Medical Oxygen Concentrators Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Medical Oxygen Concentrators Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

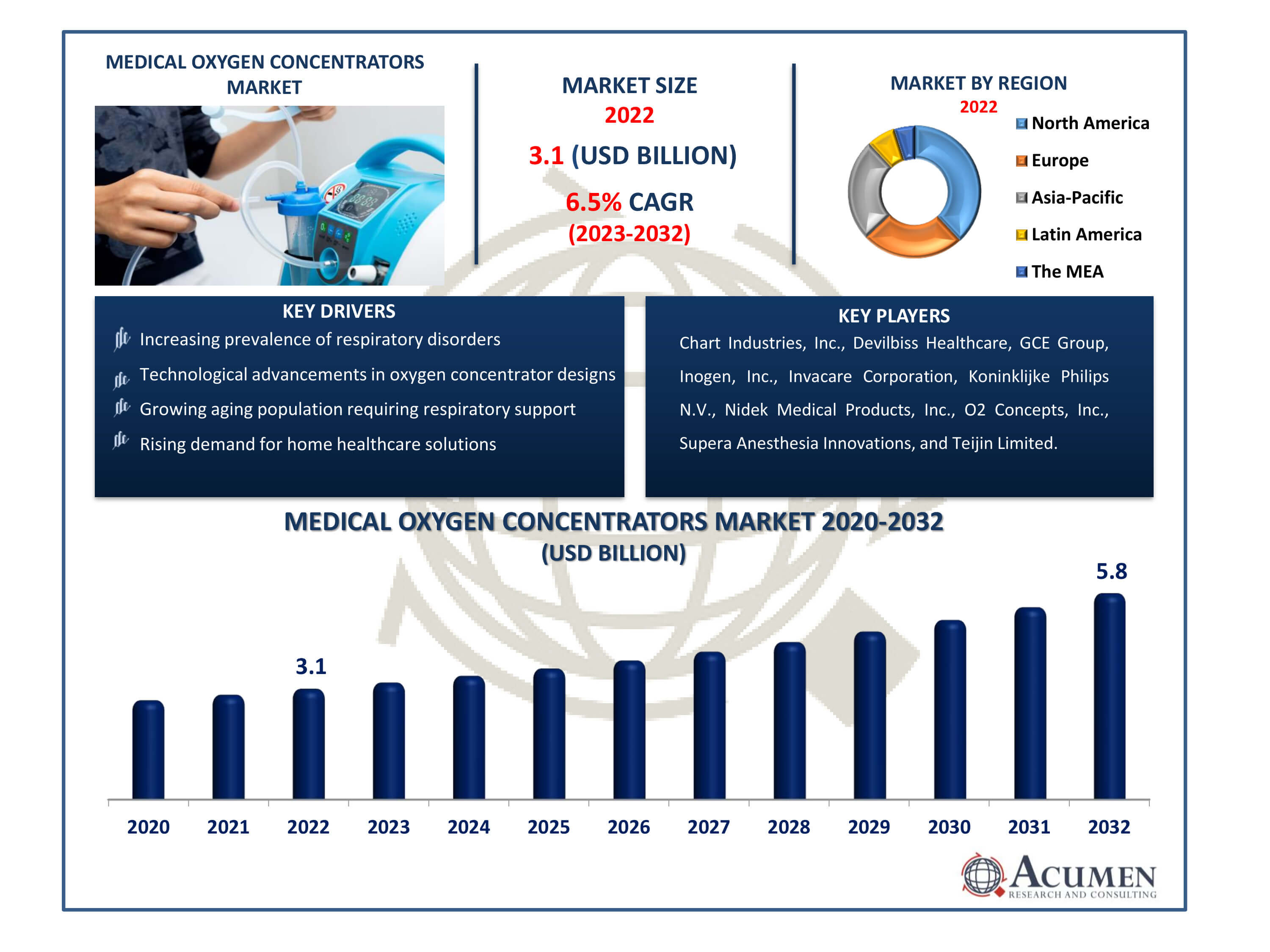

The Medical Oxygen Concentrators Market Size accounted for USD 3.1 Billion in 2022 and is estimated to achieve a market size of USD 5.8 Billion by 2032 growing at a CAGR of 6.5% from 2023 to 2032.

