Medical Nutrition Market | Acumen Research and Consulting

Medical Nutrition Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

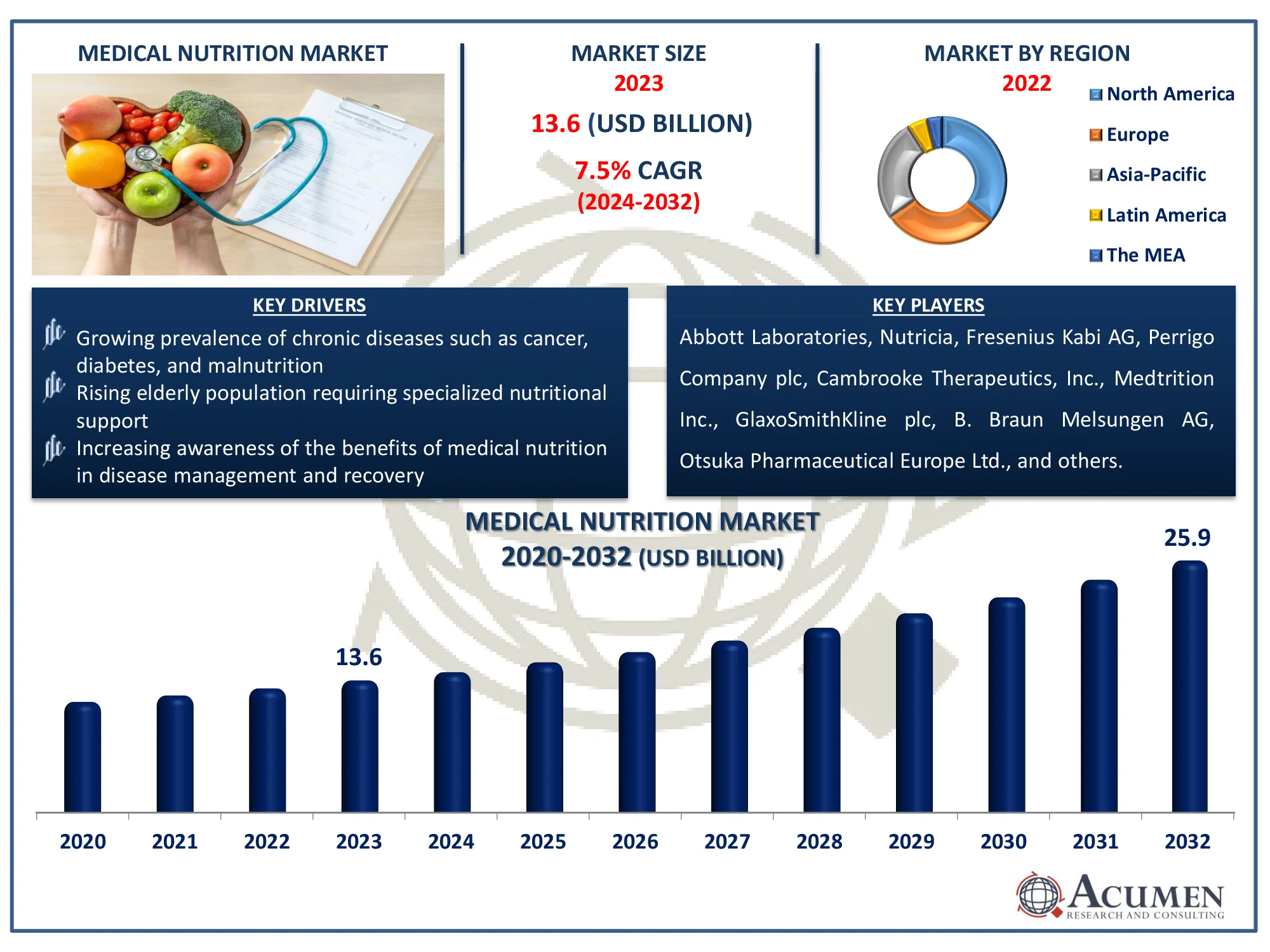

The Global Medical Nutrition Market Size accounted for USD 13.6 Billion in 2023 and is estimated to achieve a market size of USD 25.9 Billion by 2032 growing at a CAGR of 7.5% from 2024 to 2032.

