Medical Electronics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2025 - 2033

Published :

Report ID:

Pages :

Format :

Medical Electronics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2025 - 2033

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

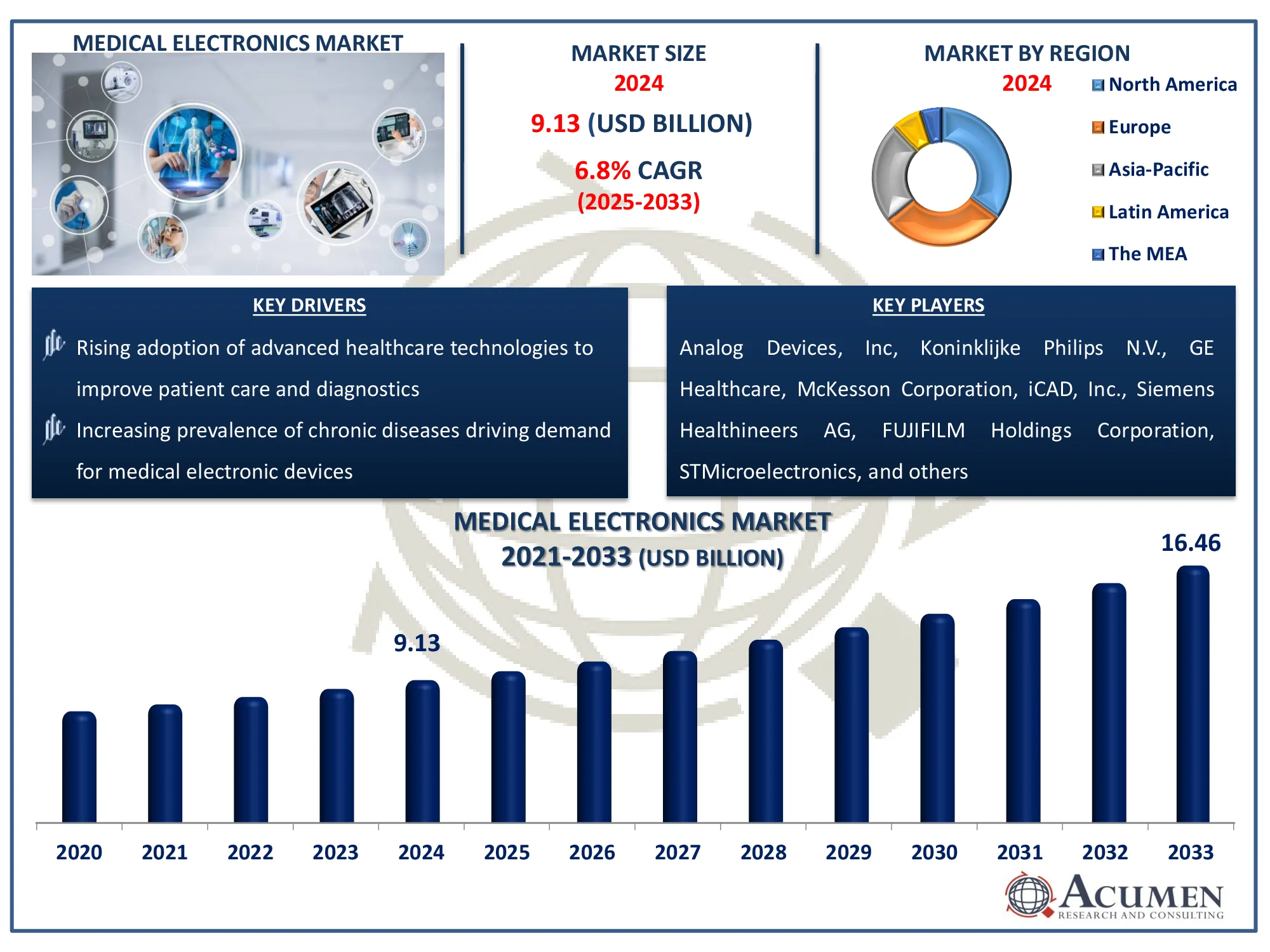

The Global Medical Electronics Market Size accounted for USD 9.13 Billion in 2024 and is estimated to achieve a market size of USD 16.46 Billion by 2033 growing at a CAGR of 6.8% from 2025 to 2033.

