Medical Spa Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Medical Spa Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

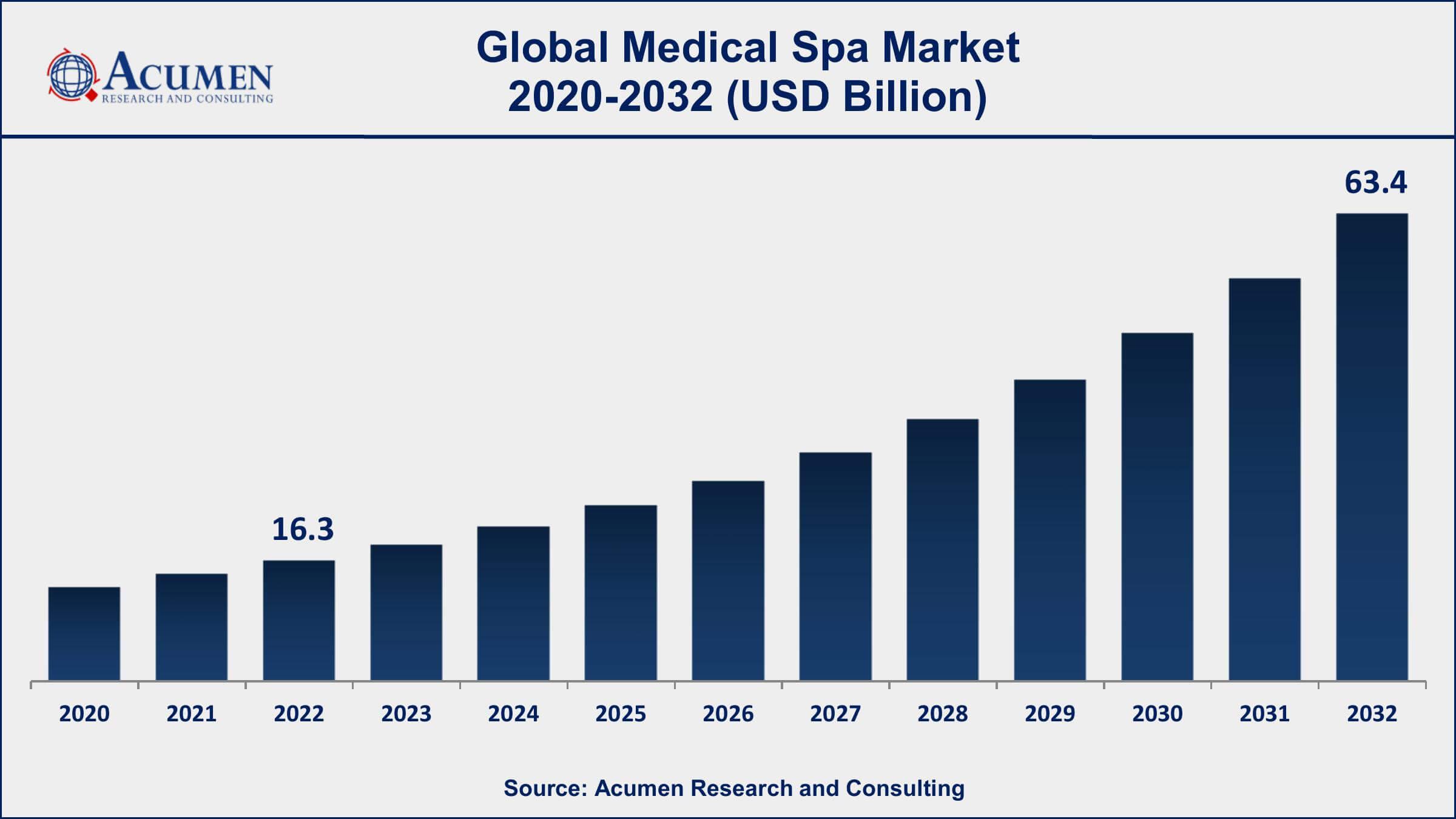

The Global Medical Spa Market Size accounted for USD 16.3 Billion in 2022 and is projected to achieve a market size of USD 63.4 Billion by 2032 growing at a CAGR of 14.7% from 2023 to 2032.