Medical Nutrition Market (By Type: Pediatric Nutrition, Parenteral Nutrition, Elderly Nutrition, Sport Nutrition; By Indication: Diabetes, Dysphagia, General Well-being, Hepatic Disorders, IBD & GI, Neurological Disorders, Oncology Nutrition, Renal Disorders, Respiratory Disorders, and Others; By Route of Administration: Oral, Enteral, Parenteral; By End User: Adult, Geriatric, Pediatric; By Distribution Channel: Direct, Indirect; and By Region: North America, Europe, Asia-Pacific, Latin America, and MEA)

Medical Nutrition Market Highlights

- Global medical nutrition market revenue is poised to garner USD 25.9 billion by 2032 with a CAGR of 7.5% from 2024 to 2032

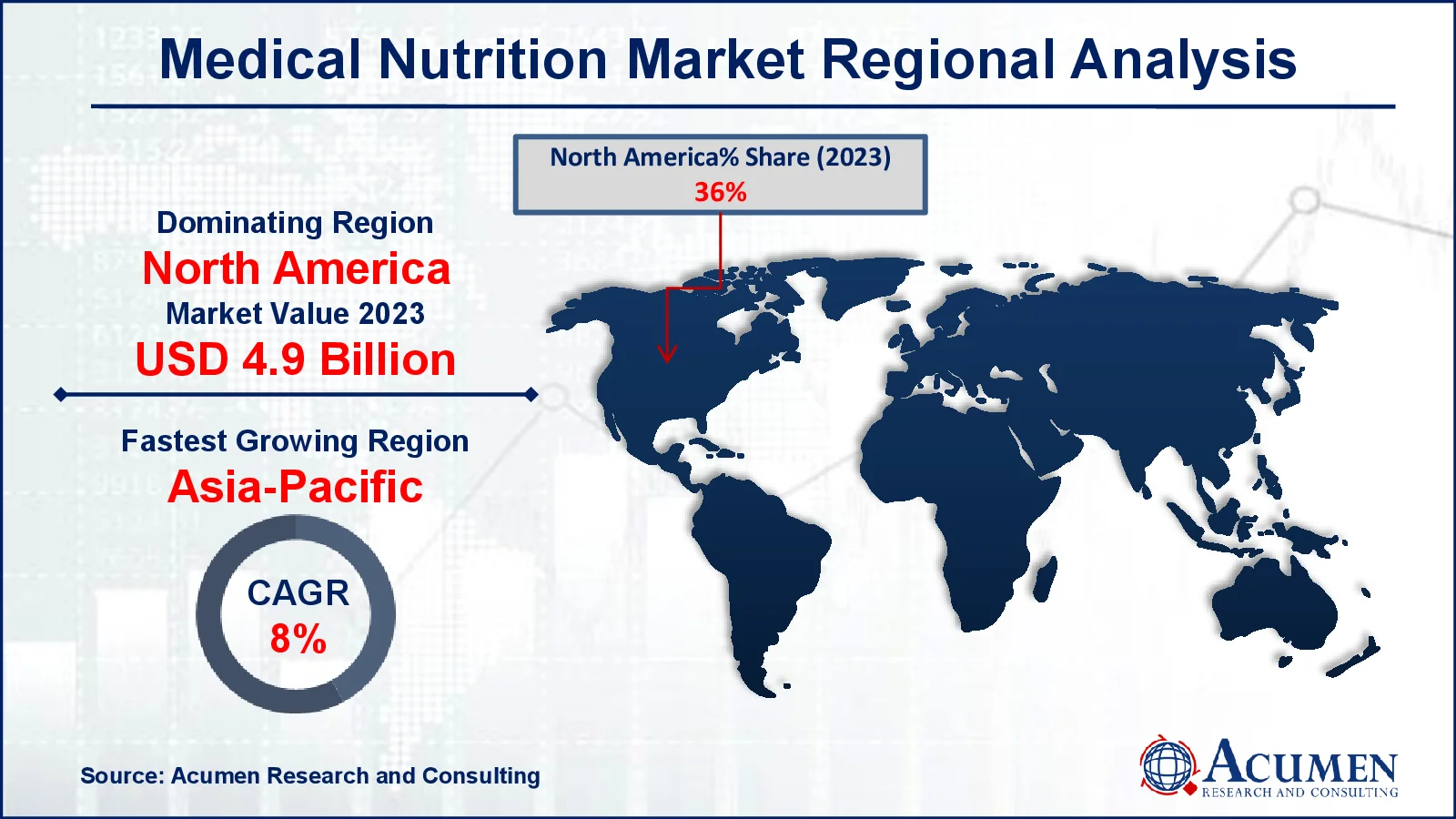

- North America medical nutrition market value occupied around USD 4.9 billion in 2023

- Asia-Pacific medical nutrition market growth will record a CAGR of more than 8% from 2024 to 2032

- Among product type, the pediatric nutrition sub-segment generated noteworthy revenue in 2023

- Based on application, the oncology nutrition generated significant medical nutrition market share in 2023

- Increasing focus on environmentally sustainable sourcing and production practices in medical nutrition products is a popular medical nutrition market trend that fuels the industry demand

Medical nutrition refers to therapeutic compositions that are specifically handled, developed, and planned for the dietary management of patients. This diet is carefully prescribed by medical professionals and is consumed under medical supervision. Medical nutrition addresses the nutritional needs of individuals with chronic conditions such as diabetes, cancer, immune system problems, and others. The changing lifestyles of patients, combined with the growth of rare diseases, have created a demand for medical nutrition. The growing aging population is now regarded as a major global concern. Changes in lifestyle have resulted in accelerated aging of the population, increasing the prevalence of numerous diseases. Furthermore, the senior population is more susceptible to disorders such as anxiety, Parkinson's, diabetes, and organ failure. Such individuals suffer the consequences of insufficient food intake and require parenteral medicinal nutrition to maintain their nutritional dimensions.