Medical Electronics Market Highlights

- The global medical electronics market is projected to reach USD 16.46 billion by 2033, with a CAGR of 6.8% from 2025 to 2033

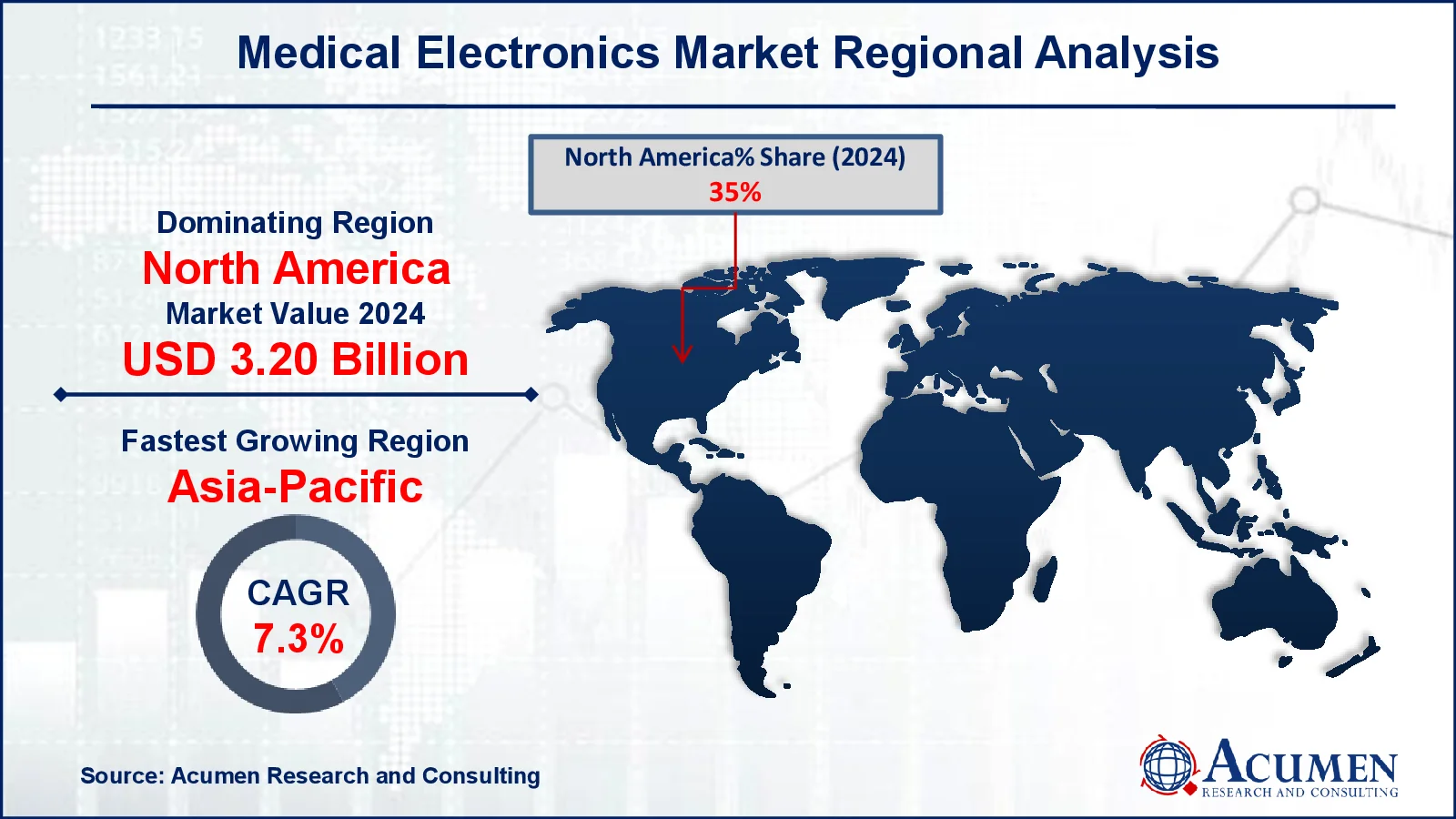

- North America's medical electronics market was valued at approximately USD 3.20 billion in 2024

- The Asia-Pacific region is expected to achieve a CAGR exceeding 7.3% from 2025 to 2033

- Imaging products accounted for 36% of the market share in 2024

- Integration of networked medical devices, such as ultrasound machines, ventilators, and data-sharing implants is a popular market trend that fuels the industry demand

Medical electronics is the use of electronic devices and technology in healthcare to diagnose, monitor, and treat medical diseases. According to the National Institute of Health (NIH), the overall objective is to make electronic health information from EHRs and PHRs available to PHAs via direct linkages or consolidated HIE. The latter will use Big Data science to conduct surveillance and make conclusions about health determinants, while implementing traditional population-level interventions and individual therapeutic interventions through CDS technology. The promise of electronic health information exchange (HIE) means faster data availability and better access when compared to traditional paper-based manual processes. The availability of advanced technology implies faster analysis and chances for innovation. Overall, the adoption of EHRs and PHRs requires advanced medical electronics devices such as wearable health monitors, cloud-based health data storage, and AI-powered diagnostic tools, leading to increased demand for medical electronics technology.

