Medium Voltage Substation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Medium Voltage Substation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Medium Voltage Substation Market Size accounted for USD 31.4 Billion in 2022 and is estimated to achieve a market size of USD 49.5 Billion by 2032 growing at a CAGR of 4.7% from 2024 to 2032.

Medium Voltage Substation Market Highlights

- Global medium voltage substation market revenue is poised to garner USD 49.5 billion by 2032 with a CAGR of 4.7% from 2024 to 2032

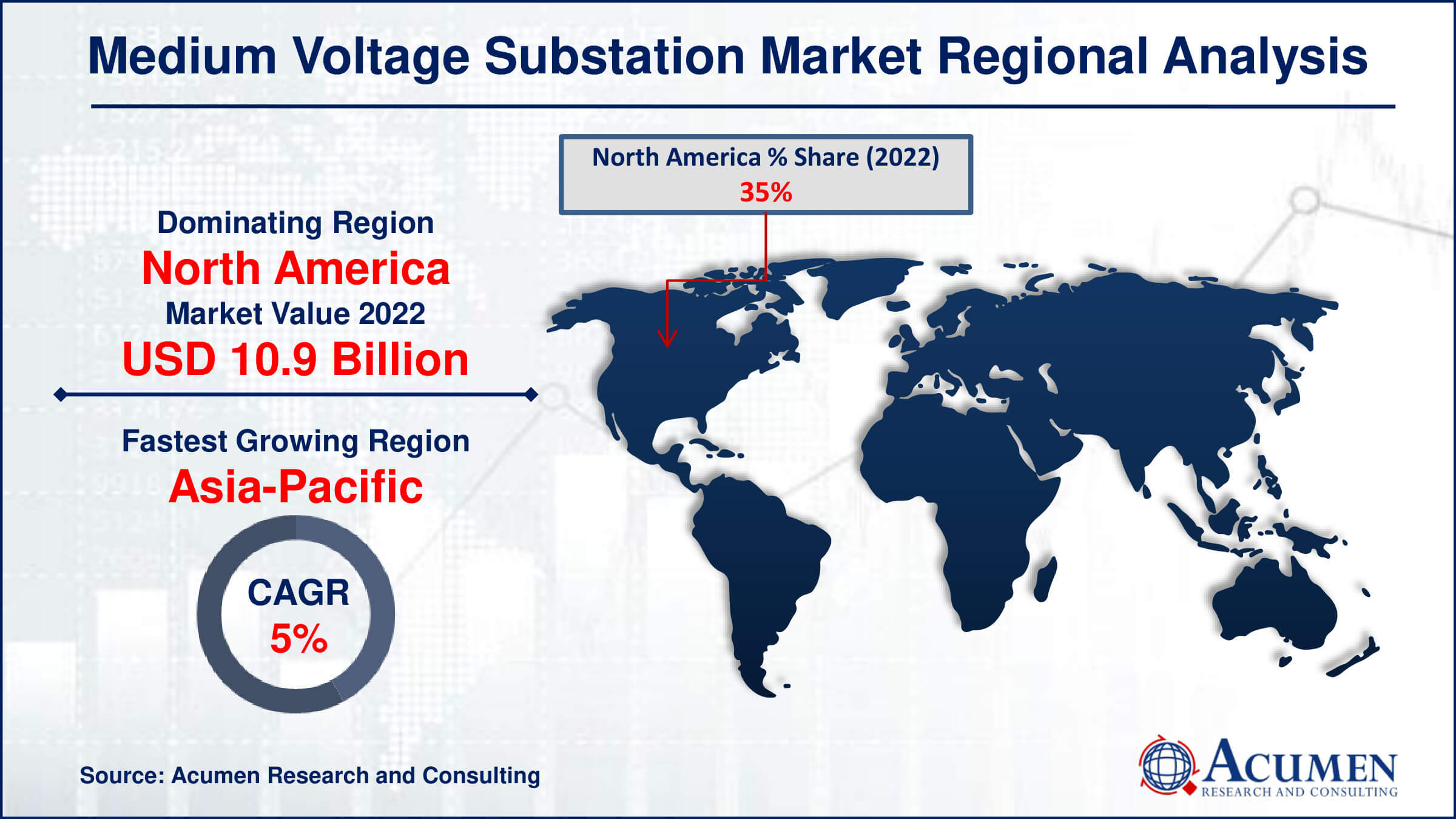

- North America medium voltage substation market value occupied around 35% market share in 2022

- Asia-Pacific medium voltage substation market growth will record a CAGR of more than 5% from 2024 to 2032

- Among component, the circuit breaker sub-segment generated significant market share in 2022

- Based on end-user, the industrial sub-segment contributed for significant revenue in 2022

- Emerging digitalization is becoming a popular medium voltage substation market trend creating demand in coming years

A medium voltage (MV) substation is a crucial component of electrical power distribution systems, typically operating at voltages ranging from 2 kV to 75 kV. It serves as an intermediary between high voltage transmission lines and low voltage distribution networks, facilitating the transformation, switching, and distribution of electrical energy. MV substations are pivotal in ensuring reliable and efficient power supply to residential, commercial, and industrial consumers. They play a vital role in voltage regulation, fault protection, and load management within the distribution grid. Additionally, they enable the integration of renewable energy sources and support the implementation of smart grid technologies for enhanced monitoring and control.

