure precision and durability. Consequently, innovations and advancements in metal forming fluids are critical to meeting the stringent requirements of modern automotive production. This trend is expected to drive continuous expansion in the market as the automotive industry evolves.

The growth of the metal forming fluids market is hindered by stringent environmental regulations and disposal challenges. These fluids, essential for various manufacturing processes, contain chemicals that can pose environmental and health risks if not properly managed. Regulatory bodies enforce strict guidelines on the use, disposal, and recycling of these fluids, increasing compliance costs for manufacturers. The complex disposal process, involving treatment and potential hazardous waste classification, further complicates adherence to these regulations. Consequently, the industry faces increased operational costs and logistical hurdles, impeding market expansion.

The expansion of end-use industries such as aerospace and defense is driving the demand for advanced metal forming solutions. For instance, according to Invest India, in the Union Budget for the financial year 2023-24, the Indian government has allocated ?1,62,600 crore for the modernization and infrastructure development of the Defence Services. This represents a 6.7% increase compared to the previous year's allocation for 2022-23. These sectors require precision-engineered components, which necessitate specialized forming techniques to meet stringent quality and performance standards. The increasing complexity and technological advancements in aerospace and defense projects are pushing manufacturers to adopt innovative metal forming processes. Consequently, the metal forming market is poised for growth as it aligns with the evolving needs of these high-tech industries.

Metal Forming Fluids Market Segmentation

The worldwide market for metal forming fluids is split based on product, process types, application, end-use industry, and geography.

Metal Forming Fluid Market By Products

- Neat Oils

- Emulsified Oils

- Semi Synthetics

- Water Based Emulsifiable Synthetic Fluids

- Water Based Synthetic Fluid Solutions

- Others

According to the metal forming fluids industry forecast, neat oils and semi-synthetics play crucial roles in the metal forming fluids market due to their superior lubrication and cooling properties, which enhance tool life and surface finish in metalworking processes. Neat oils, being pure oils, provide excellent lubrication, reducing friction and wear, while semi-synthetics, a blend of synthetic and mineral oils, offer a balance of lubrication, cooling, and cost-effectiveness. Their application ensures efficient metal deformation, lower maintenance costs, and improved production quality. As the demand for high-precision and durable metal products rises, the importance of these fluids in maintaining operational efficiency and product quality becomes increasingly significant.

Metal Forming Fluid Market By Process Type

- Stamping Fluids

- Drawing Fluids

- Forging Fluids

According to the metal forming fluids industry analysis, drawing fluids are expected to dominate the metal forming fluid market due to their crucial role in the metalworking process. These fluids are specifically formulated to facilitate the drawing of metals, such as steel or aluminum, into various shapes and forms through processes like deep drawing or cold rolling. Their ability to reduce friction, dissipate heat, and improve surface finish makes them indispensable in industrial applications. As manufacturing demands grow for precision and efficiency, drawing fluids remain integral to enhancing productivity and maintaining quality in metal forming operations.

Metal Forming Fluid Market By Application

- Forging

- Sheet Metal Stamping

- Drawing, Warm & Hot Forming

- Blanking

- Others

According to the metal forming fluids industry forecast, forging fluids are crucial in reducing friction and wear, enhancing the quality of metal parts. Sheet metal stamping fluids improve lubrication and cooling, ensuring precision and prolonging tool life. Drawing, warm, and hot forming fluids provide the necessary lubrication and heat resistance, facilitating the smooth deformation of metals. Blanking fluids are essential in maintaining clean cuts and reducing tool wear during the separation of metal sheets. Together, these fluids play a vital role in the metal forming industry by optimizing efficiency, extending tool life, and ensuring high-quality outputs.

Metal Forming Fluid Market By End-User Industry

- Automotive

- Aerospace

- Manufacturing

According to the metal forming fluids industry forecast, the automotive industry anticipated to rule the market. This dominance is primarily due to the extensive use of metal forming processes in automotive manufacturing. Car bodies, engine components, and various other parts require metal forming operations such as stamping, drawing, and extrusion, which necessitate the use of metal forming fluids. These fluids aid in reducing friction, dissipating heat, and improving the quality of formed parts, making them crucial in automotive production. Therefore, the automotive sector is a major consumer and driver of demand for metal forming fluids globally.

Metal Forming Fluids Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Metal Forming Fluids Market Regional Analysis

For several reasons, the Asia-Pacific region leads the global market for metal forming fluids due to robust industrial growth and increasing manufacturing activities across countries like China, India, and Japan. For instance, China's industrial production experienced steady growth last year, with value-added industrial output, a key economic indicator increasing by 4.6 percent year-on-year in 2023, according to the National Bureau of Statistics (NBS). This dominance is bolstered by expanding automotive and aerospace sectors, which are significant consumers of metal forming fluids for their machining operations. Additionally, rising investments in infrastructure and construction further drive demand. Local production capabilities and favorable government policies supporting industrial development contribute to the region's prominence in the metal forming fluids market. As a result, Asia-Pacific continues to be a pivotal center for both consumption and production of these essential industrial fluids.

North America is the fastest-growing region in the metal forming fluids market, driven by robust industrial and manufacturing activities. The region benefits from advanced automotive, aerospace, and construction sectors, which demand high-quality metal forming fluids. Additionally, technological innovations and a strong focus on sustainability and efficiency further bolster market growth in North America.

Metal Forming Fluids Market Players

Some of the top metal forming fluids companies offered in our report include Houghton, Quaker, BP, Fuchs SE, ExxonMobil, Metalworking Lubricants, Chevron, Henkel, Milacron, Chemtool, Yushiro, Master Chemical, Blaser, and Doware.

Frequently Asked Questions

How big is the metal forming fluids market?

The metal forming fluids market size was valued at USD 10.2 Billion in 2023.

What is the CAGR of the global metal forming fluids market from 2024 to 2032?

The CAGR of metal forming fluids is 3.9% during the analysis period of 2024 to 2032.

Which are the key players in the metal forming fluids market?

The key players operating in the global market are including Houghton, Quaker, BP, Fuchs SE, ExxonMobil, Metalworking Lubricants, Chevron, Henkel, Milacron, Chemtool, Yushiro, Master Chemical, Blaser, and Doware.

Which region dominated the global metal forming fluids market share?

Asia-Pacific held the dominating position in metal forming fluids industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of metal forming fluids during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global metal forming fluids industry?

The current trends and dynamics in the metal forming fluids industry include increasing demand from the automotive industry for lightweight and high-strength metal components, growing industrialization and manufacturing activities in emerging economies, and advancements in metalworking technologies requiring high-performance metal forming fluids.

Which process types held the maximum share in 2023?

The drawing fluids expected to hold the maximum share of the metal forming fluids industry.