Global Medical Nutrition Market Dynamics

Market Drivers

- Growing prevalence of chronic diseases such as cancer, diabetes, and malnutrition

- Rising elderly population requiring specialized nutritional support

- Increasing awareness of the benefits of medical nutrition in disease management and recovery

Market Restraints

- High costs associated with medical nutrition products

- Stringent regulatory frameworks and approval processes

- Limited reimbursement policies in certain regions, restricting access

Market Opportunities

- Expansion in emerging markets with rising healthcare expenditure

- Innovations in product formulations, including plant-based and specialized dietary solutions

- Increasing adoption of home healthcare services driving demand for medical nutrition products

Medical Nutrition Market Report Coverage

| Market | Medical Nutrition Market |

| Medical Nutrition Market Size 2022 |

USD 13.6 Billion |

| Medical Nutrition Market Forecast 2032 | USD 25.9 Billion |

| Medical Nutrition Market CAGR During 2023 - 2032 | 7.5% |

| Medical Nutrition Market Analysis Period | 2020 - 2032 |

| Medical Nutrition Market Base Year |

2022 |

| Medical Nutrition Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Indication, By Route Of Administration, By End-User, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott Laboratories, Nutricia, Perrigo Company plc, Fresenius Kabi AG, Cambrooke Therapeutics, Inc., Medtrition Inc., GlaxoSmithKline plc, B. Braun Melsungen AG, Otsuka Pharmaceutical Europe Ltd., Nutrición Médica, Kate Farms, Inc., Medifood GmbH, AYMES International Ltd., Baxter International Inc., Nestlé S.A., Pfizer Inc., Mead Johnson & Company, LLC, and Meiji Holdings Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Medical Nutrition Market Insights

Chronic obstructive pulmonary disease (COPD) is among the leading causes of disability. According to the World Health Organization (WHO), COPD has long been regarded as one of the leading causes of death and is expected to become more prevalent. Malnutrition is regarded as one of the most common issues among COPD patients who require medicinal nutrition support to survive. The increasing prevalence of disease-related malnutrition is also predicted to drive the global medical nutrition industry.

