Medical Implants Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Medical Implants Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

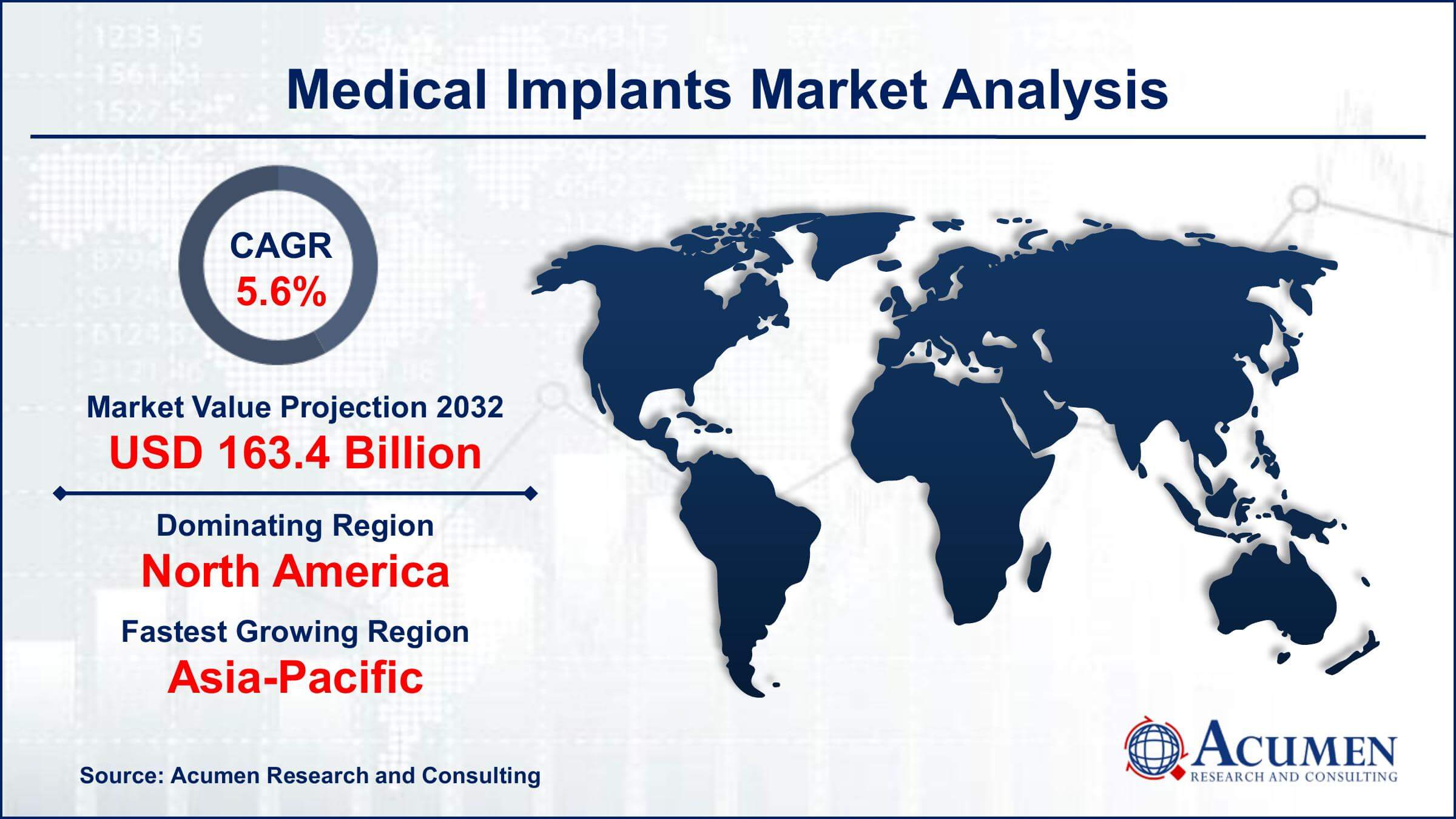

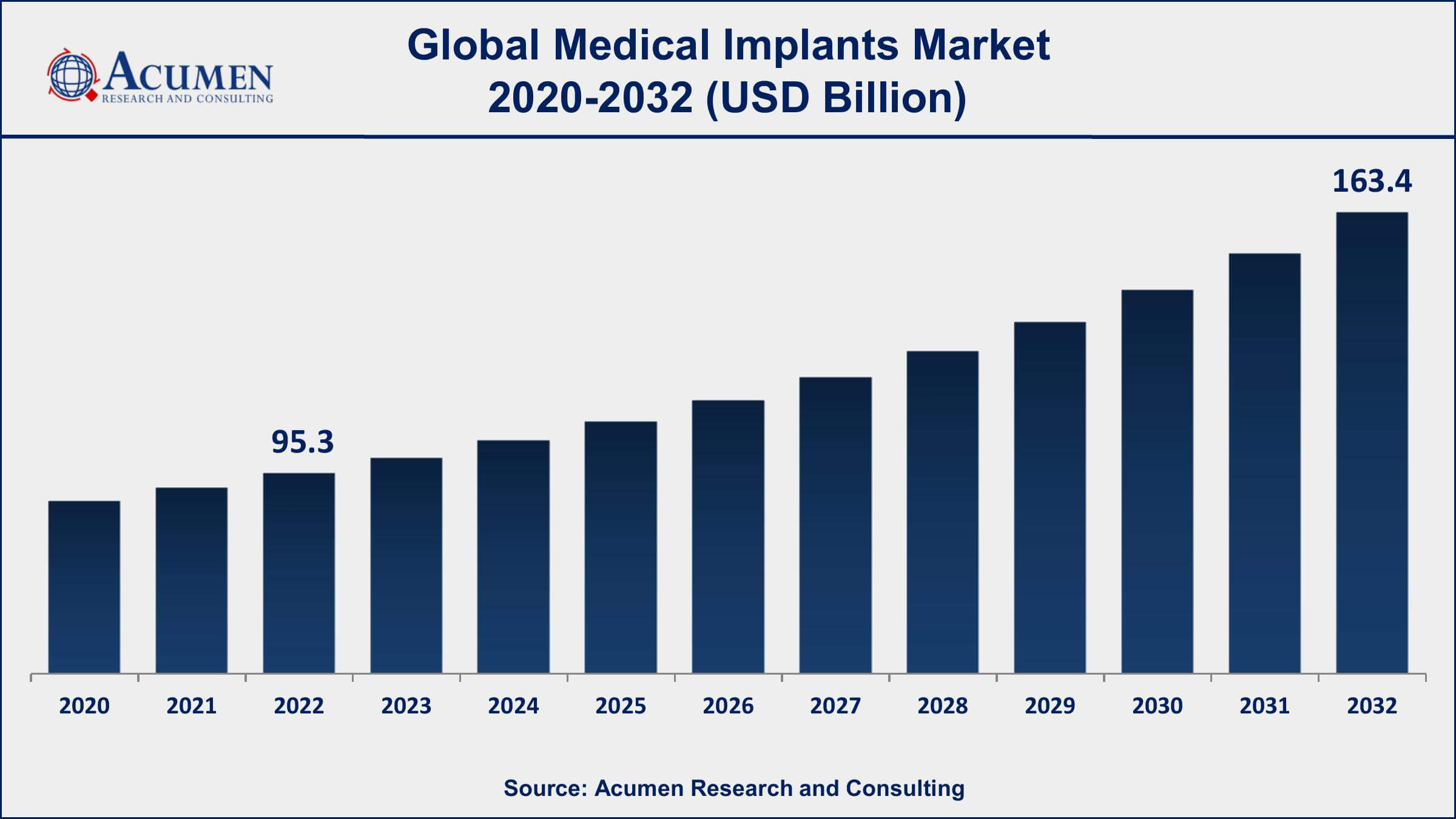

The Global Medical Implants Market Size accounted for USD 95.3 Billion in 2022 and is projected to achieve a market size of USD 163.4 Billion by 2032 growing at a CAGR of 5.6% from 2023 to 2032.

Medical Implants Market Report Key Highlights

- Global medical implants market revenue is expected to increase by USD 163.4 Billion by 2032, with a 5.6% CAGR from 2023 to 2032

- North America region led with more than 38% of medical implants market share in 2022

- According to a report by the American Joint Replacement Registry (AJRR), there were approximately 1.5 million total hip and knee replacements performed in the United States in 2019.

- Dental implants have a success rate of over 95% and are considered a safe and effective treatment for tooth loss.

- Breast implants are one of the most popular cosmetic surgery procedures in the world, with over 1.6 million procedures performed in 2019.

