Medical Drone Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Medical Drone Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

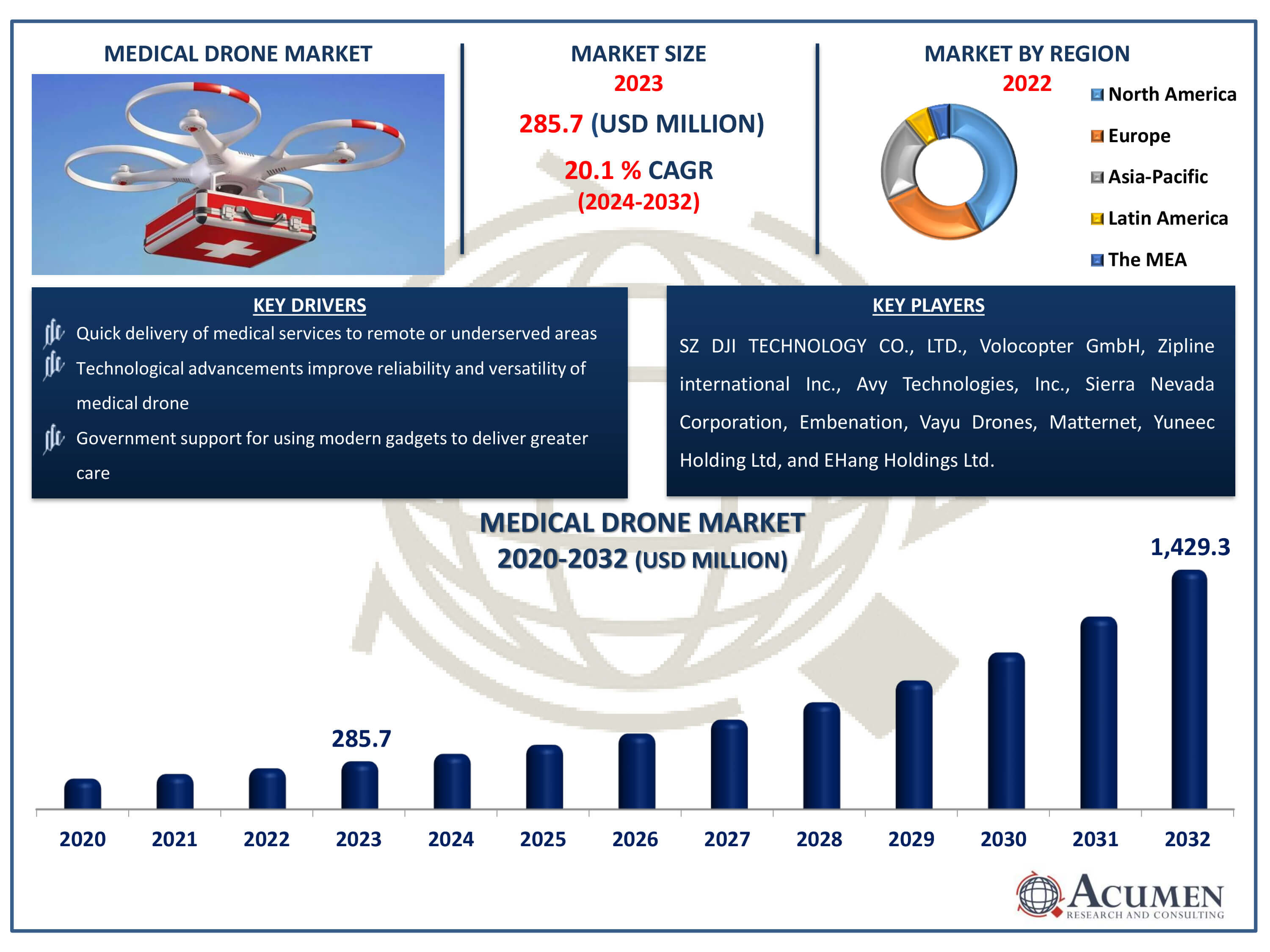

The Medical Drone Market Size accounted for USD 285.7 Million in 2023 and is estimated to achieve a market size of USD 1,429.3 Million by 2032 growing at a CAGR of 20.1% from 2024 to 2032.

