Membrane Microfiltration Market | Acumen Research and Consulting

Membrane Microfiltration Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

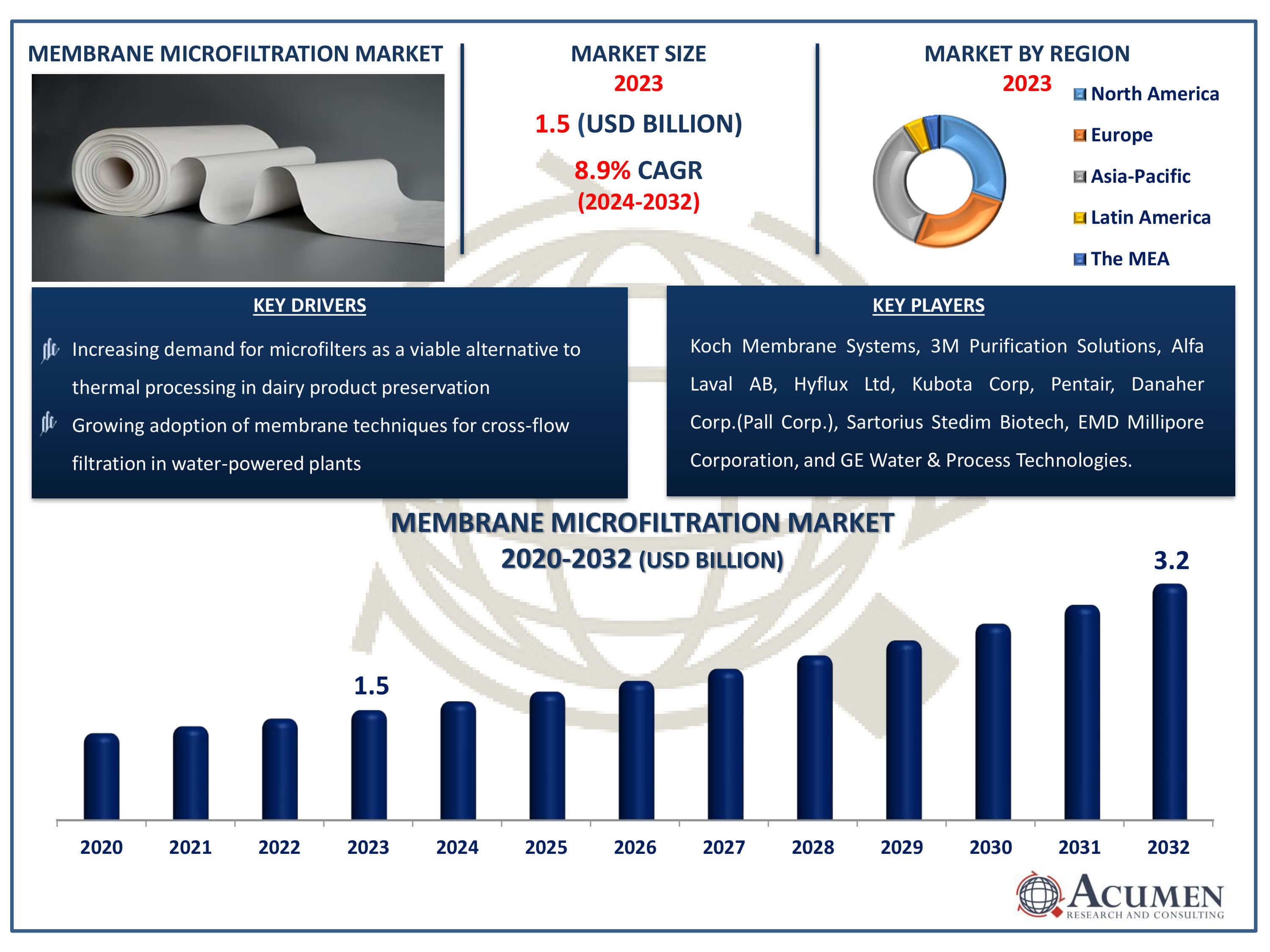

The Membrane Microfiltration Market Size accounted for USD 1.5 Billion in 2023 and is estimated to achieve a market size of USD 3.2 Billion by 2032 growing at a CAGR of 8.9% from 2024 to 2032.