Medical Spa Market Highlights

- Global Medical Spa Market revenue is expected to increase by USD 63.4 Billion by 2032, with a 14.7% CAGR from 2023 to 2032

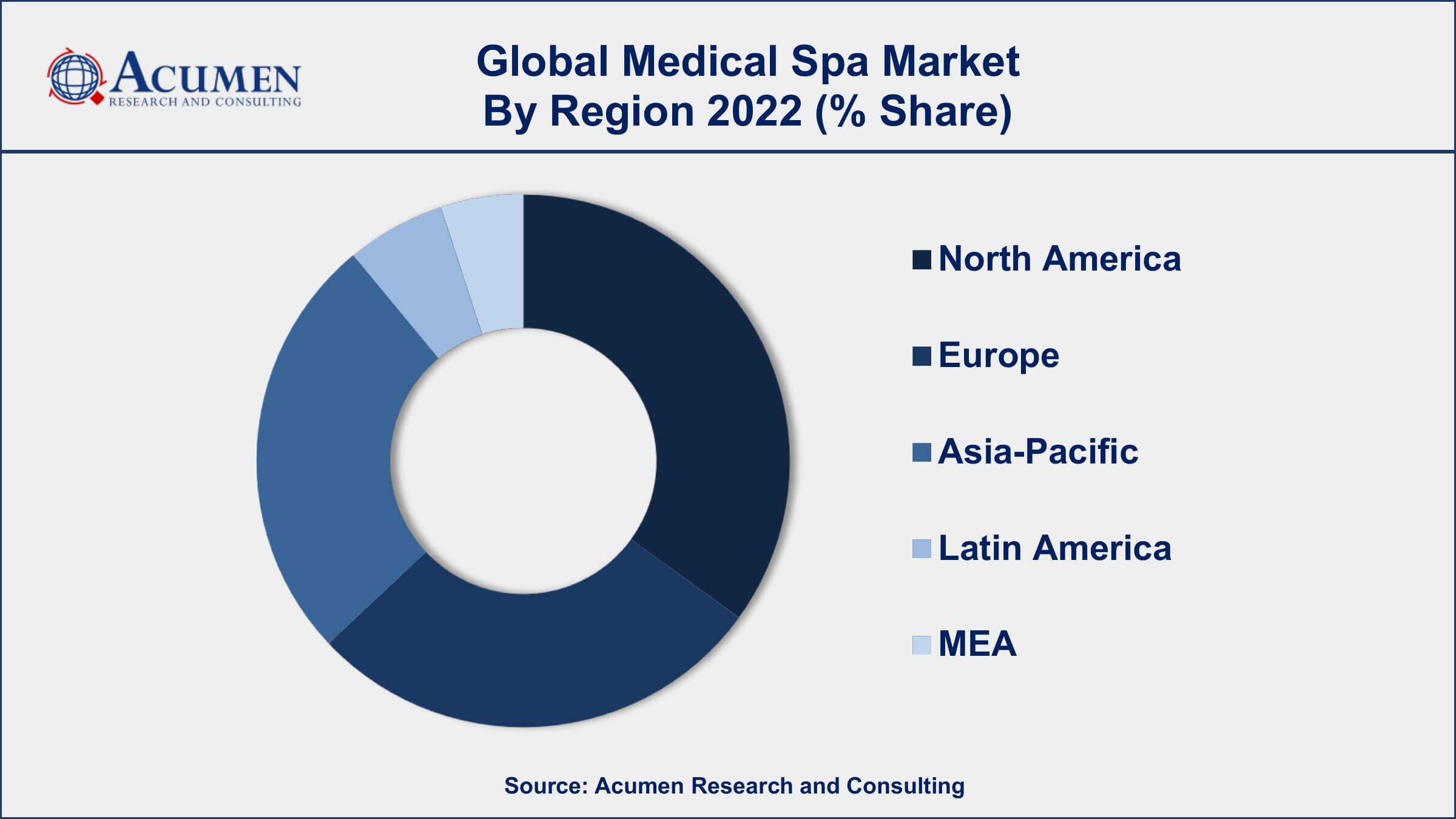

- North America region led with more than 39% of Medical Spa Market share in 2022

- Asia-Pacific Medical Spa Market growth will record a CAGR of around 15.4% from 2023 to 2032

- By service, the facial treatment segment is the largest segment in the market, accounting for over 45% of the market share in 2022

- By gender, the female segment has recorded more than 67% of the revenue share in 2022

- Increasing demand for non-surgical cosmetic procedures, drives the Medical Spa Market value

A medical spa, often referred to as a med spa, is a hybrid between a medical clinic and a day spa. It offers a range of non-invasive medical treatments and cosmetic procedures in a relaxing and luxurious environment. These treatments typically include Botox injections, dermal fillers, laser hair removal, chemical peels, microdermabrasion, and various skin rejuvenation therapies. Medical spas are staffed by licensed medical professionals, such as doctors, nurse practitioners, or registered nurses, who oversee and administer these procedures to enhance clients' physical appearance and well-being.