- Growing demand for minimally invasive surgeries, drives the medical implants market size

Medical implants refer to devices that are implanted in the human body for the purpose of restoring or replacing the function of a particular organ or tissue. These implants are usually made from biocompatible materials and are designed to stay in the body for an extended period of time. They are commonly used for a variety of medical purposes, including orthopedic, cardiovascular, dental, and neurostimulation applications.

The market for medical implants has been growing rapidly in recent years due to several factors. One of the key drivers of this growth is the increasing prevalence of chronic diseases such as osteoarthritis, cardiovascular disease, and diabetes. These conditions often require implantable devices to manage symptoms and improve patient outcomes. Another factor contributing to the growth of the medical implant market is advancements in technology. The development of new materials, such as titanium and ceramic, has allowed for the creation of more durable and long-lasting implants. Additionally, the integration of electronic sensors and other technologies has made it possible to create “smart” implants that can monitor and adjust their own function in response to changing conditions in the body.

Global Medical Implants Market Trends

Market Drivers

- Rising prevalence of chronic diseases

- Increasing geriatric population

- Growing demand for minimally invasive surgeries

- Rising adoption of robotics in implant surgery

Market Restraints

- High cost of medical implants

- Stringent regulatory requirements for approval

Market Opportunities

- Development of bioresorbable implants

- Increasing demand for dental implants

Medical Implants Market Report Coverage

| Market | Medical Implants Market |

| Medical Implants Market Size 2022 | USD 95.3 Billion |

| Medical Implants Market Forecast 2032 | USD 163.4 Billion |

| Medical Implants Market CAGR During 2023 - 2032 | 5.6% |

| Medical Implants Market Analysis Period | 2020 - 2032 |

| Medical Implants Market Base Year | 2022 |

| Medical Implants Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Biomaterial Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Boston Scientific Corporation, Medtronic Plc., LivaNova PLC, Johnson and Johnson, NuVasive, Inc., Biotronik, Institut Straumann AG, Globus Medical, Inc, Conmed Corporation, and Integra LifeSciences Holding Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Surgically implanted tissues or medical devices in the human body are called medical implants. These implants can either be positioned temporarily or permanently in the human body and can be unfastened when no longer required. Medical implants are generally used to support or replace a damaged body organ to identify errors in a healthy body functioning as well as to enhance the overall functioning and are usually made up of tissues, metals, ceramics, plastics, bone, skin, or other natural materials. These artificial tissues or devices help in the enhancement of an existing biological organ and are used as a replacement for any desecrated biological organ. Medical implants associate with a variety of risks including implant failure, surgical risks, and infections. Various applications of medical implants include orthopedic, cardiovascular, dental surgeries, and neurological ailments among others. Moreover, major medical implant surgeries include delicate human body organs such as defibrillators, artificial joint implants, spinal fusion stimulators, pacemakers, kidney and heart implants, hearing implants, and eye implants. The use of medical implants is majorly witnessed in the aged population since they are more susceptible to ceaseless diseases such as endovascular diseases, cardiovascular diseases, dental disorders, and orthopedic disorders. Medical implants generally employ microelectromechanical systems technology and the acceptance of such devices is increasing due to increasing investments in research and development in this technology. The introduction of technologically advanced devices such as novel medical implant devices, favorable demographics, and positive eco-financial dynamics coupled with augmentation in merger and acquisition activities in the healthcare industry are some other key elements scaling the global medical implant market to newer acmes.

Major factors driving the global medical implants market include the rising prevalence of chronic diseases such as cancer, cardio ailments, etc. along with the growth in the aging population, worldwide. Moreover, rising awareness towards the use of artificial implants coupled with technological advancements in medical implant techniques is some other factors surging the overall growth of the global medical implants market. Also, factors such as a rise in osteoporosis fractures, especially among children, and aging people, and an increase in physical illnesses such as obesity are also boosting the growth of the medical implants market, globally. The introduction of new technologies such as 3D technology, patient-specific medical implants (knee arthroplasty), and sculpture in AutoCAD offers numerous advantages. However, the lack of skilled health care professionals, the high cost of implants, and inadequate reimbursement policies are the factors restraining the growth of the global medical implants market.

Medical Implants Market Segmentation

The global medical implants market segmentation is based on product type, biomaterial type, and geography.