Membrane Microfiltration Market Highlights

- Global membrane microfiltration market revenue is poised to garner USD 3.2 billion by 2032 with a CAGR of 8.9% from 2024 to 2032

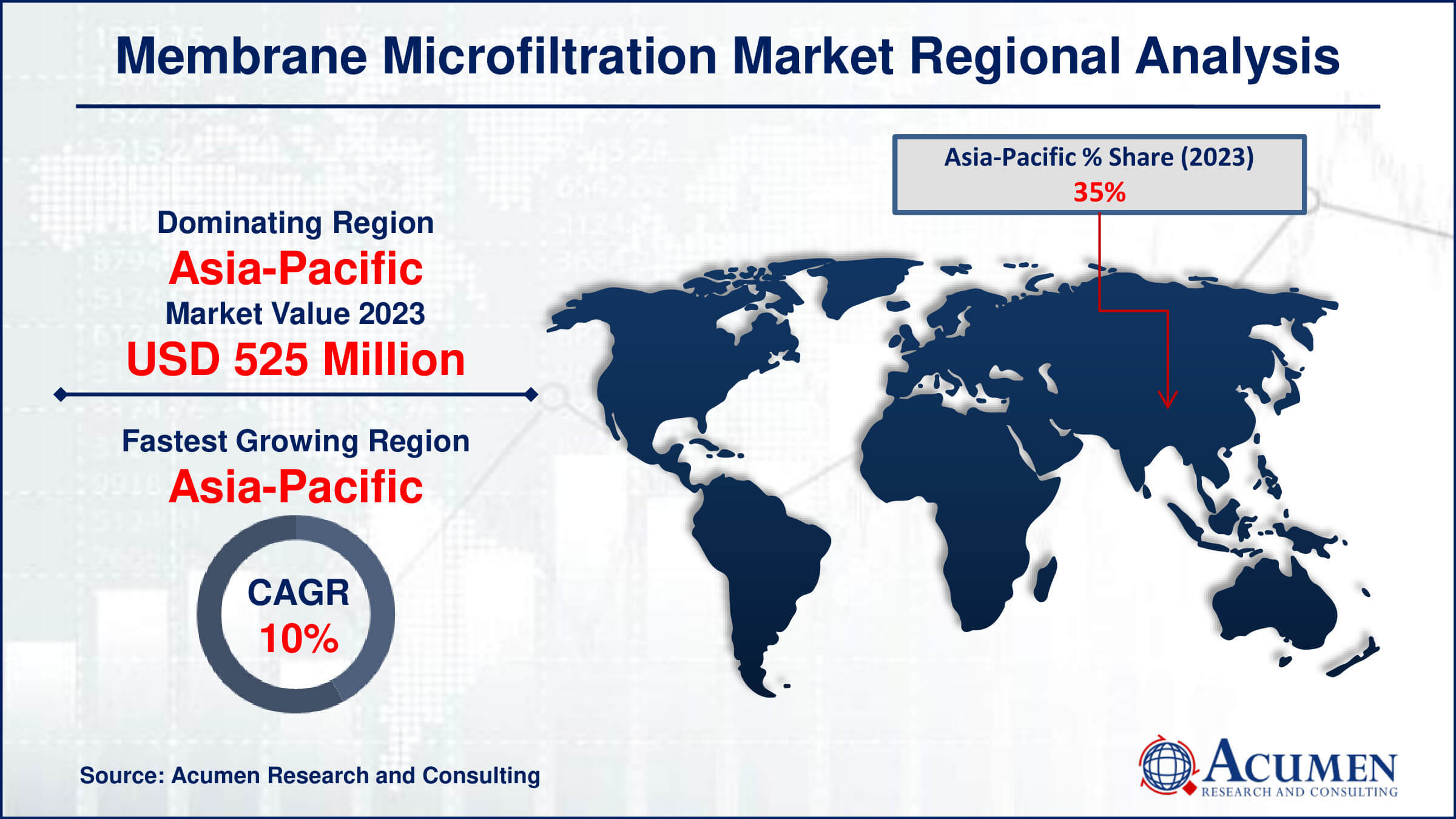

- Asia-Pacific membrane microfiltration market value occupied around USD 525 million in 2023

- Asia-Pacific membrane microfiltration market growth will record a CAGR of more than 10% from 2024 to 2032

- Among material, the organic sub-segment generated significant revenue in 2023

- Based on end user, the water and waste water treatment sub-segment generated noteworthy market share in 2023

- Expansion into emerging markets driven by rapid industrialization is a popular membrane microfiltration market trend that fuels the industry demand