Global Medium Voltage Substation Market Dynamics

Market Drivers

- Rising demand of energy and urbanization

- Aging infrastructure and rising modernization

- Grid resilience and reliability

Market Restraints

- Regulatory compliance and standards

- Retrofitting challenges and innovation barriers

Market Opportunities

- Emerging technologies and digitalization

- Grid modernization and infrastructure upgrades

- Renewable energy integration and distributed energy resources

Medium Voltage Substation Market Report Coverage

| Market | Medium Voltage Substation Market |

| Medium Voltage Substation Market Size 2022 | USD 31.4 Billion |

| Medium Voltage Substation Market Forecast 2032 |

USD 49.5 Billion |

| Medium Voltage Substation Market CAGR During 2024 - 2032 | 4.7% |

| Medium Voltage Substation Market Analysis Period | 2020 - 2032 |

| Medium Voltage Substation Market Base Year |

2022 |

| Medium Voltage Substation Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Category, by Component, by Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Mitsubishi Electric, ABB, Bharat Heavy Electricals, Hitachi, Crompton Greaves Consumer Electricals, General Electric, Eaton, Siemens, Toshiba, and Schneider Electric. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Medium Voltage Substation Market Insights

The growing need for energy and rapid urbanization propels the demand for medium-voltage substations. These substations are crucial in distributing electricity efficiently within urban areas, facilitating power supply to residential, commercial, and industrial sectors. Medium voltage substations are integral components of the electrical grid, stepping down high voltage power to levels suitable for local distribution. Factors such as expanding urban populations, increasing industrialization, and rising infrastructure development are driving the demand for medium-voltage substations globally. For instance, in India, ABB declared to invest 100 million in February 2022 to enlarge medium voltage substation development capability. Additionally, the aging infrastructure and modernization, and grid resilience and reliability further boosts the market as these substations are essential for connecting renewable energy sources to the grid and enabling advanced monitoring and control functionalities. Overall, the medium voltage substation market is expected to experience significant growth in the coming years, driven by the ongoing trends of energy demand and urban expansion.

However, retrofitting challenges and innovation barriers present significant hurdles to the growth of the medium voltage substation market. Retrofitting existing substations to meet modern standards and integrate new technologies can be complex and costly, often requiring extensive planning and downtime. Innovation barriers, such as the lack of standardized solutions and interoperability issues between different vendors' products, further complicate the adoption of advanced technologies. Additionally, regulatory constraints and concerns over cyber security and data privacy also contribute to the challenges faced by industry players. Furthermore, regulatory compliance and standards further hamper the market growth.

Furthermore, emerging technologies and digitalization is expected to be a significant opportunity for the medium voltage substation market throughout the forecast period. Addition of sensors that connect to the internet, using cloud computing, and fancy data analysis helps in predicting maintenance requirements accurately. This enhances the efficiency and longevity of substations. Additionally, transitioning to digital platforms facilitates seamless integration with renewable energy sources such as solar and wind power. These developments are driving substantial growth in the medium voltage substation market by vastly improving their performance compared to conventional systems. Moreover rapid developments and investment to expand the medium voltage substation further boosts the market. For instance, Siemens announced in March 2022 that it could invest $50 million to expand medium voltage substations in China. Furthermore, grid modernization and infrastructure upgrades, and renewable energy integration and distributed energy resources further create numerous opportunities in the market.

Medium Voltage Substation Market Segmentation

The worldwide market for medium voltage substation is split based on category, component, type, end-users, and by geography.

Medium Voltage Substation Categories

- New

- Refurbished

According to medium voltage substation industry analysis, the category segment is subsegmented into new and refurbished. New and refurbished category encompasses both freshly manufactured equipment and components that have undergone renovation or restoration to extend their operational life or enhance performance. This category caters to a range of consumer needs, offering brand-new installations for those seeking state-of-the-art solutions, as well as refurbished options that provide cost-effective alternatives without compromising reliability or efficiency. By including both new and refurbished offerings, this category provides flexibility to meet diverse demands within the medium voltage substation market.

