Medical Membranes Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Medical Membranes Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

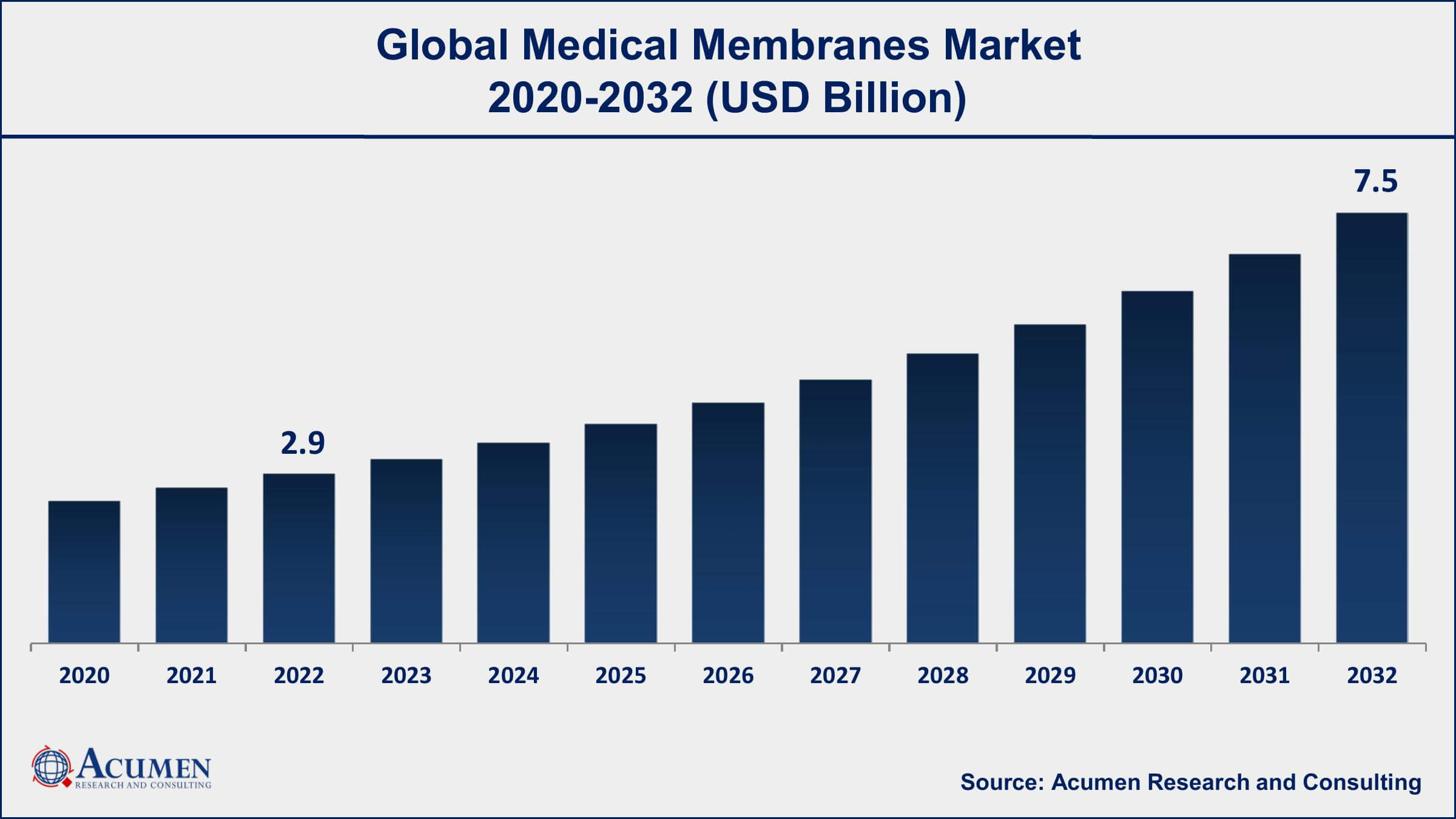

The Global Medical Membranes Market Size accounted for USD 2.9 Billion in 2022 and is projected to achieve a market size of USD 7.5 Billion by 2032 growing at a CAGR of 9.9% from 2023 to 2032.

