Medical Hyperspectral Imaging Systems Market | Acumen Research and Consulting

Medical Hyperspectral Imaging Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

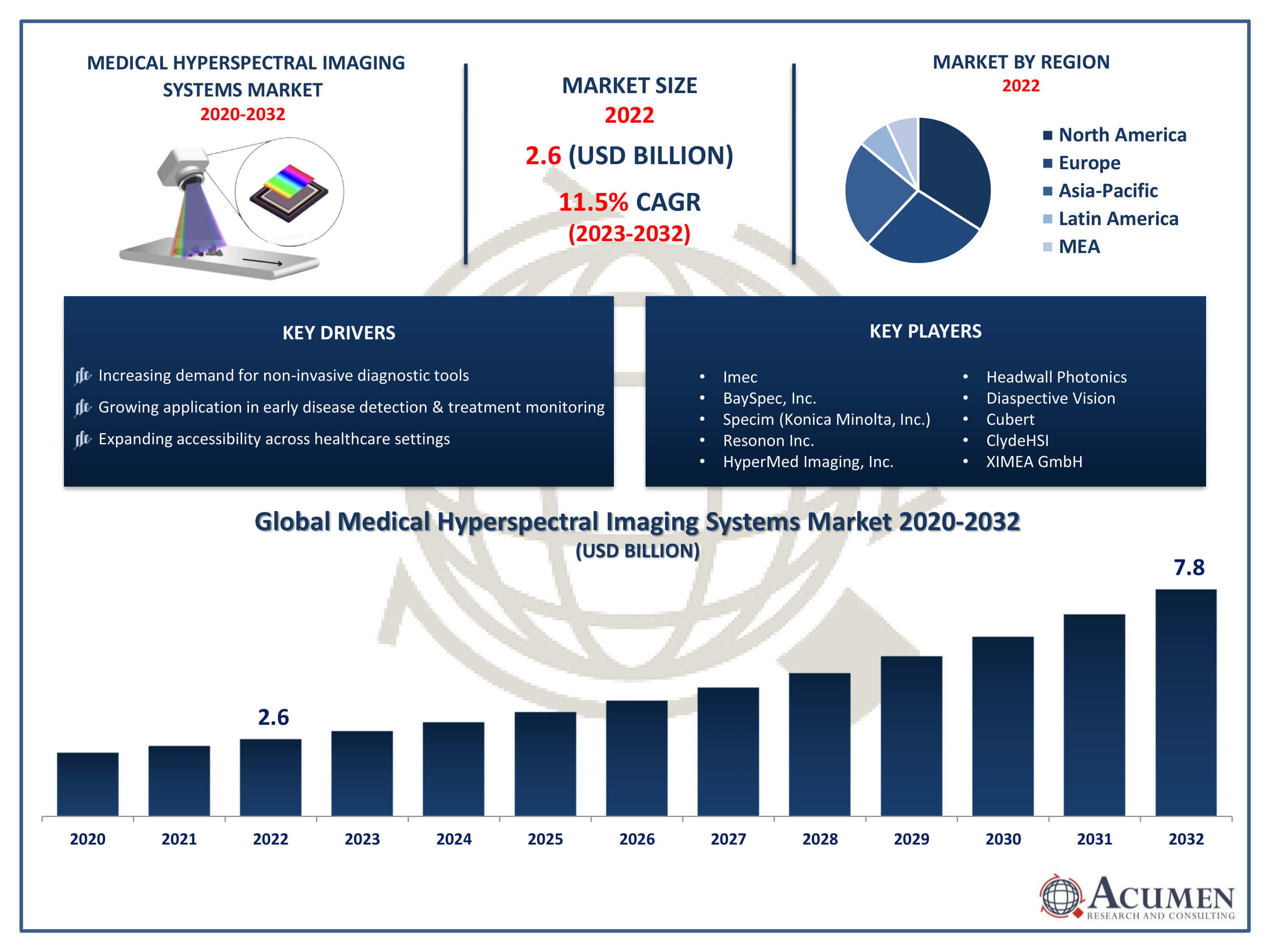

The Medical Hyperspectral Imaging Systems Market Size accounted for USD 2.6 Billion in 2022 and is projected to achieve a market size of USD 7.8 Billion by 2032 growing at a CAGR of 11.5% from 2023 to 2032.