Medical Drone Market Highlights

- Global medical drone market revenue is poised to garner USD 1,429.3 million by 2032 with a CAGR of 20.1% from 2024 to 2032

- North America medical drone market value occupied around USD 120 million in 2023

- Europe medical drone market growth will record a CAGR of more than 22% from 2024 to 2032

- Among type, the rotor drones sub-segment generated significant of the market share in 2023

- Based on application, the blood bank transportation sub-segment generated notable market share in 2023

- Increasing demand for efficient and fast delivery of medical supplies especially in hard-to-reach areas is the medical drone market trend that fuels the industry demand

Medical drones are routinely utilized to transport a variety of important supplies and healthcare equipment. These include blood, organs, test samples, vaccinations, and medications. They can also be used to transport first aid supplies in SAR (search and rescue) and first response scenarios. Additionally, medical supply drones transporting specific pharmaceuticals or biological materials such as blood and organs may be equipped with cooled cargo compartments to retain their payload at crucial temperatures. Some drones have been outfitted with AEDs (automated external defibrillators), and they may be able to reach a patient faster than an ambulance or other ground vehicle in instances where time is critical.

Global Medical Drone Market Dynamics

Market Drivers

- Quick delivery of medical services to remote or underserved areas

- Technological advancements improve reliability and versatility of medical drone

- Government support for using modern gadgets to deliver greater care

Market Restraints

- Stringent regulations hinder deployment and adoption

- Limited cargo capacity

- High costs deter adoption by budget-constrained organizations

Market Opportunities

- Expansion in emerging markets

- Integration with healthcare systems

- Increased investment by major players in product development

Medical Drone Market Report Coverage

| Market | Medical Drone Market |

| Medical Drone Market Size 2022 | USD 285.7 Million |

| Medical Drone Market Forecast 2032 | USD 1429.3 Million |

| Medical Drone Market CAGR During 2023 - 2032 | 20.1% |

| Medical Drone Market Analysis Period | 2020 - 2032 |

| Medical Drone Market Base Year |

2022 |

| Medical Drone Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By Package Size, By End Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | SZ DJI Technology Co., Ltd., Avy Technologies, Inc., Zipline international inc., Sierra Nevada Corporation, Embenation, Vayu Drones, Matternet, Volocopter GmbH., Yuneec Holding Ltd, EHang Holdings Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Medical Drone Market Insights

Quick delivery of medical services to remote or underserved areas, technological advancements improve reliability and versatility of medical drone, and government support for using modern gadgets to deliver greater care significantly drives demand of medical drone market. Manufacturers are focusing on improving drone technology, and with the widespread use of drones in numerous end-use industries, players approach to improving medical service delivery is gaining traction. The government of developed and developing countries is investing heavily in the development of the current healthcare infrastructure. As the pandemic's impact grows, governments in emerging nations are enacting new rules and regulations to provide better care to patients. For instance, in February 2024, Scandron Pvt. Ltd., an Indian UAV manufacturer, gained certification from the Director General of Civil Aviation (DGCA) in India. This allows for efficient and timely delivery of products for enterprises using unmanned aircraft vehicles in their supply chains. The deployment of a DGCA-approved logistics drone will improve medical deliveries, e-commerce logistics, and last-mile delivery.

However, limited cargo capacity hinders growth of medical drone market. Additionally, the high cost of manufacturing due to its complexity is expected to constrain the growth of the target market. Nevertheless, increased investment by major players in product development and a shift towards integrating advanced analytics to enhance delivery are anticipated to create new opportunities for participants in the medical drone market during the forecast period. Moreover, heightened collaboration and agreements among regional and international companies are projected to bolster revenue transactions in the target market. Supportive government regulations and increased investment are leading companies to introduce trial programs, which are expected to further enhance their businesses. In 2020, Zipline, a medical product delivery company, partnered with Walmart to conduct a trial run program for on-demand deliveries of health and wellness products. Zipline's launch and release system enables delivery within less than an hour and, operating from a Walmart store, can service a 50-mile radius. As public demand for quick medical service grows, companies are investing heavily to strengthen their distribution channels, aiming to improve the customer experience.

Medical Drone Market Segmentation

The worldwide market for medical drone is split based on type, application, package size, end-use industry, and geography.