Medical Membranes Market Report Key Highlights

- Global medical membranes market revenue is expected to increase by USD 7.5 Billion by 2032, with a 9.9% CAGR from 2023 to 2032

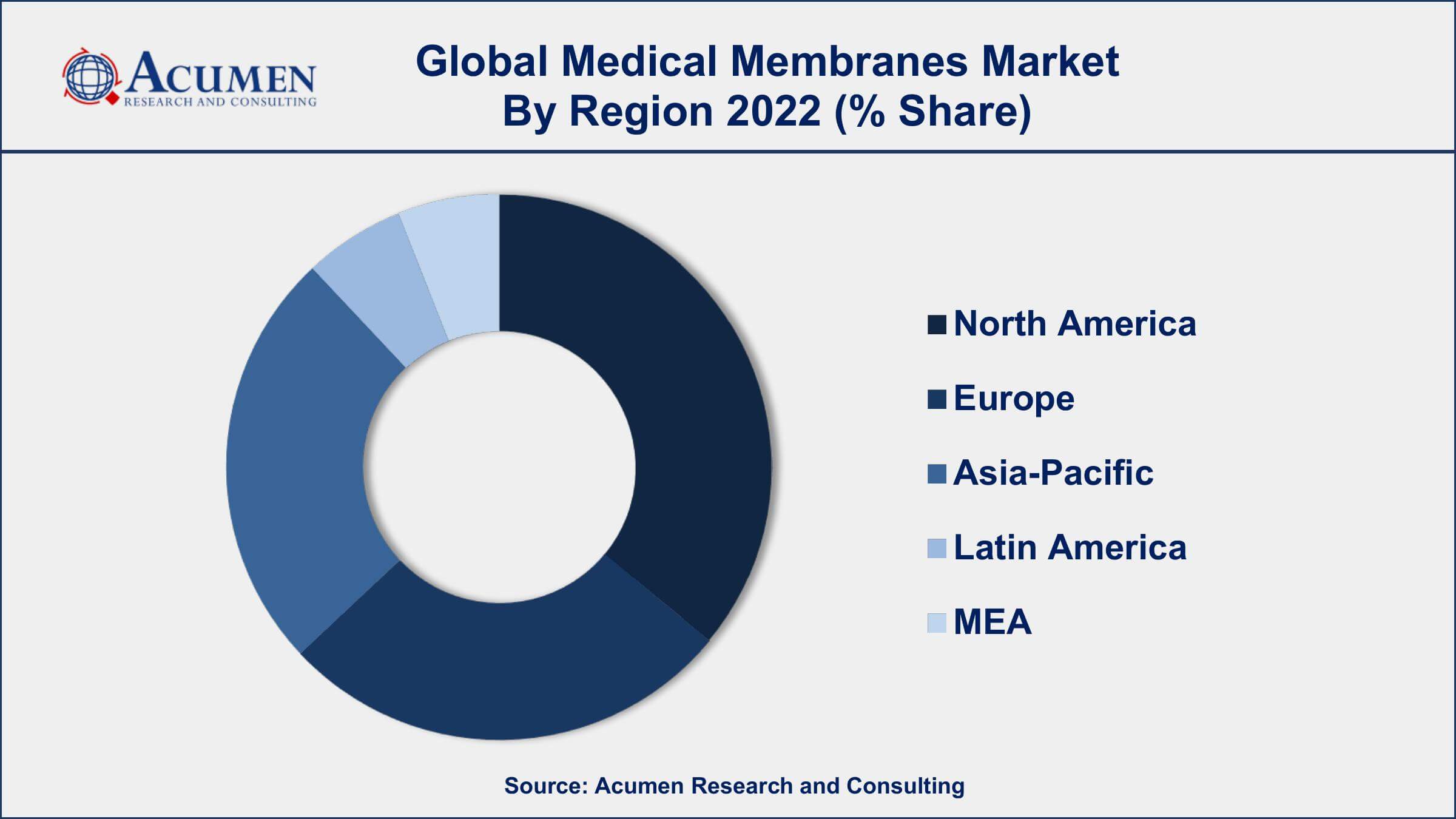

- North America region led with more than 39% of medical membranes market share in 2022