Global Medical Electronics Market Dynamics

Market Drivers

- Rising adoption of advanced healthcare technologies to improve patient care and diagnostics

- Increasing prevalence of chronic diseases driving demand for medical electronic devices

- Government initiatives and favorable FDI policies promoting healthcare infrastructure development

Market Restraints

- High costs of technologically advanced medical devices limiting affordability for hospitals and clinics

- Stringent regulatory requirements delaying product approvals and market entry

- Concerns over data security and privacy restricting the adoption of electronic health records

Market Opportunities

- Growing demand for telemedicine and remote patient monitoring in emerging markets

- Advancements in AI and IoT integration enhancing medical electronics efficiency

- Expansion of healthcare infrastructure in developing nations creating new market avenues

Medical Electronics Market Report Coverage

|

Market |

Medical Electronics Market |

|

Medical Electronics Market Size 2024 |

USD 9.13 Billion |

|

Medical Electronics Market Forecast 2033 |

USD 16.46 Billion |

|

Medical Electronics Market CAGR During 2025 - 2033 |

6.8% |

|

Medical Electronics Market Analysis Period |

2021 - 2033 |

|

Medical Electronics Market Base Year |

2024 |

|

Medical Electronics Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Component, By Application, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled Aviation |

Analog Devices, Inc, Koninklijke Philips N.V., GE Healthcare, McKesson Corporation, iCAD, Inc., Siemens Healthineers AG, FUJIFILM Holdings Corporation, STMicroelectronics, Texas Instruments Incorporated, Biotronik, and Canon Medical Systems Corporation. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Medical Electronics Market Insights

The availability of medical equipment and leasing options would increase its accessibility among healthcare practitioners, thereby positively impacting the expansion of the medical electronics business. However, due to the incorporation of advanced technology, most medical gadgets on the market are costly. The high upfront expenditures of technologically advanced medical technologies, along with the significant investment required for a comprehensive healthcare system, can raise overall prices. As a result, hospitals, diagnostic centers, and private medical practitioners are sometimes hesitant to make purchases due to the lengthy cost recovery time.

During the evaluation period, emerging economies such as India and China are likely to embrace innovative electronic medical devices at a faster rate, driving market expansion significantly. While medical electronic systems remain expensive, government measures and favorable FDI regulations will stimulate their use by healthcare practitioners. However, severe rules imposed on companies making medical electronic instruments may slow market growth in the foreseeable future.

This technology has the ability to improve healthcare quality, increase production precision, provide remote access to health information, exact accounting, allow for easy modifications to patient records, and provide an overall better patient experience. On the negative, problems like as decreased efficiency among medical practitioners, lack of uniform terminology, large learning curves, and concerns about patient data security breaches remain barriers to wider implementation.

Medical Electronics Market Segmentation

Medical Electronics Market Segmentation

The worldwide market for medical electronics is split based on component, application, end-user, and geography.

Medical Electronics Market By Component

- Sensors

- Batteries

- Displays

- MPUs/MCUs

- Others

According to medical electronics industry analysis, sensors category dominates because of its widespread use in diagnostic, monitoring, and therapeutic applications. Sensors are essential in medical imaging, wearable health devices, patient monitoring systems, and implantable medical devices, enabling real-time data collecting and accurate diagnosis. The increasing demand for remote patient monitoring, IoT-enabled healthcare equipment, and AI-powered diagnostics has accelerated the use of advanced medical sensors. Batteries, screens, and MPUs/MCUs are other important components in the sector. Batteries are necessary to power portable and implantable medical devices, while displays improve user involvement in diagnostic equipment. MPUs/MCUs (microprocessors/microcontrollers) are essential for processing medical decisions.

