Medical Fiber Optics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Medical Fiber Optics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

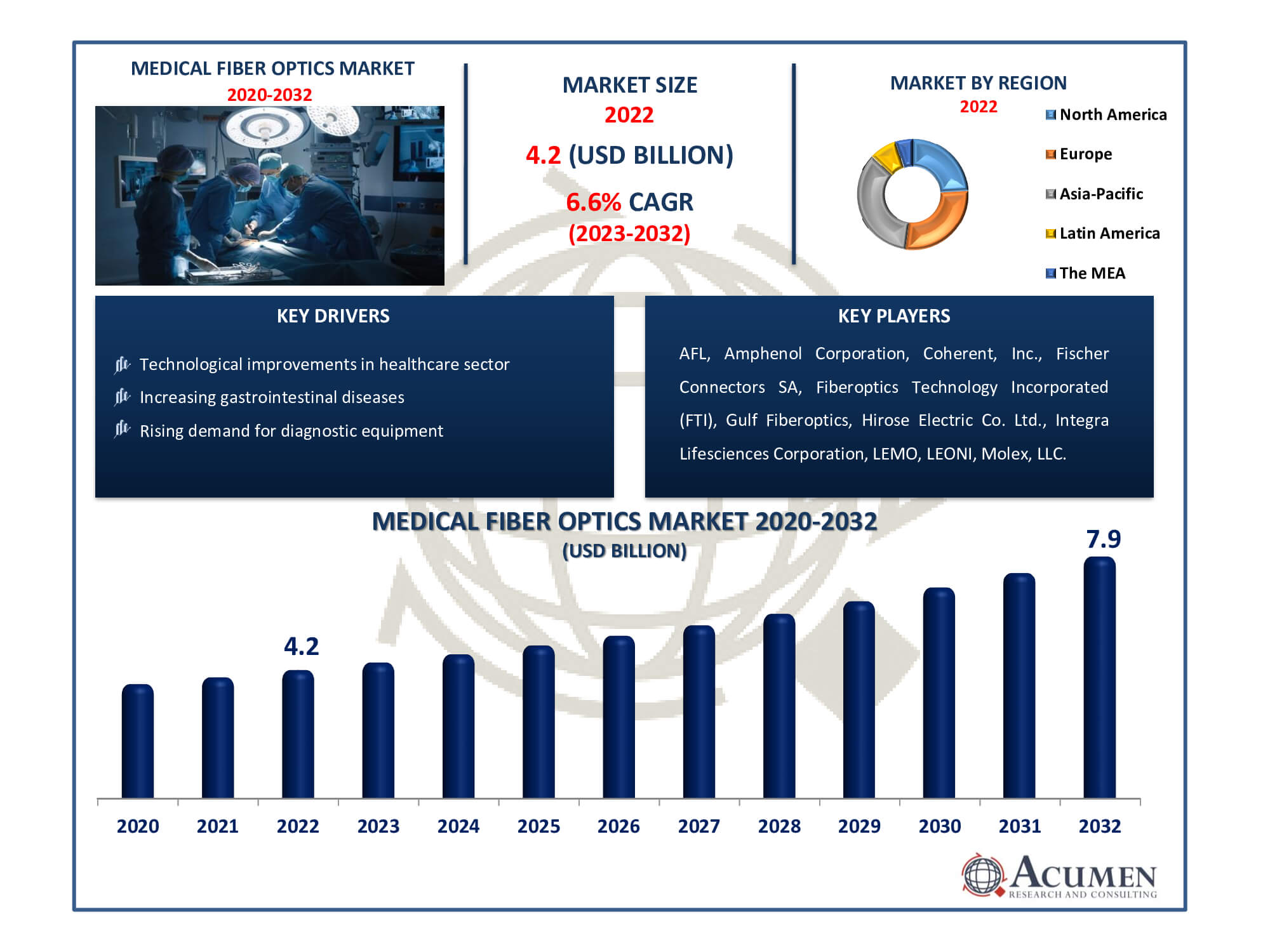

Request Sample Report

The Global Medical Fiber Optics Market Size accounted for USD 4.2 Billion in 2022 and is estimated to achieve a market size of USD 7.9 Billion by 2032 growing at a CAGR of 6.6% from 2023 to 2032.