Medical Oxygen Concentrators Market Highlights

- Global medical oxygen concentrators market revenue is poised to garner USD 5.8 billion by 2032 with a CAGR of 6.5% from 2023 to 2032

- North America medical oxygen concentrators market value occupied around USD 1.2 billion in 2022

- Asia-Pacific medical oxygen concentrators market growth will record a CAGR of more than 7% from 2023 to 2032

- Among product, the portable oxygen concentrators sub-segment generated over US$ 1.7 billion revenue in 2022

- Based on technology, the continuous flow sub-segment generated around 60% share in 2022

- R&D for innovative features improving device efficiency and usability is a popular medical oxygen concentrators market trend that fuels the industry demand

The medical oxygen concentrators market encompasses the manufacturing, distribution, and sale of devices used to provide continuous oxygen to individuals with breathing difficulties or low blood oxygen levels. Oxygen concentrators operate by extracting air from the environment, filtering out nitrogen and other gases, and delivering purified oxygen through a nasal cannula or mask. They find use in homes, healthcare facilities, and as portable units for travel. These devices offer a cost-effective alternative by eliminating the necessity for oxygen supplements and heavy tanks. By drawing in ambient air and producing concentrated medical-grade oxygen, they cater to patients' needs. The increasing prevalence of COPD within the population is expected to drive higher demand for these products.

Global Medical Oxygen Concentrators Market Dynamics

Market Drivers

- Increasing prevalence of respiratory disorders

- Technological advancements in oxygen concentrator designs

- Growing aging population requiring respiratory support

- Rising demand for home healthcare solutions

Market Restraints

- High initial costs and maintenance expenses

- Stringent regulatory requirements for product approval

- Limited awareness and accessibility in certain regions

Market Opportunities

- Expansion in emerging markets with unmet healthcare needs

- Development of portable and lightweight concentrator models

- Collaborations with healthcare providers to enhance distribution networks

Medical Oxygen Concentrators Market Report Coverage

| Market | Medical Oxygen Concentrators Market |

| Medical Oxygen Concentrators Market Size 2022 | USD 3.1 Billion |

| Medical Oxygen Concentrators Market Forecast 2032 | USD 5.8 Billion |

| Medical Oxygen Concentrators Market CAGR During 2023 - 2032 | 6.5% |

| Medical Oxygen Concentrators Market Analysis Period | 2020 - 2032 |

| Medical Oxygen Concentrators Market Base Year |

2022 |

| Medical Oxygen Concentrators Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Technology, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Chart Industries, Inc., Devilbiss Healthcare, GCE Group, Inogen, Inc., Invacare Corporation, Koninklijke Philips N.V., Nidek Medical Products, Inc., O2 Concepts, Inc., Supera Anesthesia Innovations, and Teijin Limited. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Medical Oxygen Concentrators Market Insights

The increased prevalence of COPD and advancements in technology serve as key drivers for the market. According to WHO data, in 2016, there were 251 million cases of COPD globally, resulting in 3.17 million deaths in the preceding year. Furthermore, the high levels of air pollution and the rising number of smokers in middle-income countries accounted for 90% of these fatalities. This situation presents lucrative growth opportunities for market players to initiate awareness-raising projects aimed at significantly improving the quality of life through the use of oxygen concentrations. Additionally, the growing geriatric population, which is increasingly susceptible to chronic conditions, will also contribute to the increased demand for products, thereby driving the global market.

According to the industry medical oxygen concentrators analysis, the UN estimated that the global geriatric population in 2017 was 962 million and is forecasted to reach 2.1 billion by 2050, according to data published by the United Nations. Favorable reimbursements are also expected to have a positive effect on the market for these concentrators, especially the portable ones. Additionally, awareness campaigns aimed at educating and empowering COPD patients will further boost growth, such as the World COPD Day organized by the Global Initiative for Chronic Obstructive Lung Diseases (GOLD).

Philips developed motivational content aimed at educating, involving, and empowering patients and caregivers to raise awareness about COPD. This initiative was done in partnership with athlete Russell Winwood. Technological innovations in concentrators further enhance market growth. Key companies are developing or modifying products, thereby intensifying competition. For instance, Inogen introduced a product called 'Inogen at Home' for patients with COPD, bronchitis, and/or other respiratory disorders. Inogen at Home is a lightweight and energy-efficient product that allows for a continuous oxygen flow of 5 liters per minute.

Medical Oxygen Concentrators Market Segmentation

The worldwide market for medical oxygen concentrators is split based on product, technology, application, end-user, and geography.

Medical Oxygen Concentrator Products

- Stationary Oxygen Concentrators

- Portable Oxygen Concentrators

According to medical oxygen concentrators market analysis, the portable product sector led the market by over 1.7 Billion USD in 2022 and is expected to record the fastest compound annual growth rate (CAGR) over the projected period. The demand for portable medical oxygen concentrators is being driven by increased demand, a growing geriatric population, and younger populations affected by COPD.