The rising popularity of microfilters as an alternative to thermal processing is significantly reducing bacteria and extending the shelf life of dairy products. Demand from milk processing applications remains a key driver for the growth of the membrane microfiltration market. Additionally, the increasing adoption of membrane techniques for cross-flow filtration in water-powered plants is another critical trend propelling market expansion. Manufacturers are focusing on developing robust and durable microfiltration systems with large filter cartridges, optimizing space utilization and reducing maintenance costs. The shift towards continuous fermentation over batch processing is further supported by the proactive use of membrane microfiltration techniques within industrial ecosystems, which is anticipated to positively influence market growth over the membrane microfiltration industry forecast period. China is experiencing rapid growth in the membrane microfiltration market due to its advanced industrialization. Establishing strong supply chains in these fast-growing regions will enhance market share and sustainability for companies in this sector.

Global Membrane Microfiltration Market Dynamics

Market Drivers

- Increasing demand for microfilters as a viable alternative to thermal processing in dairy product preservation

- Growing adoption of membrane techniques for cross-flow filtration in water-powered plants

- Development of robust microfiltration systems with large filter cartridges, optimizing space utilization

- Preference for continuous fermentation over batch processing, supported by membrane microfiltration techniques

Market Restraints

- Volatility in raw material prices affecting manufacturing costs

- Stringent regulations governing membrane microfiltration processes

- Competition from alternative preservation methods impacting market penetration

Market Opportunities

- Development of innovative membrane microfiltration technologies for enhanced efficiency

- Integration of microfiltration systems into various industrial processes for broader market reach

- Establishment of strong supply chains in fast-growing regions to improve market share and sustainability

Membrane Microfiltration Market Report Coverage

| Market | Membrane Microfiltration Market |

| Membrane Microfiltration Market Size 2022 | USD 1.5 Billion |

| Membrane Microfiltration Market Forecast 2032 | USD 3.2 Billion |

| Membrane Microfiltration Market CAGR During 2023 - 2032 | 8.9% |

| Membrane Microfiltration Market Analysis Period | 2020 - 2032 |

| Membrane Microfiltration Market Base Year |

2022 |

| Membrane Microfiltration Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Filtration Mode, By Material, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Koch Membrane Systems, 3M Purification Solutions, Alfa Laval AB, Hyflux Ltd, Kubota Corp, Pentair, Danaher Corp.(Pall Corp.), Sartorius Stedim Biotech, EMD Millipore Corporation, and GE Water & Process Technologies. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Membrane Microfiltration Market Insights

Microfiltration, an integral facet of physical separation processes, has emerged as a cornerstone technology across a spectrum of industries. Its pivotal role lies in water treatment applications, where it excels in sieving out particles exceeding 0.1 um in diameter, ensuring the purification of crucial resources. Beyond its fundamental utility in water treatment, microfiltration boasts versatile applications in diverse sectors, ranging from pharmaceutical sterilization to fortifying the integrity of food and beverage products by preventing contamination. The burgeoning global concerns regarding water scarcity and quality serve as potent catalysts propelling the growth of the membrane microfiltration market. As the biopharmaceutical and processed food industries witness exponential expansion, the demand for advanced filtration solutions escalates, further bolstering market prospects.

Diaphragm microfiltration emerges as a stalwart in post-aeration treatments, playing a pivotal role in enhancing water quality across various applications. Its integration into household plumbing systems and industrial-scale water treatment plants underscores its indispensability in ensuring clean water access. What sets microfiltration apart is its cost-effectiveness and self-monitoring capabilities, making it an attractive proposition for diverse end-use industries. These inherent advantages, coupled with its adaptability and reliability, position microfiltration as a cornerstone technology driving innovation and sustainability in numerous sectors worldwide.

Membrane Microfiltration Market Segmentation

The worldwide market for membrane microfiltration is split based on filtration mode, material, end user, and geography.

Membrane Microfiltration Filtration Modes

- Direct Flow Membranes

- Cross Flow Membranes

According to membrane microfiltration industry analysis, the cross flow membranes category is the fastest-growing filtration type. Cross flow membranes differ from direct flow membranes in that they enable the feed to flow parallel to the membrane surface rather than through it. This mechanism allows for the continuous removal of pollutants, increasing the effectiveness and lifespan of the filtration process. Cross flow membranes are popular because they can reduce fouling, which is a common problem with direct flow systems. Cross flow membranes prevent particle and impurities from accumulating on the membrane surface, improving membrane lifespan and lowering maintenance requirements. Moreover, Cross flow membranes are well-known for their versatility, with applications spanning industries such as water treatment, pharmaceuticals, and food and beverage processing. Their effectiveness, durability, and adaptability all contribute to their quick adoption and expansion in the membrane microfiltration market.

