Medical Radiation Detection Market | Acumen Research and Consulting

Medical Radiation Detection Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

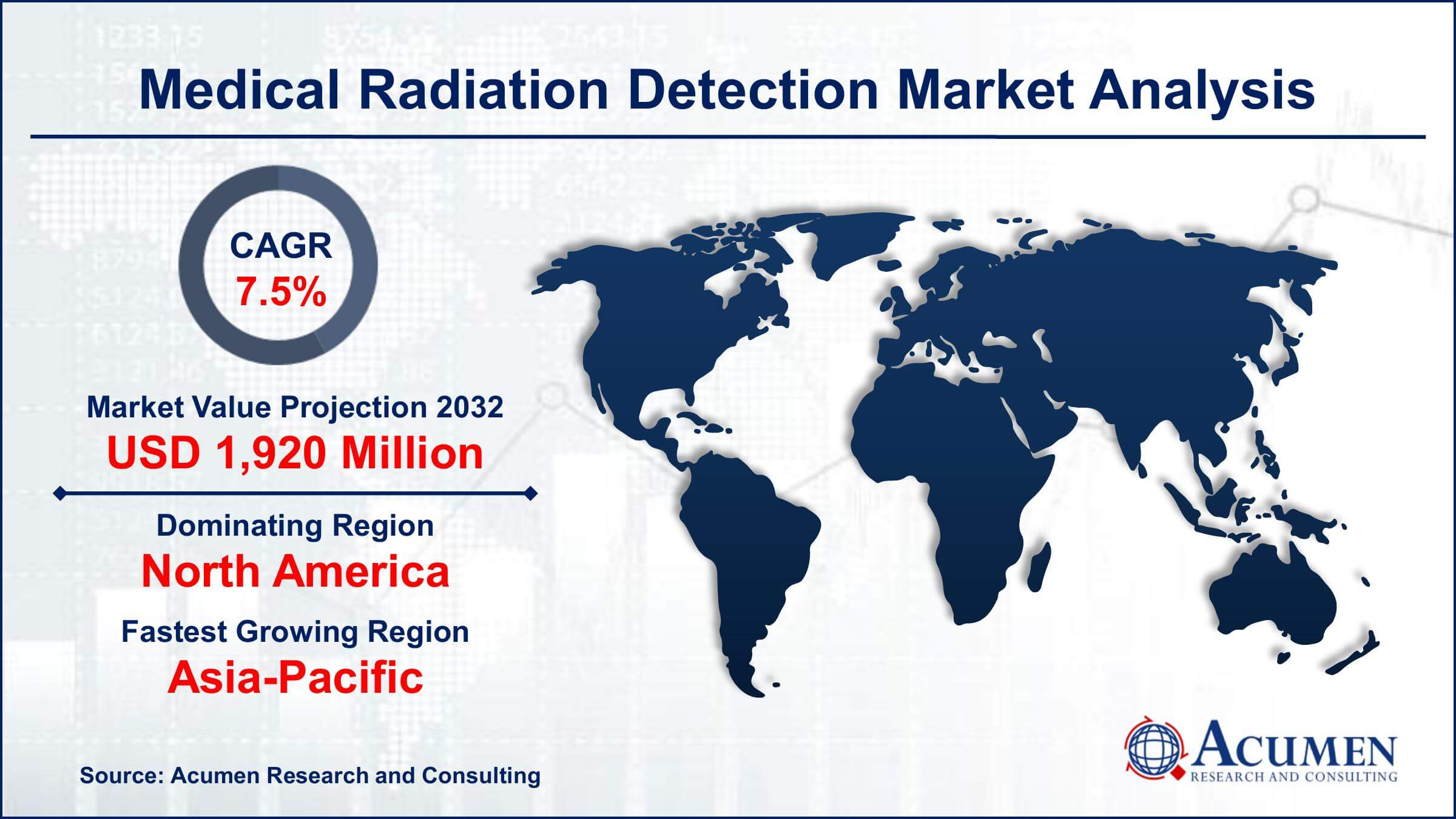

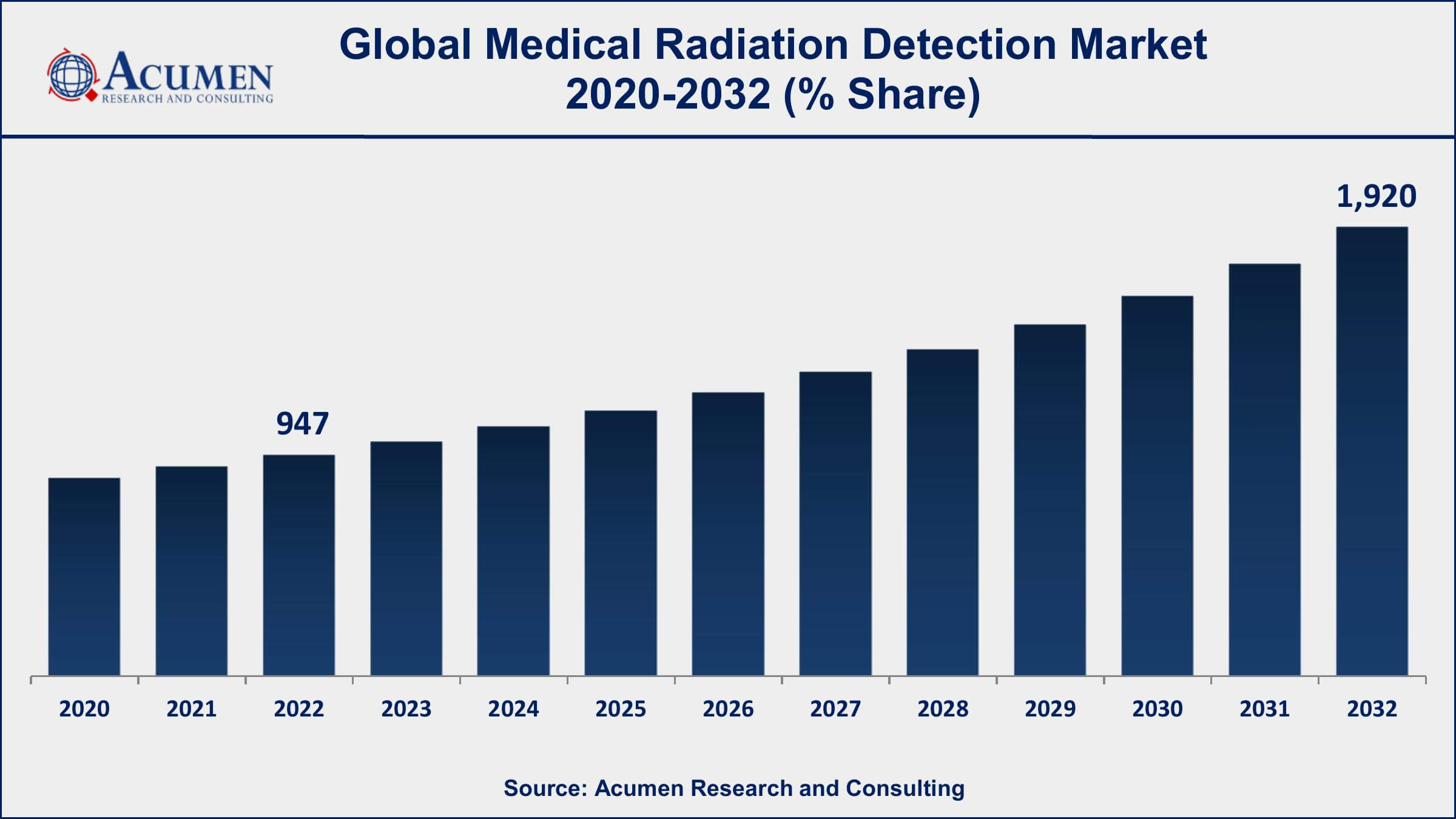

The Global Medical Radiation Detection Market Size accounted for USD 947 Million in 2022 and is projected to achieve a market size of USD 1,920 Million by 2032 growing at a CAGR of 7.5% from 2023 to 2032.

Medical Radiation Detection Market Highlights

- Global Medical Radiation Detection Market revenue is expected to increase by USD 1,920 Million by 2032, with a 7.5% CAGR from 2023 to 2032

- North America region led with more than 34% of Medical Radiation Detection Market share in 2022

- Asia-Pacific Medical Radiation Detection Market growth will record a CAGR of around 6.2% from 2023 to 2032

- By type, the gas-filled detectors segment has generated of about 42% of the revenue share in 2022

- By product, the personal dosimeters segment has accounted more than 39% of the revenue share in 2022

- Increasing use of medical imaging and radiation therapy, drives the Medical Radiation Detection Market value

Medical radiation detection refers to the technology and devices used to monitor and measure ionizing radiation exposure in healthcare settings. It plays a critical role in ensuring the safety of patients, healthcare workers, and the general public when undergoing or working with radiological procedures and equipment. This technology encompasses a wide range of devices, including dosimeters, Geiger counters, scintillation detectors, and more, which are utilized to assess the levels of radiation exposure accurately.

