Medical Micro Injection Molding Market Size - Global Industry, Share, Analysis, Trends and Forecast 2025 - 2033

Published :

Report ID:

Pages :

Format :

Medical Micro Injection Molding Market Size - Global Industry, Share, Analysis, Trends and Forecast 2025 - 2033

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

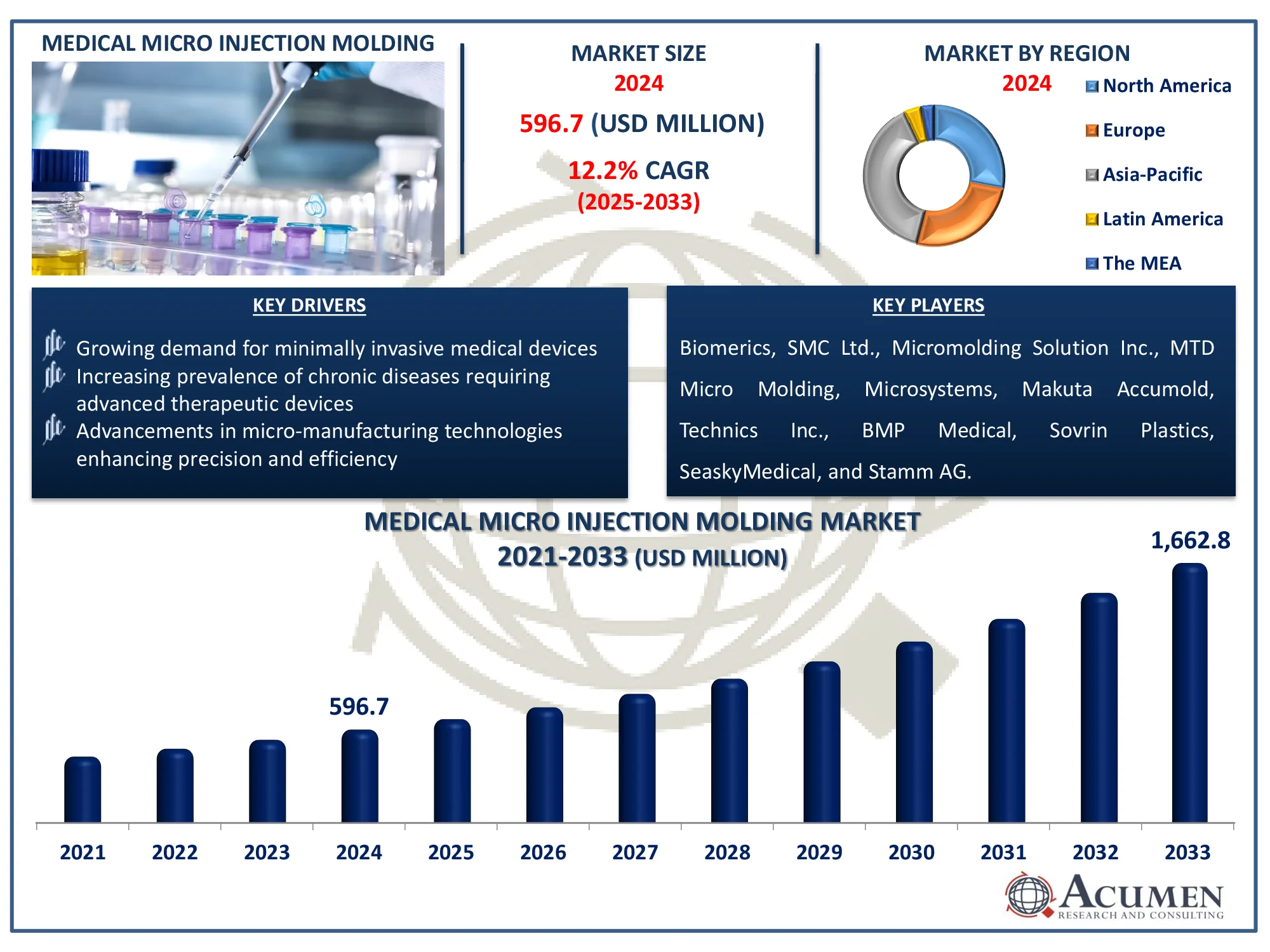

The Global Medical Micro Injection Molding Market Size accounted for USD 596.7 Million in 2024 and is estimated to achieve a market size of USD 1,662.8 Million by 2033 growing at a CAGR of 12.2% from 2025 to 2033.