- Asia-Pacific medical membranes market growth will register a CAGR of more than 10% from 2022 to 2030

- According to NIBIB, medical membranes are used in a wide range of applications, including drug delivery, tissue engineering, and blood filtration

- According to NSF, medical membranes are an important area of research in materials science and engineering

- Growing concerns about national security and internal conflicts, drives the medical membranes market size

Medical membranes are thin, semi-permeable barriers that are used in various medical applications, including drug delivery systems, artificial organs, wound dressings, and blood oxygenators. These membranes are designed to selectively allow certain substances to pass through while blocking others, making them useful in many medical settings. Medical membranes can be made from a variety of materials, including synthetic polymers, natural polymers, and ceramics, and their properties can be tailored to suit specific applications.

The global medical membranes market has been growing steadily in recent years and is expected to continue to grow in the coming years. The market is being driven by a growing demand for medical devices and equipment that use membranes, as well as increasing investment in healthcare infrastructure in developing countries. Additionally, the development of new membrane technologies and the increasing use of membranes in drug delivery systems are expected to fuel market growth.

Global Medical Membranes Market Trends

Market Drivers

- Increasing prevalence of chronic diseases

- Growing demand for medical devices and equipment

- Increasing use of membranes in drug delivery systems

- Aging population in many countries

Market Restraints

- High cost of membrane-based medical devices

- Limited availability of raw materials

Market Opportunities

- Growing demand for personalized medicine

- Development of new membrane materials and technologies

Medical Membranes Market Report Coverage

| Market | Medical Membranes Market |

| Medical Membranes Market Size 2022 | USD 2.9 Billion |

| Medical Membranes Market Forecast 2032 | USD 7.5 Billion |

| Medical Membranes Market CAGR During 2023 - 2032 | 9.9% |

| Medical Membranes Market Analysis Period | 2020 - 2032 |

| Medical Membranes Market Base Year | 2022 |

| Medical Membranes Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Material, By Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Baxter International Inc., Merck Millipore, 3M Company, Pall Corporation (Danaher Corporation), Sartorius AG, GE Healthcare Life Sciences, Asahi Kasei Corporation, Koch Membrane Systems, Inc. (Koch Industries, Inc.), W. L. Gore & Associates, Inc., and Cantel Medical Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The membrane is a special technology that offers some unique and key benefits to its end-users which aids in enhancing the overall quality of pharmaceutical products and thus helps in maintaining its operational efficiency. The membrane is used as a separation technique to cover some of the enhanced applications of membrane technologies such as concentration, separation, and purification. Medical membranes generally furnish high separation accuracy and help in the production of high-purity products. Moreover, it also offers relatively better selectivity towards the essential components and thus helps in enhancing and improving the treatment of wastewater. The key applications of membrane technology include in the medical and healthcare industry to enable a large number of comprehensive uses especially of the resources, despite improving the overall quality of healthcare and pharmaceutical products. The global medical membrane market has witnessed a lot of unprecedented growth over the last few years due to its rapidly increasing uses in several end-use industries such as biotechnology, pharmaceuticals healthcare, and many more among others.

There are rising incidents of end-stage renal disease and diabetes in the past few years due to the increasing geriatric population as well as the rise in the number of obese people across the globe. With this rise in the aging population, the pharmaceutical, healthcare, and biotechnology industry is in turn witnessing significant growth in developing countries such as China and India. In addition, India has the world’s largest number of diabetic patients and this population is anticipated to increase thoroughly over the coming years. In addition, China has the world’s second-largest diabetic population. With such an enormous population of diabetic patients, there is an increased need for medical membranes, thus creating a potential opportunity for market players. The medical membranes market is analyzed to register significant growth, especially in the Middle East & Africa, and Latin America regions in the foreseeable years owing to the increased number of diabetic patients as well as advancement in the healthcare sector.

Medical Membranes Market Segmentation

The global medical membranes market segmentation is based on material, technology, application, and geography.