Advances in biotechnology have resulted in the disruption of the medical nutrition market, with manufacturers increasingly focusing on the research and development of better and more tailored medical nutrition products. As a result, the creation of disease-specific specialist medical nutrition products is increasing, particularly in developed countries.

Parenteral medical nutrition therapy serves as an important therapeutic technique for the treatment and management of chronic illness problems. The primary rationale for the use of parenteral medical nutrition is to provide appropriate nutrient intake when oral or enteral feeding is insufficient to meet the nutritional needs of the patient. Because of the higher costs of parental medical nutrition, consumers may opt for oral and enteral nutrition intake, which is expected to stymie segmental expansion in the parenteral medical nutrition market.

The global market is expected to grow at a rapid pace as a result of patients' increasing awareness of specific meals and their favorable health effects. Demand for medical nutrition therapy to improve infant survival rates is necessary to make the market look promising in the next years. The increase in the number of malnourished patients, combined with the growth in the senior population, is likely to drive demand for medical nutrition products.

Medical nutrition refers to therapeutic nutritional supplements that are advised to meet the patient's specific nutritional needs. It is used to treat a variety of diseases and clutters, including diabetes, Parkinson's disease, cancer, gastrointestinal distress, malnutrition, and immune system problems. Supplements play an important role in the metabolic processes of the body. To allow the body to function optimally, nutrition substances must be present in sufficient quantities and in the proper form. Supplements contain vitamins and minerals. Supplements are received from the diet and internal bodily processes, including the action of gut microbes. However, when stressed or in a diseased state, these nutrients may not be absorbed by the body with a regular dietary regimen. Medical nutrition helps to address the body's specific needs.

Medical Nutrition Market Segmentation

The worldwide market for medical nutrition is split based on type, indication, application, end-user, distribution channel, and geography.

Medical Nutrition Types

- Pediatric Nutrition

- Parenteral Nutrition

- Elderly Nutrition

- Sport Nutrition

According to medical nutrition industry analysis, pediatric nutrition is gaining popularity as more people recognize the importance of early nutrition in child development and health outcomes. The rising frequency of pediatric obesity and malnutrition has prompted a renewed emphasis on individualized nutritional treatments for newborns and children. Furthermore, advances in medical research and technology have sparked innovation in pediatric nutritional products, making them more effective and appealing to both healthcare providers and parents.

Medical Nutrition Indications

- Diabetes

- Dysphagia

- General Well-being

- Hepatic Disorders

- IBD & GI

- Neurological Disorders

- Oncology Nutrition

- Renal Disorders

- Respiratory Disorders

- Others

According to medical nutrition industry analysis, on the basis of indication, oncology nutrition has a significant part of the medical nutrition industry, trailed by nervous system science nutrition. Because of the high prevalence of cerebrovascular issues, dementia, and strokes in neurological disorders, medicinal nutrition is often eaten by patients suffering from these diseases.

Medical Nutrition Route of Administrations

- Oral

- Enteral

- Parenteral

In the medical nutrition market, the oral route of administration has expected to dominate the industry due to patient comfort and ease of usage. Oral supplements are non-invasive, making them ideal for long-term use, particularly in the management of chronic illnesses such as malnutrition, cancer, and diabetes. They also provide a diverse choice of flavors and formulas, which enhances patient compliance. Furthermore, oral feeding solutions are readily available and self-administered, which reduces the need for hospitalization or specialist medical care.