Medical Fiber Optics Market Highlights

- Global medical fiber optics market revenue is poised to garner USD 7.9 billion by 2032 with a CAGR of 6.6% from 2023 to 2032

- Asia-Pacific medical fiber optics market value occupied around USD 1.4 billion in 2022

- North America medical fiber optics market growth will record a CAGR of more than 7% from 2023 to 2032

- Among fiber type, the multimode optical fiber sub-segment generated over US$ 1.8 billion revenue in 2022

- Based on product type, the fiber optics cable sub-segment generated around 42% share in 2022

- Emerging telemedicine and remote monitoring is a popular medical fiber optics market trend that fuels the industry demand

The use of fiber optics in the medical field has revolutionized a variety of applications, including cardiology, urology, and ophthalmology, to name a few. Optical fibers, which have a very small diameter and are often made of glass, fiber, or plastic strands, are commonly used for visualizing tissues and internal organs that are accessible through natural apertures in the human body. These optical fibers provide precise illumination in a wide range of medical devices. This technology is increasingly being used by biomedical sensors to aid in minimally invasive medical treatments. They have proven crucial in improving the precision and safety of medical procedures. As the desire for less invasive medical treatments grows, medical fiber optics will become increasingly important in enabling healthcare practitioners to provide precise and efficient care. Advances in fiber optic technology, such as better flexibility and interoperability with various medical equipment, are also driving market growth, eventually enhancing patient well-being and healthcare outcomes.

Global Medical Fiber Optics Market Dynamics

Market Drivers

- Growing inclination towards minimally invasive surgeries

- Technological improvements in healthcare sector

- Increasing gastrointestinal diseases

- Rising demand for diagnostic equipment

Market Restraints

- High cost of product results in lower adoption in developing countries and under developing countries

- Insufficient resources and a significant shortage of professional surgeons qualified to work with endoscopes and lasers

- Data security concerns

Market Opportunities

- Constant technological innovations can provide major business opportunities for market players

- The expansion of home healthcare services

- Ongoing innovations in fiber optic technology

Medical Fiber Optics Market Report Coverage

| Market | Medical Fiber Optics Market |

| Medical Fiber Optics Market Size 2022 | USD 4.2 Billion |

| Medical Fiber Optics Market Forecast 2032 | USD 7.9 Billion |

| Medical Fiber Optics Market CAGR During 2023 - 2032 | 6.6% |

| Medical Fiber Optics Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Fiber Type, By Product Type, By Application, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AFL, Amphenol Corporation, Coherent, Inc., Fischer Connectors SA, Fiberoptics Technology Incorporated (FTI), Gulf Fiberoptics, Hirose Electric Co. Ltd., Integra Lifesciences Corporation, LEMO, LEONI, Molex, LLC., Newport Corporation, ODU GmbH & Co. KG, SCHOTT, Smiths Interconnect, and Timbercon, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Medical Fiber Optics Market Insights

Several significant factors are driving the medical fiber optics market's rapid expansion. Rapid improvements in healthcare infrastructure have made it possible to integrate cutting-edge medical technologies in an effective manner. Fiber optic sensors, small cameras, and specialized cables are among the technologies that have become crucial components in a variety of medical operations. The use of technologically enhanced medical devices has transformed the healthcare business, allowing practitioners to provide more accurate diagnosis and treatments. Because of their patient-friendly benefits, such as less scarring, faster recovery times, and lower post-operative problems, minimally invasive operations have gained substantial popularity. This trend has increased demand for fiber optic devices, which are critical in guiding surgeons during these surgeries. Miniature cameras with fiber optic technology give high-resolution views that are required for precise surgical navigation.

The rising frequency of chronic diseases, particularly cancer, has increased the demand for sophisticated diagnostic and therapeutic techniques. Endoscopic methods used in the diagnosis and treatment of numerous medical disorders rely on fiber optics. These procedures are less painful for patients and are frequently favored over traditional surgical methods. Laser technology, a key component of medical fiber optics, is gradually displacing non-laser alternatives in a wide range of healthcare applications. Lasers provide greater precision and better patient results. They increase tissue absorption, resulting in less bleeding and faster healing. As a result, lasers are currently used in a wide range of medical applications, from dentistry and illness detection to tattoo removal and cosmetic operations.

The medical fiber optics market is expected to increase steadily as technological advancements improve healthcare practices and patient care. Fiber optics, lasers, and other revolutionary medical technologies are projected to gain popularity as medical professionals and people alike recognize their substantial benefits. This market is going to remain an important part of the ever-changing healthcare landscape.

Medical Fiber Optics Market Segmentation

The worldwide market for medical fiber optics is split based on fiber type, product type, application, end use, and geography.