Medical Membranes Market By Material

- Polytetrafluoroethylene (PTFE)

- Acrylics

- Polysulfone (PSU) & Polyether Sulfone (PESU)

- Polyvinylidene fluoride (PVDF)

- Polypropylene (PP)

- Others

According to medical membranes industry analysis, the polysulfone & polyether sulfone segment accounted for the largest market share in 2022. Polysulfone and polyether sulfone are two types of materials commonly used in the production of medical membranes due to their excellent chemical and thermal stability, high mechanical strength, and good biocompatibility. The polysulfone segment of the medical membranes market is expected to witness significant growth in the coming years, driven by its increasing use in hemodialysis and other blood purification applications. Polysulfone membranes have been widely adopted in these applications due to their ability to effectively remove toxins and other waste products from the blood. Additionally, the growing prevalence of chronic kidney diseases and the increasing demand for renal replacement therapies are expected to fuel market growth in this segment.

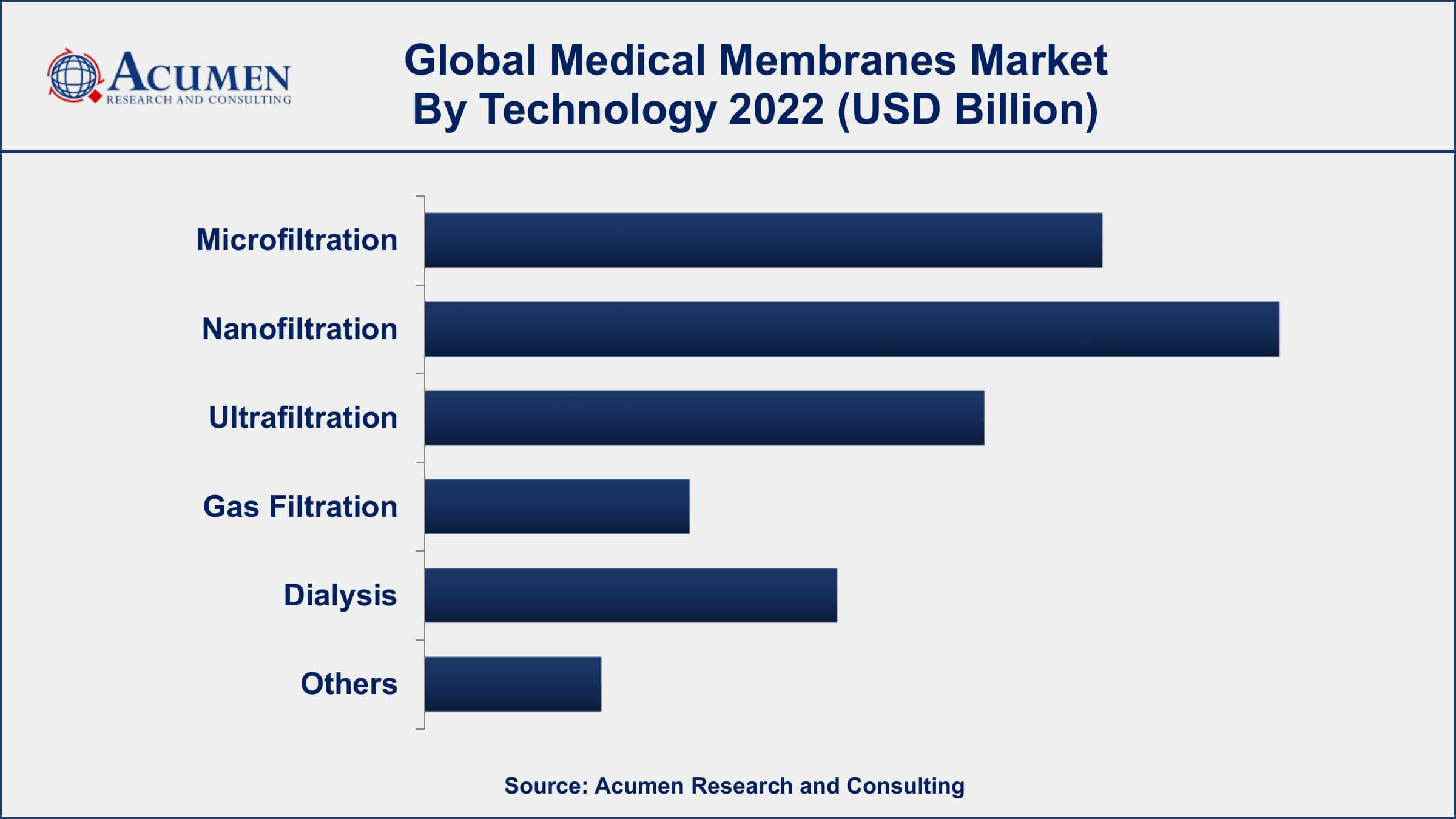

Medical Membranes Market By Technology

- Microfiltration

- Nanofiltration

- Ultrafiltration

- Gas Filtration

- Dialysis

- Others

In terms of technology, the nanofiltration segment is expected to witness significant growth in the coming years. This growth is driven by its increasing use in drug delivery systems and other medical applications. Nanofiltration is a type of filtration process that uses membranes with small pore sizes to selectively remove particles from a fluid. Nanofiltration membranes offer excellent selectivity and can be used to effectively separate and concentrate pharmaceuticals, proteins, and other biomolecules. Additionally, the growing demand for personalized medicine and targeted drug delivery is expected to fuel market growth in this segment.

Medical Membranes Market By Application

- Drug Delivery

- Pharmaceutical Filtration

- Hemodialysis

- Bio-artificial Processes

- IV Infusion & Sterile Filtration

- Others

According to the medical membranes market forecast, the IV infusion & sterile filtration segment is expected to continue to grow in the coming years. IV infusion membranes are used to filter out impurities and particles from intravenous solutions to ensure patient safety, while sterile filtration membranes are used to remove bacteria and other microorganisms from pharmaceuticals and biologics. The IV infusion segment of the medical membranes market is expected to witness steady growth in the coming years, driven by the increasing demand for intravenous therapies and the need for high-quality IV solutions. IV infusion membranes offer excellent particle retention capabilities and can effectively remove contaminants and bacteria from IV solutions. Additionally, the increasing prevalence of chronic diseases and the growing demand for personalized medicine are expected to fuel market growth in this segment.