Medical Micro Injection Molding Market Highlights

- Global medical micro injection molding market revenue is poised to garner USD 1,662.8 Million by 2033 with a CAGR of 12.2% from 2025 to 2033

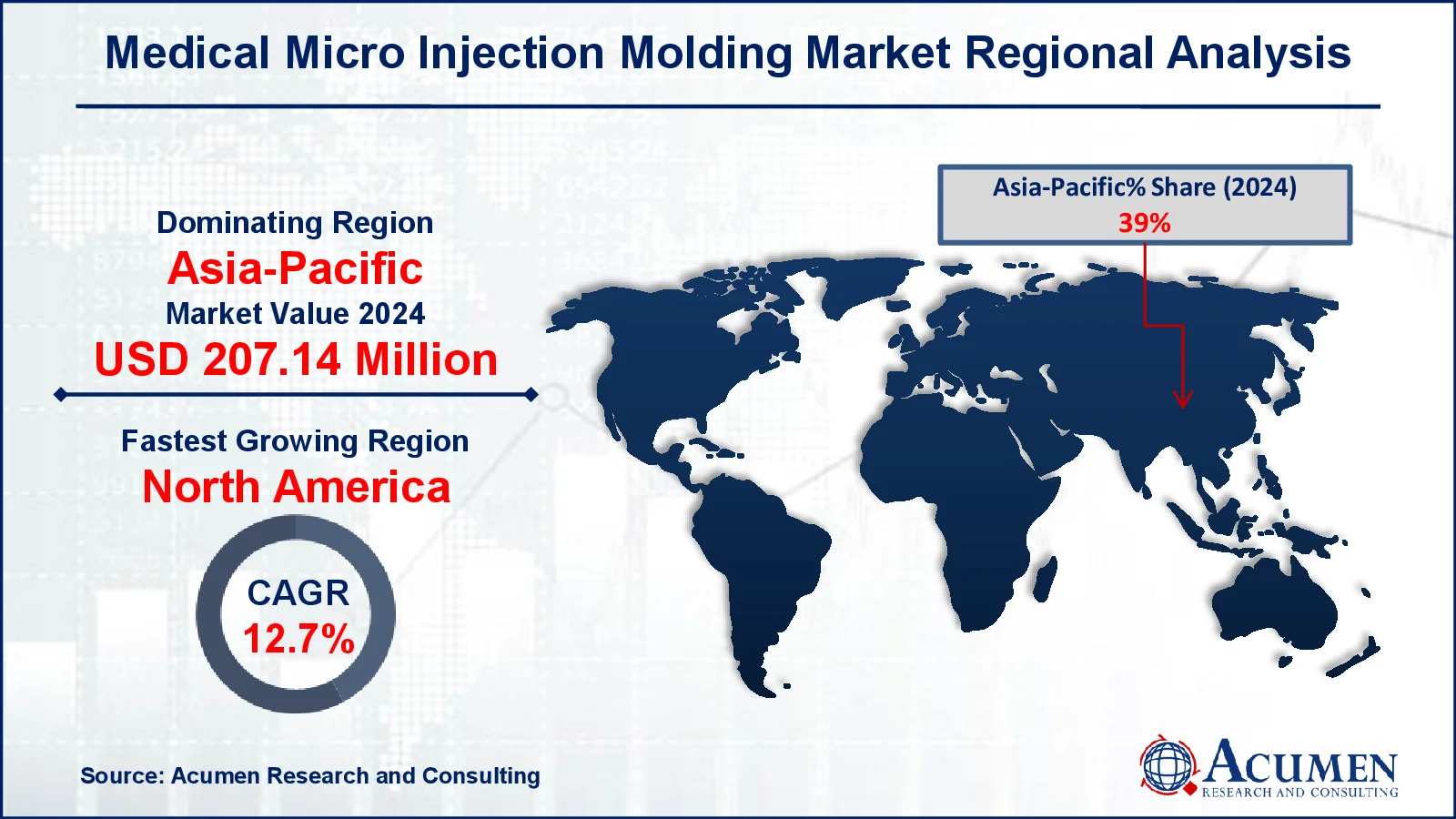

- Asia-Pacific medical micro injection molding market value occupied around USD 207.14 Million in 2024