Medical Implants Market By Product Type

- Orthopedic Implants

- Orthobiologics

- Reconstructive Joint Replacements

- Hip Replacement Implants

- Knee Replacement Implants

- Extremities

- Trauma & Craniomaxillofacial

- Spinal Implants

- Spinal Bone Stimulators

- Spinal Fusion Implants

- Motion Preservation Devices/Non-fusion Devices

- Vertebral Compression Fracture (VCF) Devices

- Cardiovascular Implants

- Pacing Devices

- Implantable Cardioverter Defibrillators (ICDs)

- Subcutaneous Implantable Cardioverter Defibrillator (S-ICDs)

- Transvenous Implantable Cardioverter Defibrillator (T-ICDs)

- Cardiac Resynchronization Therapy Devices (CRTs)

- CRT-D (CRT with pacemaker and ICD function)

- CRT-P (CRT with pacemaker function)

- Implantable Cardiac Pacemakers (ICPs)

- Implantable Cardioverter Defibrillators (ICDs)

- Stents

- Iliac

- Coronary Stents

- Bioabsorbable Stents

- Bare-metal Coronary Stents

- Drug-eluting Stents (DES)

- Peripheral Stents

- Carotid

- Femoral–Popliteal

- Renal

- Stent-related Implants

- Vena Cava Filters

- Synthetic Grafts

- Pacing Devices

- Structural Cardiac Implants

- Implantable Ventricular-assist Devices

- BIVAD

- LVAD

- RVAD

- Mechanical Heart Valves

- Implantable Ventricular-assist Devices

- Neurostimulators

- Vagus Nerve Stimulation (VNS)

- Sacral Nerve Stimulation (SNS)

- Spinal Cord Stimulation (SCS)

- Deep Brain Stimulation (DBS)