Medical Hyperspectral Imaging Systems Market Highlights

- Global medical hyperspectral imaging systems market revenue is expected to increase by USD 7.8 billion by 2032, with a 11.5% CAGR from 2023 to 2032

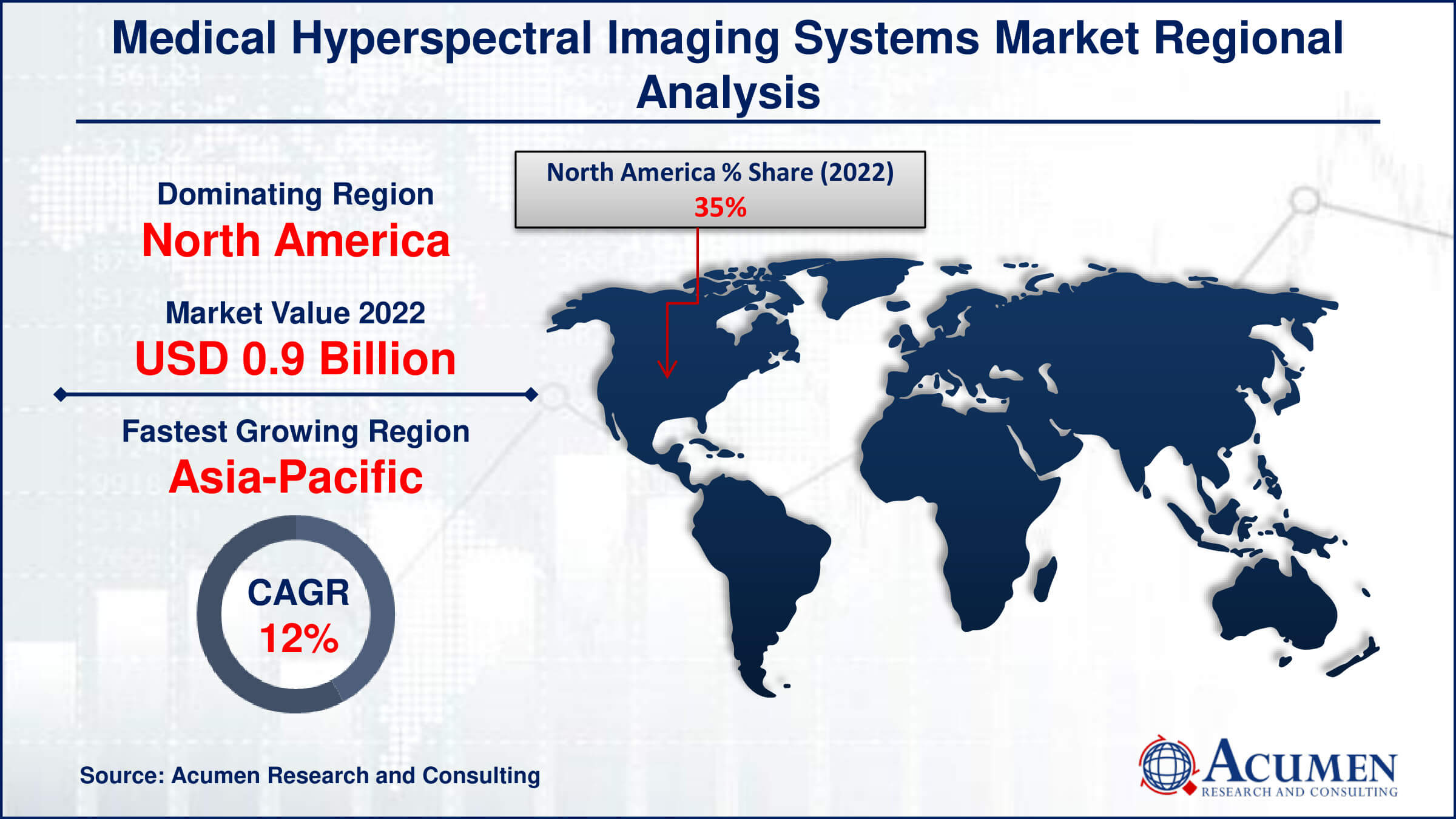

- North America region led with more than 35% of medical hyperspectral imaging systems market share in 2022

- Asia-Pacific medical hyperspectral imaging systems market growth will record a CAGR of around 12.2% from 2023 to 2032

- By product, the hyperspectral camera is the largest segment in the market, accounting for over 71% of the market share in 2022

- By application, the medical diagnostics segment is anticipated to grow at a remarkable CAGR of 12.3% between 2023 and 2032

- Increasing demand for non-invasive diagnostic tools, drives the medical hyperspectral imaging systems market value