The medical radiation detection market has witnessed significant growth in recent years, primarily driven by the increasing use of medical imaging and radiation therapy in the healthcare industry. The rising prevalence of cancer and the growing demand for diagnostic imaging procedures like X-rays, CT scans, and nuclear medicine have contributed to the expansion of this market. Additionally, the stringent regulatory guidelines and safety standards imposed by healthcare authorities worldwide have propelled the adoption of advanced radiation detection equipment and systems. With the continual advancements in technology and the need for precise and reliable radiation monitoring, the medical radiation detection market is expected to continue its growth trajectory, providing innovative solutions for radiation safety and dose management in healthcare settings.

Global Medical Radiation Detection Market Trends

Market Drivers

- Increasing use of medical imaging and radiation therapy

- Rising cancer prevalence

- Stringent regulatory guidelines for radiation safety

- Advancements in radiation detection technology

- Growing adoption of nuclear medicine

Market Restraints

- High initial costs of radiation detection equipment

- Limited awareness and education in radiation safety

Market Opportunities

- Increased focus on personalized medicine and targeted therapies

- Radiation detection solutions for home healthcare

Medical Radiation Detection Market Report Coverage

| Market | Medical Radiation Detection Market |

| Medical Radiation Detection Market Size 2022 | USD 947 Million |

| Medical Radiation Detection Market Forecast 2032 | USD 1,920 Million |

| Medical Radiation Detection Market CAGR During 2023 - 2032 | 7.5% |

| Medical Radiation Detection Market Analysis Period | 2020 - 2032 |

| Medical Radiation Detection Market Base Year |

2022 |

| Medical Radiation Detection Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Product, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Thermo Fisher Scientific, Mirion Technologies, Landauer, Inc., IBA Dosimetry, Sun Nuclear Corporation, Ludlum Measurements, Inc., AmRay Group, Bertin Instruments, Polimaster, Radiation Detection Company, Centronic Limited, and Fluke Biomedical. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Medical radiation detection is a vital aspect of healthcare safety that involves the use of specialized equipment and technologies to monitor, measure, and assess ionizing radiation exposure in medical settings. Ionizing radiation, such as X-rays, gamma rays, and certain particles, is commonly used in diagnostic imaging (e.g., X-ray, CT scans, and fluoroscopy) and radiation therapy to diagnose and treat various medical conditions, including cancer. Ensuring the accurate and safe administration of radiation is paramount in protecting both patients and healthcare workers from potential harm.

The application of medical radiation detection spans several critical areas in healthcare. One primary application is in radiation therapy, where precise dosage and delivery are crucial to target and eliminate cancerous cells while sparing healthy tissues. Radiation detectors help ensure the accuracy of treatment delivery and monitor patient exposure during therapy sessions. In diagnostic imaging, these detectors play a pivotal role in optimizing image quality with minimal radiation dose, reducing patient exposure and risk. Moreover, radiation monitoring is vital in nuclear medicine, where radioactive tracers are used to diagnose and manage various diseases. Overall, medical radiation detection contributes significantly to patient safety, treatment efficacy, and adherence to radiation safety standards in healthcare facilities.

The medical radiation detection market has experienced robust growth in recent years and is poised for continued expansion. Several key factors have contributed to this growth. One of the primary drivers is the increasing prevalence of cancer and the growing demand for diagnostic and therapeutic radiological procedures. As cancer rates rise globally, the need for accurate and reliable radiation detection equipment becomes paramount to ensure patient and healthcare worker safety. Moreover, the aging population and the rising incidence of chronic diseases have further fueled the demand for medical imaging, radiation therapy, and nuclear medicine, all of which rely on effective radiation detection solutions. Stringent regulatory guidelines and safety standards have also played a crucial role in driving the adoption of advanced radiation detection technology.

Medical Radiation Detection Market Segmentation

The global Medical Radiation Detection Market segmentation is based on type, product, end-use, and geography.

Medical Radiation Detection Market By Type

- Gas-filled Detectors

- Solid-state

- Scintillators

According to the medical radiation detection industry analysis, the gas-filled detectors segment accounted for the largest market share in 2022. These detectors, which include ionization chambers and proportional counters, are widely utilized for their accuracy and sensitivity in detecting ionizing radiation in medical applications. One of the key factors contributing to the growth of gas-filled detectors is their precision in measuring radiation doses, making them essential in radiation therapy for cancer treatment. These detectors help healthcare providers deliver precise doses of radiation to cancerous tissues while minimizing exposure to healthy surrounding tissues. Furthermore, gas-filled detectors are commonly used in diagnostic radiology and nuclear medicine for monitoring radiation levels, ensuring patient safety during procedures like X-rays, CT scans, and PET scans.