Medical Nutrition End-Users

- Adult

- Geriatric

- Pediatric

Historically, among the pediatric population, medical nutrition consumption is highest among newborns under the age of one year. The usual length of hospital stay for pediatric patients is less than that for adult and geriatric patients, which explains why adult and geriatric end-client categories have a larger market share in medical nutrition.

Medical Nutrition Distribution Channels

- Direct

- Indirect

As per the medical nutrition market forecast, the direct distribution channel is expected to lead the market throughout 2024 to 2032 because it enables suppliers to deliver products directly to hospitals, clinics, and long-term care facilities. This allows for improved control over product quality, delivery deadlines, and inventory management. Direct routes also foster better relationships between suppliers and healthcare professionals, ensuring that specialized products reach patients more efficiently. It also helps to reduce the costs associated with supply chain intermediaries.

Medical Nutrition Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Medical Nutrition Market Regional Analysis

North America is the largest region for the medical nutrition market. The rising prevalence of malnutrition has accelerated the growth of the medical nutrition industry in North America. For instance, the number of people living in food insecure households in the United States climbed to 47 million in 2023, including nearly 14 million children, according to a research by the United States Department of Agriculture. The North American market is expected to lead the worldwide medical nutrition industry in 2023. North America is expected to gain a major portion of the income market by the end of 2032. Furthermore, the US medical nutrition market is expected to grow at a substantial CAGR throughout the forecast period.

The prevalence of IBD and GI tract issues is steadily increasing in the Asia-Pacific area, which is expected to accelerate the segmental growth of the medical nutrition market. The Asia Pacific region is expected to be the dominating location for the medical nutrition market over the forecast period, with factors contributing to an increasing number of ailments such as diabetes, cancer, and others. The rapidly increasing prevalence of cancer is also predicted to significantly contribute to the growth of the global medical nutrition industry.

On the other hand, the Middle East and Africa region is expected to experience relatively slow growth in the medical nutrition industry, as restricted access to exceptional care remains prevalent.

Medical Nutrition Market Players

Some of the top medical nutrition companies offered in our report includes Abbott Laboratories, Nutricia, Perrigo Company plc, Fresenius Kabi AG, Cambrooke Therapeutics, Inc., Medtrition Inc., GlaxoSmithKline plc, B. Braun Melsungen AG, Otsuka Pharmaceutical Europe Ltd., Nutrición Médica, Kate Farms, Inc., Medifood GmbH, AYMES International Ltd., Baxter International Inc., Nestlé S.A., Pfizer Inc., Mead Johnson & Company, LLC, and Meiji Holdings Co., Ltd.

Frequently Asked Questions

How big is the medical nutrition market?

The medical nutrition market size was valued at USD 13.6 billion in 2023.

What is the CAGR of the global medical nutrition market from 2024 to 2032?

The CAGR of medical nutrition is 7.5% during the analysis period of 2024 to 2032.

Which are the key players in the medical nutrition market?

The key players operating in the global market are including Abbott Laboratories, Nutricia, Perrigo Company plc, Fresenius Kabi AG, Cambrooke Therapeutics, Inc., Medtrition Inc., GlaxoSmithKline plc, B. Braun Melsungen AG, Otsuka Pharmaceutical Europe Ltd., Nutrición Médica, Kate Farms, Inc., Medifood GmbH, AYMES International Ltd., Baxter International Inc., Nestlé S.A., Pfizer Inc., Mead Johnson & Company, LLC, and Meiji Holdings Co., Ltd.

Which region dominated the global medical nutrition market share?

North America held the dominating position in medical nutrition industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of medical nutrition during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global medical nutrition industry?

The current trends and dynamics in the medical nutrition industry include growing prevalence of chronic diseases such as cancer, diabetes, and malnutrition, rising elderly population requiring specialized nutritional support, and increasing awareness of the benefits of medical nutrition in disease management and recovery.

Which product type held the maximum share in 2023?

The pediatric nutrition held the maximum share of the medical nutrition industry.