- Other neurostimulators

- Dental Implants

- Root Form Dental Implants

- Plate Form Dental Implants

- Opthalmic Implants

- Glaucoma Implants

- Intraocular Lens

- Breast implants

- Facial Implants

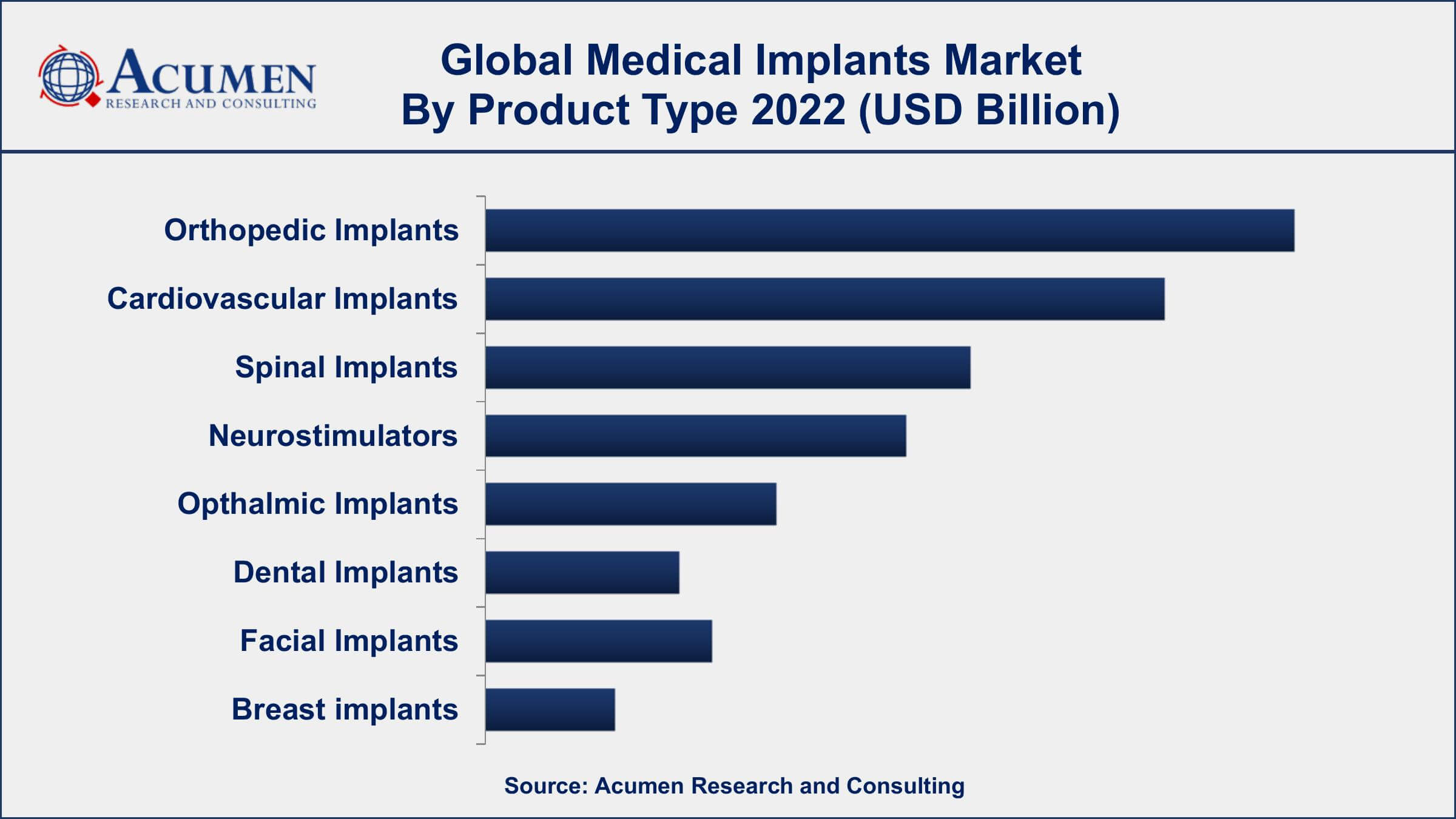

According to a medical implants industry analysis, the orthopedic implants segment accounted for a significant share of the market, and its demand is expected to continue to grow in the coming years. Orthopedic implants are devices that are used in the treatment of bone and joint disorders such as osteoarthritis, fractures, and spinal injuries. These implants are made from materials such as titanium, stainless steel, and cobalt-chromium alloys, and can be designed to replace damaged bones, provide support for fractures, or stabilize spinal conditions. The orthopedic implants segment of the medical implants market has been growing steadily in recent years, driven by several factors. One of the primary drivers of growth is the increasing prevalence of orthopedic disorders, particularly among the aging population. As people live longer, the incidence of conditions such as osteoarthritis and osteoporosis is rising, driving demand for orthopedic implants.