Medical Radiation Detection Market By Product

- Personal Dosimeters

- Surface Contamination Monitors

- Area Process Dosimeters

- Others

In terms of products, the personal dosimeters segment is expected to witness significant growth in the coming years. This growth due to its critical role in ensuring the safety of healthcare workers and individuals who are exposed to ionizing radiation as part of their occupational duties. Personal dosimeters are wearable devices that measure and record an individual's radiation exposure over time, providing essential data for dose management and compliance with safety regulations. One of the primary drivers for the growth of personal dosimeters is the increasing awareness of radiation safety and the need to minimize occupational exposure among healthcare professionals. Radiologic technologists, nuclear medicine technicians, and radiation therapists, among others, rely on personal dosimeters to monitor their radiation exposure levels accurately. Stringent regulatory standards and guidelines have further emphasized the importance of continuous monitoring, making personal dosimeters an indispensable tool for maintaining a safe working environment in healthcare facilities.

Medical Radiation Detection Market By End-use

- Hospitals

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers

- Homecare

According to the medical radiation detection market forecast, the hospitals segment is expected to witness significant growth in the coming years. Hospitals are among the primary users of medical radiation technology, employing various diagnostic imaging and radiation therapy procedures to diagnose and treat a wide range of medical conditions. As the demand for these services continues to rise globally, hospitals have increasingly recognized the importance of radiation safety, which has driven the adoption of advanced radiation detection solutions. One of the primary drivers of growth in this segment is the increasing prevalence of cancer and the growing need for radiation therapy. Radiation therapy is a crucial component of cancer treatment, and hospitals heavily rely on radiation detection technology to ensure precise and safe delivery of radiation doses to cancer patients. Additionally, the use of medical imaging procedures, such as X-rays, CT scans, and fluoroscopy, for diagnosis and monitoring has surged in hospital settings. This has led to a higher demand for radiation detection equipment to monitor and control radiation exposure for both patients and healthcare workers.

Medical Radiation Detection Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Medical Radiation Detection Market Regional Analysis

North America has emerged as a growing region in the medical radiation detection market for several reasons. One of the primary drivers of growth in this region is the significant investment in healthcare infrastructure and advanced medical technologies. The United States and Canada, in particular, have well-established healthcare systems with a high prevalence of diagnostic imaging and radiation therapy procedures. As these procedures become increasingly vital in the diagnosis and treatment of various medical conditions, the demand for reliable radiation detection solutions has surged, contributing to the growth of the market. Furthermore, North America is characterized by stringent regulatory standards and guidelines governing radiation safety in healthcare settings. The region's commitment to patient and worker safety has necessitated the adoption of advanced radiation monitoring and measurement devices. Healthcare facilities in North America are often required to adhere to strict radiation dose limits and implement comprehensive radiation safety programs. This has driven the adoption of state-of-the-art radiation detection technology to ensure compliance with these regulations, further boosting the market's growth. Another key factor contributing to the growth of the medical radiation detection market in North America is ongoing research and development efforts aimed at improving the precision, efficiency, and usability of radiation detection solutions.

Medical Radiation Detection Market Player

Some of the top medical radiation detection market companies offered in the professional report include Thermo Fisher Scientific, Mirion Technologies, Landauer, Inc., IBA Dosimetry, Sun Nuclear Corporation, Ludlum Measurements, Inc., AmRay Group, Bertin Instruments, Polimaster, Radiation Detection Company, Centronic Limited, and Fluke Biomedical.

Frequently Asked Questions

What was the market size of the global medical radiation detection in 2022?

The market size of medical radiation detection was USD 947 Million in 2022.

What is the CAGR of the global medical radiation detection market from 2023 to 2032?

The CAGR of medical radiation detection is 7.5% during the analysis period of 2023 to 2032.

Which are the key players in the medical radiation detection market?

The key players operating in the global market are including Thermo Fisher Scientific, Mirion Technologies, Landauer, Inc., IBA Dosimetry, Sun Nuclear Corporation, Ludlum Measurements, Inc., AmRay Group, Bertin Instruments, Polimaster, Radiation Detection Company, Centronic Limited, and Fluke Biomedical.

Which region dominated the global medical radiation detection market share?

North America held the dominating position in medical radiation detection industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of medical radiation detection during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global medical radiation detection industry?

The current trends and dynamics in the medical radiation detection industry include increasing use of medical imaging and radiation therapy, rising cancer prevalence, and stringent regulatory guidelines for radiation safety.

Which product held the maximum share in 2022?

The personal dosimeters product held the maximum share of the medical radiation detection industry.