The medical spa market has experienced significant growth in recent years. This expansion can be attributed to several factors, including an increasing demand for non-surgical cosmetic treatments, a growing emphasis on self-care and wellness, and advancements in technology and treatment techniques. Consumers are increasingly seeking less invasive alternatives to traditional surgical procedures, making medical spas a popular choice for enhancing their appearance. Additionally, the market has seen a rise in men and younger individuals seeking these services, broadening the client base. The medical spa industry's future growth prospects remain promising, driven by ongoing innovations in skincare and cosmetic procedures, coupled with a growing awareness of the importance of self-care and aesthetic enhancements.

Global Medical Spa Market Trends

Market Drivers

- Increasing demand for non-surgical cosmetic procedures

- Advancements in technology and treatment efficacy

- The aging population seeking anti-aging treatments

- Social media influence on beauty standards

- Growing disposable income and willingness to invest in appearance

Market Restraints

- Stringent regulatory requirements and compliance

- High initial equipment and training costs

- Limited insurance coverage for cosmetic procedures

Market Opportunities

- Personalized treatment plans and customization

- Development of at-home skincare products

- Expanding range of available aesthetic treatments

Medical Spa Market Report Coverage

| Market | Medical Spa Market |

| Medical Spa Market Size 2022 | USD 16.3 Billion |

| Medical Spa Market Forecast 2032 | USD 63.4 Billion |

| Medical Spa Market CAGR During 2023 - 2032 | 14.7% |

| Medical Spa Market Analysis Period | 2020 - 2032 |

| Medical Spa Market Base Year |

2022 |

| Medical Spa Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Service, By Gender, By Age Group, By Service Provider, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BIOVITAL MEDSPA, Chic la Vie Med Spa, Westchase Medsap, LLC, Aesthetics Medispa, Lanserhof, Sha Wellness Clinic, Serenity Medspa, Brenners Park-Hotel & Spa, Bijoux Medi-Spa, Cocoona, Canyon Ranch, and Lily's Medi Spa |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

A medical spa, commonly known as a medspa, is a healthcare facility that combines the luxurious and soothing ambiance of a traditional day spa with the expertise and technology of a medical clinic. These establishments offer a range of cosmetic and aesthetic treatments that are performed by trained medical professionals, such as licensed physicians, nurse practitioners, and aestheticians. Medical spas are designed to provide a comprehensive suite of non-invasive or minimally invasive procedures aimed at enhancing one's appearance, rejuvenating the skin, and addressing various cosmetic concerns.

The applications of medical spas are diverse and cater to individuals seeking cosmetic improvements without the need for surgical interventions. Some common applications include Botox injections to reduce wrinkles and fine lines, dermal fillers for volume restoration, laser treatments for hair removal and skin rejuvenation, chemical peels to improve skin texture, and body contouring procedures to sculpt and tone the body. Medical spas are also known for their expertise in skincare, offering customized regimens and products to address specific skin issues, such as acne, pigmentation, and aging. These establishments prioritize safety, efficacy, and patient comfort, making them a popular choice for individuals looking to enhance their appearance and overall well-being.

The medical spa market has experienced robust growth in recent years and continues to be a dynamic and evolving industry. One of the primary drivers of this growth is the increasing demand for non-invasive and minimally invasive cosmetic procedures. Consumers are increasingly seeking out medical spas as a means to achieve their aesthetic goals without the need for surgery and with minimal downtime. This trend is driven by a combination of factors, including a desire for a more youthful appearance, social media influence, and the accessibility of these procedures to a wider range of individuals. As a result, medical spas have become a popular choice for those looking to enhance their appearance and boost their self-confidence.

Medical Spa Market Segmentation

The global Medical Spa Market segmentation is based on service, gender, age group, service provider, and geography.

Medical Spa Market By Service

- Facial Treatment

- Hair Removal

- Body Shaping & Contouring

- Tattoo Removal

- Scar Revision

- Others

According to the medical spa industry analysis, the facial treatment segment accounted for the largest market share in 2022. One of the primary drivers is the increasing awareness and focus on skincare and facial aesthetics among consumers of all age groups. As people become more conscious of maintaining a youthful appearance and addressing skin concerns, they are turning to medical spas for a wide range of facial treatments. Another significant factor contributing to the growth of this segment is the development of advanced technologies and techniques in facial treatments. Medical spas now offer a plethora of options, including chemical peels, microdermabrasion, facial fillers, laser therapies, and microneedling, all tailored to address specific skin concerns such as wrinkles, acne, pigmentation issues, and overall skin rejuvenation. These treatments are becoming more sophisticated, safer, and less invasive, making them attractive to a broader clientele.