- North America medical micro injection molding market growth will record a CAGR of more than 12.7% from 2025 to 2033

- Growing demand for smaller, more precise medical components is a popular medical micro injection molding market trend that fuels the industry demand

The micro injection molding process is intended to reduce medical equipment size within the reach of several microns or sub-microns. Products developed with these techniques are extremely precise in order to manufacture a large number of micro components repeatedly and continuously with complex type and higher quality at low cost. Micro molding is used in the electrical, biomedical and automotive industries. The medical system has a particular value in miniature precision, which in turn raises the market for micro molding process in medical devices. Size and precision play an important role in the medical industry because it impacts its functionality and device protection. Medical instruments consist of bioabsorbables or thermoplastics for microinjection molding. The normal medical product that is developed by microshaping is surgical devices, hearing aids, monitoring devices, catheters, endoscopic devices, other sequencing devices and DNA-based science.

Global Medical Micro Injection Molding Market Dynamics

Market Drivers

- Growing demand for minimally invasive medical devices

- Increasing prevalence of chronic diseases requiring advanced therapeutic devices

- Advancements in micro-manufacturing technologies enhancing precision and efficiency

Market Restraints

- High initial setup and tooling costs

- Stringent regulatory requirements for medical device manufacturing

- Limited availability of skilled professionals for micro molding processes

Market Opportunities

- Rising adoption of point-of-care diagnostic devices

- Growing demand for wearable medical devices and implants

- Technological innovations in biocompatible and sustainable micro molding materials

Medical Micro Injection Molding Market Report Coverage

|

Market |

Medical Micro Injection Molding Market |

|

Medical Micro Injection Molding Market Size 2024 |

USD 596.7 Million |

|

Medical Micro Injection Molding Market Forecast 2033 |

USD 1,662.8 Million |

|

Medical Micro Injection Molding Market CAGR During 2025 - 2033 |

12.2% |

|

Medical Micro Injection Molding Market Analysis Period |

2021 - 2033 |

|

Medical Micro Injection Molding Market Base Year |

2024 |

|

Medical Micro Injection Molding Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Type, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled Aviation |

Biomerics, SMC Ltd., Micromolding Solution Inc., MTD Micro Molding, Accumold, Microsystems, Makuta Technics Inc., BMP Medical, Sovrin Plastics, SeaskyMedical, Spectrum Plastics Group, and Stamm AG. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Medical Micro Injection Molding Market Insights

The increasing demand for healthcare goods made from plastic-based injection moldings is likely to drive growth in the global medical injection molding market. For example, Plastics Engineering claims that plastic injection molding accounts for roughly half of all plastic processing methods. Compared to other procedures like as blow molding and thermoforming. Furthermore, according to our analysis, the worldwide plastic injection molding market size was USD 271.6 billion in 2021 and is expected to reach USD 419.1 billion by 2030, rising at a 5% CAGR between 2022 and 2030. The volume of medical equipment, medications, and consumables has increased, resulting in increased use of this technology, which is expected to stimulate consumer development.

The high prevalence of several environmental hazards associated to the injection molding technology, as well as the high regulatory requirements on medical goods and their development, are some limiting factors that can stymie market expansion.

Microinjection moulding is also one of the most common microprocessing technologies due to its large production capabilities and low production costs. Electronic components and appliances are intended for long-term usage, so the components used in production must be of the greatest quality. The micro-molding technology of thermoplastics allows the electronics industry to meet its needs. Such molded components are rarely used in the electronic sector for SIM card connections, pin connectors, single and multi-mode ferrules, and coax plugs.

Advancements in molding equipment present an opportunity for the medical micro injection molding industry. For example, in November 2021, QNES Global launched a micro injection molding machine. The business has created a small-sized grinder that has been downsized for larger grinders. It is a passive ultra-small injection machine with excellent capacity, convenience, and design. These revolutionary product advancements by leading manufacturers will boost industry growth in the forecast year.

Medical Micro Injection Molding Market Segmentation

Medical Micro Injection Molding Market Segmentation

The worldwide market for medical micro injection molding is split based on type, application, and geography.