Medical Fiber Optics Fiber Types

- Plastic Optical Fiber (POF)

- Single Mode Optical Fiber

- Multimode Optical Fiber

- Fiber Bundles

As per the medical fiber optics industry analysis, multimode optical fibre category highlights its critical position in the entire market. It garnered more than 44% of market revenue the prior year. The importance of this area is enhanced by its outstanding adaptability. Because of its ability to efficiently transport signals and light over short distances, it is widely used in diagnostic instruments, endoscopy equipment, and patient monitoring systems in addition to illumination and surgical lights. Its low cost, ease of manufacture, and versatility cement its place as a pillar in the medical fibre optics environment, guaranteeing continuing growth and innovation.

Medical Fiber Optics Product Types

- Fiber Optics Connectors

- Custom Fiber Optics Connectors

- Hybrid Circular with Fiber and Electrical

- Circular with Optics

- Standard Fiber Optics Connectors

- Multi-Fiber Push On Connectors

- Lucent Connectors (LC)

- Other

- Custom Fiber Optics Connectors

- Fiber Optics Cable

- Others

Fibre optics cable is the largest and most important category in the medical fibre optics market's product type section. These specialized cables act as lifelines in the medical industry, conveying vital data and light. They are essential components in a variety of medical equipment, allowing for the smooth flow of information, signals, and illumination. Because of their high-speed, efficient, and dependable data transmission, fibre optic cables are used for applications such as endoscopy, diagnostics, and patient monitoring. They are a cornerstone of medical technology due to their dependability and versatility, ensuring that crucial data and pictures reach healthcare practitioners with precision and speed.

Medical Fiber Optics Applications

- Endoscopic Imaging

- Biomedical Sensors

- Laser Signal Delivery

- Illumination

- Laser Soldering

- Others

As per the medical fiber optics market forecast, illumination is expected to be the largrest revenue generatng application segment from 2023 to 2032. Illumination is essential in the medical industry, especially during procedures, surgeries, and diagnostic procedures. Fibre optics allow for the delivery of powerful and precise light to highlight surgical areas and medical tools, hence improving vision for healthcare practitioners. This is critical for minimally invasive operations, where accuracy is critical. Fibre optic illumination systems provide bright, shadow-free lighting, allowing for more precise medical procedures. The importance of the illumination section stems from its ability to improve patient outcomes and contribute to the success of numerous medical operations.

Medical Fiber Optics End-Uses

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Diagnostic Laboratories

- Contract Research Organization (CRO)

Hospitals emerge as the largest end-use segment in the medical fibre optics market, as they contain a wide range of medical applications and procedures that largely rely on fibre optics technology. Fibre optics are used in diagnostics, surgeries, and various medical equipment at these institutes. The ambulatory surgical centres segment is the second largest, as they increasingly use fibre optics for minimally invasive operations, maintaining precision and patient care while providing a more convenient and efficient alternative to traditional hospital-based surgeries.

Medical Fiber Optics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Medical Fiber Optics Market Regional Analysis