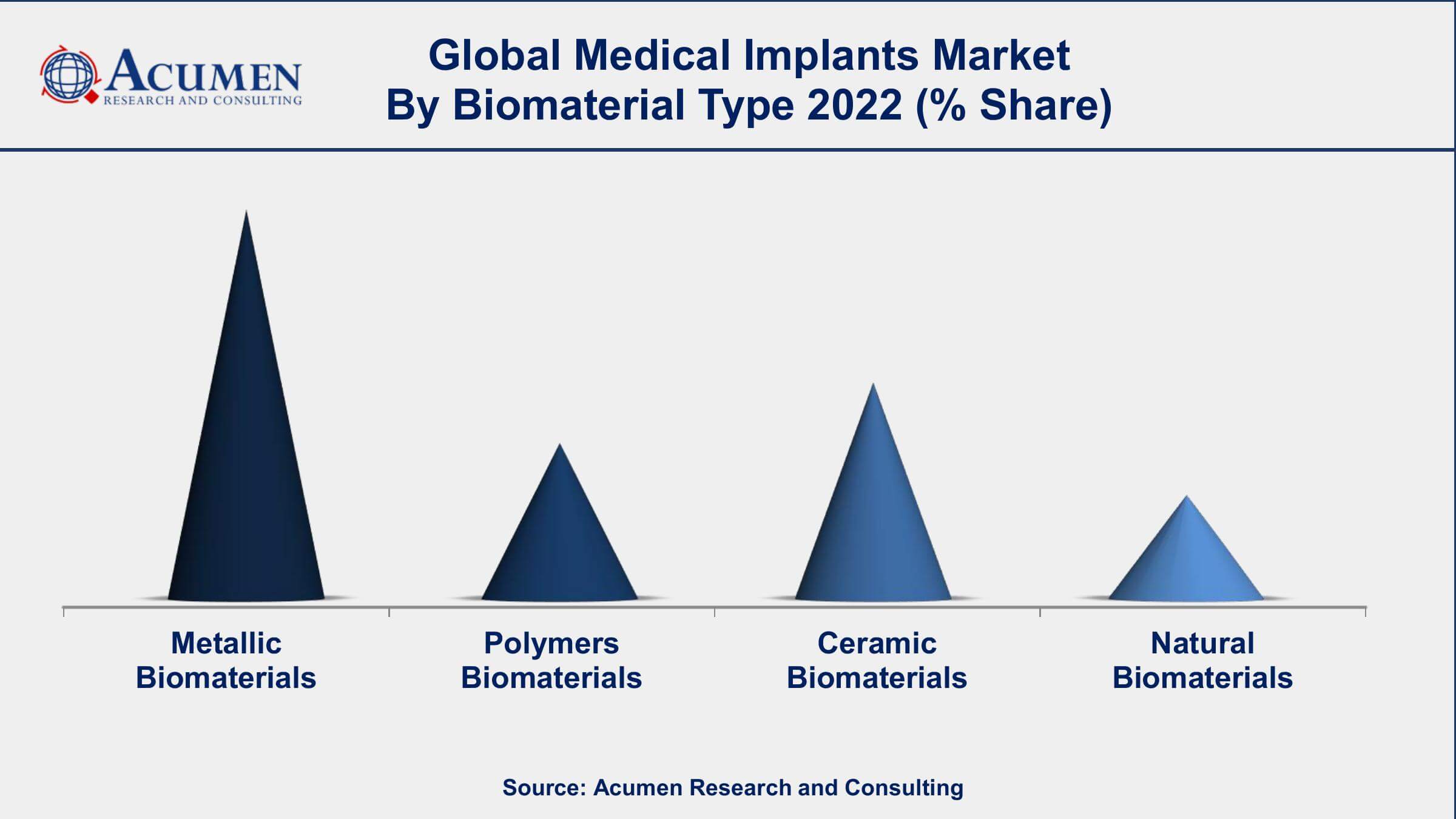

Medical Implants Market By Biomaterial Type

- Metallic Biomaterials

- Polymers Biomaterials

- Ceramic Biomaterials

- Natural Biomaterials

According to the medical implants market forecast, the metallic biomaterials segment is expected to grow significantly in the coming years. Metallic biomaterials are widely used in the medical implant market due to their favorable mechanical and chemical properties. These materials are used in a variety of medical implants such as joint replacements, dental implants, orthopedic implants, and cardiovascular implants. Some of the commonly used metallic biomaterials in medical implants include titanium, cobalt-chromium, stainless steel, and tantalum. These materials are preferred in medical implants due to their biocompatibility, corrosion resistance, and mechanical strength. The market for metallic biomaterials in medical implants is expected to continue to grow due to the increasing prevalence of chronic diseases, such as osteoarthritis, cardiovascular diseases, and dental disorders, which require medical implants. Additionally, advancements in technology and material science are also contributing to the growth of this market.

Medical Implants Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Medical Implants Market Regional Analysis

North America dominates the medical implants market due to several factors, including a strong healthcare infrastructure, a high prevalence of chronic diseases, and favorable reimbursement policies. The region has well-established healthcare facilities and advanced medical technologies, making it an attractive market for medical implant manufacturers. The high prevalence of chronic diseases such as osteoarthritis, cardiovascular diseases, and dental disorders in North America has also contributed to the dominance of the medical implants market in this region. According to the Centers for Disease Control and Prevention (CDC), approximately 54 million adults in the United States have some form of arthritis, and this number is expected to increase to 78 million by 2040. This high prevalence of chronic diseases has led to an increase in demand for medical implants, including joint replacements and cardiovascular implants.

Medical Implants Market Player

Some of the top medical implants market companies offered in the professional report includes Boston Scientific Corporation, Medtronic Plc., LivaNova PLC, Johnson and Johnson, NuVasive, Inc., Biotronik, Institut Straumann AG, Globus Medical, Inc, Conmed Corporation, and Integra LifeSciences Holding Corporation.

Frequently Asked Questions

What was the market size of the global medical implants in 2022?

The market size of medical implants was USD 95.3 Billion in 2022.

What is the CAGR of the global medical implants market during forecast period of 2023 to 2032?

The CAGR of medical implants market is 5.6% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global medical implants market are Boston Scientific Corporation, Medtronic Plc., LivaNova PLC, Johnson and Johnson, NuVasive, Inc., Biotronik, Institut Straumann AG, Globus Medical, Inc, Conmed Corporation, and Integra LifeSciences Holding Corporation.

Which region held the dominating position in the global medical implants market?

North America held the dominating position in medical implants market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for medical implants market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global medical implants market?

The current trends and dynamics in the medical implants industry include the increasing geriatric population and growing demand for minimally invasive surgeries.

Which product type held the maximum share in 2022?

The orthopedic implants product type held the maximum share of the medical implants market.