Medical hyperspectral imaging systems are cutting-edge tools that change the way clinicians see tissues and organs by capturing and processing data across a wide range of wavelengths. Unlike conventional imaging techniques such as MRI or CT scans, hyperspectral imaging provides a detailed spectral profile for each pixel, allowing for the detection of subtle tissue changes that may indicate abnormalities or diseases. This advanced technology has applications in a variety of medical fields, including oncology, dermatology, neurology, and ophthalmology. The medical hyperspectral imaging systems market is expanding rapidly, owing to a number of compelling factors. The rising prevalence of chronic diseases is a significant driver. For example, the global cancer burden is increasing, with an estimated 19.3 million new cases in 2020 alone, according to the World Health Organization. The ability of hyperspectral imaging to detect early-stage tumors noninvasively is revolutionizing cancer diagnosis and treatment planning.

Medical hyperspectral imaging systems are cutting-edge tools that change the way clinicians see tissues and organs by capturing and processing data across a wide range of wavelengths. Unlike conventional imaging techniques such as MRI or CT scans, hyperspectral imaging provides a detailed spectral profile for each pixel, allowing for the detection of subtle tissue changes that may indicate abnormalities or diseases. This advanced technology has applications in a variety of medical fields, including oncology, dermatology, neurology, and ophthalmology. The medical hyperspectral imaging systems market is expanding rapidly, owing to a number of compelling factors. The rising prevalence of chronic diseases is a significant driver. For example, the global cancer burden is increasing, with an estimated 19.3 million new cases in 2020 alone, according to the World Health Organization. The ability of hyperspectral imaging to detect early-stage tumors noninvasively is revolutionizing cancer diagnosis and treatment planning.

Imaging technology advancements have greatly improved hyperspectral imaging systems' capabilities. Improved image resolution and sophisticated processing algorithms enable more precise and accurate diagnostics. For example, in dermatology, hyperspectral imaging can distinguish between benign and malignant skin lesions more effectively than traditional methods, potentially reducing the need for invasive biopsies.

Global Medical Hyperspectral Imaging Systems Market Trends

Market Drivers

- Increasing demand for non-invasive diagnostic tools

- Advancements in technology leading to more affordable and user-friendly systems

- Growing application in early disease detection and treatment monitoring

- Expanding accessibility across healthcare settings

- Ongoing research for improving spatial resolution and spectral sensitivity

Market Restraints

- High initial costs associated with implementation and maintenance

- Limited awareness and expertise among healthcare professionals

Market Opportunities

- Integration with artificial intelligence for automated analysis

- Development of portable and handheld devices for point-of-care applications

Medical Hyperspectral Imaging Systems Market Report Coverage

| Market | Medical Hyperspectral Imaging Systems Market |

| Medical Hyperspectral Imaging Systems Market Size 2022 | USD 2.6 Billion |

| Medical Hyperspectral Imaging Systems Market Forecast 2032 |

USD 7.8 Billion |

| Medical Hyperspectral Imaging Systems Market CAGR During 2023 - 2032 | 11.5% |

| Medical Hyperspectral Imaging Systems Market Analysis Period | 2020 - 2032 |

| Medical Hyperspectral Imaging Systems Market Base Year |

2022 |

| Medical Hyperspectral Imaging Systems Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Technology, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Imec, BaySpec, Inc., Specim (Konica Minolta, Inc.), Resonon Inc., HyperMed Imaging, Inc., Headwall Photonics, Diaspective Vision, Cubert, ClydeHSI, and XIMEA GmbH. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Medical hyperspectral imaging systems utilize advanced imaging techniques that capture and process information across a wide range of wavelengths. Unlike conventional imaging methods that produce structural images, hyperspectral imaging provides detailed spectral data, enabling the analysis of tissue composition at a molecular level. This technology allows healthcare professionals to detect subtle changes in tissues that may indicate various diseases or abnormalities. By leveraging the principles of spectroscopy, hyperspectral imaging offers valuable insights into tissue physiology, pathology, and biochemical processes, facilitating early disease detection, treatment monitoring, and surgical guidance. The applications of medical hyperspectral imaging systems span across multiple medical fields. In oncology, hyperspectral imaging aids in the early detection and characterization of tumors by identifying spectral signatures associated with cancerous tissues. It can also assist in surgical resections by delineating tumor margins more accurately, thereby reducing the risk of leaving residual cancer cells.