Medical Electronics Market By Application

- Imaging

- Therapeutics

- Patient Monitoring

- Homecare/Handheld Products

According to medical electronics industry analysis, imaging application is leading because of its critical role in disease diagnosis, treatment planning, and monitoring. Advanced imaging technologies such as MRI, CT scans, ultrasound, and X-rays rely on cutting-edge electronic components to improve precision and efficiency. The increased need for non-invasive diagnostic methods, together with technology breakthroughs such as AI-powered imaging and 3D visualization, has accelerated market growth. Furthermore, the increased prevalence of chronic diseases and the need for early detection have accelerated global use of medical imaging equipment.

Medical Electronics Market By End-User

- Hospital

- Clinic

- Ambulatory Surgical Centers

According to medical electronics market forecast, hospital market is quickly expanding because of the rising need for improved medical devices for diagnostics, treatment, and patient monitoring. To provide complete healthcare services, hospitals must use a variety of medical electronics, such as imaging systems, patient monitoring devices, surgical equipment, and life-support systems. The expanding prevalence of chronic diseases, more hospital admissions, and advances in medical technology all contribute to the adoption of medical electronics in hospitals. Furthermore, hospitals have larger finances and greater infrastructure to integrate cutting-edge medical technologies than clinics and ambulator.

Medical Electronics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Medical Electronics Market Regional Analysis

Medical Electronics Market Regional Analysis

In terms of regional segments, North America is predicted to hold the greatest market share in the medical electronics industry, owing to improved healthcare innovation by leading manufacturers. For example, in May 2024, Canon deployed the first Aquilion Serve SP CT scanner in the United States with INSTINX workflow automation, combining superior imaging capabilities with increased efficiency and consistency. The region's market expansion is being driven by technical advancements, seamless integration with other medical equipment, and increased patient awareness of the benefits of early diagnosis. Furthermore, the availability of high-tech diagnostic methods and a well-developed healthcare infrastructure will boost regional growth in the next years.

Asia-Pacific is the fastest-growing medical electronics market, with double-digit growth expected during the forecast period owing to rising urbanization in emerging nations like as India and China. Rising per capita income and demand for sophisticated healthcare facilities are other major development factors. China's medical electronics market has grown significantly and is predicted to continue to develop rapidly, aided by a burgeoning geriatric population. According to the Economic and Social Commission for Asia and the Pacific (ESCAP), the Asia-Pacific area would have 721 million people aged 60 and up by 2024, accounting for about one in every seven people. By 2050, it is estimated that one in every four persons in this region will belong to this age group, amounting to roughly 1.3 billion older persons.

The medical electronics market in Latin America is expanding as healthcare infrastructure improves and the population grows. Individual health awareness is likely to increase, accelerating regional market expansion. Meanwhile, the Middle East and Africa are gaining a significant portion of the global medical electronics market, with increased private sector expenditures expected to drive industry growth in the near future.

Medical Electronics Market Players

Some of the top medical electronics companies offered in our report includes Analog Devices, Inc, Koninklijke Philips N.V., GE Healthcare, McKesson Corporation, iCAD, Inc., Siemens Healthineers AG, FUJIFILM Holdings Corporation, STMicroelectronics, Texas Instruments Incorporated, Biotronik, and Canon Medical Systems Corporation.

Frequently Asked Questions

What was the market size of the global Medical Electronics in 2024?

The market size of medical electronics was USD 9.13 Billion in 2024.

What is the CAGR of the global Medical Electronics market from 2025 to 2033?

The CAGR of medical electronics is 6.8% during the analysis period of 2025 to 2033.

Which are the key players in the Medical Electronics market?

The key players operating in the global market are including Analog Devices, Inc, Koninklijke Philips N.V., GE Healthcare, McKesson Corporation, iCAD, Inc., Siemens Healthineers AG, FUJIFILM Holdings Corporation, STMicroelectronics, Texas Instruments Incorporated, Biotronik, and Canon Medical Systems Corporation.

Which region dominated the global Medical Electronics market share?

North America held the dominating position in medical electronics industry during the analysis period of 2025 to 2033.

Which region registered fastest CAGR from 2025 to 2033?

Asia-Pacific region exhibited fastest growing CAGR for market of medical electronics during the analysis period of 2025 to 2033.

What are the current trends and dynamics in the global Medical Electronics industry?

The current trends and dynamics in the medical electronics industry rising adoption of advanced healthcare technologies to improve patient care and diagnostics, increasing prevalence of chronic diseases driving demand for medical electronic devices, and government initiatives and favorable fdi policies promoting healthcare infrastructure development

Which Component held the maximum share in 2024?

The sensors held the maximum share of the medical electronics industry.