Portable devices offer higher concentrations of oxygen compared to ambient air and are commonly used for oxygen therapies. These devices possess advantages such as smaller dimensions, improved mobility, and higher oxygen capacities, making them suitable for various circumstances, especially for travelers. The increasing prevalence of different respiratory disorders is expected to further boost the demand for portable devices. Moreover, a significant shift toward mobile products is expected to strengthen this segment's growth, particularly in terms of reimbursement coverage. These concentrators offer numerous advantages, including continuous oxygen supply, improved exercise tolerance, easier handling, lower maintenance, enhanced battery power, and permitted usage on airplanes and in airports.

In contrast, stationary concentrators are projected to show steady growth during medical oxygen concentrators industry forecast period. These devices offer more stability compared to mobile oxygen sources as they are hands-free and have fixed tubing.

Medical Oxygen Concentrator Technologies

- Pulse Dose

- Continuous Flow

The continuous flow technology category led the overall market in 2022 due to significant technological breakthroughs and product improvements. NSBRI Smart Medical Systems and Technology, through their ongoing innovations such as the development of pressurized swing adsorption technology tailored for astronauts to meet spacecraft oxygen demands, is expected to further contribute to market growth. The expanding segment is propelled by the increasing prevalence of chronic respiratory issues and the continuous use of respiratory equipment for oxygen therapy. Pulse dose technology is anticipated to experience the fastest compound annual growth rate (CAGR) over the medical oxygen concentrators market forecast period. This technology is known for its 'demand flow of oxygen supply.'

The benefits offered by pulse dose technology, such as high mobility, advanced features, improved comfort, and increased efficiency, are driving its demand in the global market. Widely used in portable concentrator systems, pulse dose technology is considered safer and more reliable than continuous flow technology due to its sensor's capability to detect the next inhalation. An upper limit of 40 breaths per minute has been estimated for the pulse dose device. Even when the breath rate reaches 40 breaths per minute, the device still delivers a dose in every breath.

Medical Oxygen Concentrator Applications

- Chronic Obstructive Pulmonary Disease (COPD)

- Asthma

- Respiratory Distress Syndrome

- Sleep Apnea

- Others

The segment catering to chronic obstructive pulmonary disease (COPD) owns the highest proportion of the medical oxygen concentrator market. COPD, a progressive lung illness that affects airflow, accounts for a sizable percentage of the market due to its global prevalence. The increased prevalence of COPD cases, which is mostly due to factors such as smoking, pollution, and ageing populations, drives the demand for oxygen concentrators. Because COPD patients require continuous oxygen therapy, the COPD category has the largest market share due to its high and steady demand for medical oxygen concentrators.

Medical Oxygen Concentrator End-Users

- Hospital & Clinics

- Home Care

- Ambulatory Surgical Centers

The home care sector dominates the medical oxygen concentrator market due to a multitude of factors. The ageing population's desire for independence, along with an increasing preference for home-based care for chronic respiratory illnesses such as COPD, drives demand. Portable concentrator technological developments make them easier to use at home, increasing patient comfort and adherence to therapy. Furthermore, cost-effectiveness, reduced hospital visits, and enhanced healthcare infrastructure supporting home care services all contribute considerably to the Home Care segment's prominence, making it the market's leading end-user segment.

Medical Oxygen Concentrators Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