Medical Drone Types

- Rotor Drones

- Fixed Wing Drones

- Hybrid Drones

According to the medical drone industry analysis, rotor drone type dominates market due to their versatility and precision in maneuvering. These drones can hover in place, making them ideal for delivering medical supplies and emergency response equipment to hard-to-reach areas. Their ability to take off and land vertically allows for deployment in urban environments and remote locations alike. Additionally, advances in payload capacity and battery life have enhanced their reliability and efficiency in medical logistics.

Medical Drone Applications

- Blood Bank Transportation

- Vaccines Transportation

- Organs Transportation

- Others

According to the medical drone industry analysis, blood bank transportation application segment showcasing notable share in 2023. The blood bank transportation application is a dominant force in the medical drone market due to its critical role in saving lives, especially in remote and inaccessible areas. Drones offer rapid and reliable delivery of blood supplies, overcoming logistical challenges and reducing the time to reach patients in need. This capability is crucial in emergencies, where timely transfusion can be life-saving. As a result, the demand for medical drones is driven significantly by their use in blood bank transportation, highlighting their value in modern healthcare logistics.

Medical Drone Package Sizes

- Less Than 2 Kg

- 2-5 Kg

- Above 5 Kg

According to the medical drone market forecast, the industry is expected to be dominated by drones weighing less than 2 kg. These lightweight drones offer greater maneuverability, faster deployment, and ease of use in urban and rural settings. Their smaller size makes them ideal for delivering critical medical supplies, such as medications, blood samples, and emergency equipment, particularly in hard-to-reach areas. The increased adoption of these drones is driven by advancements in battery technology and the growing need for rapid medical response solutions.

Medical Drone End Uses

- Emergency Medical Services

- Blood Banks

- Government Institutions

- Others

According to the medical drone industry forecast, the emergency medical services (EMS) segment is projected to dominate the market due to its critical role in rapidly delivering medical supplies, blood, and organs to remote or inaccessible areas. Drones enhance response times during emergencies, providing life-saving interventions faster than traditional methods. The increasing adoption of drones for EMS reflects their efficiency, reliability, and potential to revolutionize urgent healthcare delivery. This trend is driven by the growing need for prompt medical assistance and the advancement of.drone technology.