The medical hyperspectral imaging systems market has been experiencing robust growth in recent years and is projected to continue expanding significantly. This growth is primarily driven by the increasing adoption of hyperspectral imaging technology in various medical applications, including disease diagnosis, surgical guidance, and monitoring treatment responses. One of the key factors contributing to this growth is the growing demand for non-invasive and real-time diagnostic tools that can provide detailed information about tissue composition and pathology. Hyperspectral imaging systems offer the ability to capture spectral data across a wide range of wavelengths, enabling healthcare professionals to detect subtle molecular differences indicative of diseases such as cancer, cardiovascular disorders, and neurological conditions. Additionally, technological advancements have led to the development of more compact, affordable, and user-friendly hyperspectral imaging systems, making them more accessible across different healthcare settings, including hospitals, clinics, and research laboratories.

Rising application in Cancer Treatment Creates Lucrative Opportunities for the Medical Hyperspectral Imaging Systems Market

Hyperspectral imaging (HSI) is emerging as a game-changing non-invasive, non-ionizing, and label-free technology in the medical field, particularly for cancer detection. Originally intended for remote sensing, recent technological advancements have enabled its use in healthcare, specifically to detect various types of skin tumors. Skin cancer, which affects the body's largest organ, is one of the most common malignancies. It begins in the epidermis and can affect squamous cells, basal cells, or melanocytes.

Epidermal lesions are classified by healthcare providers as melanoma or non-melanoma skin cancer (MSC or NMSC). Melanoma, which develops from melanin-producing cells, has three subtypes: superficial spreading, lentigo maligna, and nodular melanoma. While melanoma is the rarest type of skin cancer, it is also the deadliest due to a lack of early detection. NMSC, on the other hand, accounts for over 98% of skin cancer cases in the United States. Of these, 75-80% are basal cell carcinoma (BCC), 15-20% are squamous cell carcinoma (SCC), and 1.6% are melanoma.

The increased use of HSI in cancer treatment is creating significant opportunities in the medical imaging market. Its ability to provide detailed spectral information for each pixel in an image allows clinicians to better identify and differentiate between different types of skin lesions than traditional methods. This technology not only aids in early detection but also allows for more precise treatment planning, resulting in better patient outcomes.

Medical Hyperspectral Imaging Systems Market Segmentation

The global medical hyperspectral imaging systems market segmentation is based on product, technology, application, end-use, and geography.

Medical Hyperspectral Imaging Systems Market By Product

- Accessories

- Hyperspectral Camera

According to the medical hyperspectral imaging systems industry analysis, the hyperspectral camera segment accounted for the largest market share in 2022. Hyperspectral cameras are integral components of hyperspectral imaging systems, capturing data across numerous spectral bands to provide detailed information about tissue composition and pathology. These cameras have gained traction due to their ability to detect subtle molecular differences indicative of various diseases, facilitating early diagnosis and precise treatment monitoring. One of the key drivers of growth in the hyperspectral camera segment is the continuous innovation in camera technology, leading to improvements in spatial and spectral resolution, sensitivity, and speed. These advancements have resulted in the development of more compact, lightweight, and affordable hyperspectral cameras, making them more accessible for medical applications. Moreover, the integration of hyperspectral cameras with other imaging modalities and medical devices has expanded their utility in various clinical settings, ranging from oncology and dermatology to ophthalmology and surgical guidance.

Medical Hyperspectral Imaging Systems Market By Technology

- Push Broom

- Snapshot

- Others

In terms of technology, the snapshot segment is expected to witness significant growth in the coming years. Snapshot hyperspectral imaging systems capture the entire spectral data cube in a single snapshot, unlike scanning systems that acquire data sequentially. This enables rapid imaging of tissues and objects, making snapshot systems particularly suitable for real-time applications in medical diagnostics, surgical guidance, and research. One of the key drivers of growth in the snapshot segment is the increasing demand for fast and efficient imaging solutions in healthcare settings. Snapshot systems offer the ability to acquire high-quality spectral data quickly, minimizing imaging time and improving patient throughput. This makes them ideal for applications where real-time information is critical, such as intraoperative tissue analysis, wound assessment, and endoscopic procedures.

Medical Hyperspectral Imaging Systems Market By Application

- Quality Assurance & Drug Testing

- Medical Diagnostics

- Others

According to the medical hyperspectral imaging systems market forecast, the medical diagnostics segment is expected to witness significant growth in the coming years. Hyperspectral imaging offers a unique advantage in medical diagnostics by providing detailed spectral data that can reveal subtle molecular and compositional differences in tissues indicative of various diseases. This capability has led to its adoption in applications such as cancer detection, tissue characterization, and assessment of skin lesions, among others. One of the key drivers of growth in the medical diagnostics segment is the growing demand for non-invasive and more accurate diagnostic tools. Hyperspectral imaging systems enable healthcare professionals to obtain comprehensive information about tissue morphology, physiology, and pathology in real-time, facilitating early detection and precise characterization of diseases. Moreover, the integration of hyperspectral imaging with artificial intelligence and machine learning algorithms further enhances diagnostic accuracy and efficiency, driving its adoption in clinical practice.