Membrane Microfiltration Materials

- Organic

- Inorganic

In the membrane microfiltration market, the organic segment is growing faster than the inorganic segment. Several causes have contributed to the recent growth increase. Organic membranes, made from natural polymers or synthetic materials, have several advantages, including increased selectivity, flexibility, and biocompatibility. These membranes are especially suitable for use in delicate industries such as pharmaceuticals and biotechnology, where precise filtration is required to ensure product purity. Furthermore, advances in organic membrane technology have resulted in the creation of novel materials with superior performance characteristics, such as increased fouling resistance and permeability. As industries stress sustainability and environmental responsibility, the biodegradability of organic membranes becomes an appealing attribute, further promoting their use.

Membrane Microfiltration End Users

- Hospitals and Laboratories

- Pharmaceutical and Biopharmaceutical Companies

- Food and Beverage

- Water and Waste Water Treatment

- Others

Water and waste water treatment is anticipated to dominate the end-user segment during the membrane microfiltration market forecast period. This projection is underpinned by several factors. With escalating global concerns regarding water scarcity and pollution, there is a heightened demand for effective water treatment solutions to ensure the availability of clean and safe water for various applications. Membrane microfiltration plays a crucial role in this domain by providing efficient filtration processes that remove contaminants and impurities from water sources. Additionally, stringent regulatory standards and increasing awareness about the importance of water quality drive the adoption of membrane microfiltration technologies in water and wastewater treatment facilities. As a result, this sector is poised to command the largest share of the market, reflecting its significance in addressing pressing environmental and public health challenges.

Membrane Microfiltration Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Membrane Microfiltration Market Regional Analysis

In terms of membrane microfiltration market analysis, Asia-Pacific is both the largest and fastest-growing area. Several variables contribute to this pattern. Asia Pacific, with its growing population and rapid urbanization, is facing serious water scarcity and pollution issues. As a result, there is an urgent need for enhanced water treatment solutions, which drives demand for membrane microfiltration technology. Furthermore, the region's thriving pharmaceutical and biopharmaceutical sectors require stringent filtering processes to ensure product purity, which drives market expansion.

Within the Asia-Pacific region, China stands out as a prominent market growth driver. The country's strong industrialization efforts, combined with government measures to increase environmental sustainability, have boosted investment in water treatment infrastructure and technologies. Furthermore, the growing use of membrane microfiltration in numerous industries, including food and beverage, contributes to market expansion. Furthermore, favorable government regulations and investments in R&D activities promote technological breakthroughs and innovation in membrane microfiltration systems, driving market expansion in the region.

Membrane Microfiltration Market Players

Some of the top membrane microfiltration companies offered in our report includes Koch Membrane Systems, 3M Purification Solutions, Alfa Laval AB, Hyflux Ltd, Kubota Corp, Pentair, Danaher Corp.(Pall Corp.), Sartorius Stedim Biotech, EMD Millipore Corporation, and GE Water & Process Technologies.

Frequently Asked Questions

How big is the membrane microfiltration market?

The membrane microfiltration market size was valued at USD 1.5 billion in 2023.

What is the CAGR of the global membrane microfiltration market from 2024 to 2032?

The CAGR of membrane microfiltration is 8.9% during the analysis period of 2024 to 2032.

Which are the key players in the membrane microfiltration market?

The key players operating in the global market are including Koch Membrane Systems, 3M Purification Solutions, Alfa Laval AB, Hyflux Ltd, Kubota Corp, Pentair, Danaher Corp.(Pall Corp.), Sartorius Stedim Biotech, EMD Millipore Corporation, and GE Water & Process Technologies.

Which region dominated the global membrane microfiltration market share?

Asia-Pacific held the dominating position in membrane microfiltration industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of membrane microfiltration during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global membrane microfiltration industry?

The current trends and dynamics in the membrane microfiltration industry include increasing demand for microfilters as a viable alternative to thermal processing in dairy product preservation, growing adoption of membrane techniques for cross-flow filtration in water-powered plants, development of robust microfiltration systems with large filter cartridges, optimizing space utilization, and preference for continuous fermentation over batch processing, supported by membrane microfiltration techniques.

Which material held the maximum share in 2023?

The organic material held the maximum share of the membrane microfiltration industry.