Medical Membranes Market Regional Outlook

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Medical Membranes Market Regional Analysis

North America dominates the medical membranes market for several reasons, including its well-established healthcare infrastructure, strong presence of leading medical device manufacturers, and high demand for advanced medical technologies. The region is home to several major players in the medical membranes industry, including Pall Corporation, Merck Millipore, and 3M Company, among others. These companies have a strong presence in North America and are constantly investing in R&D to develop new and innovative medical membrane technologies. In addition, the region has a large and aging population, which is driving demand for medical devices and equipment, including medical membranes. The increasing prevalence of chronic diseases such as diabetes, cancer, and cardiovascular diseases is also driving the demand for advanced medical technologies, including medical membranes.

Medical Membranes Market Player

Some of the top medical membranes market companies offered in the professional report include Baxter International Inc., Merck Millipore, 3M Company, Pall Corporation (Danaher Corporation), Sartorius AG, GE Healthcare Life Sciences, Asahi Kasei Corporation, Koch Membrane Systems, Inc. (Koch Industries, Inc.), W. L. Gore & Associates, Inc., and Cantel Medical Corporation.

Frequently Asked Questions

What was the market size of the global medical membranes in 2022?

The market size of medical membranes was USD 2.9 Billion in 2022.

What is the CAGR of the global medical membranes market during forecast period of 2023 to 2032?

The CAGR of medical membranes market is 9.9% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global medical membranes market are Baxter International Inc., Merck Millipore, 3M Company, Pall Corporation (Danaher Corporation), Sartorius AG, GE Healthcare Life Sciences, Asahi Kasei Corporation, Koch Membrane Systems, Inc. (Koch Industries, Inc.), W. L. Gore & Associates, Inc., and Cantel Medical Corporation.

Which region held the dominating position in the global medical membranes market?

North America held the dominating position in medical membranes market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for medical membranes market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global medical membranes market?

The current trends and dynamics in the medical membranes industry include the increasing prevalence of chronic diseases, and growing demand for medical devices and equipment.

Which technology held the maximum share in 2022?

The nanofiltration technology held the maximum share of the medical membranes market.