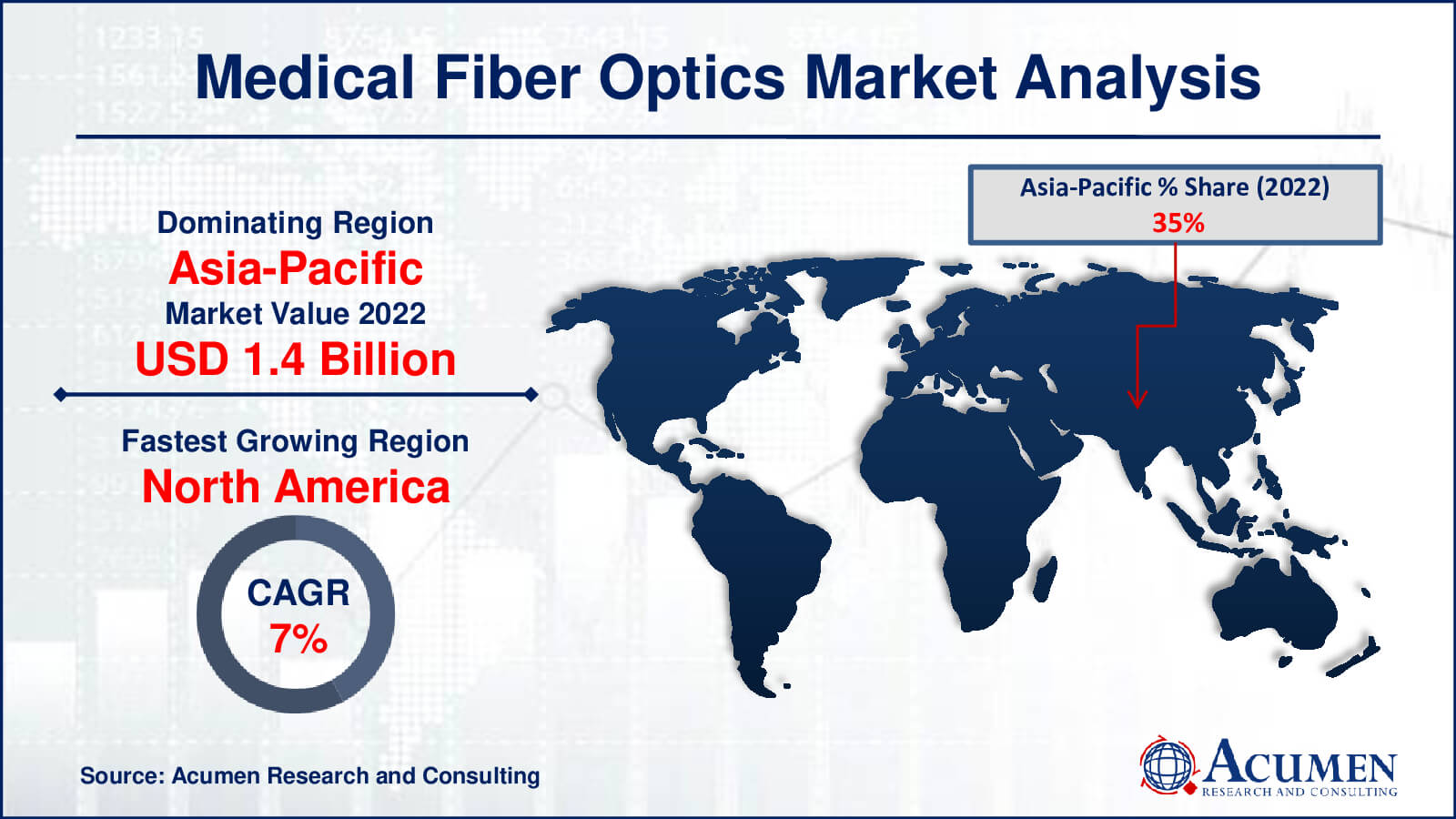

In 2022, the Asia-Pacific region led the market with the largest revenue share, accounting for over 35% of the total. This was attributed to several factors, including rapid economic development, an improving standard of living, the increasing popularity of medical tourism, advancements in healthcare infrastructure, a growing import of high-quality medical devices, and favorable government initiatives. To tap into the untapped market potential, many key players are adopting strategies that involve collaborating and forming strategic alliances with regional players in developing economies such as India and China.

In contrast, the Middle East and Africa region are expected to experience the fastest growth during the forecast period. This is driven by factors such as the increasing prevalence of cancer, ongoing enhancements in healthcare infrastructure, and rising awareness in the region about the benefits of minimally invasive surgical procedures. Additionally, there is a rising demand for early screening tests to detect various diseases, which is projected to fuel market growth in this region throughout the forecast period.

Medical Fiber Optics Market Players

Some of the top medical fiber optics companies offered in our report includes AFL, Amphenol Corporation, Coherent, Inc., Fischer Connectors SA, Fiberoptics Technology Incorporated (FTI), Gulf Fiberoptics, Hirose Electric Co. Ltd., Integra Lifesciences Corporation, LEMO, LEONI, Molex, LLC., Newport Corporation, ODU GmbH & Co. KG, SCHOTT, Smiths Interconnect, Timbercon, Inc.

Frequently Asked Questions

How big is the medical fiber optics market?

The market size of medical fiber optics was USD 4.2 billion in 2022.

What is the CAGR of the global medical fiber optics market from 2023 to 2032?

The CAGR of medical fiber optics is 6.6% during the analysis period of 2023 to 2032.

Which are the key players in the medical fiber optics market?

The key players operating in the global market are including AFL, Amphenol Corporation, Coherent, Inc., Fischer Connectors SA, Fiberoptics Technology Incorporated (FTI), Gulf Fiberoptics, Hirose Electric Co. Ltd., Integra Lifesciences Corporation, LEMO, LEONI, Molex, LLC., Newport Corporation, ODU GmbH & Co. KG, SCHOTT, Smiths Interconnect, Timbercon, Inc.

Which region dominated the global medical fiber optics market share?

Asia-Pacific held the dominating position in Medical Fiber Optics industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of medical fiber optics during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global medical fiber optics industry?

The current trends and dynamics in the medical fiber optics industry include growing inclination towards minimally invasive surgeries, technological improvements in healthcare sector, increasing gastrointestinal diseases, and rising demand for diagnostic equipment.

Which type held the maximum share in 2022?

The multimode optical fiber type held the maximum share of the medical fiber optics industry.