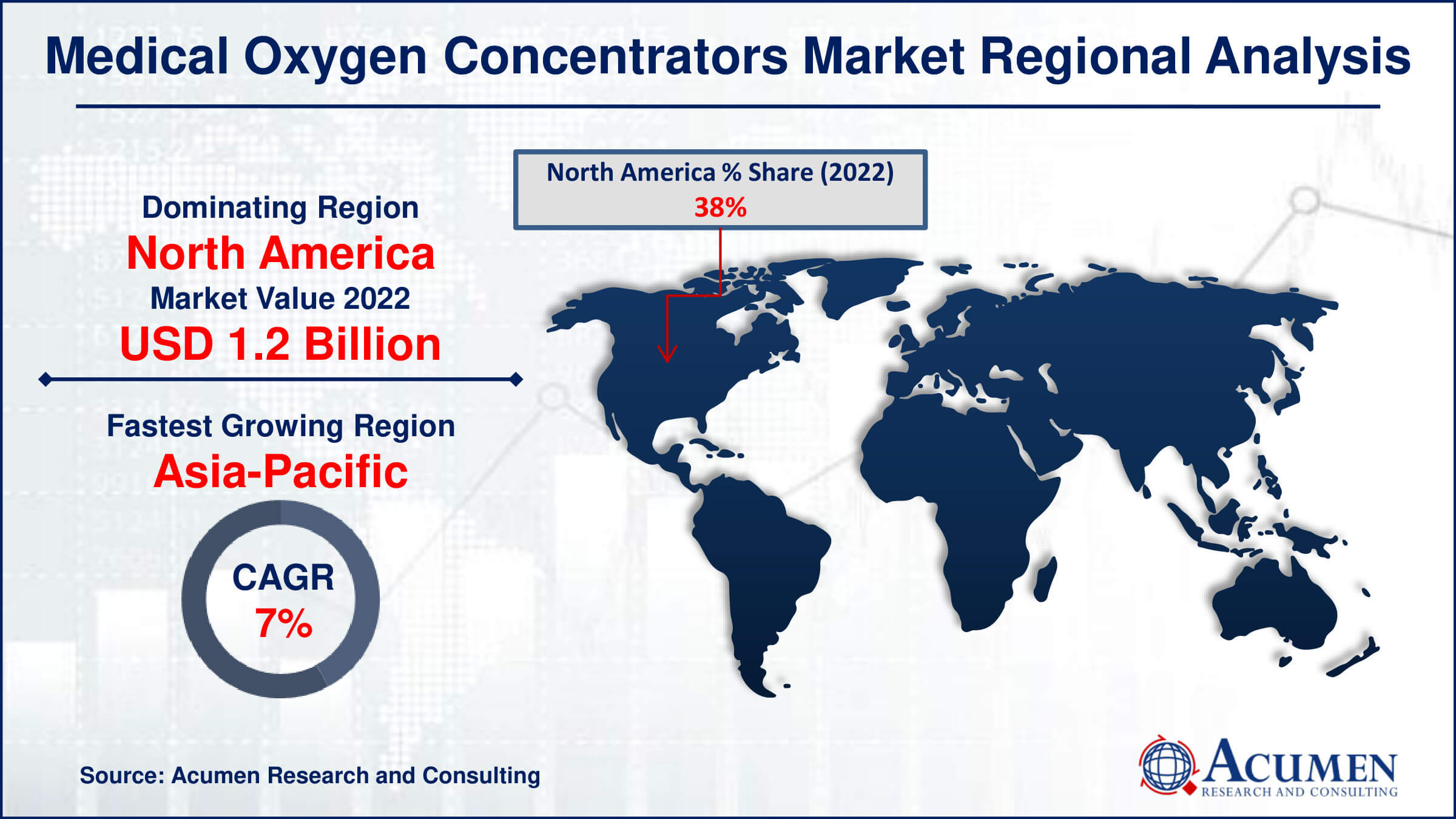

Medical Oxygen Concentrators Market Regional Analysis

In terms of regional segments, due to well-established home healthcare services, prevalent respiratory disorders, and favorable reimbursement policies, North America held the largest revenue share in the medical oxygen concentrator market. The increasing geriatric population, aged over 60 as per UN data, acts as another growth driver in the region.

North America is set for further advancement through government initiatives like the Federal Aviation Administration (FAA), allowing portable concentrator usage during air travel. Major companies including Philips Respironics, SeQual, Invacare, Oxus, Inogen, AirSep, and Inova Labs Inc. significantly contribute to the region's growth.

Looking ahead, Asia-Pacific is poised to emerge as the fastest-growing region. India's market displays promising growth due to the rising prevalence of COPDs and other respiratory disorders. Moreover, increased healthcare spending, awareness of diagnostic technological advancements, and the demand for portable concentrator systems are expected to fuel the regional market.

Medical Oxygen Concentrators Market Players

Some of the top medical oxygen concentrators companies offered in our report includes Chart Industries, Inc., Devilbiss Healthcare, GCE Group, Inogen, Inc., Invacare Corporation, Koninklijke Philips N.V., Nidek Medical Products, Inc., O2 Concepts, Inc., Supera Anesthesia Innovations, and Teijin Limited.

Frequently Asked Questions

How big is the medical oxygen concentrators market?

The market size of medical oxygen concentrators was USD 3.1 billion in 2022.

What is the CAGR of the global medical oxygen concentrators market from 2023 to 2032?

The CAGR of medical oxygen concentrators is 6.5% during the analysis period of 2023 to 2032.

Which are the key players in the medical oxygen concentrators market?

The key players operating in the global market are including Chart Industries, Inc., Devilbiss Healthcare, GCE Group, Inogen, Inc., Invacare Corporation, Koninklijke Philips N.V., Nidek Medical Products, Inc., O2 Concepts, Inc., Supera Anesthesia Innovations, and Teijin Limited.

Which region dominated the global medical oxygen concentrators market share?

North America held the dominating position in medical oxygen concentrators industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of medical oxygen concentrators during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global medical oxygen concentrators industry?

The current trends and dynamics in the medical oxygen concentrators industry include increasing prevalence of respiratory disorders, technological advancements in oxygen concentrator designs, growing aging population requiring respiratory support, and rising demand for home healthcare solutions.

Which product held the maximum share in 2022?

The portable oxygen concentrators product held the maximum share of the medical oxygen concentrators industry.