Medical Micro Injection Molding Market By Type

- PEEK

- PVC

- PE

- Others

According to medical micro injection molding industry analysis, polyethylene (PE) is predicted to experience significant growth in 2024 due to its biocompatibility, adaptability, and cost-effectiveness. It is commonly utilized in disposable medical devices and components. Polyvinyl chloride (PVC) follows closely due to its flexibility, simplicity of manufacturing, and low cost, making it ideal for tubing and connectors. Polyether ether ketone (PEEK) is gaining popularity in high-performance applications due to its superior mechanical qualities, chemical resistance, and biocompatibility. Continuous innovation and demand for smaller medical devices are driving growth in all segments.

Medical Micro Injection Molding Market By Application

- Diagnostic Devices

- Therapeutic Devices

According to medical micro injection molding market forecast, therapeutic devices are expected to expand in the market due to the rising need for precision components in drug delivery systems, surgical instruments, and implants. Their intricate designs and miniaturization requirements necessitate the use of micro injection molding for manufacturing precision and efficiency. The increasing frequency of chronic diseases drives up demand for these devices. Diagnostic devices, while a smaller market, are gaining popularity as a result of advances in point-of-care testing and less invasive diagnostic instruments. To work accurately and reliably, these devices require sophisticated micro-components.

Medical Micro Injection Molding Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Medical Micro Injection Molding Market Regional Analysis

Medical Micro Injection Molding Market Regional Analysis

In terms of regional segments, the medical device manufacturing in Asia-Pacific, as well as ongoing expenditures in medical technologies are boosting demand for medical micro injection molding industry. China, Korea, and Japan are likely to dominate the market due to their advanced medical device industries and automation. The increased usage of hearing aids and medical equipment is also driving demand. In May 2022, Argon Medical, the world leader in specialty medical equipment such as guide wires, IVC filters and retrievals, bone and soft tissue biopsy needles, and other products, signed a collaboration agreement with Terumo India, the Indian division of Terumo Corporation. Medical devices such as guide wires, biopsy needles, and other precision tools demand high levels of accuracy and miniaturization, which are frequently achieved through micro injection molding, resulting in increased market growth.

North America is experiencing rapid growth in the medical micro injection molding market. The presence of large medical device manufacturers in the region increases the need for micro injection molded plastic components. For example, in April 2023, LS Mtron Injection Molding Machines USA expanded their One-E series of electric injection molding machines to include models weighing 55, 90, 145, and 440 tons. According to business President Peter Gardner, this high-speed line expands the capabilities of regular all-electric machines ranging from 35 to 950 tons. Furthermore, the region's mature and technologically proficient manufacturing sector, particularly in the United States, where the medical industry considerably contribute to market demand.

Medical Micro Injection Molding Market Players

Some of the top medical micro injection molding companies offered in our report includes Biomerics, SMC Ltd., Micromolding Solution Inc., MTD Micro Molding, Accumold, Microsystems, Makuta Technics Inc., BMP Medical, Sovrin Plastics, SeaskyMedical, and Stamm AG.

Frequently Asked Questions

What was the market size of the global Medical Micro Injection Molding in 2024?

The market size of medical micro injection molding was USD 596.7 Million in 2024.

What is the CAGR of the global Medical Micro Injection Molding market from 2025 to 2033?

The CAGR of medical micro injection molding is 12.2% during the analysis period of 2025 to 2033.

Which are the key players in the Medical Micro Injection Molding market?

The key players operating in the global market are including Biomerics, SMC Ltd., Micromolding Solution Inc., MTD Micro Molding, Accumold, Microsystems, Makuta Technics Inc., BMP Medical, Sovrin Plastics, SeaskyMedical, and Stamm AG

Which region dominated the global Medical Micro Injection Molding market share?

Asia-Pacific held the dominating position in medical micro injection molding industry during the analysis period of 2025 to 2033.

Which region registered fastest CAGR from 2025 to 2033?

North America region exhibited fastest growing CAGR for market of medical micro injection molding during the analysis period of 2025 to 2033.

What are the current trends and dynamics in the global Medical Micro Injection Molding industry?

The current trends and dynamics in the medical micro injection molding industry includes growing demand for minimally invasive medical devices, increasing prevalence of chronic diseases requiring advanced therapeutic devices, and advancements in micro-manufacturing technologies enhancing precision and efficiency.

Which application held the maximum share in 2024?

The therapeutic devices held the maximum share of the medical micro injection molding industry.