Medical Spa Market By Gender

- Male

- Female

In terms of gender, the male segment is expected to witness significant growth in the coming years. Historically, medical spas were predominantly frequented by female clients, but there has been a substantial increase in the number of men seeking aesthetic and wellness services. This growth can be attributed to several key factors. Firstly, there has been a changing perception of masculinity and self-care among men. Men are now more open to exploring options for enhancing their appearance and overall well-being. The desire to maintain a youthful and groomed look has driven men to embrace treatments such as Botox, dermal fillers, laser hair removal, and skincare procedures. This cultural shift has created a new market for medical spas targeting male clientele. Secondly, the rise of social media and digital platforms has contributed to the growth of the male segment.

Medical Spa Market By Age Group

- Adolescent

- Geriatric

- Adult

According to the medical spa market forecast, the geriatric segment is expected to witness significant growth in the coming years. Traditionally, medical spas have been associated with younger clientele seeking cosmetic enhancements, but there is a growing recognition among older individuals that aesthetic and wellness treatments can significantly improve their quality of life as they age. One of the primary drivers of this growth is the desire among the geriatric population to maintain a youthful appearance and boost self-esteem. As people live longer and lead more active lives, they are seeking treatments such as Botox, dermal fillers, skin rejuvenation, and other non-invasive procedures to address age-related concerns like wrinkles, sagging skin, and age spots. Medical spas are adapting to meet the unique needs of older clients by offering specialized treatments and customized skincare regimens that promote healthy aging.

Medical Spa Market By Service Provider

- Single Ownership

- Free-standing

- Group Ownership

- Medical Practice Associated Spas

Based on the service provider, the single ownership segment is expected to continue its growth trajectory in the coming years. Historically, many medical spas were operated as individual practices or owned by a single practitioner, often a physician or aesthetician. However, this segment has evolved significantly to keep pace with industry trends and consumer demands. One of the primary drivers of growth in the single ownership segment is the increasing demand for personalized and boutique-style experiences. Clients are seeking a more intimate and customized approach to their aesthetic and wellness treatments. Single ownership medical spas can provide a higher level of individualized care, allowing practitioners to establish strong relationships with their clients and tailor treatments to specific needs and preferences.

Medical Spa Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Medical Spa Market Regional Analysis

North America's domination of the medical spa market can be attributed to a combination of factors that have converged to create a highly favorable environment for the industry's growth in the region. North America, particularly the United States, has a well-established and robust healthcare infrastructure with a strong emphasis on aesthetics and wellness. This includes a large number of skilled healthcare professionals, including dermatologists, plastic surgeons, and nurse practitioners, who are well-versed in providing cosmetic and aesthetic treatments. The presence of these experts contributes to the credibility and safety of the medical spa industry. Moreover, North America has a higher disposable income per capita compared to many other regions, enabling a larger portion of the population to afford medical spa treatments. The cultural emphasis on personal appearance and youthfulness, often fueled by the influence of media and celebrity culture, has driven the demand for cosmetic procedures. In addition, the increasing popularity of non-invasive and minimally invasive treatments aligns with the preferences of North American consumers, who seek effective solutions with minimal downtime.

Medical Spa Market Player

Some of the top medical spa market companies offered in the professional report include BIOVITAL MEDSPA, Chic la Vie Med Spa, Westchase Medsap, LLC, Aesthetics Medispa, Lanserhof, Sha Wellness Clinic, Serenity Medspa, Brenners Park-Hotel & Spa, Bijoux Medi-Spa, Cocoona, Canyon Ranch, and Lily's Medi Spa.

Frequently Asked Questions

What was the market size of the global medical spa in 2022?

The market size of medical spa was USD 16.3 Billion in 2022.

What is the CAGR of the global medical spa market from 2023 to 2032?

The CAGR of medical spa is 14.7% during the analysis period of 2023 to 2032.

Which are the key players in the medical spa market?

The key players operating in the global market are including BIOVITAL MEDSPA, Chic la Vie Med Spa, Westchase Medsap, LLC, Aesthetics Medispa, Lanserhof, Sha Wellness Clinic, Serenity Medspa, Brenners Park-Hotel & Spa, Bijoux Medi-Spa, Cocoona, Canyon Ranch, and Lily's Medi Spa.

Which region dominated the global medical spa market share?

North America held the dominating position in medical spa industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of medical spa during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global medical spa industry?

The current trends and dynamics in the medical spa industry include increasing demand for non-surgical cosmetic procedures, advancements in technology and treatment efficacy, and aging population seeking anti-aging treatments.

Which gender held the maximum share in 2022?

The female gender held the maximum share of the medical spa industry.