Medical Drone Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

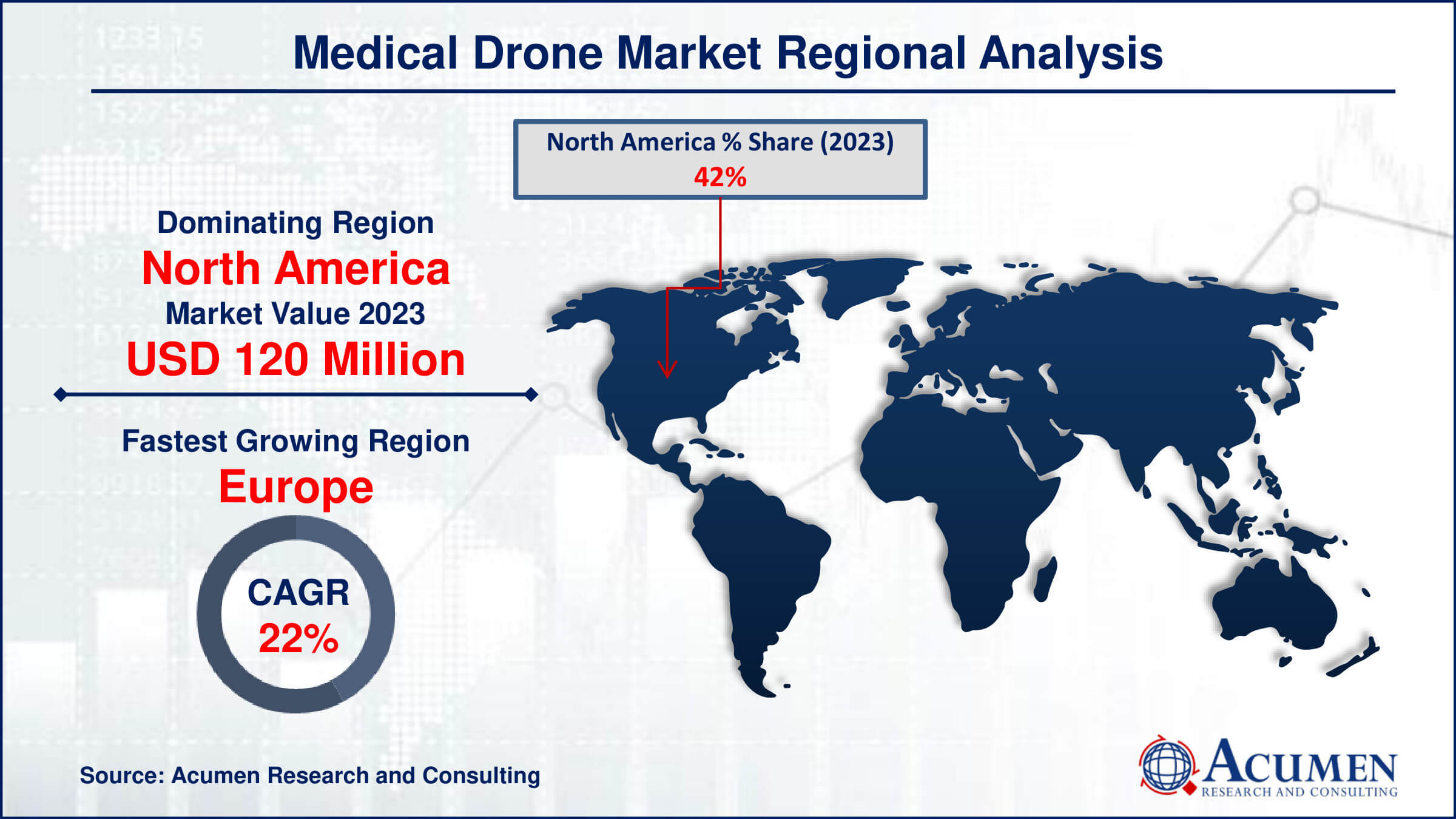

Medical Drone Market Regional Analysis

For several reasons, the North America region dominates the medical drone market due to increased government funding on the development of smart healthcare systems. Furthermore, the large number of players operating in the country, as well as the introduction of innovative solutions to attract new consumers is likely to promote the expansion of the regional medical drone market. For instance, Sierra Nevada Corporation stated in October 2022 that it had acquired the assets and intellectual property linked to Volansi's Voly-50 and Voly-T line of unmanned aerial vehicles (UAVs). The action underlines SNC's commitment to delivering a next-generation, multi-role, long-haul, vertical takeoff and landing (VTOL) platform to DOD clients while also establishing SNC as a premier UAV solution supplier. As a result, North America maintains its dominance in market due to key strong focus on smart healthcare systems.

Europe is fastest growing region in medical drone market due to the development of government rules on goods delivery. Furthermore, favorable government regulations and significant investment by manufacturers in product development are projected to fuel the expansion of the medical drone market. For instance, in March 2023, researchers financed by the European Union created a drone-based device to offer situational awareness to first responders during disasters, saving lives. Major firm’s commitment to tracking unexplored markets in emerging economies is projected to enhance regional market growth.

Medical Drone Market Players

Some of the top medical drone companies offered in our report include SZ DJI Technology Co., Ltd., Avy Technologies, Inc., Zipline international inc., Sierra Nevada Corporation, Embenation, Vayu Drones, Matternet, Volocopter GmbH., Yuneec Holding Ltd, EHang Holdings Ltd.

Frequently Asked Questions

How big is the medical drone market?

The medical drone market size was valued at USD 285.7 million in 2023.

What is the CAGR of the global medical drone market from 2024 to 2032?

The CAGR of medical drone is 20.1% during the analysis period of 2024 to 2032.

Which are the key players in the medical drone market?

The key players operating in the global market are including SZ DJI Technology Co., Ltd., Avy Technologies, Inc., Zipline international inc., Sierra Nevada Corporation, Embenation, Vayu Drones, Matternet, Volocopter GmbH, Yuneec Holding Ltd, EHang Holdings Ltd.

Which region dominated the global medical drone market share?

North America held the dominating position in medical drone industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of medical drone during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global medical drone industry?

The current trends and dynamics in the medical drone industry include quick delivery of medical services to remote or underserved areas, technological advancements improve reliability and versatility of medical drone, and government support for using modern gadgets to deliver greater care.

Which type held the maximum share in 2023?

The rotor drones type held the maximum share of the medical drone industry.