Medium Voltage Substation Components

- Circuit Breaker

- Protective Relay

- Transformer

- Switchgear

- Others

According to the medium voltage substation market analysis, circuit breaker component dominates the industry in 2022. Circuit breakers are designed to handle medium voltage levels typically ranging from 1 kV to 72.5 kV, making them essential components in substations that supply power to industrial facilities, commercial complexes, and residential areas. The market for medium voltage circuit breakers is characterized by technological advancements aimed at enhancing efficiency, reducing maintenance requirements, and improving overall performance, driving their widespread adoption in modern substation infrastructure. For instance, In March 2020, Phoenix Contact unveiled a thermo magnetic circuit breaker designed to safeguard electrical MCC panels and extended cable pathways.

Medium Voltage Substation Types

- Transmission

- Distribution

According to the medium voltage substation market forecast, distribution type is anticipated to grow during the forecast period 2024 to 2032. In the medium voltage substation market, the distribution type plays a pivotal role in facilitating the efficient delivery of electricity to end-users. Distribution type encompasses various methods of delivering electricity from the substation to consumers, including radial, ring main unit (RMU), and others. The choice of distribution type influences factors such as system reliability, load management, fault tolerance, and overall grid performance. Moreover, advancements in smart grid technologies are driving the adoption of distribution automation.

Medium Voltage Substation End-Users

- Residential

- Commercial

- Industrial

- Metal & Mining

- Oil & Gas

- Manufacturing & Process Industries

- Others

Based on medium voltage substation market study, industrial end-users are expected to boost the demand during 2022. Industrial end-users including metal and mining, oil and gas, and manufacturing and process industries, are anticipated to drive demand. These sectors rely heavily on reliable power distribution infrastructure to sustain their operations efficiently. Medium voltage substations play a crucial role in ensuring a steady supply of electricity to power equipment and machinery essential for industrial processes. As these industries expand and modernize, the need for medium voltage substations is expected to increase, fueling market growth. Additionally, factors such as technological advancements, increasing automation, and the focus on energy efficiency are further driving the demand for medium voltage substations in industrial setting.

Medium Voltage Substation Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Medium Voltage Substation Market Regional Analysis

In terms of medium voltage substation market analysis, North America stands as a dominant force in the due to several key factors. These include the region's robust infrastructure, substantial investments in renewable energy projects, and the increasing demand for efficient power distribution systems. For instance, over the past five years, global investment in solar PV and wind projects has surged by over USD 300 billion, constituting approximately total clean energy investment of USD 1.8 trillion in 2023. These investments have substantially increased the demand for North America’s medium voltage substation industry. Moreover, stringent regulations regarding energy efficiency and grid modernization initiatives drive the adoption of medium voltage substations across industries. Additionally, technological advancements such as smart grid solutions and digital substations and growing demand of electricity further bolster North America's position in this market, offering enhanced monitoring, control, and reliability in power distribution networks. Furthermore, the United States relies heavily on electricity for its economy, safety, and well-being. For instance, the U.S. electrical grid stands as a remarkable feat of engineering, boasting over 9,200 electric generating units, totaling over 1 million megawatts of capacity, linked by over 600,000 miles of transmission lines.

Additionally, in recent years, Asia-Pacific has emerged as the fastest-growing region in the medium voltage substation market, driven by several key factors. One significant catalyst is the region's increasing focus on renewable energy sources, such as wind and solar power, leading to extensive investments in infrastructure to support their integration into the grid. Additionally, stringent regulations aimed at modernizing and enhancing grid reliability have increased demand for advanced medium voltage substations equipped with smart technologies for efficient energy management and distribution. Moreover, the rise of urbanization and industrialization across Asia-Pacific has further propelled the need for reliable electricity supply.

Medium Voltage Substation Market Players

Some of the top medium voltage substation companies offered in our report include Mitsubishi Electric, ABB, Bharat Heavy Electricals, Hitachi, Crompton Greaves Consumer Electricals, General Electric, Eaton, Siemens, Toshiba, and Schneider Electric.

Frequently Asked Questions

How big is the medium voltage substation market?

The medium voltage substation market size was valued at USD 31.4 billion in 2022.

What is the CAGR of the global medium voltage substation market from 2024 to 2032?

The CAGR of medium voltage substation is 4.7 % during the analysis period of 2024 to 2032.

Which are the key players in the medium voltage substation market?

The key players operating in the global market are Mitsubishi Electric, ABB, Bharat Heavy Electricals, Hitachi, Crompton Greaves Consumer Electricals, General Electric, Eaton, Siemens, Toshiba, and Schneider Electric.

Which region dominated the global medium voltage substation market share?

North America held the dominating position in medium voltage substation industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia Pacific region exhibited fastest growing CAGR for market of medium voltage substation during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global medium voltage substation industry?

The current trends and dynamics in the medium voltage substation market are raising demand of energy and urbanization, aging infrastructure and modernization, and grid resilience and reliability.

Which component held the maximum share in 2022?

Circuit breaker component held the maximum share of the medium voltage substation market.