Medical Hyperspectral Imaging Systems Market By End-Use

- Hospitals & Clinics

- Pharmaceutical and Biotechnology Companies

- Research & Academic Institutes

Based on the end-use, the hospitals & clinics segment is expected to continue its growth trajectory in the coming years. Hospitals and clinics are key end-users of medical imaging systems, and the demand for advanced diagnostic tools that offer enhanced capabilities for disease detection and treatment monitoring is driving the integration of hyperspectral imaging into their facilities. Hyperspectral imaging systems provide healthcare professionals with valuable insights into tissue composition and pathology, enabling more accurate diagnoses and better treatment planning. One of the primary drivers of growth in the hospitals and clinics segment is the growing awareness of the benefits of hyperspectral imaging among healthcare providers. As clinicians seek to improve patient care outcomes and optimize treatment strategies, there is a growing interest in leveraging advanced imaging technologies like hyperspectral imaging. Moreover, the availability of compact and user-friendly hyperspectral imaging systems tailored for clinical use has facilitated their integration into hospitals and clinics, making them more accessible to healthcare professionals across different specialties.

Medical Hyperspectral Imaging Systems Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Medical Hyperspectral Imaging Systems Market Regional Analysis

North America dominates the medical hyperspectral imaging systems market due to several key factors. Firstly, the region is home to a robust healthcare infrastructure, including leading research institutions, academic medical centers, and advanced healthcare facilities. This infrastructure fosters innovation and drives the adoption of cutting-edge medical technologies like hyperspectral imaging systems. Additionally, North America boasts a strong base of healthcare professionals who are early adopters of new technologies and are keen on implementing advanced imaging modalities to improve patient care. Moreover, the presence of major players and key research organizations focused on medical imaging technologies in North America contributes to the region's dominance in the hyperspectral imaging systems market. These companies invest heavily in research and development, driving technological advancements and innovation in hyperspectral imaging systems. Furthermore, North America has a favorable regulatory environment that supports the approval and commercialization of medical devices, including hyperspectral imaging systems. This regulatory framework facilitates the introduction of new products into the market, enabling rapid adoption and market growth.

The Asia-Pacific (APAC) medical hyperspectral imaging systems market is expected to grow significantly, owing to advances in healthcare technology and increased R&D investments. The region's large and aging population, combined with an increasing prevalence of chronic diseases such as cancer, is driving up demand for non-invasive diagnostic tools. Countries such as China, Japan, and India are at the forefront of implementing innovative medical technologies, aided by government initiatives and expanding healthcare infrastructure. The APAC market is also boosted by the presence of leading technology providers and a strong emphasis on improving diagnostic accuracy and patient outcomes.

Medical Hyperspectral Imaging Systems Market Player

Some of the top medical hyperspectral imaging systems market companies offered in the professional report include Imec, BaySpec, Inc., Specim (Konica Minolta, Inc.), Resonon Inc., HyperMed Imaging, Inc., Headwall Photonics, Diaspective Vision, Cubert, ClydeHSI, and XIMEA GmbH.

Frequently Asked Questions

How big is the medical hyperspectral imaging systems market?

The medical hyperspectral imaging systems market size was USD 2.6 Billion in 2022.

What is the CAGR of the global medical hyperspectral imaging systems market from 2023 to 2032?

The CAGR of medical hyperspectral imaging systems is 11.5% during the analysis period of 2023 to 2032.

Which are the key players in the medical hyperspectral imaging systems market?

The key players operating in the global market are including Imec, BaySpec, Inc., Specim (Konica Minolta, Inc.), Resonon Inc., HyperMed Imaging, Inc., Headwall Photonics, Diaspective Vision, Cubert, ClydeHSI, and XIMEA GmbH.

Which region dominated the global medical hyperspectral imaging systems market share?

North America held the dominating position in medical hyperspectral imaging systems industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of medical hyperspectral imaging systems during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global medical hyperspectral imaging systems industry?

The current trends and dynamics in the medical hyperspectral imaging systems industry include increasing demand for non-invasive diagnostic tools, advancements in technology leading to more affordable and user-friendly systems, and growing application in early disease detection and treatment monitoring.

Which technology held the maximum share in 2022?

The snapshot technology held the maximum share of the medical hyperspectral imaging systems industry.